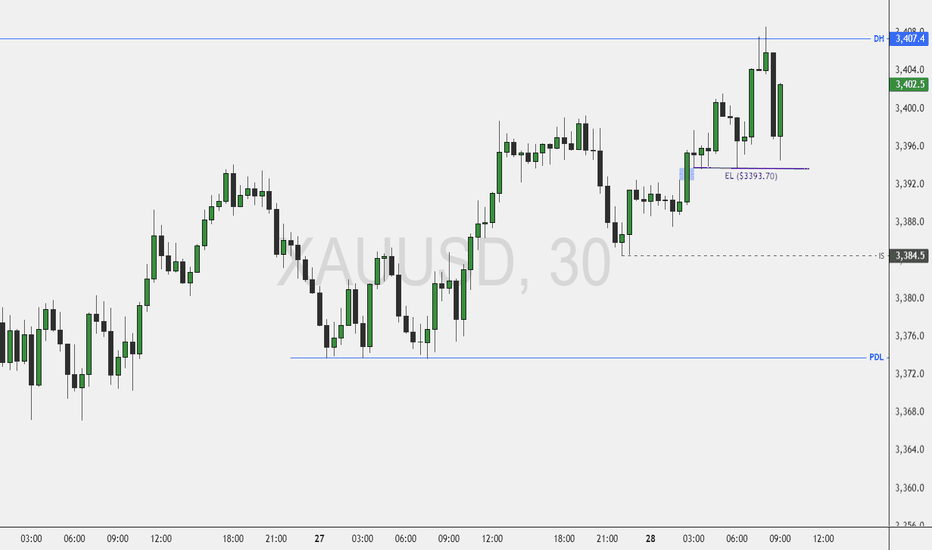

Gold Rejects Daily HighsFenzoFx—Gold swept liquidity above the daily highs at $3,407.40 before retreating below this level. Prior to this move, Gold formed equal lows at $3,393.70, a level likely to be targeted next.

From a technical standpoint, this suggests potential downside. If selling pressure continues, XAU/USD could slide toward the next support at $3,384.50.

Fenzofx

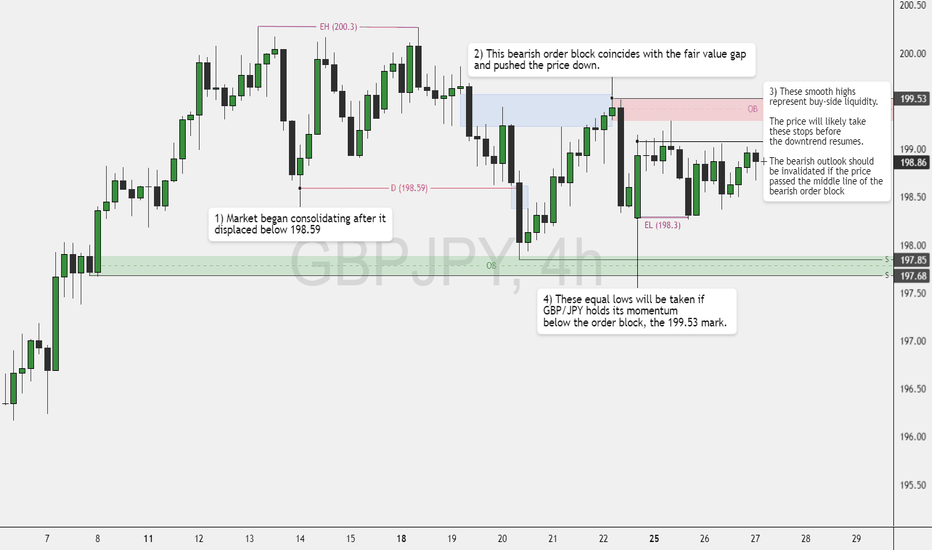

GBP/JPY: Key Levels to Watch: 199.53 and 198.3 FenzoFx—GBP/JPY trades sideways after dropping below 198.59. A recent momentum shift formed a bearish order block at 199.53. The outlook stays bearish if price remains below this level.

The 4-hour chart reveals equal lows at 198.3, a key target. For the bearish trend to continue, price must stay under the midpoint of the order block. If selling pressure persists, 197.85 is the next target. A break above 199.53 would invalidate this setup.

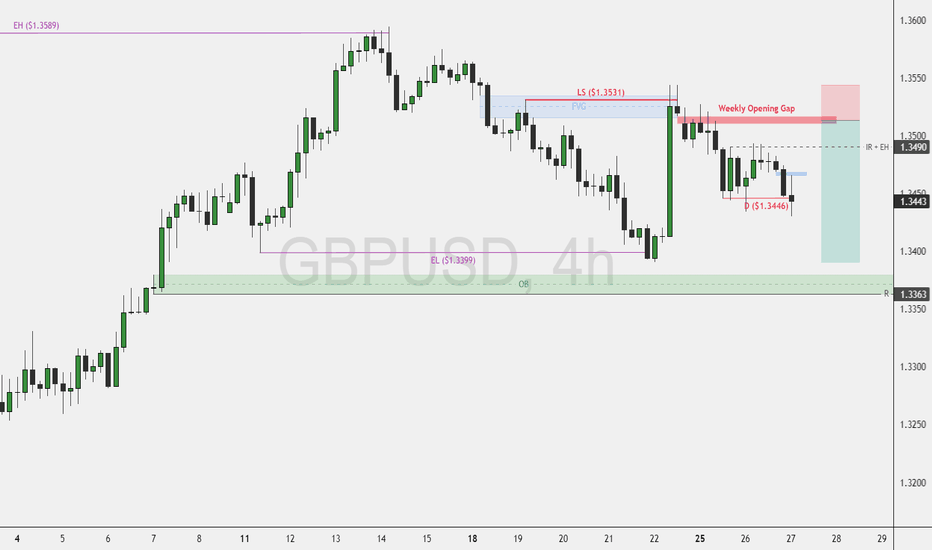

GBP/USD Is Falling: Here's Why Selling Could Be RiskyFenzoFx—GBP/USD displaced below $1.3446 minor support in today's trading session. This dip in the price could be a trap for two major reasons:

There is a smooth equal highs at $1.3490, and above it exists the weekly opening gap. The market tends to invalidate equal highs and fill the weekly opening gap price.

Therefore, selling at the current price is risky. We suggest using the weekly opening gap to plan a bearish trade. If this scenario unfolds, we expect GBP/USD to target the equal lows at $1.3399. This setup provides a 1 to 4 risk to reward.

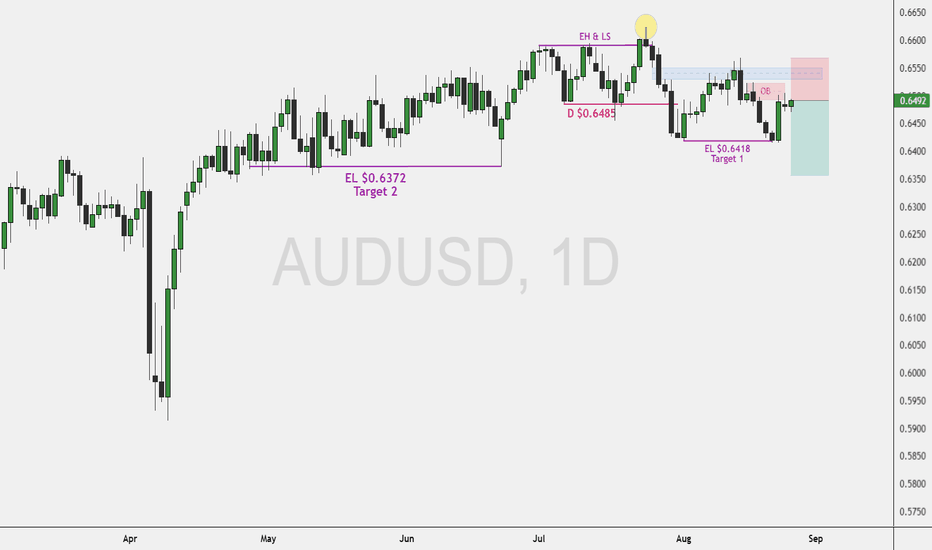

AUD/USD Bearish Setup with Targets ExplainedFenzoFx—AUD/USD formed new lower lows and lower highs after it was displaced by closing below $0.6485. Interestingly, the pair created equal lows at $0.6418. This indicates the trend should be considered bearish, and liquidity is present below $0.6418.

Currently, AUD/USD is consolidating by tapping into the bearish order block. From a technical perspective, we expect the downtrend to resume.

Targets: $0.6418 followed by $0.6372.

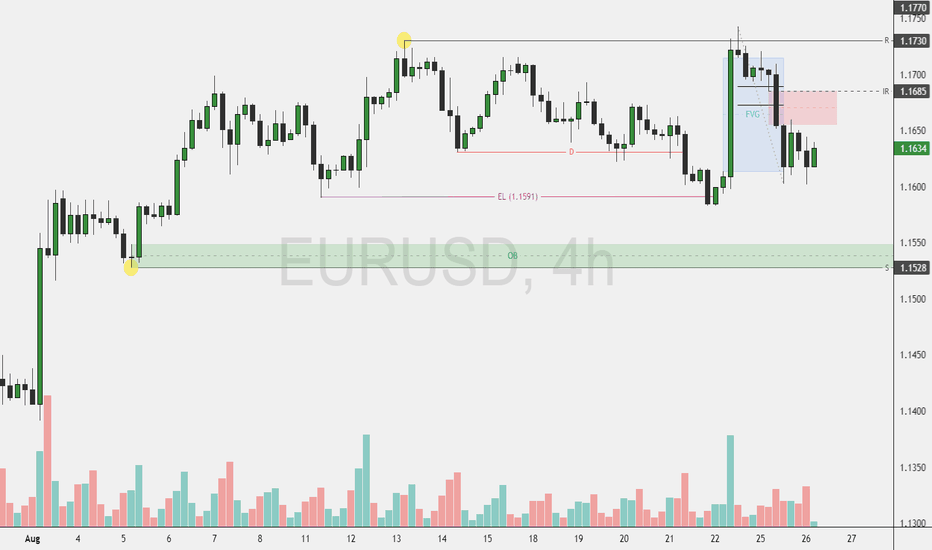

EUR/USD Bearish SetupFenzoFx—EUR/USD filled the bullish fair value gap after it swept the highs at 1.1730, formed a double top. However, the recent decline in the currency pair did not result in a liquidity sweep below recent lows.

Therefore, the bearish outlook remains valid despite the primary trend, which is bullish. This week, we expect EUR/USD to trade below $1.1591 to accumulate liquidity before rallying higher.

Retail traders should monitor the middle line of the bearish engulfing pattern with resistance at $1.1685 for a bearish setup, targeting the equal lows followed by the bullish order block with ultimate support at $1.1528.

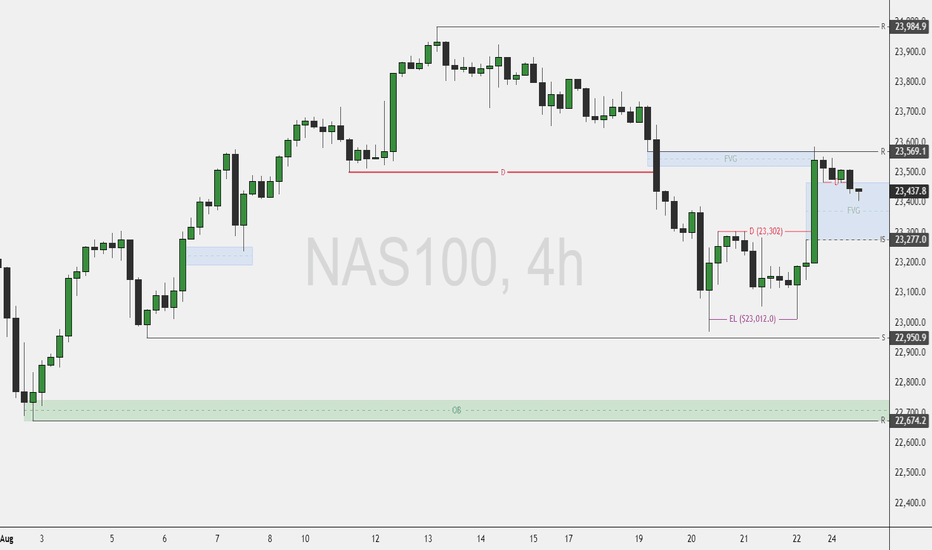

Nasdaq's Bearish Drift: Key Levels in FocusFenzoFx—Nasdaq's short-term trend is bearish. Friday's rally eased after the price filled the fair value gap with resistance at $23,569.00. Today, NQ displaced below the recent lows, currently trading inside the bullish FVG.

There is a relevant equal low at $23,012.00. From a technical perspective, the bearish outlook remains valid if the price holds below $23,569.00. In this scenario, we expect the market to fill the FVG with immediate support at $23,277.00.

Furthermore, if the selling pressure persists, Nasdaq could sweep the equal low by targeting the support at $22,950.00.

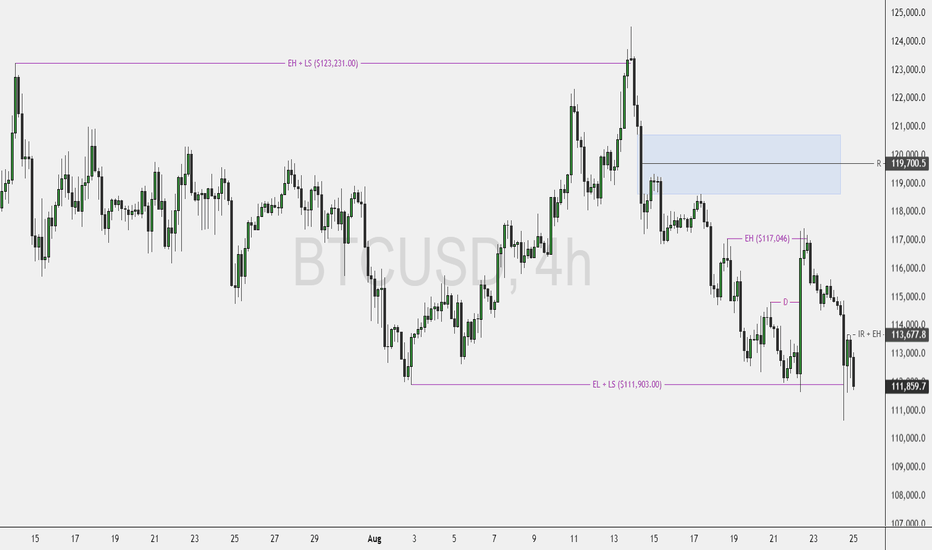

Bitcoin Holds Bullish StructureFenzoFx—Bitcoin formed equal highs after sweeping liquidity above $117,046.00 on Friday. Technically, Bitcoin remains bullish due to Friday’s price displacement.

Immediate resistance lies at $113,677.00. If bulls close and stabilize above this level, the uptrend may resume, targeting the equal highs at $117,046.00. A further rise could fill half of the bearish fair value gap toward $119,700.00.

Currently, no bearish setup is expected unless BTC reaches the premium price zone of $119,700.00 and above.

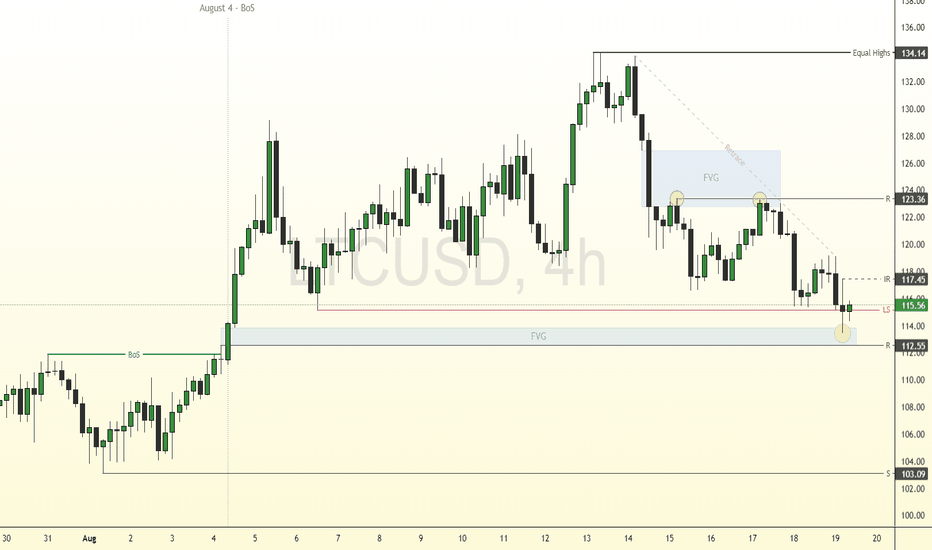

Litecoin Eyes Reversal from $112.5 SupportFenzoFx—Litecoin currently trades near $115.5, having swept last week's low liquidity. This level is supported by a bullish fair value gap, with key support at $112.5, offering a potential reversal point.

Immediate resistance stands at $117.4. A close above this level could trigger a bullish wave toward the next supply zone at $123.3.

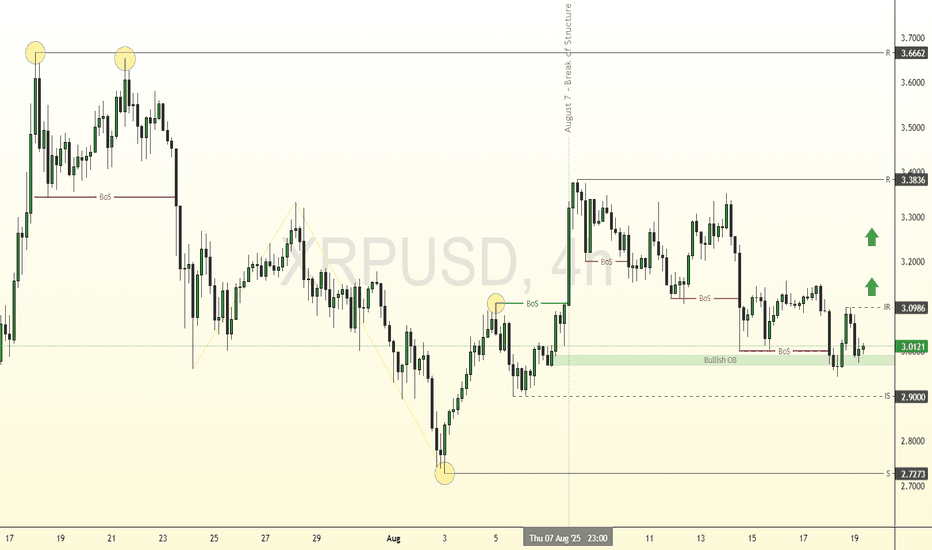

XRP: Key Support at $2.72 Holds Bullish OutlookFenzoFx—XRP (Ripple) broke its bearish structure with a strong engulfing pattern on August 7 and is now consolidating near $3.00. This level is supported by a bullish order block, with immediate support at $2.90.

The 4-hour chart shows equal highs at $3.66, marking a liquidity target. Immediate resistance lies at $3.09, and a close above this level could resume the uptrend.

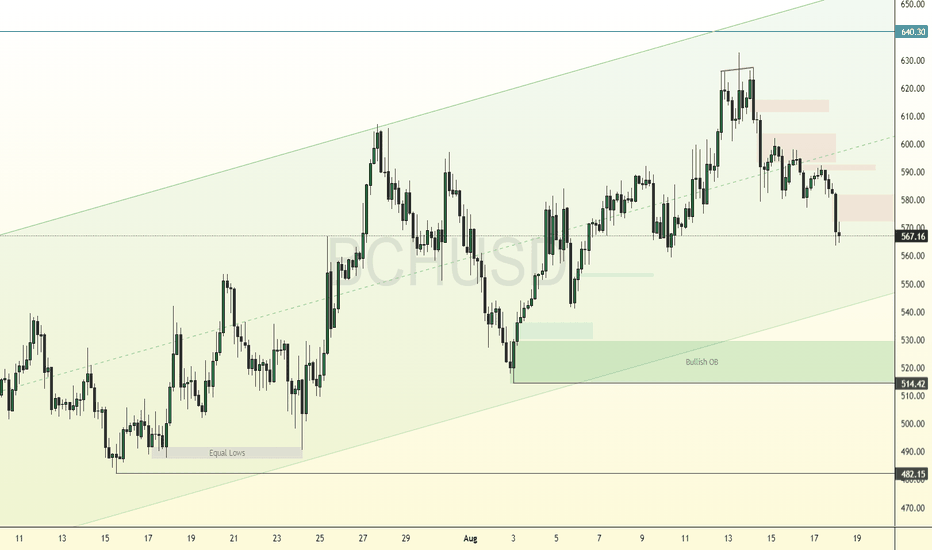

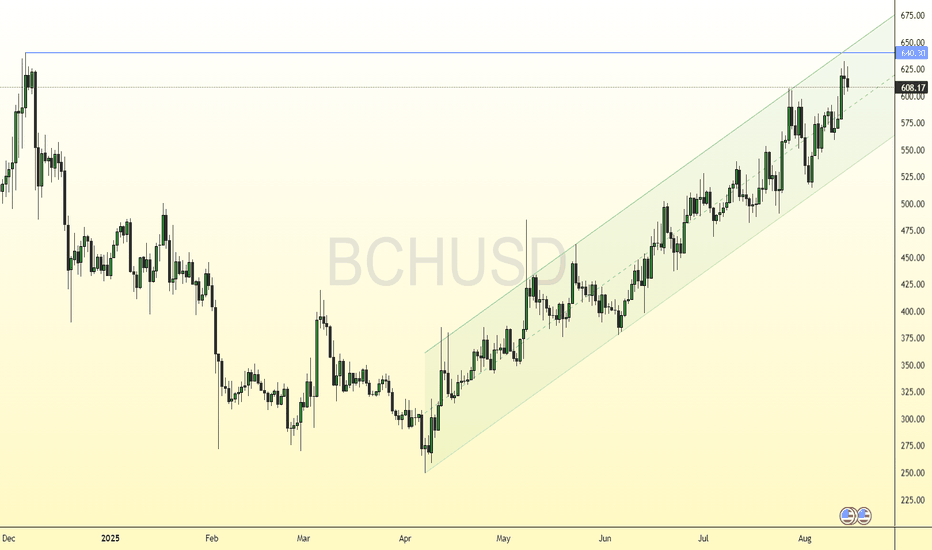

BCH Consolidates Below $620 HighsFenzoFx—Bitcoin Cash is consolidating after forming equal highs at $620.0. While the trend remains bullish, the current phase may push toward lower support.

Equal highs signal low liquidity, often followed by a move to lower levels before a rally. The bullish order block at $514.0 is a key discount level, offering a potential entry for buyers targeting $640.0 resistance.

If BCH closes below $514.4, consolidation could deepen toward $482.1.

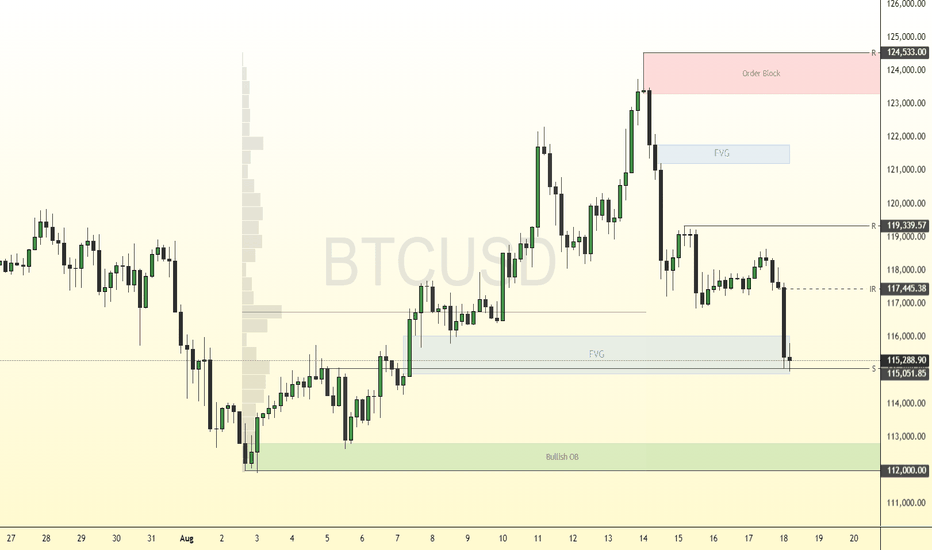

Bitcoin Tests Key Support at $115KFenzoFx—Bitcoin's downtrend extended to $115,000, filling the bullish fair value gap now acting as support. The current price equals 25.0% of the previous bullish leg. If BTC closes and stabilizes below $115,000.0, the downtrend may deepen toward the $112,000.0 support order block.

Conversely, a close above $117,445.0 would invalidate the bearish outlook. This level marks the last bearish candlestick pattern and a break of structure. If confirmed, BTC/USD could recover recent losses, targeting resistance at $119,339.0.

Bitcoin Cash: - Bearish Setup Awaits Liquidity SweepFenzoFx—Bitcoin Cash continues its bullish momentum, currently trading around $609.5. The uptrend is expected to persist, with BCH targeting the December 2024 high of $640.0.

Once liquidity above this level is cleared, bearish setups may will likely come into play.

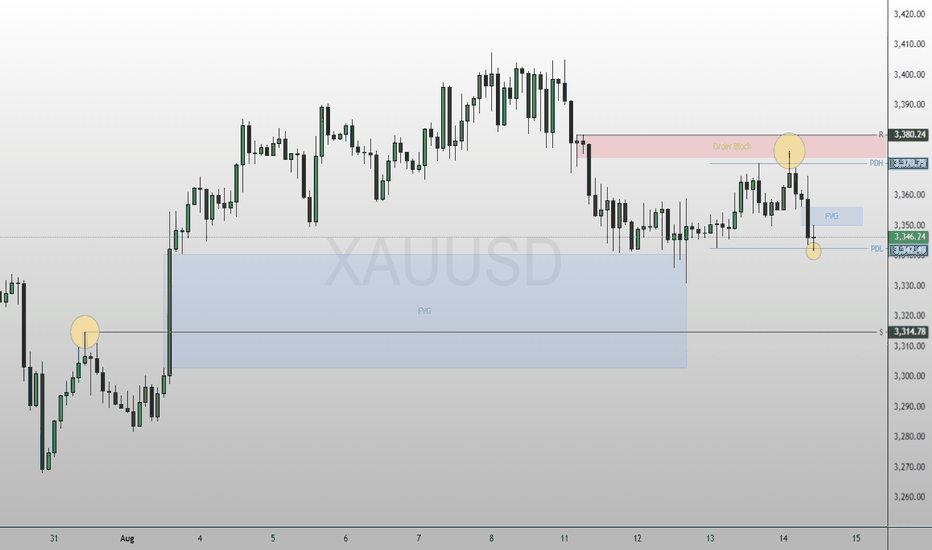

Gold: Bearish Momentum Poised to ResumeFenzoFx—Gold opened the London session by sweeping liquidity below the previous day's low and is now consolidating above the $3,342.0 support.

Technically, bearish momentum is expected to resume. A break below $3,342.0 could lead XAU/USD to partially fill the bullish FVG, with support at $3,314.0.

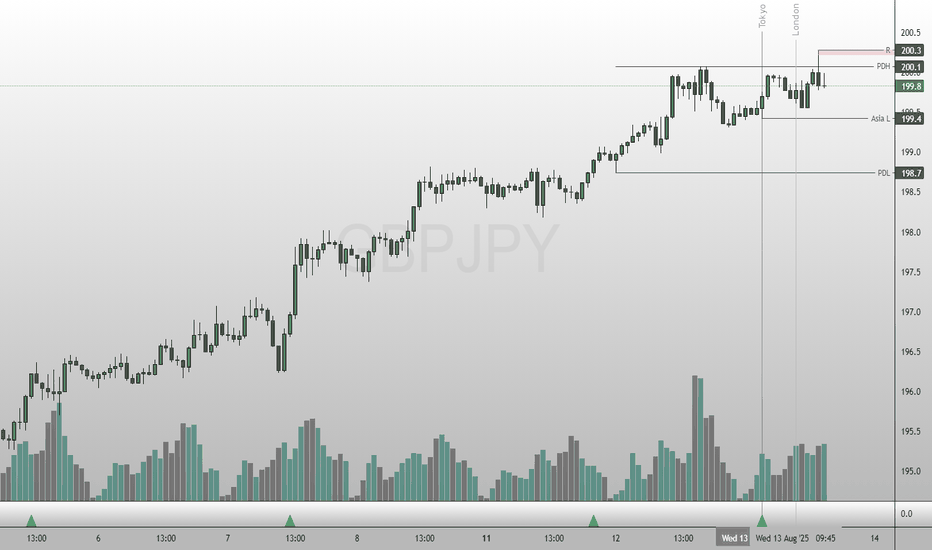

GBPJPY: Liquidity Sweep Triggers Downside FenzoFx—GBP/JPY swept the previous day's high, forming a bearish long-wick candle with resistance at 200.2.

A bearish fair value gap appeared on the 5-minute chart, signaling increased selling pressure after liquidity was swept. Technically, GBP/JPY may first target the Asia low at 199.4. If bearish momentum continues, the move could extend to the previous day's low at 198.7.

This outlook is invalidated if the pair closes above today's high at 200.3.

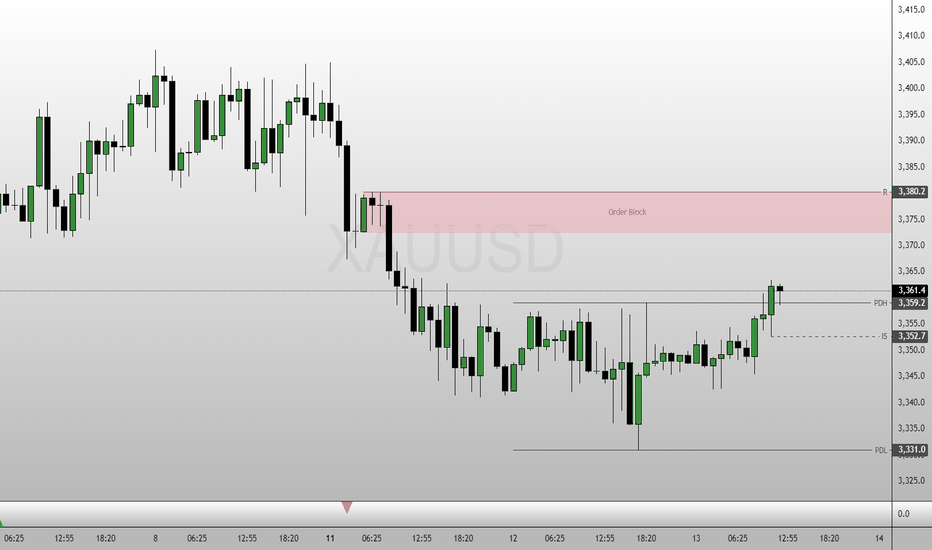

Gold: Bullish Setup Builds Above $3,352.0FenzoFx—Gold has taken out the previous day's high, currently testing this level as support. The immediate support is at $3,352.0, below the bullish candle that broke the resistance.

From a technical perspective, the uptrend will likely resume if the support holds. In this scenario, the next bullish target will likely be the order block with the highest resistance price at $3,380.

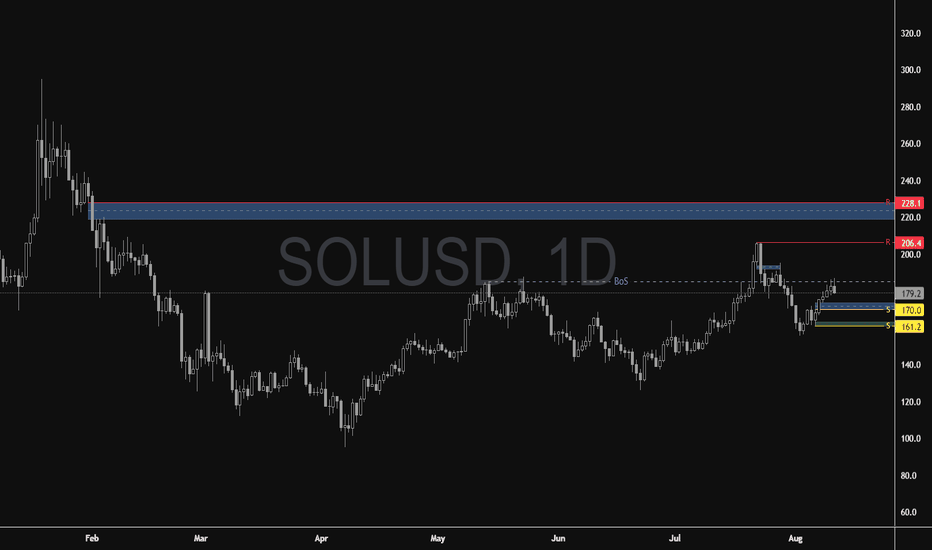

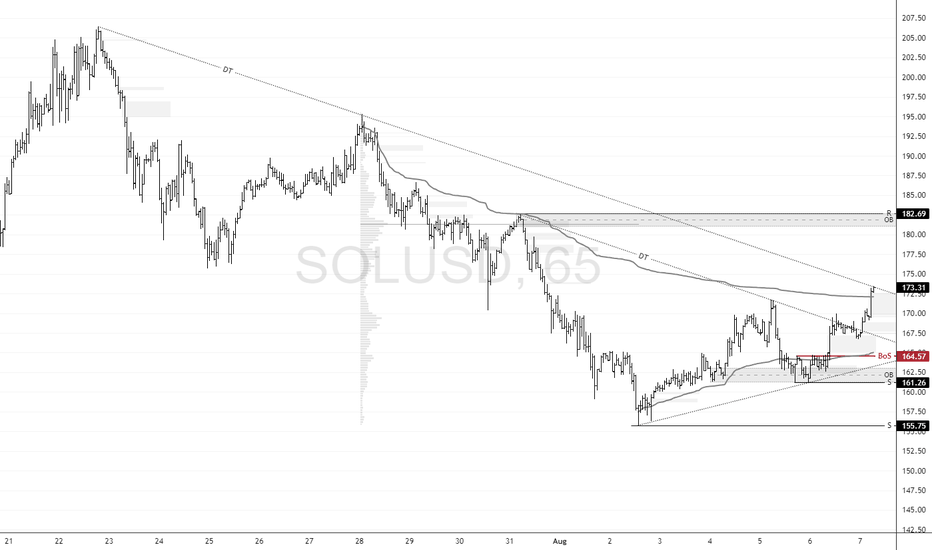

Solana's Bullish Breakout: Eyes on $228.1FenzoFx—Solana broke the structure on July 21, and then pulled back below this level, providing discount entries. We expect the uptrend to resume and target the resistance at $228.1.

A dip toward $170.0 followed by a better price for bullish entry at $161.2 could be ideal and low risk. Monitoring these levels for candlestick patterns, break of structure in 5 minutes, and fair value gaps to confirm if there would be a bounce and continuation of the uptrend from any of these two levels.

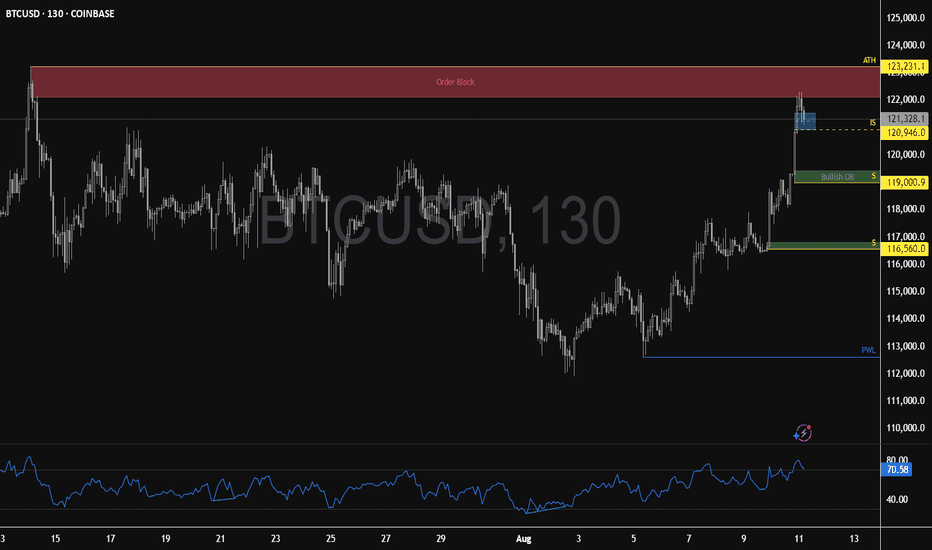

Bitcoin Pulls Back After Testing Bearish BlockFenzoFx—Bitcoin hit the bearish order block and pulled back as expected. RSI 14 dropped below the overbought zone to, signaling increased selling pressure.

Immediate support lies at $120,946. A close below this level could extend the downtrend, targeting the bullish order block at $119,000.00. No bullish setup is expected until price consolidates near discount levels at $119,000.00 and $116,560.00.

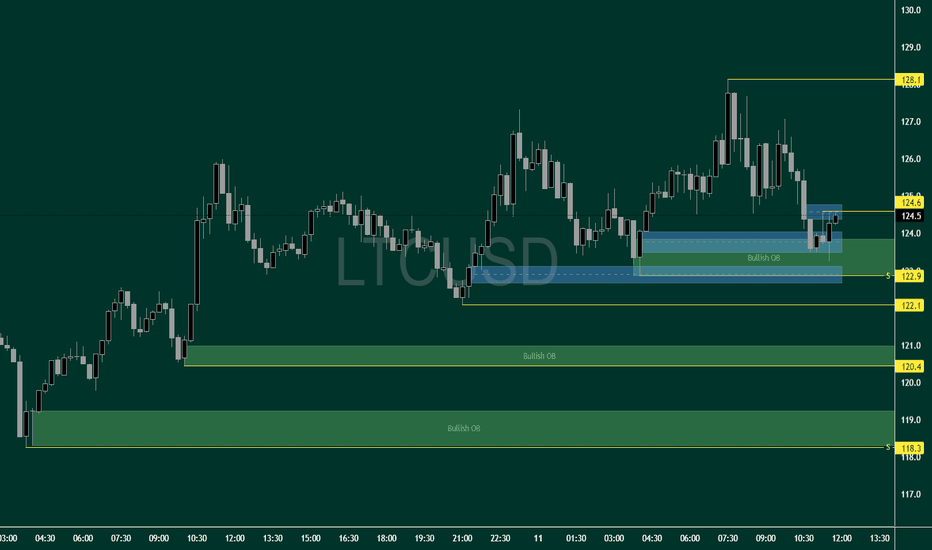

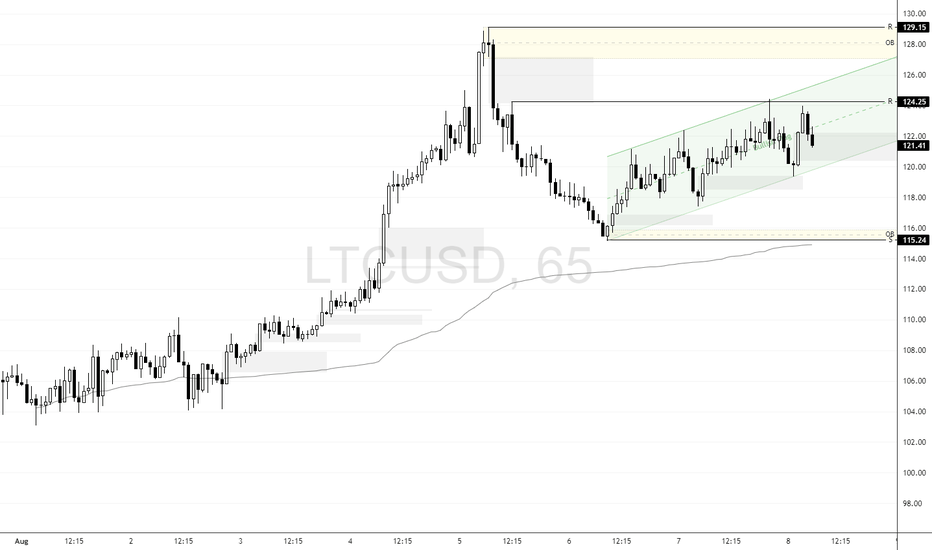

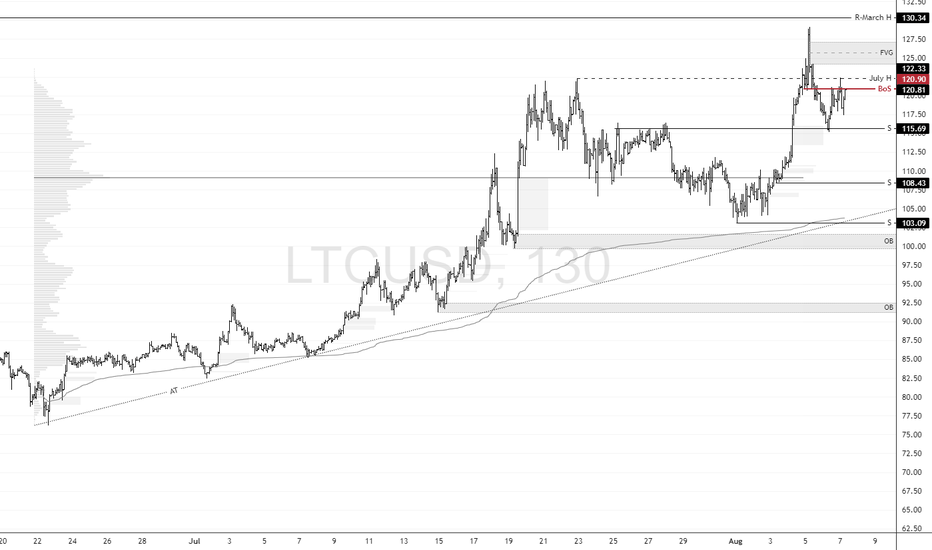

Litecoin Eyes Buy Side Liquidity Shift After $124.2 SweepFenzoFx—Litecoin remains in a bullish channel, with the current wave originating from the order block at $115.2. LTC now trades around $121.7.

Yesterday, it swept liquidity above the $124.2 resistance, signaling a potential shift toward bearish pressure. If momentum fades, price may revisit the $115.2 support zone.

However, if LTC/USD closes above $124.2, this bearish outlook is invalidated. In that case, the next target is the order block with resistance at $129.1.

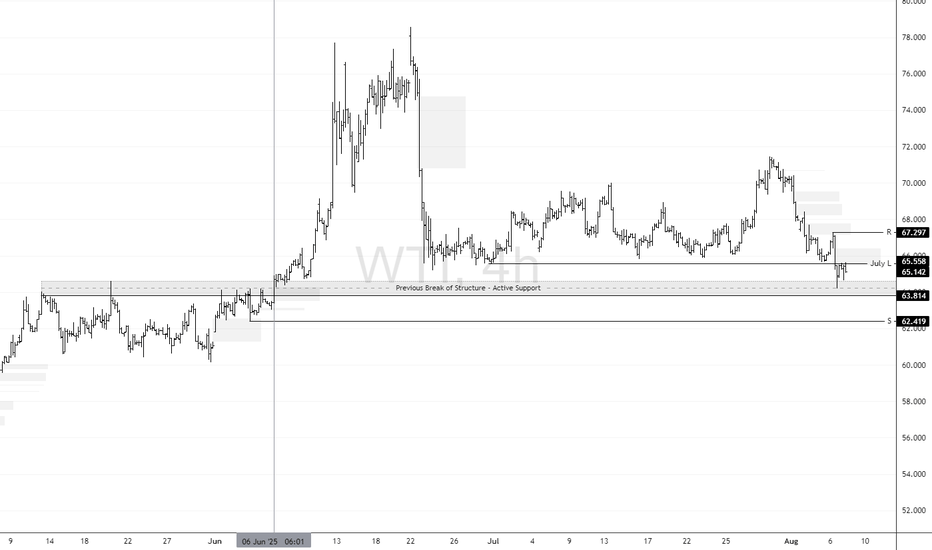

Oil Left Bulls Bruised and Bankrupt: A Silver Lining for RecoverFenzoFx—Crude Oil remains bearish, taking out bulls and breaking July's low this week—an unexpected move for the month. WTI Crude currently trades near $65.2, aligning with its prior market structure shift from bearish to bullish, marked by a bullish engulfing on June 6.

Forecast : Immediate resistance stands at July's low of $65.5. If price breaks above, Oil may begin to recover some losses. Technically, the next upside target is the order block at $67.29.

Solana Surges, Yet Still Lags Behind LTCFenzoFx—Solana targeted the primary descending trendline after it broke the structure by closing above $164.5. While LTC, which is a cryptocurrency like Solana with a price range between $100.0 and $200.0, reached its previous monthly highs, Solana still lags behind.

Currently, SOL is testing the average volume weight at approximately $173.0, in conjunction with the primary descending trendline.

Forecast : With the primary support at $161.2, we expect SOL/USD to resume its uptick momentum. In this scenario, the price should target the order block with peak resistance at $182.6.

Litecoin: Eyeing Discount Entry Near $108FenzoFx—Litecoin's uptrend stalled near March’s peak at $130.3, a strong resistance level. The price now trades at $120.7, below July’s high, breaking the bullish structure.

Immediate support lies at $115.6. A bearish close below this level could trigger further downside toward $108.4. This zone is backed by a volume point of interest, offering a potential discount entry aligned with the broader bullish trend.

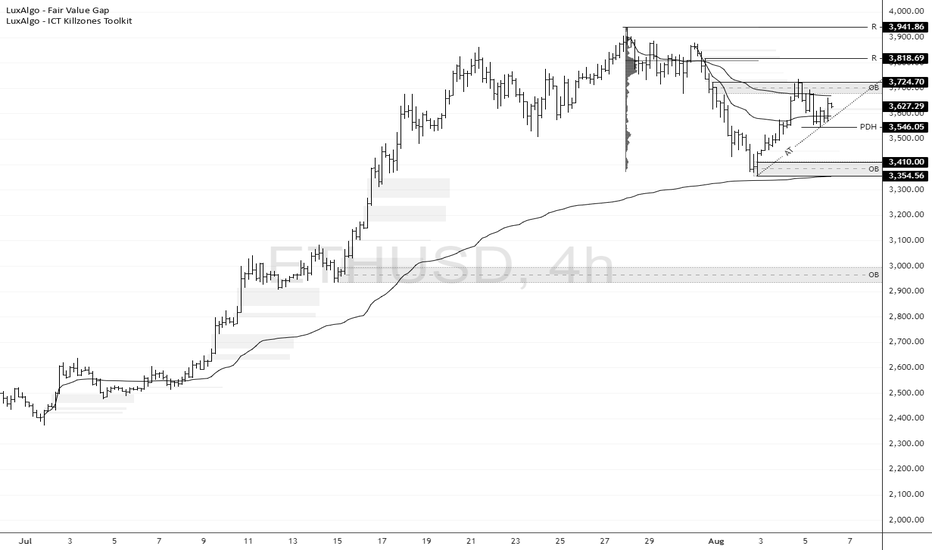

ETH/USD Rebounds, Faces Key ResistanceFenzoFx—Ethereum rebounded from the previous day's low, now trading near $3,639.0. This level contains an order block that triggered bearish reactions earlier this week.

The trend remains bullish as price holds above the VWAP from July 1st. A close above $3,724.0 is needed to confirm continuation.

If bullish momentum holds, ETH may target $3,818.0 and $3,941.0. However, a drop below $3,546.0 would invalidate the bullish outlook. In that case, ETH/USD could revisit $3,410.0 and $3,354.0.