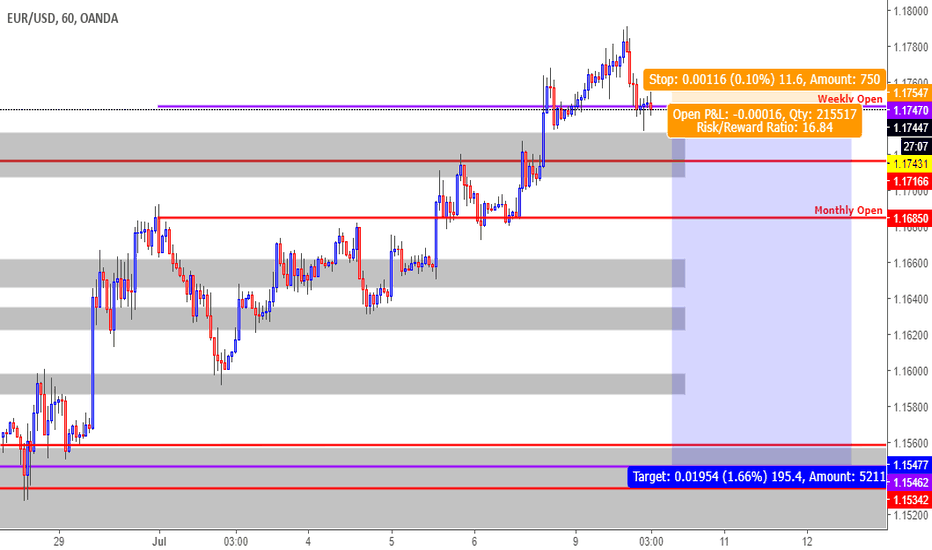

$EURUSD - I'm Being a BearDue to the major shift yesterday, my daily bias is to be bearish. And even though we have not made a lower low, we have yet to create a higher high so I'm being a little aggressive with a bearish call since I don't have as many confirmations as I would like to have.

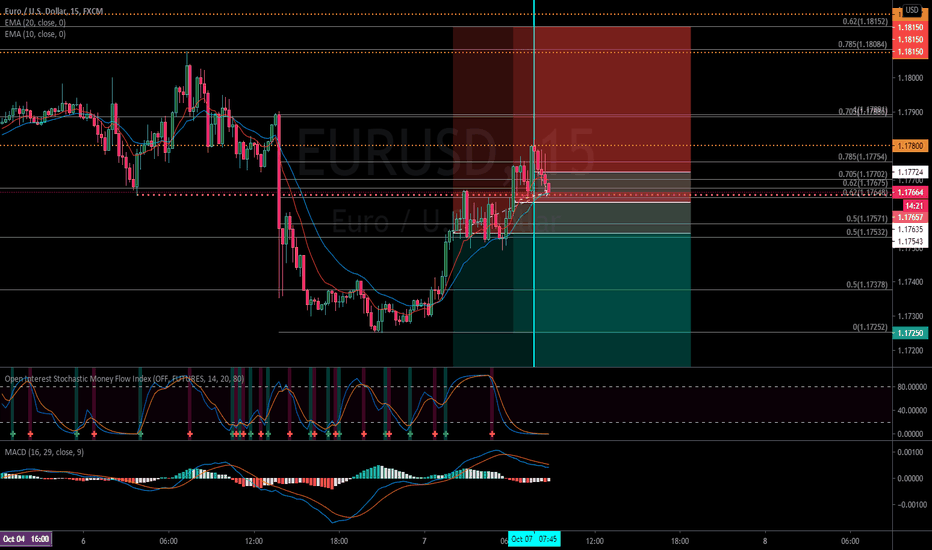

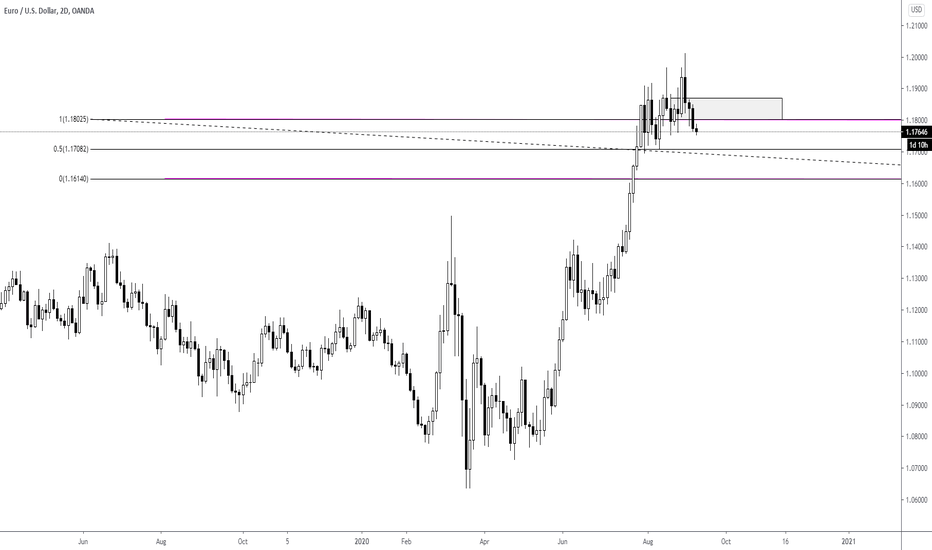

I pulled fibs across a few situations and entered on each three of those situations shown and 3 different take profits for all 3. I've entered at 1.17724, 1.17635, and 1.17543. First Goal is 1.17250, Second is 1.17075, Third is the 1.16860. These are the 0. -27%, and -62% extensions. If it makes it to -100% at 1.16615 that would be great.

1.1800 is serving as a major resistance. And when overlaying bond yields, the German yield (conducive of the Euro), it steadily declined during the hours of 6 a.m. and 8 a.m. (CST U.S.). However since 8 a.m., they've both shifted toward more positive yields and the German yield is a bit more aggressive, so that is a little worrisome.

I could be completely wrong. We may need a higher retracement before we start seeing the seasonality of the fall of the EU. I'm just hoping it's sooner than later.

Side note #1 - I'm in the positive on my last position I took. Crossing my fingers it stays that way.

Side note #2 - I don't believe in trendlines.

Side note #3 - I use the Dollar Sign ($) in front of the symbol because I post these to twitter and it will tag $EURUSD like a hashtag except. And it can be searchable like a hashtag.

Fibershort

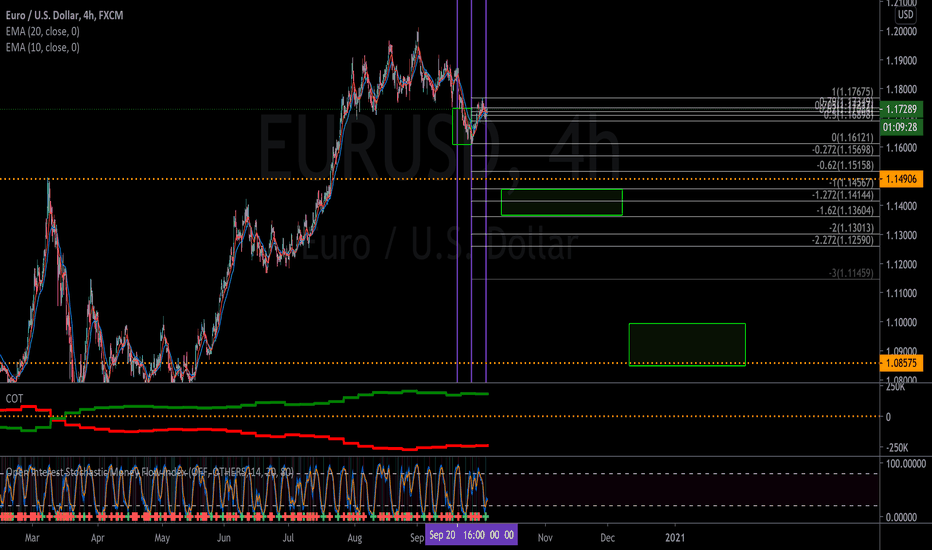

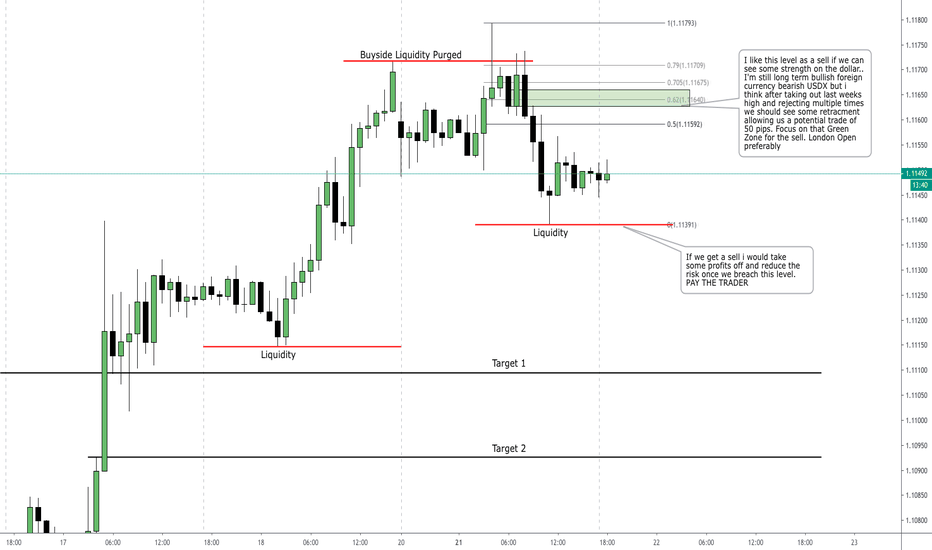

$EURUSD Weekly Outlook - To Summarize - ShortCoT has the commercial banks shorting the EURUSD still. Yeah, they added a few long positions this weel, but that was to get back to a level they wanted to add more shorts. They/ve been shorting since the height of the Pandemic swing. so for the Central banks to start being profitable, the price will have to be below 1.13500. If you draw a fib from the start of the EURUSD commercial shorts to the height of the commercial shorts, you can see it unfold in the fib extensions where price wants to reach.

I personally like to see a bit of a larger retracement to the green box notated in this chart during the London/NY session before aggressively going short.

Plus theirs divergence in the 10 year bonds between the currencies. As most are going up, the EUR is taking a dip as of recent.

DIVERGENCE IN 10 YEAR BONDS

Strong Bear tendencies this week. It will be London op and NY open to find the best setups to go short.

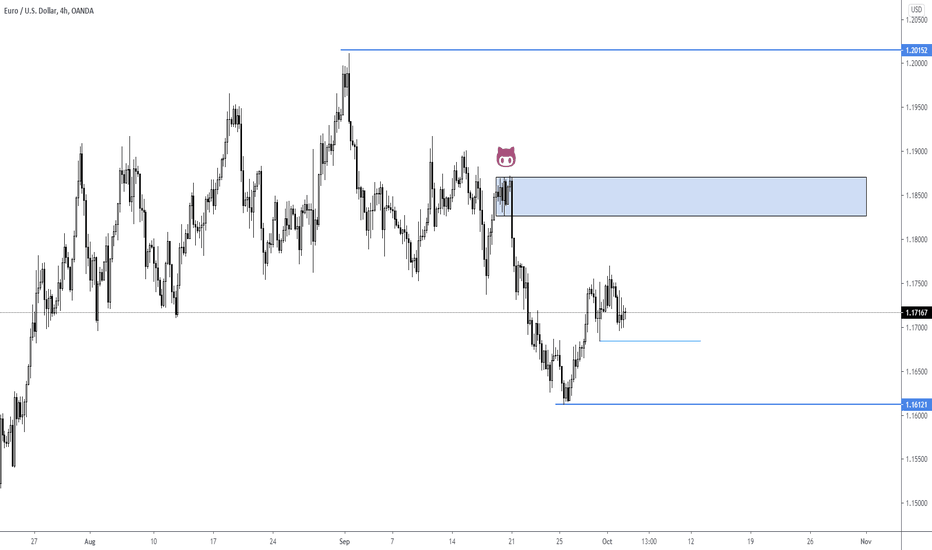

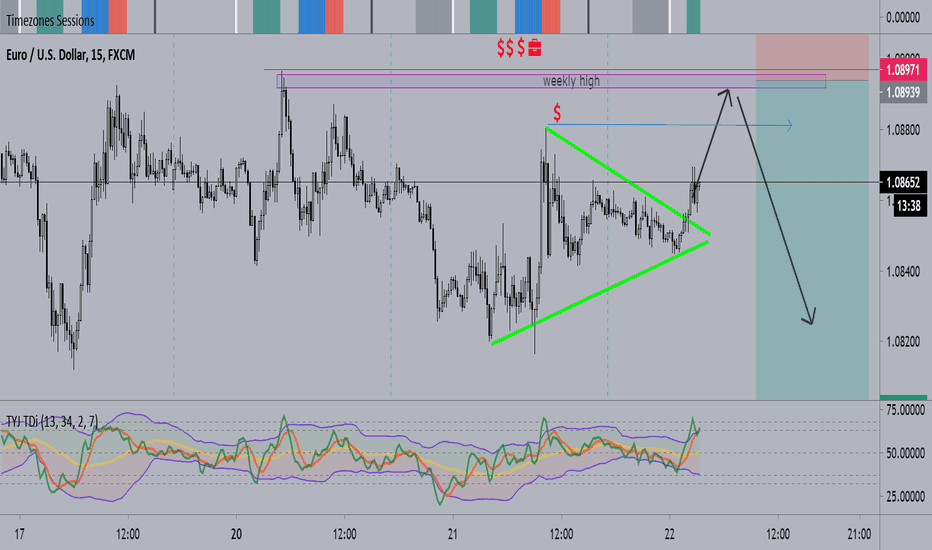

EURUSD - Looking For Higher Prices.Hello and welcome back. If you found this idea helpful, please leave a like. Last week was very tricky for me. It was one of my tougher NFP weeks I've had all year. Anyhow, I believe EURUSD has formed a low and I will be looking for higher prices. My idea for 1.1500 will need to be put aside for now. First objective would be 1.1800 and then trade into the blue box.

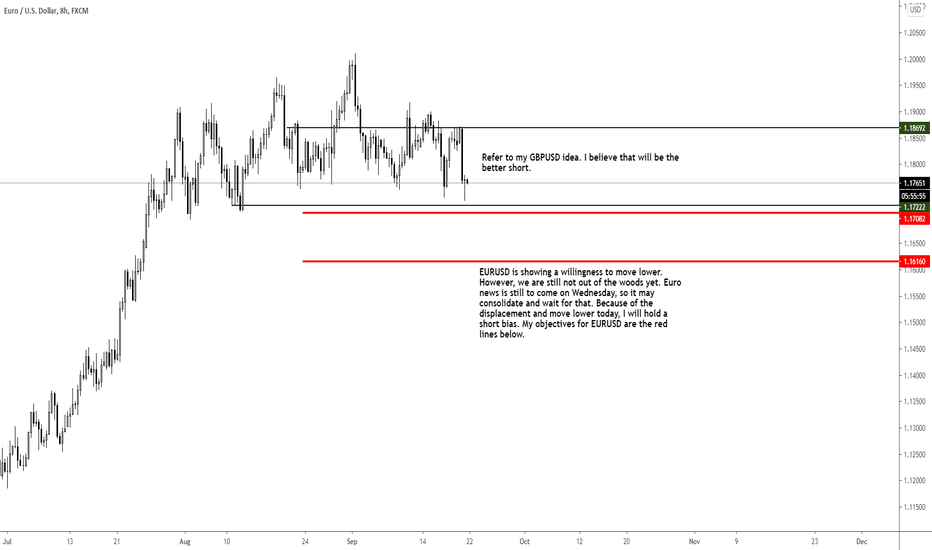

EURUSD - Showing a Willingness to Move Lower. If you found this idea helpful, please leave a like. EURUSD is not out the woods yet. Euro news is still to come on Wednesday. I do hold a short bias for this pair, but I believe the better trade/short will be in GBPUSD. Refer to the related ideas below. The red lines are my objectives for EURUSD.

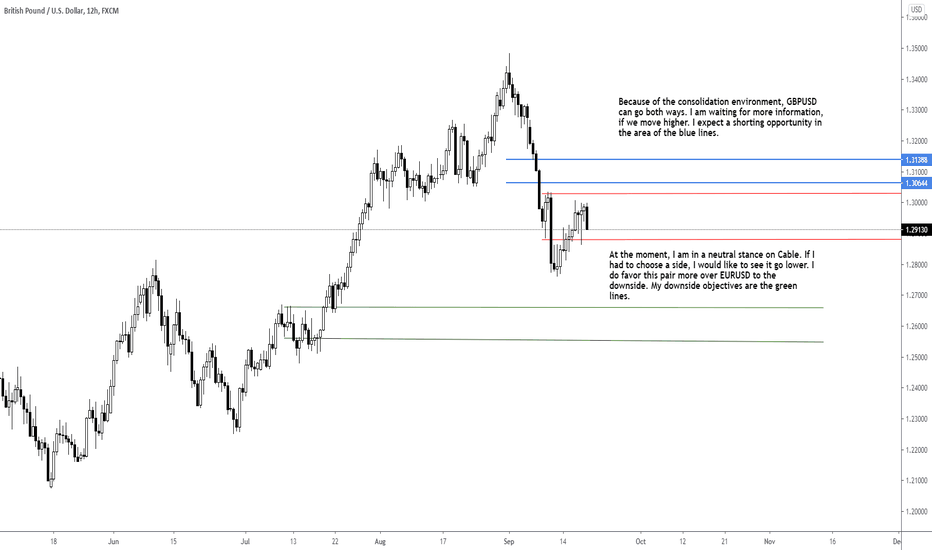

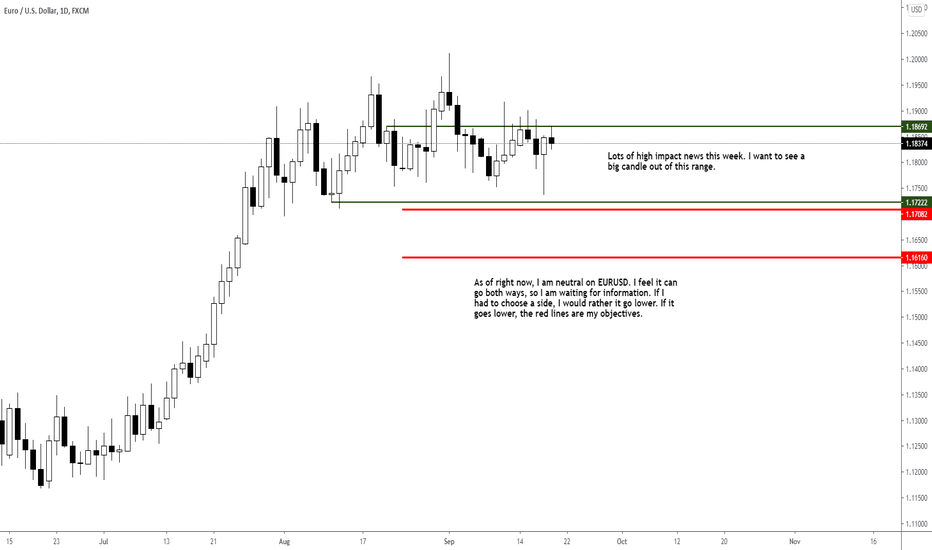

*Week Ahead* EURUSD - Consolidation Environment - NeutralIf you found this idea helpful, please leave a like. EURUSD is still bouncing around in the range that I have defined. There is lots of high impact news this week, so I am expecting some volatility. I am neutral at the moment, but if I had to choose a side, I'd like to see it go lower from here.

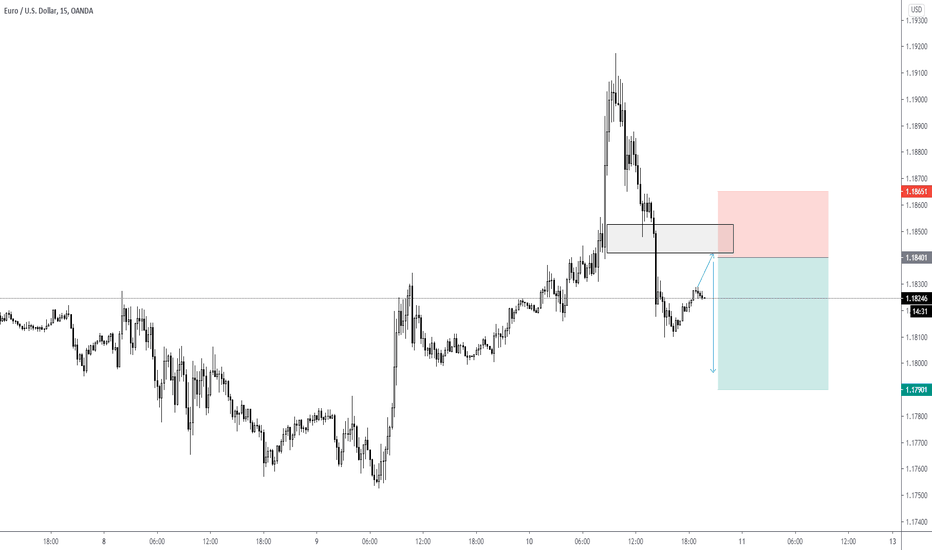

EURUSD 1.1700 - 1.1620 Downside Objectives For Now. *OHLC* I can see shorts for EURUSD. Price needs to stay above the grey box to maintain the bearish outlook. If the top of the grey box is traded to, we need to get away quickly from that area. Otherwise, we will consolidate or move back into a bullish stance.

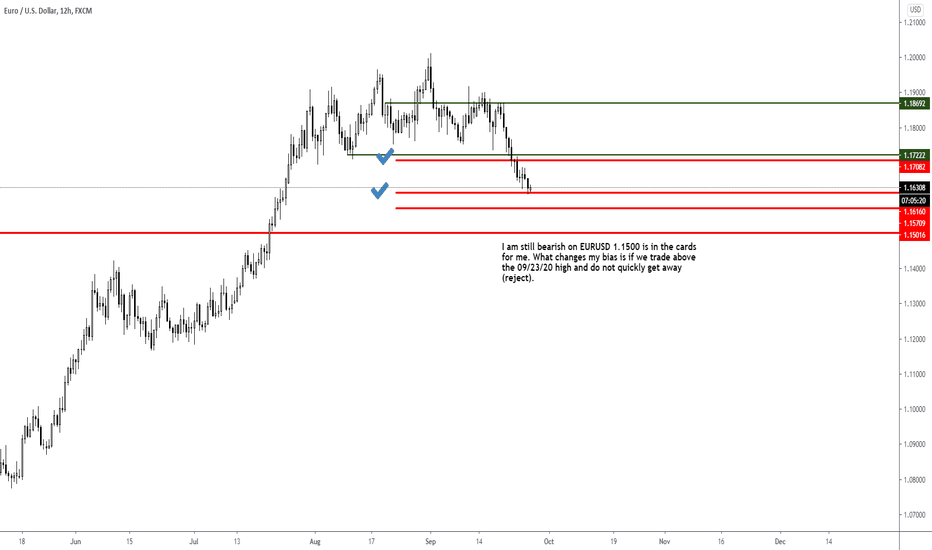

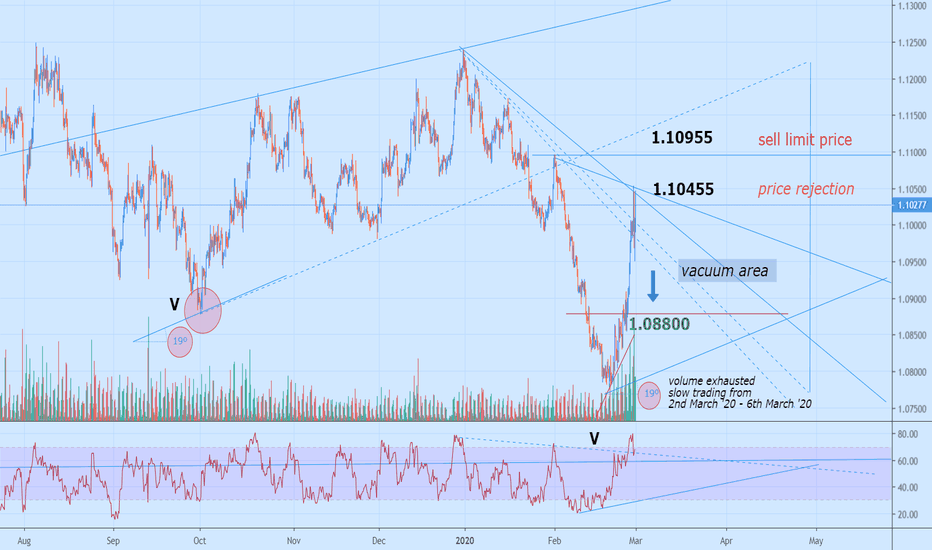

EURUSD Bearish To 1.08800| 2nd March 2020What you see is EURUSD on H4 timeframe. The price will bearish to 1.08800. You can take any profit above 1.08800. The volatility this week slow regarding towards the fundamental week. Market will be slow, choppy and spiky upon 2nd March 2020 - 6th March 2020. Heading towards the payroll report on 6th.

This will be the correction towards the market as EURUSD will going to make the uptrend as soon as it clear by this week. I am looking the EURUSD to reach 1.12000 in the future.

While this happen, please look toward the small timeframe as this post applied. Will be making a new post as soon as the price reached 1.08800.

Please like, share and subscribe if you like this prediction prophecy.

Regards,

Zezu Zaza