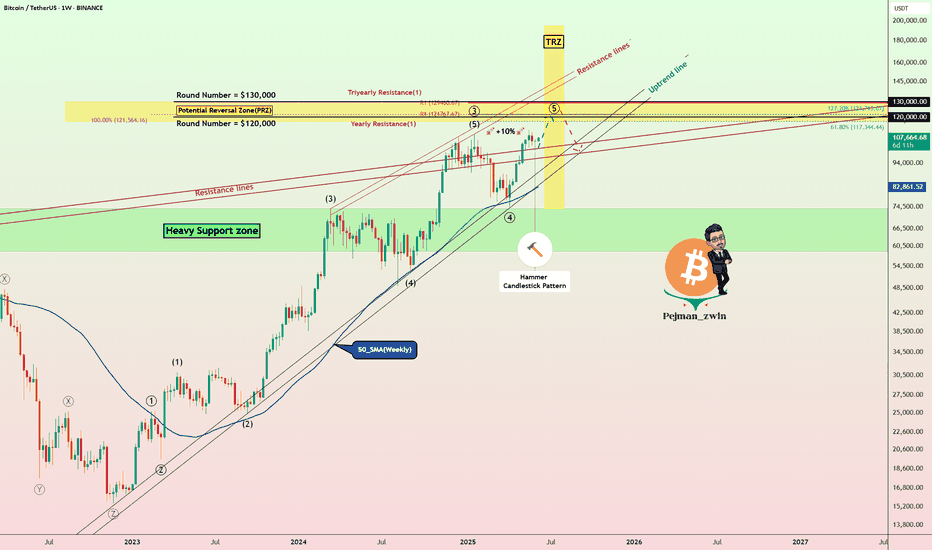

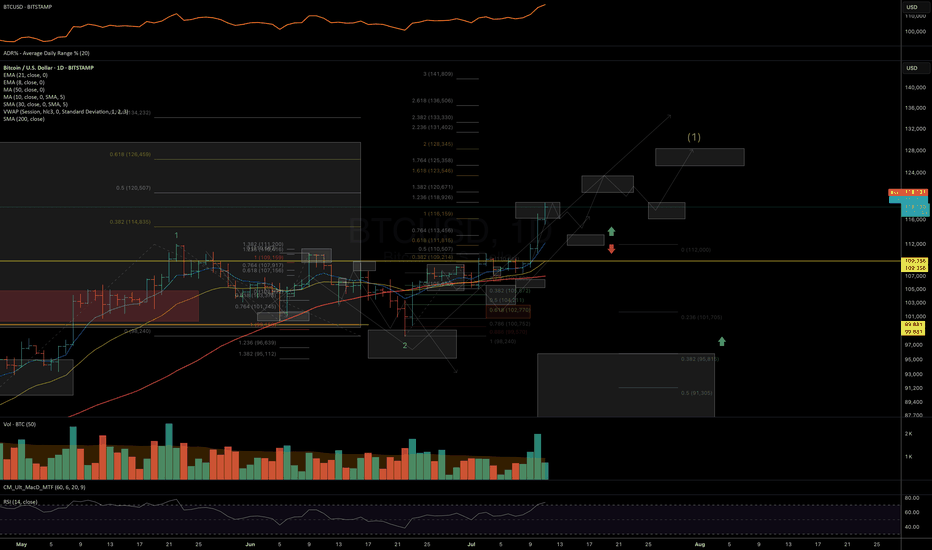

Bitcoin’s Final Wave & Time Reversal Zone _ New ATH Loading?Today, I want to analyze Bitcoin ( BINANCE:BTCUSDT ) on the weekly time frame and answer these questions :

Can Bitcoin create a new All-time High(ATH) or not!?

At what price range can Bitcoin's uptrend end!?

When can we expect the uptrend to end!?

Please stay with me.

Bitcoin appears to have managed to break the Resistance lines , although we saw a fake break a few months ago , and it also appears to have a Hammer Candlestick Pattern in the previous weekly candle , which could signal the completion of Bitcoin's pullback to the Resistance lines(broken).

In terms of time , if we want to analyze the Bitcoin chart and look at Bitcoin's past, in general, the months of June(Average=-0.13%/Median=+2.20%) and especially July(Average=+7.56%/Median=+8.90%) have been among the most productive months for Bitcoin , and the months of August(Average=+1.75%/Median=-8.04%) and September(Average=-3.77%/Median=-4.35%) were the months when Bitcoin had a correction . Technical analysis tools show the end of the upward trend and the beginning of Bitcoin's correction at the Time Reversal Zone(TRZ=June 23 to August 4) .

In terms of Elliott Wave theory , Bitcoin appears to be completing the main wave 5 , as the main wave 3 was extended .

I expect Bitcoin to trend higher(+10%) in the coming weeks and create a new ATH . New ATH could be created in the Potential Reversal Zone(PRZ) and TRZ , and then we can wait for the start of the main correction .

What do you think about Bitcoin’s future movement? Can Bitcoin create a new ATH? When and at what price?

Note: If Bitcoin falls below $100,000, we should expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), weekly time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

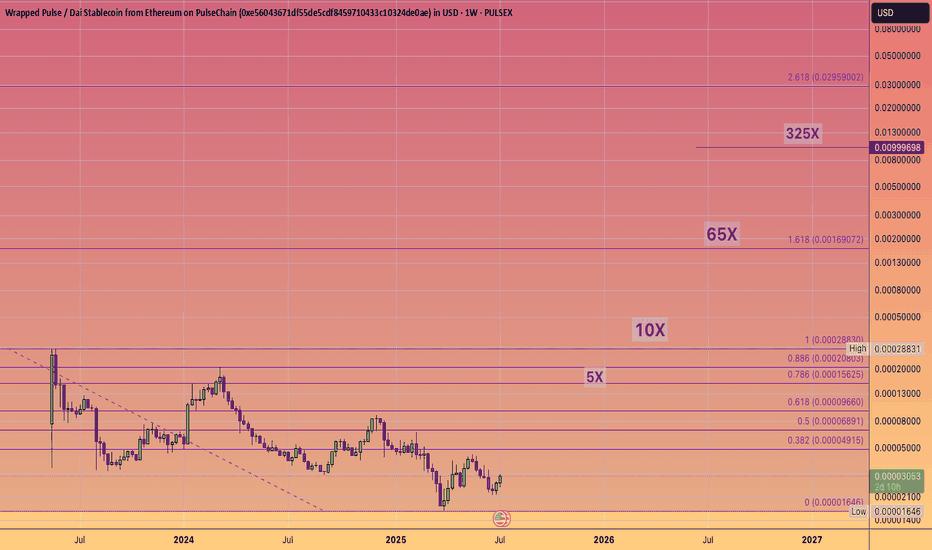

Fibonacci

If Pulsechain reaches a penny, it would = a 325XOr around $165 billion in user-based valuation, excluding the significant portion of coins held by the founder.

It's certainly a long shot, and it would probably depend on Ethereum's price reaching well into the teens

(which, as you know, I strongly support).

Thus, it is definitely within the realm of possibility considering the low initial user base and the potential influx of individuals who will join EVMs in the upcoming years.

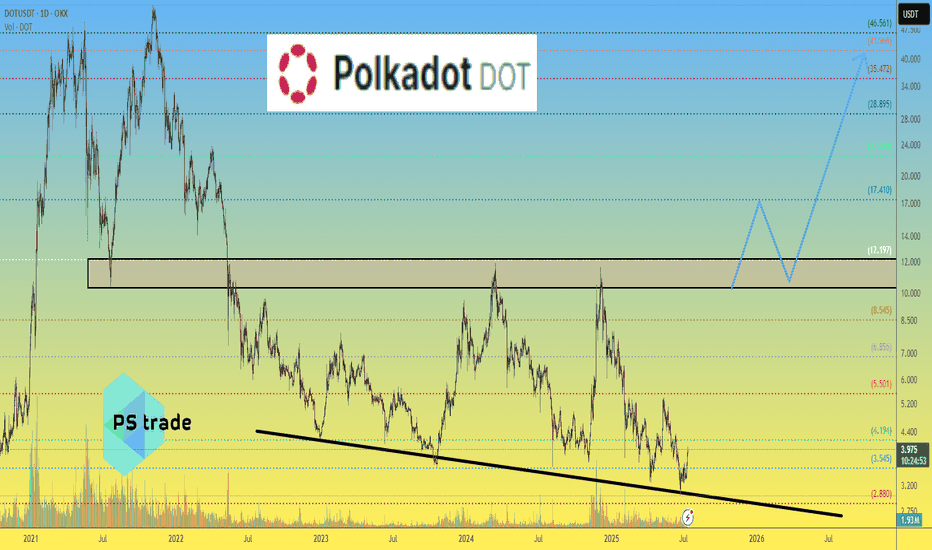

Polkadot DOT price analysisAt night, only CRYPTOCAP:BTC impressively updated its ATH, while the rest of the altcoins... haven't really woken up yet after many months, if not years, of hibernation.

For example, if memory serves, in 2020, CRYPTOCAP:DOT was buying at $1.7-1.9 during the presale (please correct me in the comments if I'm wrong). Now, the price of OKX:DOTUSDT is not that far from the initial price.

🤪 It seems that no one believes in the ultra-fashionable #Polkadot “parachain” fairy tales anymore, and that is why if the price of #DOT rises again to $11-12, it will be super happiness and luck.

✈️ Well, dreams that #DOTUSD will cost $42 again can only be included after the price has firmly consolidated above $12, and with the current price dynamics, this is something at the level of fantasy.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

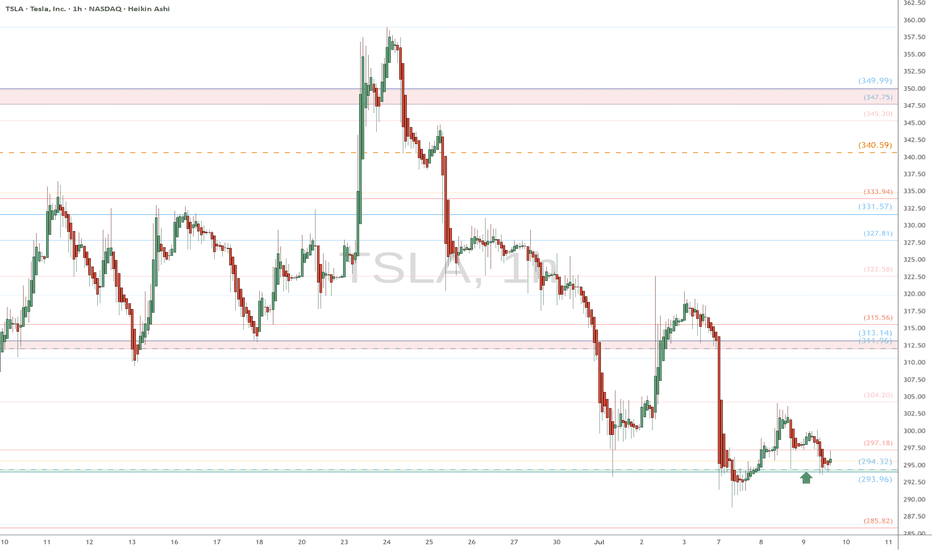

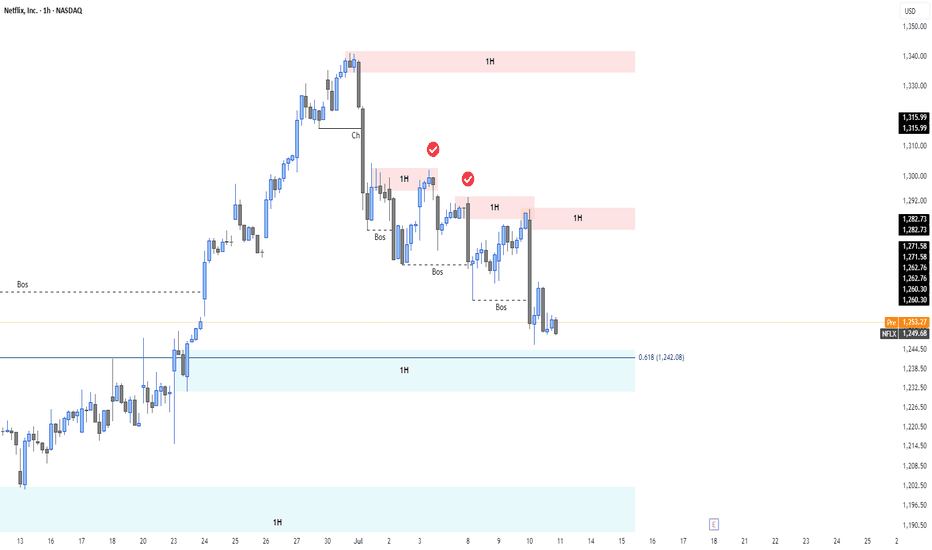

NFLX Bear Call Spread Near Max Profit – Watching 61.8% Fib Zone📉 I'm currently holding a Bear Call Spread 1300/1280 expiring on Jul 18. After multiple Breaks of Structure (BOS) and strong rejection from 1300, price is trending toward a key 1H demand zone near the 61.8% Fibonacci retracement (1242).

📊 Technical Context:

Bearish CHoCH + BOS confirms short-term trend reversal

Clear rejection from 1280–1300 supply

1242 = strong confluence: Fib + demand zone

🎯 Plan:

Hold the spread close to expiration for max profit

Close before earnings on Jul 17 to avoid volatility

If price shows strength at 1242, I may flip bias and look for a bull call spread post-earnings

🔔 TradingView Alerts:

1242: “Watch for bullish reaction at demand zone”

1278: “Rebound in progress – reassess post-earnings”

📌 This is a two-stage plan: secure gains on the short side, then prepare for potential upside.

➡️ Follow me for more structured trade ideas based on price action, options, and macro timing.

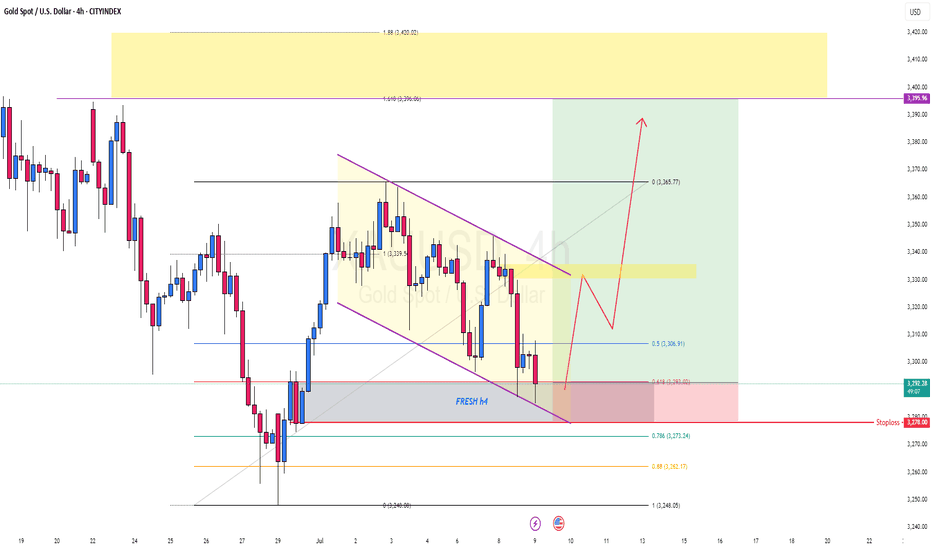

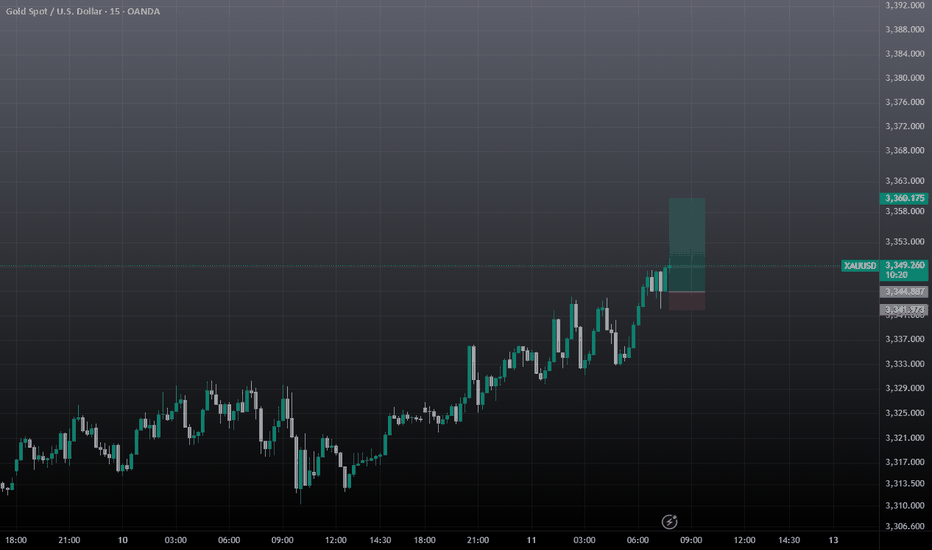

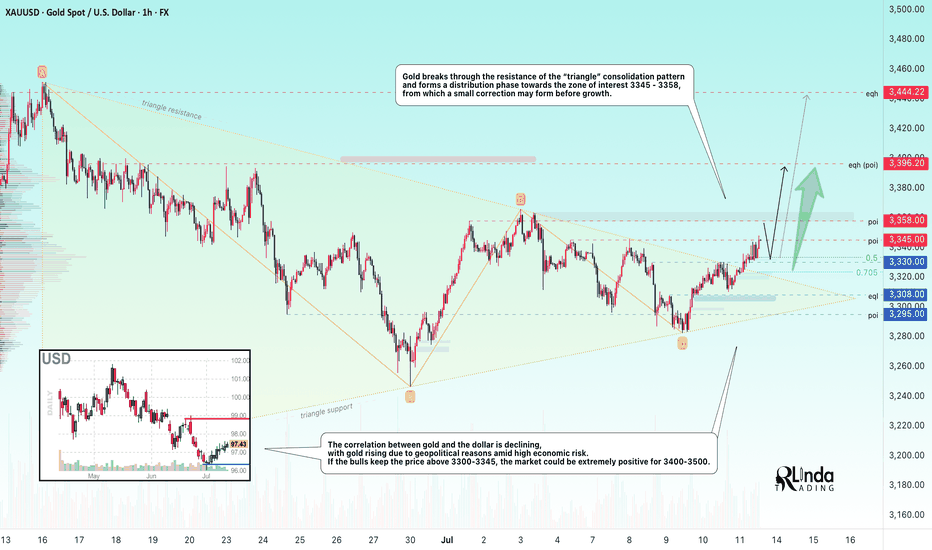

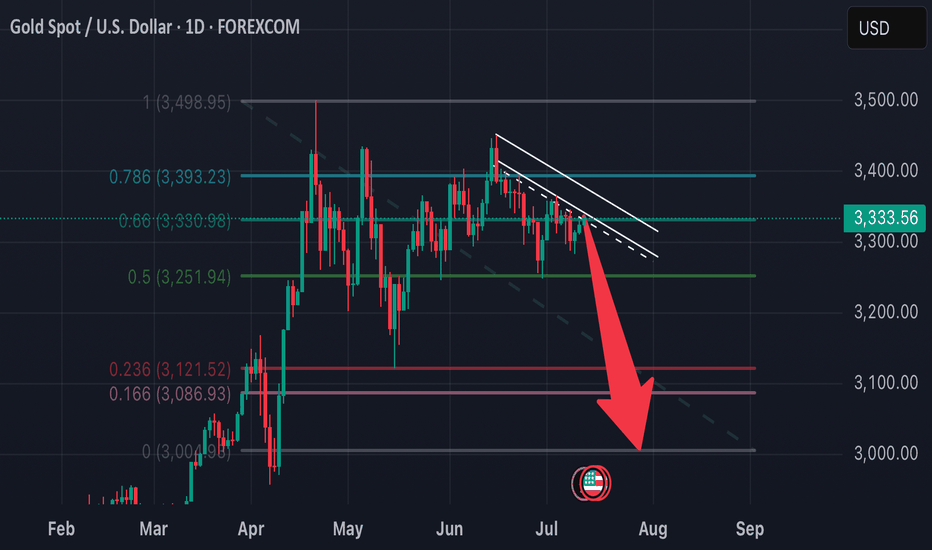

GOLD → Distribution. There is potential for growth to 3450–3500FX:XAUUSD breaks through consolidation resistance and forms a distribution pattern. A breakout of 3345-3358 could lead to another rally amid high economic risks...

Gold is rising for the third day in a row amid growing concerns about new tariffs announced by Trump. He threatened to impose tariffs on Canada and most of its trading partners, as well as the EU. Despite the strengthening of the dollar, demand for gold remains strong due to uncertainty and expectations for US inflation data next week. Investors are cautious ahead of CPI and the Fed's possible response

The correlation between gold and the dollar is declining, with gold rising due to geopolitical reasons amid high economic risks.

If the bulls keep the price above 3300-3345, the market could be extremely positive for 3400-3500.

Resistance levels: 3345, 3358

Support levels: 3330, 3308

Gold has broken through the resistance of the “triangle” consolidation pattern and is forming a distribution phase towards the zone of interest 3345 - 3358, from which a small correction may form before growth. Since 3345 is an intermediate level, the focus is on 3358. I do not rule out the possibility of a long squeeze of the support levels 3330, the triangle support, and 3310 before the growth continues.

Best regards, R. Linda!

[UPD] BTC / ETH / SOL / XRP / HYPE / SUPER / FLOKIUpdating my view on intermediate trend structures I am tracking in CRYPTOCAP:BTC , CRYPTOCAP:ETH , CRYPTOCAP:SOL , CRYPTOCAP:XRP , GETTEX:HYPE , BSE:SUPER and SEED_DONKEYDAN_MARKET_CAP:FLOKI highlighting key support and resistance zones to watch in the coming sessions

Charts featured in the video:

BTC

ETH

XRP

SOL

HYPE

SUPER

FLOKI

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking — feel free to ask in the comments (just don’t forget to boost the idea first 😉).

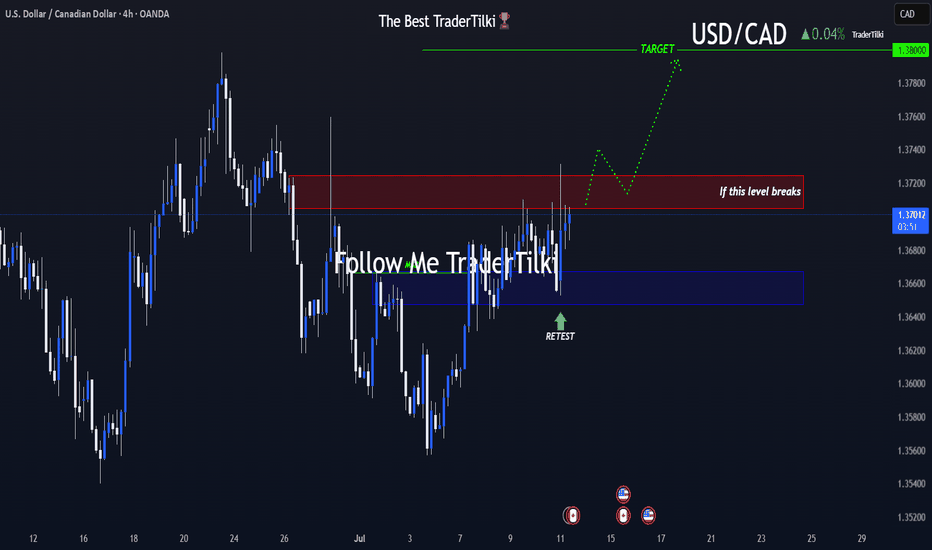

USDCAD's Opportunity Bell Is Ringing — Don’t Miss Out!Hey there, my valued friends!

I’ve prepared a fresh USDCAD analysis just for you.

📌 If the 1.37245 level breaks, the next target will be 1.38000.

Every single like you send my way is the biggest motivation behind sharing these analyses.

🙌 Huge thanks to each and every one of you who supports me!

Would you like to add a visual or a catchy headline to boost engagement even more? I can help with that too.

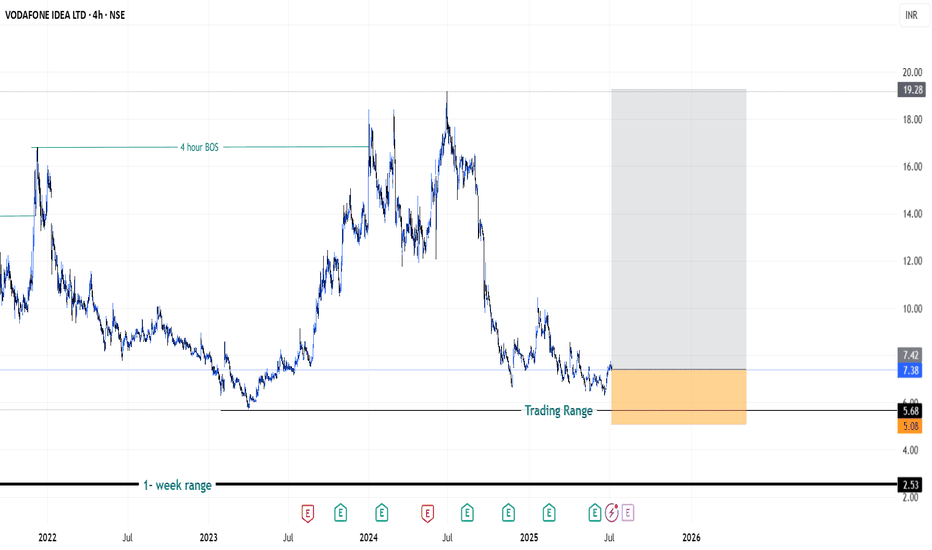

VI Stock(India) Looking for bullish Rally! {5/07/2025}Educational Analysis says that VI Stock (India) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

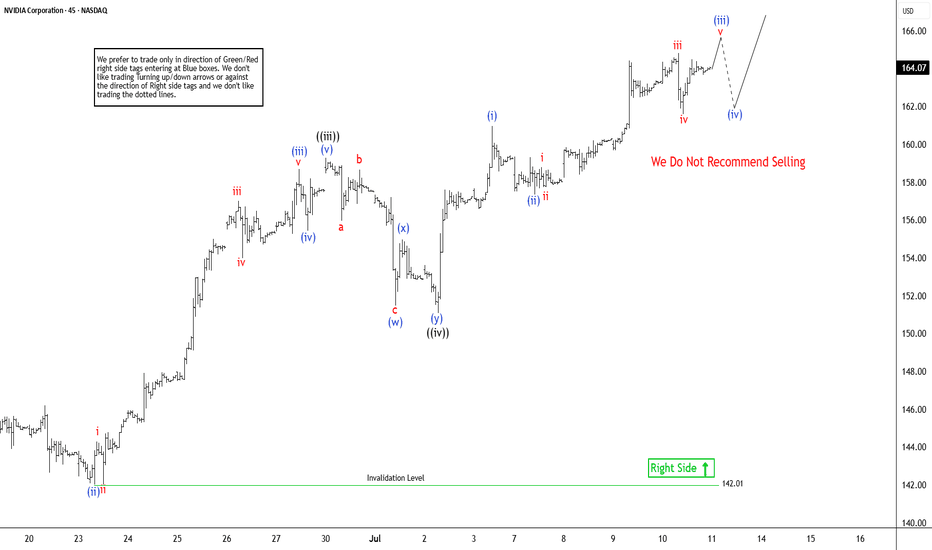

NVIDIA ($NVDA) Elliott Wave Outlook: Larger Pullback on the HoriNvidia (NVDA) continues its remarkable ascent, consistently reaching new all-time highs and reinforcing a robust bullish outlook. The ongoing rally, which began from a significant low on April 7, 2025, remains structured as an impulsive wave pattern, indicative of strong upward momentum. However, despite the potential for further short-term gains, the cycle appears mature. This suggests a larger-degree pullback could be imminent. Investors should exercise caution when considering chasing this rally in shorter time frames, as the risk of a corrective move grows.

In the short term, the cycle initiated from the June 2 low is progressing as a lower-degree impulse. From this low, wave ((i)) peaked at $144, followed by a corrective pullback in wave ((ii)) that concluded at $137.88. The stock then surged in wave ((iii)) to $159.42. The subsequent wave ((iv)) correction unfolded as a double-three structure, with wave (w) ending at $151.49, wave (x) at $154.98, and wave (y) completing at $151.10, finalizing wave ((iv)). Currently, Nvidia is advancing in wave ((v)), exhibiting a five-wave subdivision. Within this, wave (i) of ((v)) reached $160.98, with a minor pullback in wave (ii) concluding at $157.34. As long as the pivotal low at $142.01 holds, any near-term pullbacks are likely to attract buyers in a 3, 7, or 11-swing pattern, supporting further upside potential. This technical setup underscores Nvidia’s strength but highlights the need for prudent risk management.

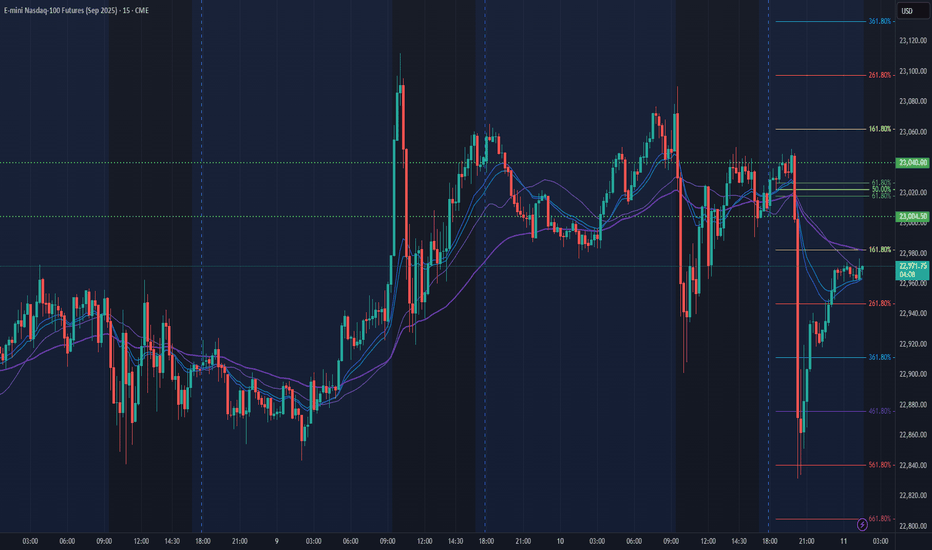

NQ Power Range Report with FIB Ext - 7/11/2025 SessionCME_MINI:NQU2025

- PR High: 23039.75

- PR Low: 23004.50

- NZ Spread: 78.75

No key scheduled economic events

High 200+ range volatility during Asian hours

Session Open Stats (As of 1:35 AM 7/11)

- Session Open ATR: 301.79

- Volume: 48K

- Open Int: 268K

- Trend Grade: Neutral

- From BA ATH: -0.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

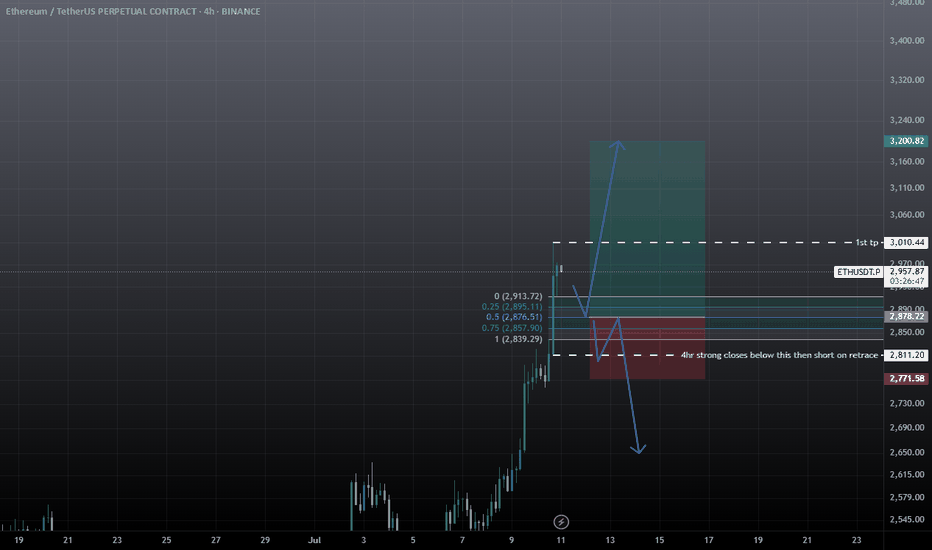

ETH Long / Buy SetupAs of many times mentioned that, will short eth above 3k or 3k, but it still shows Bullish momentum no sign of weakness, maybe this entry triggers during weekend due too low volume, search for ifvg, if any 1D or 4hr Bullish fvg truns into bearish ifvg then will take short on ETH. For now will take long with SL and proper risk management.

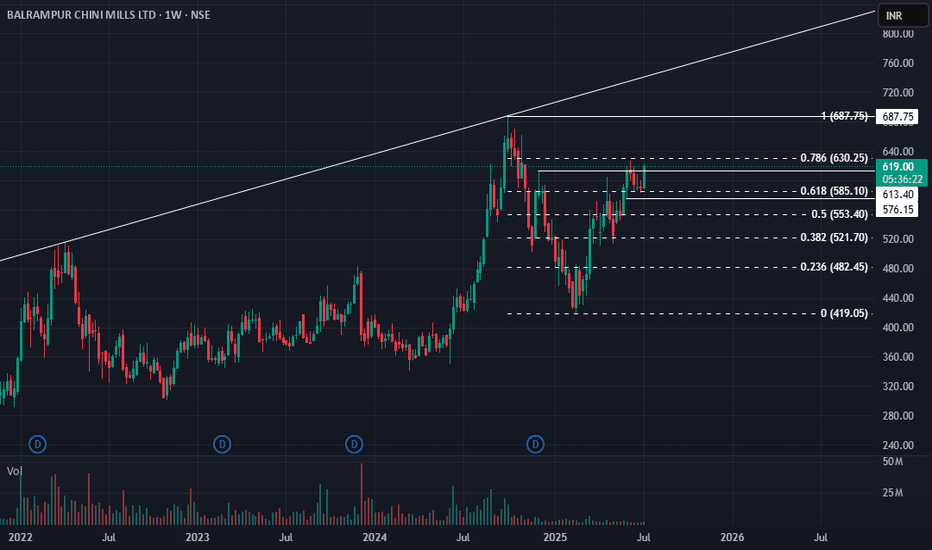

Balrampur Chini: Eyeing All-Time High! 🚀 Balrampur Chini: Eyeing All-Time High! 🚀

📉 CMP: ₹619

🔒 Stop Loss: ₹575

🎯 Target: ₹700

🔍 Why Balrampur Chini Looks Promising?

✅ Technical Strength: Trading above 61.8% Fibonacci level post-correction, indicating strong support

✅ Consolidation Base: Tight range between ₹615–₹580 signals accumulation before a potential breakout

✅ Upside Potential: Breakout from current range could take the stock to all-time high levels

💡 Strategy & Risk Management:

📈 Staggered Entry: Accumulate in phases as the market remains sideways; avoid expecting sharp moves

🔒 Strict SL: Maintain stop loss at ₹575 to manage risk effectively

📍 Outlook: Strong base formation with Fibonacci support makes Balrampur Chini an attractive swing opportunity towards ₹700.

📉 Disclaimer: Not SEBI-registered. Please do your own research or consult a financial advisor before investing.

#BalrampurChini #SugarStocks #TechnicalAnalysis #BreakoutTrade #SwingTrading #StockMarketIndia #InvestmentOpportunities

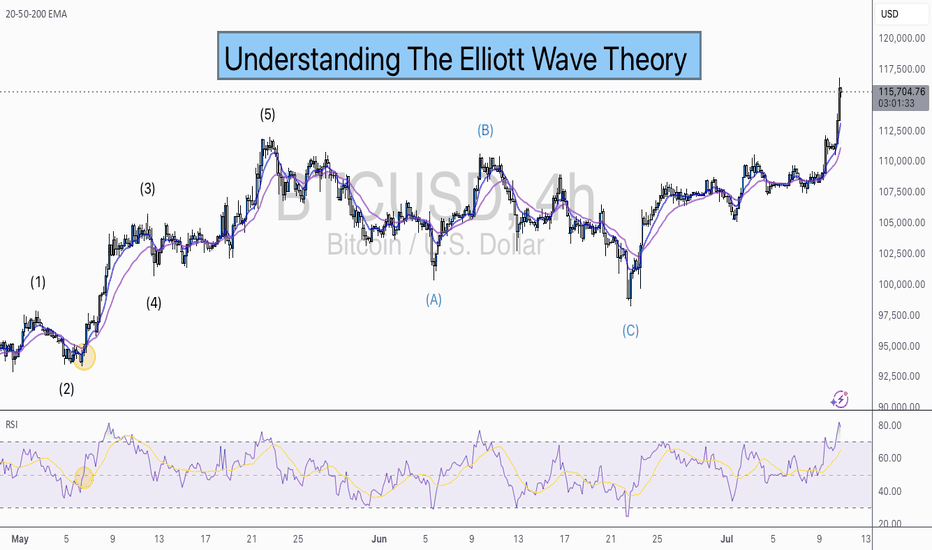

Understanding Elliott Wave Theory with BTC/USDIntroduction to Elliott Wave Theory:

Elliott Wave Theory is a popular method of technical analysis that seeks to predict the future price movement of financial markets. Developed by Ralph Nelson Elliott in the 1930s, the theory is based on the idea that market movements follow a repetitive pattern, driven by investor psychology.

At the core of Elliott’s theory is the idea that markets move in a 5-wave pattern in the direction of the trend, followed by a 3-wave corrective pattern. These waves can be seen on all timeframes and help traders identify potential entry and exit points in the market.

Key Concepts of Elliott Wave Theory:

1. Impulse Waves (The Trend)

2. These are the waves that move in the direction of the overall trend. They are labeled 1, 2, 3, 4, 5 and represent the price movement in the main direction of the market.

* Wave 1: The initial move up (or down in a bearish market). I like to mark up the first wave how I do my Fibs, from the point where price showed a major impulse.

* Wave 2: A correction of Wave 1 (it doesn’t go lower than the starting point of Wave 1).

* Wave 3: The longest and most powerful wave in the trend.

* Wave 4: A smaller correction in the direction of the trend.

* Wave 5: The final push in the direction of the trend, which can be shorter and weaker than Wave 3.

3. Corrective Waves (The Pullbacks)

4. After the five-wave impulse, the market enters a corrective phase, moving against the trend. This corrective phase is generally a 3-wave pattern, labeled A, B, C:

* Wave A: The initial correction, typically smaller than Wave 3.

* Wave B: A temporary move against the correction (it often confuses traders who think the trend has resumed).

* Wave C: The final move against the trend, usually the strongest and most aggressive.

How to Implement Elliott Wave on BTC/USD:

Let’s break down how you can apply the Elliott Wave Theory to BTC/USD using a simple example.

1. Identify the Trend

2. Start by identifying the current market trend for BTC/USD. Are we in an uptrend or downtrend? This will determine whether you’re looking for a 5-wave impulse up (bullish) or down (bearish).

3. Locate the Waves

4. Look for the five-wave structure in the trend direction. Once you identify a potential impulse move, label the waves accordingly:

* Wave 1: A new uptrend starts.

* Wave 2: A small pullback (usually less than the size of Wave 1).

* Wave 3: A significant surge in price, often the most volatile.

* Wave 4: A smaller pullback or consolidation.

* Wave 5: The final push higher, which might show signs of exhaustion.

5. Corrective Phase

6. After completing the 5-wave impulse, expect a corrective 3-wave pattern (A, B, C). These corrections typically last longer than expected and can often confuse traders.

* Wave A: Price starts to reverse.

* Wave B: A retracement that may confuse traders into thinking the trend is resuming.

* Wave C: A strong pullback that brings the price even lower.

7. Use Fibonacci Levels as confluence

8. One of the most powerful tools in Elliott Wave analysis is Fibonacci retracement levels. You can use these to predict potential levels where Wave 2 and Wave 4 could end, or where Wave C might complete the correction. Common retracement levels are 38.2%-50% for Wave 4, and 50-61.8% For Waves 2 and B but keep in mind, these wave can retrace up to 100% before the wave analysis becomes invalid. But ideally these points are where you look to make an entry.

Wave 2 Example:

This one hit the golden spot (0.5-0.618) perfectly and continued to push upward.

Wave B and C Example:

This example hit closer to the 0.786 level which is also a key level for retracement.

Wave 4 Example:

This one hit the golden spot (0.382-0.5) for Wave 4 perfectly before continue the bullish momentum.

I try to use the RED levels below (1.1 and 1.2) as my invalidation (Stop Loss) levels and the GREEN levels (-0.27 and -0.618) as my Take Profit levels. Depending on your goals you can also use Fib Levels 0.236 and 0 as partial Take Profit levels.

9. Confirm with Indicators

10. To validate your Elliott Wave counts, use other indicators like the RSI (Relative Strength Index), MACD, or Moving Averages. For example, a Wave 3 might occur when the RSI is above 50, indicating strength in the trend.

In this example you can see the RSI cross the 50 threshold and the 3rd Wave form.

Continuation after the Wave is complete:

Tips for Trading with Elliott Wave Theory:

* Stay Flexible: Elliott Wave Theory is not set in stone. If the market doesn’t follow the expected pattern, adjust your wave counts accordingly.

* Don’t Rely on One Timeframe: A 5-wave structure on one timeframe may be part of a larger wave pattern on a higher timeframe. Always analyze multiple timeframes.

* Wave Personality: Waves don’t always look the same as stated earlier. Wave 2 can retrace up to 100% of Wave 1 and Wave 4 should generally not overlap Wave 1 or this may invalidate the Wave structure.

* Risk Management: Always use proper risk management techniques. No theory is perfect, so make sure you have a stop-loss in place to manage your risk.

Conclusion: Using Elliott Wave Theory on BTC/USD:

The Elliott Wave Theory can be a powerful tool for analyzing and forecasting price movements. By identifying the 5-wave impulse and 3-wave corrective patterns, you can gain insights into potential market direction. Just remember to use it alongside other tools and indicators for confirmation, and don’t forget to manage your risk.

As you apply it to BTC/USD or any other asset, remember that the market doesn’t always follow the "ideal" patterns, and flexibility is key. Practice on different timeframes, refine your skills, and use the theory as a part of your overall trading strategy.

Final Thoughts:

If you're just starting, don't get discouraged if you miss a wave or two. Trading is a journey, and with patience and practice, you'll begin to spot these patterns more naturally. Whether you’re analyzing Bitcoin's price action or any other asset, Elliott Wave Theory can give you a deeper understanding of market psychology.

Good Luck and Happy Trading!

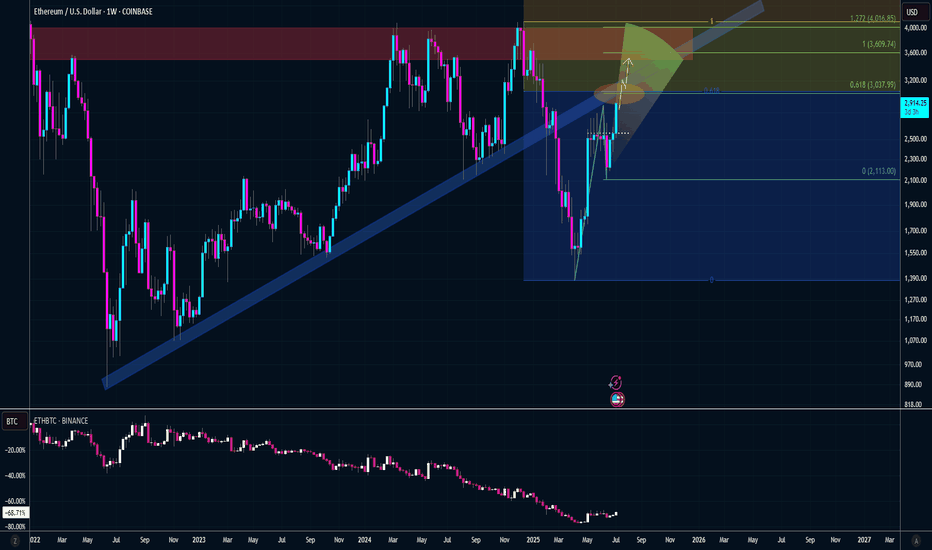

GO LONG ETH BEFORE "CRYPTO WEEK"Next week is "Crypto Week" in the U.S. House of Representatives. The House will consider the CLARITY Act, the Anti-CBDC Surveillance State Act, and the GENIUS Act.

Bill Helps Ethereum By...

CLARITY Act Protecting decentralized infrastructure from U.S. blacklists

Anti-CBDC Act Preserving demand for decentralized stablecoins, defending privacy

GENIUS Act Encouraging gov use of public blockchains like Ethereum

GBPUSD set for a move lower?Table is set! The GBPUSD is in a rising wedge, with the test (today) of the 61.8% Fibonacci level once again and now ascending wedge support and horizontal support as well. A break of the 1.3530 would put the 1.3440 breakout point (high from Sept 2024) and a possible breakdown back below the 1.3370 level. Bulls should be cautious with this technical setup.

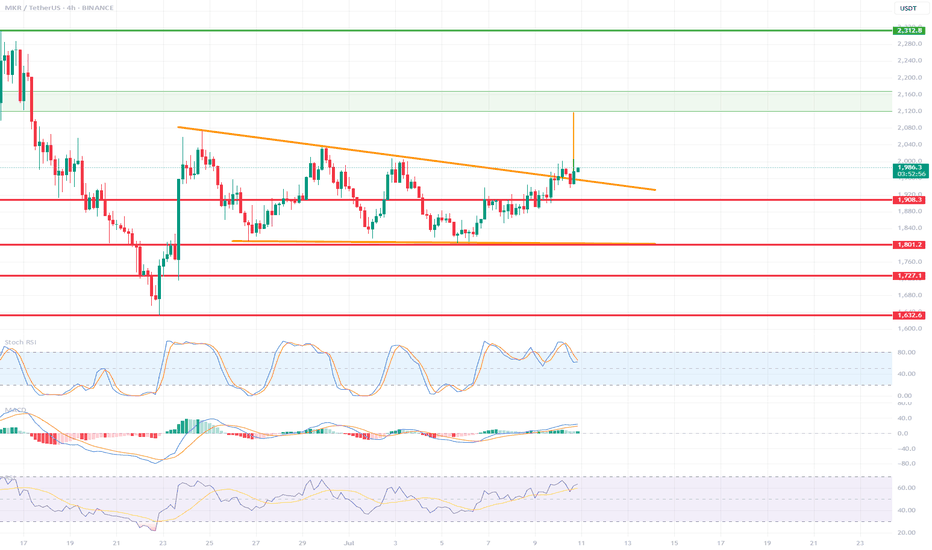

MKR/USDT 4H Chart🔍 1. Technical Pattern:

The chart shows a descending wedge (orange lines) that has broken out upward.

The breakout occurred on increasing volume (a signal of bullish strength).

The price is currently trading above a resistance line, which is now acting as support (~1980 USDT).

📊 2. Support and Resistance Levels:

Support (red lines):

1903 USDT – local consolidation support.

1801 USDT – strong support at the previous bottom.

1727 and 1632 USDT – fallback zones in case of strong declines.

Resistance (green and blue lines):

2120 USDT – first target after the breakout.

2168 USDT – another strong resistance from the previous consolidation.

2312 USDT – high resistance, potential target if the uptrend continues.

📈 3. Indicators:

🔹 Stochastic RSI:

Close to the overbought zone, but not yet giving a sell signal.

A short consolidation or correction may occur in the coming hours.

🔹 MACD:

The MACD line is above the signal and the histogram is still rising – a buy signal.

No signs of weakening momentum.

🔹 RSI:

The RSI is rising, but not yet in the overbought zone (>70).

Shows the strength of the trend, but there is room for further upward movement.

🧠 Summary and scenarios:

✅ Bullish scenario:

If the price remains above 1980 USDT, the next targets are:

2120 USDT

2168 USDT

Potentially 2312 USDT with continued demand

⚠️ Bearish scenario (less likely at this time):

If the price returns below 1980 USDT and does not regain this level:

Possible return to 1903 or lower (1801 USDT).

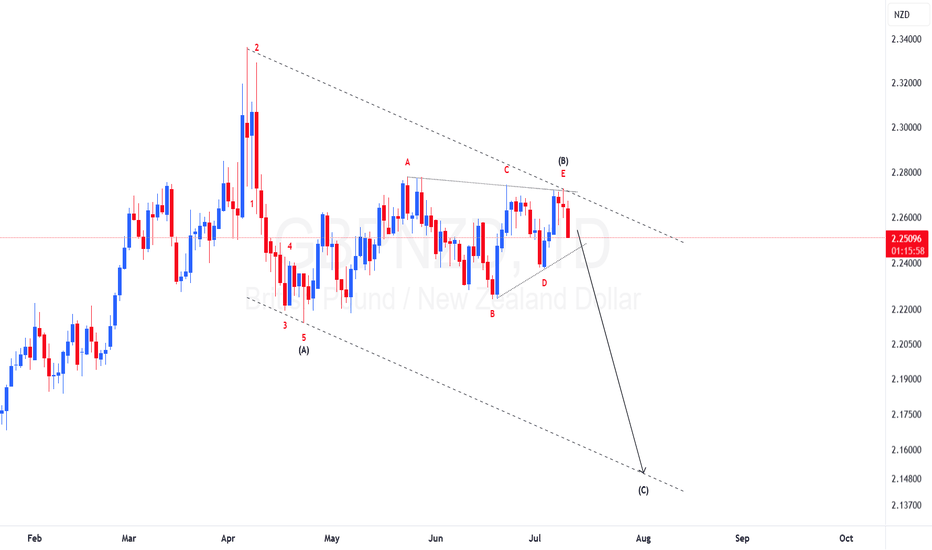

GBPNZD Elliot waves forecastPrice made impulsive move to the downside followed with a triangle correction, since triangles will only appear in 4th wave and as wave B or X in corrections then I am expecting price to continue to drop to complete this zigzag correction before resuming bullish momentum. To take advantage of the bearish move one should find area of resistance to short the market.

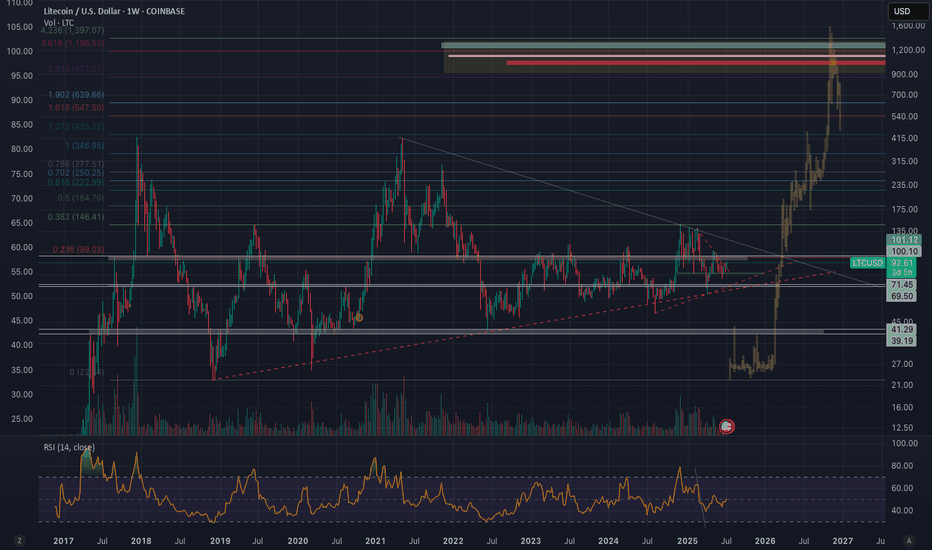

Litecoin to $1100 (12X) In This Coming AltseasonBased on tried and true fractals, multi-fib confluences, and historical price action, Litecoin is poised to hit prices between $900-1500 this cycle. The multi-fib confluences are pointing to $1100-1200 range as the most likely target. This is expected over the next 6-12 months if things continue to play out how I am expecting. As of today SEC approval of a LTC ETF is imminent but yet to be actualized.

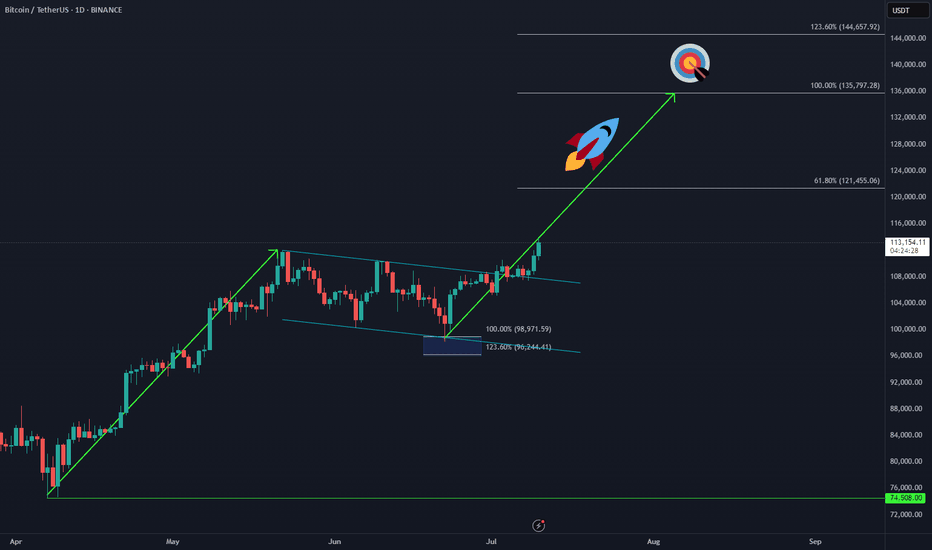

Bitcoin Makes New ATH – Next Sequence in Play 🚀 CRYPTO:BTCUSD has officially broken into new all-time highs, confirming the next bullish sequence is underway.

The upside projection now opens toward the $135K–$144K zone, aligning with long-term Fibonacci extensions and cycle projections.

📌 As always, it won’t be a straight line—expect step-by-step progress, with consolidations and pullbacks along the way. But the structure remains bullish, and the path is unfolding.