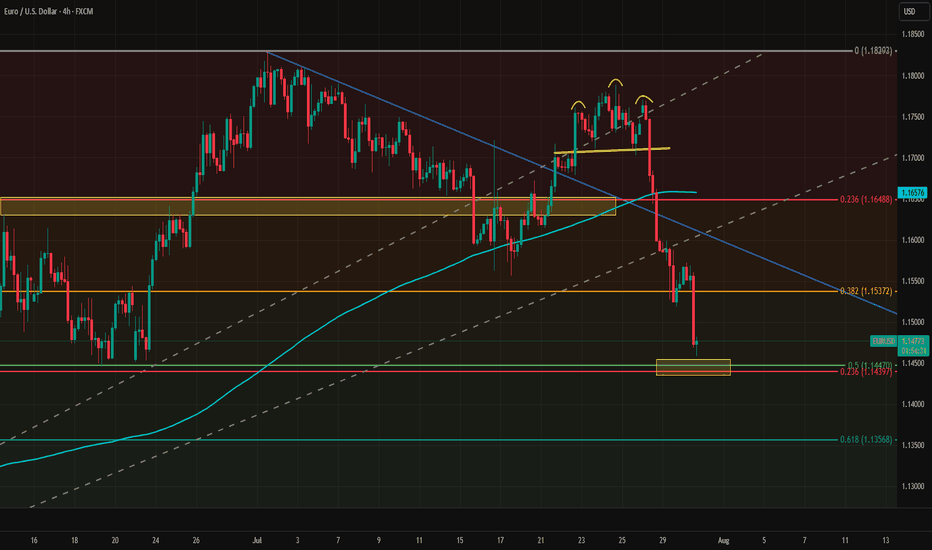

EURUSD Tests Key Support Ahead of FOMCFollowing the strong U.S. GDP data, EURUSD dropped to the 1.1450 support level. This area is significant, as it marks the convergence of the 23.6% retracement from the January–July move and the 50% retracement from the May–July move.

While the FOMC decision will ultimately shape the direction, from a technical perspective, a long position may offer a favorable risk/reward setup at current levels. A stop just below the key support would help manage downside risk.

Fibonacci

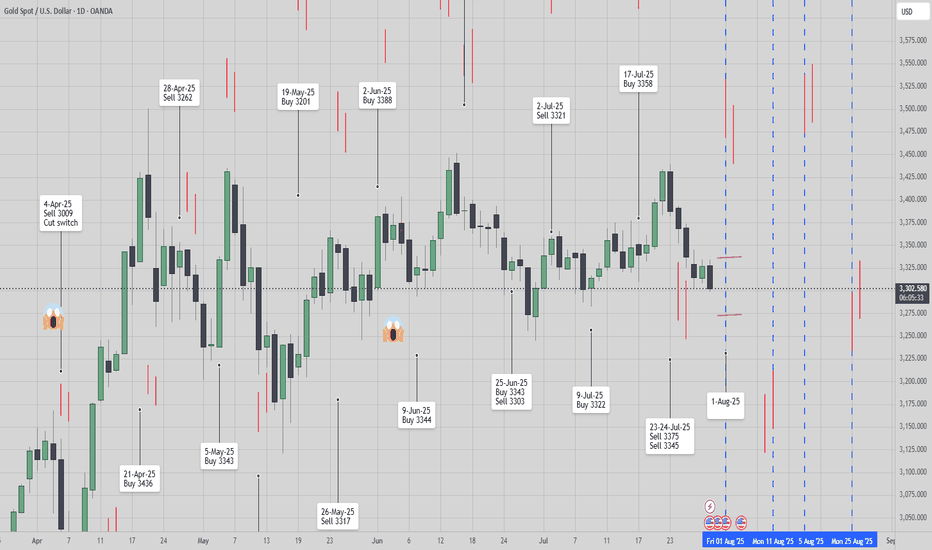

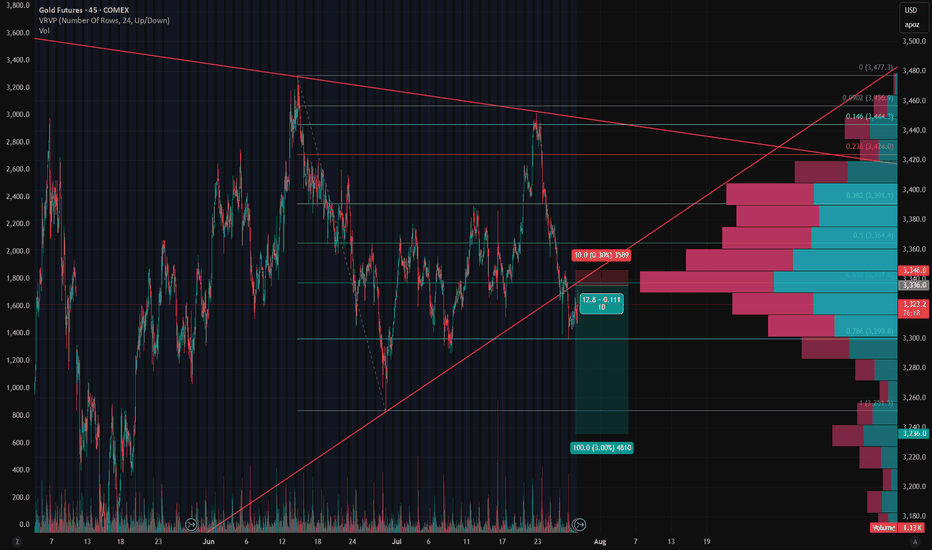

[ TimeLine ] Gold 31 July 2025📆 Today’s Date: Wednesday, July 30, 2025

📌 Upcoming Signal Dates:

• July 31, 2025 (Thursday) — Single-candle setup

• July 31–August 1, 2025 (Thursday–Friday) — Two-candle combined range

🧠 Trading Outlook & Notes

✅ Gold has recently dropped sharply from 3439 to 3298, and current conditions suggest this bearish momentum may continue.

✅ I’ll be actively trading both the July 31 and July 31–August 1 setups as part of my ongoing strategy testing and live analysis.

✅ This method and timing structure can also be applied to other assets like BTC, the US Index, and various commodities.

⚠️ For those taking a more cautious approach, it’s absolutely okay to skip the single-candle setup on July 31 and wait for the more confirmed 2-day range setup (July 31–August 1).

📋 Execution Guidelines

🔹 Range Identification:

• Let the Hi-Lo range of the chosen candle(s) form completely.

• Purple lines will mark these ranges on the chart.

• After the daily close, charts will be updated to include a 60-pip buffer, Fibonacci zones, and relevant indicators.

🔹 Entry Conditions:

• Trades are triggered only if price breaks above/below the full range, including the buffer zone.

🔹 Risk Management – Recovery Logic:

• If the Stop Loss is triggered, the trade is exited or switched, and the next valid breakout setup will use a doubled lot size to attempt recovery.

📉📈 Chart Snapshot

🔗 Paste this in TradingView: TV/x/fykxBG6w/

📌 Stick to the plan, follow the system, and let the chart lead the way.

🛡️ Capital protection comes first — always manage your risk.

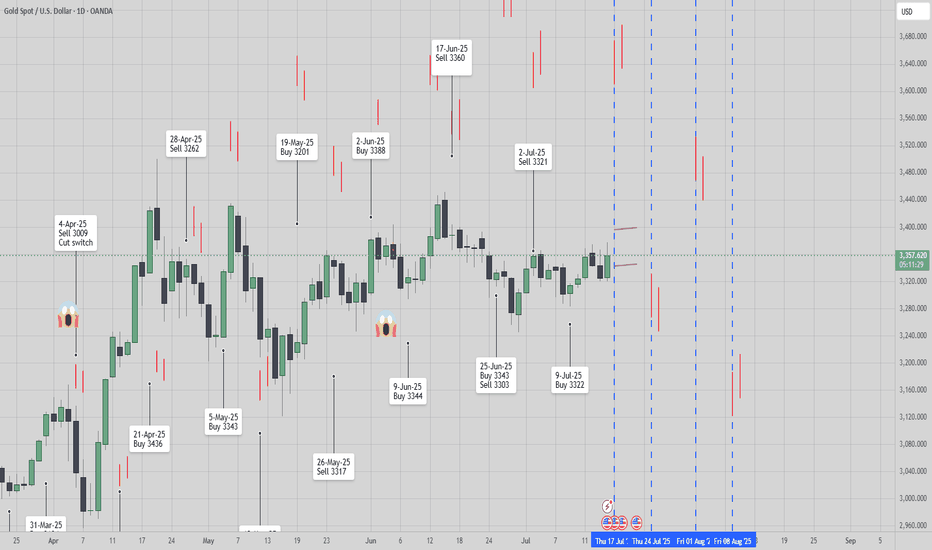

[ TimeLine ] Gold 17 July 2025📆 Today is Wednesday, July 16, 2025

📌 Upcoming Signal Dates:

• July 17, 2025 (Thursday) — Single-candle setup

• July 17–18, 2025 (Thursday–Friday) — Two-candle combined range

🧠 Trading Plan & Notes

✅ Gold recently moved in a wide range between 3365 to 3282, and by the time this signal is published, we’re seeing signs of a strong reversal.

✅ I will be trading both the July 17 and July 17–18 signals as part of my ongoing live research and strategy development.

✅ The same timeframe and signal approach also applies to other instruments such as BTC, US Index, and several commodity pairs.

⚠️ If you’re feeling cautious or risk-averse, it’s perfectly fine to skip the July 17 single-candle setup and wait for the 2-day range (July 17–18) for added confirmation.

📋 Execution Plan

🔹 Range Formation:

• Wait for the Hi-Lo range from the selected candle(s) to fully form.

• Ranges will be marked with purple lines on the chart.

• After market close, the chart will be updated with 60-pip buffer zones, Fibonacci retracement levels, and supporting indicators.

🔹 Entry Trigger Rule:

• Entry only if price breaks out beyond the defined range, including the 60-pip buffer.

🔹 Risk Management – Recovery Strategy:

• If Stop Loss (SL) is hit, the trade will be cut/switch, and position size doubled on the next valid breakout signal to aim for recovery.

📉📈 Chart Reference

🔗 Copy & paste into TradingView: TV/x/6x8VJKs1/

📌 Stay disciplined, trust the process, and let the chart guide your decisions.

🛡️ Manage your risk — protect your capital.

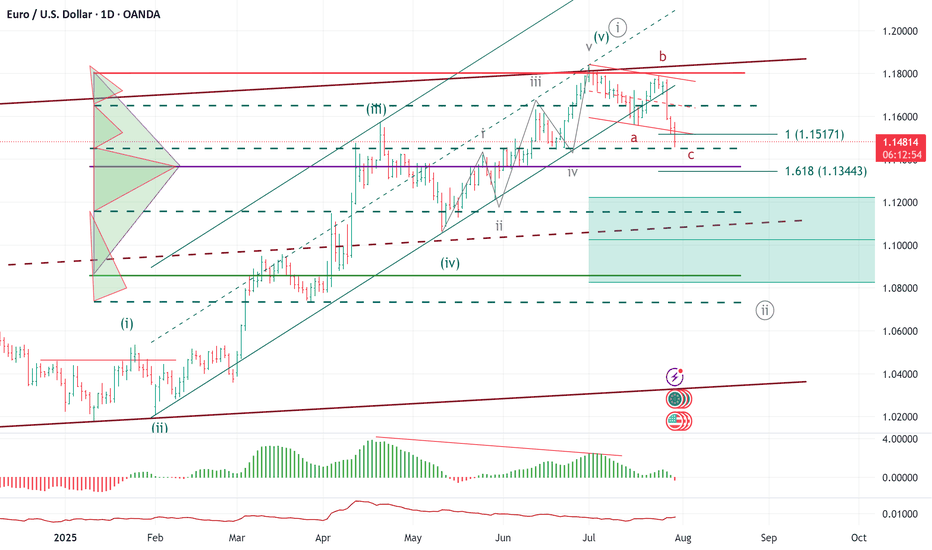

ELLIOTT WAVE EURUSD Daily update

EW Trade Set Up daily

minute ((i)) seems finished

H4 scenario 210725:

the price upward movement from 1.1557 area on 17/07/25 has broken decisively 1.1684-1.1705 area but it had not the

strenght to go further so that the lagging span (green line) could break upward the leading span B (red line).

A decrescent high has been registered at 1.1800 area on 24/07/25.

In this new scenario it looks like that the impulsive movement that started from 1.0180 on 13/01/25

finisced at 1.1834 on 010725 in the minute wave (i). (EWO divergence, break down of the upward (ii)/(iv) channel).

So i have to register that a correction to minute wave ((ii) has started

key levels VP area

1.1800

1.1370 POC

1.0850

note :

monitor the price reaction at any supports level: VP area and LVN

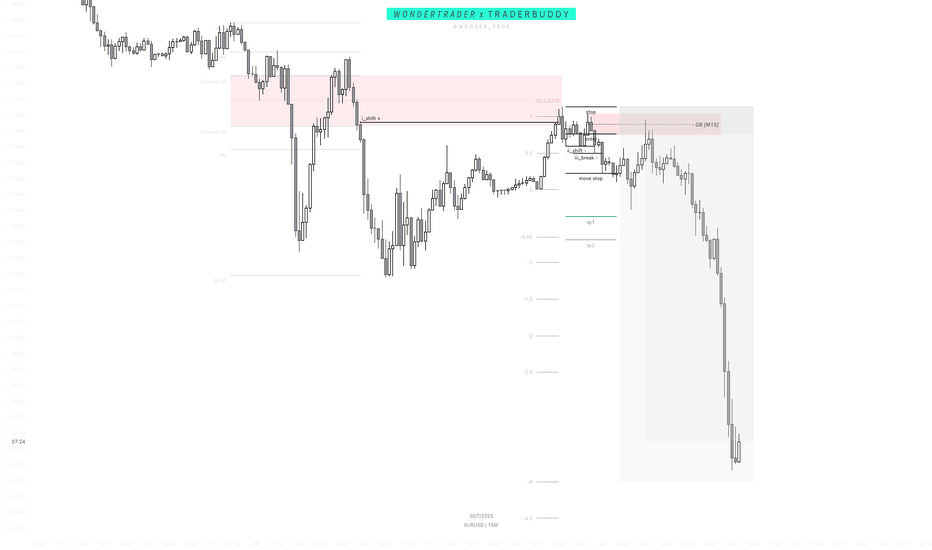

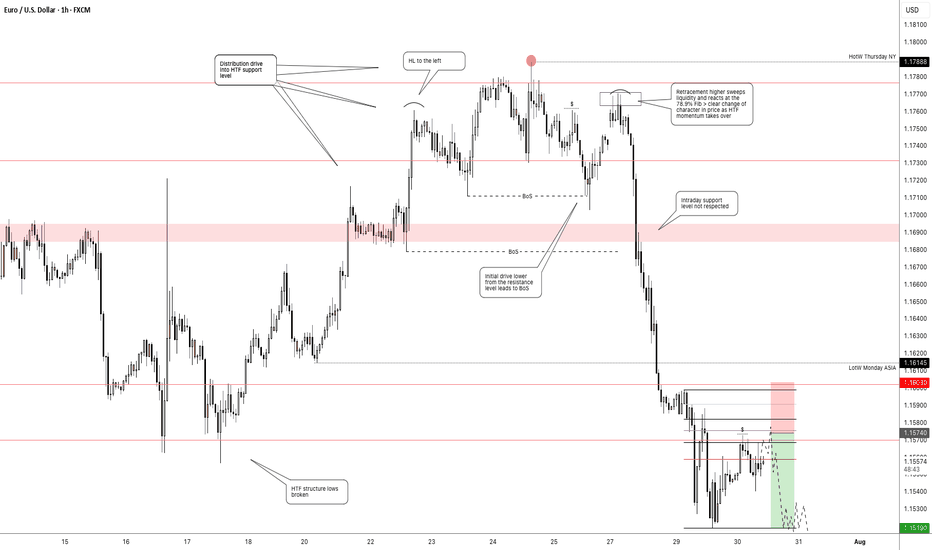

Getting short on EUR/USD!The dollar has looked set for a reversal and coming into the week it didn't hang around at all. I had a bit of a short bias on EUR/USD and was looking for confirmation signal which pretty much came at market open.

Price pushed higher back into the key level taking out a short term high, but was unable to follow through to form a new higher high. Heading into Monday London session, momentum immediately took hold with a clear bearish change of character and price didn't look back > breaking structure and key levels with minimal effort.

I was waiting for a pull back to get short early which didn't occur. But no need to chase price, waiting and patience is part of the game.

Price has now broken another key support level and is set to retest it as resistance. This will be my entry point (see screenshot) > using the 70.5%-78.6% fib retracement level and my stop above Tuesdays high. Keep it simple.

tradingview.sweetlogin.com/proxy-s3

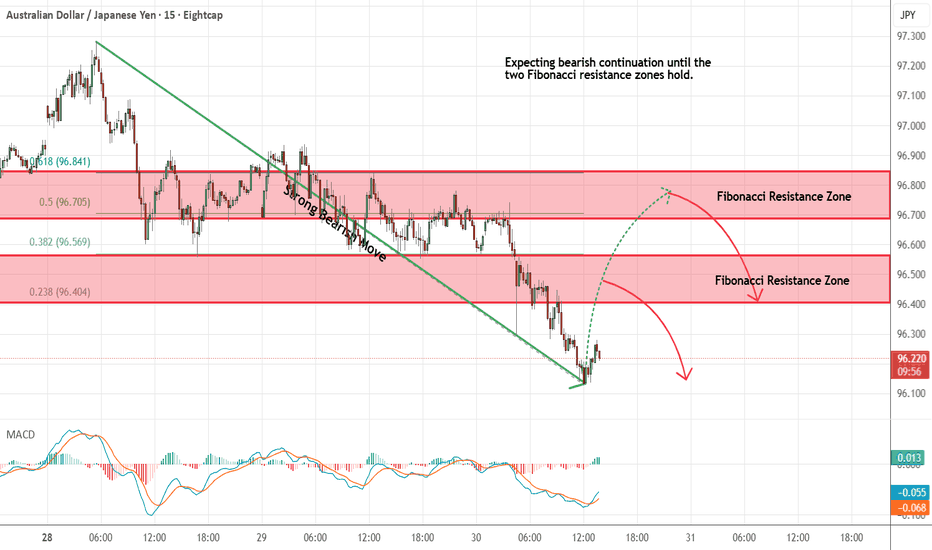

AUDJPY - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

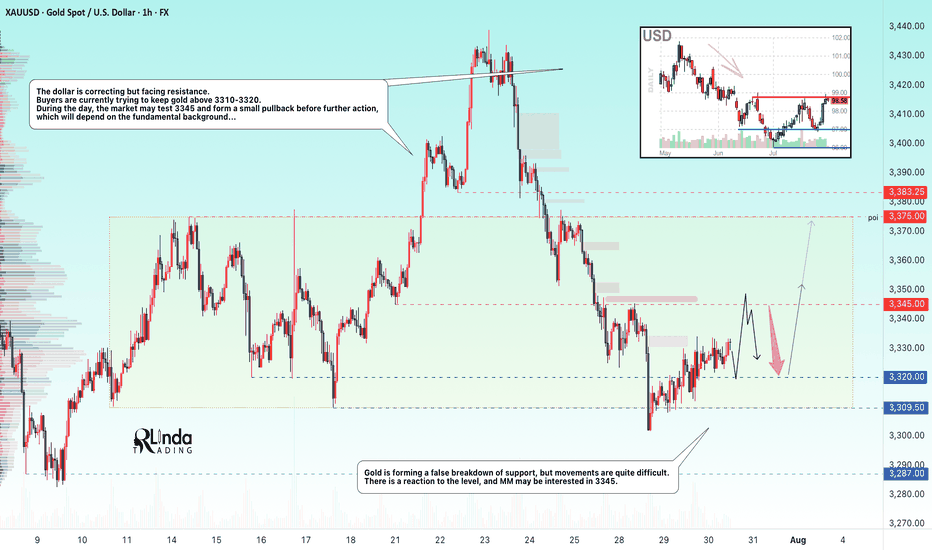

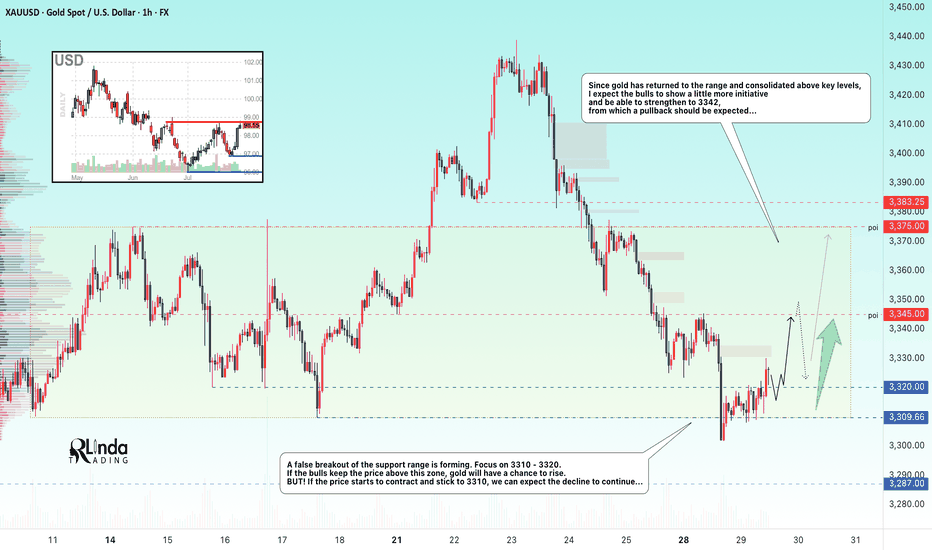

GOLD → False breakdown 3310. Consolidation ahead of news...FX:XAUUSD is forming a false breakdown of support at 3310, thereby confirming the boundaries of the trading range. The dollar is testing strong resistance within the global downtrend. And in the near future, we can expect more economic news...

Gold is trading below the key resistance level of $3345, remaining in a narrow range ahead of the Fed's decision and US GDP data for Q2. Weak data could reinforce expectations of a rate cut and support gold, while strong data would strengthen the dollar. The Fed is likely to keep rates at 4.25–4.5%, with markets pricing in a 64% chance of a 25 bps cut in September. Investors are waiting for signals from Jerome Powell, with a possible split within the Fed: some members may support calls for easing, which would be a driver for gold.

Technically, the situation on D1 is quite interesting. Gold is still below the previously broken trend resistance, but there is no continuation of the momentum. Buyers are reacting to support at 3310, but the market is stagnating due to uncertainty ahead of the news...

Resistance levels: 3345, 3375

Support levels: 3320, 3310, 3287

Thus, from a technical analysis perspective, I expect a retest of 3345, followed by a pullback to support at 3320, from which gold could move higher (if the bulls take the initiative), but if 3320 breaks and 3310 comes under pressure, gold could test 3287. Again, the emphasis is on trend support (the upward line) in the 3335-33450 zone. If the price can consolidate in this zone, we will have confirmation that the price has returned to the boundaries of the upward trend.

Best regards, R. Linda!

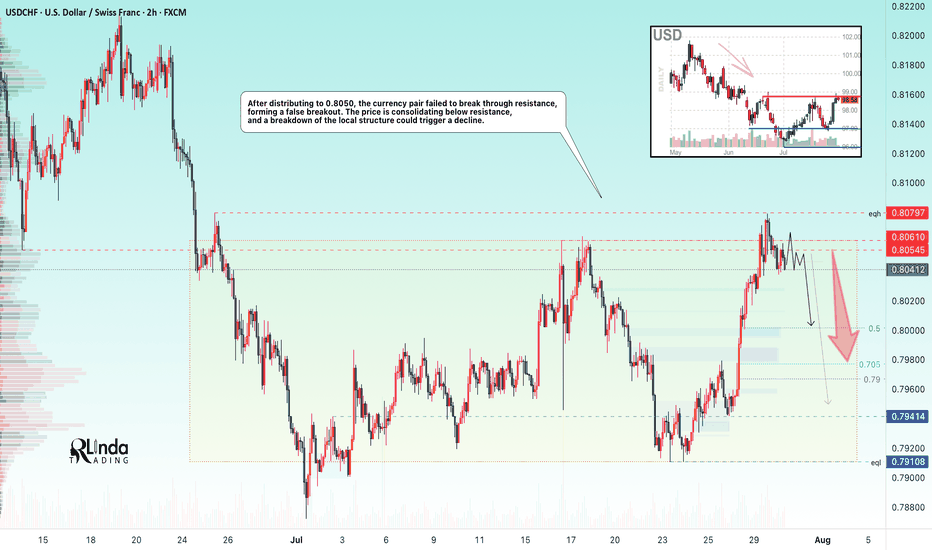

USDCHF → The resistance retest ended with a false breakoutFX:USDCHF tested resistance at 0.805 - 0.806 and formed a false breakout without the possibility of continuing growth. The global trend is downward...

Against the backdrop of the dollar's growth (reaction to news), the currency pair also moved to distribution to 0.8050. The price failed to break through resistance, forming a false breakout. USDCHF is consolidating below resistance, and a breakdown of the local structure could trigger a decline.

The dollar index is also facing fairly strong resistance and may continue its downward trend, which will also affect the decline in the USDCHF price.

Resistance levels: 0.805, 0.806, 0.81

Support levels: 0.800, 0.794, 0.791

If, within the current consolidation, the price begins to fall and break the local structure, then we can expect the decline to continue towards the specified targets!

Best regards, R. Linda!

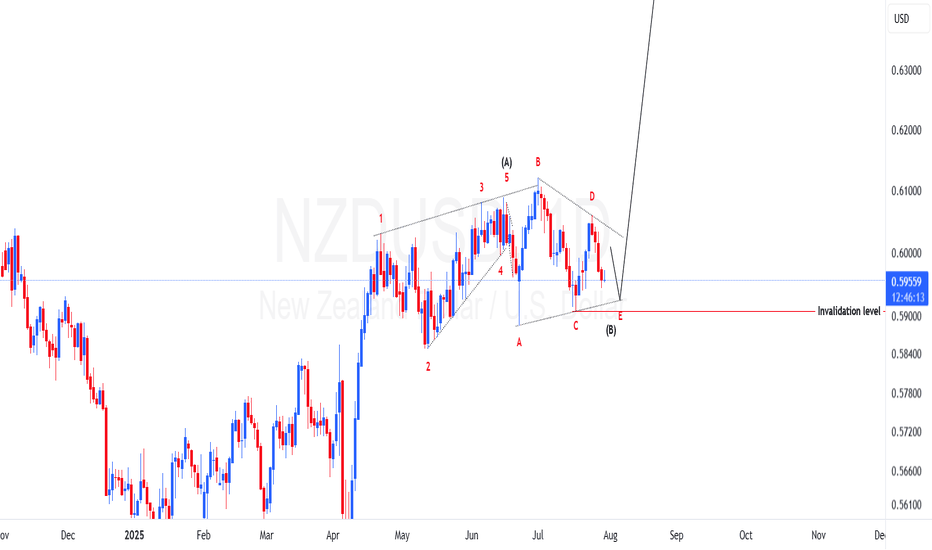

NZDUSD potential 600 pips in makingPrice of NZDUSD have made a structure that has a high probability to be a triangle just after a leading diagonal. If this view is favored then we should expect price to regain its bullish momentum to make wave C. To take advantage of this possibility a trade should find areas of support to go long. One of the places is as marked on the chart on lower trendline of the triangle.

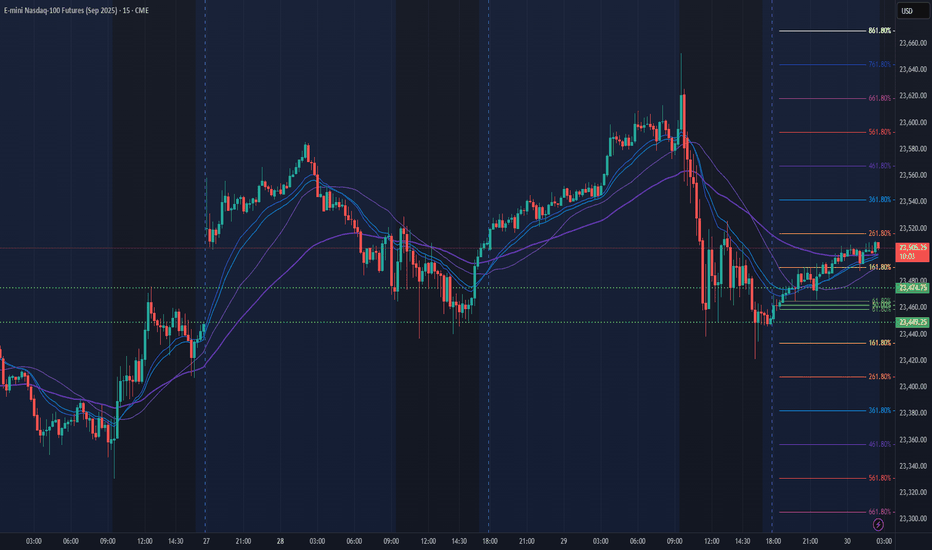

NQ Power Range Report with FIB Ext - 7/30/2025 SessionCME_MINI:NQU2025

- PR High: 23474.75

- PR Low: 23449.25

- NZ Spread: 57.0

Key scheduled economic events:

08:15 | ADP Nonfarm Employment Change

08:30 | GDP

10:30 | Crude Oil Inventories

14:00 | FOMC Statement

- Fed Interest Rate Decision

14:30 | FOMC Press Conference

AMP temp margins increase anticipating vol spike for economic events

Session Open Stats (As of 12:25 AM 7/30)

- Session Open ATR: 232.98

- Volume: 16K

- Open Int: 281K

- Trend Grade: Long

- From BA ATH: -0.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

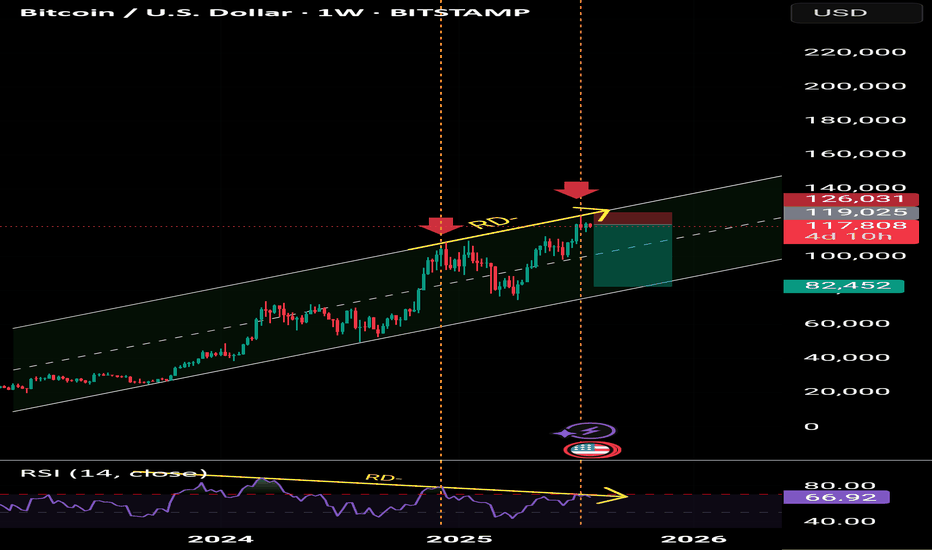

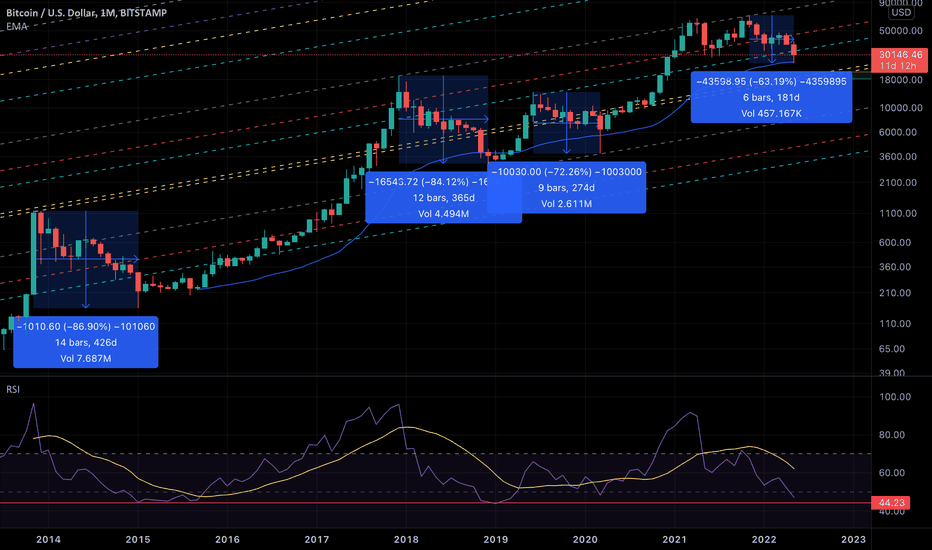

Where exactly is the most probable bottom of BTC for this cycle?This is the analysis based on the following data points

1. Monthly historical price action

2. Monthly Fibonacci Channel

3. Monthly Fibonacci Extension

4. EMA50 (Monthly)

5. RSI

We have been analyzing long term BTC price movements accurately since December 2021. Now that BTC is in sideway again, we are going to analyze the possible next moves. To be honest, current market is the hardest to analyze for us. There are mixed signals on the chart. We will try to provide as much information and perspectives as we can.

We will start with the Fibonacci extension which we have drawn based on monthly swing high/low. And zoomed in as a daily chart. Below you can see that the price bounced back exactly at 0.618 line of the fib extension. If you look at the Monthly chart above, it just touched monthly 50EMA line that day too. Coincidence? If we hit that golden pocket again and restart the bull run again, I won’t be surprised.

However, there is still a chance that we will go down further.

Let’s look at the monthly chart above for that assumption.

If we look at 2014/2015, 2017/2018, and 2019/2020 price actions, we are very near our maximum pain level. We are already in 6 months with -63% from the top. It also aligned with what we have suggested in our RSI based analysis here .

If we combine that two data points with the fib channel, we conclude that the area of fib channel golden pocket should be the bottom for this cycle. It will be -73% from the top. RSI monthly will also hit the bottom line.

One thing to note is that if we are going to break below that golden pocket, we will be looking at one of the worst bear market in the history.

Good luck.

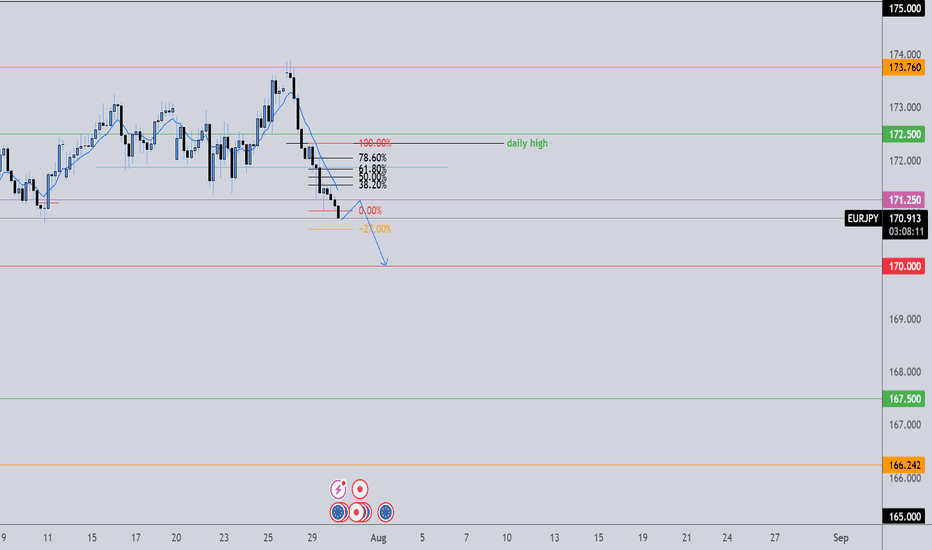

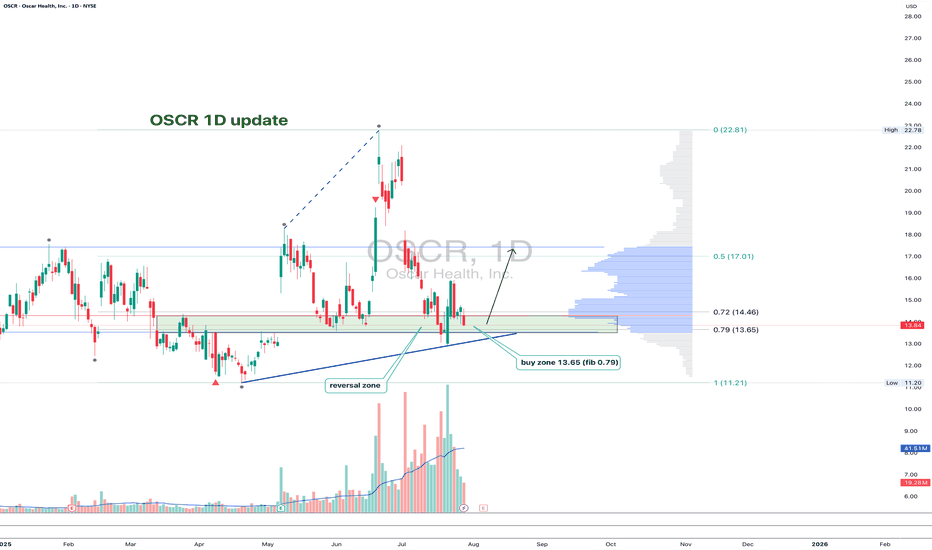

OSCR: back to support and now it’s decision timeAfter the recent impulse move, OSCR has pulled back to a key support zone around 13.65. That area aligns with the 0.79 Fib retracement, a horizontal level from spring, and a rising trendline that has already triggered reversals in the past. The structure is still intact, and buyers are testing the level again. If support holds and we get a bullish confirmation, the next target is 17.01, followed by a potential breakout toward the high at 22.81.

Volume remains elevated, the overall structure is healthy, and the correction is controlled. A break below 13.00 would invalidate the setup - until then, it’s a clean, high-reward zone with tight risk.

Fundamentally, Oscar Health has revised its 2025 guidance: revenue is expected in the $12–12.2B range, with operating losses projected between $200M and $300M. Despite softening topline growth, earnings per share are improving, and investor sentiment has been shifting. Technical strength is also reflected in the recent rise in RS Rating to 93, confirming that the stock is showing relative leadership even as the market cools.

This is one of those setups where both technicals and narrative are aligning - now we just need confirmation from the chart.

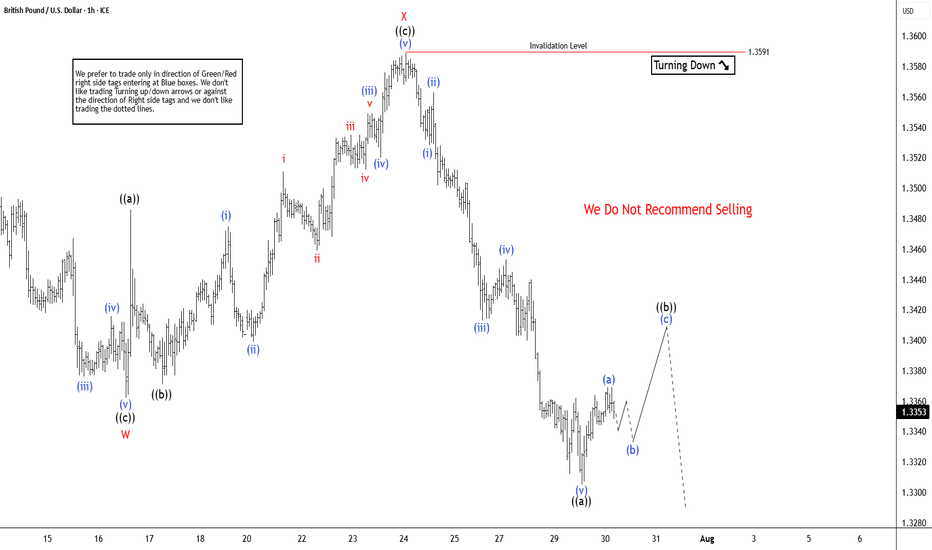

GBPUSD Elliott Wave Insight Bounce Should Fail Into Support ZoneThe GBPUSD is trading in higher high sequence from 9.22.2022 low in weekly. The bounce is corrective Elliott Wave sequence & expect further upside. It favors pullback in proposed 7 swings from 7.01.2025 high & extend into 1.3162 – 1.2898 area, while below 7.23.2025 high. It should find buyers into extreme area for next leg higher in daily or at least 3 swings bounce. In 4-hour, it started correcting lower from 7.01.2025 high. It ended W at 1.3362 low of 7.16.2025 & X at 1.3589 high of 7.23.2025 each in 3 swings. Below X high, it favors downside in Y in 3 swings as it broke below 7.16.2025 low, expecting into extreme area. Within W, it ended ((a)) at 1.3523 low, ((b)) at 1.3620 high & ((c)) at 1.3362 low. Above there, it placed ((a)) at 1.3486 high, ((b)) at 1.3371 low & ((c)) as X connector at 1.3589 high. The double correction unfolds in 3-3-3 structure, which will complete, when current bounce fails below 7.23.2025 high to new low into extreme area. It ended ((a)) of Y into 0.618 – 0.764 Fibonacci extension area of W & expect 3 or 7 swings bounce in ((b)).

Below X high, it placed ((a)) of Y at 1.3305 low & favors bounce in ((b)) in 3 or 7 swings against 7.23.2025 high. Within ((a)), it ended (i) at 1.3528 low, (ii) at 1.3563 high, (iii) at 1.3413 low, (iv) at 1.3543 high & (v) at 1.3305 low. Above there, it favors bounce in (a) of ((b)) and expect small upside before it should pullback in (b). The next pullback in (b) should stay above 1.3305 low choppy price action before continue upside in (c). Ideally, ((b)) can bounce between 1.3413 – 1.3481 area as 0.382 – 0.618 Fibonacci retracement of ((a)) before continuing lower. Wave ((b)) bounce expect to fail below 1.3591 high before extending lower in ((c)) into 1.3162 – 1.2898 to finish double correction. Because of higher high in daily since September-2022 low, it should find buyers in extreme area to resume higher. It expects sideways to higher until FOMC event followed by selloff, while bounce fail below 7.23.2025 high. We like to buy the pullback into extreme area for next leg higher or at least 3 swings reaction.

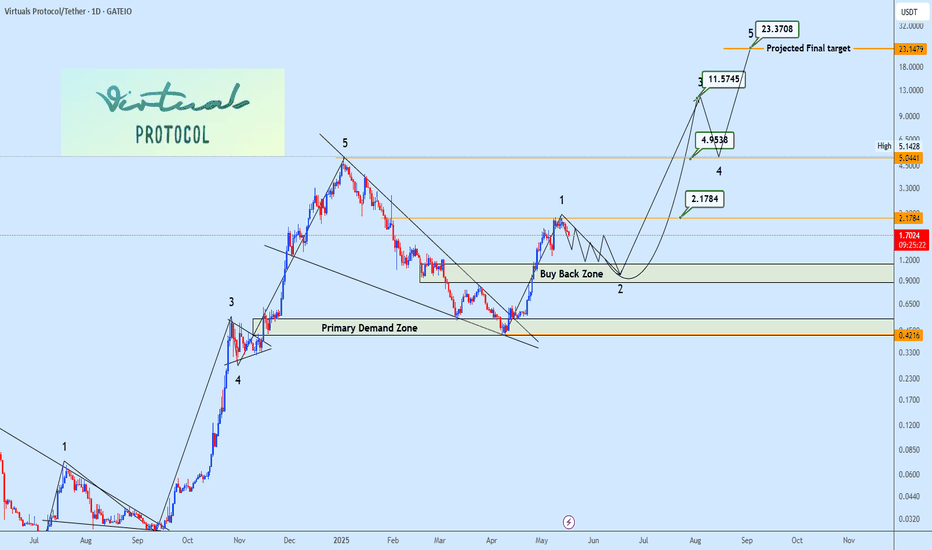

VIRTUAL PROTOCOL Wave 2 Correction in Play After 4x ImpulseFollowing the completion of its previous cycle correction, Virtual Protocol confirmed a bullish reversal via a breakout from a falling wedge, initiating Impulse Wave (1) with an impressive ~4x move. Current price action signals the commencement of Wave (2) corrective structure, aligning with standard Elliott Wave Theory post-impulsive behavior.

The buy-back zone (highlighted on chart) represents the high-probability retracement region based on Fib confluence (0.5–0.618 retracement levels) and prior structural support.

Wave (3) and Wave (5) targets are projected using Fibonacci extensions and historical momentum analogs. Eyes remain on the buy-back zone for optimal re-entry.

Gold - Short Setup Off Major Trendline Rejection📉 Gold - Short Setup Off Major Trendline Rejection

Gold has broken down through the rising trendline and is now retesting it — the moment of truth! 🧐

🔻 Short Entry: 3,336

🎯 Target: 3,236 (Fib 1.0 + HVN gap fill)

🛑 Stop: 3,346 (Above trendline retest)

⚖️ Risk/Reward: ~1:10

📊 Bonus: High volume node above adds resistance. Bearish volume profile structure confirms the breakdown bias.

Watching for volume to pick up on the move down. Let's see if GC bleeds into August. 🩸📆

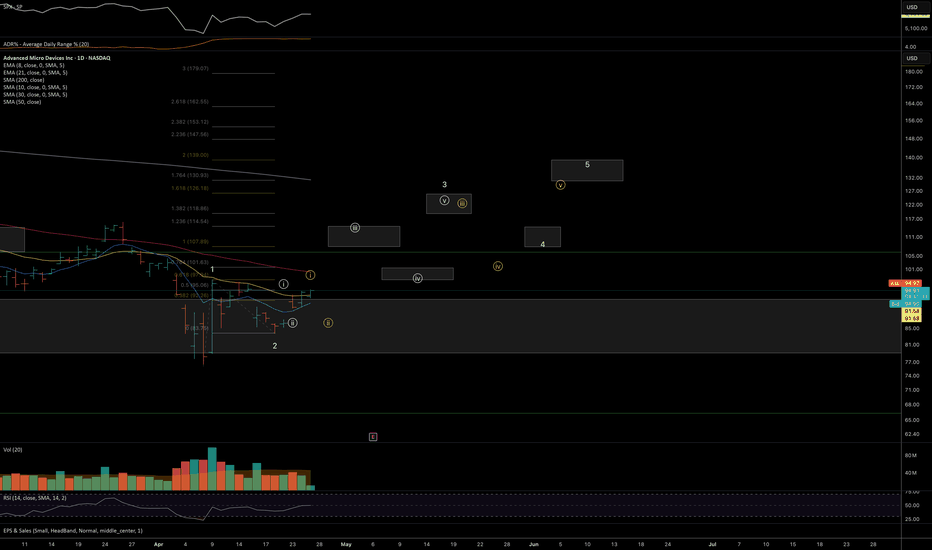

AMD: Potential Mid-Term Reversal from Macro SupportPrice has reached ideal macro support zone: 90-70 within proper proportion and structure for at least a first wave correction to be finished.

Weekly

As long as price is holding above this week lows, odds to me are moving towards continuation of the uptrend in coming weeks (and even years).

1h timeframe:

Thank you for attention and best of luck to your trading!

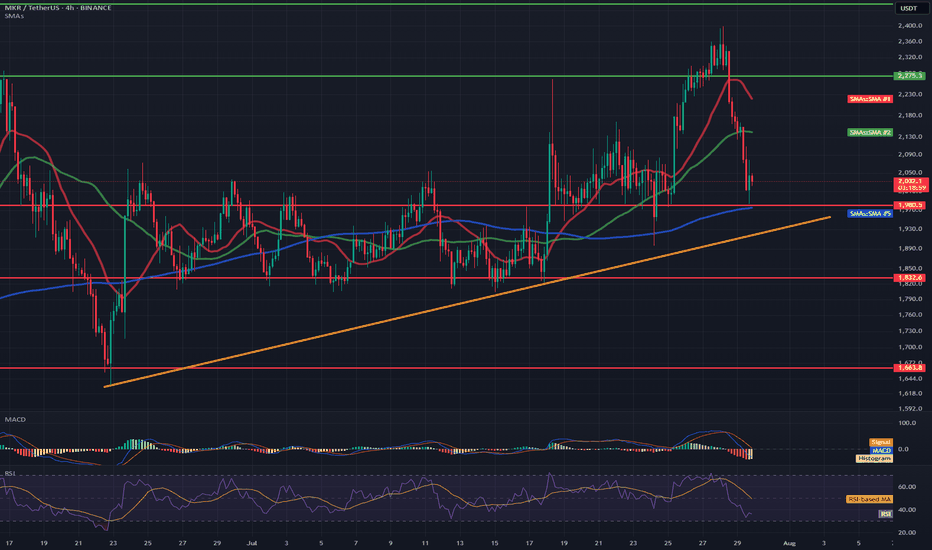

MKR/USDT 4H Chart📉 Short-term situation:

The price is currently trading around 2028 USDT, after a sharp decline from around 2273 USDT (resistance).

The support level around 2000 USDT is currently being tested (coinciding with the SMA 200 – blue line).

A dynamic uptrend line (orange) is also visible, which could act as a key support level in the event of further declines.

🔍 Support and Resistance Levels:

Resistance:

🔴 2188 USDT – recent local high and convergence with the SMA 21.

🟢 2273 USDT – major resistance; previous rebound and point of significant price reaction.

Support:

🔵 1980 USDT – local support + SMA200.

🟠 Uptrend line (~1940–1960 USDT).

🔴 1832 USDT – stronger horizontal support with multiple confirmations.

🔴 1623 USDT – very strong support, from previous lows.

📊 Technical indicators:

RSI (Relative Strength Index):

Current value: ~42, neutral, but approaching the oversold zone (<30).

The RSI is falling rapidly, suggesting selling pressure, but a reaction is possible near current support.

MACD:

Negative signal: signal line crossing from above + descending histogram.

Indicates a continuation of the correction, but we are approaching the potential exhaustion of the downward momentum.

📈 Moving averages:

EMA/SMA 50 and 200:

The price is currently testing the SMA200 – crucial for the medium-term trend.

SMA21 (red) and SMA50 (green) – have reversed downward, which may suggest a weakening of bullish momentum.

🔮 Scenarios:

🟢 Bullish scenario (confirmation of support):

A rebound from 1980–2000 USDT and further upward movement.

Potential target: first ~2180 USDT, then ~2273 USDT.

The condition is a demand response at the current level + an improvement in the RSI/MACD.

🔴 Bearish scenario (breakout of support):

If the 1980 USDT level is broken and the price falls below the uptrend line, a continued decline to 1832 USDT or even lower is possible.

Confirmation will be a strong bearish candle with high volume and a further decline in the RSI/MACD.

GOLD → Formation of a trading range. 3345?FX:XAUUSD confirms support for the local range. A false breakdown has formed and the price has returned to the buying zone. We are waiting for the bulls to take the initiative...

Gold is trying to recover after falling to $3302, remaining under pressure ahead of key events in the US: the publication of GDP data and the Fed's decision on interest rates. Support is provided by a pause in the dollar's growth, expectations of an extension of the US-China trade truce, and growing demand for safe-haven assets amid a surge in oil prices due to the threat of new sanctions against Russia. However, the sustainability of growth is in question: the dollar may strengthen thanks to optimism about the US economy and progress in negotiations.

A false breakdown of the support range is forming. Focus on 3310-3320. If the bulls keep the price above this zone, gold will have a chance to grow. BUT! If the price starts to contract and stick to 3310, we can expect the decline to continue...

Resistance levels: 3345, 3375

Support levels: 3320, 3310, 3287

The two-day movement has most likely exhausted its potential, or the market has decided to recover slightly due to the unpredictability factor. A false breakdown of support could trigger a pullback to the strong level of 3345, from which a rebound could form (either before growth or before the continuation of the decline; it is necessary to monitor the reaction and the market background...).

Best regards, R. Linda!

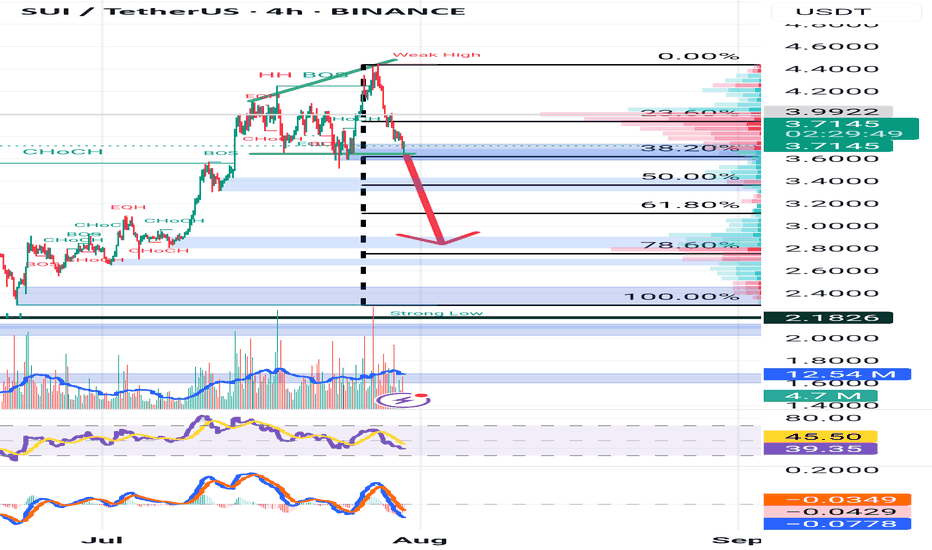

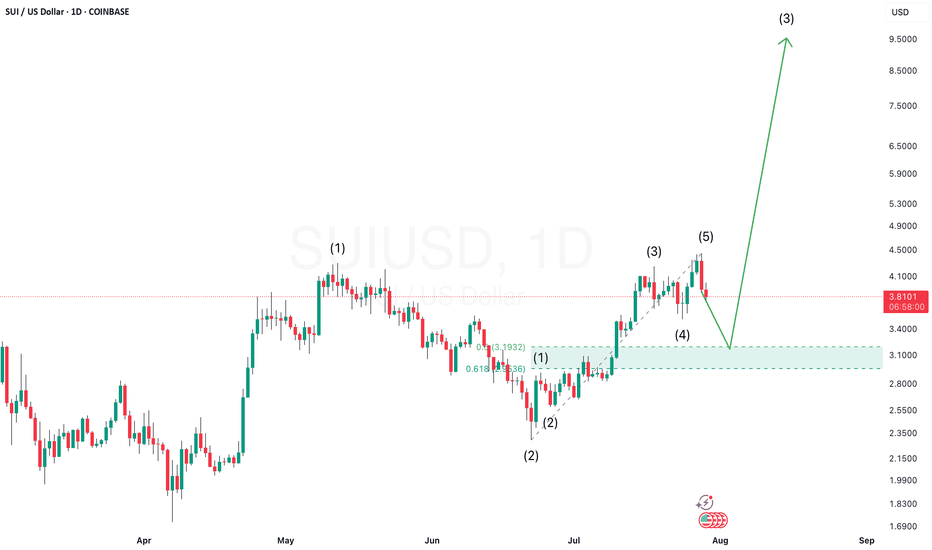

SUIUSD Setting Up for a Potential 1-2, 1-2 Pattern — Wave 3 BlasSUIUSD appears to be forming a classic 1-2, 1-2 Elliott Wave setup — a bullish structure that often precedes an explosive third wave rally.

In this pattern, we first see a motive Wave 1 followed by a corrective Wave 2, then another smaller-degree Wave 1 and 2 within the larger Wave 3. This kind of nested structure shows strong underlying bullish momentum building up in layers.

Once the second minor Wave 2 completes, SUI could launch into a powerful third wave of Wave 3, typically the strongest and most extended move in the sequence. That’s the breakout phase where price accelerates rapidly, often leaving late buyers behind.

Watch for confirmation