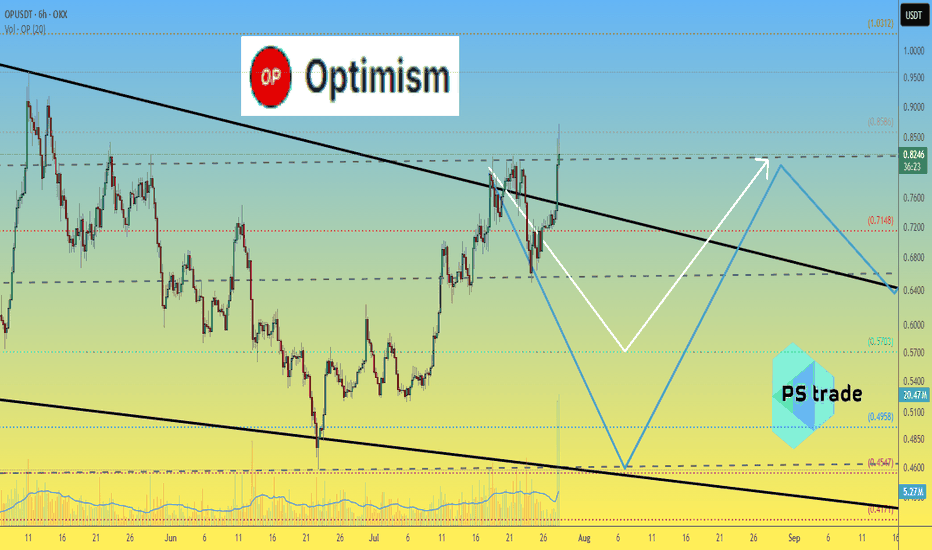

Optimism Op price analysis - be careful After the listing of #OP on the Korean exchange, known for its "pump events", we observe a surge in volume along with a breakout from the downtrend.

🐻 The current 6-hour candle on OKX:OPUSDT is attempting to form a pin bar — a potential reversal signal.

⚠️ High volumes often indicate the final phase of a move. Such pumps are usually short-lived — proceed with caution.

👌 Our previously published medium-term forecast for #Optimism remains relevant

________________

📚 Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves!

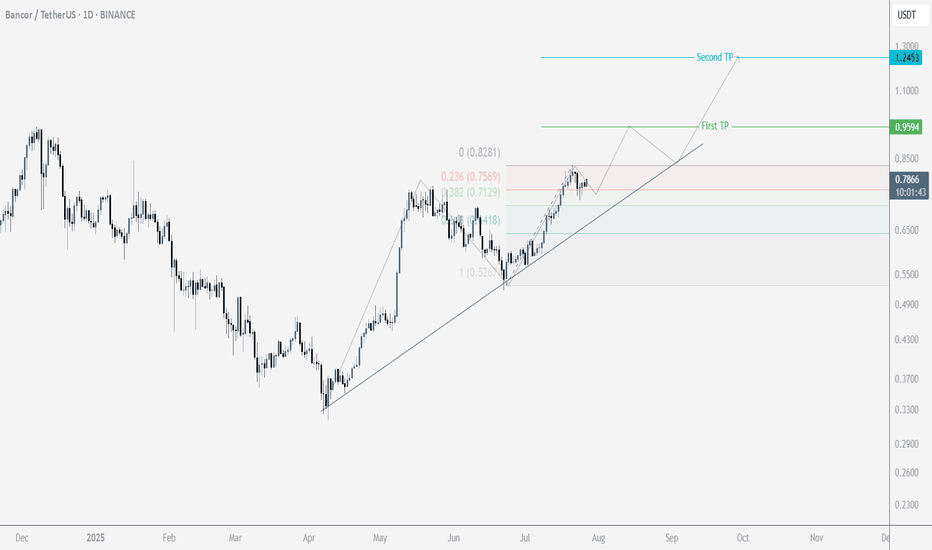

Fibonacci

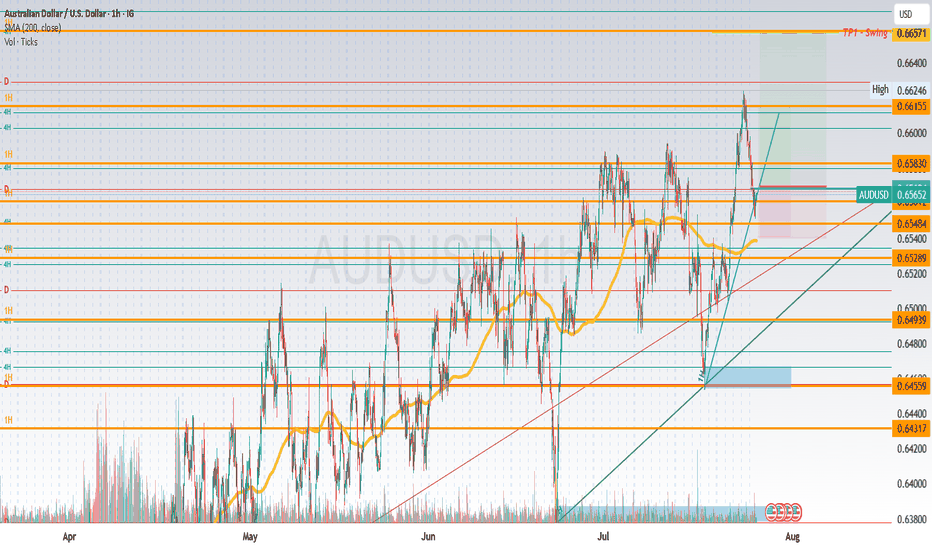

AU LongAUDUSD Entry

Entry @ break and retest of minor support/resistance and trendlines minor and 1H

TP1 where 1H and 4H PRZ share @ 0.66155 TP2 @ 0.66584

which also -27 on major structure fib

HH and HL showing on major structure, continuing the uptrend

Price retraced to 38.2, retesting 1H trendline

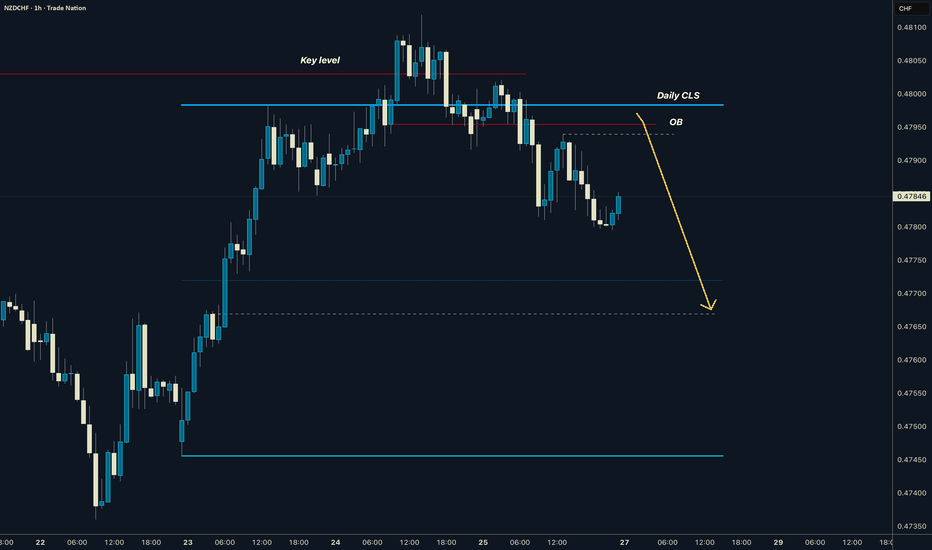

NZDCHF I Daily CLS I Model 1 I Pullback entryYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Comment any Coin I ll give you my quick view

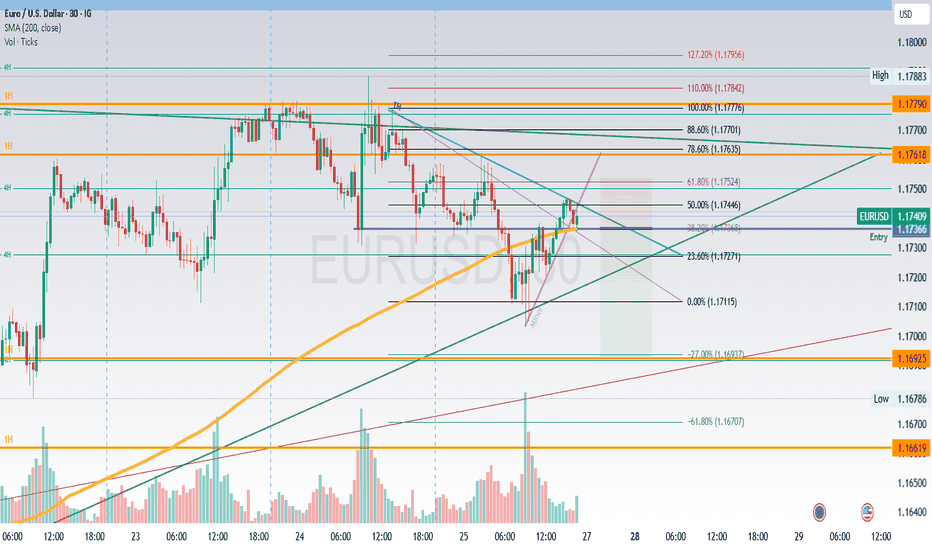

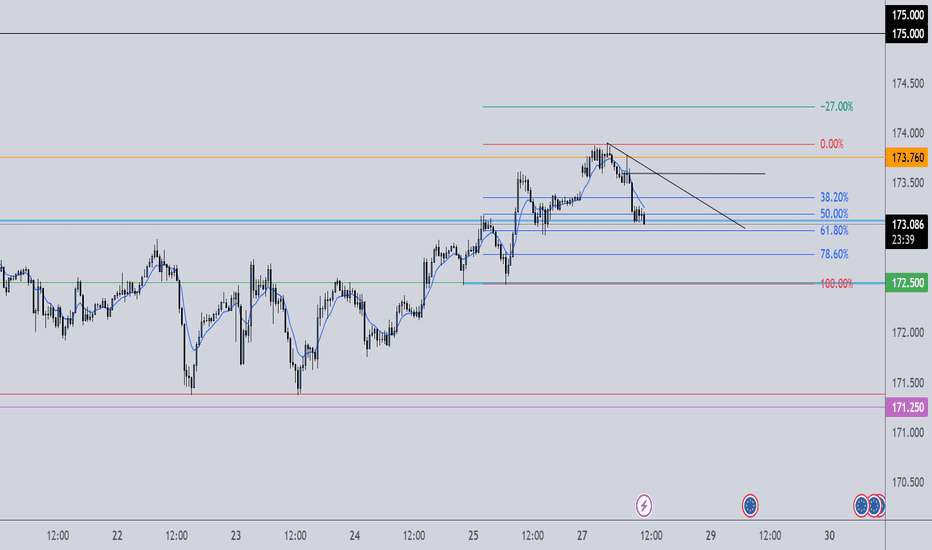

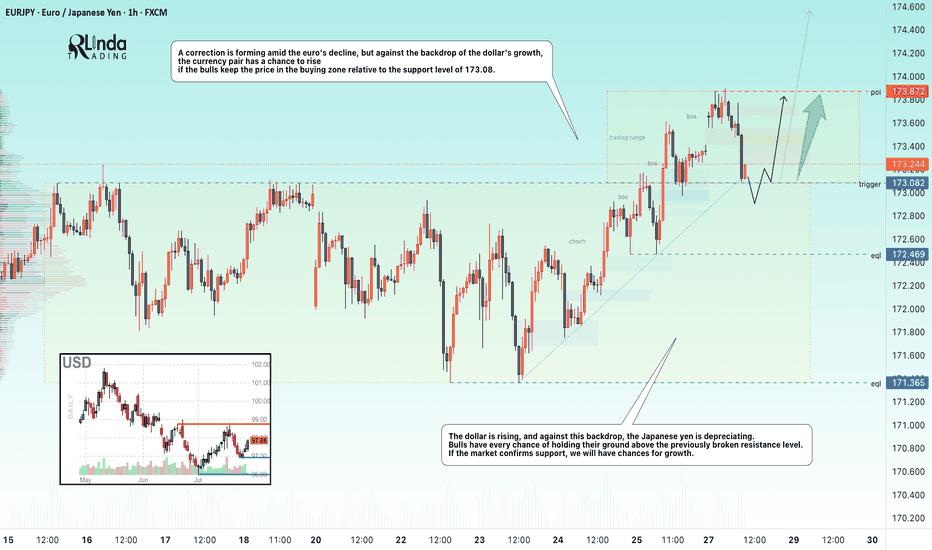

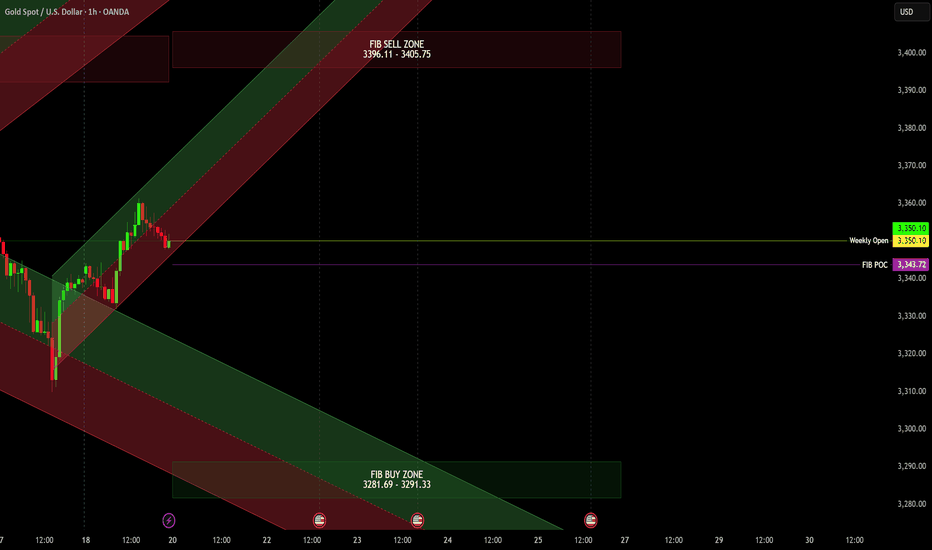

EURJPY → Retest support before growthFX:EURJPY has been correcting since the opening of the European session. The movement was triggered by yesterday's news related to the trade deal between the US and Europe...

EURJPY is reacting to news related to the deal between the US and Europe. A correction is forming amid the fall of the euro, but against the backdrop of the dollar's growth, the currency pair has a chance to rise if the bulls keep the price in the buying zone relative to the support level of 173.08.

The dollar is rising, and against this backdrop, the Japanese yen is falling. Bulls have every chance of holding their ground above the previously broken resistance. If the market confirms support, we will have chances for growth.

Resistance levels: 173.87

Support levels: 173.082, 172.47

The currency pair may form a liquidity trap relative to the previously broken consolidation resistance. A false breakdown of support and price consolidation in the buying zone (above 173.1) could trigger further growth.

Best regards, R. Linda!

Missed the Altseason Start? CHZ/USDT Is the Opportunity You NeedMany traders feel they’ve missed the start of the altseason, but CHZ/USDT is offering a second chance.

On the weekly timeframe, CHZ is breaking out of a long-term falling wedge pattern — a classic bullish reversal structure that often precedes explosive moves.

Combining this with Fibonacci extensions, we identify 4 major upside targets:

Target 1: 0.618 Fib - 0.59 – initial breakout confirmation

Target 2: 0.786 Fib - 0.74 – mid-term resistance level

Target 3: 1.272 Fib – 1.19 - extended bullish leg

Target 4: 1.618 Fib – 1.50 - full potential of the wedge breakout

CHZ is currently undervalued and positioned near its bottom, making it one of the best risk/reward plays in the current market for those who still want exposure to the altseason wave.

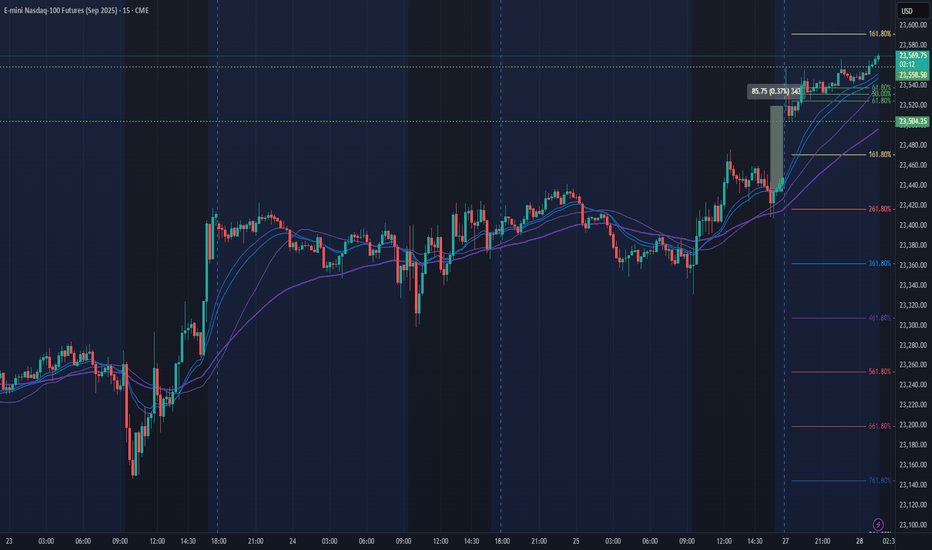

NQ Power Range Report with FIB Ext - 7/28/2025 SessionCME_MINI:NQU2025

- PR High: 23558.25

- PR Low: 23504.00

- NZ Spread: 121.25

No key scheduled economic events

Weekend gap up of 0.37% into new ATH

Session Open Stats (As of 12:25 AM 7/28)

- Session Open ATR: 245.44

- Volume: 23K

- Open Int: 276K

- Trend Grade: Long

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

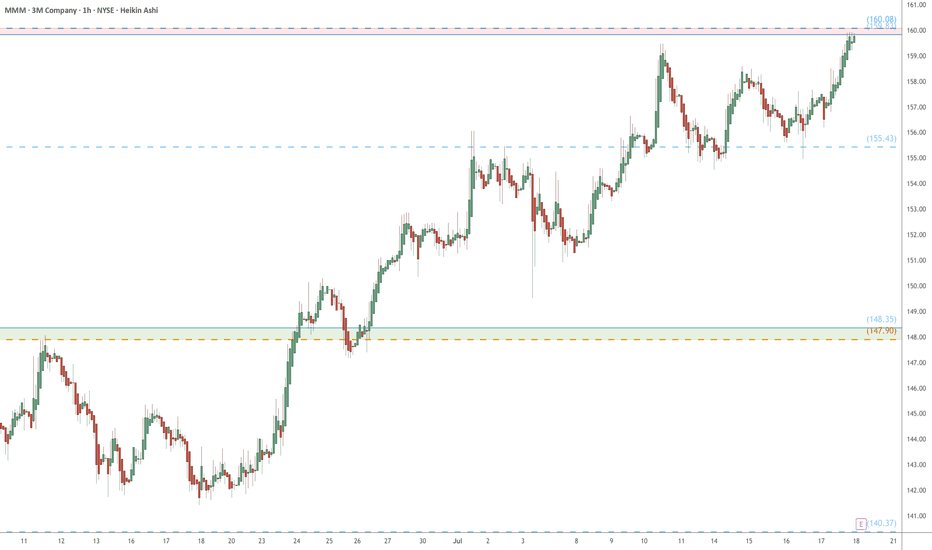

MMM eyes on $160: Resistance Zone waiting for Earnings reportMMM has been crawling off a decade long bottom.

Testing a significant resistance at $159.83-160.08

Earnings report tomorrow, so a key 24 hours here.

.

Previous analysis that caught the BREAK OUT:

Hit the BOOST and FOLLOW for more PRECISE and TIMELY charts.

========================================================

.

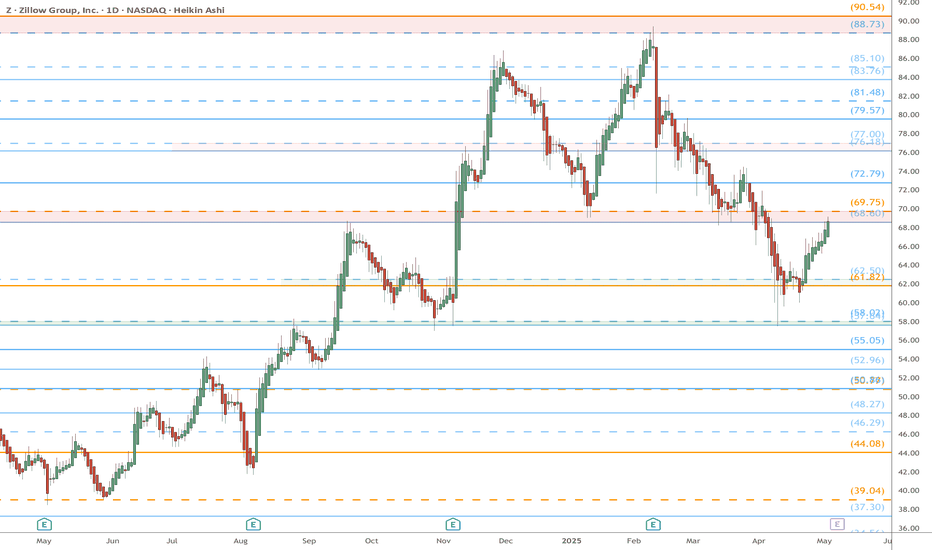

Z eyes on $68.80-69.75: Resistance even the Fib-Blind can SEEZillow has bounced into a major landmark of its lifetime.

Zone is defined by a Golden Covid and a Minor Genesis fib.

This has been tested from both sides many times already.

$ 68.60-69.75 is the exact resistance to watch.

$ 61.82-62.50 is the first support below to hold.

$ 76.18-7./00 is a good first Target for longs.

===================================================

.

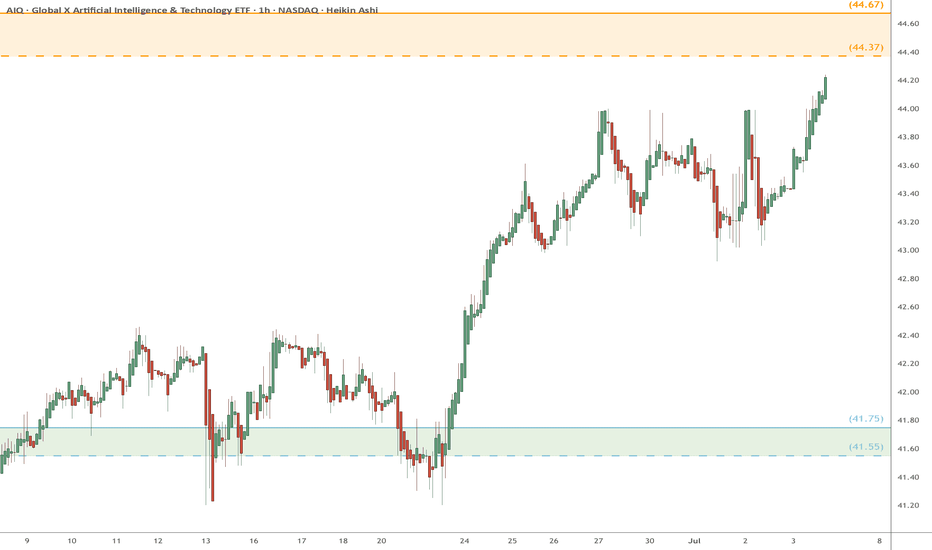

AIQ heads up at $44.37/67: Double Golden fib zone will be strongAIQ has been floating up towards a Double Golden zone.

$44.37 is a Golden Covid and $44.67 a Golden Genesis fib.

High-Gravity area is likely to hold this in orbit for some time.

.

Previous analysis that caught a PERFECT BREAK OUT:

=======================================================

.

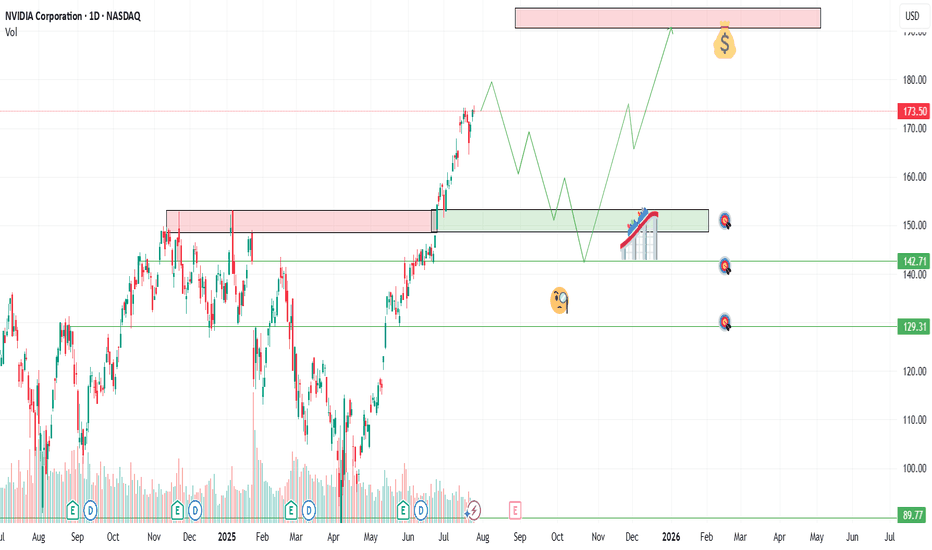

NVDA-the AI TitanNVIDIA (NVDA) continues to dominate the AI semiconductor space and remains one of the strongest momentum names in the market. After reaching new highs, price action is now offering a clean multi-tiered entry opportunity for swing traders positioning for the next leg up.

Entry Points

✅ $160 – Breakout retest zone

✅ $145 – Key technical support

✅ $130 – Strong demand zone from prior consolidation

Profit Targets

📈 TP1: $180

🚀 TP2: $190

💰 TP3: $200+

📌 Disclaimer: This is not financial advice. Just sharing my view and trade idea. Always do your own research and manage risk accordingly.

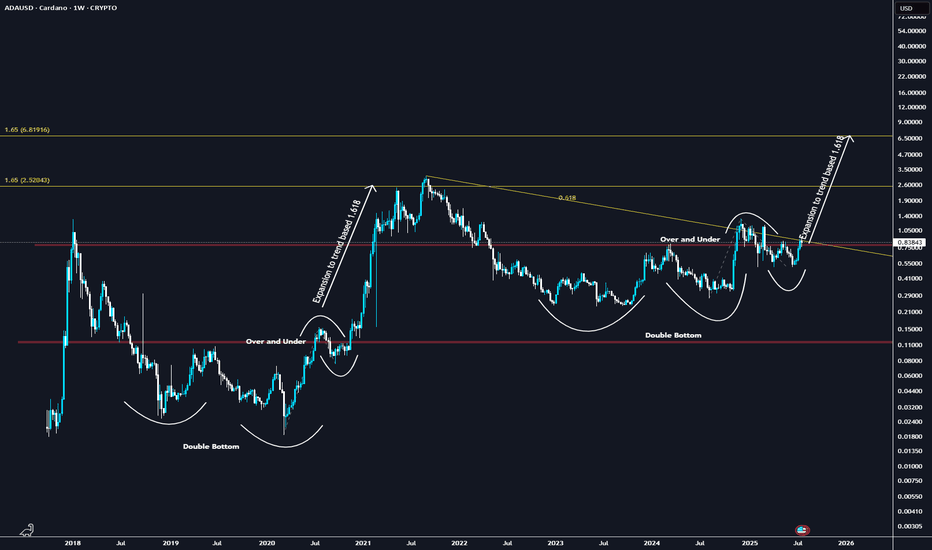

ATH for ADA soonChart says it all, ADA looks prime to run, could reach as high as $6.80

1. Technological Upgrades and Hard ForksThe Plomin Hard Fork in Q1 2025 enhanced governance, while upcoming features like Leios for scalability, BTC DeFi interoperability, L2s, and partnerchains boost efficiency and adoption, positioning Cardano as a leader in secure, sustainable blockchain tech.

2. Spot ETF Speculation and Institutional InterestGrayscale's pending ADA ETF filing with Nasdaq, plus inclusion in their Large Cap ETF, could unlock massive demand. Analysts see this as a game-changer, similar to Bitcoin/ETH ETFs, potentially driving prices to $5+ by year-end.

3. Ecosystem Expansion and IntegrationsNew tools like the EMURGO global Cardano card for ADA payments, Blockchain.com DeFi wallet integration (37M users), and Tokeo Wallet's XRP bridge enhance real-world utility. DeFi TVL and on-chain activity (unique addresses +4.79%, active wallets +12%) are surging.

4. Whale Activity and On-Chain MomentumWhales are accumulating amid spikes in network volume and no downtimes/hacks. Features like privacy via Midnight Network and Charles Hoskinson's White House advisory role add credibility, fueling a "silent surge."

5. Technical Breakouts and Market CorrelationADA has formed bullish patterns like a golden cross, double-bottom, and breakout from descending channels, correlating with Bitcoin's rally. RSI at 76 signals strong momentum, with targets at $0.82–$1.18 short-term and up to $2.80+ long-term.

6. Airdrops and Community HypeUpcoming events like the Glacier airdrop and NIGHT airdrop are creating buzz, alongside Cardano's unmatched decentralization and energy efficiency, potentially sparking a 383% rally as in past cycles.

APLD heads up at $13.10: Golden Genesis fib may stop the SurgeAPLD on a massive surge over various company news.

Currently about to hit a Golden Genesis fib at $8.10

Looking for usual Dip-to-Fib or Break-and-Retest to buy.

It is PROBABLE that we "orbit" this fib a few times.

It is POSSIBLE that we get a significant dip from here.

It is PLAUSIBLE that we break and run if bulls are hyper.

.

See "Related Publications" for previous EXACT plots --------------------->>>>>>>

.

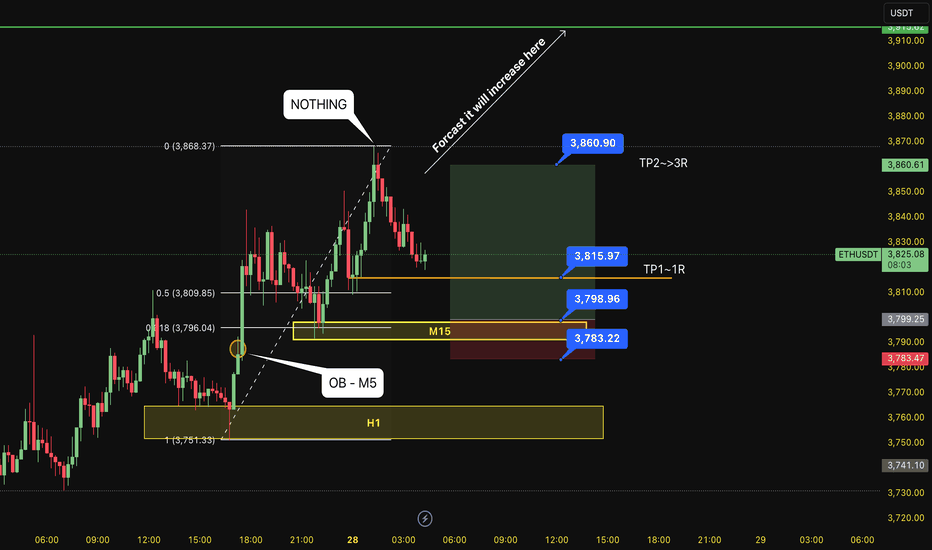

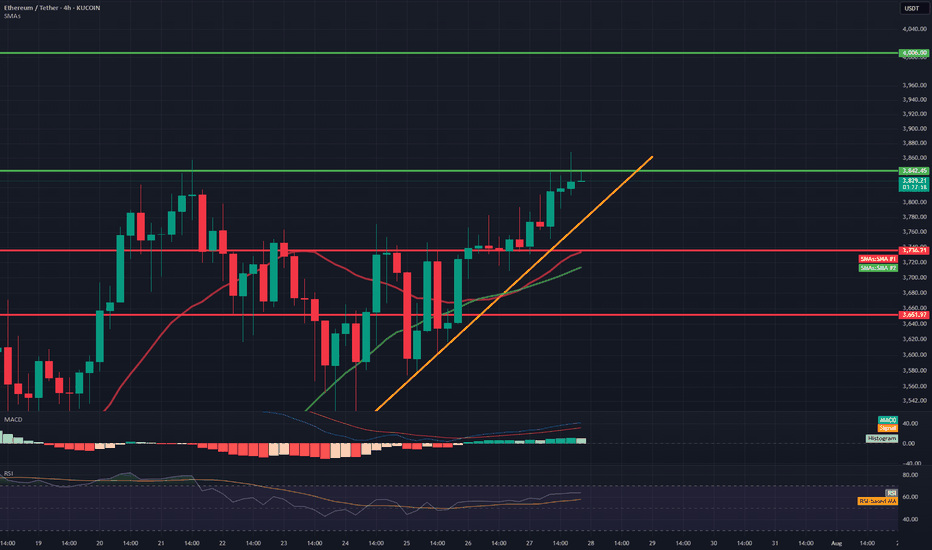

BUY ETH 28.7.2025Confluence order: BUY at M15

Type of order: Limit order

Reason:

- The current top is not touching anything, expected to rise to the H1 above.

- M15~FIBO 0,5-0,618 (same position)

Note:

- Management of money carefully at the last bottom (3,815)

Set up entry:

- Entry buy at 3,798

- SL at 3,783 (below OB NOT USED of M5)

- TP1: 3,815 (~1R)

- TP2: 3,860

Trading Method: Price action (No indicator, only trend and candles)

ETH/USDT 4H Chart📊 General Context

Ethereum is rising in a strong short-term uptrend, supported by a rising trendline (orange).

Current price: 3831 USDT

We are approaching a significant resistance level around 3842–3850 USDT (green line).

Technical support is located around 3760 USDT (previous consolidation level and 50/200 SMA).

🔍 Technical Levels

Resistance:

3842–3850 USDT – local high, currently being tested.

4006 USDT – key psychological level and the last local high on the chart.

Support:

3762 USDT – previous resistance, currently turned into support (may be tested in a correction).

3650 USDT – strong technical support, confirmed several times in the past.

SMA50 and SMA200 – currently just below the price, also acting as dynamic support.

📈 Technical Indicators

MACD:

The histogram is rising and positive → bullish momentum.

The MACD line crosses the signal line from below → a buy signal.

RSI (14):

Currently: around 64 → not yet overbought, but close to the overbought zone.

Slightly rising trend, but may suggest impending market overheating with further gains.

🧭 Trend

Short-term: strong uptrend (trend line, green candles, breakout from consolidation).

Medium-term: higher lows and higher highs – the uptrend is maintained.

The price is holding above the 50 and 200 SMAs – confirming bullish sentiment.

⚠️ What to watch next?

A 4-hour candle close above 3842 USDT → confirmation of a breakout, a potential attack on 4000–4010 USDT.

A break of the trend line (orange) → a possible correction to 3760 or even 3650 USDT is possible.

An RSI rise above 70 → an overbought signal, a possible pullback or consolidation.

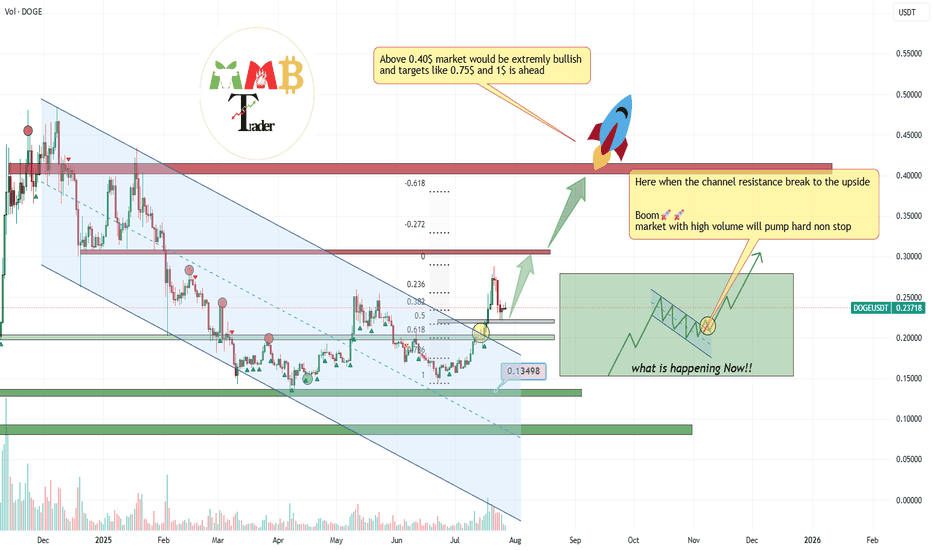

DOGEUSDT is testing 0.5 Fibonacci support (more gain)As we can see the breakout of red trendline also completed and volume increases after that and now market is testing major Fib levels like 0.5 & 0.61 soon we can expect more pump and gain here like the green arrows.

so many stop loss also hit on this fast correction to the downside and price is ready to start next boom pump with kicking out leverage buyers first.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚