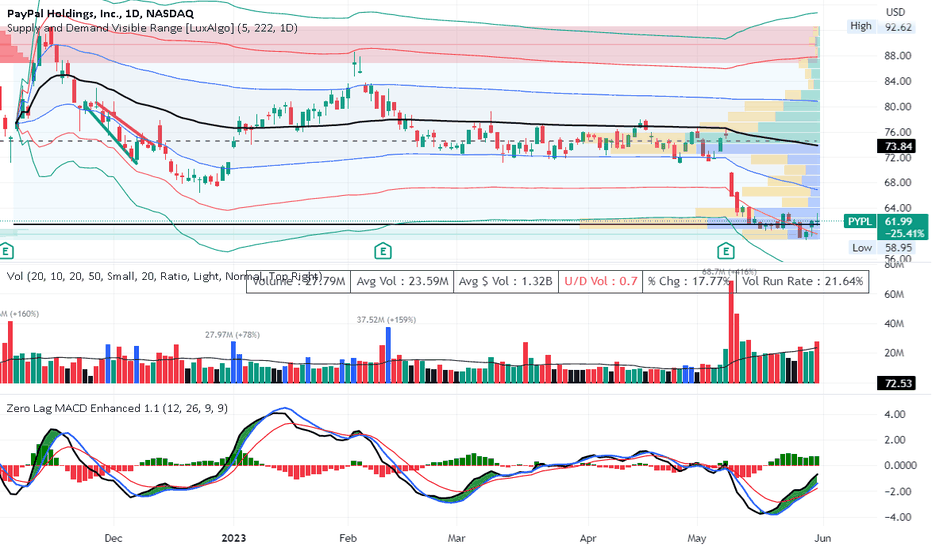

Is PYPL ready for recovery?n the daily chart PYPL is at its six-month lows sitting on the support /demand zone after recent

earnings which were helpful in showing earnings and revenues holding up. Upside to resistance

is about 25%. The volume profile shows heavy volumes at both the current price and at $75

Any upward price action would likely experience volatility at $7 5 as that is where a large

a number of institutional traders are situated. This is also approximately where the mean long

term anchored VWAP is extending. The MACD indicator's lines have crossed under the histogram

which is now green and positive. They are approaching the horizontal zero line. Trading volumes

have increased since the last earnings and so shares are being accumulated which usually

results in prices rising gradually over time.

I see this as an excellent long trade setup targeting first $ 75 and then $87 just under the

resistance zone with a stop loss in or under the support.

Fintechapplications

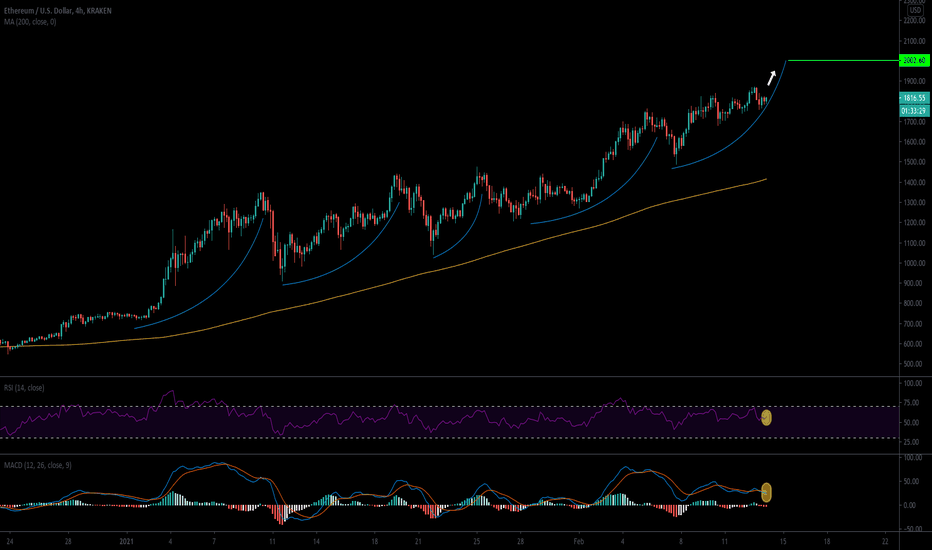

Road to $2,000 for ETHMACD is signaling a buy. RSI shows it is not overbought. When you look at the overall trends of each growth cycle that ETH goes through, it gets to a point of exhaustion and cools off for a while before tearing back up the curve.

According to the current trend, this rally still has legs and it looks like its heading directly to $2,000,

ETH is being integrated into many fintech applications and payment platforms. It is Bitcoin's smarter cousin. It is continuing to get more and more street cred which should propel it further. Go long ETHUSD.