Once It Starts, It Might Be Too Late to Jump InHey guys, vacation’s over — time to get back behind the screen and into the reports. Naturally, I kicked things off with a deep dive into ETH options activity , because that’s where the real market whispers come from.

Here’s what stood out:

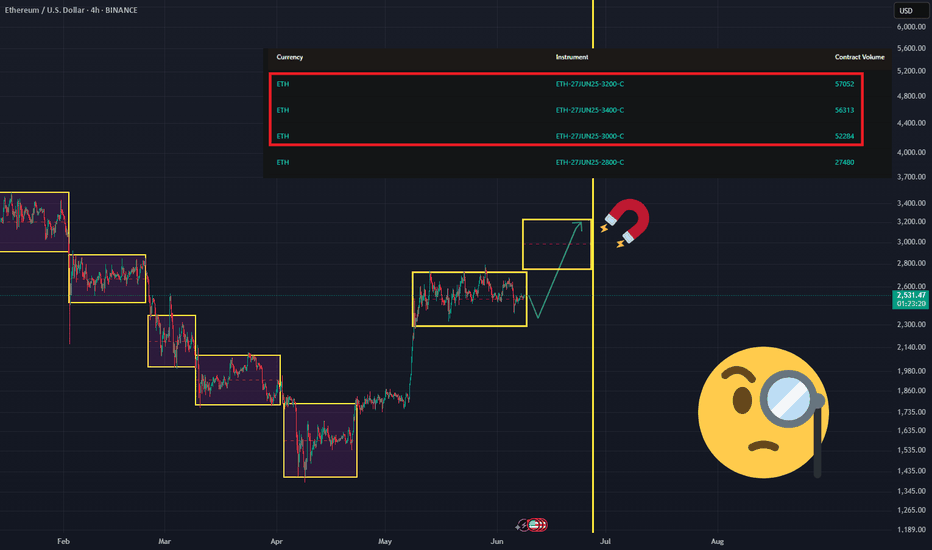

Over the past week, the biggest trading volume and open interest inflow came at strikes $3000–$3200–$3400 (see screenshot). Most of the action was in standalone calls , though a portion showed up as call spreads — meaning some players are betting on a controlled rally, not just blind bullishness.

The June 27, 2025 expiry remains the clear leader in open interest — still the date everyone’s watching.

With implied volatility at 67.9% , ETH has about a 68% probability (1σ) of reaching $2,950 by expiry — just 18 days away .

Key Takeaways:

$3000–$3200 looks totally within reach.

$3400 , though? Less than 15% chance based on current levels.

The sentiment among options traders is clearly bullish — they’re positioning for a breakout up from the sideways range, roughly by the full width of the pattern.

Flowethereum

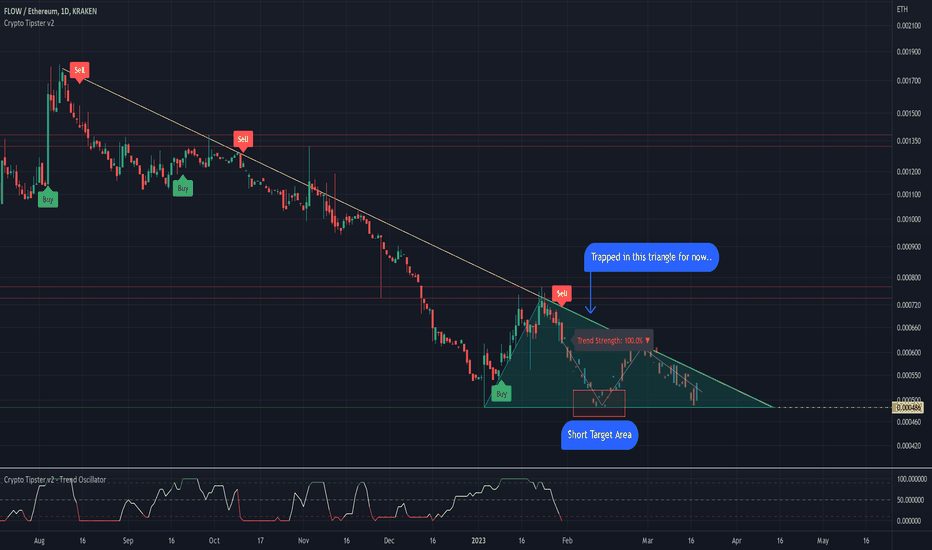

FLOWETH - 20% Short to Deep Down SupportA big long descending trend line which has been tested by flow on numerous occasions historically has just recently been tested once again, causing a price rejection to the downside once again. As you can see from the recent swing low we've created a triangular wedge pattern which we are going to be ranging in for the next few weeks.

This gives us a big opportunity to get a 20% Short trade in from near the top edge of the wedge and watch the price travel down the the horizontal support line at the bottom of the wedge.