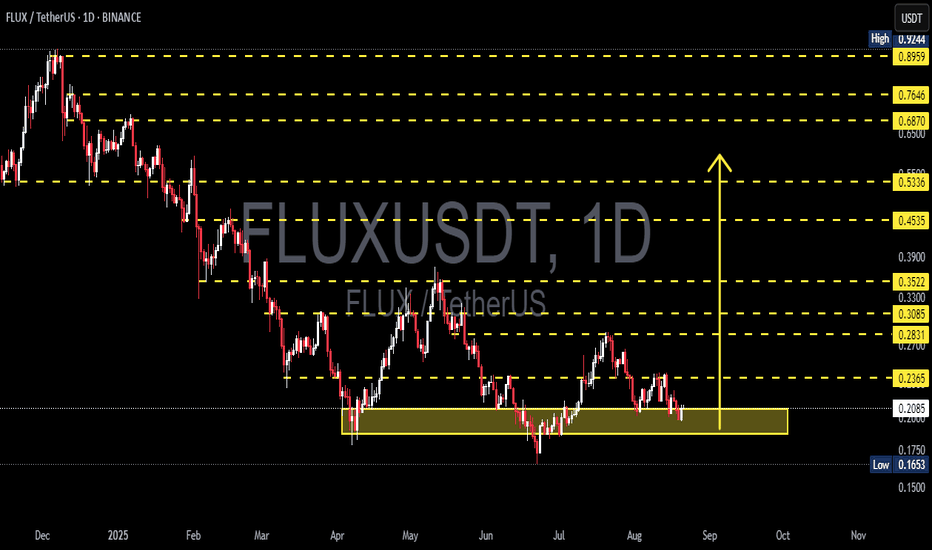

FLUX/USDT — Critical Demand Zone Under Test!Currently, FLUX/USDT is at a make-or-break level, retesting the key demand zone 0.1653–0.2081 that has repeatedly acted as a strong support since March 2025. This zone is not just numbers on the chart, but a battlefield between bulls and bears where market direction can be decided.

---

🔎 Price Structure & Pattern

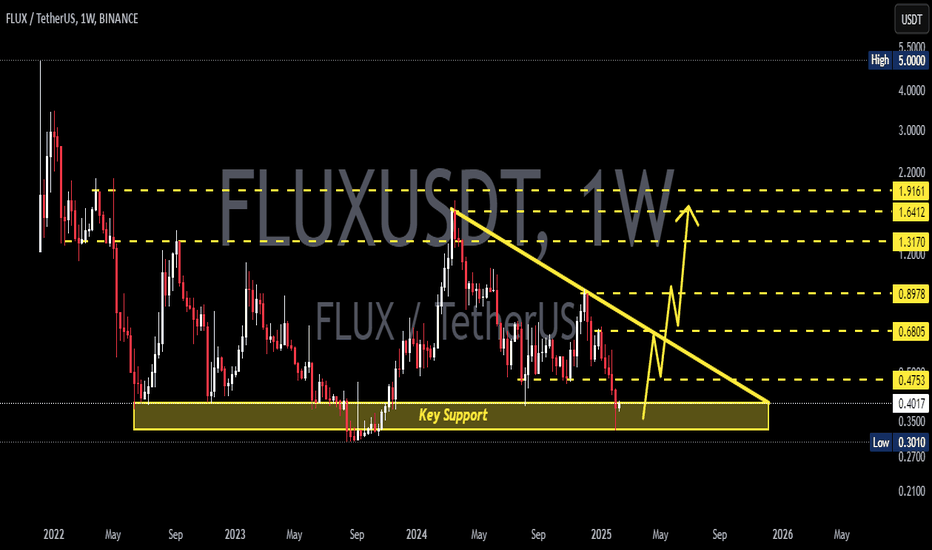

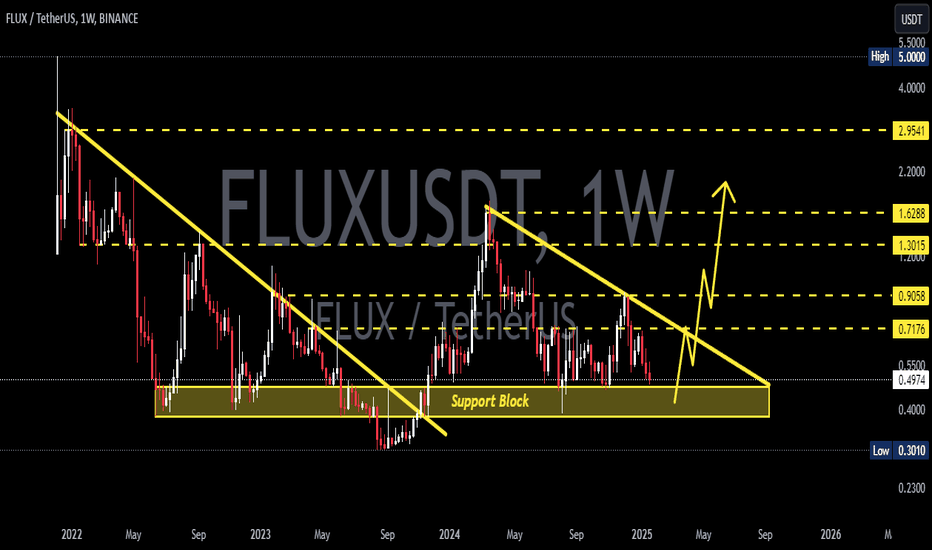

Mid-term downtrend: Price has been forming consistent lower highs since the peak earlier this year.

Accumulation zone: The yellow box (0.165–0.21) is a major base of consolidation where buyers have stepped in multiple times.

Rejections at mid-level resistance: Price has failed several times at 0.283–0.308 → indicating strong supply in that area.

Current action: Price is once again testing the demand zone — will it hold, or finally break?

---

🚀 Bullish Scenario

If the 0.165–0.21 support zone holds, a rebound could trigger significant upside:

1. Initial confirmation: Daily close above 0.2365.

2. Short-term targets: 0.2831 → 0.3085.

3. Extended targets (if momentum builds): 0.3522 → 0.4535.

4. Macro confirmation: Above 0.5336, the trend could flip bullish in a bigger structure.

✨ Watch for bullish engulfing, hammer candles, or a strong volume spike inside this zone as early signals of buyer strength.

---

⚠️ Bearish Scenario

If 0.1653 breaks down with a valid daily close:

1. Downtrend resumes with room for deeper corrections.

2. A drop from 0.208 → 0.165 = roughly –20% decline.

3. Once broken, the 0.165–0.21 zone could flip into a new supply zone (resistance).

---

📌 Key Levels to Watch

Major support: 0.1653–0.2081 (demand zone)

Nearest resistance: 0.2365

Breakout trigger: 0.2831 → 0.3085

Macro bullish confirmation: >0.3522

---

📝 Conclusion

FLUX is standing at a crossroad:

Holding above 0.165–0.21 = strong rebound potential.

Breakdown below 0.165 = bearish continuation.

For traders, this is a highly strategic zone. Waiting for clear confirmation in price action and volume is key. This area could become a golden opportunity for disciplined traders — or a dangerous trap for impatient ones.

#FLUX #FLUXUSDT #CryptoAnalysis #PriceAction #AltcoinSetup #SupportResistance #CryptoBreakout #MarketUpdate #RiskManagement

Fluxusdtidea

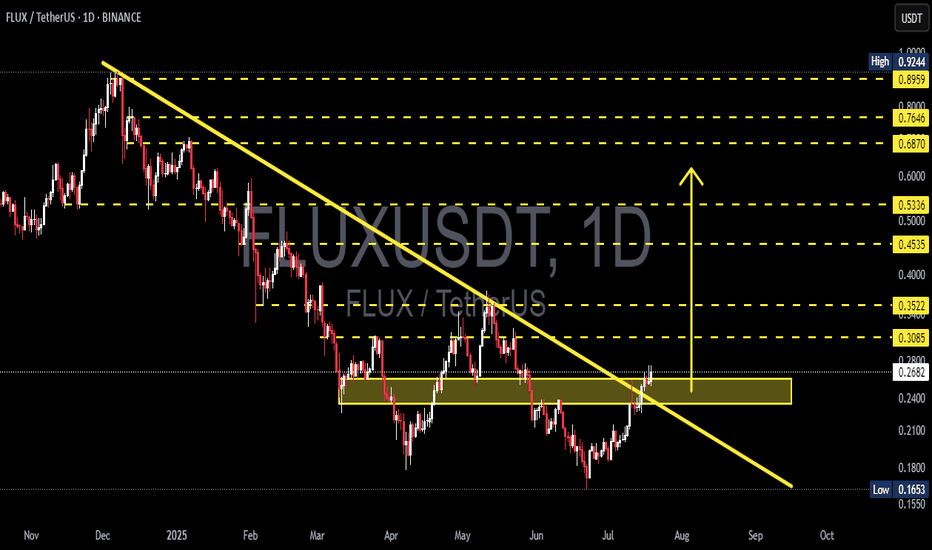

FLUX/USDT – Major Trendline Breakout!

📊 Technical Analysis Overview (Daily Timeframe)

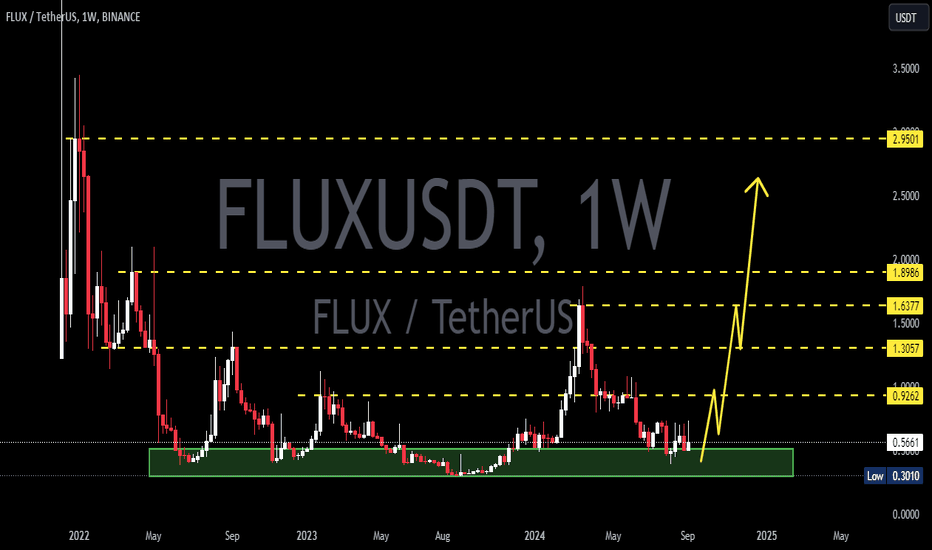

After months of persistent downtrend pressure since late 2024, FLUX/USDT has finally flashed a high-probability bullish reversal signal. The recent breakout above a long-standing descending trendline may mark the beginning of a new bullish structure that could fuel an explosive upside move.

🔍 Market Structure & Technical Pattern

✅ Descending Trendline Breakout:

FLUX has successfully broken out of the dominant bearish trendline that has acted as resistance since December 2024. This breakout is an early sign of a trend reversal, shifting momentum in favor of the bulls.

✅ Demand Zone Reclaim (0.22 – 0.26 USDT):

This critical horizontal range has served as both support and resistance in recent months. Price has now reclaimed this zone with strength, indicating renewed buying pressure and a possible shift into accumulation or markup phase.

✅ Bullish Breakout Candle:

A strong bullish candle has closed above both the descending trendline and the demand zone, confirming breakout strength and increasing the odds of bullish continuation.

✅ Potential Bullish Continuation Setup:

If the price holds above 0.26 and prints a higher low, this will likely confirm a bullish structure and support a continuation move toward key resistance levels.

📈 Bullish Scenario – Potential Upside Targets

Should bullish momentum sustain, here are the major resistance levels to watch:

1. 0.3085 USDT – Immediate resistance zone.

2. 0.3522 USDT – Historical horizontal resistance.

3. 0.4535 – 0.5336 USDT – Consolidation range from Q1 2025.

4. 0.6870 USDT – Psychological level and potential Fibonacci confluence.

5. 0.7646 – 0.8959 USDT – Long-term bullish target, up to +200% from current levels.

📌 Note: A breakout supported by strong volume will add greater confirmation to the bullish thesis.

📉 Bearish Scenario – Watch Out for a Fakeout

Although the breakout looks promising, risks remain:

If the price fails to hold above 0.26, it may result in a false breakout.

A break below 0.24 could push price back into the 0.20 – 0.22 USDT zone.

If selling intensifies, FLUX may retest the 0.1653 USDT low.

⚠️ Always manage risk. A re-entry below the broken support would invalidate the breakout setup.

📌 Summary Strategy:

✅ Confirmed breakout from multi-month downtrend structure.

🟨 Demand zone has flipped into support.

📈 Multiple upside targets with strong reward-to-risk potential.

⚠️ Watch for confirmation via volume and price retest behavior.

#FLUXUSDT #CryptoBreakout #AltcoinAnalysis #FLUX #TechnicalAnalysis #TrendReversal #CryptoTrading #TradingViewTA #PriceAction #CryptoBulls

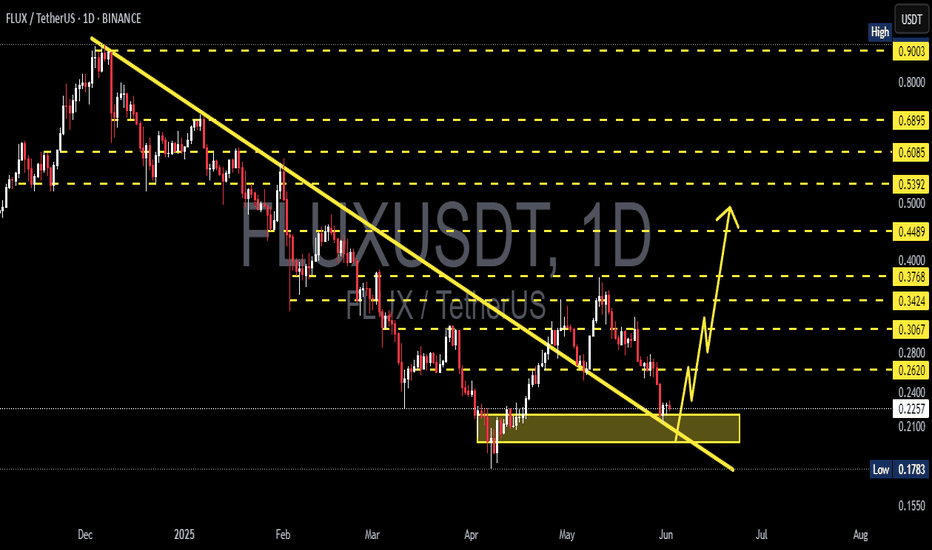

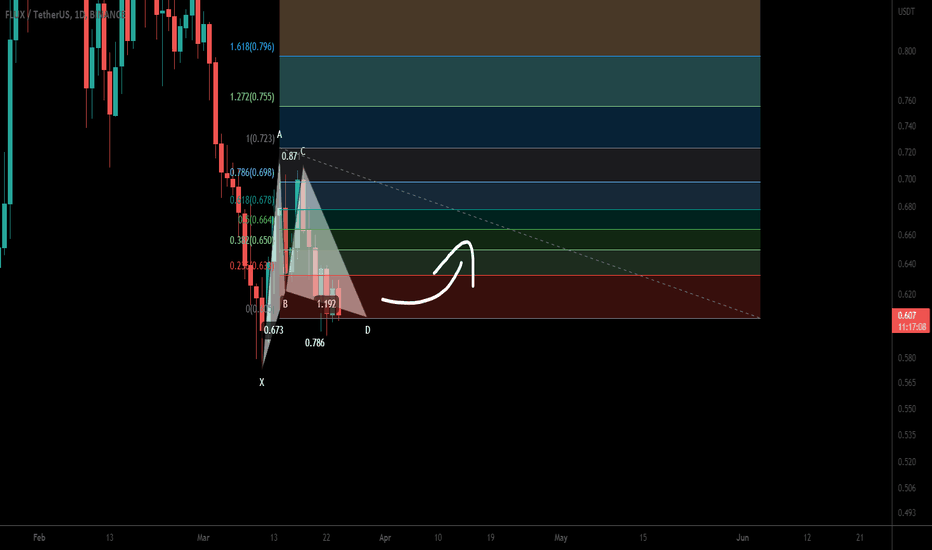

Flux coin forming bullish Gartley for upto 21.50% moveHi dear friends, hope you are well and welcome to the new trade setup of Flux coin with US Dollar pair.

Previously we caught a nice pump of FLUX as below:

Now on a daily time frame, FLUX has formed a bullish Gartley for another price reversal move.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

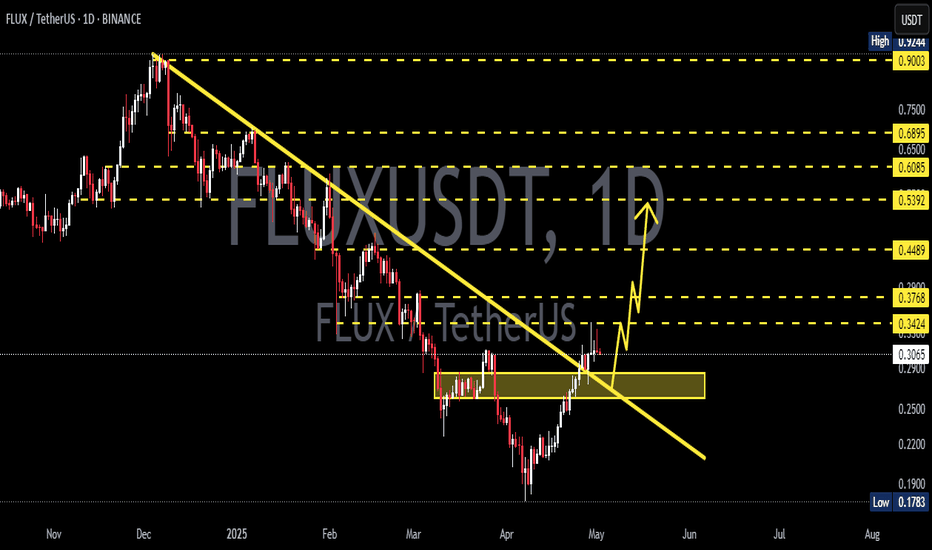

Flux coin forming bullish Gartley for upto 35.50% pumpHi dear friends, hope you are well and welcome to the new trade setup of Flux coin with Bitcoin pair.

Recently we caught more than 80% pump of FLUX as below:

Now on a 2-hr time frame, FLUX is completing the final leg of a bullish Gartley move for another pump soon.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

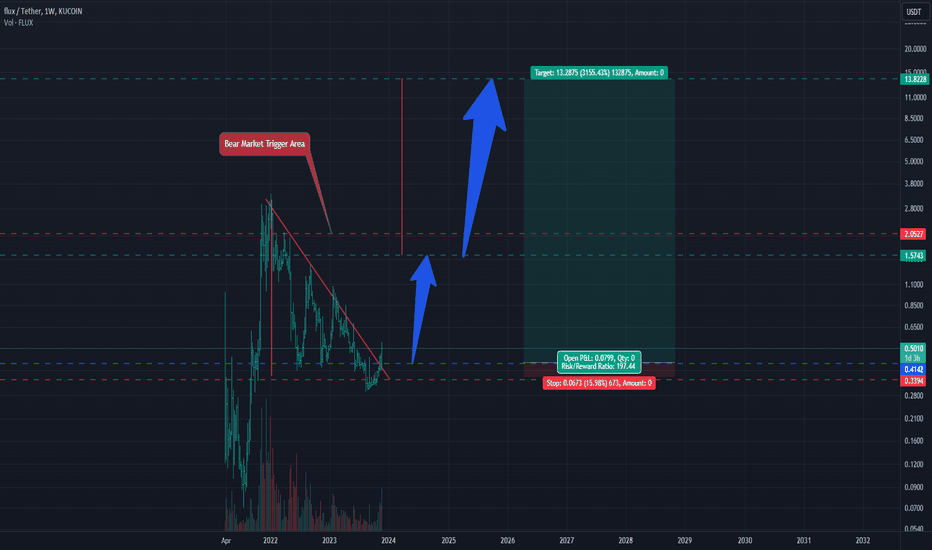

FLUXUSDT (Local Signal)Hello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart.

Entry: market and lower

Target zone: 0.9 - 0.93

Stop: ~0.63 (depending of ur risk). ALWAYS follow ur RM .

Risk/Reward: 1 to 3

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions.