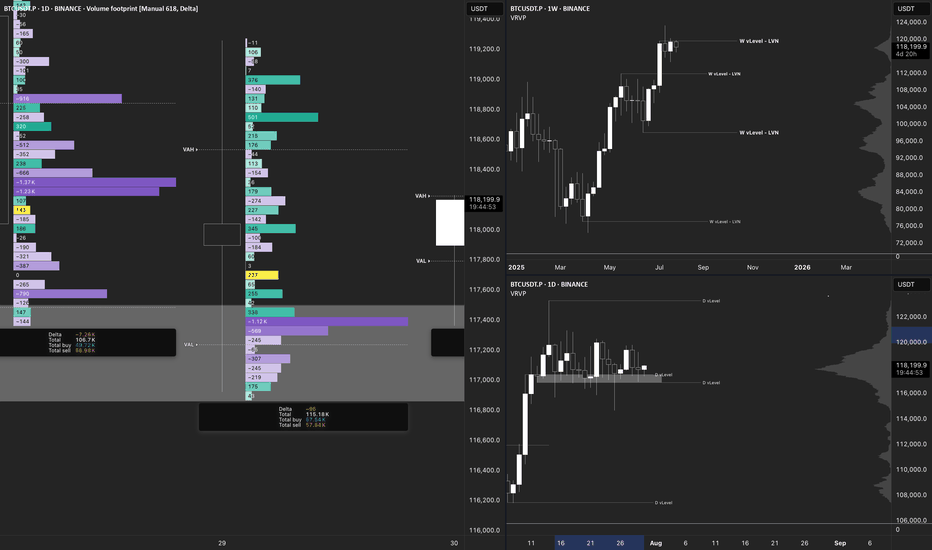

$BTC Daily OutlookDaily Chart

Today’s close printed a small bearish doji; visually bearish but still another inside-day that keeps BTC boxed between the High-Volume Node / v-Level cluster at $116 860-$123 300.

Holding $116 860 remains critical; lose it on a daily close and price can easily slide to the weekly breakout shelf near $111 960. We are now 16 days inside this balance. Per Auction-Market-Theory rule #5, the longer price churns at the edge, the more resting liquidity is absorbed, eventually a decisive push will follow. If buyers defend $116 860 again, the path opens toward range high $123 300 and the prior ATH; if they fail, expect a fast flush to the weekly V-Level.

Footprint Read

Value Area High and Low span the full candle, with the POC parked mid-range, classic two-sided trade. Delta finished negative and the heaviest prints sit at session lows: sellers hit the bid hard, yet could not follow through. That absorption leaves shorts vulnerable to a squeeze if new selling momentum doesn’t appear quickly.

Fundamental Pulse – Week Ahead

ETF Flows: Spot-Bitcoin ETFs booked three consecutive inflow days to close last week (+$180 M net). Sustained demand under the range supports the bullish case.

Macro Data: U.S. FOMC & Federal Fund Rates prints for this week; expect more volatility starting from tomorrow.

Game Plan

Primary bias stays long while daily candles close above $116 860; upside trigger is a clean for now or shorts squeeze toward $123 300.

If $116 860 breaks with volume, prepare for a quick liquidity hunt into the weekly shelf at $111 960, where we reassess for swing longs.

Intraday: I’ll monitor the Intraday Chart on tomorrow's High impact events and look for best opportunities across the board. Alt window: a fresh downtick in BTC Dominance could spark rotation; watch high-Open Interest majors if BTC ranges.

Footprintchart

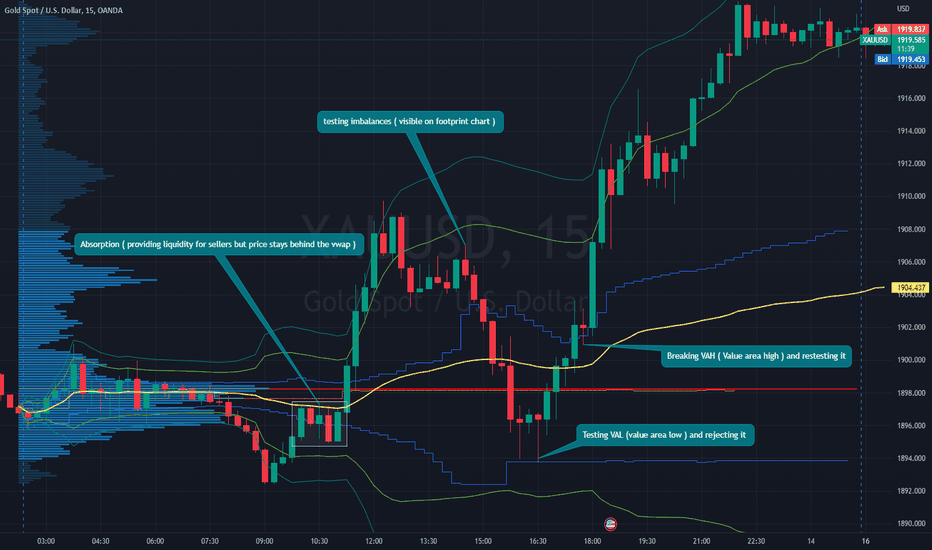

Trading with Volume profile there was 3 setup for intraday trading

first one after seeing rejection of imbalances ( high risk until we entered the Value again ) take profit @ POC or VAL

second one after seeing rejection of VAL ( this one was most valid setup of the day , we rejected imbalances and VAL at the same time , there were clear signs in the footprint ) take profit @ VWAP or POC or VAH or even finding new values at higher prices

third one was after breaking of VAH and retesting it ( usually u shouldn't enter at breakouts , cause it might be just liquidity hunt . u should wait for retest of breaking point ) take profit @ new values at higher prices

i usually dont like break out trades , but there was another opportunity after seeing absorption behind the vwap .

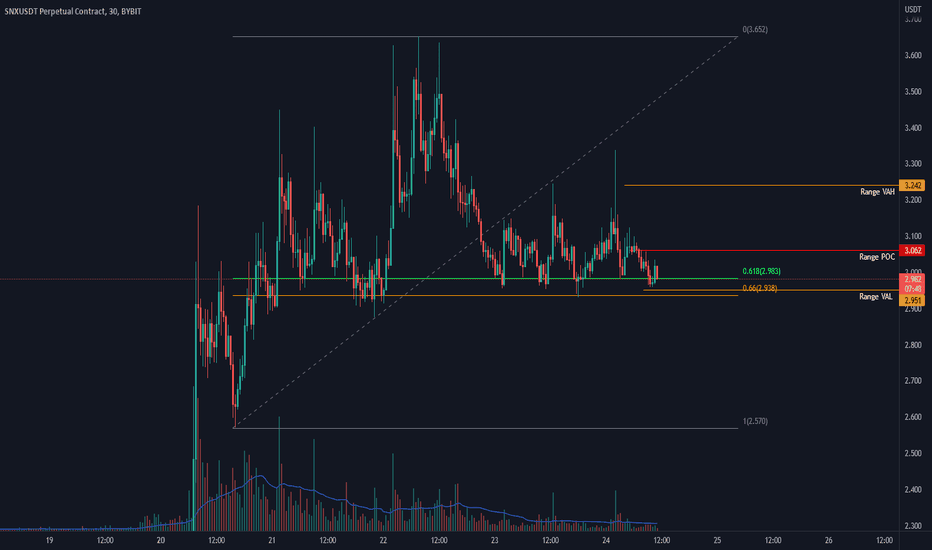

SNXUSDT at Support - Seeing confluence to go longSynthetix has been ranging between the current support of $2.95 and $3.60

I'm seeing a few points of confluence at support and see on the TPO and 30minute imbalance chart that there is a possibility of short traders being trapped at the low if price moves up sharply

Confluence:

1. Fibonacci golden pocket area

2. Value area low of the fixed range

3. Possible Trapped short traders

4. Failed aution on a TPO (Time Price Opportunity) chart

5. Bullish divergence on the 15m (Vumanchu cipher b)

Not Financial advice. DYOR. Papertrade before using real money.

If you like this idea, please comment, give a thumbs up and follow for more ideas like these.

Safe trading guys!

Shawn

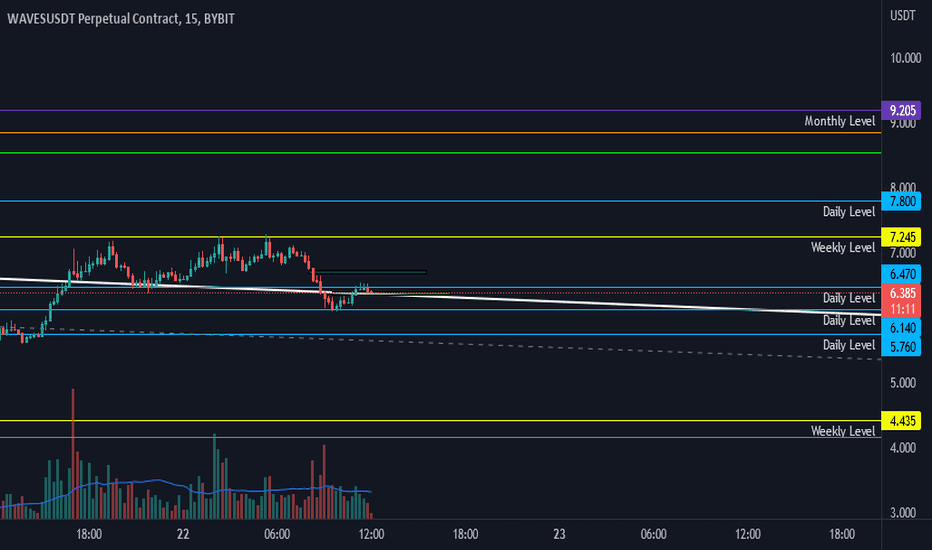

WAVESUSDT Ready for another breakout today?Waves Had a run of about 75% to the upside yesterday to $7.27

This morning it dumped down to $6.10

Currently we are seeing a bounce off this area which is a daily support.

If you aren't already in a trade, it might not be the best place to enter a long, but if you are already in the trade, it could be a reason for you to stay long.

One of the reasons I entered a long at $6.22 because of what I saw on a TPO chart and footprint chart.

I talk about likely reversal areas and where I am taking profits.

Open interest is currently increasing, which is another reason to hold a long if you are already in the trade

Not Financial advice. DYOR. Papertrade before using real money.

Safe trading guys!

Shawn