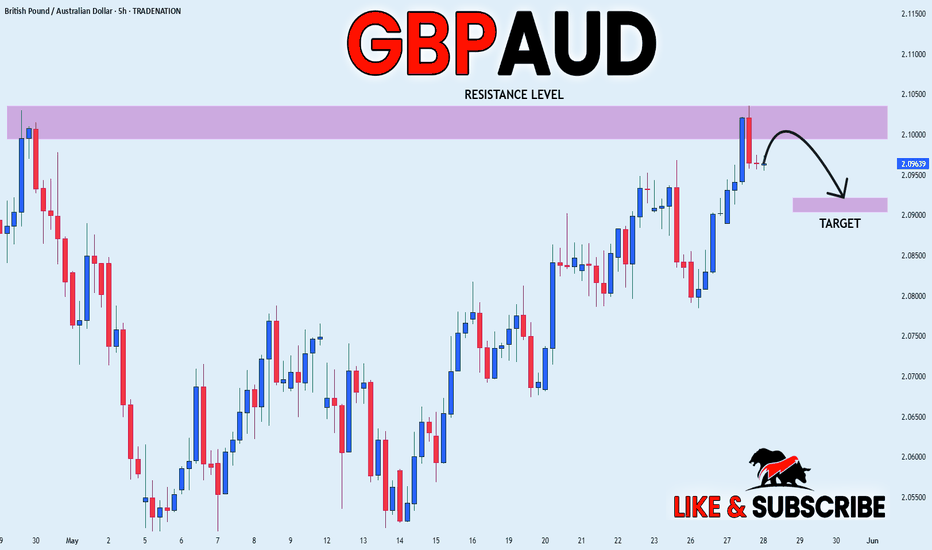

GBP_AUD PULLBACK AHEAD|SHORT|

b]✅GBP_AUD has retested

A resistance level of 2.1036

And we are seeing a bearish reaction

With the price going down so we are

Bearish biased now and we will be

Expecting the pair to go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Forex-trading

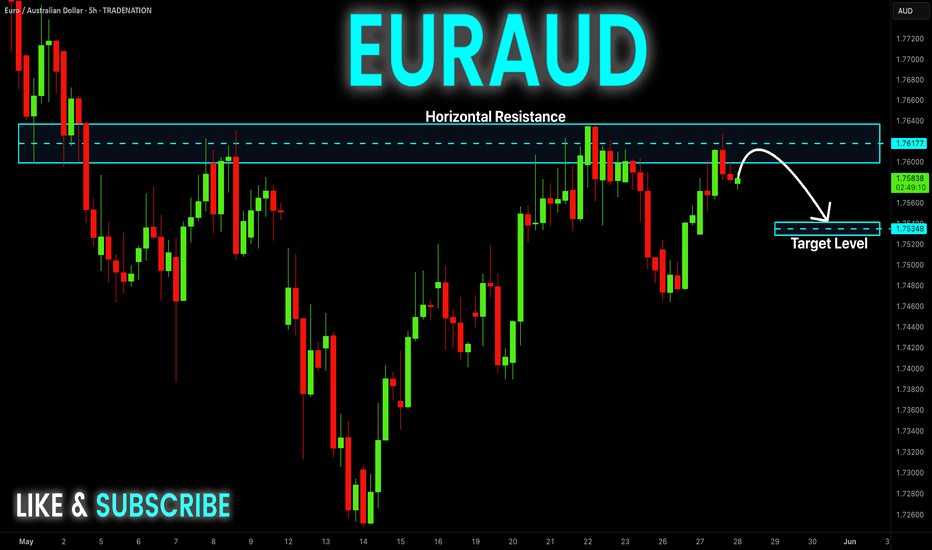

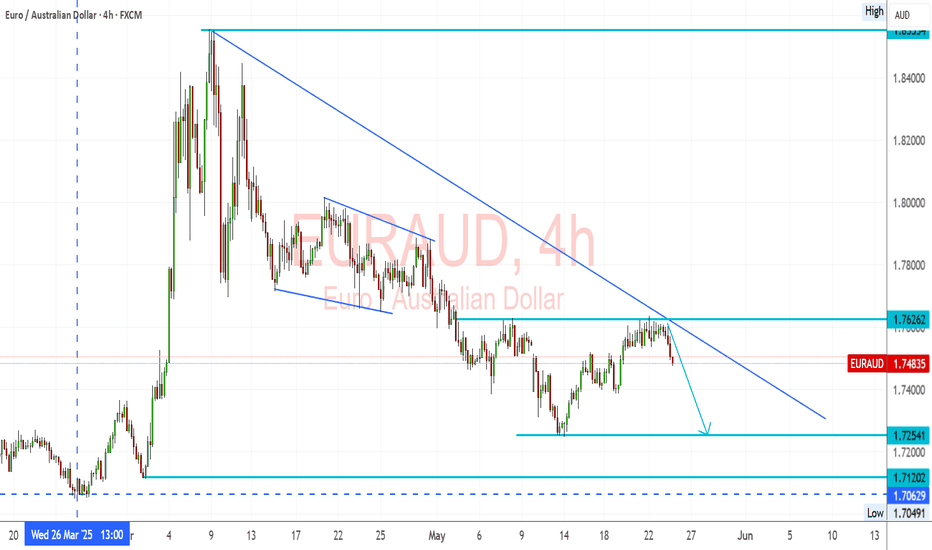

EUR-AUD Short From Resistance! Sell!

Hello,Traders!

EUR-AUD made a retest

Of the key horizontal

Resistance level of 1.7640

From where we are already

Seeing a bearish pullback so

As we are locally bearish

Biased and we will be

Expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_USD LONG FROM RISING SUPPORT|

✅AUD_USD is trading along

The rising support line

And as the pair will soon retest it

I am expecting the price to go up

To retest the supply levels above 0.6460

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-JPY Resistance Cluster! Sell!

Hello,Traders!

GBP-JPY made a retest

Of the resistance cluster

Of the rising and horizontal

Resistance lines around 193.989

And we are already seeing a

Bearish reaction so we will be

Expecting a further bearish

Move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

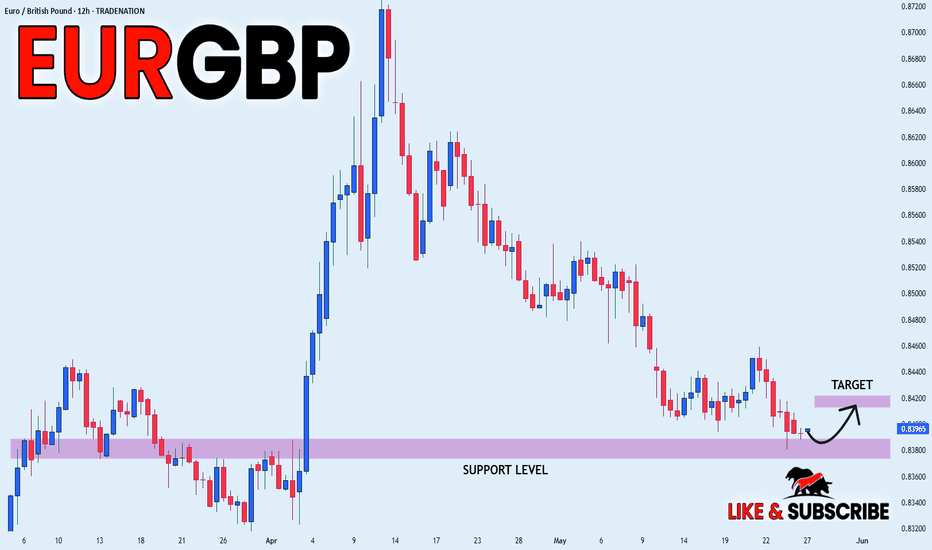

EUR_GBP RISKY LONG|

✅EUR_GBP is going down to retest

A horizontal support of 0.8380

Which makes me locally bullish biased

And I think that we will see a rebound

And a move up from the level

Towards the target above at 0.8414

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

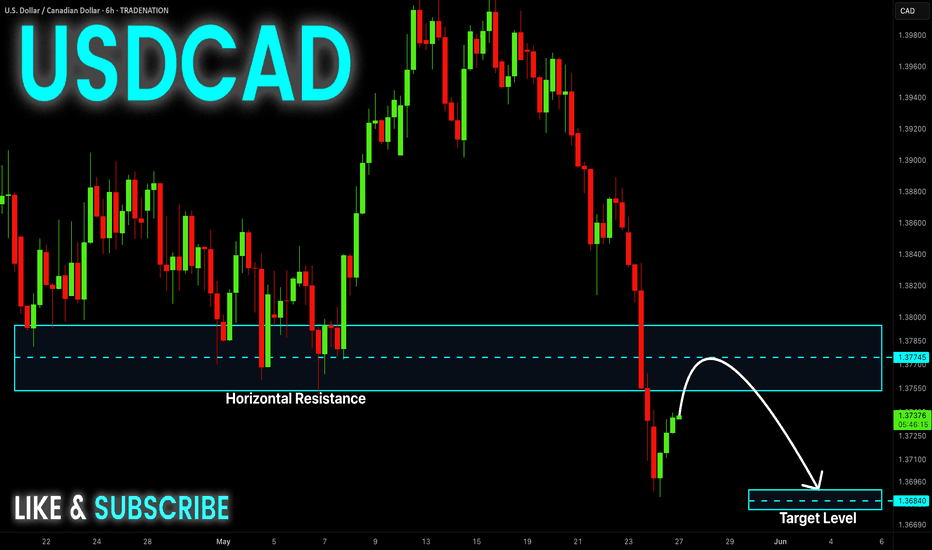

USD-CAD Bearish Bias! Sell!

Hello,Traders!

USD-CAD is trading in a

Downtrend and the pair

Made a bearish breakout

Of the key horizontal level

Of 1.3774 which is now a

Resistance and the pair is

Making a local pullback

To retest the new resistance

From where we will be

Expecting a further

Bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

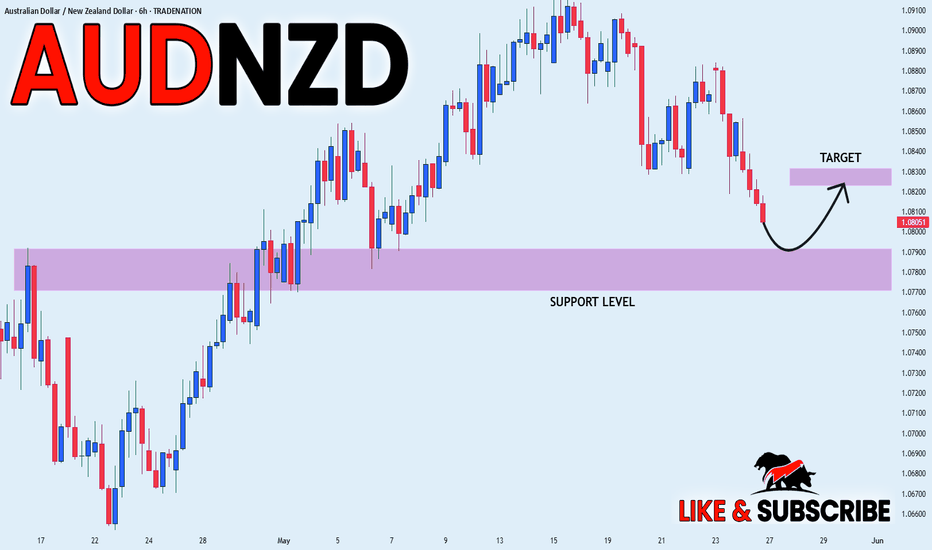

AUD_NZD SUPPORT AHEAD|LONG|

✅AUD_NZD is going down now

But a strong support level is ahead at 1.0780

Thus I am expecting a rebound

And a move up towards the target at 1.0827

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

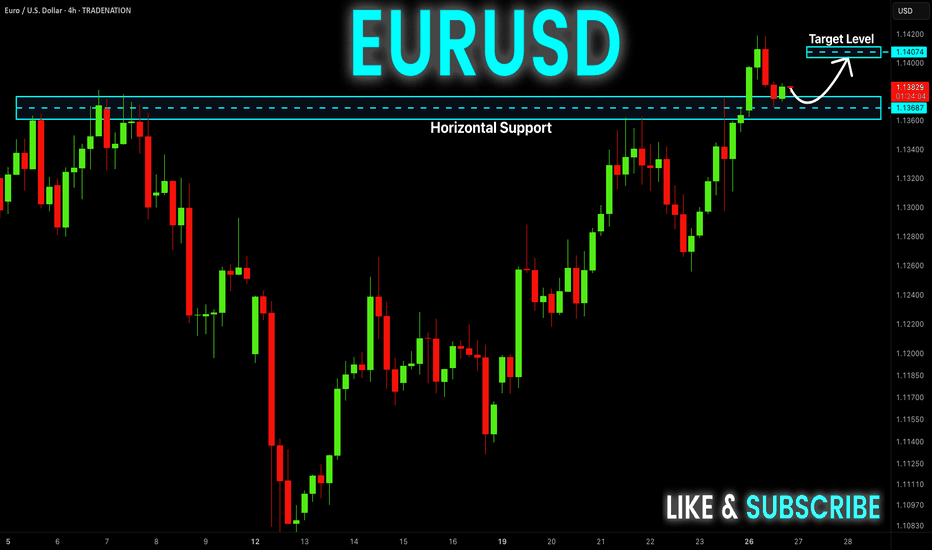

EUR-USD Local Long! Buy!

Hello,Traders!

EUR-USD made a retest

Of the key horizontal

Support level of 1.1369

And we are already seeing

A bullish rebound so we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

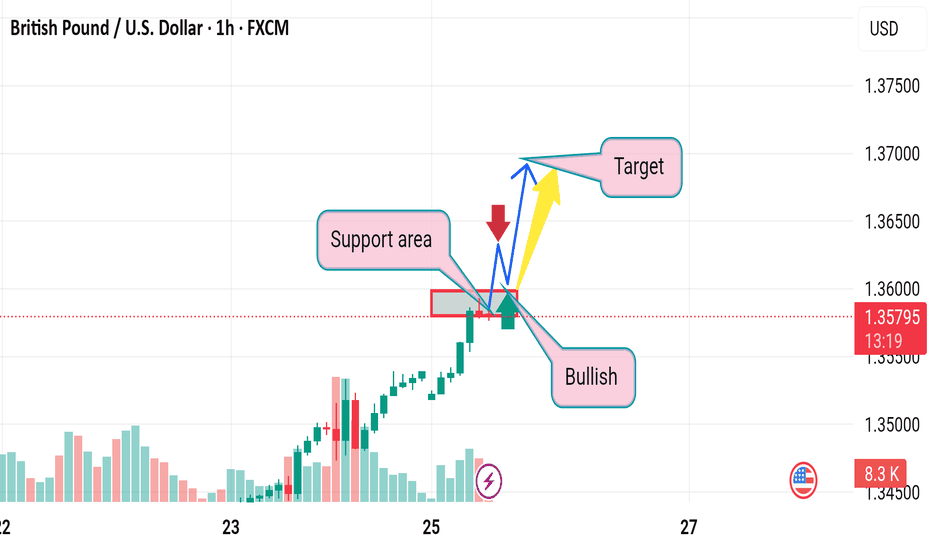

Market next target

Original Analysis Summary:

Identifies a bullish breakout above a support zone.

Expects continuation upward to a target zone after minor pullback.

Assumes support holds and bullish trend continues.

---

Disruptive Bearish Interpretation:

1. Fakeout Risk (Bull Trap):

Price broke above the support area, but this could be a false breakout designed to lure in long positions before a reversal.

2. Trendline Retest Failure:

The price is testing a trendline or resistance zone. Failure to break above this area could indicate rejection and reversal.

3. Bearish Divergence:

If momentum indicators (e.g., RSI or MACD, not shown here but inferred) show divergence, it may warn of weakening bullish strength despite price rising.

4. Candlestick Exhaustion:

Recent candles show upper wicks and slowing momentum — a common sign of potential exhaustion.

EUR_CAD RISKY LONG|

✅EUR_CAD is going down to retest

A horizontal support of 1.5570

Which makes me locally bullish biased

And I think that we will see a rebound

And a move up from the level

Towards the target above at 1.5630

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

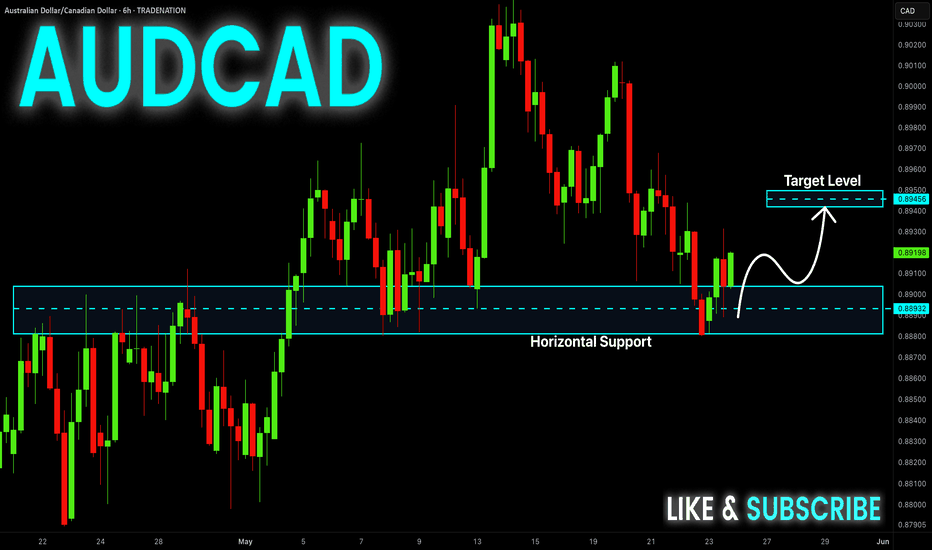

AUD-CAD Will Go UP! Buy!

Hello,Traders!

AUD-CAD made a retest

Of the horizontal support

Level of 0.8880 and we

Are already seeing a

Bullish rebound so we are

Locally bullish biased and

We will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

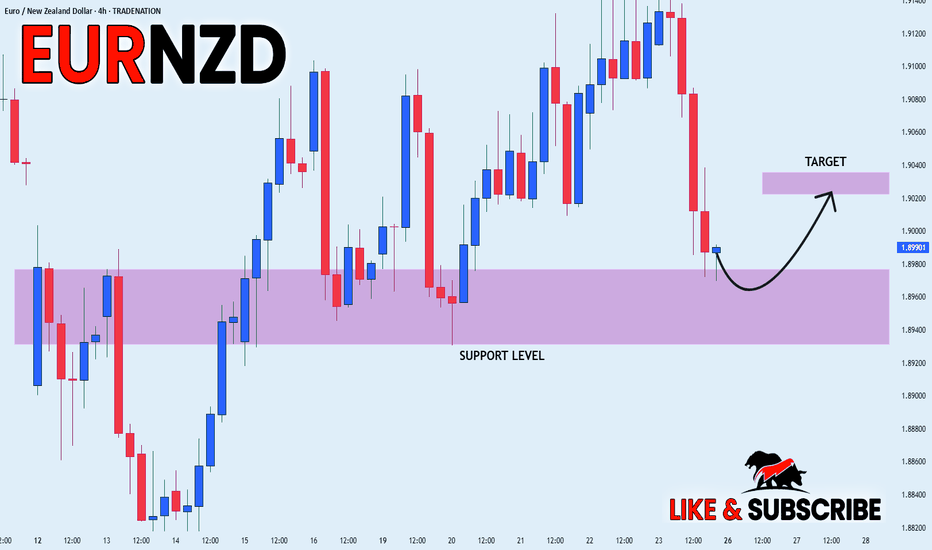

EUR_NZD LOCAL LONG|

✅EUR_NZD is going down now

But a strong support level is ahead at 1.8940

Thus I am expecting a rebound

And a move up towards the target of 1.9022

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

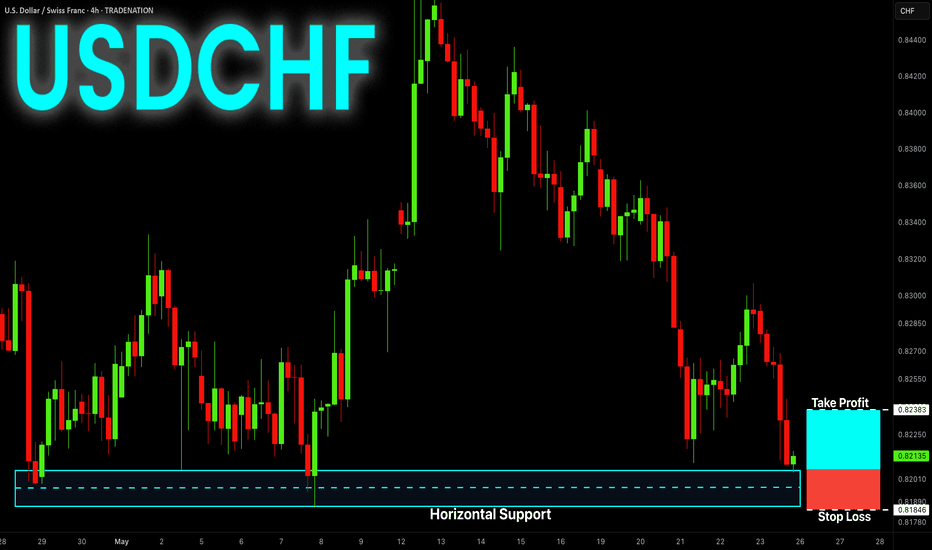

USD-CHF Free Signal! Buy!

Hello,Traders!

USD-CHF is once again

Retesting a horizontal support

Level around 0.8189 and the

Pair seems to have formed

A H&S pattern, so we are bearish

Biased, however, a local bullish

Rebound from the support

Is possible so while risky

A long trade still makes sense

With the Take Profit of 0.8238

And the Stop Loss of 0.8184

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

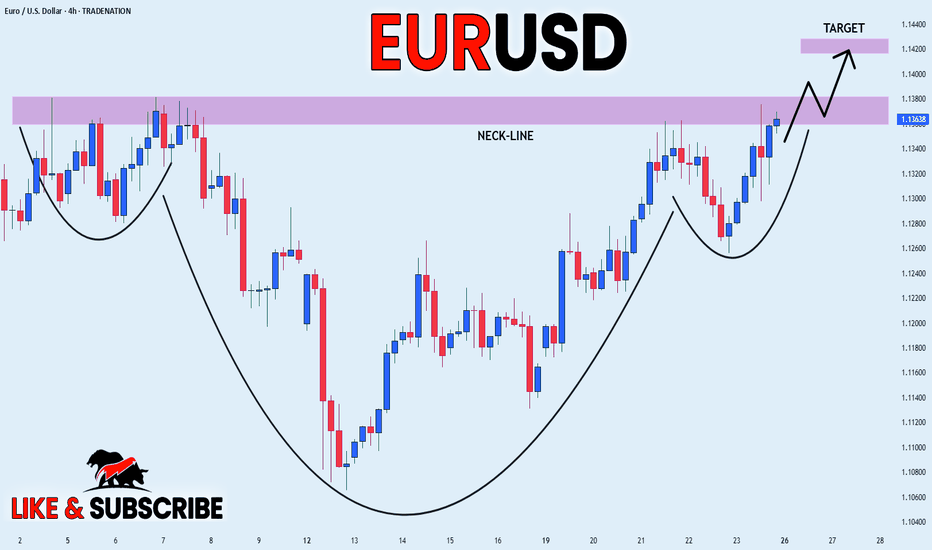

EUR_USD HEAD AND SHOULDERS|LONG|

✅EUR_USD has formed a

Head and Shoulders pattern

And the pair has now formed

The last leg of it, so we are

Bullish biased and IF we see

A bullish breakout of the

Neckline of 1.1380 next week

Then we will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

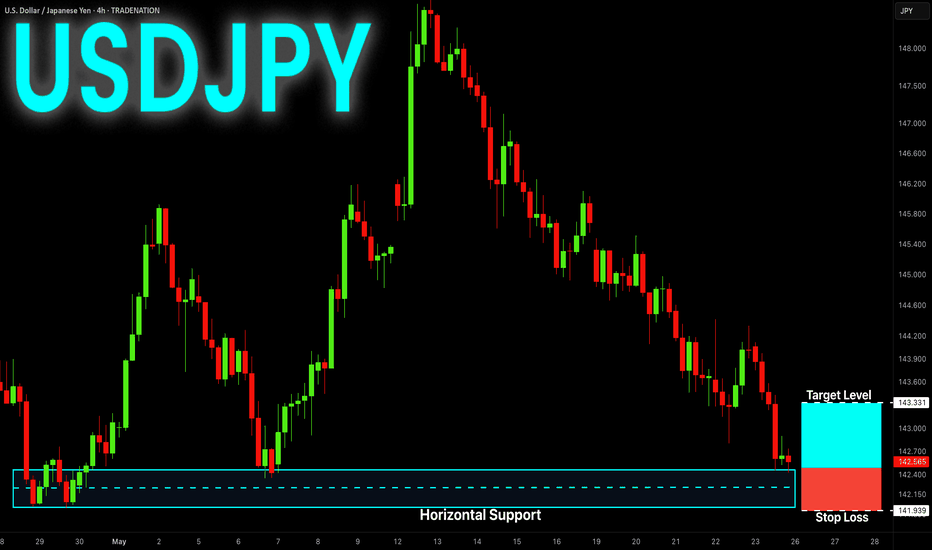

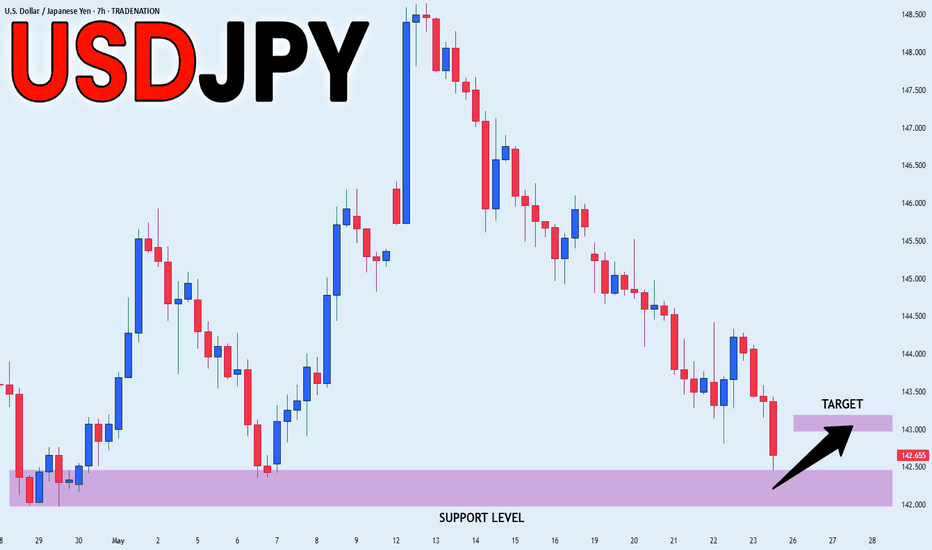

USD-JPY Free Signal For Monday! Buy!

Hello,Traders!

USD-JPY is about to retest

A horizontal support level

Around 142.000 and after

The retest on Monday we

Will be able to go long on

The pair with the Take

Profit of 143.331 and the

Stop Loss of 141.939

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

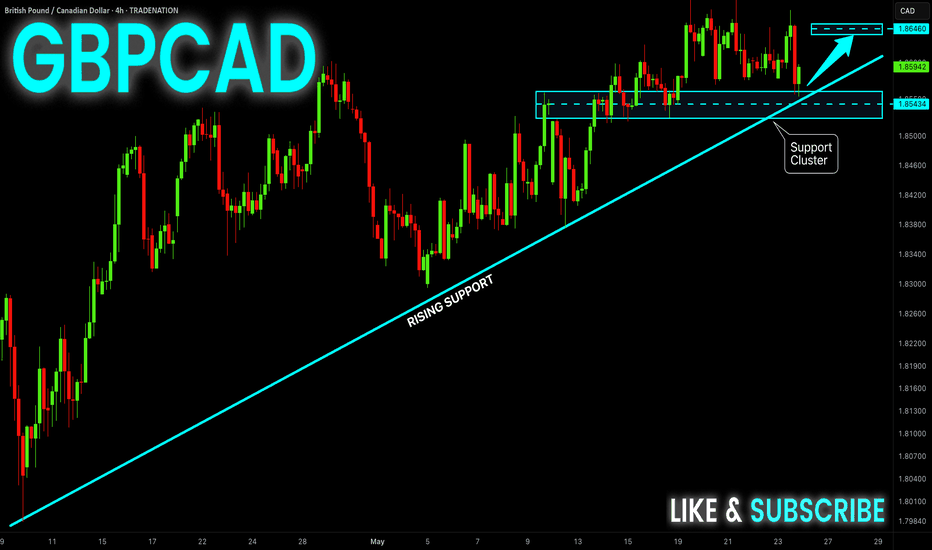

GBP-CAD Support Cluster! Buy!

Hello,Traders!

GBP-CAD is trading in a

Local uptrend along the

Rising support and the pair

Made a retest of the support

Cluster of the rising and

Horizontal support lines

Around 1.8546 from where

We are already seeing a

Bullish rebound so we

Will be expecting a

Further local bullish move

Up on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

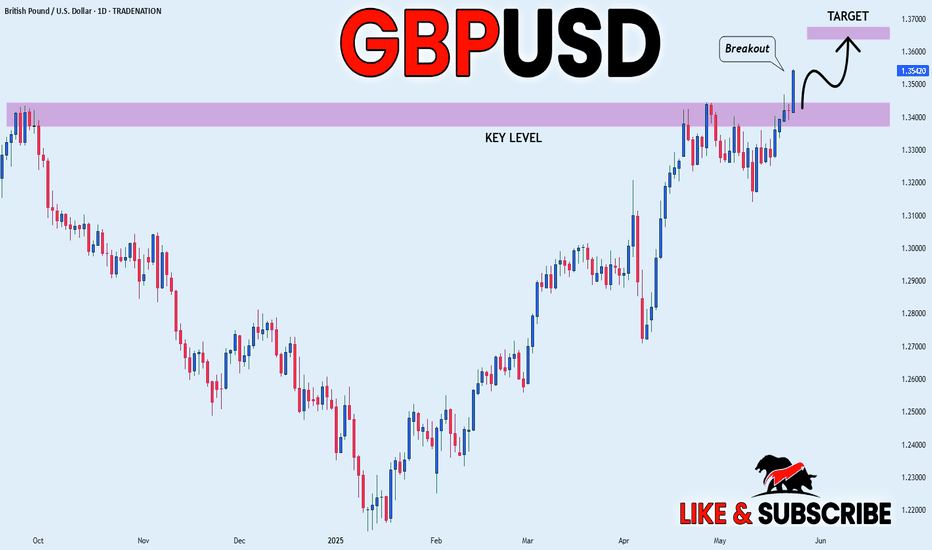

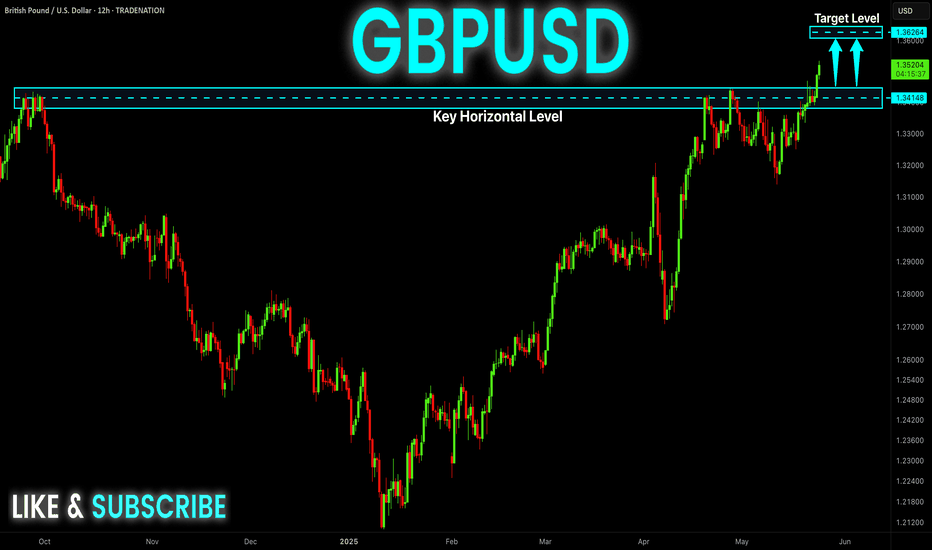

GBP_USD SWING BREAKOUT|LONG|

✅GBP_USD made an absolutely

EPIC breakout of the key horizontal

Level of 1.3426 and the breakout is

Confirmed even on a DAILY timeframe

Which combined with the strong uptrend

Makes us extremely bullish biased on

The pair and we will be expecting

Further growth in the coming weeks

After a potential local pullback

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

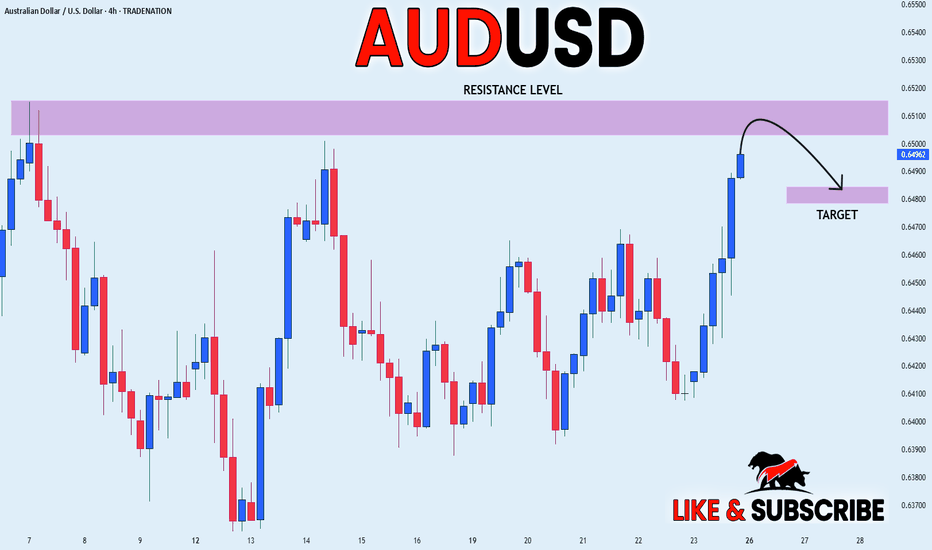

AUD-USD Free Signal For Monday! Sell!

Hello,Traders!

AUD-USD keep growing in

An uptrend an we are bullish

Biased mid-term, however

The pair is locally overbought

So after the pair enters the

Resistance area around 0.6510

On Monday we will be able

To go short on the pair

With the Take Profit of 0.6480

And the Stop Loss of 0.6516

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD – Trendline Holds, Bearish Setup Below 1.7626EURAUD Trend: EURAUD pair remains in a strong downtrend, marked by consistent lower highs and a descending trendline.

Resistance: 1.7626 has been retested and rejected, confirming it as a short-term ceiling.

Structure: The latest rejection from both horizontal resistance and the trendline confirms bearish intent.

🔽 Bearish Targets:

1.7254 – minor support and near-term target

1.7120 – stronger support zone

1.7060 – previous low and potential extended target

A clear break below 1.7400 could confirm continuation of the trend toward those levels.

Fundamental Overview:

🔻 EUR Weakness:

The Eurozone is slowing, particularly in Germany and France.

ECB remains cautious; recent comments show concern about tight financial conditions and sticky inflation.

Political uncertainties and mixed data prints are adding pressure.

🟢 AUD Support:

The RBA remains firm with hawkish language, holding rates while global peers lean dovish.

Commodities remain stable, and Australia benefits from demand out of Asia.

Domestic data (jobs and retail) shows surprising resilience.

Summary:

Bias: Bearish below 1.7626

Break Trigger: 1.7400

Target Range: 1.7250 – 1.7060

Fundamentals: Favor AUD on stronger economic footing and RBA policy tone

📉 EURAUD looks ready for another leg lower unless we see a breakout above 1.7630 with conviction.

AUD_USD SHORT FROM RESISTANCE|

✅AUD_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching a horizontal resistance of 0.6515

Price decline is to be expected on Monday

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_CAD RISING SUPPORT AHEAD|LONG|

✅GBP_CAD is trading along the rising support

And as the pair will soon retest it

I am expecting the price to go up

To retest the supply levels above at 1.8605

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_JPY SUPPORT AHEAD|LONG|

✅USD_JPY is going down now

But a strong support level is ahead at 142.000

Thus I am expecting a rebound

And a move up towards the target of 143.000

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-USD Massive Swing Breakout! Buy!

Hello,Traders!

GBP-USD is trading in a

Strong uptrend and the

Pair made a massive

Bullish breakout of the

Key horizontal level

Of 1.3444 and went

Further up which reinforces

Our bullish bias and after

A potential pullback we

Will be expecting a

Further bullish move up

Next week

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.