Forex-trading

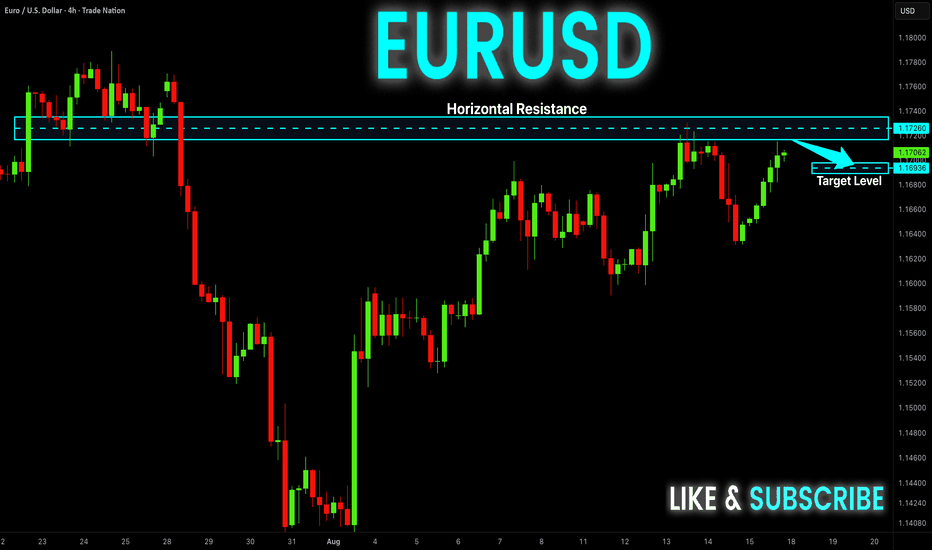

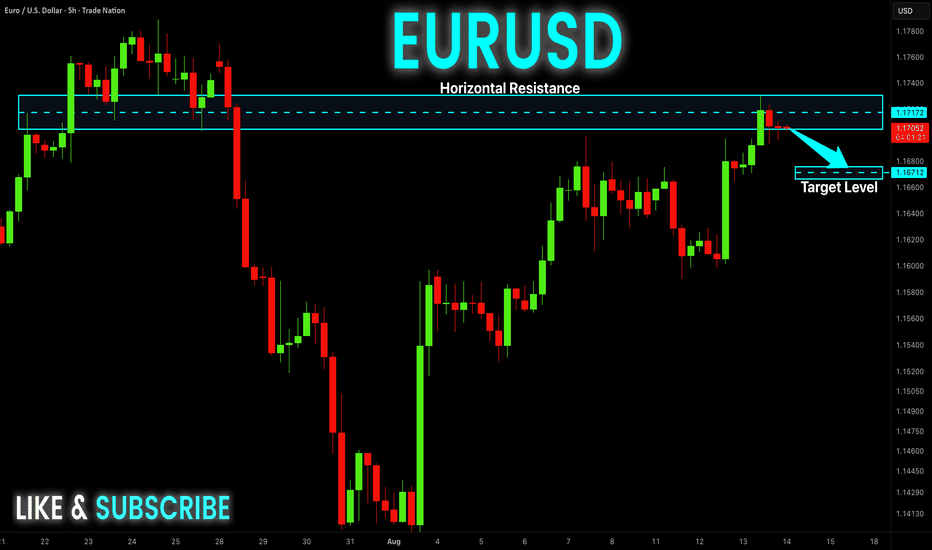

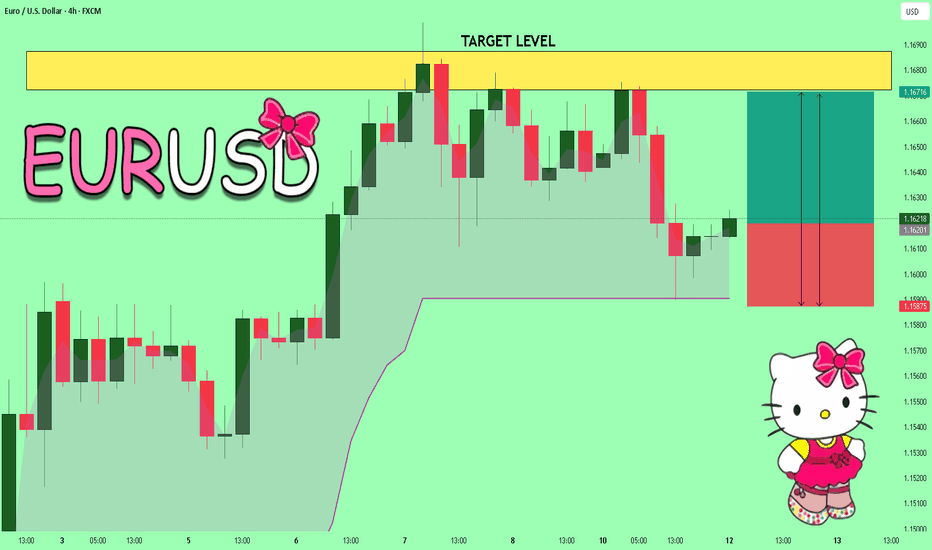

EUR-USD Local Short! Sell!

Hello,Traders!

EUR-USD is going up now

But will soon hit a horizontal

Resistance of 1.1734 from

Where we will be expecting a

Local pullback and we will

Be expecting a local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

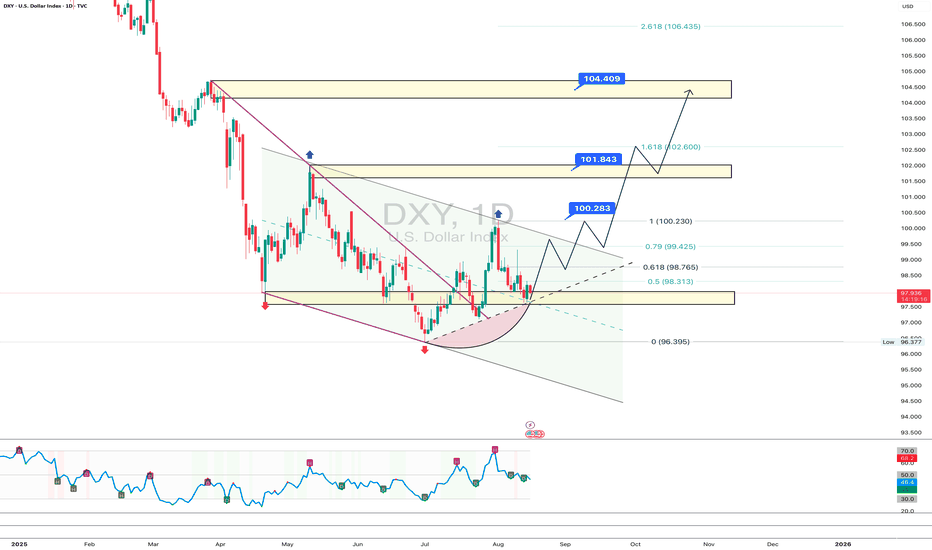

DXY: Dollar’s ready, but the starter pistol’s still silentDXY is holding in the 97.50–97.60 support zone, an area where buyers have stepped in multiple times. Current market structure suggests possible liquidity accumulation before an upside move. The key tactical trigger is a breakout and close above 98.76, opening the path to 100.28, then 101.84 where historical selling pressure has emerged. The long-term target, if all levels break in sequence, is 104.40. While price remains below 98.76, buyers have no confirmed advantage and any rally remains speculative.

Fundamentally , the dollar lacks unconditional support: US macro data is mixed and Fed policy remains uncertain. However, safe-haven demand and cautious risk positioning by large players create a backdrop for a potential upward correction.

Tactical plan: watch 97.50–97.60, a confirmed break above 98.76 activates a move towards 100.28 → 101.84 → 104.40. Failure to break cancels the idea until a fresh impulse emerges.

The dollar right now is like a boxer before stepping into the ring - warmed up, focused, but waiting for the bell.

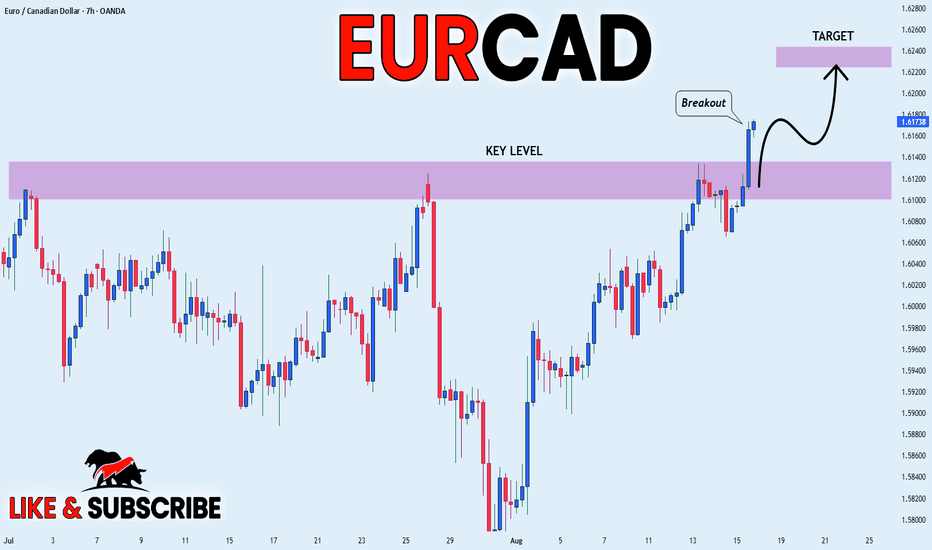

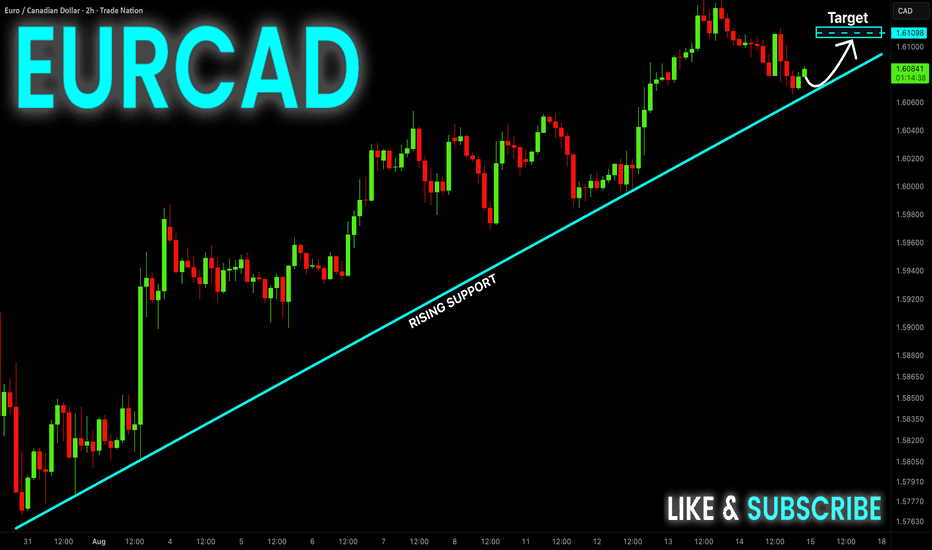

EUR-CAD Rising Support! Buy!

Hello,Traders!

EUR-CAD is trading along

The rising support line

And as the pair made a

Retest of the line and

We are already seeing a

Bullish rebound we will

Be expecting further growth

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-USD Local Long! Buy!

Hello,Traders!

EUR-USD went down sharply

Just as I predicted in my

Previous analysis but the

Pair has now retested

A rising support from where

We are already seeing a

Bullish rebound and we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

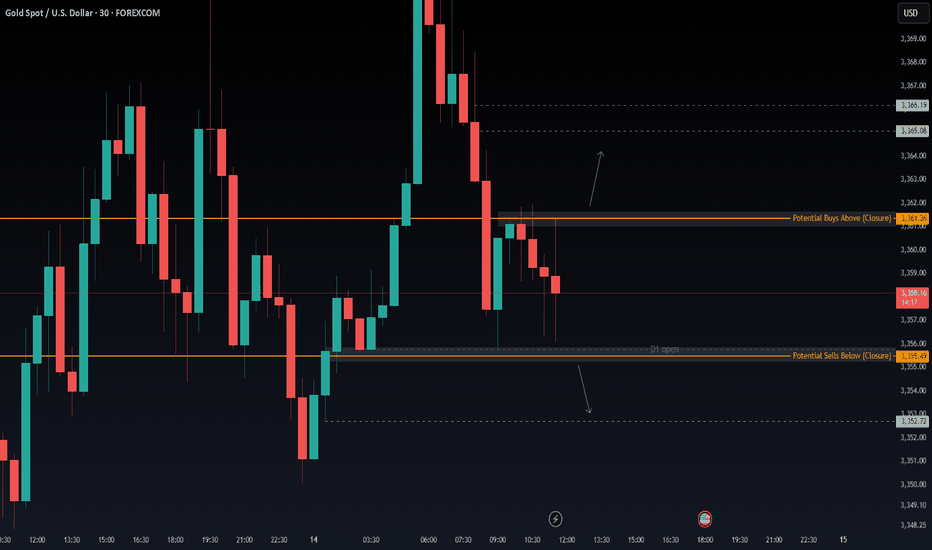

XAUUSD 30M – Intraday Plan Around the RangePrice is holding between $3,361.36 and $3,355.49. We’re currently chopping in the middle around $3,360, with the D1 open acting as a pivot just above the lower boundary. Trades inside this box are possible but riskier due to wicks and fast reversals.

Bullish plan (need confirmation)

Trigger: A clean 30min body close above $3,361.36 (not just a wick).

Targets: First into $3,365.08, then $3,366.19. If momentum holds, trail stops for extended upside.

Management: Take partials at the first target, move SL to breakeven once $3,361 is defended.

Bearish plan (cleaner if we break the floor)

Trigger: 30min close below $3,355.49.

Targets: First into $3,352.72; trail if sellers stay in control.

Management: Scale partials at $3,352.7, protect the rest.

Range scalp (higher risk)

Shorts: Near $3,361 on strong rejection; target mid range ($3,357–$3,358), SL above rejection high.

Longs: Near $3,355–$3,356 on strong rejection wick; target mid, SL under lows.

Use smaller size; this chop can reverse quickly.

What would confirm the break

Strong 30min body close through the level.

Retest holds as S/R.

Momentum expansion after the close.

What invalidates

Breakout closes back inside the range on the next candle → likely a trap.

Multiple wicks through the level without follow through.

Bottom line: Waiting for a 30-min close outside $3,355.49–$3,361.36. Upside focus above $3,361.36 toward $3,366.19; downside focus below $3,355.49 toward $3,352.72.

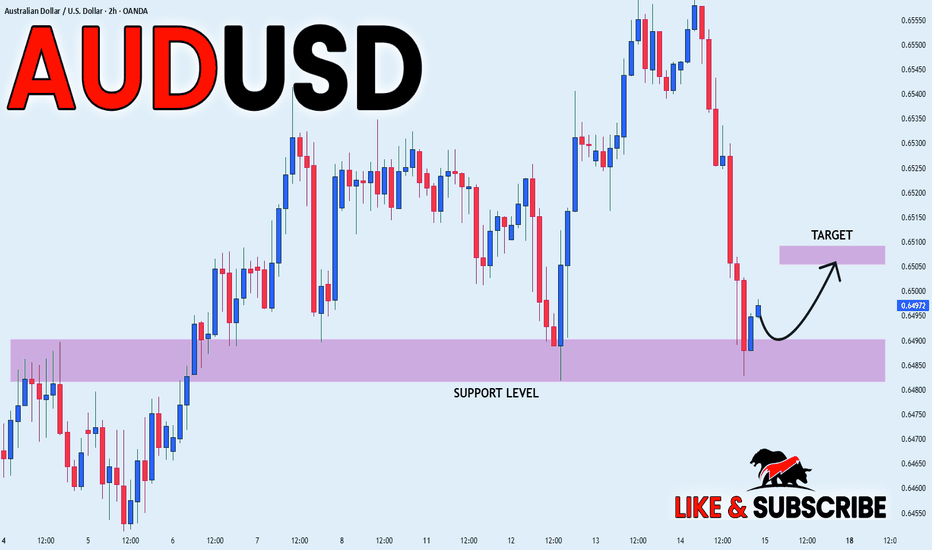

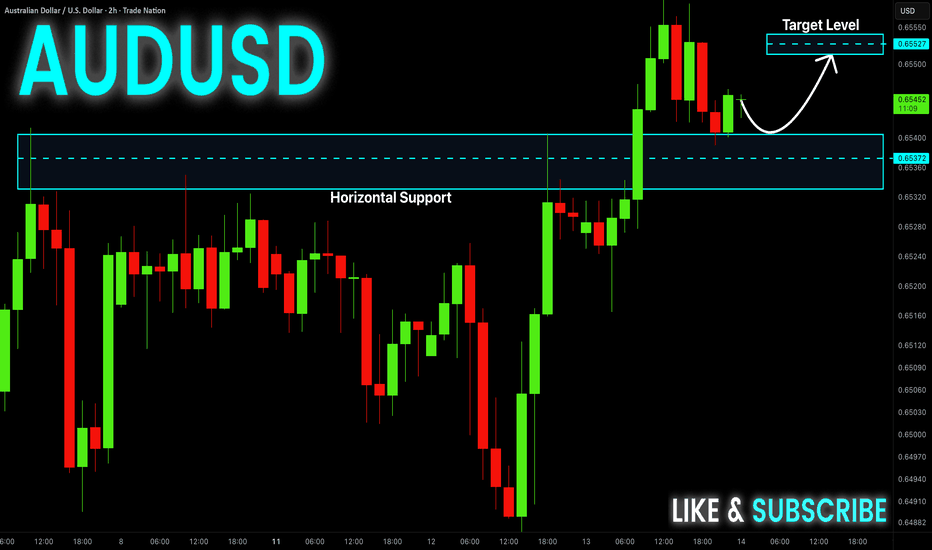

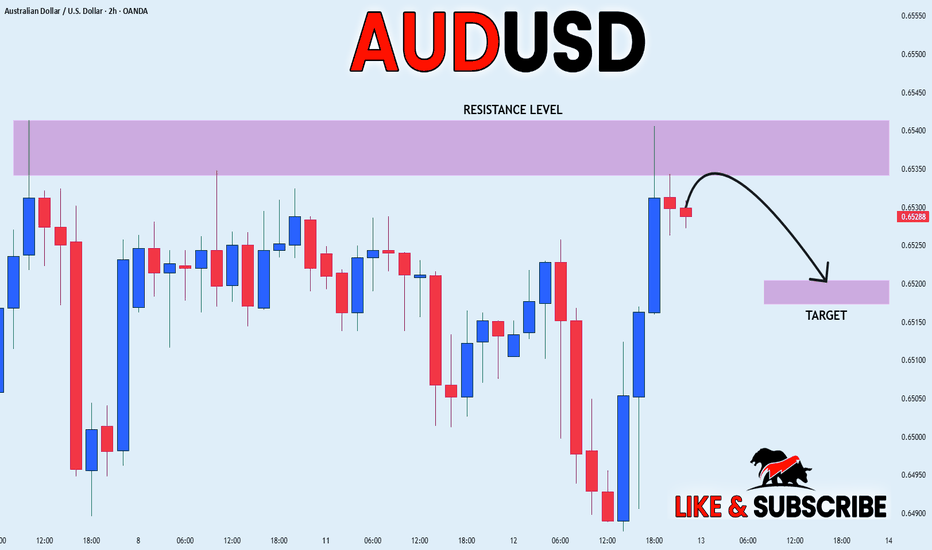

AUD-USD Will Go UP! Buy!

Hello,Traders!

AUD-USD is making a retest

Of the horizontal support

Of 0.6540 and as we are

Bullish biased we will be

Expecting a local bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-USD Risky Short! Sell!

Hello,Traders!

EUR-USD went up sharply

But then hit a horizontal

Resistance of 1.1731

From where we are already

Seeing a local bearish reaction

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

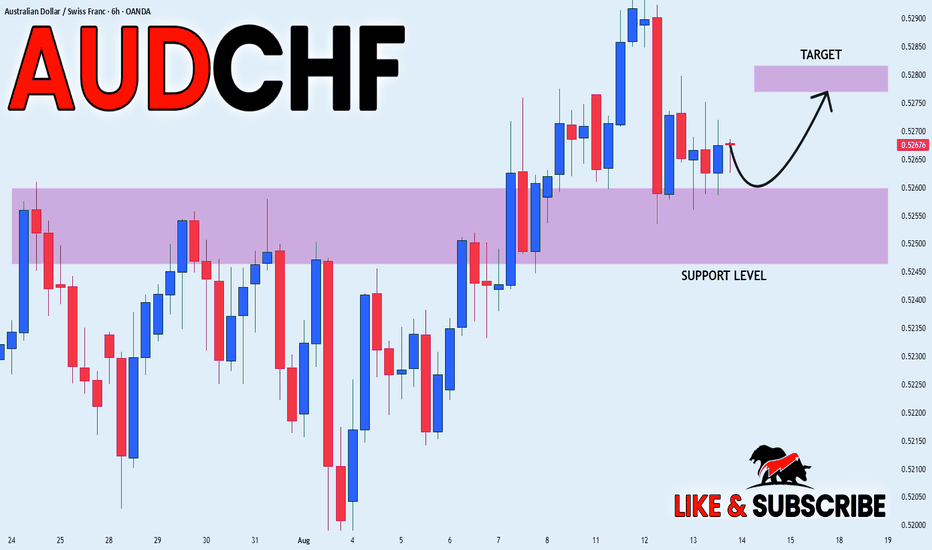

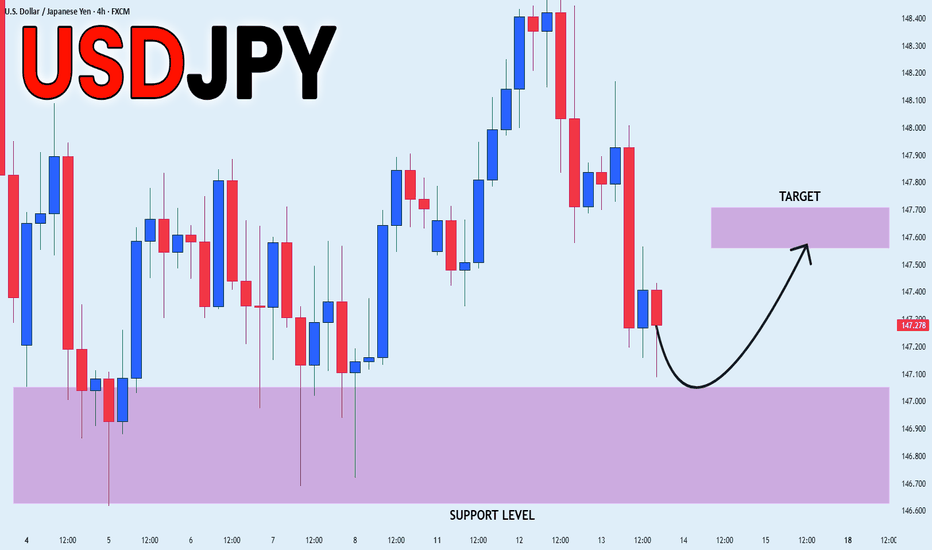

USD_JPY SUPPORT AHEAD|LONG|

✅USD_JPY is set to retest a

Strong support level below at 146.800

After trading in a local downtrend for some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 147.600

LONG🚀

✅Like and subscribe to never miss a new idea!✅

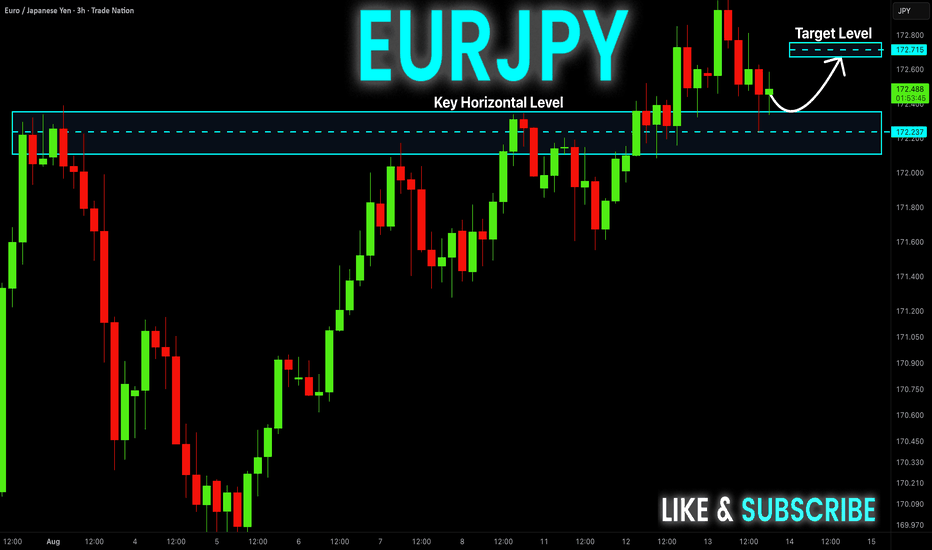

EUR-JPY Bullish Bias! Buy!

Hello,Traders!

EUR-JPY is trading in an

Uptrend and the pair is

Making a retest of the

Horizontal support level

Of 172.300 and we are

Bullish biased and we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

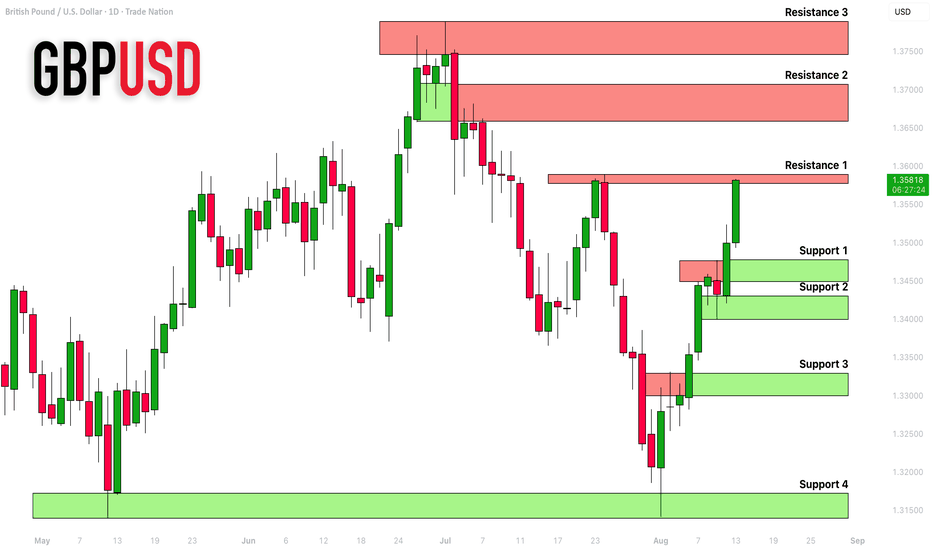

GBPUSD: Complete Support & Resistance Analysis 🇬🇧🇺🇸

Here is my latest structure analysis for GBPUSD.

Resistance 1: 1.3577 - 1.3590 area

Resistance 2: 1.3657 - 1.3705 area

Resistance 3: 1.3745 - 1.3790 area

Support 1: 1.3450 - 1.3480 area

Support 2: 1.3400 - 1.3430 area

Support 3: 1.3300 - 1.3330 area

Support 4: 1.3140 - 1.3174 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

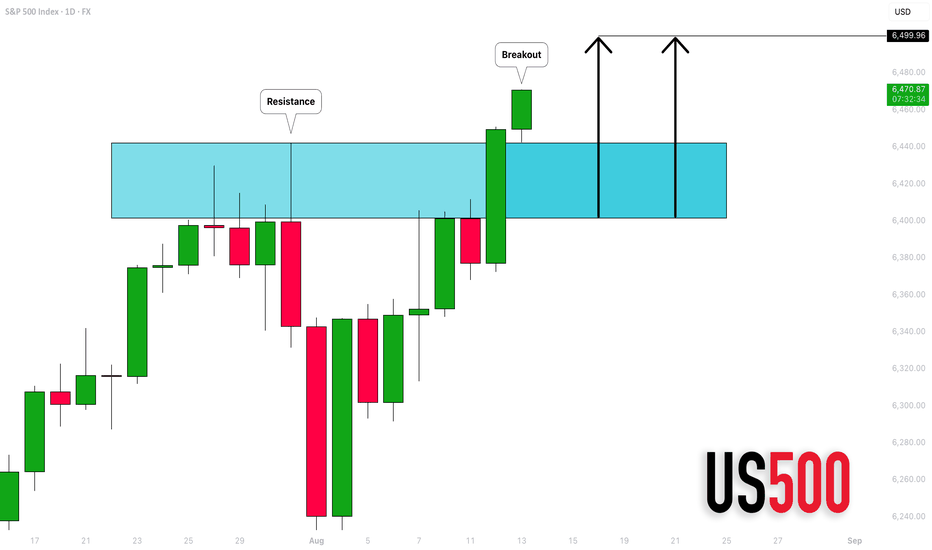

S&P500 INDEX (US500): Bullish Rally Continues

S&P500 is going to continue rising at least to 6500 level.

A confirmed break of structure BoS on a daily indicates

a clear dominance of the buyers.

With the absence of high impact US news today, the market will

remain strongly bullish.

❤️Please, support my work with like, thank you!❤️

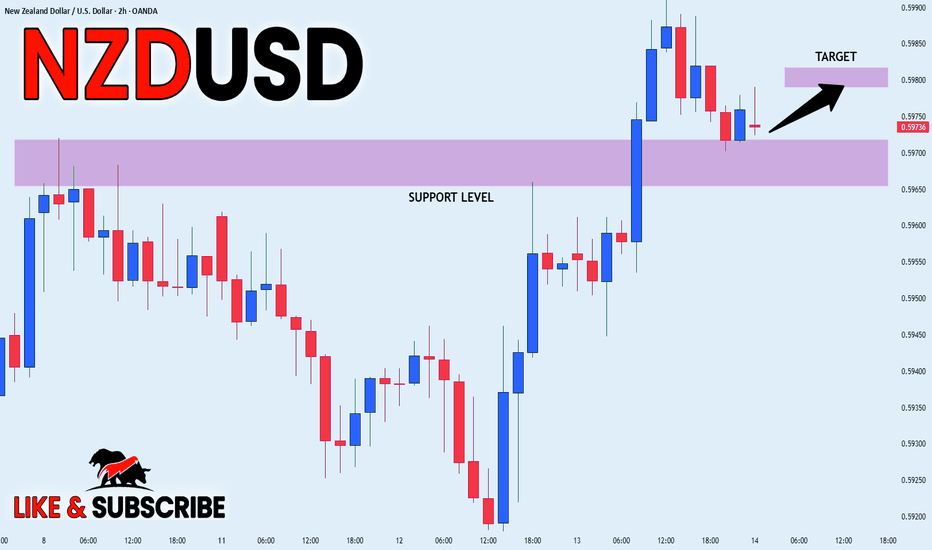

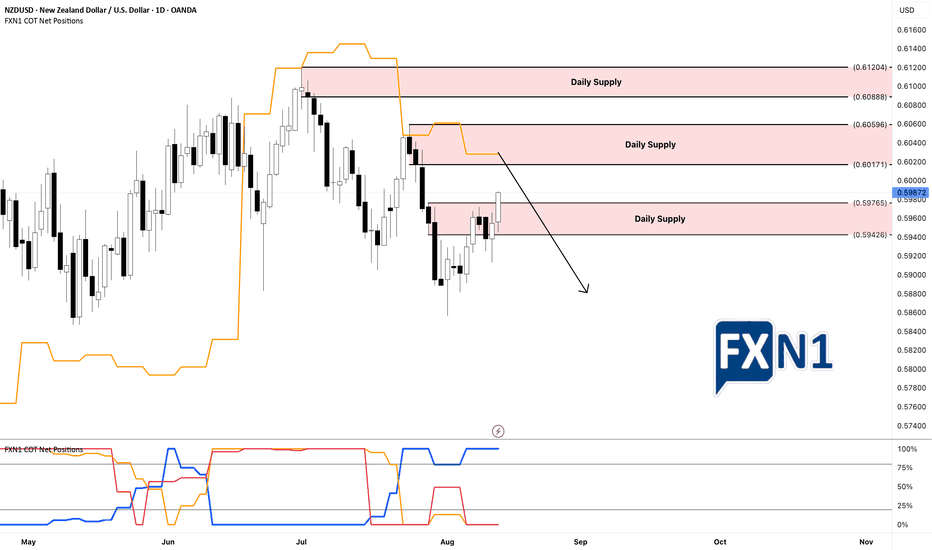

NZD/USD Chart Breakdown and Divergence Amid Market UncertaintyThe U.S. dollar continued its downward trend yesterday, influenced by dovish remarks from Federal Reserve's Kashkari, who aligned with other policymakers in suggesting a potential rate cut as early as September. This shift in tone was largely prompted by the softer-than-expected Non-Farm Payroll (NFP) report released last Friday.

While the employment data wasn’t as dire as initial market reactions suggested, it did cause some reevaluation. Prior to the report, market positioning was geared toward a robust labor market, and the Fed’s hawkish stance had already been priced in. The unexpectedly weak data, therefore, prompted a swift adjustment in expectations, leading to a rapid reprice of the dollar.

On the technical front, the NZD/USD chart highlights the breach of our previous daily supply zone following the release of the CPI data. However, I’ve decided to place a limit order at the next supply level. From a fundamental perspective, the recent activity of non-commercial traders adding short positions last week indicates a potential divergence between the chart pattern and underlying fundamentals. This divergence suggests opportunities for strategic entries as market sentiment and macroeconomic signals appear to be at odds.

✅ Please share your thoughts about NZDUSD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

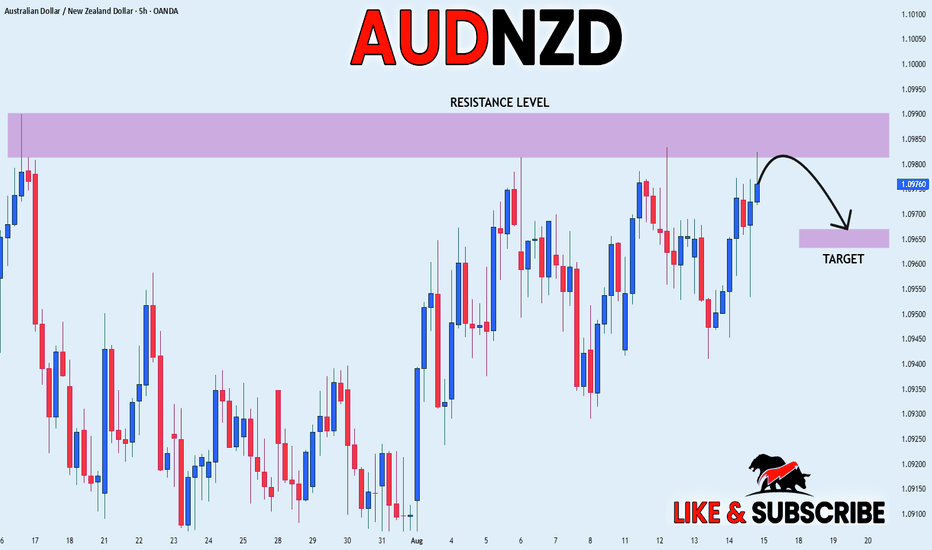

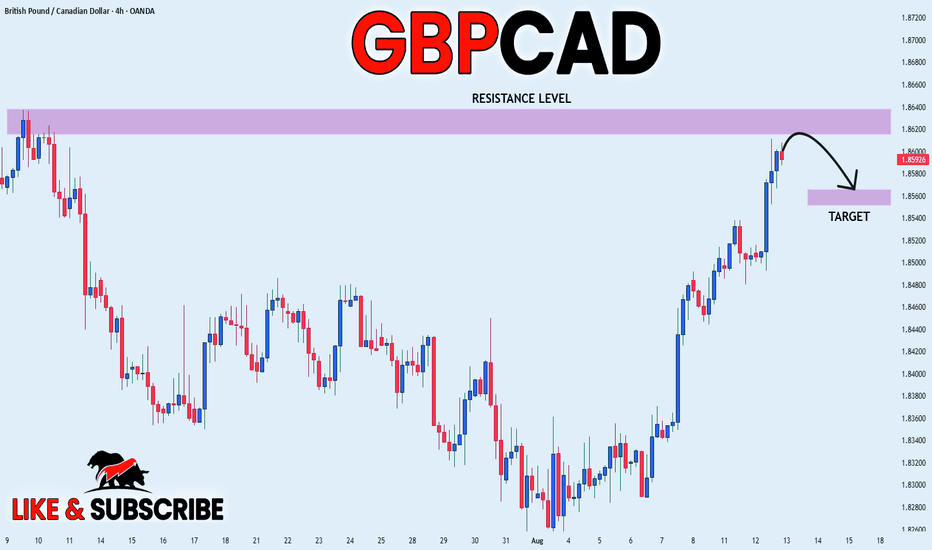

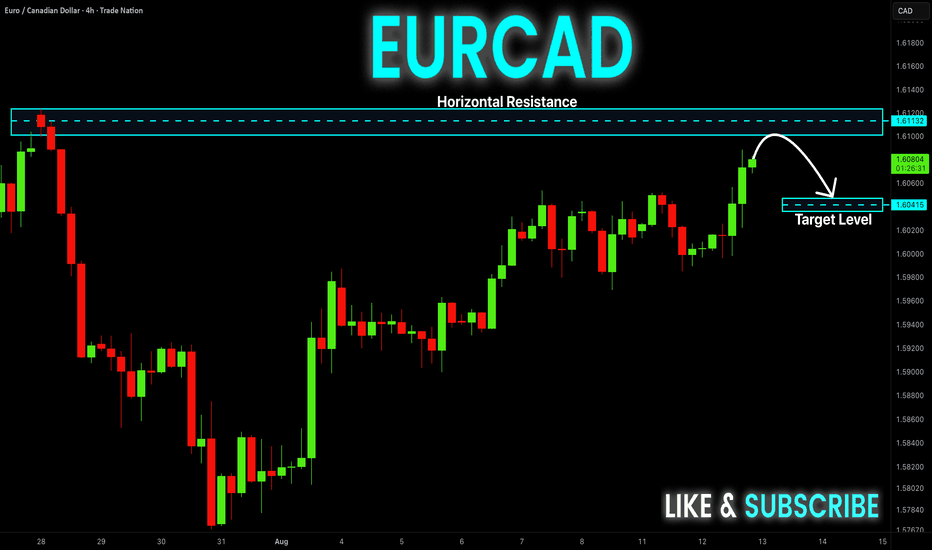

EUR-CAD Resistance Ahead! Sell!

Hello,Traders!

EUR-CAD keeps going up

But the pair will retest a

Horizontal resistance

Of 1.6124 and from there

A local bearish correction

Is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

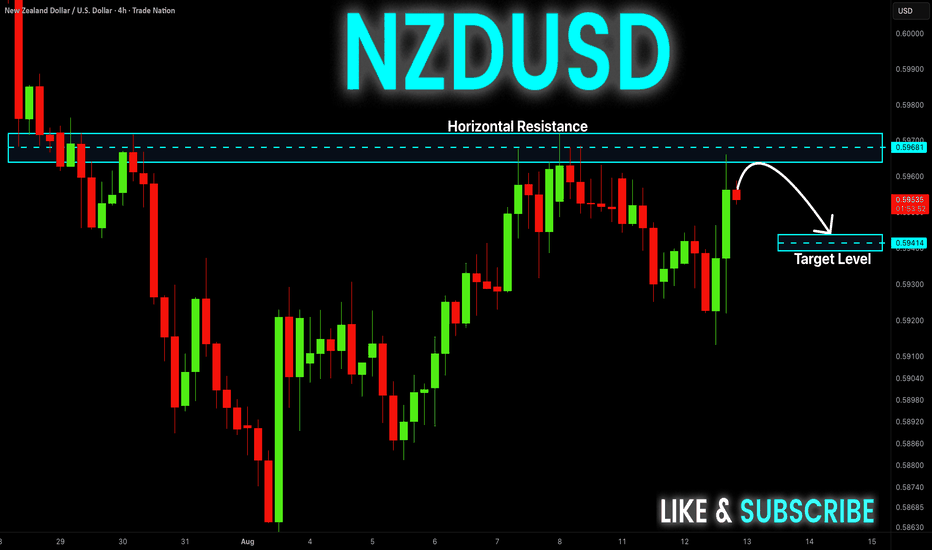

NZD-USD Short From Resistance! Sell!

Hello,Traders!

NZD-USD went up sharply

But will soon hit a horizontal

Resistance of 0.5972 from

Where we will be expecting

A local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Economic Factors That May Affect the Forex MarketEconomic Factors That Affect the Forex Market

The foreign exchange market is influenced by a wide range of economic factors which have a significant impact on currency exchange rates. Knowing about these factors is crucial for anyone looking to trade in the forex market, as they can help analyse price movements.

This article explores some key factors that may affect the forex market and lead to changes in the rates of currency pairs. You’ll learn about the influence of macroeconomic statistics, capital markets, economic data, and more. These factors collectively contribute to the volatility and dynamics of the forex market.

Economic Factors

These economic factors interact with each other in complex ways, and forex traders use a combination of analysis and research to make informed trading decisions. Understanding how these factors impact currency movements is essential for participants in the forex market.

Economic Health

Macroeconomic statistics fall into a category of factors affecting the currency market. The term refers to a set of main indicators that provide insights into the overall performance and health of an economy. These are GDP data, unemployment rates, trade and current account balances, interest rates, and inflation data. Countries with strong economic indicators are typically more attractive to foreign investors. This leads to an appreciation of their currencies. On the contrary, poor economic performance can lead to a decline in a country’s currency value.

Central Bank Policies

Central bank monetary policy decisions, including quantitative easing, forward guidance, and open market operations, can have a direct impact on a country's currency. Announcements and statements by central bank officials are closely monitored by forex traders.

Interest rates are among the most popular central bank tools. Central banks around the world set and regularly change them, and these rates have a direct impact on the value of a country’s currency. In most cases, higher interest rates attract foreign investment. The increased demand for the currency can cause its value to appreciate. In contrast, lower interest rates can lead to a decrease in the value of a currency as investors seek higher returns elsewhere.

The Influence of the Capital Markets

One of the factors affecting the foreign exchange market that we should remember is the influence of the capital markets. Commodity, stock, bond, and other markets also have a strong influence on exchange rates. To illustrate, when a country experiences a rise or sell-off in securities, this may indicate a change in its economic outlook. This typically affects investor sentiment and capital flows.

Traders try to stay updated to apply the most efficient strategy and avoid large losses. They can learn about these events through various sources, including news outlets, financial websites, and even trading platform blogs and news sections.

Imports and Exports

Other significant factors that affect forex trading are imports and exports. When a country’s exports exceed imports, a trade surplus occurs, which strengthens the economy and causes the value of the currency to rise. This happens because foreign consumers buy foreign currency to purchase exported goods. Conversely, when imports exceed exports, a trade deficit occurs, and the country is forced to sell its currency to buy imported goods. This may lead to a decline in the value of the domestic currency.

Government Debt

Government debt is not necessarily a bad thing; however, a government with high debt may find it more difficult to obtain foreign capital if it isn’t seen as reliable by investors. Conversely, a government with low debt and a history of not defaulting is likely to be considered more stable, which can positively impact its currency value. Traders can find information on government debt in financial news outlets, on economic research websites, and in other national sources.

Trade-Weighted Index

A Trade-Weighted Index (TWI) is a measure used in international economics and finance to assess the relative strength or value of a country's currency against a basket of other currencies. Unlike a simple exchange rate, which reflects the value of one currency in terms of another, a Trade-Weighted Index takes into account a country's trade relationships with multiple trading partners.

A Trade-Weighted Index provides a more comprehensive view of a country's currency value because it considers the impact of its trade relationships with multiple partners. It is particularly useful for countries heavily involved in international trade and can be used by policymakers, investors, and economists to gauge currency competitiveness and evaluate the potential impact of currency movements on a country's trade balance.

Final Thoughts

Experienced traders carefully consider factors influencing the forex market and explore their potential impact on exchange rates. It is critical to note that these economic factors do not operate in isolation, and their impact on the forex market can be complex. For example, while high interest rates may attract foreign investment in a certain country and cause its currency to appreciate, they can also lead to decreased consumer spending and economic slowdown, which may ultimately lead to a depreciation of the currency.

Often, traders rely on both economic indicators and technical analysis tools, considering previous price movements in the market. They can compare historical quotes of currency pairs and track what news or indicators were associated with the changes.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURUSD: Will Go UP! BUY!

My dear friends,

Please, find my technical outlook for EURUSD below:

The price is coiling around a solid key level - 1.1623

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.1671

Safe Stop Loss - 1.1587

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK