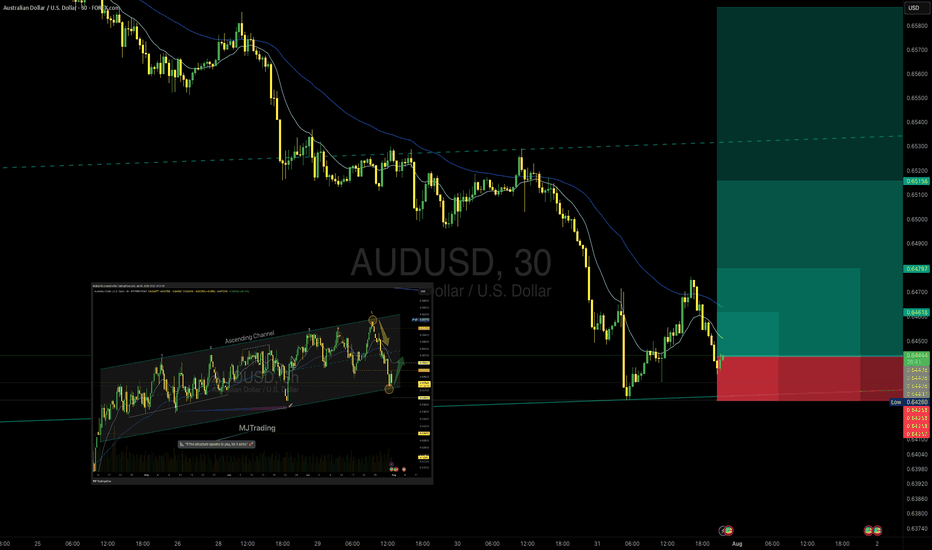

AUD/USD – Potential Bounce Buy SetupOANDA:AUDUSD

Timeframe: 30m

Type: Counter-trend / Bounce from Support

Risk Level: Medium to High

Possible Reward: 4+

🔹 Setup:

Price is testing the lower boundary of the recent support zone (0.6432 – 0.6420), aligning with the previous channel structure visible on the 8h chart. The descending move has shown initial signs of exhaustion, suggesting a potential bounce.

📈 Entry:

Current price zone 0.6432 – 0.6445

🎯 Targets (TP):

TP1: 0.64624

TP2: 0.64797

TP4: 0.65158

⛔ Stop Loss (SL):

0.64250 (below recent swing low and liquidity pool)

8H chart Overview:

Previous Position from top of Channel:

#AUDUSD #Forex #SmartMoney #PriceAction #MJTrading #ChartDesigner

Psychology Always Matters:

Forex

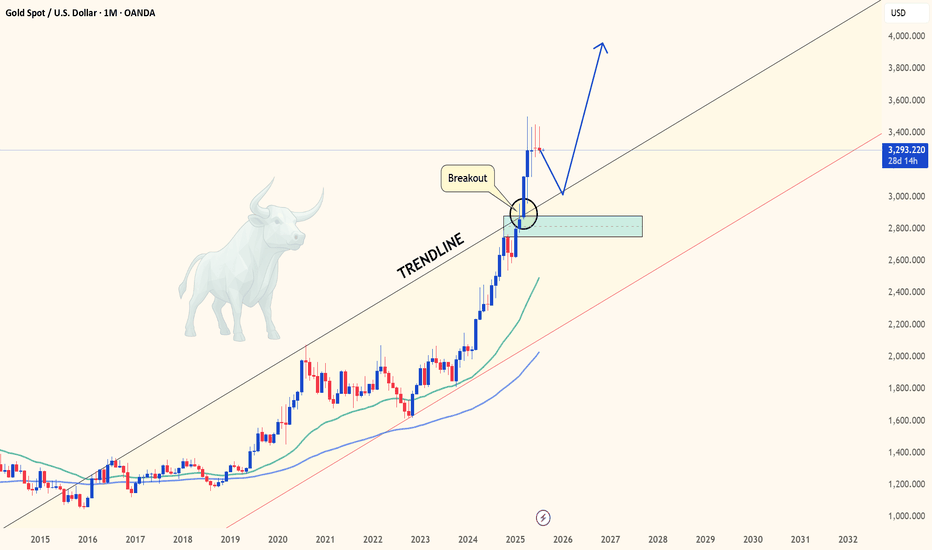

GOLD - Monthly breakout retest may confirm multi-year bull cycleHello everyone, what are your thoughts on the long-term outlook for XAUUSD?

Looking at the monthly chart (1M), we can clearly see that XAUUSD has broken out of the long-standing ascending channel that has held since 2015 — a major signal suggesting the start of a new bullish cycle. Price is now retesting the previously broken trendline, hinting at the possibility of a fresh upward leg to resume the longer-term bullish trend we've seen recently.

Personally, I'm targeting $3,600 in the medium term, and potentially $4,000 by 2026–2028 if institutional capital continues to rotate back into safe-haven assets like gold.

What about you — do you think BTC/USD will rise or fall in the coming years?

And what’s your target for it?

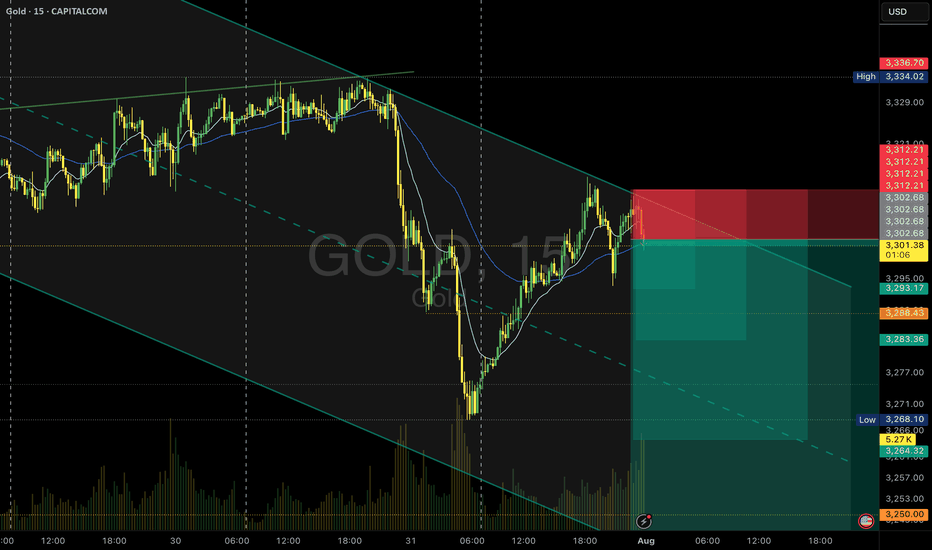

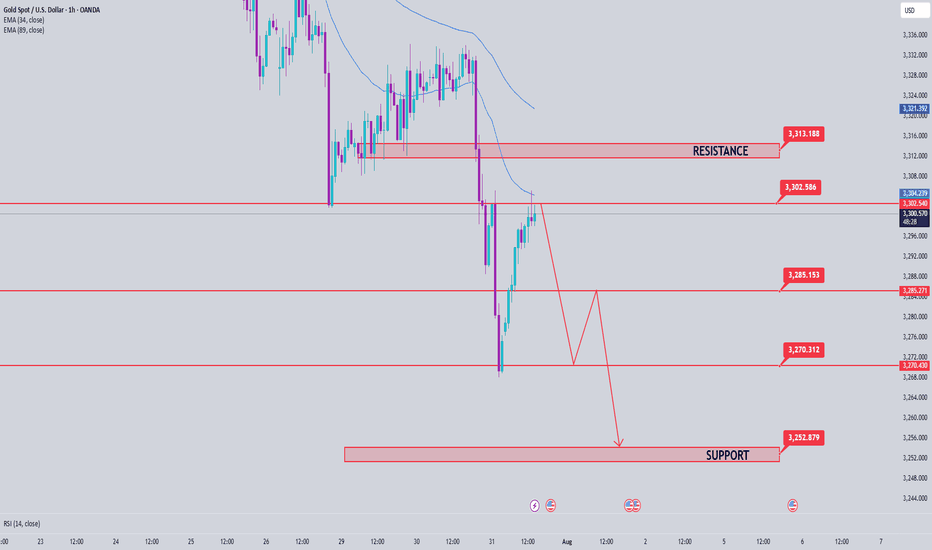

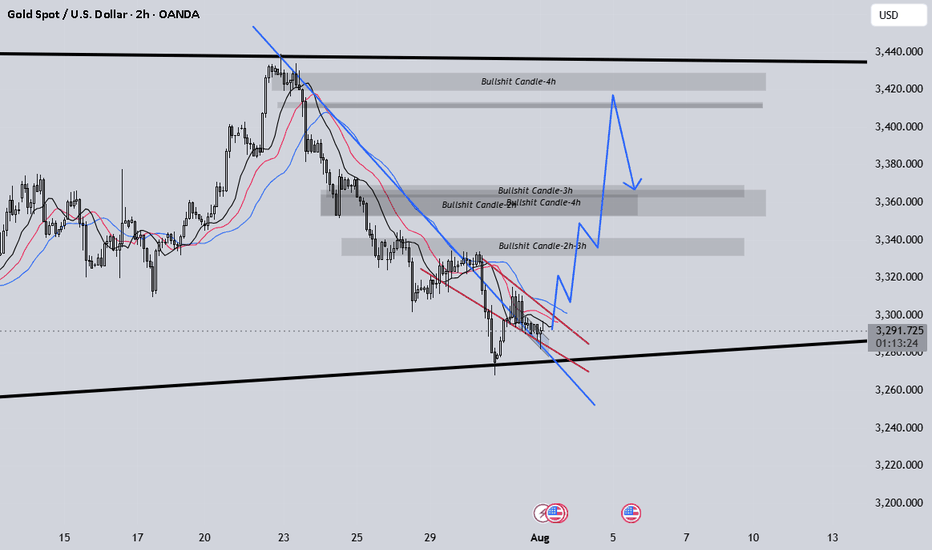

Gold Sell Setup - M15PEPPERSTONE:XAUUSD

Timeframe: m15

Risk Level: Medium

🔹 Setup:

Price is testing the upper boundary of the descending channel.

📈 Entry:

Current price zone: 3302.5

🎯 Targets (TP):

TP1: 3393

TP2: 3283

TP4: 3264

TP6: 3244

⛔ Stop Loss (SL):

3312.2

#XAUUSD #GOLD #SELL #Signal #MJTrading

Psychology Always Matters:

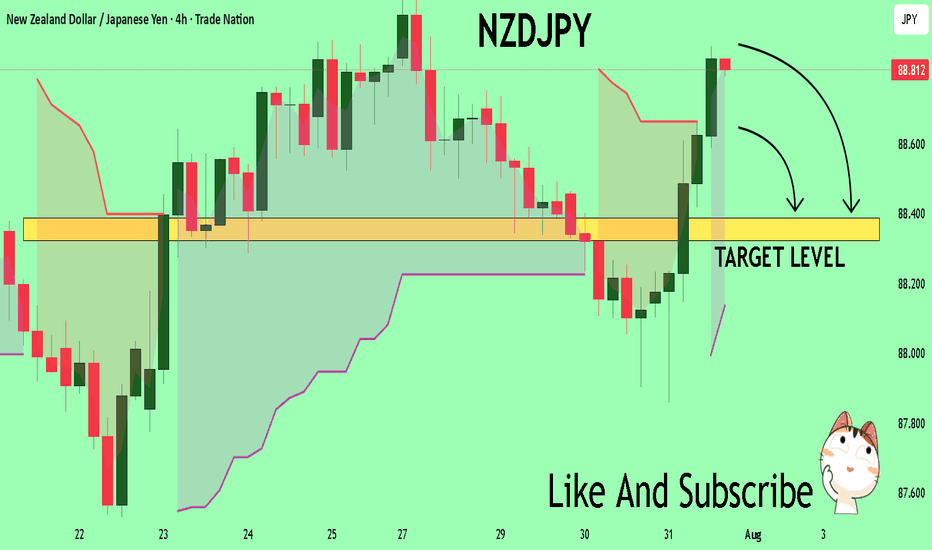

NZDJPY The Target Is DOWN! SELL!

My dear friends,

Please, find my technical outlook for NZDJPY below:

The price is coiling around a solid key level - 88.806

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 88.388

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Gold price analysis July 31XAUUSD – Bearish pressure still prevails, watch for SELL in the direction of the trend

Yesterday's session witnessed a strong decline when the D1 candle closed with selling pressure up to 60 prices, forming a key candle that shapes the trend. When the market forms a main candle, the 25% and 50% candle body areas are often important price areas to continue trading in the direction of the main trend.

In the current context, the priority strategy will be to sell in the direction of the downtrend when the price rebounds to the resistance areas and there is a rejection signal.

🔹 Important resistance areas:

3301 – 3312 – 3333

🔸 Target support areas:

3285 – 3270 – 3250

🎯 Trading strategy:

Prioritize SELLing at the resistance area of 3301–3312 when there is a price reaction (rejection).

Target: 3250

BUY only considered when 3313 area is broken decisively.

Staying disciplined and sticking to the reaction price zone will be key in the context of the market moving in a clear trend.

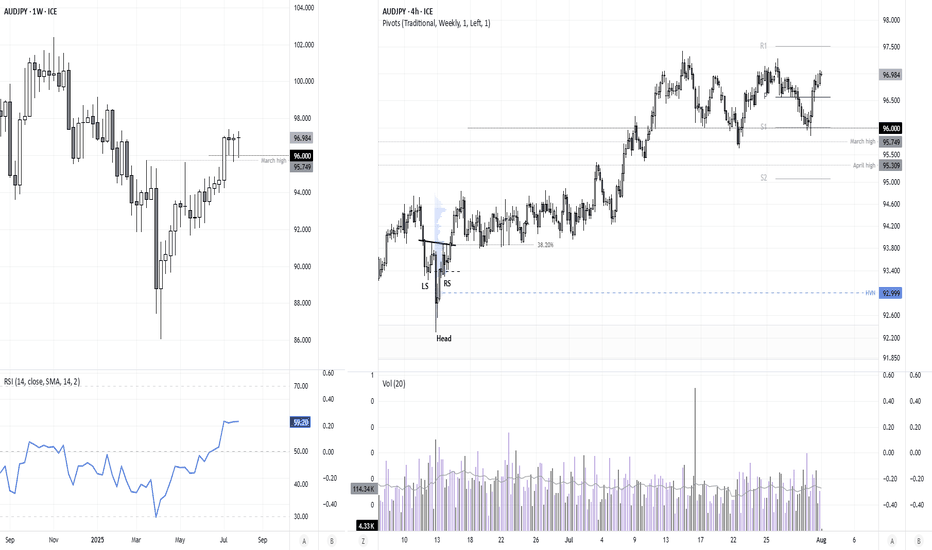

AUD/JPY bulls eye 99, 100The yen is broadly weaker, which is even allowing a weaker Australian dollar to rise. And with a decent bullish trend on the daily chart, I am now seeking dips within a recent consolidation range in anticipation of a move to 99 or even 100.

Matt Simpson, Market Analyst at City Index and Forex.com

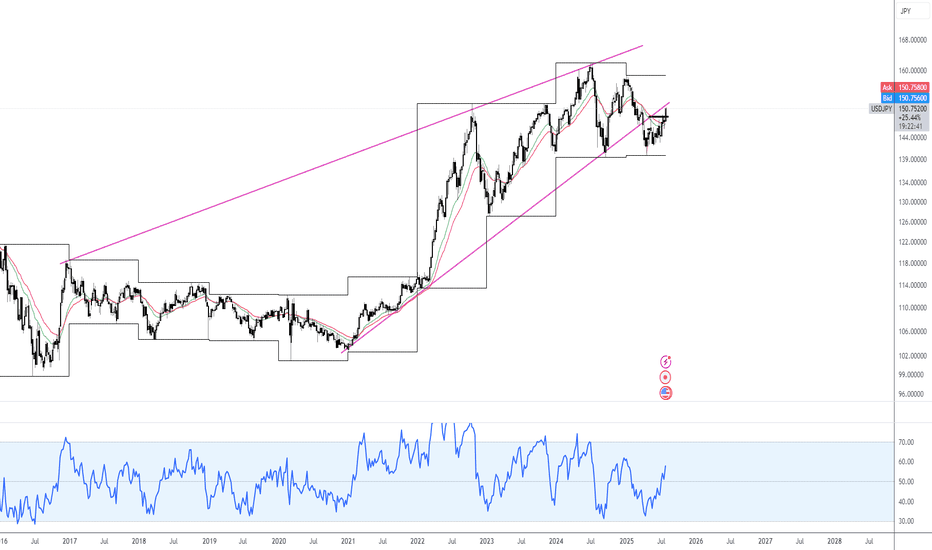

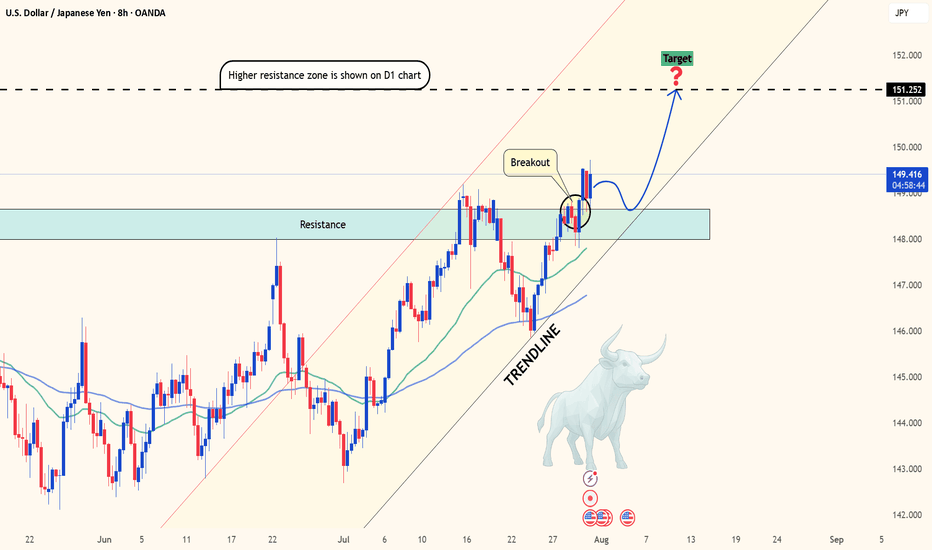

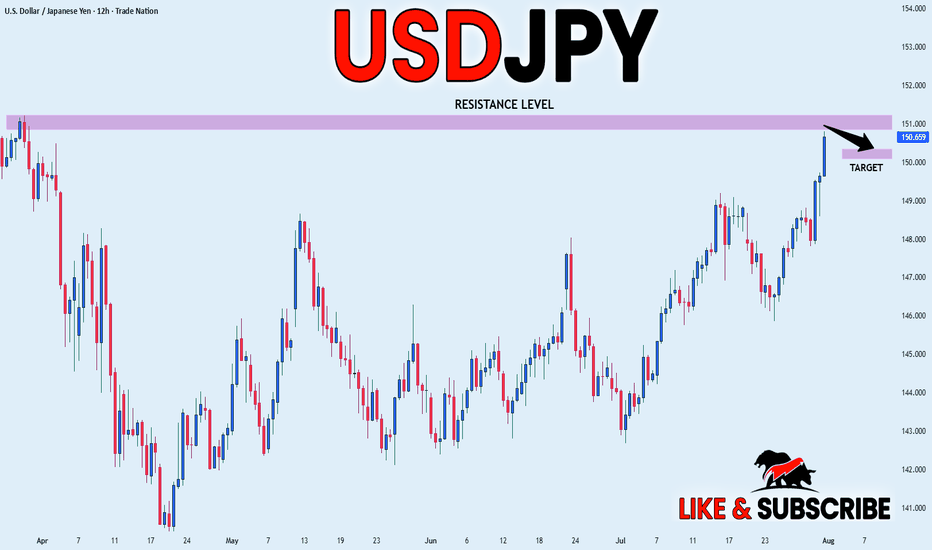

USDJPY breaks out as US data crushes forecastsHello traders! Do you think USDJPY will continue its upward momentum?

From a technical perspective, after several sessions of "building pressure," this pair has finally broken through a key resistance zone—opening the door to what could be the next bullish breakout.

Current price action suggests the uptrend remains firmly intact. The market continues to respect the rising trendline and finds strong support near the 34 & 89 EMA – a powerful technical combination that buyers often rely on. This isn’t just a typical breakout; it could be the start of a brand-new bullish cycle.

On the fundamental side, the U.S. dollar remains strong, supported by a string of solid economic data: employment, PCE, and consumer spending have all exceeded expectations. Meanwhile, the Japanese yen remains in “hibernation” as the Bank of Japan shows no sign of shifting away from its ultra-loose monetary policy. This divergence makes USDJPY one of the hottest pairs on the radar right now.

What’s next? If bullish momentum continues, the 151.25 level is likely the next short-term target. However, if the price encounters strong resistance at that level, a minor pullback could occur before the uptrend resumes.

So, what do you think? Is this the beginning of a major rally – or just a false breakout? Share your thoughts in the comments!

Wishing you successful and well-timed trades ahead!

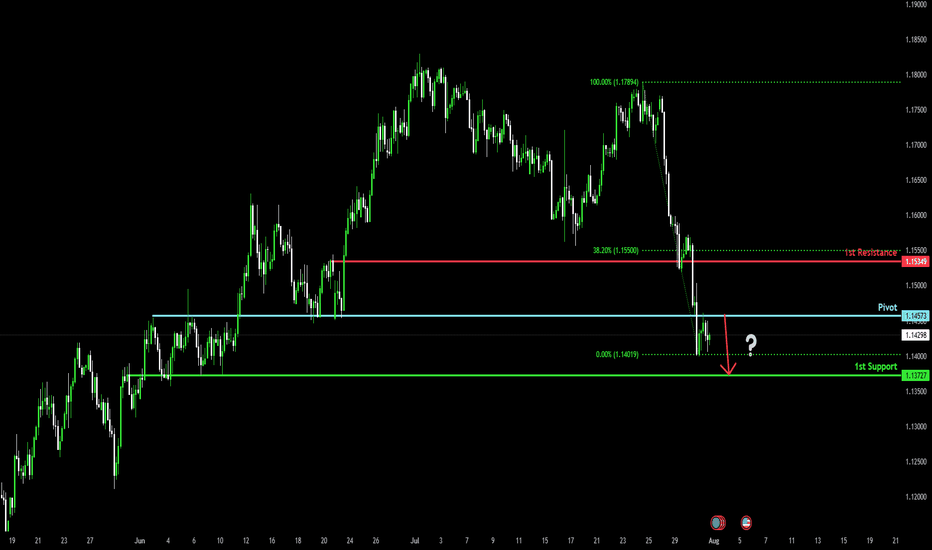

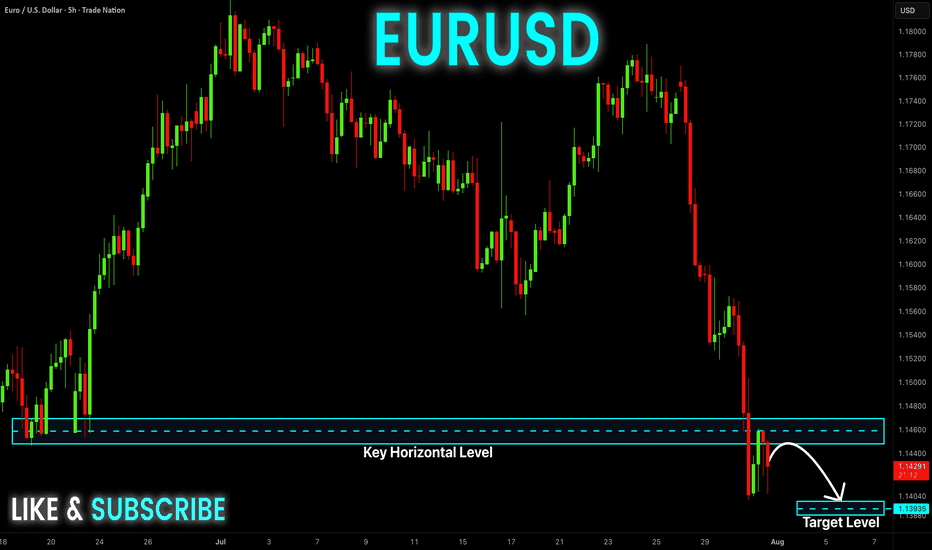

Bearish drop?The Fiber (EUR/USD) has rejected off the pivot and could potentially drop to the 1st support, which acts as an overlap support.

Pivot: 1.1457

1st Support: 1.1372

1st Resistance: 1.1534

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

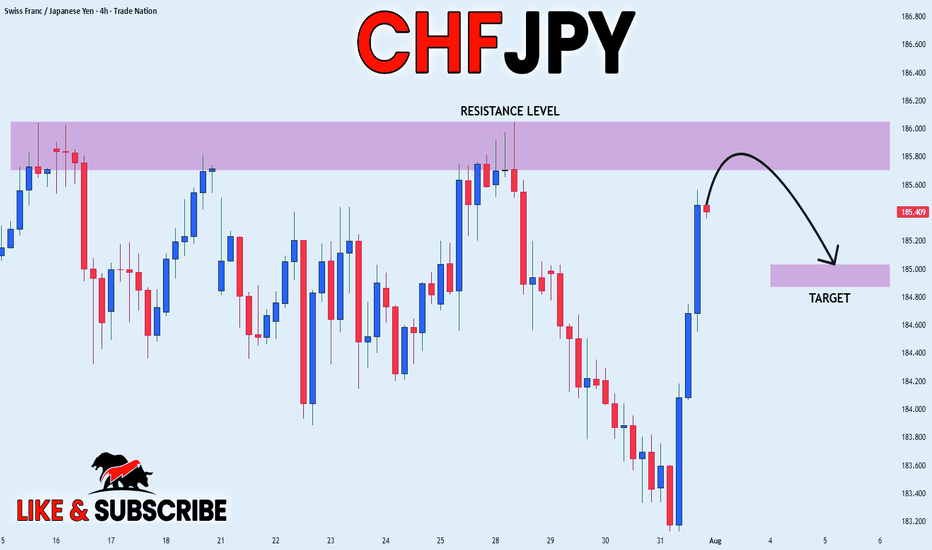

CHF_JPY LOCAL SHORT|

✅CHF_JPY has been growing recently

And the pair seems locally overbought

So as the pair is approaching a

Horizontal resistance of 186.000

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_JPY RESISTANCE AHEAD|SHORT|

✅USD_JPY is going up now

But a strong resistance level is ahead at 151.232

Thus I am expecting a pullback

And a move down towards the target of 150.368

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-USD Bearish Breakout! Sell!

Hello,Traders!

EUR-USD made a bearish

Breakout of the key horizontal

Level of 1.1460 then made

A retest and a pullback so

We are bearish biased and

We will be expecting a

Further bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

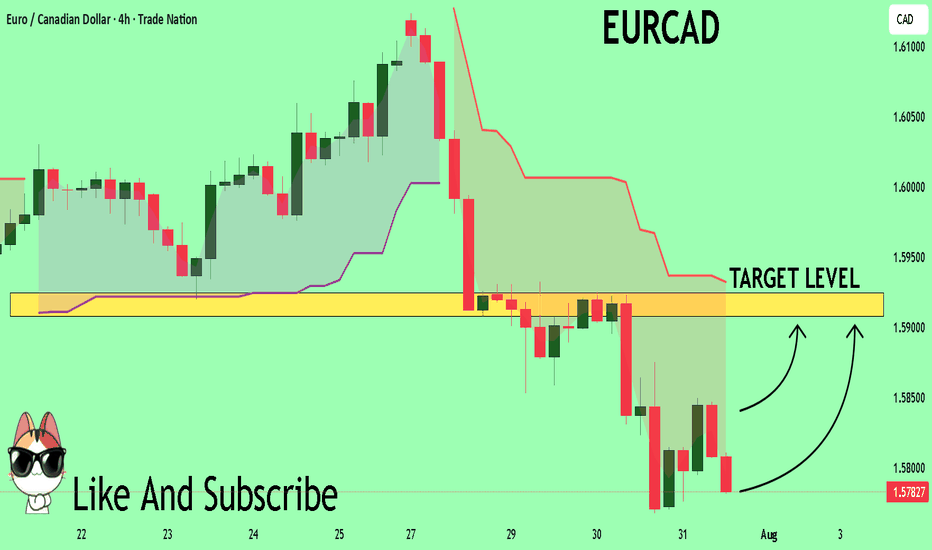

EURCAD What Next? BUY!

My dear friends,

My technical analysis for EURCAD is below:

The market is trading on 1.5784 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.5907

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

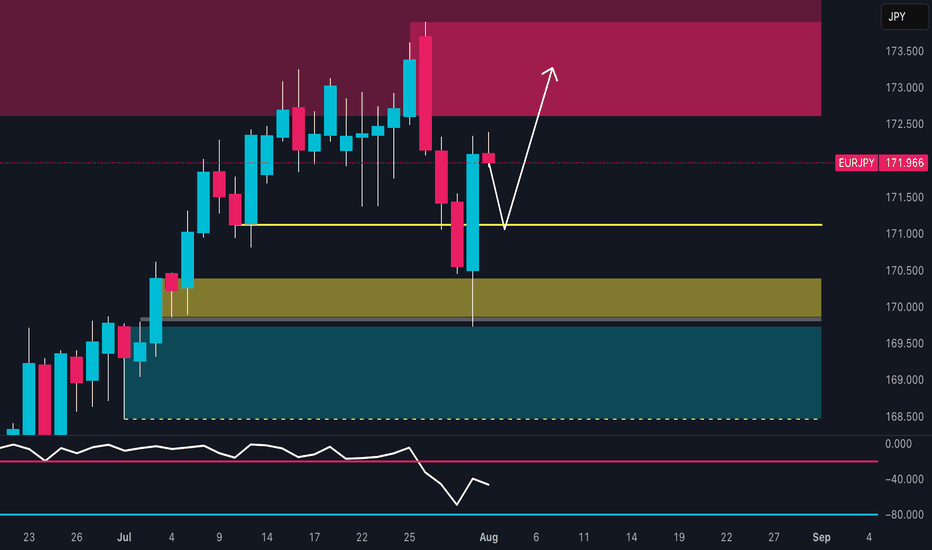

EUR/JPY Setup: Retail is 82% Short – Squeeze First, Drop After?🔹 Technical Context

Price reacted with a strong bullish wick in the 169.50–170.30 demand zone, signaling clear buyer defense. The RSI bounced from weakness but remains subdued, showing limited momentum.

📍 Current price action suggests a potential retest of the 172.50–173.30 area, which aligns with a supply zone, before a possible directional decision is made.

🗓️ Seasonality

Historically, August tends to be bearish for EUR/JPY:

5Y average: -0.48%

10Y average: -0.12%

15Y/20Y averages: -1.3% and -1.2%

📉 Seasonality indicates potential weakness, especially in the second half of the month.

🪙 COT Report (EURO & YEN) – July 22

EURO: Strong long accumulation by non-commercials (+6,284) and commercials (+17,575)

JPY: Net decline in both longs (-1,033) and shorts (-4,096), with a drop in total open interest

🧠 The market is heavily positioned on the Euro, while Yen positioning is fading. This creates a divergence between the two currencies, favoring a short-term technical bounce on EUR/JPY, though downside risks remain in the mid-term.

📉 Sentiment

82% of retail traders are short EUR/JPY

Volume: 1,564 lots short vs 352 lots long

📣 This extreme sentiment imbalance suggests a potential short-term squeeze against retail traders.

📊 Market Mood & DPO

Overall mood: Neutral

DPO at -9.0, Wyckoff score below 50

Momentum remains weak, but not showing a clear divergence.

🧩 Operational Summary

Retest of the 172.50–173.30 supply zone

Likely exhaustion in that area

Ideal setup: rejection + bearish confirmation

→ Targets: 170.30, then 169.00

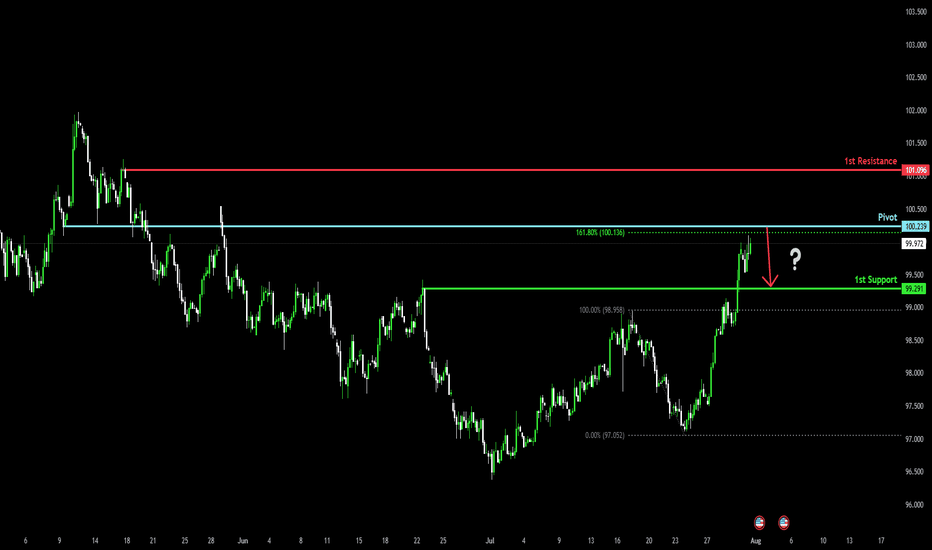

Bearish reversal off overlap resistance?The US Dollar Index (DXY) is rising towards the pivot and could reverse to the 1st support.

Pivot: 100.23

1st Support: 99.29

1st Resistance: 101.09

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

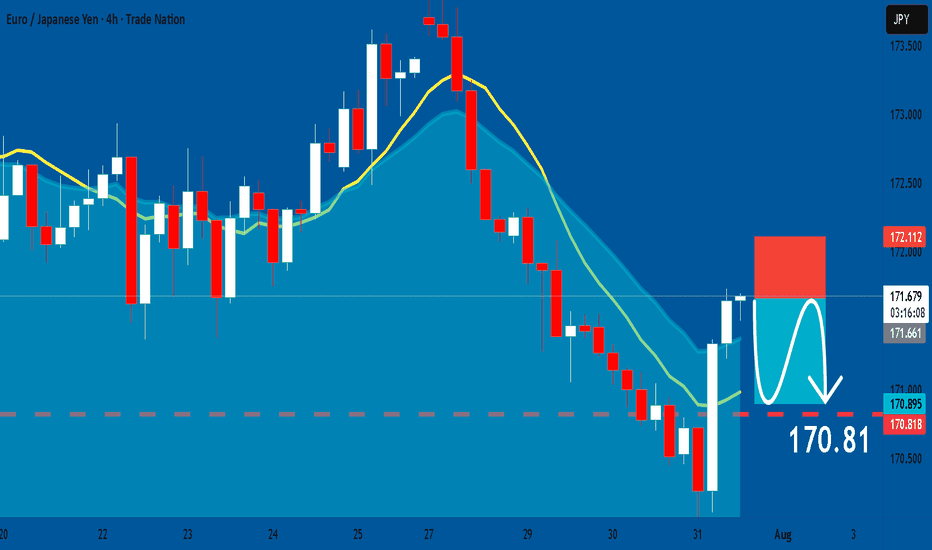

EURJPY: Short Trade Explained

EURJPY

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short EURJPY

Entry - 171.66

Sl - 172.11

Tp - 170.81

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

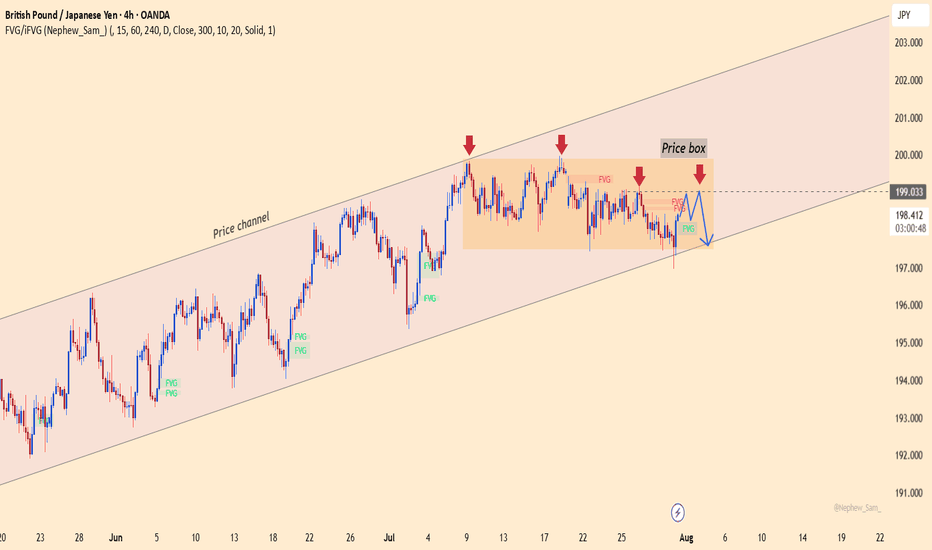

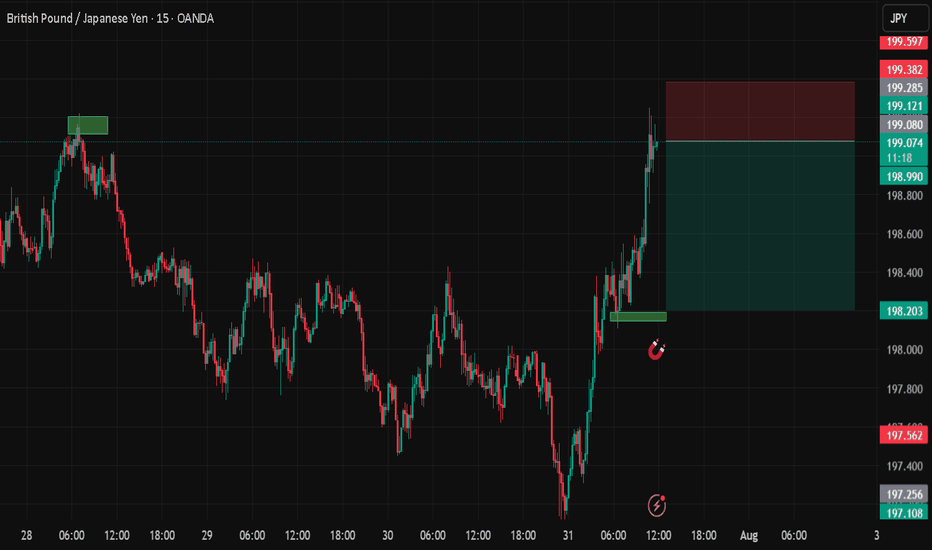

GBPJPY – Losing control zone, downtrend taking shapeGBPJPY is still trading within a long-term ascending price channel. However, what’s concerning is that recent price action has broken out of the previously established price box – which had acted as a stabilizing structure for the uptrend. Buyers failed to maintain momentum, repeatedly getting rejected at the top of the box.

Currently, GBPJPY is showing signs of breaking below the short-term support inside the price box, raising the risk of a deeper correction toward the lower boundary of the channel. A “lower high” structure is clearly forming, confirming that selling pressure is taking over.

From a news perspective, the Japanese yen is gaining strength as risk-off sentiment increases, while the pound is losing ground due to cautious tones from the Bank of England following a string of weak economic data. This shift is weakening GBP's appeal and could accelerate the bearish trend.

Strategy:

Wait to SELL if price pulls back to the former resistance zone within the price box and shows rejection signals. The downtrend will be confirmed if the recent low is broken. Stay out if there’s no clear confirmation.

What do you think will happen next with GBPJPY?

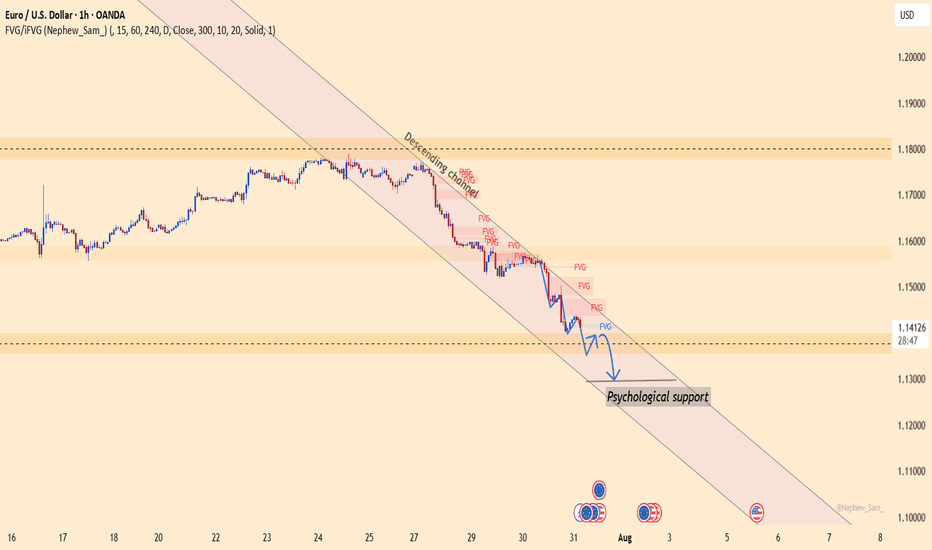

EURUSD plunges without brakes – The bears take full control!EURUSD continues its steep decline as both macroeconomic and technical pressures mount. A trade deal unfavorable to the EU, combined with the Fed’s hawkish stance, has fueled USD strength and dragged the euro sharply lower. At the same time, strong U.S. labor data and rising employment costs further reinforce the bearish outlook.

On the H1 chart, EURUSD is clearly moving within a descending channel. Key price zones have been broken with no significant bullish reaction, indicating that sellers remain firmly in control. The market is heading toward a psychological support area, with no signs of reversal as RSI stays weak.

I remain biased toward SELL setups on any short-term pullbacks, avoiding countertrend trades in this environment. If downside momentum continues, deeper targets may still be ahead.

In a market dominated by bearish sentiment, trading with the trend remains the smartest and safest approach.

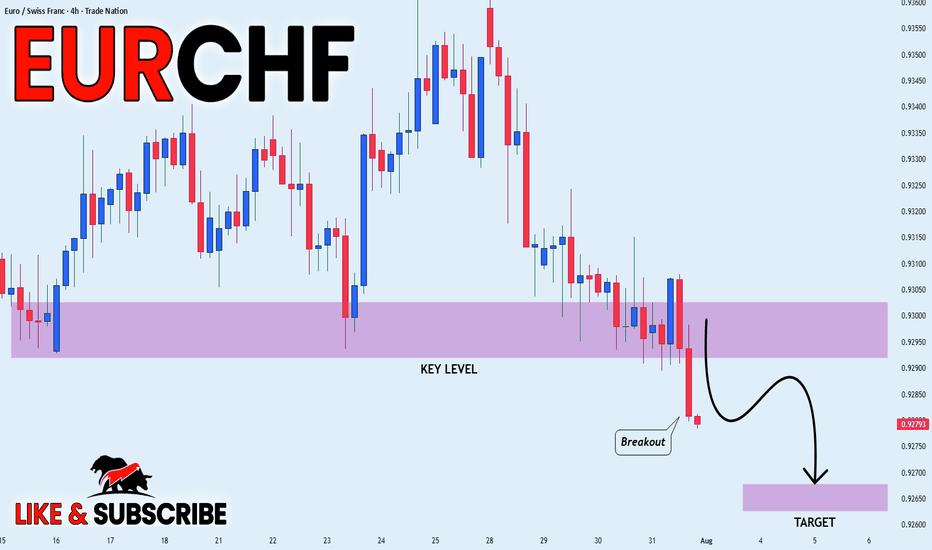

EUR_CHF WILL KEEP FALLING|SHORT|

✅EUR_CHF broke the key

Structure level of 0.9295

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of the

Broken level is complete

A rebound and bearish

Continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

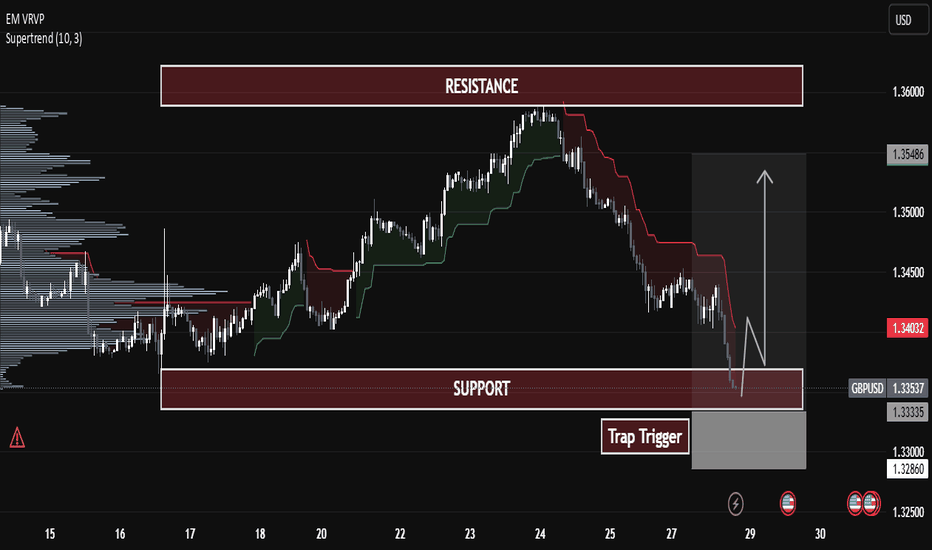

GBP/USD Professional Analysis – “Trap Trigger at Support”GBP/USD Professional Analysis – “Trap Trigger at Support”

📈 Market Overview:

• Pair: GBP/USD

• Timeframe: Likely 1H or 2H based on candle spacing

• Date: July 28, 2025

• Current Price: 1.33529

⸻

🔍 Technical Breakdown

🔴 Resistance Zone: 1.35800 – 1.36200

• Strong supply area where the last bullish impulse failed.

• Price got rejected hard, initiating a new downtrend.

• Sell-side pressure was confirmed with Supertrend turning red.

🟤 Support Zone: 1.32860 – 1.33400

• Major demand area where price previously reversed sharply.

• Currently being tested again after a clean sweep into the Trap Trigger zone.

⚠ Trap Trigger Zone (Liquidity Sweep Area):

• Price wicked just below support, tapping into a low-volume/high-liquidity area.

• This wick likely cleared sell-side liquidity and trapped breakout sellers.

• Followed by a bullish rejection wick, implying smart money accumulation.

⸻

🛠 Indicators & Tools:

• Supertrend (10,3): Currently red, indicating short-term bearish momentum.

• However, if price closes above 1.34032 (Supertrend level), it could flip bullish.

• Volume Profile (VRVP):

• Low-volume node under support suggests a quick “stop hunt” move, not genuine selling.

• High-volume acceptance area sits higher, near 1.34500–1.35000.

⸻

🎯 Forecast:

🔴 Bearish Invalidations:

• Price closing below 1.32860 with volume would invalidate this setup.

• That could signal continuation to deeper liquidity (1.32500 or below).

⸻

🧠 Smart Money Perspective:

• Liquidity engineered beneath support

• Trap Trigger activated — ideal for institutional reversal setups

• This is a classic “Stop Hunt → Reclaim → Expand” model

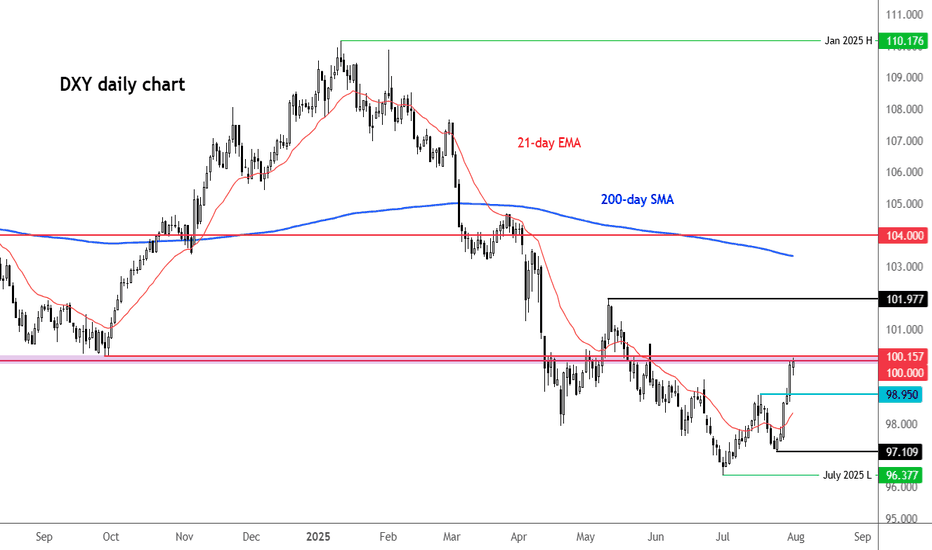

DXY testing 100.00 resistanceThe US dollar index has risen to rest a key resistance area around the 100.00 level. Previously a key support and resistance zone, what happens here could determine the near-term technical direction for the US dollar.

Key support below this zone is at 98.95, marking a prior resistance. Given the short-term bullish price structure, I would expect this level to hold if the greenback were to ease back from here.

If the bullish momentum gathers pace, then 101.00 could be the next stop, followed by the recent high of 101.97.

From a macro point of view, resilient economic data and persistent core inflation concerns continue to support the Federal Reserve’s cautious policy approach. Today’s core PCE inflation reading came in slightly above forecast, at 2.8% year-over-year versus the expected 2.7%. In addition, jobless claims were better than anticipated, registering 218,000 compared to the 224,000 forecast. The Q2 Employment Cost Index also surprised to the upside, rising 0.9% quarter-on-quarter.

These figures follow yesterday’s stronger-than-expected GDP report and a solid ADP private payrolls release, further underscoring the strength of the U.S. economy.

Attention now turns to Friday’s nonfarm payrolls report, which could have a meaningful impact on rate expectations. Fed Chair Jerome Powell has emphasized the importance of the unemployment rate as a key metric, so any upside surprise could reinforce the Fed’s current position.

However, expectations are not very high for the non-farm payrolls report. Current forecasts suggest an increase of 106,000 jobs, with average weekly earnings rising 0.3% month-over-month, and the unemployment rate edging up to 4.2%. Yet, the scarcity of strong leading indicators this month adds a layer of uncertainty to the outlook.

By Fawad Razaqzada, market analyst with FOREX.com