GBPJPY – Bearish Continuation Setup AheadPair: GBPJPY

Timeframe: 4H

Bias: Bearish

🔍 Technical Overview:

GBPJPY has broken down with high momentum and is now hovering at a 4H support zone (195.30). A clean break and close below this level opens the door for a deeper move toward the next support areas:

Entry Trigger: Break below 195.30

🎯 Target 1: 194.05

🎯 Target 2: 192.50

🛑 Stop Loss: Above 195.95 (previous resistance-turned-supply zone)

📉 RSI: 27.63 (Oversold but momentum-driven selloff suggests more downside)

🧠 Macro + Fundamental Confluence:

🏦 Central Bank Policy:

BOE (Bank of England) cut rates by 25bps (to 4.25%) in a hawkish tone, with internal disagreement (7–2 vote), signaling uncertainty and potential for further divergence.

Despite the “hawkish cut,” the market interpreted it cautiously, especially with falling UK economic momentum and weak retail data.

💴 Bank of Japan:

BoJ is slowly tightening policy — signaling an eventual exit from ultra-loose conditions.

Real interest rates remain negative, but the direction is now incrementally hawkish, strengthening the JPY across the board.

💡 Market Sentiment:

VIX at 20.42 = Risk-Off Environment → capital flows into safe-haven JPY, out of GBP.

With Nasdaq bullish, but volatility ticking up, JPY benefits from its safe-haven role.

📊 CFTC Positioning:

GBP: Longs decreasing, shorts rising, NNCs decreasing → Bearish bias

JPY: Longs flat, but massive drop in NNCs → institutional positioning is turning defensive

🧾 Economic Weakness:

UK Services PMI showing signs of stagnation

CPI and Retail Sales remain weak, suggesting limited scope for further GBP upside

Japan's latest Household Spending and Economy Watchers Survey show stabilizing conditions, supporting yen strength

📌 Final Take:

Fundamentals support the breakdown as monetary divergence and global sentiment drive capital into the JPY. Watch for confirmation via H4 close below 195.30 before entering the trade.

🧭 Trade idea aligns with macro, technicals, seasonality, and institutional flows.

Forexanaylsis

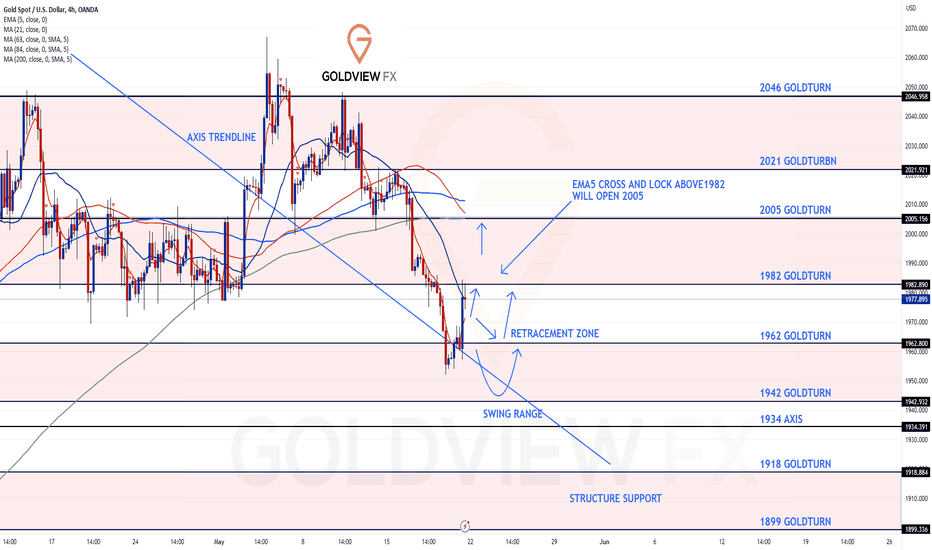

GoldViewFX - 4H CHART UPDATED LEVELS & TARGETSHey Everyone,

Please see our updated 4H chart levels and targets. We have also added a axis trendline (our unique trendline drawing method).

1962 has provided a nice suport bounce last Friday for a push up and test to 1982. Price closed at 1977 with a detachment below to ema5 also close to the retracement range and a likely test to 1982 again is also a likely target. We will need a cross and lock above 1982 to open target to 2005.

We have updated the retracement range and swing range accordingly and will use these zones for areas to pick bounces for buys, inline with our plans to buy dips and also to track the movement level to level with our EMA5 cross and lock confirmation and our algo generated targets.

We are also in range of the support structure, which is maintaining the Bullish structure. A break below the swing range will open the support structure and if we see the support structure break with ema5 cross and lock then we can expect a dump into the 1800's.

Our long term projection still remains Bullish.

BULLISH TARGETS

1982 -

EMA5 CROSS AND LOCK ABOVE 1982 WILL OPEN 2005

BEARISH TARGETS

1962 -

EMA5 CROSS AND LOCK BELOW 1962 WILL OPEN THE SWING RANGE

SWING RANGE

1942 - 1934

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

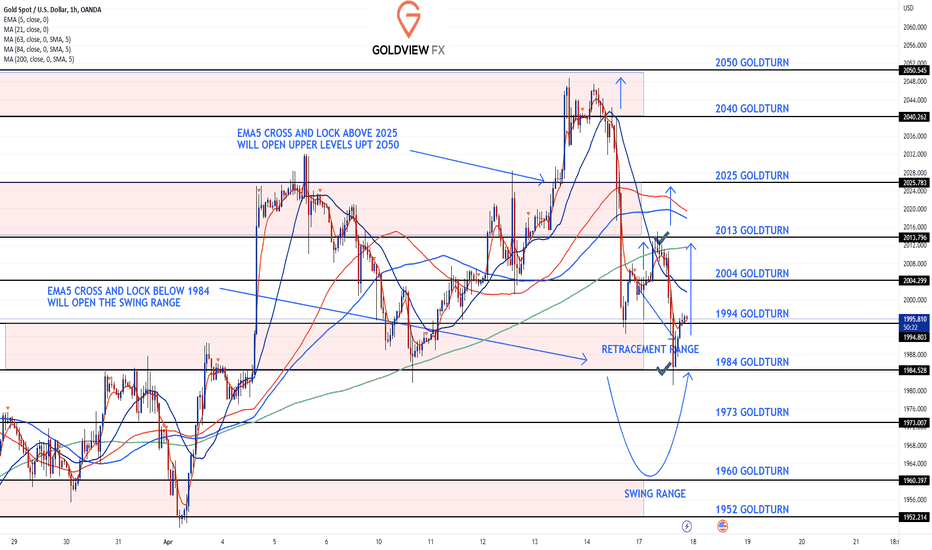

GoldViewFX - MARKET UPDATEHey Everyone,

Update on our 1H chart idea. We got our first Bullish target at 2013 and then followed with a push down into the retracement range, as highlighted on the chart. The retracement range held perfectly, as support with a nice bounce up.

We will now wait to see if the support provides enough momentum for the full range test back to 2013 - 2025. As long as EMA5 remains above the retracement range the upper targets remain strong. A EMA5 break below 1984 will open the swing range, in which case we will manage our risk accordingly when planning to buy dips.

We plan to continue with our plans to buy dips from strategic support levels.

BULLISH TARGETS

2013 - DONE

2025 -

EMA5 CROSS AND LOCK ABOVE 2025 WILL OPEN 2040, 2050

2040 -

2050 -

BEARISH TARGETS

1994 - DONE

1984 - DONE

EMA5 CROSS AND LOCK BELOW 1984 WILL OPEN THE SWING RANGE

SWING RANGE

1960

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

NZDCAD Sell Opportunity - Upcoming RBNZ RateNZDCAD sell setup.

Indicators: Downwards trend and support has not yet been hit.

Entry:

1. Look for a break below 0.8738 area for a sell confirmation.

2. Sell retrace at 0.8796 area.

TP @ 0.8565 but I recommend taking 40-50 pip increments as you trade down.

Good luck trading. Please like these free analysis so others may benefit from it.

Let me know how I can help.

Charles V

www.cvfxmanagement.com

Trading made simple