USDJPY Analysis for November 6, 2024: Slight Bullish Bias DrivenUSDJPY Analysis for November 6, 2024: Slight Bullish Bias Driven by Key Market Fundamentals

As of November 6, 2024, USDJPY appears to have a slightly bullish bias, influenced by various fundamental factors and recent shifts in market conditions. Traders and investors are paying close attention to developments affecting both the US dollar (USD) and the Japanese yen (JPY) as economic data and policy expectations guide market sentiment. Here’s a look at the key drivers contributing to USDJPY’s bullish outlook today.

Key Drivers Supporting a Bullish Bias for USDJPY

1. Federal Reserve’s Hawkish Stance

The Federal Reserve has maintained a hawkish stance, signaling a commitment to keeping interest rates elevated for an extended period. This approach supports the USD as higher yields attract investors, driving demand and potentially leading to further gains in USDJPY. If the Fed continues to prioritize inflation control, this could provide a steady tailwind for the dollar against the yen.

2. Divergent Monetary Policies Between the US and Japan

While the Fed remains hawkish, the Bank of Japan (BoJ) is expected to maintain its ultra-loose monetary policy. The BoJ has shown little intention of changing its low-interest-rate environment, making JPY less attractive in comparison to USD. This divergence in monetary policy provides a bullish edge for USDJPY as the yield differential widens.

3. Strong US Economic Data

Recent economic data from the US, including robust GDP growth and stable employment figures, further supports USD strength. These indicators suggest a resilient economy, giving the Federal Reserve more flexibility to maintain or even raise rates. Consequently, the USD is positioned favorably against the yen in the near term.

4. Risk Appetite Supporting USD over JPY

Although JPY traditionally benefits as a safe-haven currency during periods of market uncertainty, today’s risk sentiment leans toward moderate optimism. As risk appetite grows, traders are more likely to favor the USD over JPY, adding another layer of support to the USDJPY’s bullish momentum.

Technical Indicators Highlight Potential Upside

From a technical perspective, USDJPY is trading above its key support level at 150.00, a sign of bullish resilience. If USDJPY can break above the 150.80 resistance, it may pave the way for further gains toward the 151.50 mark.

Conclusion

In summary, today’s analysis indicates a slightly bullish bias for USDJPY, driven by the Fed’s hawkish stance, divergent monetary policies, positive US economic data, and favorable risk sentiment. Traders should watch for potential resistance levels that could influence USDJPY’s momentum in the short term.

Tags:

#USDJPYanalysis

#Japaneseyenforecast

#Forexmarkettrends

#USdollaroutlook

#FederalReservepolicyimpact

#USDJPYNovember62024

#Interestratedivergence

#Forexbullishtrends

#Riskappetitecurrencytrading

Forexmarkettrends

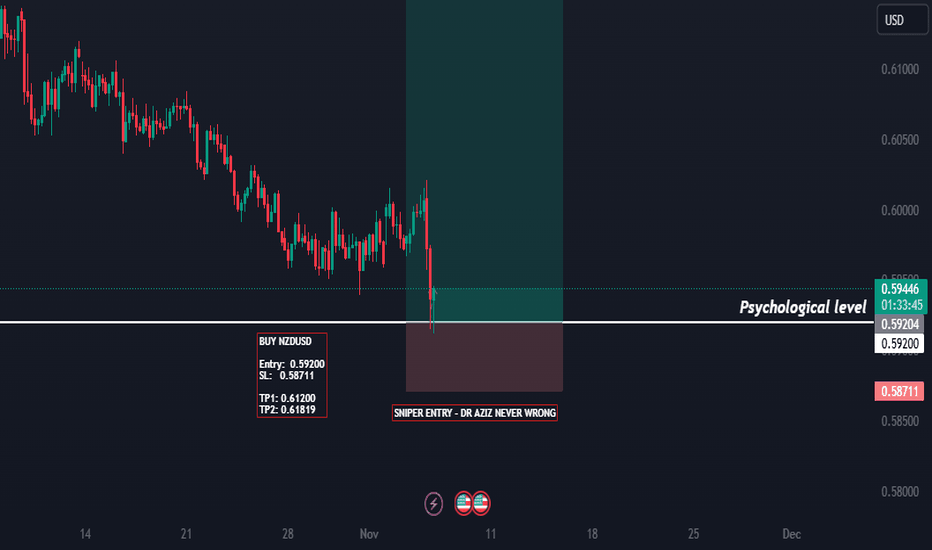

NZDUSD Analysis for November 6, 2024: Slight Bullish Bias Amid.As of November 6, 2024, NZDUSD shows a slight bullish bias amid a variety of fundamental factors influencing the currency pair. With recent market conditions shifting, the New Zealand dollar (NZD) gains some support against the US dollar (USD). Let's delve into the primary factors that could drive NZDUSD today.

Key Drivers Supporting a Bullish Bias for NZDUSD

1. New Zealand Economic Resilience

New Zealand’s economic fundamentals continue to show resilience, with recent data indicating stable inflation and a manageable interest rate environment. These conditions provide a supportive backdrop for the New Zealand dollar, encouraging modest gains against the US dollar.

2. US Dollar Weakness on Rate Expectations

The USD has shown signs of weakness due to shifting expectations around the Federal Reserve's monetary policy. Recent statements from the Fed suggest a dovish approach may prevail, potentially signaling fewer rate hikes in the near term. This sentiment dampens the USD’s appeal, providing a tailwind for NZDUSD's bullish momentum.

3. Positive Risk Sentiment

Risk sentiment remains moderately positive in global markets, which often benefits higher-yielding currencies like the NZD. Investors appear more optimistic, drawing them towards risk assets and risk-associated currencies. This trend is likely to support NZDUSD in the near term, especially if risk sentiment persists.

4. Commodity Prices Influence

NZD is historically correlated with commodity prices, and recent stability in commodity markets has provided additional support for the currency. As New Zealand is a major exporter of dairy and other commodities, the steady prices bolster NZD, adding strength to the bullish case for NZDUSD.

Technical Indicators Show Cautious Optimism

Technically, NZDUSD is trading above key moving averages, further confirming a slight bullish trend. If the pair holds above the 0.5900 support level, we could see an attempt to test the 0.5980 resistance, driven by today’s bullish sentiment and the outlined fundamental factors.

Conclusion

In conclusion, today’s analysis suggests a slightly bullish bias for NZDUSD, driven by New Zealand’s economic stability, US dollar softness, favorable risk sentiment, and supportive commodity prices. Traders should monitor any changes in Fed policy or risk sentiment that could alter this outlook.

Tags:

- NZDUSD analysis

- New Zealand dollar forecast

- Forex market trends

- US dollar outlook

- Federal Reserve rate impact

- NZDUSD November 6, 2024

- Risk sentiment currency trading

- Forex bullish trends

- Commodity currency

USDJPY Bearish Bias on October 29, 2024: Fundamental Analysis !USDJPY Bearish Bias on October 29, 2024: Fundamental Analysis and Key Market Drivers

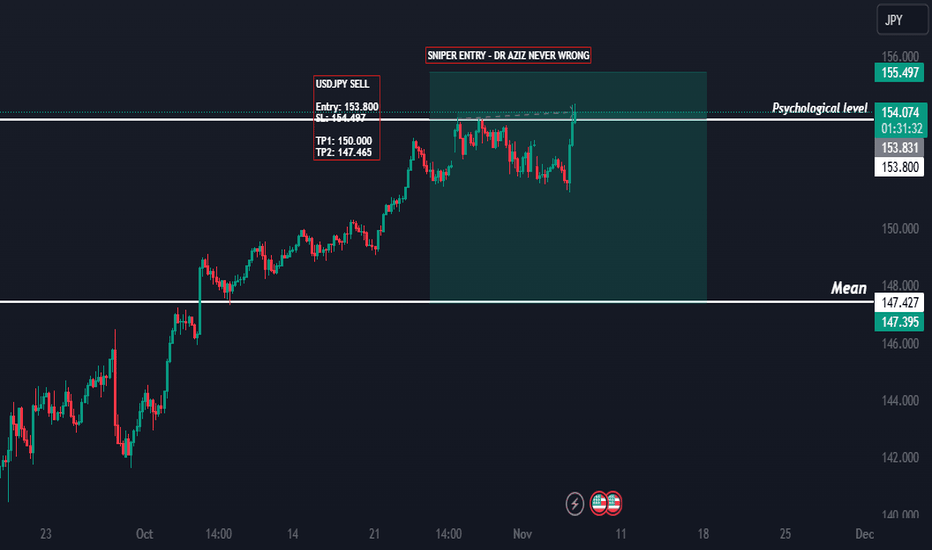

Overview: USDJPY Daily Analysis with Slight Bearish Bias on 29/10/2024

As of October 29, 2024, the USDJPY (U.S. Dollar to Japanese Yen) currency pair leans toward a bearish bias, driven by a range of economic factors and shifting market sentiment. The Japanese Yen, often considered a safe-haven currency, appears set for gains as investor risk appetite remains cautious. In this analysis, we’ll break down the primary drivers of a bearish USDJPY outlook and explore what this could mean for traders today.

Key Drivers for USDJPY Bearish Bias

1. Dovish Stance from the Federal Reserve

- The U.S. Federal Reserve's recent statements have indicated a more dovish tone, with Chair Jerome Powell suggesting a pause in rate hikes as the U.S. economy faces slower growth and moderating inflation.

- As the Fed scales back aggressive tightening, demand for the USD could soften, giving way to downward pressure on USDJPY.

2. Economic Resilience in Japan

- Japan’s latest economic indicators, including rising exports and steady growth in industrial output, are showing signs of resilience. The Bank of Japan (BOJ) has maintained its accommodative policies, yet recent remarks hint at a more balanced approach, adding stability to the JPY.

- With the Japanese economy performing well, the Yen is gaining support, especially against a potentially weaker USD.

3. Risk-Off Sentiment in Global Markets

- USDJPY typically reacts to shifts in risk sentiment, as the Yen benefits from safe-haven flows. In today’s market, concerns over geopolitical risks and potential global economic slowdown are driving investors to seek safer assets.

- This risk-off environment is reducing demand for USD-denominated assets while increasing interest in JPY, putting additional bearish pressure on USDJPY.

4. U.S. Dollar Weakness Amidst Lower Treasury Yields

- U.S. Treasury yields have pulled back as the Fed pauses its rate hikes. Lower yields tend to weaken the appeal of the USD compared to safe-haven currencies like the Yen.

- This yield differential further supports a bearish USDJPY outlook, as lower Treasury returns make the USD less attractive in the FX market.

Technical Analysis of USDJPY

On the technical front, USDJPY is approaching a support zone near 148.00, with resistance around the 149.80 level. If the bearish bias continues and the pair falls below this support, we could see USDJPY trend lower, making this an important level to watch.

Conclusion: USDJPY Outlook on October 29, 2024

Today’s fundamental and market conditions suggest a bearish bias for USDJPY. A dovish Fed, Japan’s economic resilience, cautious market sentiment, and lower U.S. Treasury yields are all factors likely to favor the Yen over the Dollar. Traders should monitor key support levels and any shifts in risk sentiment, as these could impact USDJPY’s trend throughout the day.

---

Tags:

USDJPY analysis, USDJPY forecast, Japanese Yen outlook, Forex market trends, USDJPY bearish trend, Federal Reserve impact on USD, USDJPY technical levels, Forex trading insights, October 2024 USDJPY