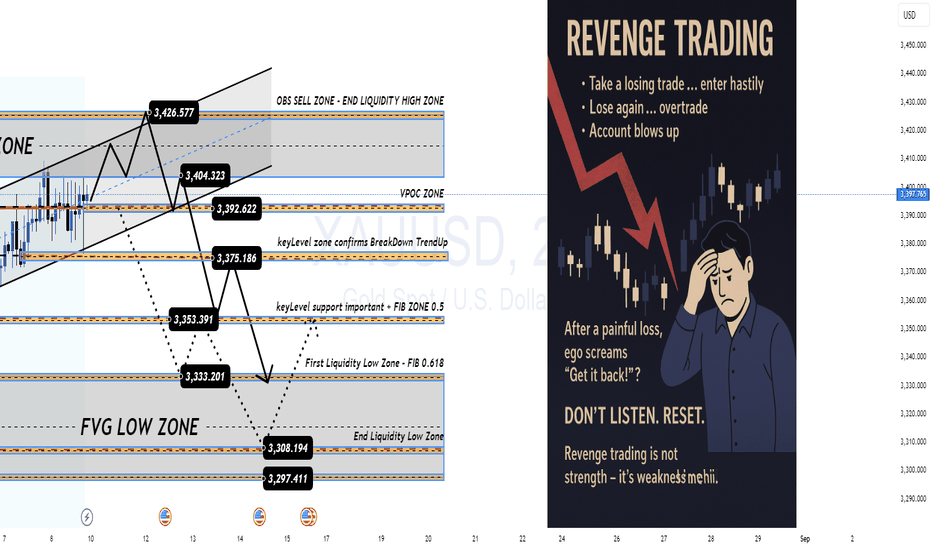

When Ego Takes Over, Your Account Pays the Price Revenge Trading – When Ego Takes Over, Your Account Pays the Price 💔

Traders, be honest…

How many times have you taken a painful SL, and before you could even breathe, your finger was already clicking “Buy/Sell” without a second thought?

In your head: “I’ll get it back right now… the market can’t do this to me!”

And then…

🔻 A candle goes straight against your position.

🔻 SL beeps again.

🔻 Your account balance drops faster than your mood.

That’s Revenge Trading – it sounds fierce, but in reality, it’s just an emotional storm pulling you further away from shore.

1️⃣ The Sweet but Deadly Psychological Trap

After a loss, your brain refuses to accept reality. It pushes you into the “must recover immediately” mode.

You throw discipline out the window – no setup, no plan.

You increase your lot size recklessly – “Just one win and I’ll be back.”

And… the market doesn’t care if you’re mad or not.

The danger is, at that moment, you’re no longer trading with logic — you’re trading with a wounded ego.

2️⃣ The Downward Spiral

Lose one trade → frustration.

Jump into a revenge trade → bigger lot size.

Lose again → account drains faster.

Emotions spiral out of control → random clicking.

Account blown.

It’s like standing at the edge of a cliff — you could step back and be safe… but you jump, thinking there’s a cushion down there.

3️⃣ How to Cut the Revenge Trading Cycle Before It Eats You Alive

Step away from the charts immediately after a losing streak — go for a walk, exercise, do something unrelated to trading.

Set a daily/weekly loss limit (e.g., -2R) and stick to it.

Journal your emotions after each trade to spot when revenge impulses start creeping in.

Trade smaller when you return — the goal now is to recover your mindset, not your money.

Remind yourself: “The market will always be here. My capital and mental state won’t wait for me.”

4️⃣ MMF’s Note to You

Revenge trading is not strength — it’s weakness in disguise.

It doesn’t help you beat the market; it just helps the market beat you faster.

Keeping a cool head is what keeps a trader alive in the long run.

Forexmindset

Risk Capacity: The Real Reason Traders Blow Accounts | Ep. 4In this pre-recorded video, I unpack one of the most overlooked reasons why traders blow their accounts over and over again, and it’s not about your system, strategy, or signal.

It’s about risk capacity, the internal threshold your nervous system can handle before fear, greed, or shutdown kicks in.

This is part of my ongoing series on YouTube “Rebuilding the Trader Within”, where I reflect on the emotional and psychological dimensions of trading that no indicator can fix.

If you've ever found yourself repeating the same mistakes, feeling stuck at the same equity level, or losing composure in high-stakes trades... this might be the pattern underneath it all.

I'm still learning too, and I’d love to hear your thoughts. Drop a comment — let’s grow together.

#RiskCapacity #TradingPsychology #TraderMindset #RebuildingTheTraderWithin #ForexMentorship #TraderGrowth #InnerWork #ForexPsychology

Discipline Over MotivationSuccess in trading doesn't come from motivation—it comes from discipline.

Motivation will get you started, but

discipline will keep you consistent, even on the tough days."

In trading, emotions often try to take control. Fear of missing out, revenge trading, or overconfidence can lead to poor decisions.

Discipline means following your plan no matter how you feel.

Consistency is the bridge between your trading plan and long-term results. Without it, even the best strategies can fail.

How to Stay Disciplined?

Define Your Rules: Have a clear entry, exit, and risk management plan before you trade.

Track Your Performance: Use a journal to review trades—both wins and losses.

Take Breaks: A tired mind leads to impulsive decisions.

Detach from Outcomes: Focus on the process, not on winning every trade.

Remember: The best traders aren't the most motivated—they're the most disciplined.

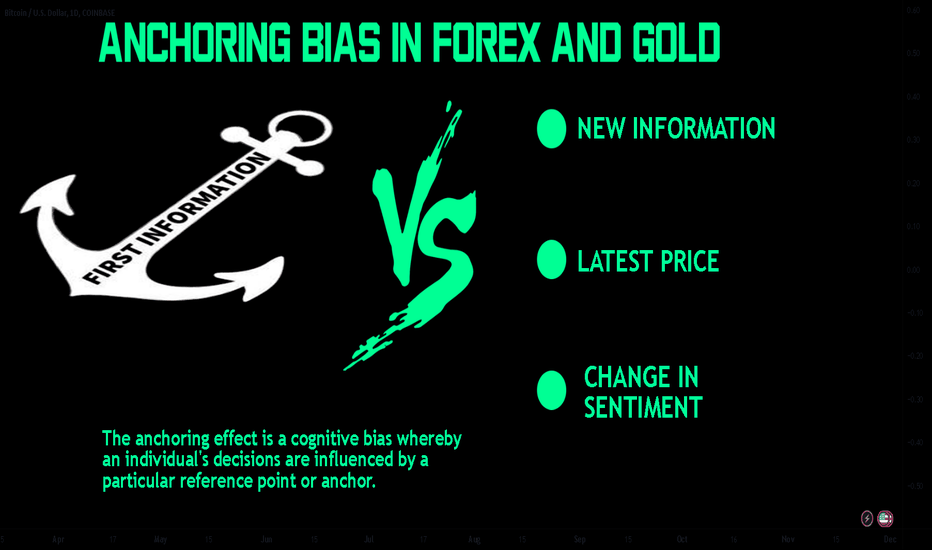

Anchoring Bias in Forex and Gold: Unshackling the Trader's Mind

Anchoring bias is a psychological trap that subtly influences decision-making in forex and gold trading. This cognitive bias anchors traders to specific reference points, hindering rational analysis and leading to skewed perceptions. In this article, we'll explore the pervasive impact of anchoring bias in trading, shedding light on its effects and strategies to overcome it.

Understanding Anchoring Bias

Anchoring bias occurs when traders rely heavily on specific price points, past trends, or perceived market norms as reference anchors for making trading decisions. It influences their perceptions of value and potential market movements, often leading to erroneous assessments.

Reliance on Historical Highs:

Attachment to Round Numbers:

Mitigating Anchoring Bias

Overcoming anchoring bias involves deliberate efforts to detach from fixed reference points and embrace a more holistic and analytical approach to trading.

Adopting Technical Analysis:

Anchoring bias is a subtle yet potent force affecting traders in the forex and gold markets. Recognizing its influence and employing strategies to mitigate its effects is pivotal for making informed and unbiased trading decisions. ⚓️📈✨

Please, like this post and subscribe to our tradingview page!👍