Gold faces pressure from investors when in high positionWhile investors are also cautious about how hawkish the Fed will be

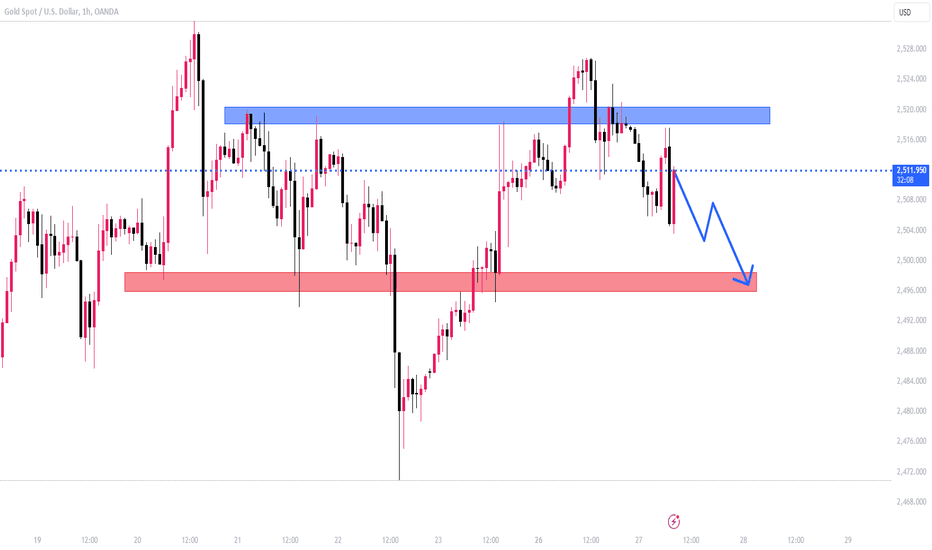

Caution and profit-taking pressure may be factors that prevent gold from continuing to rise.

However, many recent forecasts show that the medium and long-term trend of gold is still quite bright. Demand for this commodity is forecast to increase.

Major funds in the world are also increasing their gold reserves

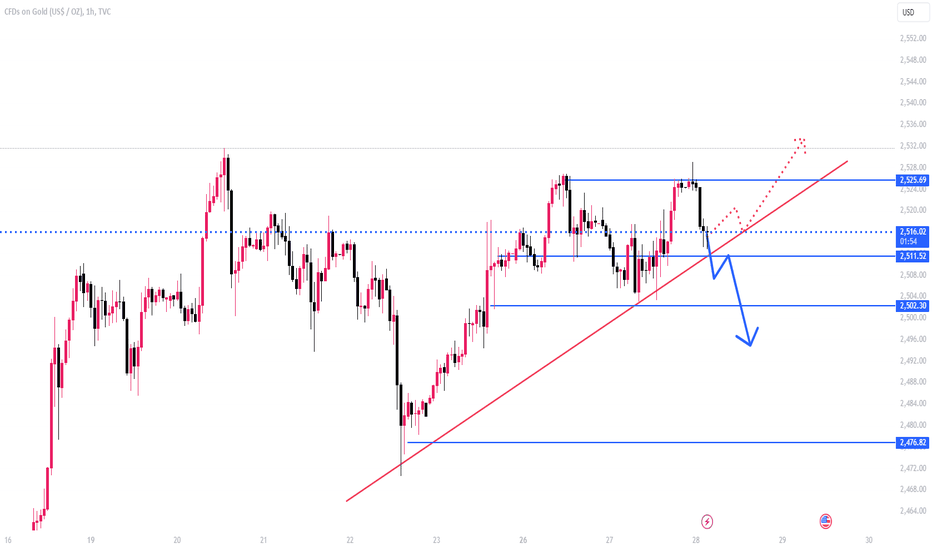

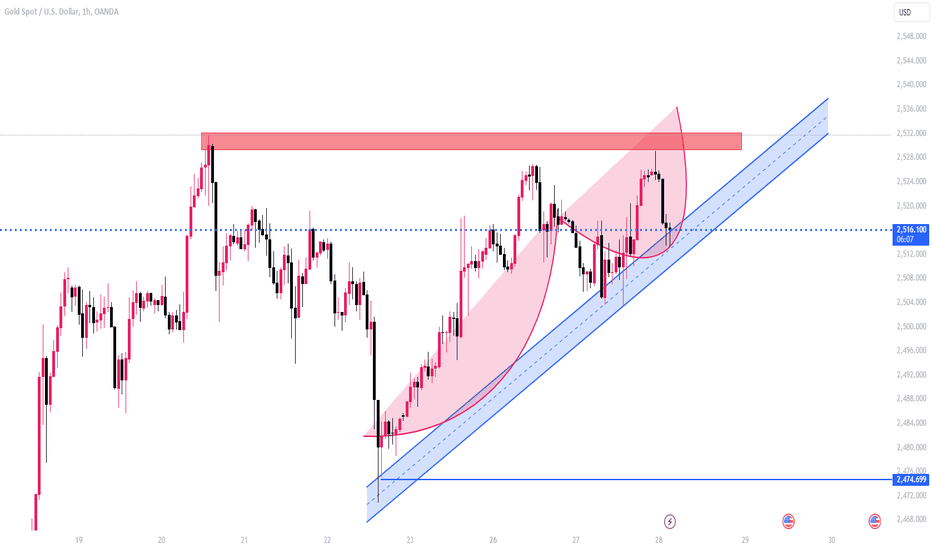

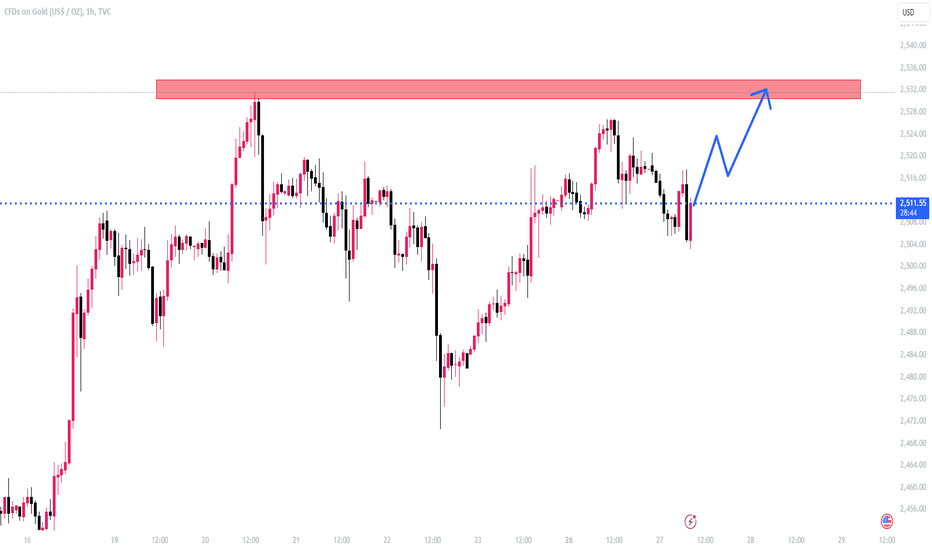

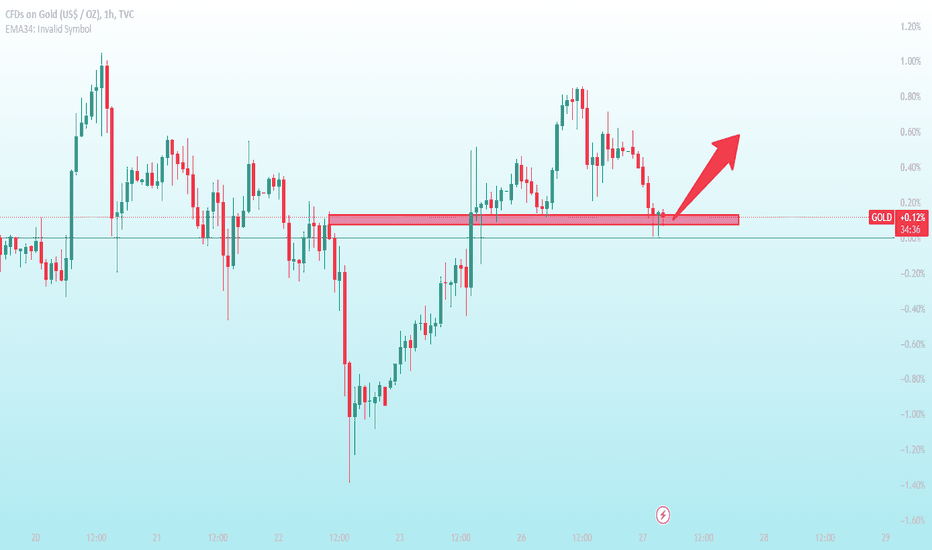

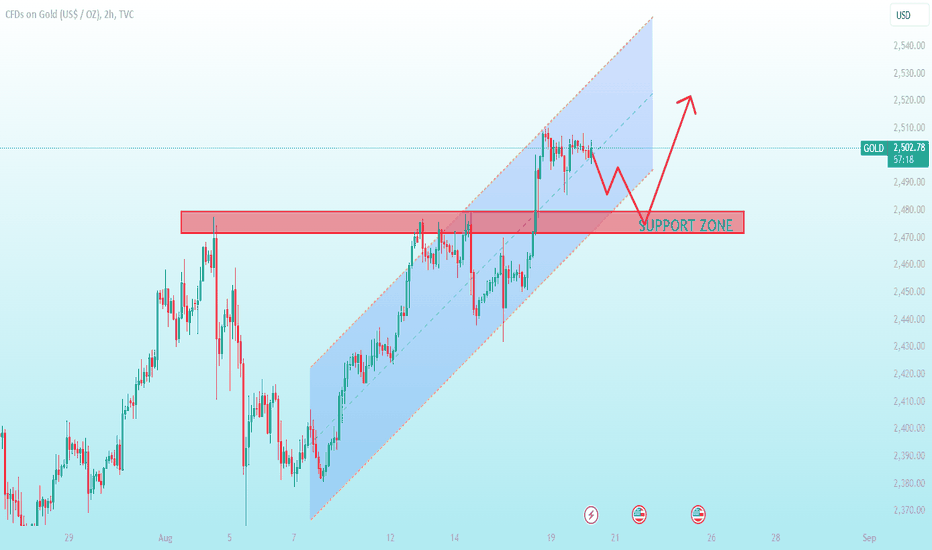

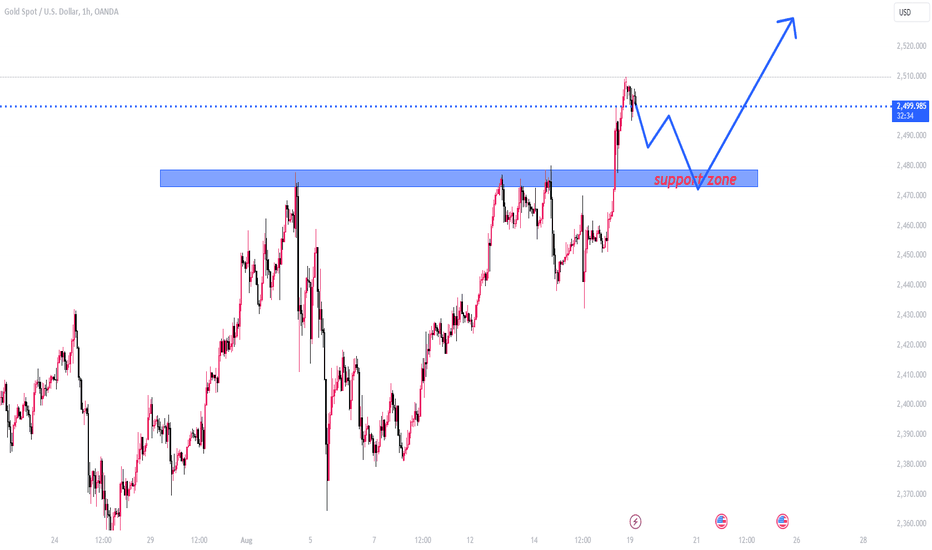

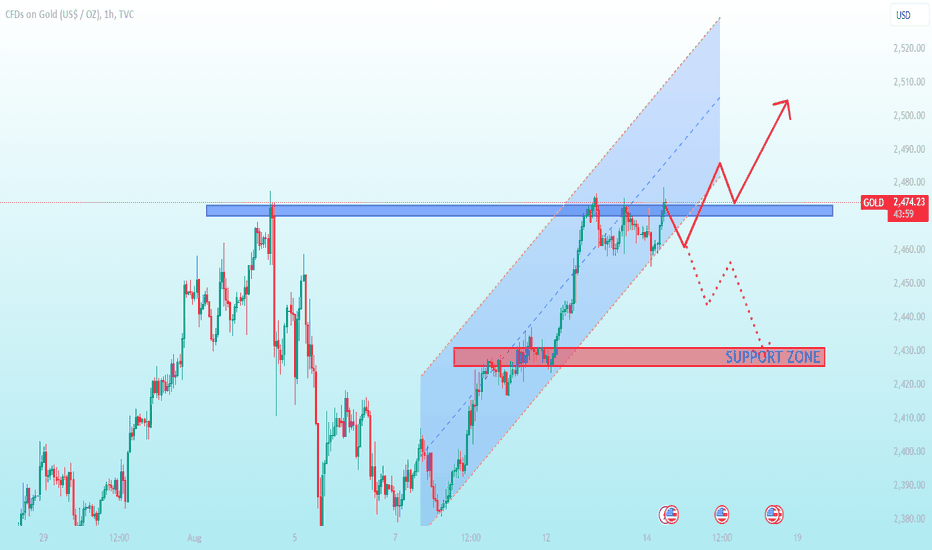

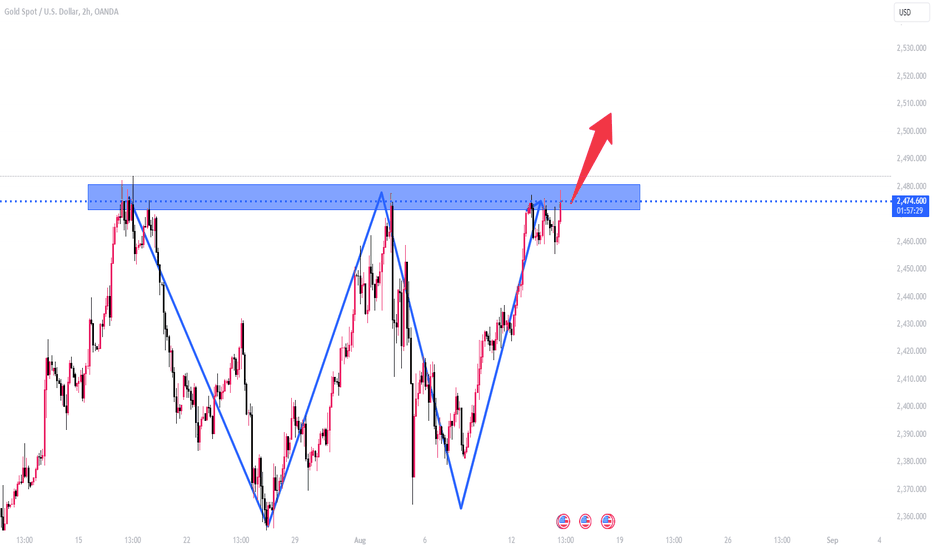

According to technical analysis, gold prices still tend to increase strongly in the short term

Forexpower

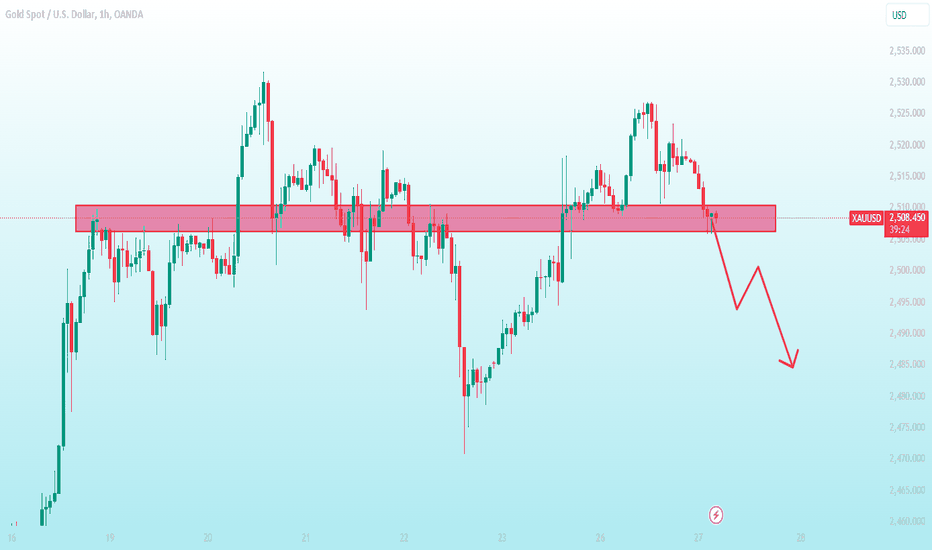

XAU tends to fall as investors take profitsGold prices surged in the first session of the week after Federal Reserve Chairman Jerome Powell delivered a historic speech at the Jackson Hole conference, marking a reversal in US monetary policy.

Accordingly, Mr. Jerome Powell signaled that "it is time to adjust policy", reducing interest rates to support the economy.

According to Mr. Powell, inflation has gradually decreased closer to the 2% target, while expressing concerns about the US labor market.

The USD immediately fell sharply, thereby pushing gold prices up.

Fed rate cut expectations unlikely to materializeSpot gold rose 0.3% to $2,518.forty seven an oz., barely underneath its preceding top of $2,531.60 an oz. hit closing week. US gold futures additionally rose 0.3% to $2,555.20.

Interest charge expectancies and safe-haven call for on Middle East tensions may want to push gold better withinside the quick term, with XAU/USD forecast to go towards $2,six hundred an oz..

China`s latest halt in gold purchases has weighed at the valuable metal. However, Grant stated that although China does now no longer return, primary financial institution call for remains robust and could remain robust.

Rate cut expectations and geopolitical concernsSpot gold rose 0.3% to $2,518.47 an ounce, slightly below its previous peak of $2,531.60 an ounce hit last week. US gold futures also rose 0.3% to $2,555.20.

Interest rate expectations and safe-haven demand on Middle East tensions could push gold higher in the short term, with XAU/USD forecast to head towards $2,600 an ounce.

China’s recent halt in gold purchases has weighed on the precious metal. However, Grant said that even if China does not return, central bank demand is still strong and will continue to be strong.

Gold likely to hit 2600Gold expenses fell however remained close to their current document highs, supported through a weaker US greenback and growing expectancies of a price reduce on the September assembly following dovish remarks from Federal Reserve Chairman Jerome Powell.

Traders have now completely priced in a price reduce subsequent month, with a 64% threat of a 25 foundation factor reduce and a 36% threat of a 50 foundation factor reduce, consistent with the CME FedWatch tool.

Zaner Metals senior metals strategist Peter A. Grant stated that price expectancies and safe-haven call for because of issues approximately Middle East tensions may want to push gold expenses better withinside the quick term, and forecasted that XAU/USD may want to pass towards $2,600/ounce.

XAU slightly down after US sessionGold prices fell but remained near their recent record highs, supported by a weaker US dollar and rising expectations of a rate cut at the September meeting following dovish comments from Federal Reserve Chairman Jerome Powell.

Traders have now fully priced in a rate cut next month, with a 64% chance of a 25 basis point cut and a 36% chance of a 50 basis point cut, according to the CME FedWatch tool.

Zaner Metals senior metals strategist Peter A. Grant said that rate expectations and safe-haven demand due to concerns about Middle East tensions could push gold prices higher in the short term, and forecasted that XAU/USD could move towards $2,600/ounce.

The gold rally is not over yet, because FEDCurrently, according to the CME FedWatch tool, the market is 36.5% certain that interest rates will be cut by 50 basis points at the monetary policy meeting next month.

Experts said that the move to loosen monetary policy will have a negative impact on the USD, which is good support for the upward trend of gold prices.

The biggest risk for the precious metal market in the coming time is inflation data, focusing on the US personal consumption expenditure (PCE) index in July. If inflation decreases, it will strengthen the possibility of the Fed easing monetary policy. Conversely, if inflation increases, it will be a drag on precious metals.

XAU price increased in early US sessionWorld gold prices increased, approaching the historical high of 2,531 USD/ounce (set on August 20), due to the demand for safe havens after the military conflict between Israel and Hezbollah last weekend.

In addition, experts believe that the gold price increase has not ended yet, because the US Federal Reserve (Fed) is about to begin a monetary policy easing cycle.

Recent moves by the Fed show that officials of the US Central Bank clearly support a policy pivot at the next meeting. The Fed Chairman emphasized that it is time to cut interest rates. This information continues to create confidence for investors as the direction of gold prices becomes clearer.

XAU will continue to increase in the coming timesaid the gold market is focused on the Fed's interest rate cut. Since the beginning of the year, gold prices have increased by more than 20%, as investors expect the Fed to cut interest rates soon.

"Gold prices are still rising despite high interest rates. Data shows that gold prices have been stable for a long time even before the Fed did not cut interest rates

When interest rates decrease, gold tends to increase. Investors see this as a tool to hedge against inflation.

The strong gold market is also thanks to central banks actively buying to reduce dependence on the USD. This positively supports gold prices to reach new peaks.

XAU price forecast to continue risingkeep an eye on the Fed's next moves

The initial jobless claims report and S&P Global PMI data will provide further signals on the health of the US economy.

Initial jobless claims for the week ending August 17 are expected to rise to 230K, up slightly from 227K last week. Services activity is expected to contract slightly, while the manufacturing PMI is expected to be flat.

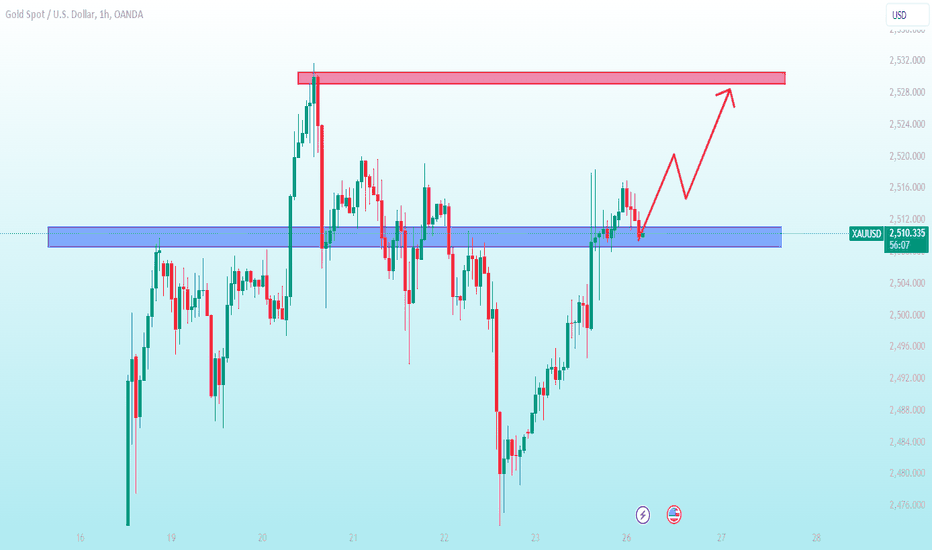

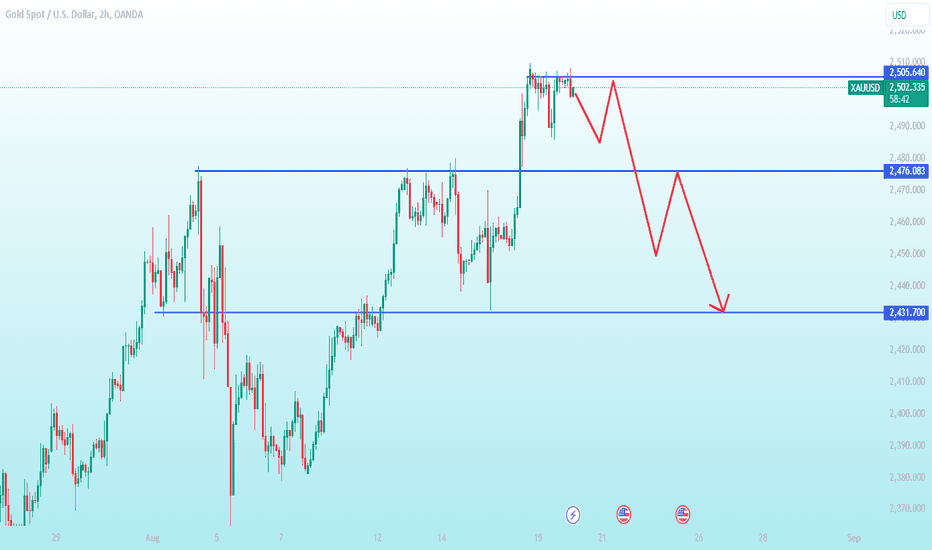

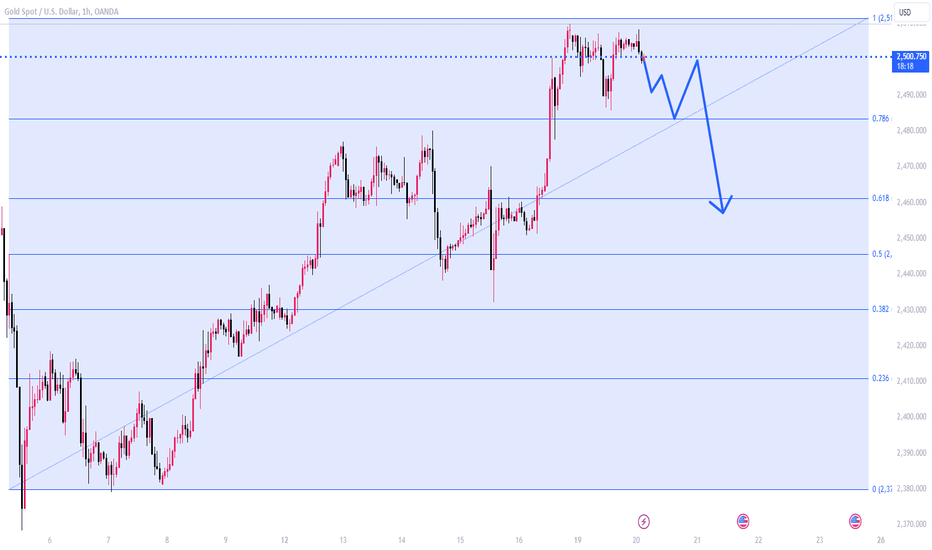

The first resistance level for XAU/USD to conquer is the $2,550 area, followed by the $2,600 mark.

However, if gold fails to hold above $2,500, key support levels will be at $2,483 (July 17 high), followed by $2,450 (May 20 high). In a stronger bearish scenario, deeper support could be the 50-day simple moving average at $2,395.

XAU continues to rise and hit a recordGold resumed its losses today and hovered near an all-time high after minutes from the US Federal Reserve's latest meeting showed officials were strongly inclined to cut interest rates at their September policy meeting. "Gold has the potential to move higher but not accelerate sharply without any unexpected events to spur it," Tai Wong added. "Gold prices closed higher after minutes from the Fed meeting showed 'majority' of the committee is ready to cut interest rates in September"

XAU slightly decreased in this afternoon trading sessionGold expenses had been little modified this morning, the USD weakened and buyers more and more more consider that americaA Federal Reserve (Fed) might also additionally reduce hobby prices in September.

"The essential driving force of the upward thrust in gold expenses has been economic funding demand, particularly as ETF shopping for has stepped forward and universal sentiment has stepped forward on expectancies of a Fed easing cycle beginning in September."

holdings of the world`s biggest gold-sponsored exchange-traded fund, rose to a seven-month excessive of 859 tonnes on August 19.

XAU all time highGold prices were little changed this morning, the USD weakened and investors increasingly believe that the US Federal Reserve (Fed) may cut interest rates in September.

"The main driver of the rise in gold prices has been financial investment demand, especially as ETF buying has improved and overall sentiment has improved on expectations of a Fed easing cycle starting in September."

holdings of the world's largest gold-backed exchange-traded fund, rose to a seven-month high of 859 tonnes on August 19.

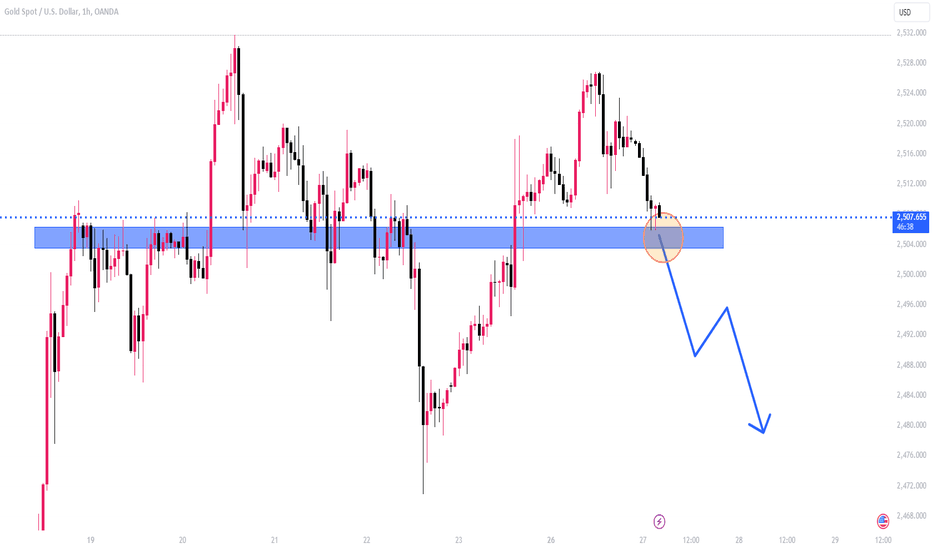

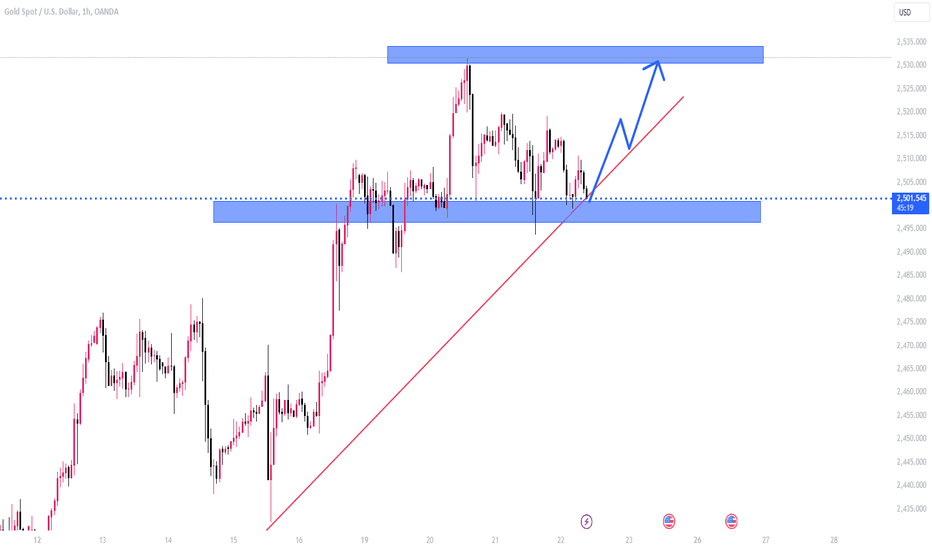

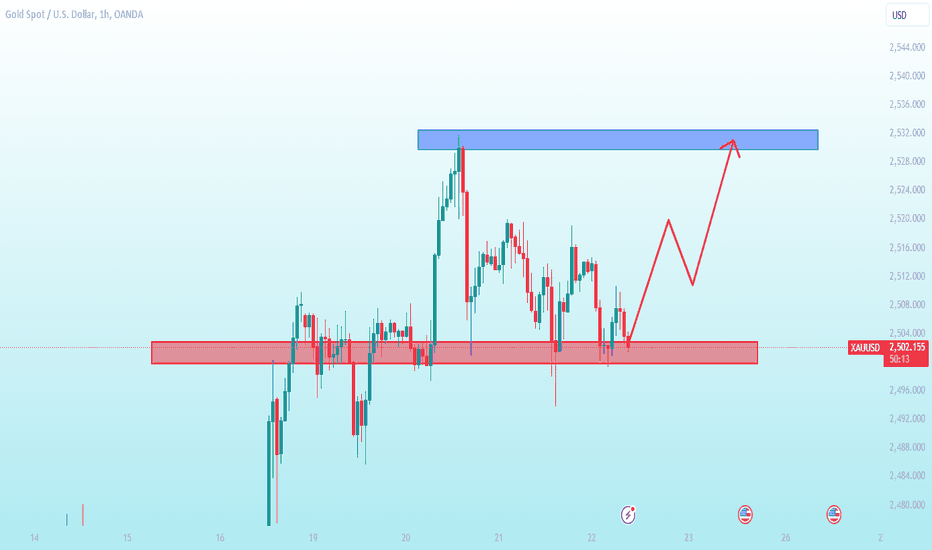

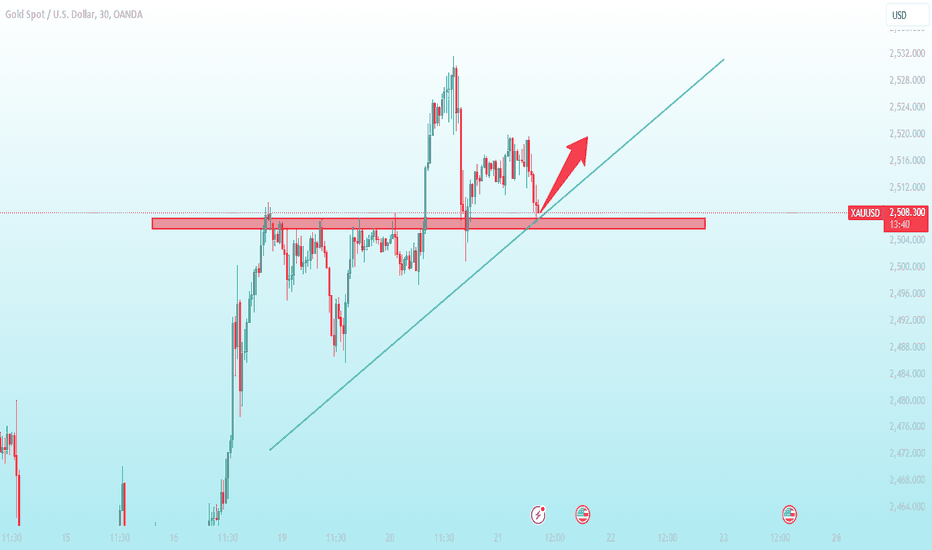

World gold will reach 2,600 USD/ounce when the Fed cuts interestGeopolitical tensions continue to be a catalyst supporting the gold rally. In today's trading session, XAU/USD is expected to continue to maintain above the 2,500 zone and has the potential to increase further. However, investors should note that if the price closes below 2,499 on the H4 time frame, it could be a sign of a short-term correction.

There is no news for gold today, the current trend is still sideways at 2482 and 2510, it can trade in this price range.

XAU increases sharply to maintain record high priceThe $2,500/ounce level of the precious metal is very difficult to maintain. Because, after reaching a new historical milestone, gold is easily sold off by investors to take profits. Not only that, at such a high price, it is difficult to attract new buyers to the market, also causing this commodity to decrease in price.

The upward trend of gold is still in place and the direction of the precious metal will depend on the policy direction of the US Federal Reserve (Fed).

The balance between economic growth and inflation is reduced, which will strengthen the possibility of a stronger interest rate cut. On the contrary, if he is optimistic and does not make a specific commitment, the market may have to readjust current expectations.

XAU receives strong support from USDWeaker USD Supports Strong XAU Gains

XAU is currently at an all-time high

Although gold has since been hit by a wave of profit-taking from investors, the decline in the USD is providing positive support and halting the decline in the precious metal.

Traders are now looking ahead to the annual Jackson Hole Federal Reserve meeting that begins later this week. In previous years, central bank officials have made market-moving statements at the meeting. Federal Reserve Chairman Jerome Powell is scheduled to speak at the meeting on Thursday morning.

XAU has a long term uptrendGold had a stellar week, with a rally on August 17 pushing the precious metal to an all-time high above $2,500 an ounce and, according to experts, the long-term trend is definitely up. The housing data released this morning was so bad that it pushed market expectations even higher. "It really amplified the gold market and the possibility of a rate cut in September will continue to increase

XAU Could Surpass All-Time HighThis gold buying trend is expected to remain unchanged in the coming period due to the impact of the current economic situation and geopolitical conflicts. At the same time, consumer prices have fallen after hitting a record high, easing pressure on the market.

The focus of gold investors next week is the annual central bank conference at the Fed's Jackson Hole resort. Fed Chairman Jerome Powell will speak on Friday, expected to share the prospect of an upcoming Fed rate cut.

Positive US inflation data in July has paved the way for the Fed to cut interest rates in September. The market predicts the Fed will cut by 0.25 percentage points at this meeting.

XAU surges despite positive news for DXYThe drop in jobless claims suggests the US economy is recovering well, which further strengthens the case for a lower-than-expected interest rate cut by the Federal Reserve in September.

The precious metal, which has been under pressure from the sell-off earlier this week, was further weighed down by the latest inflation report, which dampened market optimism about a September monetary policy pivot.

The US consumer price index (CPI) rose 0.2% in July, compared to a 2.9% increase in the same month last year, according to the US Department of Labor's Bureau of Labor Statistics.

Tai Wong, an independent metals trader in New York, said that a September rate cut was a certainty. However, the latest data disappointed the market by reinforcing the case for a 25 basis point cut, instead of the expected 50 basis points.

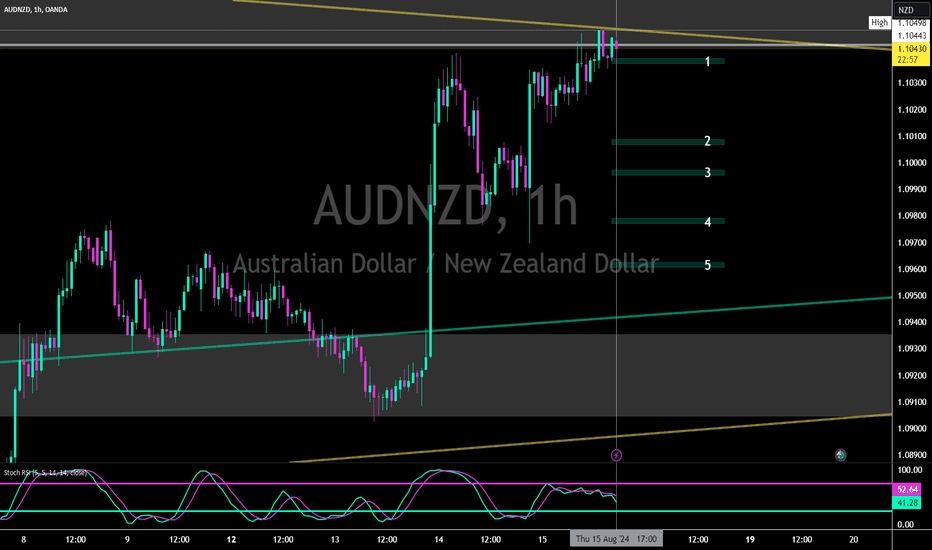

$AUDNZD TAKES A DUMP [SELL] INTO MARKET CLOSE.Much-needed price correction for the pair after strong deviation. Expecting the midline between 0.618 and 0.786 Fibonacci levels. I’ve gathered at least five confirmations on four different higher time frames, with smaller time frames only confirming further. ¡Buena suerte, mi gente!

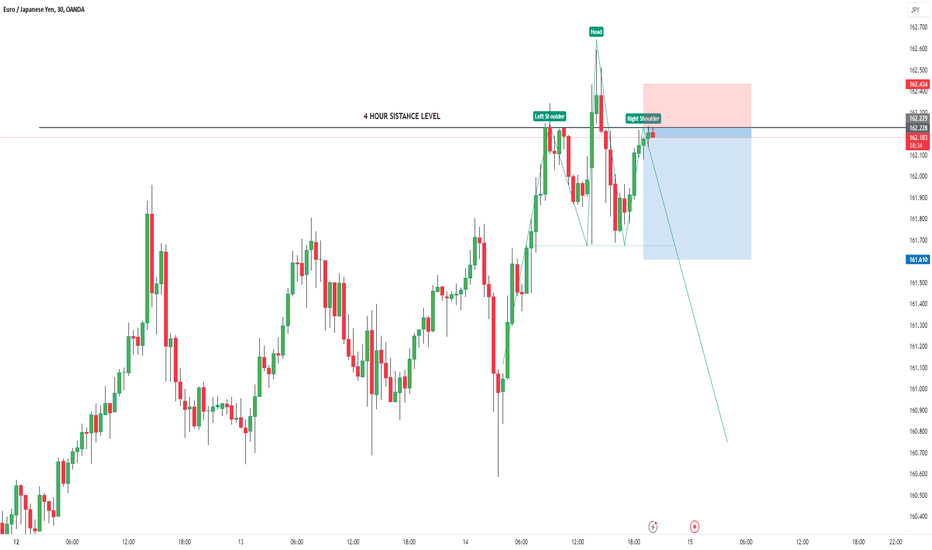

EUR JPY Trade Setup 30 mins timeframe. EUR JPY has formed an head and shoulders pattern on the 30 mins timeframe.

This pattern was formed at the 4 hour resistance level.

Now we need to see a soild candlesticks confirmation pattern before going short.

Don't trade all the time, trade forex only at the confirmed trade setups.

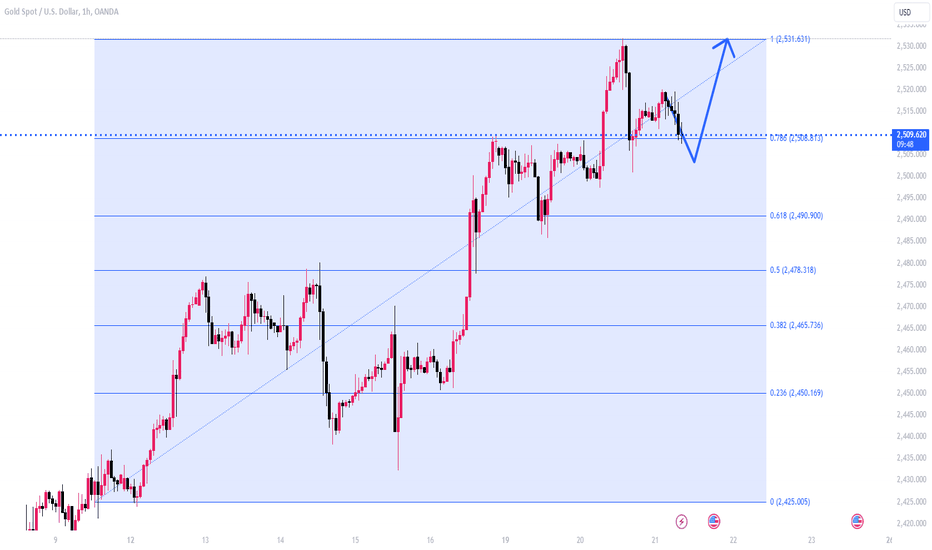

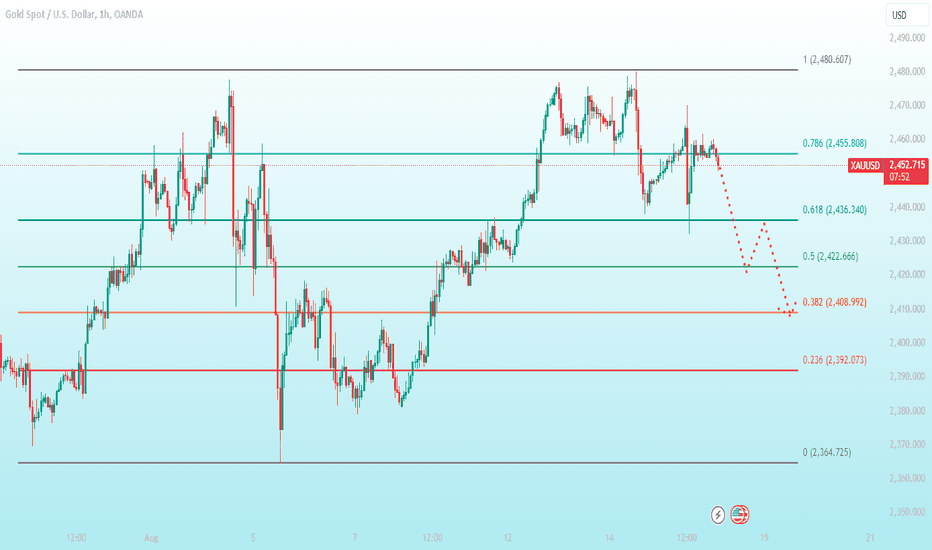

Long term strategy when trading goldAfter gold fell and corrected from the 0.618% Fibonacci extension stage to $2,455, as readers stated in yesterday`s edition, gold has now recovered barely and misplaced its bearish corrective momentum.

In the short, medium and lengthy time period, the technical shape in addition to the fashion continue to be bullish. With gold breaking above the 0.618% Fibonacci stage, it'll open a brand new uptrend. With the short-time period goal at $2,484 (all-time high) and above the preliminary fee of $2,500-2,505.

As lengthy as gold stays above the $2,455-$2,448 area, it'll nevertheless have a bullish short-time period technical outlook and the principle fashion is highlighted through the fee channel and the principle aid stage is highlighted through the EMA21.

For the day, the technical outlook for gold charges stays bullish because the Relative Strength Index continues to be a ways from oversold territory, suggesting there's nevertheless room for boom ahead. And the tremendous fee tiers may be indexed once more as follows.

Support: 2,455 - 2,448 USD

Resistance: 2,471 -2,484-2,500 USD

Focus on the consumer price index (CPI) reportGold prices are currently at a very high level, up about 36% compared to October 2023, so there is always pressure to take profits after each strong increase.

Investors are closely monitoring the conflict in the Middle East. This is still considered a powder keg that can cause tension in the global financial market.

Investors are also paying attention to the US consumer price index (CPI) report, expected to be announced on August 14. This is considered one of the most important indicators that the Fed monitors to make decisions on monetary policy. If the CPI continues to show a downward trend in inflationary pressure, the possibility of the Fed cutting interest rates in the coming months becomes even clearer.

Gold is forecast to reach $2,500/ounce in the second half of the year. This is easier than ever when the price for December delivery has exceeded this threshold. If tensions escalate uncontrollably in the Middle East, gold prices could climb further.