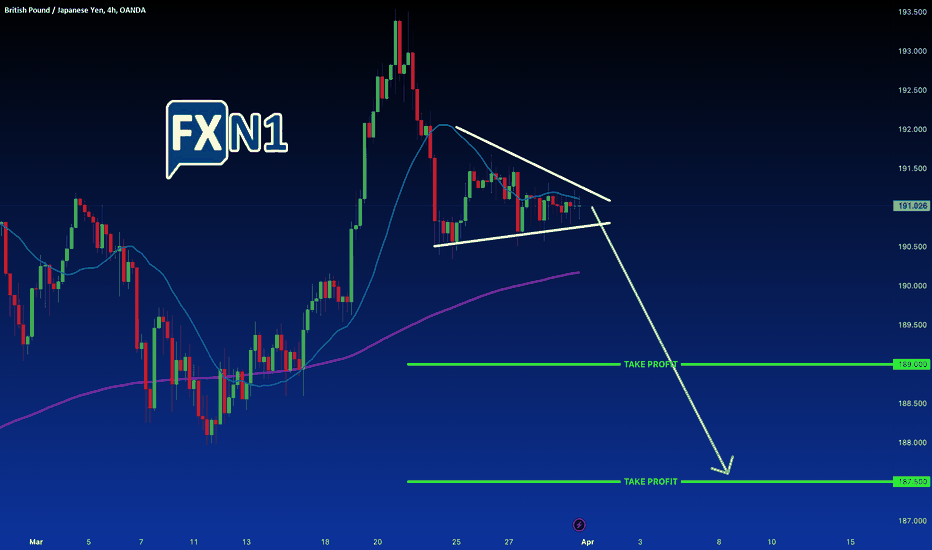

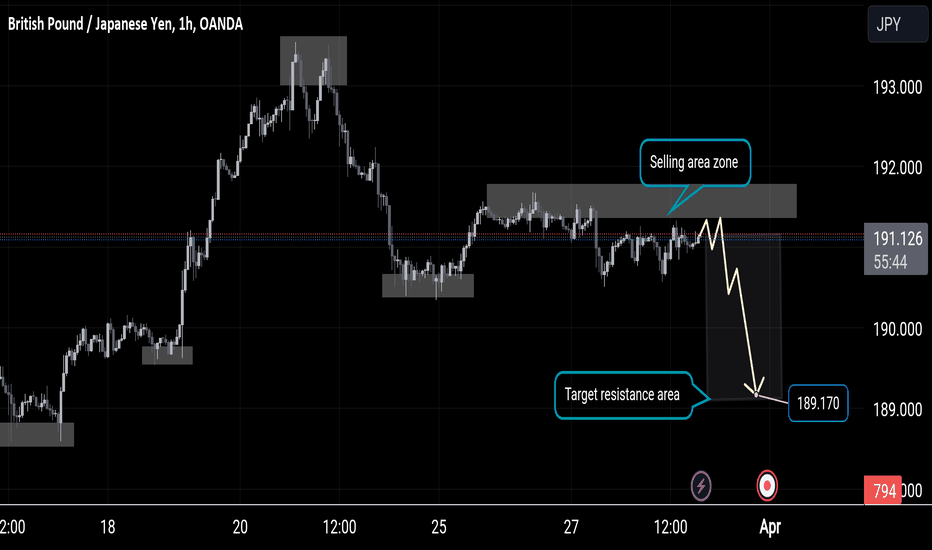

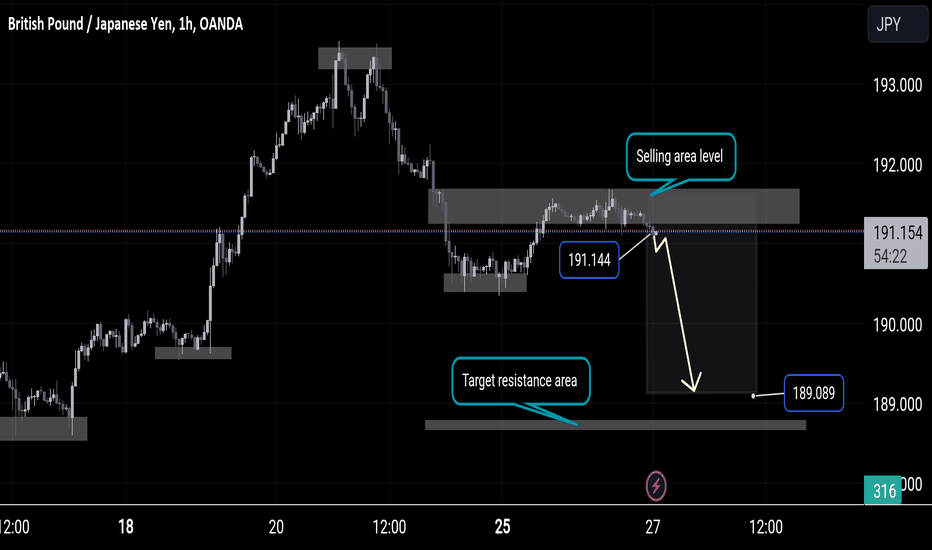

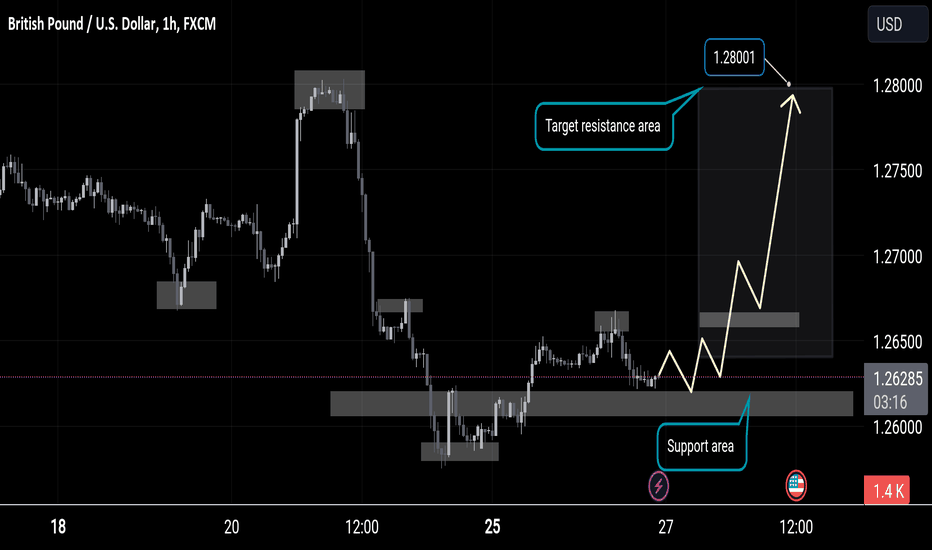

GBP/JPY Holds Steady Amid Easter Break, Eyes Bearish ContinuatioAs the financial markets took a pause for the Easter holiday, the GBP/JPY pair maintained stability around the 191.00 level on Friday, showing minimal movement. Meanwhile, Federal Reserve Chair Jerome Powell made statements emphasizing the adaptability of monetary policy to various economic scenarios.

Technically, the price experienced a reversal near 193.500, as anticipated in our previous analysis, leading to a decline of nearly 200 points. Currently, the pair is consolidating within a range, forming a triangle pattern that appeals to enthusiasts of technical analysis.

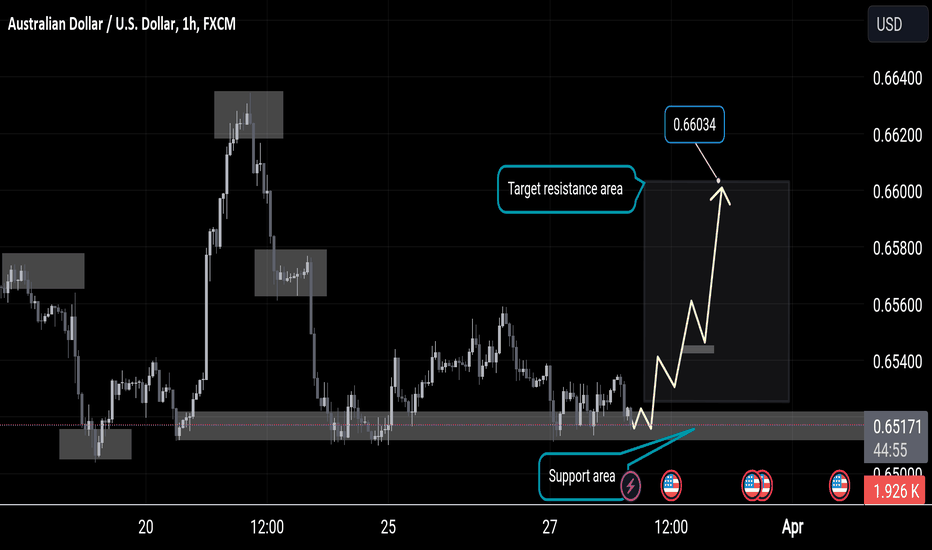

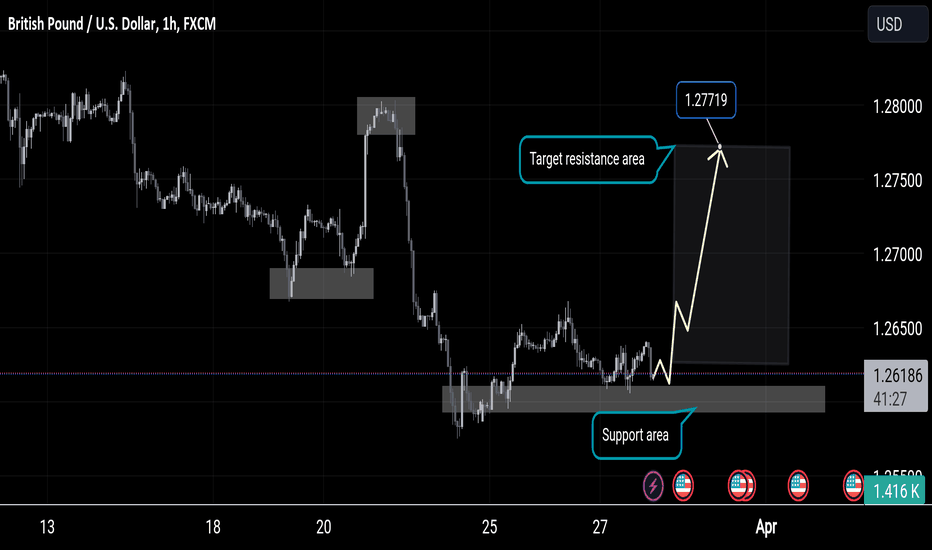

Our analysis indicates a bearish continuation for the GBP/JPY pair, considering its correlation with the GBP/USD, which is currently in a bearish trend on the H4 and lower timeframes.

For further details, you can refer to our previous analysis of GBP/JPY by following the provided link.

Forexsignal

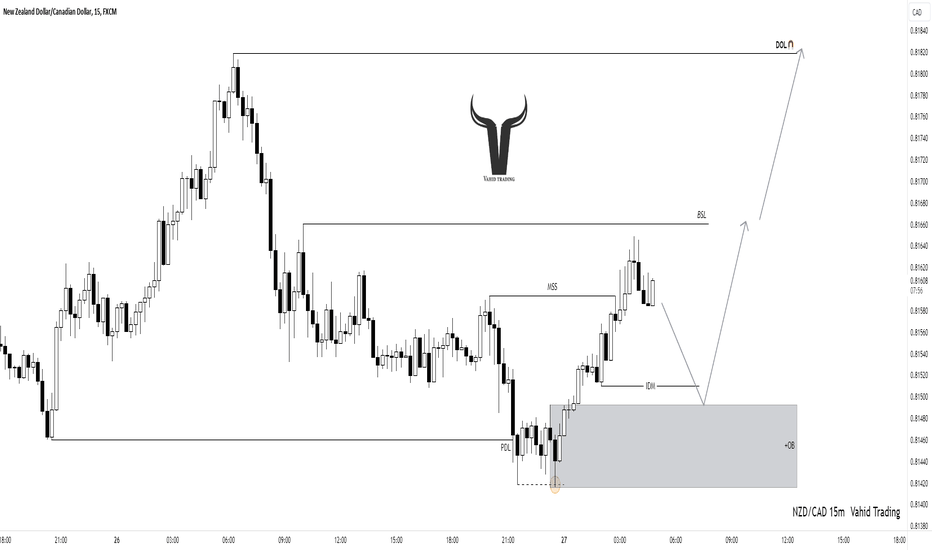

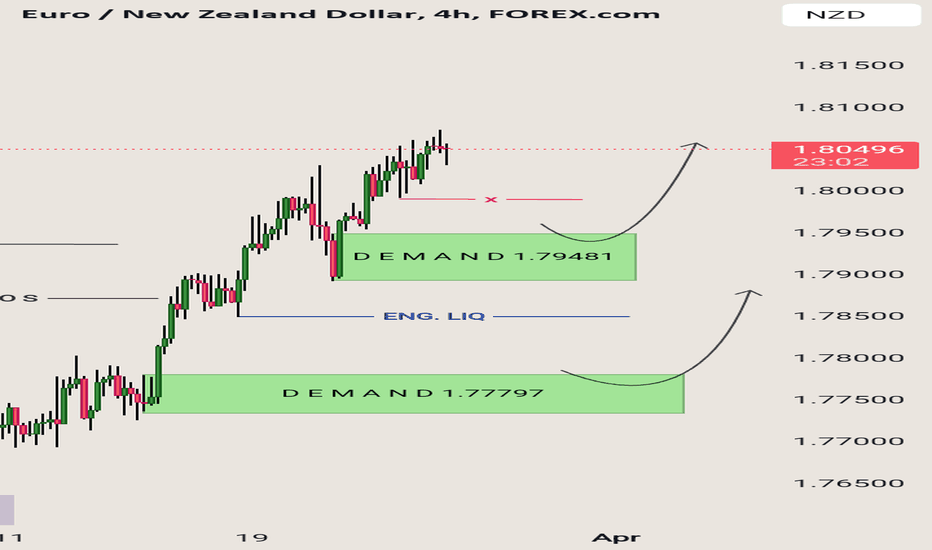

NZDCAD:🟢Buy Opportunity🟢

As you can see, the price swept the liquidity below the previous day's low and shifted the market structure.

Now we can expect that the price move lower to collect the inducement and then move higher.

We can define buy-side liquidity as the first target and the previous day's high as our final target.

Please pay attention: We need LTF confirmation in this scenario.

💡Wait for the update!

🗓️27/03/2024

🔎 DYOR

💌It is my honor to share your comments with me💌

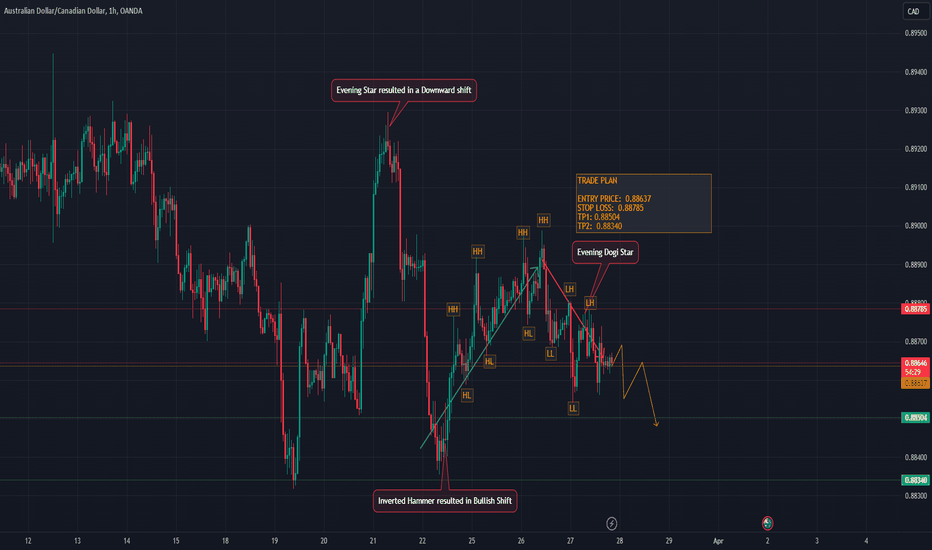

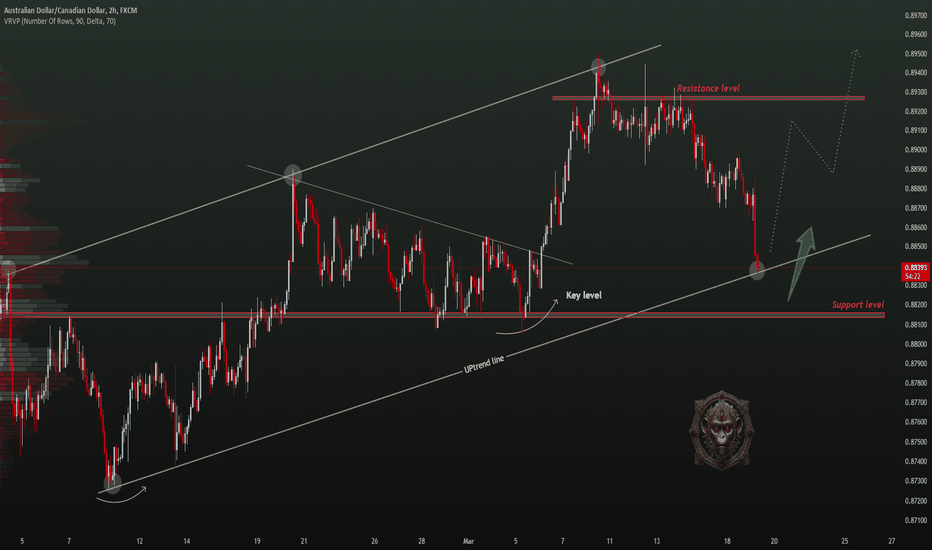

AUDCAD→ Day Analysis | BUY SetupHello Traders, here is the full analysis.

Price reversal going up, levels for BUY . AUDCAD long

! Great BUY opportunity AUDCAD

I still did my best and this is the most likely count for me at the moment.

Support the idea with like and follow my profile TO SEE MORE.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Patience is the If You Have Any Question, Feel Free To Ask 🤗

Just follow chart with idea and analysis and when you are ready come in THE GROVE | VIP GROUP, earn more and safe, wait for the signal at the right moment and make money with us💰

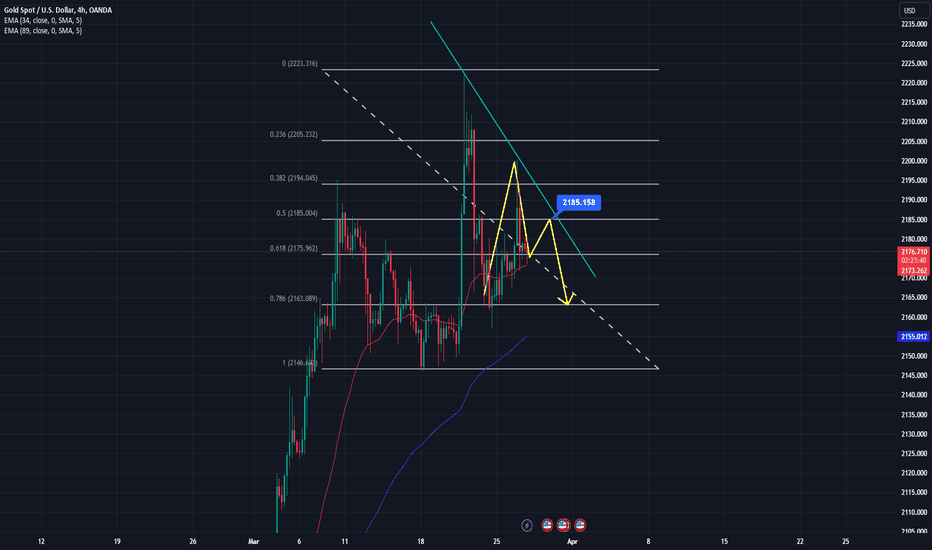

Gold continues to move unexpectedly, entry sell todayWorld gold prices inched up slightly with spot gold increasing by 5.7 USD to 2,176.5 USD/ounce. Gold futures last traded at 2,177.6 USD/ounce, up 4.6 USD compared to yesterday morning.

The world gold market fluctuated slightly as investors were still waiting for US inflation data later this week to know more about when the US Federal Reserve (Fed) will begin to loosen monetary policy. bad this year.

RJO Futures senior market strategist Bob Haberkorn predicts gold will rise in the near term on interest rate expectations, unless the Fed changes its stance or makes some announcement that it will eliminate interest rate cuts. capacity.

Gold could fall again if personal consumption spending data is stronger than expected, Haberkorn said. However, this precious metal will quickly regain its upward momentum.

Last week, gold hit a record high of $2,222.39 an ounce after Fed policymakers said they still expected to cut interest rates by three-quarters of a percentage point in 2024 despite persistent inflation. still far from the target level of 2%. Currently, traders are currently forecasting a 71% chance that the first rate cut will take place in June.

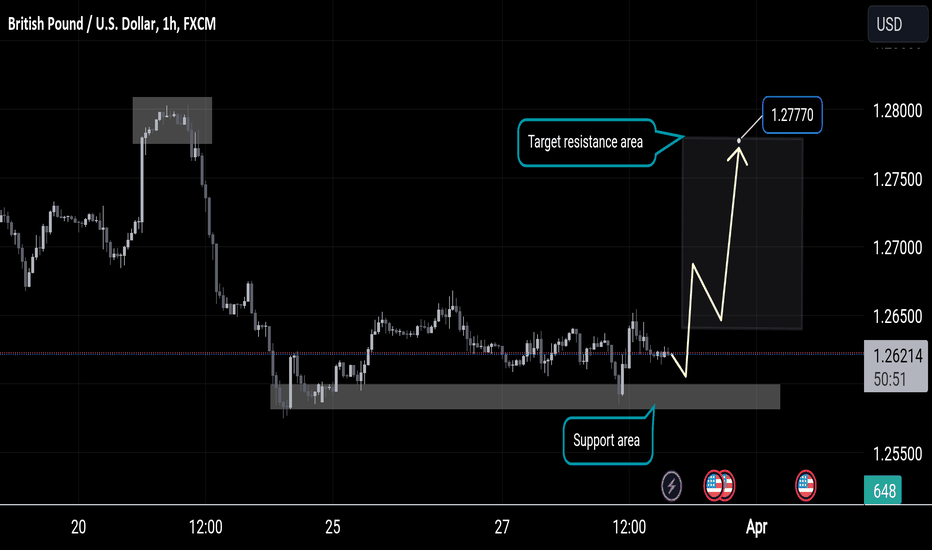

GBPJPY sell opportunity strong and big fall soon GBPJPY falling soon which is generally considered a signal of weakening momentum often followed by pullbacks or reversals In this case it might be a signal for a pullback into the lowered bound Of the channel but we will need a catalyst to kick off such a big corrections

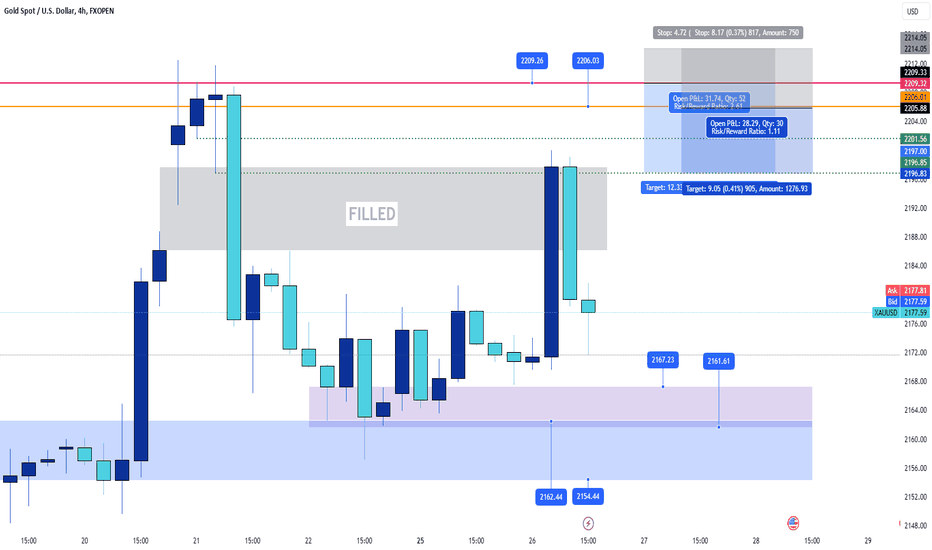

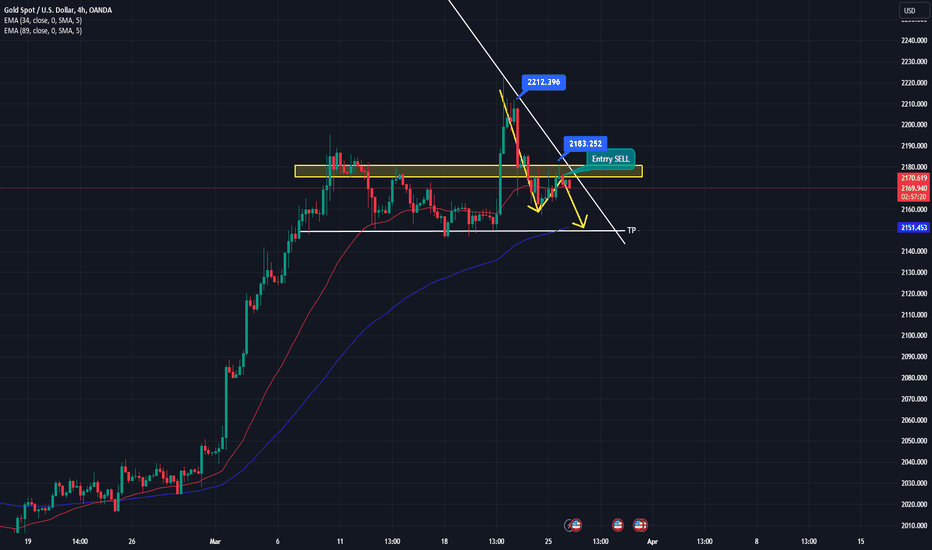

Gold sell zone 2206.00 - 2209.00XAUUSD GOLD Update

Gold sell zone 2206.00 - 2209.00

TAKE PROFIT 01 : 2201.00

TAKE PROFIT 02. 2196.00

STOPLOSS 2212.00

When hitting targets:

Set Break-Even after 35-40 pips.

Partial close at 1st target or book minimum 40-50 pips.

Implement minimum 2 layers in the zone.

Stay sharp, stay savvy. Let's conquer those markets together

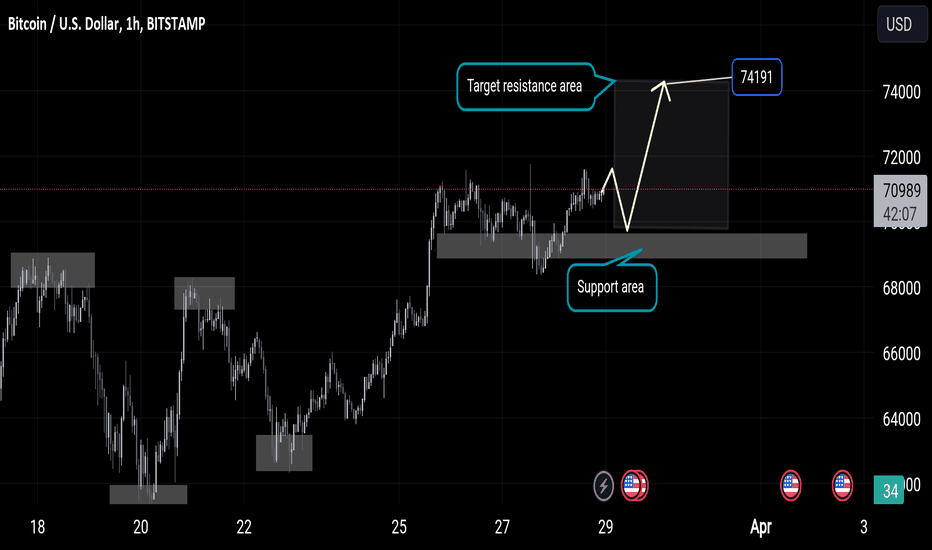

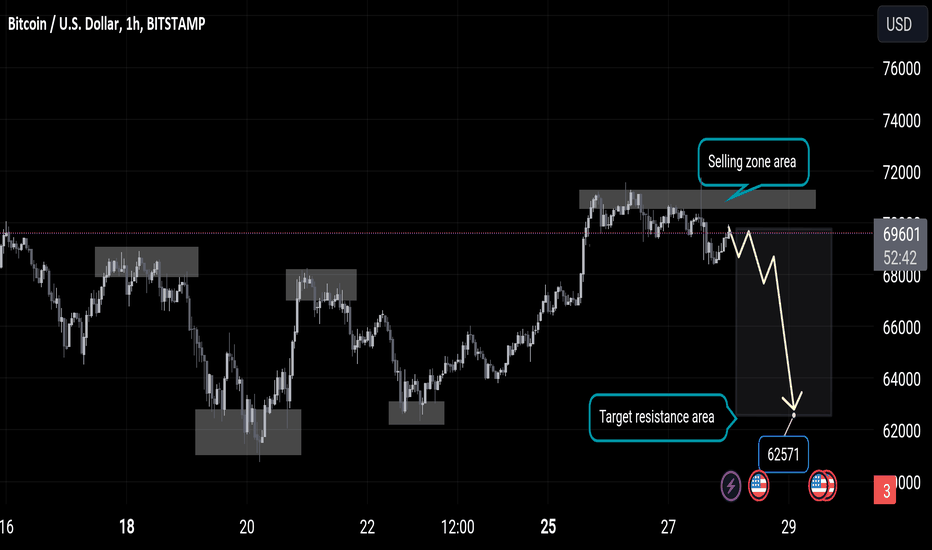

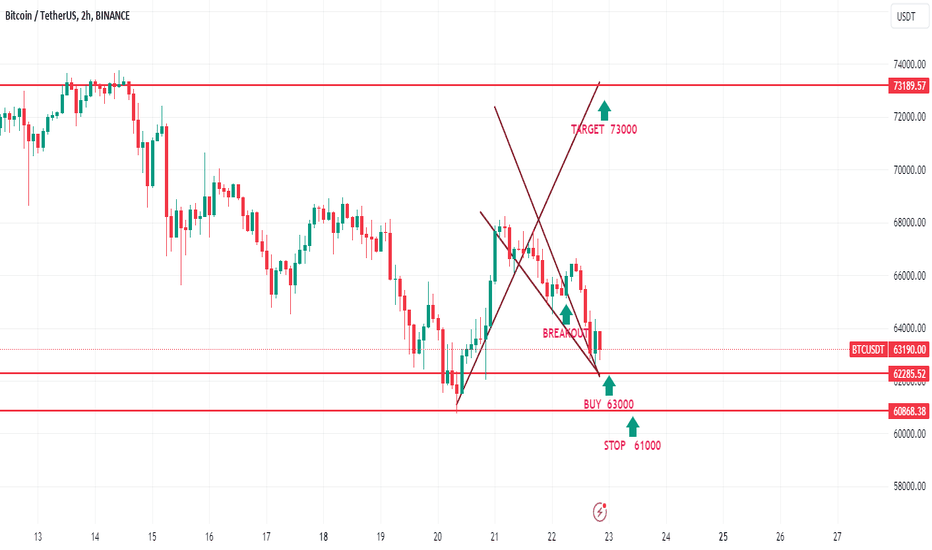

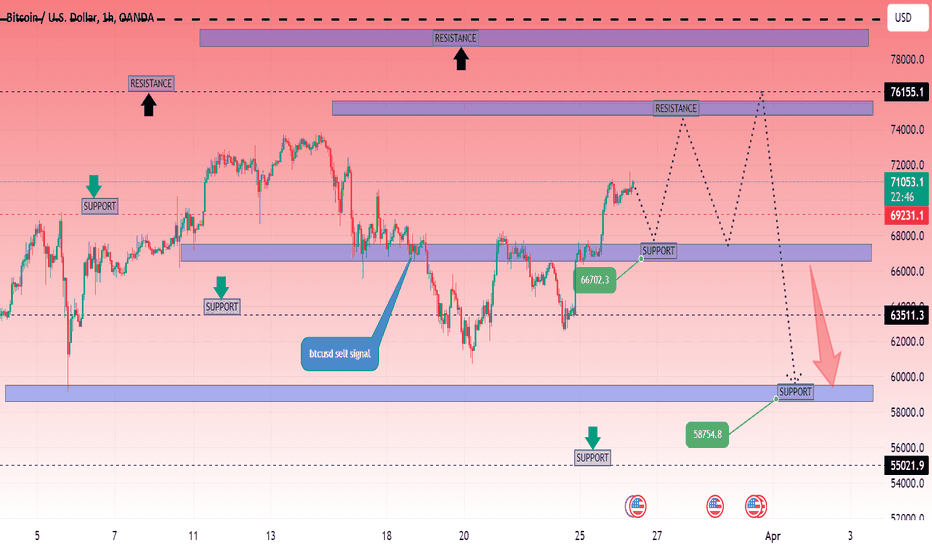

btcusd sell signal

Bitcoin (BTC) is recognised as the world's first truly digitalised digital currency (also known as a cryptocurrency). The Bitcoin price is prone to volatile swings; making it historically popular for traders to speculate on. Follow the live Bitcoin price using the real-time chart, and read the latest Bitcoin news and forecasts to plan your trades using fundamental and technical analysis.

Bitcoin Price (BTC) Real-Time Live Price

Bitcoin has rallied by around 12% since Sunday’s opening print as demand for the largest cryptocurrency by market cap continues to increase prices. A technical, bullish, break of a short-term descending channel now suggests that Bitcoin will attempt to make a fresh record high in the near-term and likely ahead of next month’s halving event. Any pullbacks will find initial support around SWB:69K before just under FWB:65K comes into focus. The Average True Range (ATR) reading is at a multi-month high, while the CCI indicator shows Bitcoin nearing overbought territory. The chart set-up suggests Bitcoin will move higher over the coming days but a short-term turn lower cannot be discounted. confirm btcusd sell signal

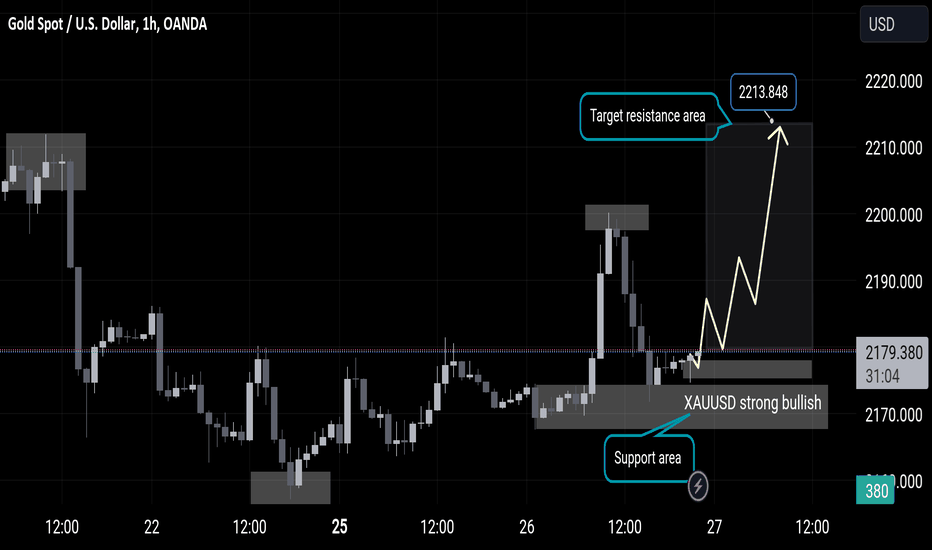

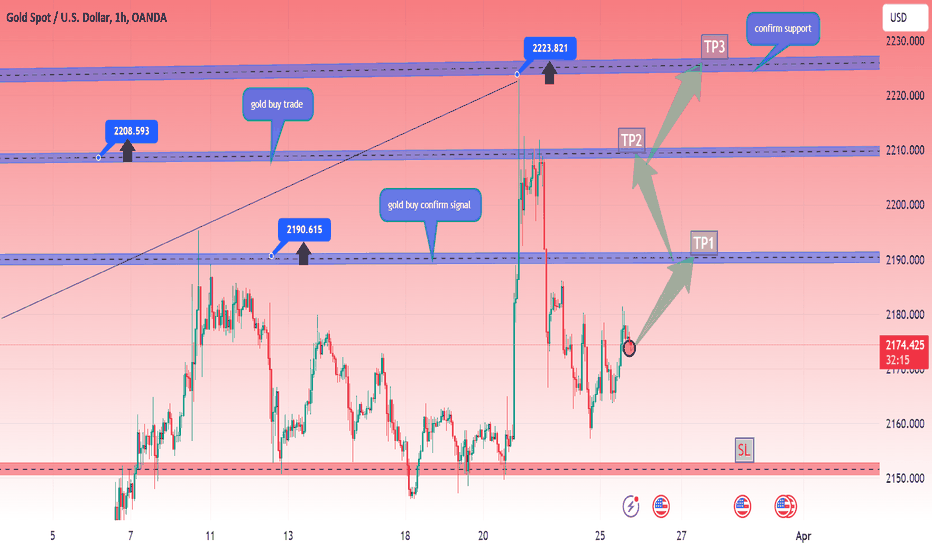

gold buy chartFollowing a quiet Asian session, Gold turned north and advanced to $2,180 in the American session. Although the benchmark 10-year US Treasury bond yield stays in positive territory above 4.2%, the selling pressure surrounding the USD supports XAU/USD.

The daily chart for the XAU/USD pair shows that bulls retain control. The bright metal develops above all its moving averages, with the 20 Simple Moving Average (SMA) heading firmly north below the current level while above also bullish 100 and 200 SMAs. At the same time, technical indicators have turned flat within positive levels after correcting extreme overbought conditions, reflecting absent selling interest.

Gold has been considered a highly valuable commodity for millennia and the gold price is widely followed in financial markets around the world. Mostly quoted in US Dollars (XAU/USD), gold price tends to increase as stocks and bonds decline. The metal holds its value well, making it a reliable safe-haven. It's traded constantly based on the intra-day spot rate. Improve your technical analysis of live gold prices with the real-time XAU/USD chart, and read our latest gold news, expert analysis and gold price forecast.

gold buy now 2174

TP1 2180

TP2 2190

TP3 2200

SL 2150

Selling strategy today, downtrendWorld gold prices increased with spot gold increasing by 7.5 USD to 2,170.8 USD/ounce. Gold futures last traded at 2,173 USD/ounce, up 13.2 USD compared to yesterday morning.

Prices for the yellow metal rose slightly in early trading as investors awaited key economic data and comments from US Federal Reserve (Fed) officials this week for further confirmation. loosening monetary policy of the US Central Bank.

The market is currently waiting for weekly initial jobless claims data to be released on March 28 and core personal consumption expenditure index (PCE) data expected to be released. the day after that. However, because the market will be closed this Friday as the US closes for the Good Friday holiday, PCE data will not have an impact on gold until early next week.

Research expert Kunal Shah of Nirmal Bang Commodities predicts that US inflation indicators will have a significant impact on the gold market. According to him, any PCE figure lower than expected will weaken the USD and push up gold prices and vice versa.