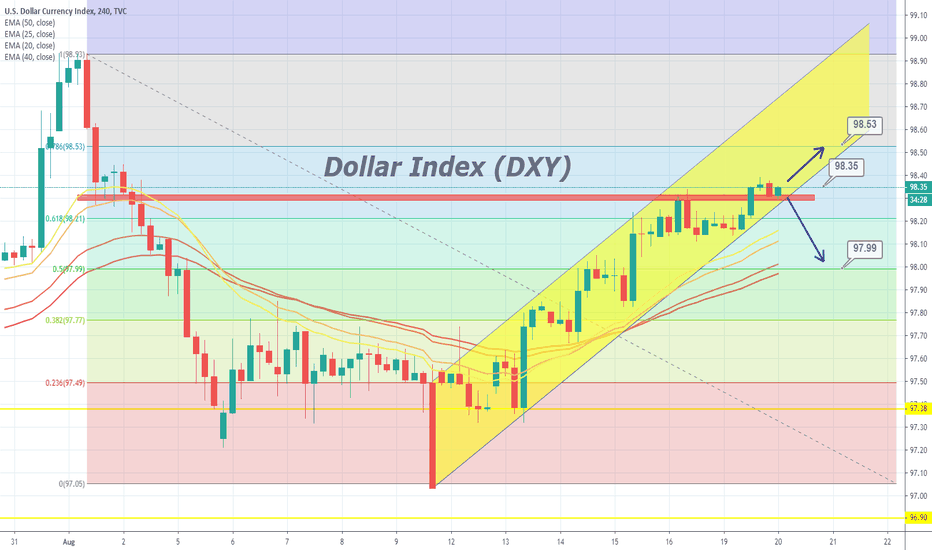

Dollar Index - DXY - Aug 20

On the technical side, the DXY has violated the weekly resistance at 97.72, which has exposed dollar index towards the 98.92 July 29 high as the first port of resistance, closely shadowed by weekly resistance at 99.62.

On the lower side, resistance continues to stay at 98.10 and 98. Bullish channel and series of EMA on 4-hour timeframe as suggesting a bullish bias for the dollar.

Forexters

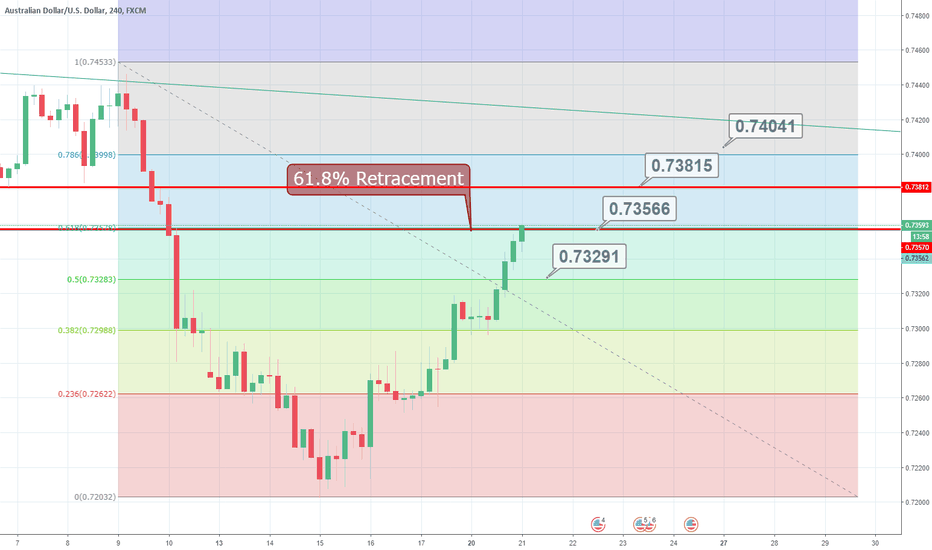

AUD/USD - Quick UpdateSpeaking about the technical side, the AUD/USD has completed the 61.8% retracement near $0.7360. The bullish trend seems strong but we should see if buyers respect a Fibo resistance level of $0.7355 or they violate it. Anyhow, we should be ready for both scenarios. The violation of $0.7350 is likely to lead the AUD/USD towards $0.7380 and $0.7400.