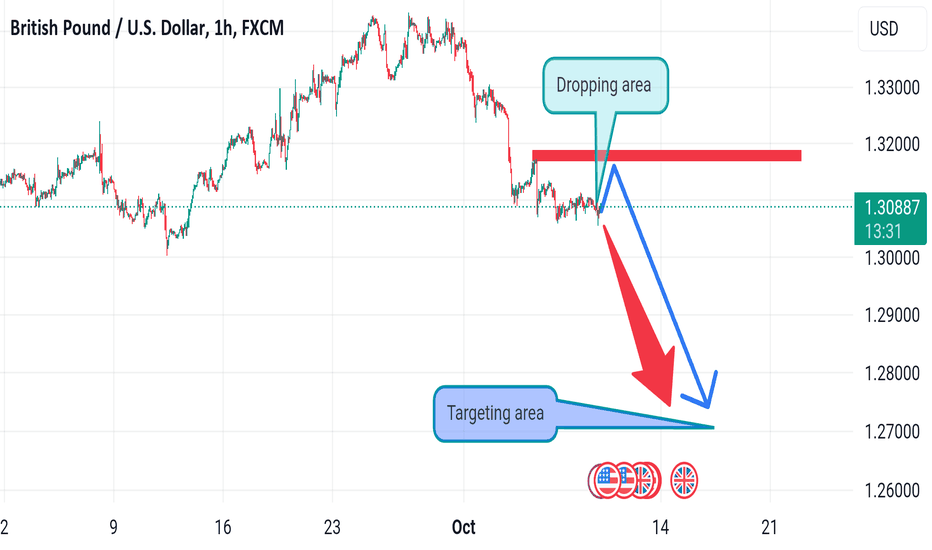

Gbpusd downfall big dip read the caption Intraday bias in GBP/USD is turned neutral with loss of downside momentum as seen in 4H MACD. While corrective fall from 1.3433 might extend lower, strong support should be seen from 1.3000 cluster support (38.2% retracement of 1.2298 to 1.3433 at 1.2999) to contained downside. Above 1.3174 minor resistance will turn bias back to the upside for stronger rebound. However, decisive break of 1.3001 will carry larger bearish implications

Forextrader

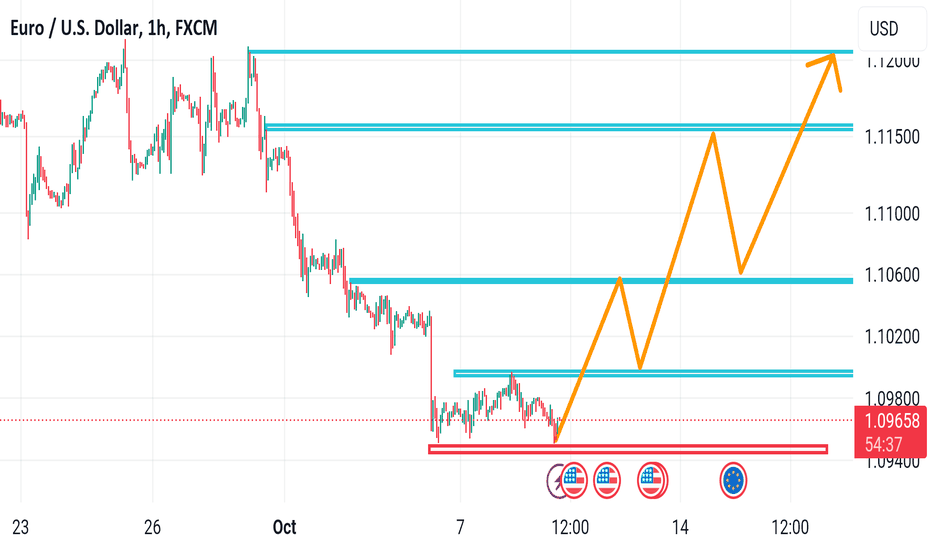

Eurusd confirm buy trendline read the caption EUR/USD skates on thin ice near the eight-week low of 1.0950 in Wednesday’s European session. The major currency pair stays under pressure as the US Dollar (USD) gathers strength to extend its previous week’s rally further, with the US Dollar Index (DXY) hovering near a seven-week high around 102.60.

The appeal of the US Dollar has strengthened as traders have priced out expectations for the Federal Reserve

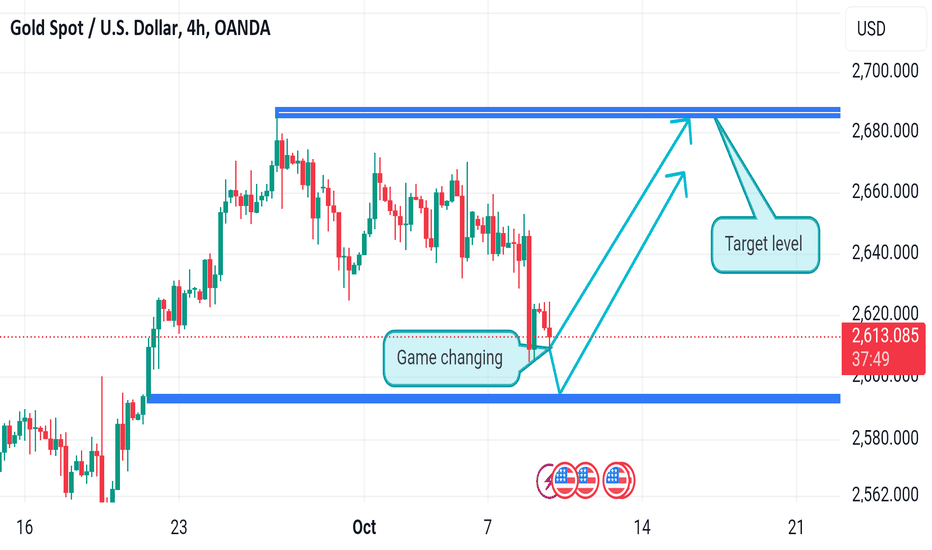

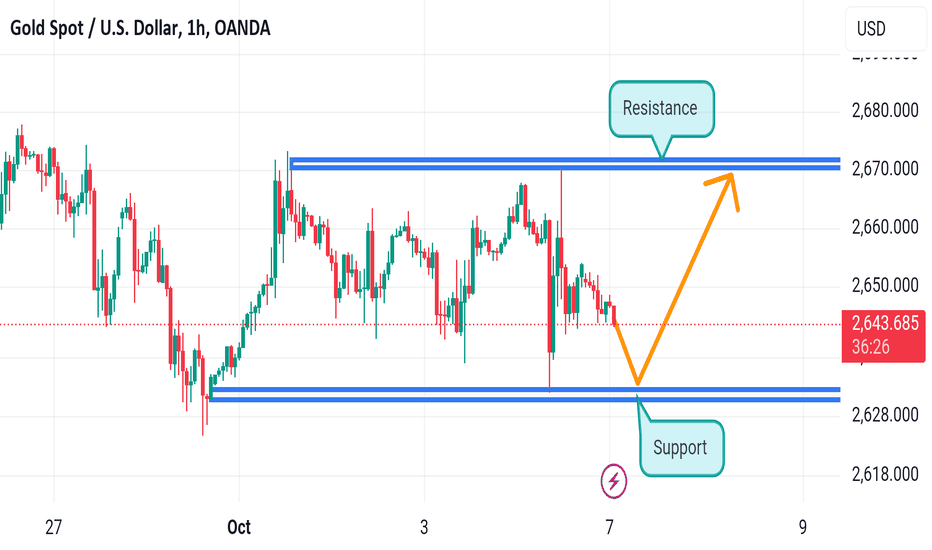

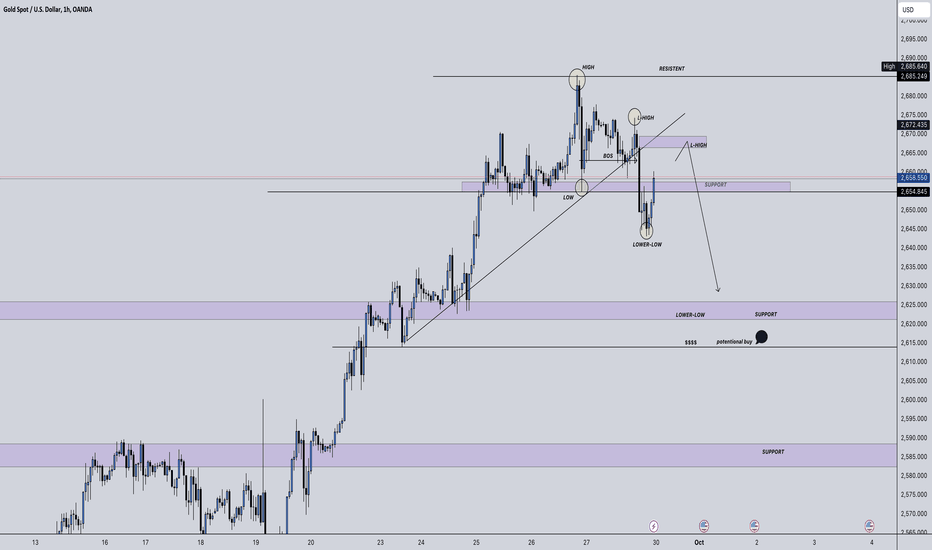

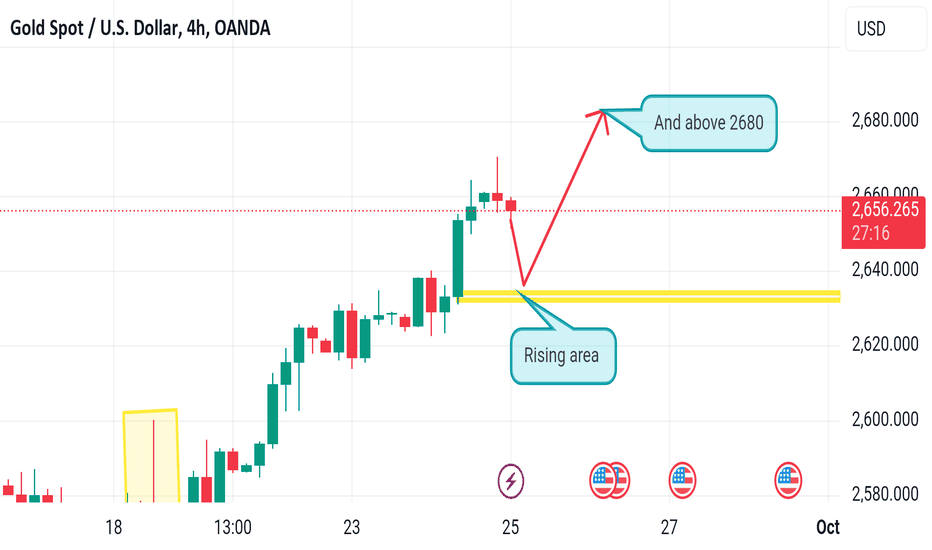

Gold move range higher read the caption Tomorrow, we have the US CPI report and that could be a catalyst for either a rally or a selloff. If we get an upside surprise in the data, then we will likely see new lows in gold. Conversely, a very soft report might trigger another rally and take us to a new all-time high

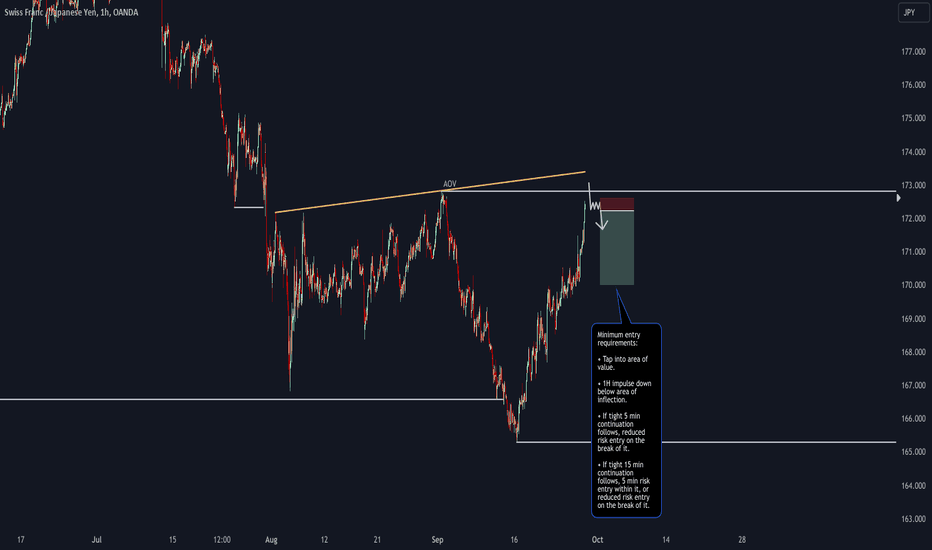

EUR/JPY Short, GBP/NZD Short and USD/CHF ShortEUR/JPY Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

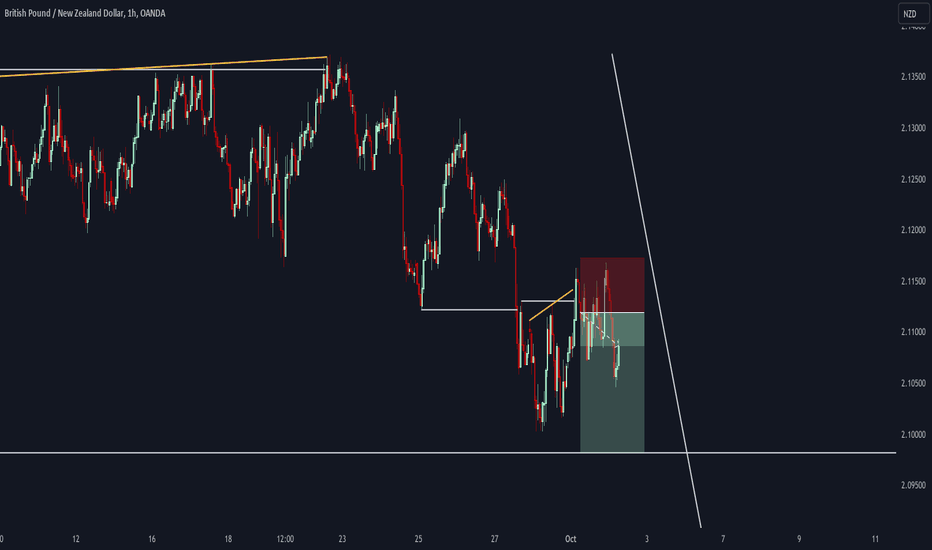

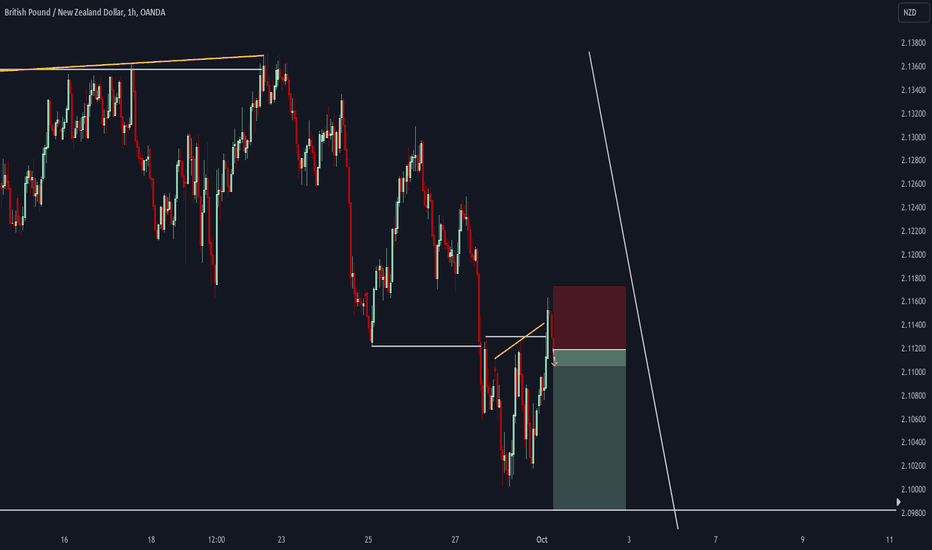

GBP/NZD Short

Minimum entry requirements:

• 4H risk entry.

or

• 1H impulse down below area of value.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

USD/CHF Short

Minimum entry requirements:

• 1H impulse down.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

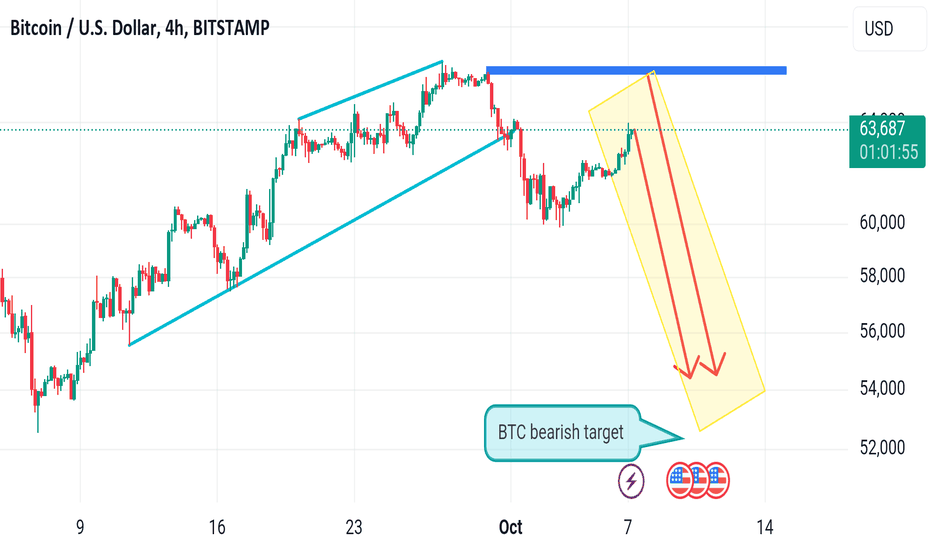

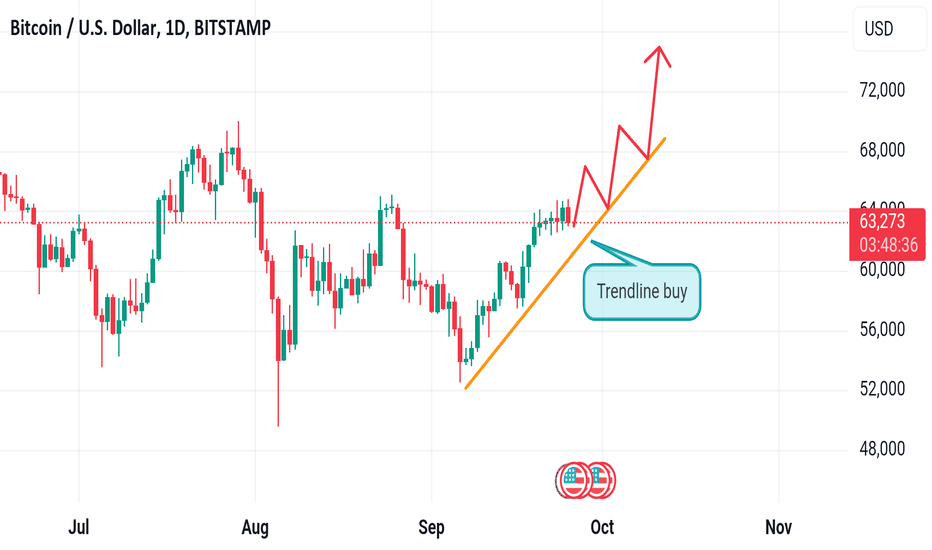

Btc fall badly high volatility read the caption After finding a bottom at $60,700, BTC's performance has left traders somewhat in limbo as they eye $53,000 and $66,000 as two main options for the near future, and as we may see, the bulls are leading the charge as they have managed to take the tug to their side by over 3% so far.

Is another attempt at a new all-time high in play? Based on the recent price action, yes is the more likely answer. However, it is still a long way to go as bulls would first have to defend the weekly close above $60,700, get to $66,001 per BTC and then perhaps hold there for another week

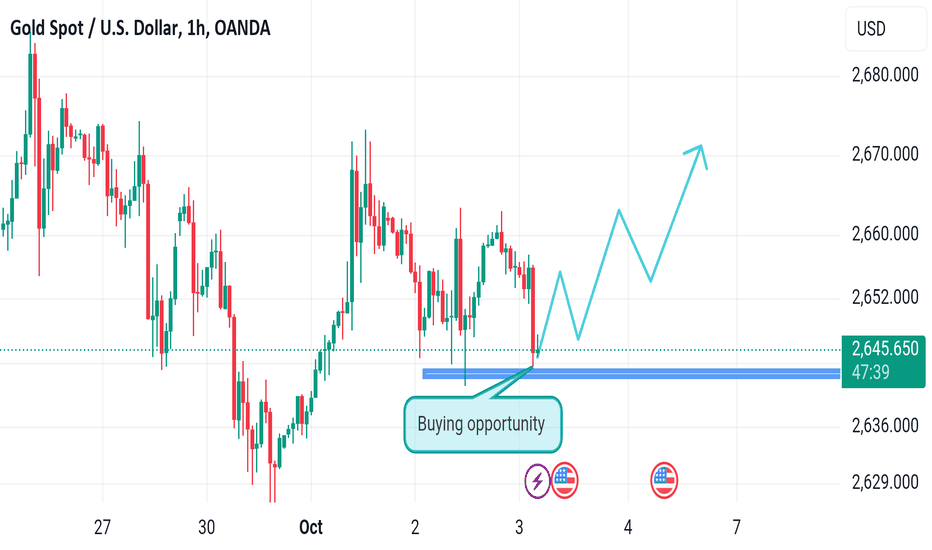

Gold interday movement expected read the caption However, Gold price has managed to keep its corrective downside restricted, thanks to the persistent geopolitical risks emanating from the escalating conflict between Israel and Iran. On Sunday evening, the Israel Defense Forces (IDF) said it struck multiple Hezbollah targets in Beirut, including Hezbollah’s intelligence headquarters. In retaliation, Hezbollah said it also launched a barrage of rockets at northern Israel Sunday night

Gold range higher read the caption Gold price is trading listlessly in a narrow range under the key $2,670 static resistance, lacking a clear directional impetus so far this Thursday. The focus now shifts toward a fresh batch of US economic statistics and speeches from Federal Reserve (Fed) policymakers fresh directives amid the escalating geopolitical conflict between Israel and Iran

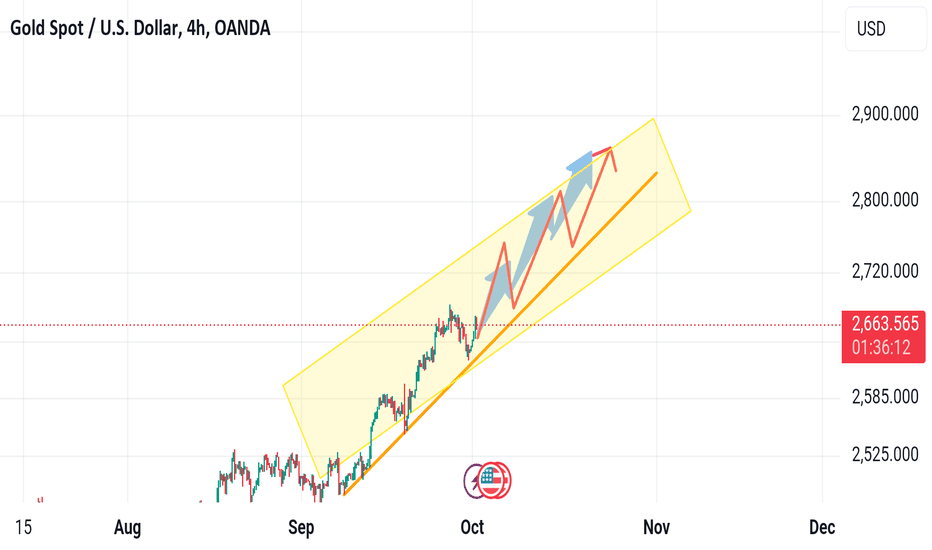

Raises gold prices target to hit 2800 read the caption From the all-time high of $2,685 per troy ounce recorded last Thursday, it has lost a good $50. We had pointed out that the last part of the price increase was no longer justified by interest rate expectations. These had also already gone much too far and were therefore scaled back again somewhat in the last few days. This means that Gold currently lacks a key driving force

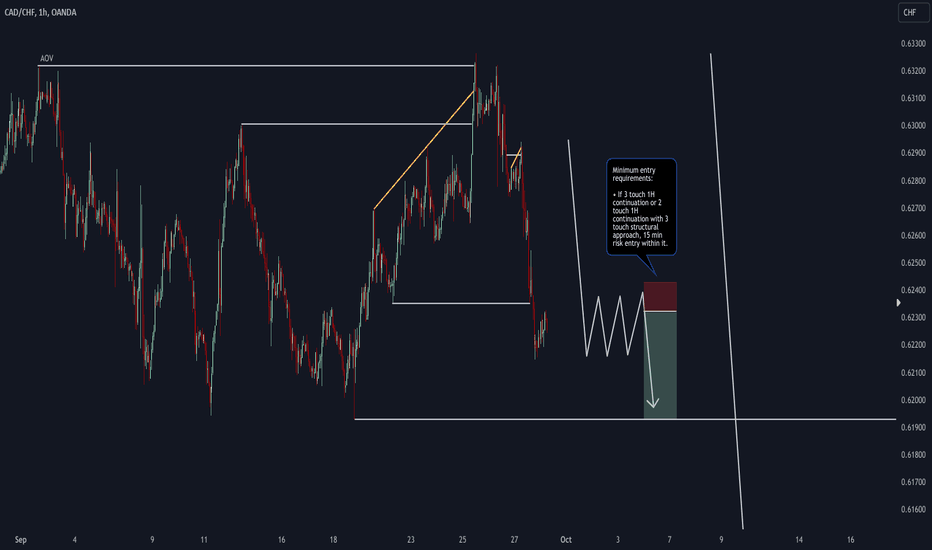

NZD/JPY Short, AUD/JPY Short and CAD/CHF ShortNZD/JPY Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

AUD/JPY Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

CAD/CHF Short

Minimum entry requirements:

• If 3 touch 1H continuation or 2 touch 1H continuation with 3 touch structural approach, 15 min risk entry within it.

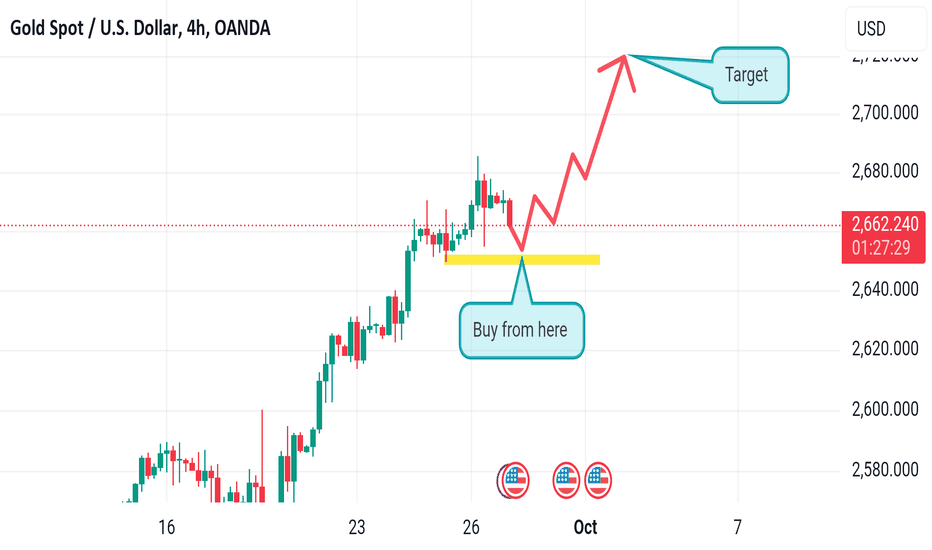

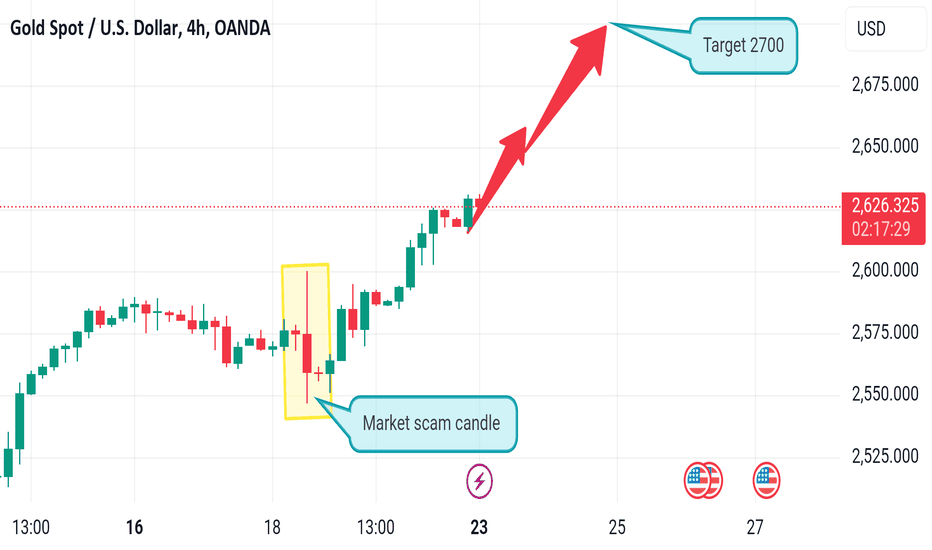

Gold trend is buy with target 2700 read the caption Despite the recent dovish comments from US Federal Reserve (Fed) policymakers and mixed US economic data, market expectations for a 50 basis points (bps) interest rate cut in November ease, with the odds of such a move now standing at 50%, down from about 62% seen a day ago, the CME Group’s FedWatch Tool shows.

CAD/JPY Short and CHF/JPY ShortCAD/JPY Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of inflection.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

CHF/JPY Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of inflection.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

BTC making buy zone BTC rise expected read the caption Bitcoin halving is here, an event expected to raise the curtain on the next market cycle. There has been a lot of turbulence in the market of late. Events such as flows from exchange-traded funds (ETFs) and tensions in the Middle East between Iran and Israel have sent traders into their shells. However, there could be some relief in the market after Iranian officials indicated there are no plans to retaliate

CAD/JPY Short and CHF/JPY ShortCAD/JPY Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

CHF/JPY Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

Gold 2700 confirm target read the caption If buyers manage to defy the bearish pressures, the $2,530 round level needs to be taken out decisively for further upside. Acceptance above that level will call for a test of the $2,650 psychological barrier, as buyers then target the $2,700 threshold for the first time ever

USD/CAD Short, NATGAS/USD Short and GBP/NZD LongUSD/CAD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

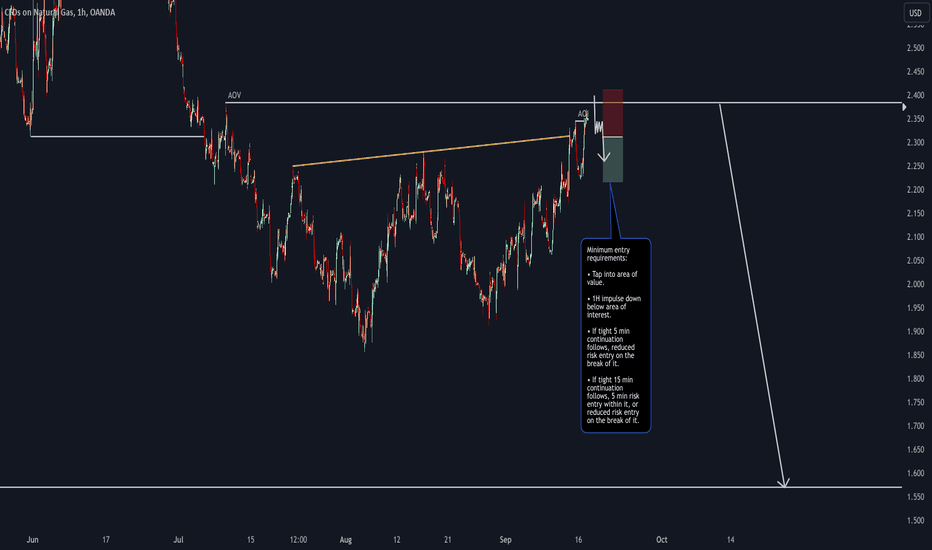

NATGAS/USD Short

Minimum entry requirements:

• 1H impulse down below area of value.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

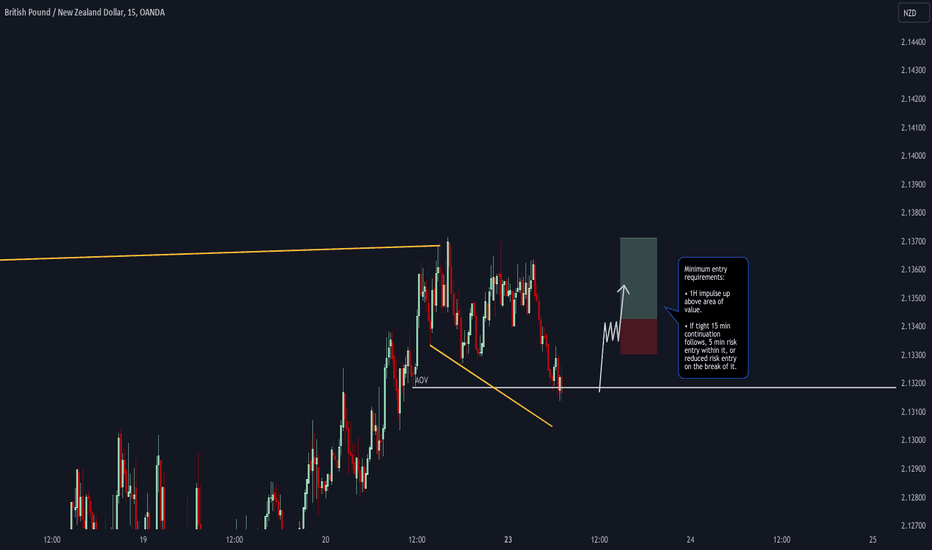

GBP/NZD Long

Minimum entry requirements:

• 1H impulse up above area of value.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

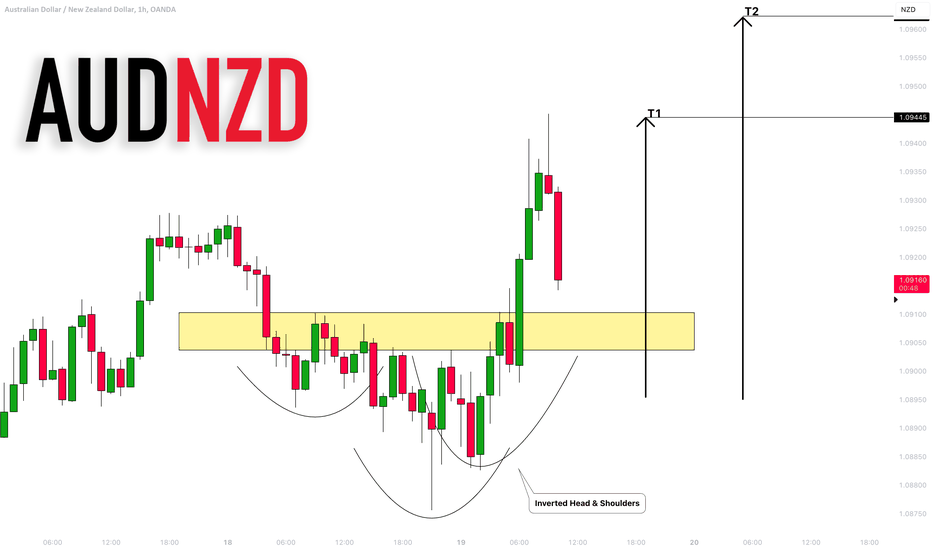

AUDNZD: Intraday Bullish Confirmation?!🇦🇺🇳🇿

Update for our yesterday's setup on AUDNZD.

The pair leaves clear bullish clues, forming an

inverted head and shoulders pattern on an hourly time frame

and breaking its neckline.

The market has a nice potential to continue growing.

Next resistance - 1.0944

❤️Please, support my work with like, thank you!❤️

AUD/JPY Short, AUD/NZD Short and NATGAS/USD ShortAUD/JPY Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

AUD/NZD Short

Minimum entry requirements:

• Break above area of value.

• 1H impulse down below area of interest.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.

NATGAS/USD Short

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of interest.

• If tight 5 min continuation follows, reduced risk entry on the break of it.

• If tight 15 min continuation follows, 5 min risk entry within it, or reduced risk entry on the break of it.