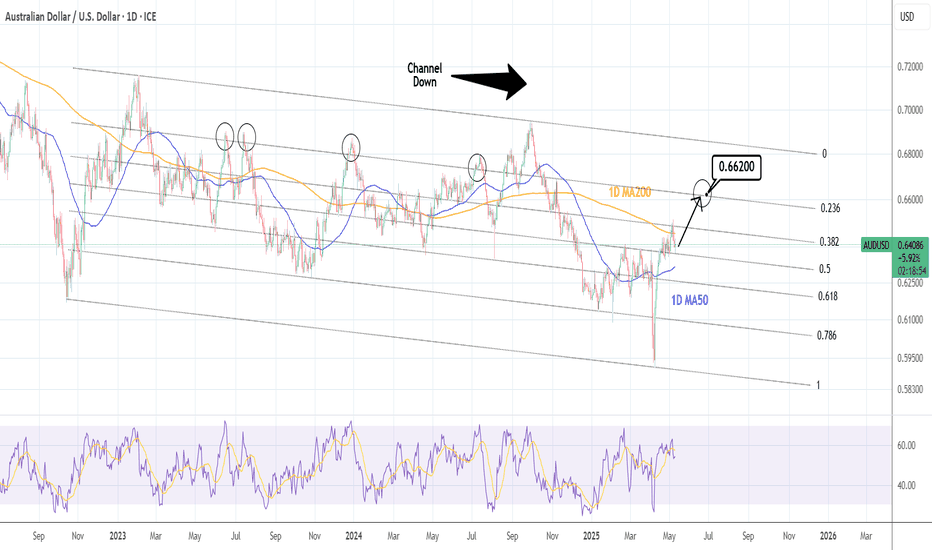

AUDUSD: Channel Down aiming higher.AUDUSD is neutral on its 1D technical outlook (RSI = 53.946, MACD = 0.004, ADX = 53.336) trading between the 1D MA200 and 1D MA50. It is now on the middle (0.5 Fibonacci level) of the long term Channel Down and every bullish wave touched at least the 0.236 Fib. The trade is long, TP = 0.66200.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Forextrading

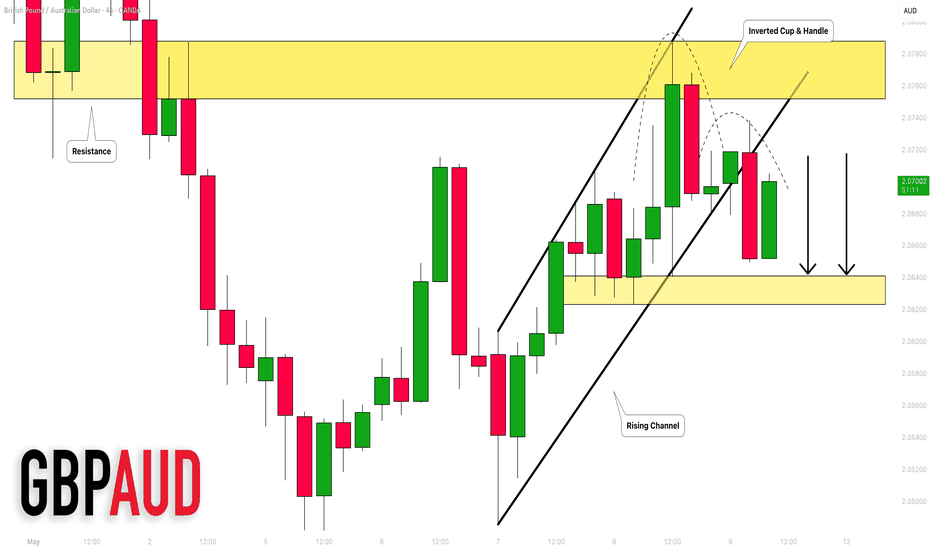

GBPAUD: 2 Strong Bearish Confirmations 🇬🇧🇦🇺

GBPAUD is in a very bearish price action after a test

of the underlined horizontal resistance.

The price formed an inverted cup and handle pattern

and violated its neckline and a support line of a rising

parallel channel on an hourly time frame.

Probabilities will be high to see a decline at least to 2.064 support.

❤️Please, support my work with like, thank you!❤️

Market Analysis: USD/CHF Regains StrengthMarket Analysis: USD/CHF Regains Strength

USD/CHF is rising and might aim for a move toward the 0.8400 resistance.

Important Takeaways for USD/CHF Analysis Today

- USD/CHF is showing positive signs above the 0.8265 resistance zone.

- There is a connecting bullish trend line forming with support at 0.8300 on the hourly chart at FXOpen.

USD/CHF Technical Analysis

On the hourly chart of USD/CHF at FXOpen, the pair started a decent increase from the 0.8200 support. The US Dollar climbed above the 0.8245 resistance zone against the Swiss Franc.

The bulls were able to pump the pair above the 50-hour simple moving average and 0.8300. A high was formed at 0.8340 and the pair is now consolidating gains above the 23.6% Fib retracement level of the upward move from the 0.8185 swing low to the 0.8340 high.

There is also a connecting bullish trend line forming with support at 0.8300. On the upside, the pair is now facing resistance near 0.8340. The main resistance is now near 0.8350.

If there is a clear break above the 0.8350 resistance zone and the RSI remains above 50, the pair could start another increase. In the stated case, it could test 0.8400. If there is a downside correction, the pair might test the 0.8300 level.

The first major support on the USD/CHF chart is near the 0.8265 level and the 50% Fib retracement level of the upward move from the 0.8185 swing low to the 0.8340 high.

The next key support is near the 0.8245 level. A downside break below 0.8245 might spark bearish moves. Any more losses may possibly open the doors for a move toward the 0.8200 level in the near term.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

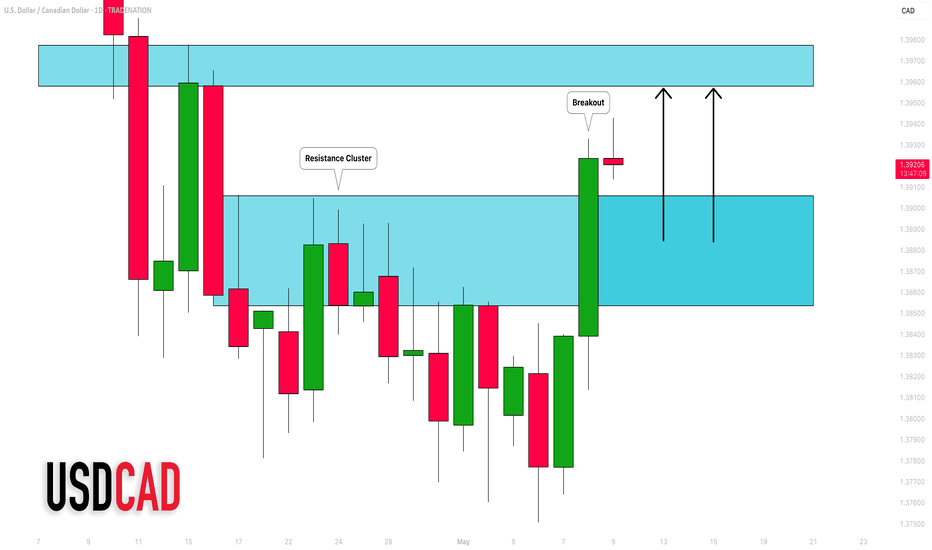

USDCAD: Important Breakout 🇺🇸🇨🇦

USDCAD broke and closed above a significant daily resistance cluster.

The broken structure turns into a solid demand zone now.

The next strong resistance is 1.3957.

It will most likely be the next goal for the buyers.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/AUD Short, EUR/CAD Short, USD/JPY Short and EUR/USD NeutralGBP/AUD Short

Minimum entry requirements:

• If tight non-structured 15 min continuation forms, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation forms, reduced risk entry on the break of it or 15 min risk entry within it.

• If tight non-structured 1H continuation forms, 15 min risk entry within it if the continuation is structured on the 15 min chart or reduced risk entry on the break of it.

• If tight structured 1H continuation forms, 1H risk entry within it or reduced risk entry on the break of it.

EUR/CAD Short

Minimum entry requirements:

• If structured 1H continuation forms, 1H risk entry within it.

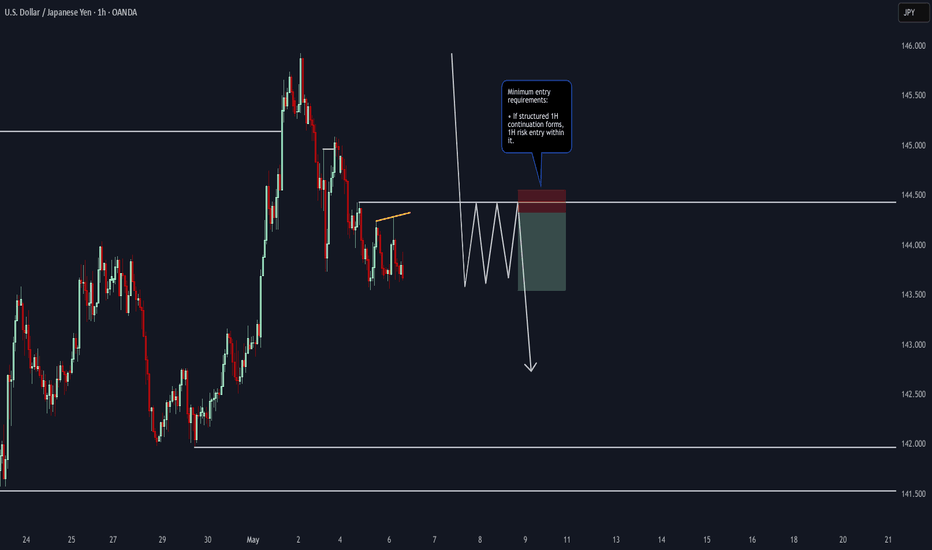

USD/JPY Short

Minimum entry requirements:

• 1H impulse down below area of value.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

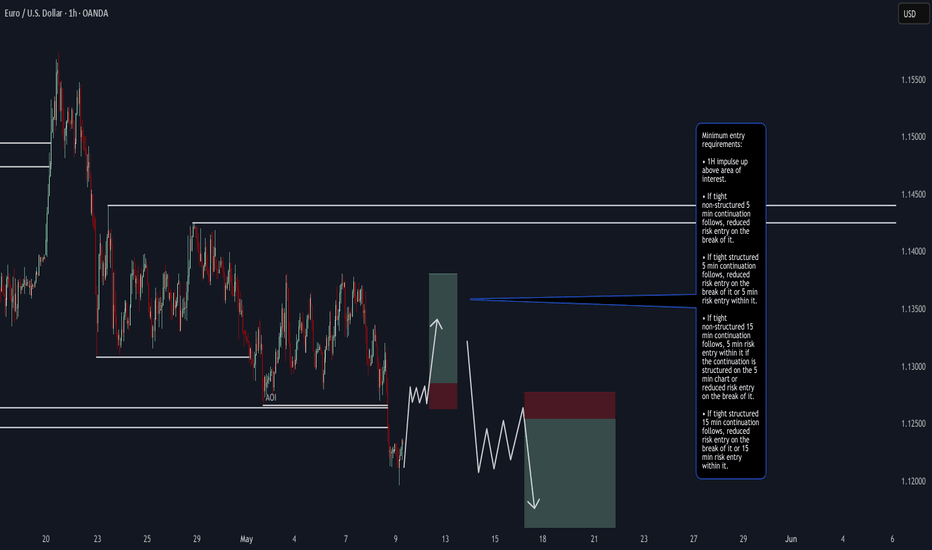

EUR/USD Neutral

Minimum entry requirements:

• 1H impulse up above area of interest.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

Minimum entry requirements:

• If structured 1H continuation forms, 1H risk entry within it.

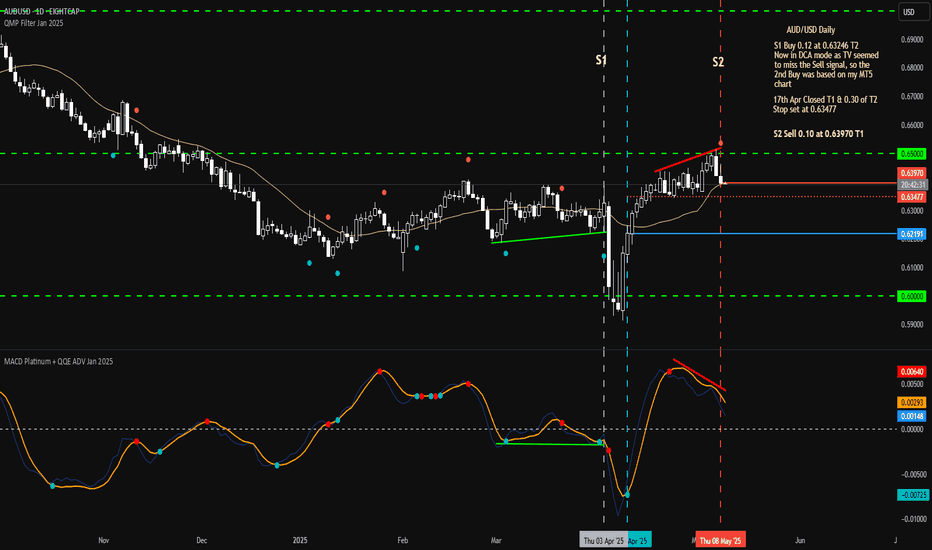

Fri 9th May 2025 AUD/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a AUD/USD Sell. Enjoy the day all. Cheers. Jim

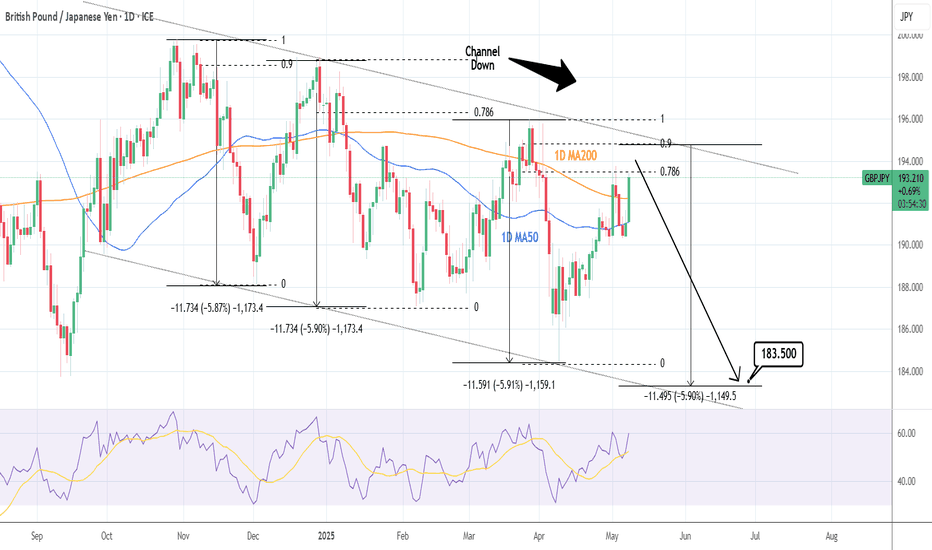

GBPJPY: Entering the most optimal medium-term Sell Zone.The GBPJPY pair is bullish on its 1D technical outlook (RSI = 59.237, MACD = 0.300, ADX = 16.909) as it is expanding the bullish wave of the 6 month Channel Down. The two prior peaked on the 0.786 and 0.9 Fibonacci retracement level respectively. This bullish wave has already reached the 0.786 Fib, so it has entered the most optimal Sell Zone for the medium term. Even if it peaks on the 0.9 Fib, a -5.90% bearish wave (similar with the 3 prior) would test 183.500.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

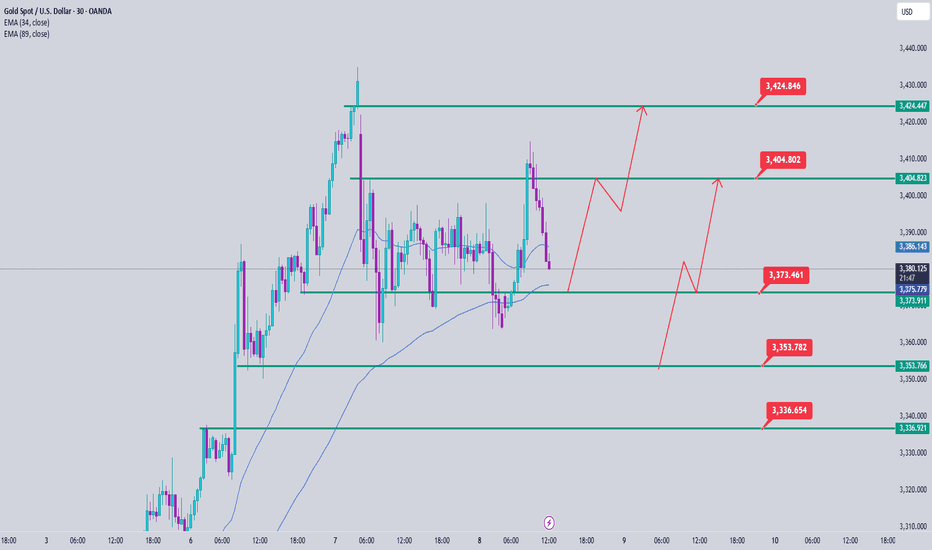

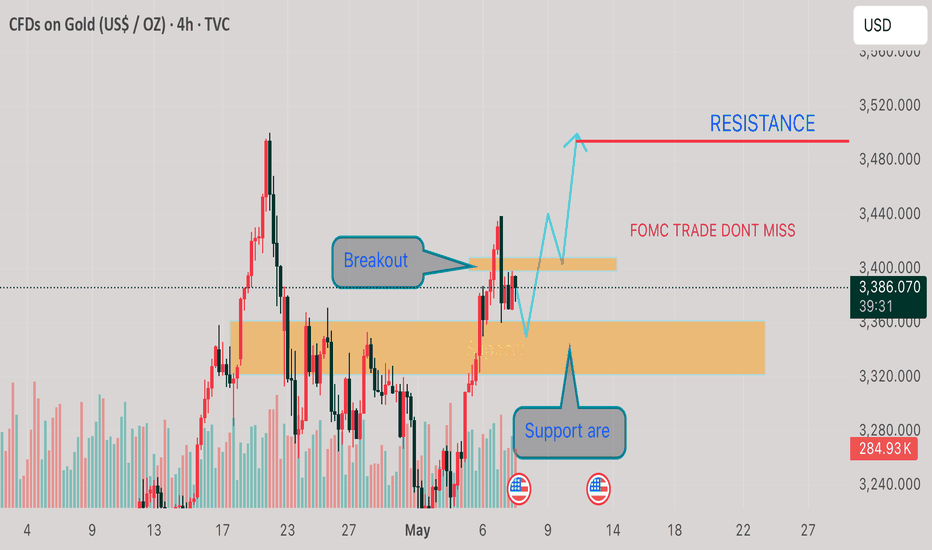

Gold Price Analysis May 8D1 candlesticks started to show some selling pressure but were still pushed back by buyers at the beginning of today's Asian session

Gold is falling at the end of the Asian session towards 3373. BUY zones are noted at the support zones that buyers are waiting for first 3373-3353-3338

On the opposite side, the sell borders 3405 and 3424 are considered for scalping when the price pushes up. These are data analyzing price zones with strong buying and selling pressure in the past, paying more attention to the current price reaction to have the best trading strategy.

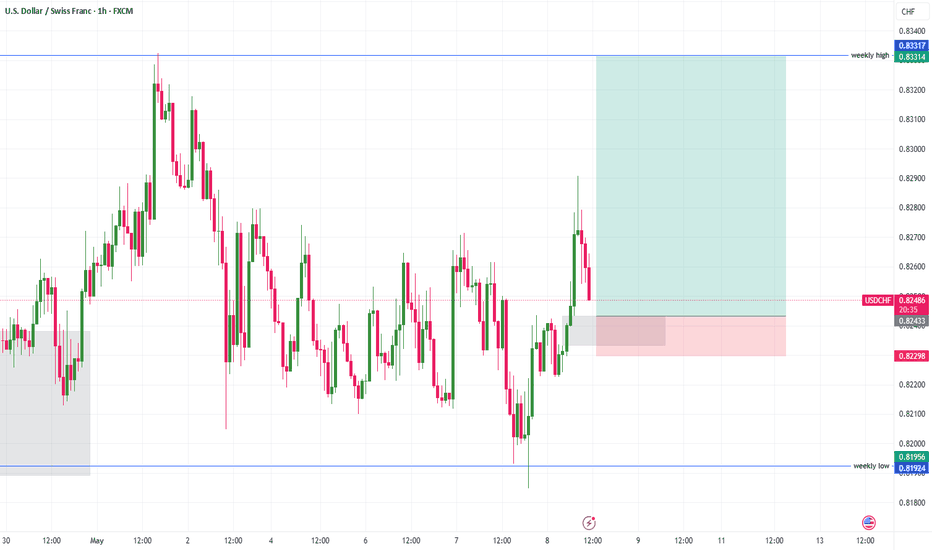

USDCHF Trade Idea, AMD PATTERN: last trade of the week for meClean setup unfolding on USDCHF! After grabbing liquidity near the weekly low (0.81924), price showed strength and reversed with conviction (AMD Pattern). Entered long from the refined demand zone and now eyeing the weekly high at 0.83317 as target.

📌 Trade Breakdown:

🔹 Entry Zone: Bullish reaction from demand

🔹 Confluence: Liquidity sweep + internal structure shift

🔹 Target: Weekly high zone at 0.83317

🔹 Risk/Reward: Solid R:R with protected downside below recent low

Let’s see if bulls can maintain momentum and drive us to TP! 📈🔥

#USDCHF #SmartMoneyConcepts #ForexTrading #LiquiditySweep #TradingView #TradeSetu

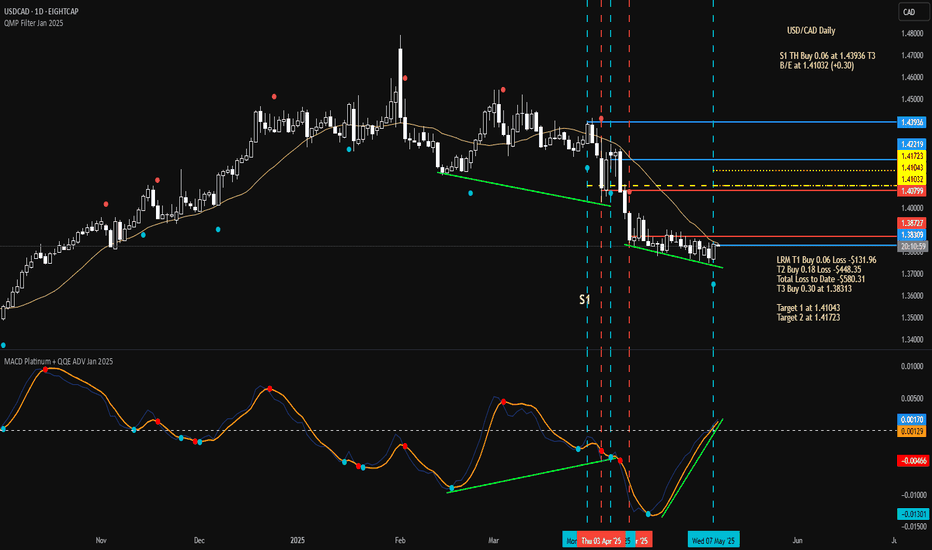

Thu 8th May 2025 USD/CAD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/CAD Buy. Enjoy the day all. Cheers. Jim

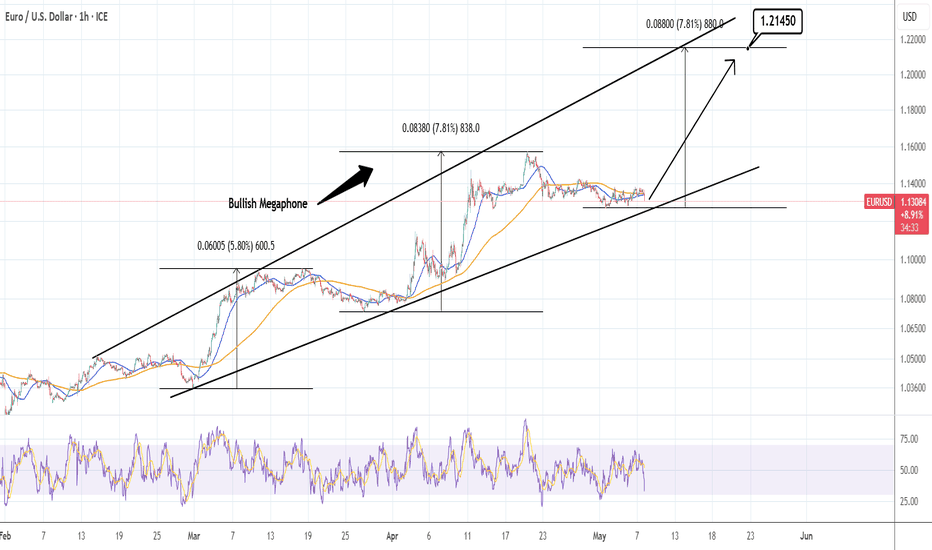

EURUSD: Bullish trend intact unless this pattern breaks.EURUSD remains marginally bullish on its 1D technical outlook (RSI = 56.708, MACD = 0.008, ADX = 33.048) as in spite of correction of the last 2 weeks, the Bullish Megaphone remains intact with the price almost on its bottom. This maintains the bullish trend for at least another +7.80% bullish wave (TP = 1.21450). If the Megaphone breaks, the pattern and thus the trade are negated, and the trend turns bearish aiming at the 1D MA50, so the risk of going long now is very low.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XAUUSD Update – +450 Pips Running SmoothPrice followed our mapped path beautifully, exploding past resistance zones and continuing the bullish trend.

Key breakout levels held strong and momentum stayed aligned with structure.

📈 Current Progress:

✅ +450 pips from entry

📍 Target zone in reach: 3420–3440

📊 Structure remains bullish above 3360–3375

🔔 Follow for precise entries, structure-based ideas, and clean momentum trading.

#XAUUSD #GoldTrading #450Pips #SmartMoneyMoves #FXGoldVision #PriceAction #IntradayTrader

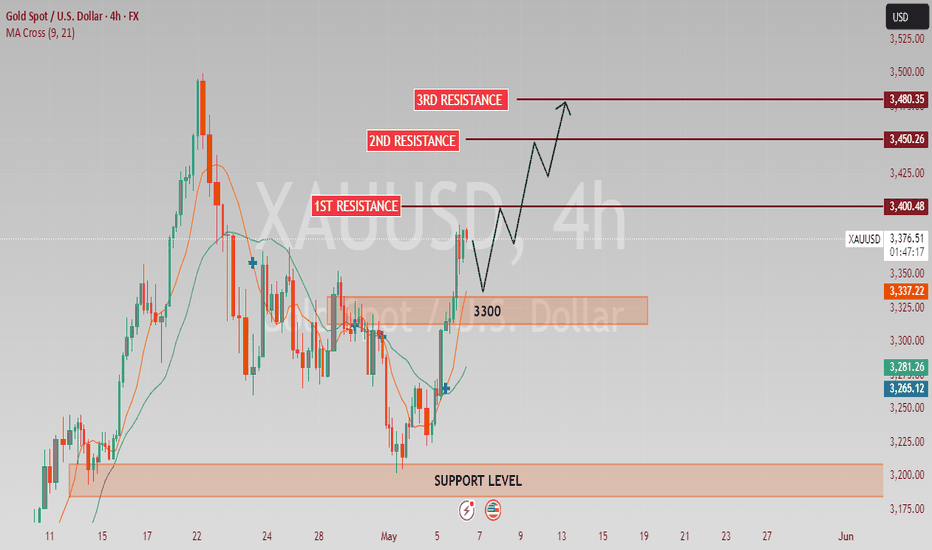

XAU/USD (GOLD) TRADE PLAN 6/5/2025XAU/USD (Gold) Trading Outlook

The current price of XAU/USD around 3380 to 3375. We are anticipating a pullback towards the 3300 level, at which point we will look for long (buy) entry opportunities.

Key Resistance/Target Level:

TARGET 1: 3400

TARGET 2: 3450

TARGET 3: 3480

Key Support Levels:

SUPPORT 1: 3200

SUPPORT 2: 3150

This Strategy is based on the expectation of a price retracement, providing a more favorable risk-reward setup for long positions.

EUR/CAD Short, AUD/CAD Short, USD/CHF Long and USD/JPY ShortEUR/CAD Short

Minimum entry requirements:

• If structured 1H continuation forms, 1H risk entry within it.

AUD/CAD Short

Minimum entry requirements:

• 1H impulse down below area of value.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

USD/CHF Long

Minimum entry requirements:

• Tap into area of value.

• 1H impulse up above area of value.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

USD/JPY Short

Minimum entry requirements:

• If structured 1H continuation forms, 1H risk entry within it.

Tue 6th May 2025 GBP/JPY Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/JPY Sell. Enjoy the day all. Cheers. Jim

GBP/JPY Short, GBP/USD Short, AUD/CAD Short and AUD/USD ShortGBP/JPY Short

Minimum entry requirements:

• If structured 1H continuation forms, 1H risk entry within it.

GBP/USD Short

Minimum entry requirements:

• Corrective tap into area of value.

• 4H risk entry or 1H risk entry after 2 x 1H rejection candles.

Minimum entry requirements:

• Tap into area of value.

• 1H impulse down below area of value.

• If tight non-structured 5 min continuation follows, reduced risk entry on the break of it.

• If tight structured 5 min continuation follows, reduced risk entry on the break of it or 5 min risk entry within it.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

AUD/CAD Short

Minimum entry requirements:

• 1H impulse down below area of value.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

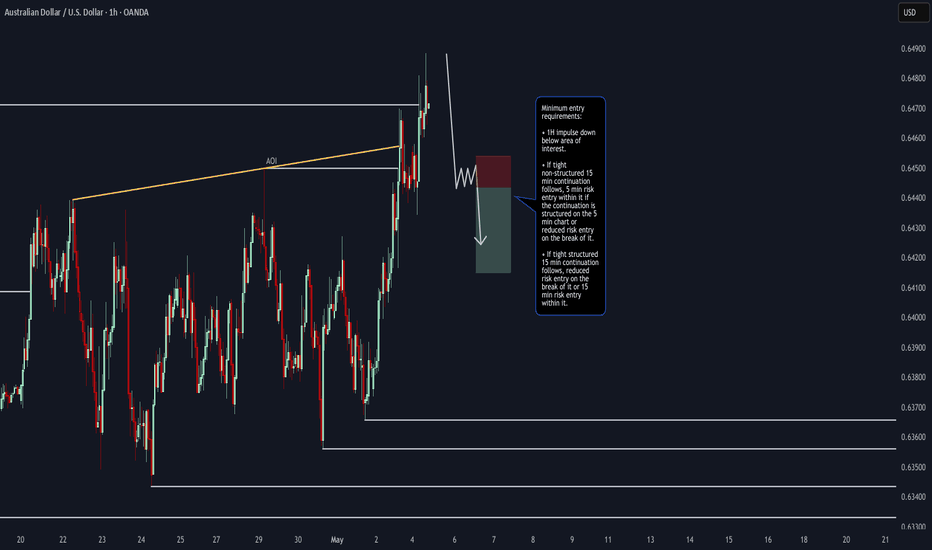

AUD/USD Short

Minimum entry requirements:

• 1H impulse down below area of interest.

• If tight non-structured 15 min continuation follows, 5 min risk entry within it if the continuation is structured on the 5 min chart or reduced risk entry on the break of it.

• If tight structured 15 min continuation follows, reduced risk entry on the break of it or 15 min risk entry within it.

EURCAD: Still Bearish Outlook 🇪🇺🇨🇦

Last week, we discussed a confirmed bearish breakout of

a major horizontal support on EURCAD.

The broken structure was retested, and I see a strong bearish

intraday price action on an hourly time frame.

Probabilities will be high to see a down movement at least to 1.558 level today.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

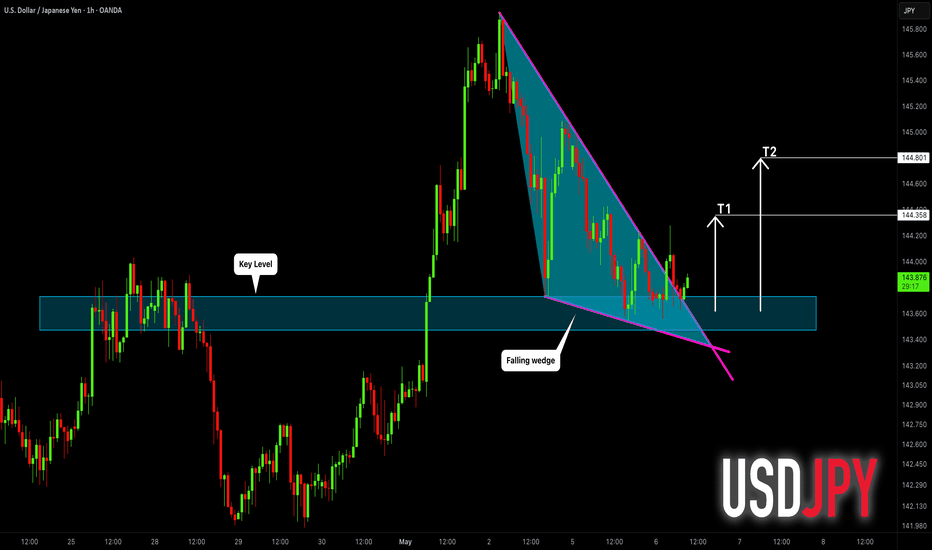

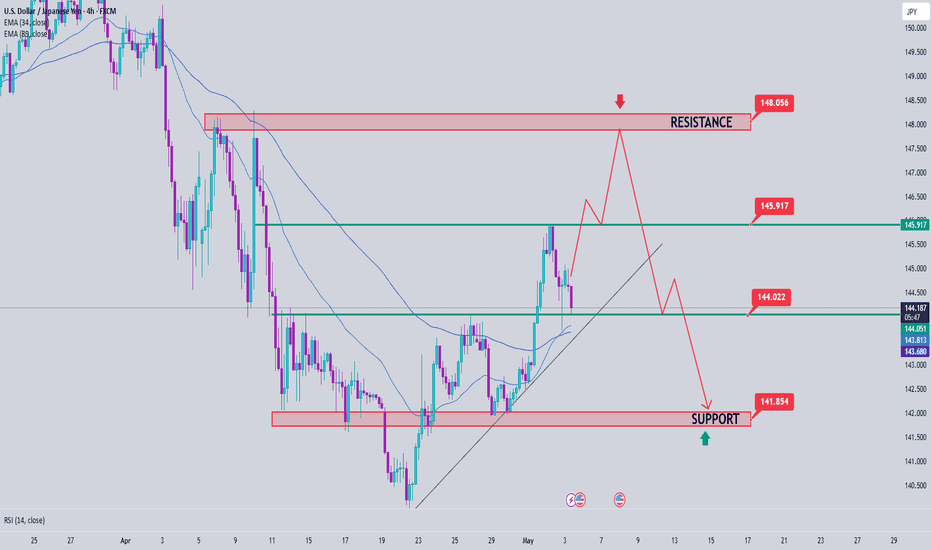

USDJPY Analysis week 19🌐Fundamental Analysis

Signs of rising inflation in Japan still open the door for the BoJ to tighten interest rates further. Moreover, persistent geopolitical tensions and uncertainty over US President Donald Trump’s trade policies have kept investors on edge. Moreover, bets on more aggressive easing by the Federal Reserve will limit any meaningful gains in the dollar and help limit deeper losses for the lower-yielding yen.

🕯Technical Analysis

After a breakout and bounce late Friday, USDJPY is looking to continue its strong uptrend. Last week’s high of 145.900 will act as a temporary buffer before the pair heads towards the weekly resistance around 148.000. On the other side, last week’s liquidity sweep converging with the trendline also creates an important buying zone for the week if the pair reverses. The support level that the bears are strong at is also the weekly support level of interest around 142.000.

📈📉Trading Signals

SELL USDJPY 148.000-148.200 Stoploss 148.500

BUY USDJPY 142.000-141.800 Stoploss 141.500

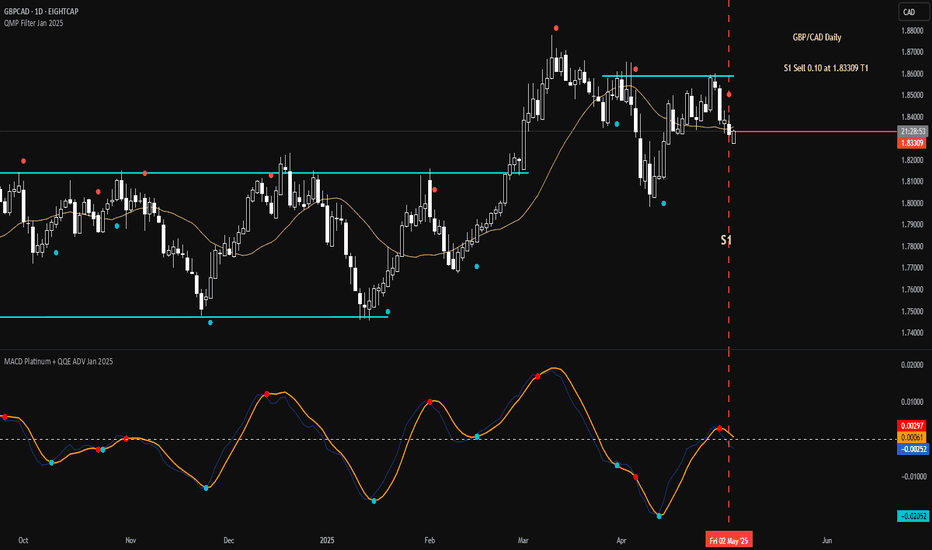

Mon 5th May 2025 GBP/CAD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Sell. Enjoy the day all. Cheers. Jim

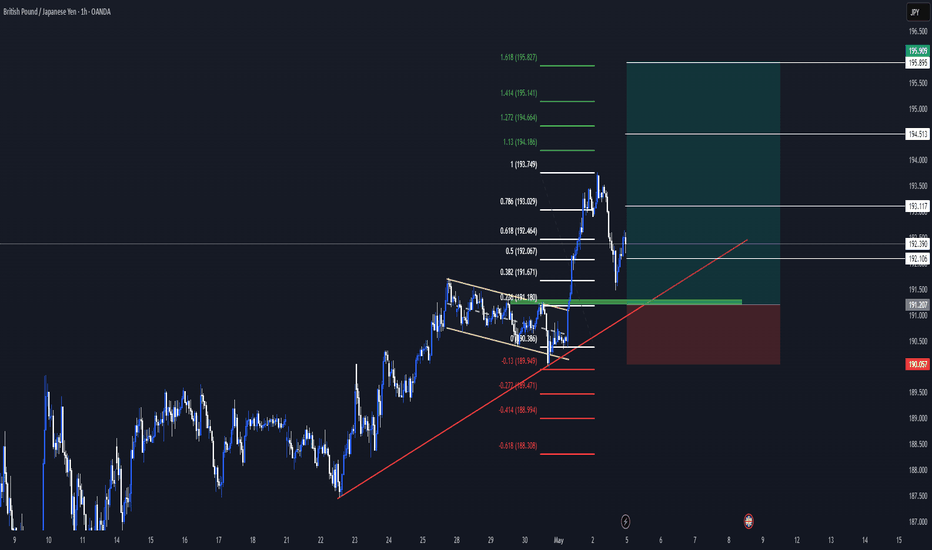

GBPJPY Signal : 1H / 4H Beautiful buy !!!Hello Traders! 👋

What are your thoughts on GBPJPY ?

GBPJPY

Market price : 192.40

Buy Limit: 191.20 - 191.00

Tp1 : 192.10

Tp2 : 193.10

Tp3 : 194.50

Tp4 : 195.90

Sl : 190.10 ( 100 pip )

Don’t forget to like and share your thoughts in the comments! ❤️

Remember this is a position that was found by me and it is a personal idea not a financial advice, you are responsible for your loss and gain.

Learn KEY PRINCIPLES of Technical Analysis in Gold Forex Trading

In the today's article, we will discuss the absolute basics of trading - 3 key principles of technical analysis in Forex & Gold Trading.

1️⃣History Repeats

History tends to repeat itself in the Forex market.

Certain trends are cyclical and may reemerge in a predictable manner, certain key levels are respected again and again over time.

Take a look at the example:

Silver perfectly respected a historical horizontal resistance in 2011 that was respected in 1980 already. Moreover, the price action before and after the tests of the underlined zone were absolutely identical.

2️⃣Priced In

All relevant information about a currency pair: economical and political events, rumors, and facts; is already reflected in a price.

When the FED increased the rate 26th of July by 25 bp, EURUSD bounced instead of falling. Before the rate hike, the market was going down on EXPECTATIONS of a rate hike. The release of the news was already price in.

3️⃣Pattern DO Work

Some specific price models can be applied for predicting the future price movements.

Technicians strongly believe that certain formations - being applied and interpreted properly, can give the edge on the market.

Depending on the trading style, different categories of patterns exist: harmonic patterns, price action patterns, wave patterns, candlestick patterns...

Above, I have listed various price action patterns that are applied by many traders and investors as the main tool for analyzing the financial markets.

If you believe in these 3 principles, you are an inborn technician!

Study technical analysis and learn to apply these principles to make money in trading.

b]❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.