BTC/USD (Bitcoin vs USD).BTC/USD (Bitcoin vs USD)

Timeframe: 2-hour (2H)

Indicators: Ichimoku Cloud, Trendline, Support/Resistance zones

---

📊 Indicators Used

1. Ichimoku Cloud

Price recently broke above the descending trendline and is pushing into the cloud.

If it sustains above the cloud, that signals a potential trend reversal from bearish to bullish.

2. Support Zone (Green box)

Around 109,000 – 110,000 USD.

This is the base where buyers are stepping in.

3. Trendline Breakout

A downtrend line has been broken, suggesting the end of the short-term bearish momentum.

---

🎯 Targets (Based on my chart)

Target 1 (short-term): 117,173 USD

This is the first major resistance level.

Target 2 (medium-term): 123,000 USD

Next strong resistance zone and the final target marked on my chart.

---

⚠ Stop-Loss Suggestion

Below the support zone: ~108,500 – 109,000 USD

This protects against a false breakout.

---

✅ Summary

Breakout above downtrend line and moving into Ichimoku cloud = bullish signal.

First target: 117,173 USD

Second target: 123,000 USD

Stop-loss: Below 106,000 USD

Forexupdate

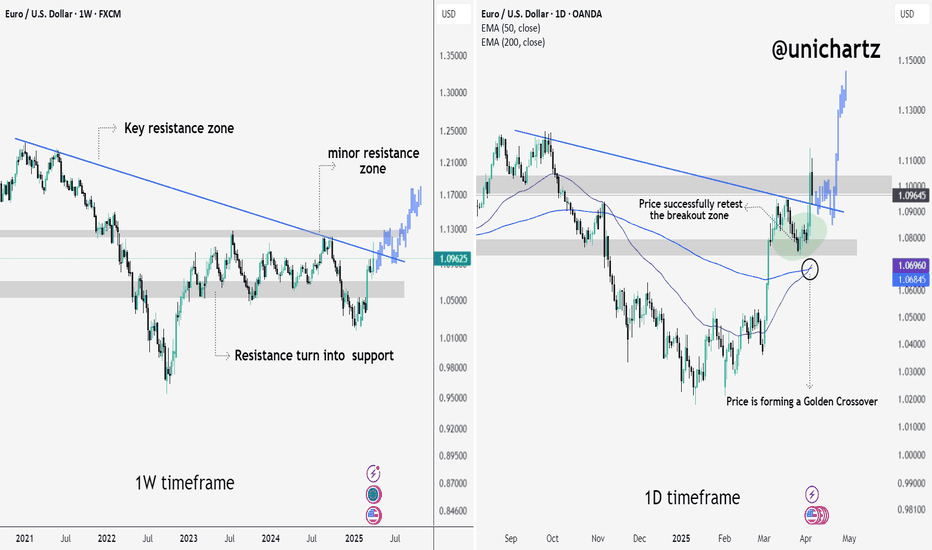

EUR/USD – Golden Crossover & Breakout Confirmation (Multi-T.F)EUR/USD is showing strong bullish signs across both the weekly and daily timeframes, suggesting a potential macro trend reversal in the making. After being trapped below a long-term descending trendline for nearly two years, price has not only broken out but also successfully retested the breakout zone — a key validation for trend continuation.

On the daily chart, a Golden Crossover is now forming, which historically precedes major uptrends in forex pairs. Combined with reclaiming key structural levels and building higher lows, EUR/USD could be positioning for a powerful upside move in Q2 2025.

Let’s dive into the multi-timeframe analysis to understand why this setup could be one of the cleanest trend reversals on the board.

1W Timeframe – Macro Breakout in Progress

EUR/USD has officially broken out of a long-standing descending resistance trendline. This breakout occurred from a structurally important zone that had acted as a ceiling for over 2 years.

📌 Key Observations:

🔹 Price reclaimed and held above the key resistance zone, turning it into strong support.

🔹 Minor resistance zones lie ahead, but structure favors further upside.

🔹 Projection shows potential continuation toward 1.16+ if momentum sustains.

1D Timeframe – Bullish Retest + Golden Cross Forming

Zooming into the daily chart, we see:

✅ A successful retest of the breakout zone, which held as support (bullish confirmation).

✅ Price is now forming a Golden Crossover – where the 50 EMA is crossing above the 200 EMA. This is typically seen as a strong bullish signal in trending markets.

📌 What’s Bullish:

Clean breakout ✔️

Retest with strength ✔️

Momentum crossover ✔️

EUR/USD is now in a strong bullish structure, backed by a confirmed breakout on the weekly and a golden crossover on the daily. If price holds above 1.09, we may see continued upside toward 1.13–1.16 levels in the coming weeks.

Thank you for reading and supporting @unichartz. If you found this analysis helpful, don’t forget to like, follow, and share! 💙

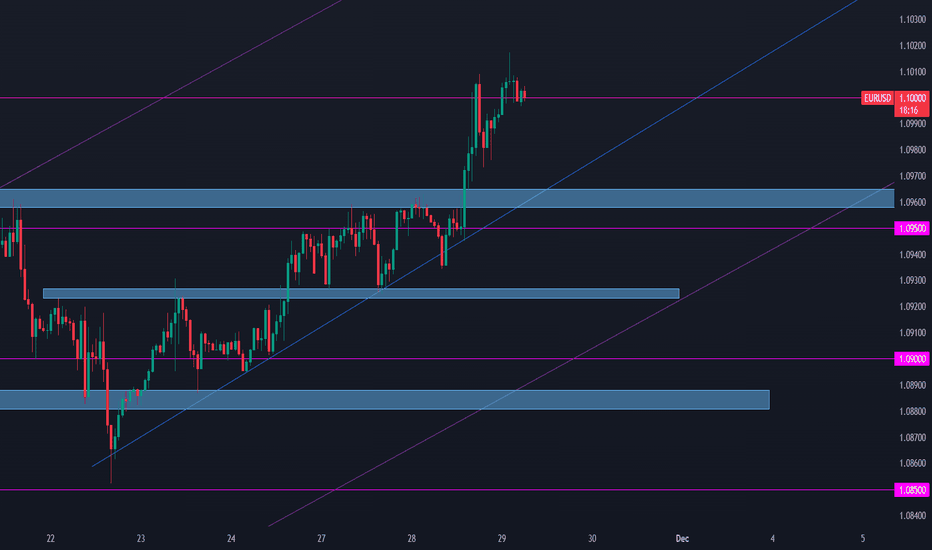

EURUSD ANALSYSIS FOR 29/11/2023In this video, I talked about eurusd (the only pair I trade). I made a full break down from the weekly timeframe all the way down to the daily timeframe. I talked about what the market had done and what I expect the market to do over the next few hours. I also talked about the levels I'm going to be watching out for before I take a trade on the pair. I'm sure you're going to enjoy this video so do not forget to give me a boost, and follow.