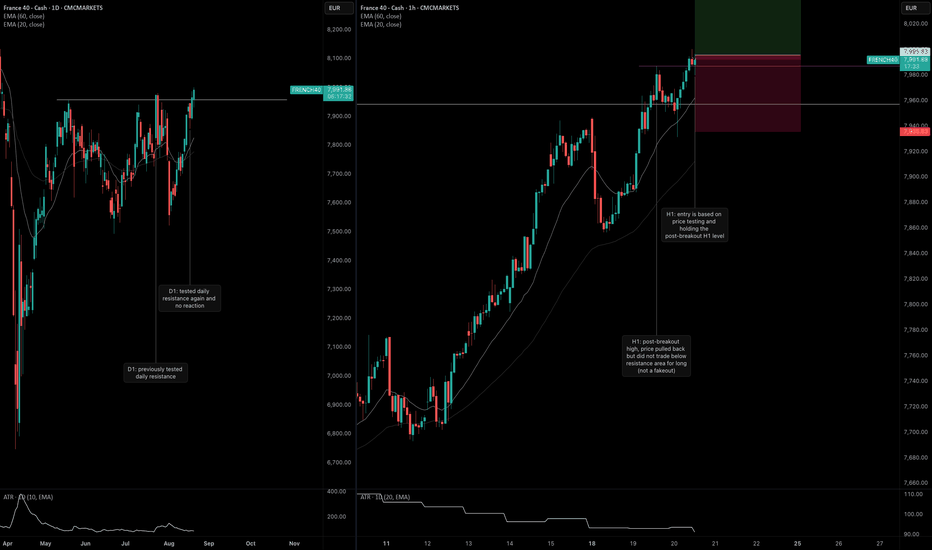

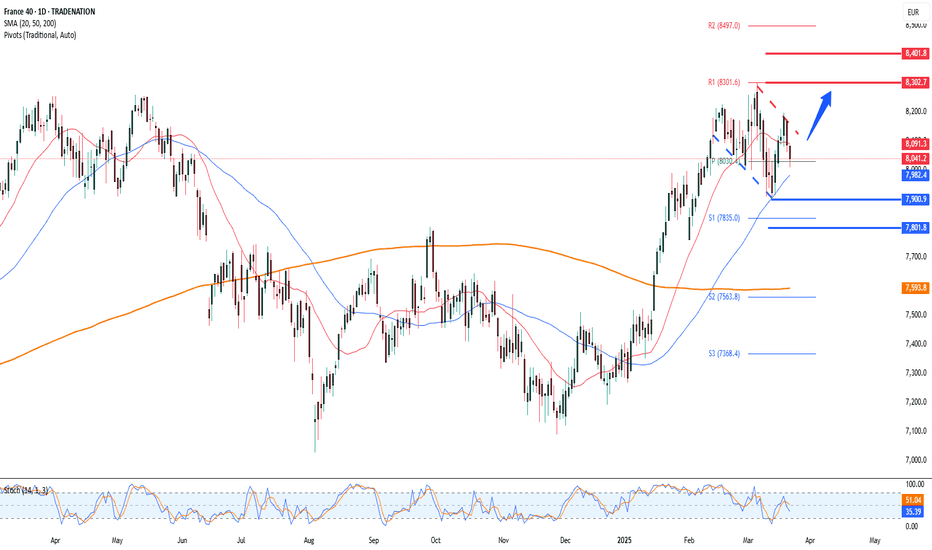

FR40: Resistance BreakoutOn the daily timeframe, price tested a resistance level twice. The first time was in mid-July, which resulted in a strong bearish reaction.

The second time price tested the resistance was last and current week. There was barely any reaction, which leads me to believe sellers do not see this as an overbought area.

On the hourly timeframe, price did pull back slightly after crossing above the daily level. However, this is not a clear false breakout since price crossed above the intraday high rather quickly.

Fr40

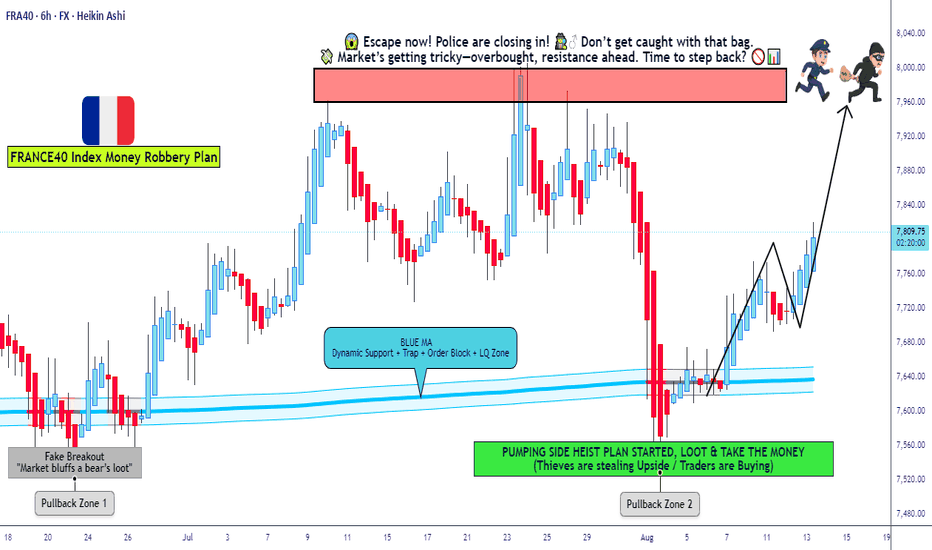

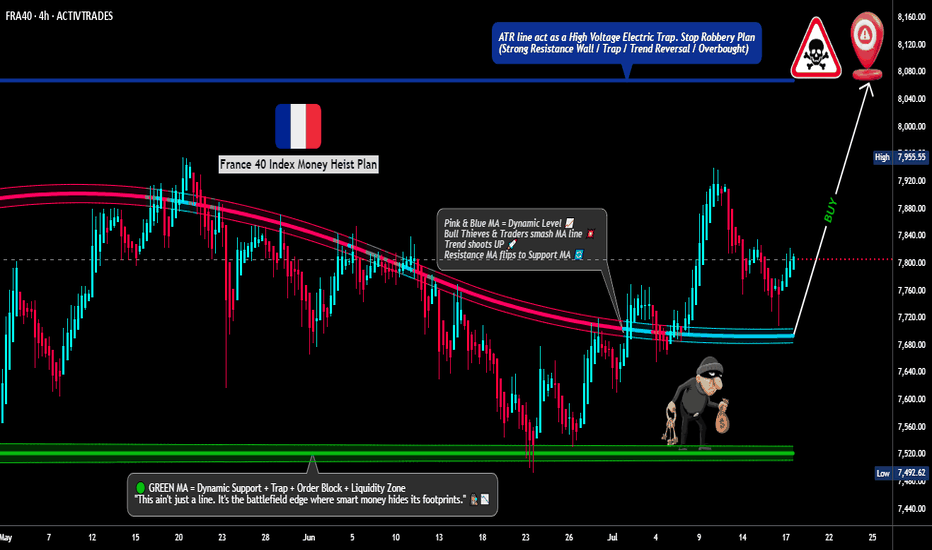

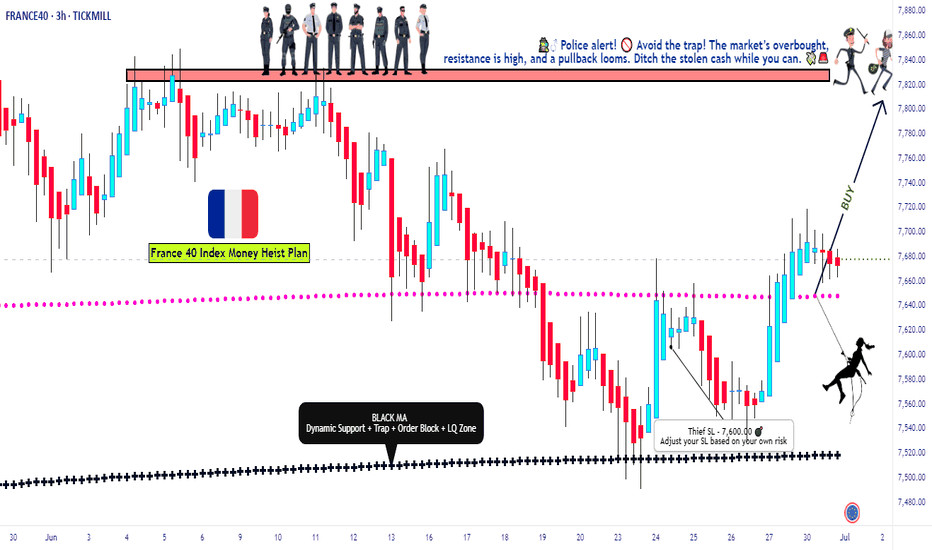

FRA40 Heist Incoming – Are You Positioning for the Escape?💰 FRA40/CAC40 "FRANCE40" INDEX HEIST – ULTIMATE BULLISH LOOTING PLAN 🏴☠️🚀

🔥 STEAL LIKE A PRO – LAYERED ENTRY MASTERCLASS 🔥

🤑 GREETINGS, FELLOW MARKET ROBBERS!

"This ain’t trading… IT’S A HEIST!" 🎭💸

Time to SWIPE the France40 index before the bears set their trap! Thief OG’s know the drill—LAYERED LIMIT ORDERS + STRATEGIC ESCAPE = MAX PROFIT!

📜 THIEF’S HEIST BLUEPRINT

🎯 PLAN: BULLISH RAID

🚨 ENTRY: ANY PRICE (BUT SMART THIEVES USE LAYERS!)

⚡ Pro Thief Move: Deploy limit orders like a stealthy bandit at key levels:

1st Layer: 7700.00 (Dip-buy ambush)

2nd Layer: 7690.00 (Weak hands panic, WE STRIKE!)

3rd Layer: 7650.00 (Institutional trap? NO—OUR TRAP!)

4th Layer: 7620.00 (Max pain = Max gain!)

(Add more layers if market gives FREE MONEY!)

🛑 STOP LOSS: THIEF’S SAFETY NET @7550.00

⚠️ Warning: Adjust SL based on your risk appetite & entry layers! (Thieves don’t get caught—they ESCAPE!)

🎯 TARGET: 8000.00+ (MAJOR BAG ALERT!)

💎 Hold for full heist OR partial escape near resistance zones!

📡 Why This Heist Works (Fundamental Backing)

💵 Eurozone momentum pushing the bulls forward.

🏛 Institutional buyers stacking the order books.

🕊 Geopolitical calm boosting investor confidence.

💎 Luxury & tech stocks fueling index strength.

🚨 Thief’s Tactical Reminders

🔒 Avoid entering during high-impact news – chaos attracts unwanted heat.

🎯 Trailing stops = lock the bag & protect the loot.

⏳ Patience – let the vault doors swing open before rushing in.

⚡ Support the Crew!

💎 Smash that Boost & join the robbery squad.

📈 More boosts = more intel, more loot, more wins.

🔐 Disclaimer:

This is NOT financial advice – just the blueprint for our fictional market heist. You’re the mastermind of your own risk & reward. Markets move fast – adapt, or the vault slams shut!

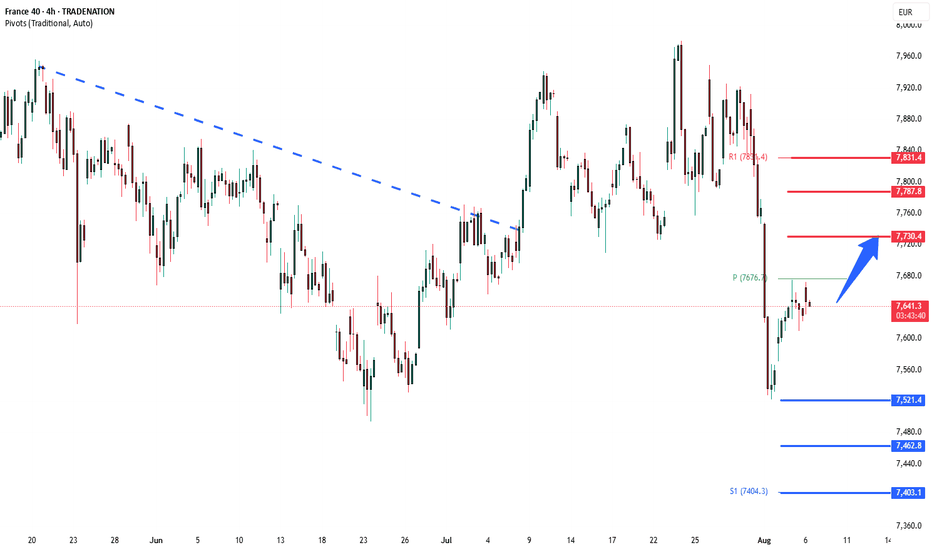

CAC40 Pivotal trading zone at 7730The CAC remains in a neutral trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 7520 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7520 would confirm ongoing upside momentum, with potential targets at:

7730 – initial resistance

7787 – psychological and structural level

7830 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 7520 would weaken the bullish outlook and suggest deeper downside risk toward:

7463 – minor support

7400 – stronger support and potential demand zone

Outlook:

Neutral bias remains intact while the CAC trades around pivotal 7730 level. A sustained break below or above this level could shift momentum.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

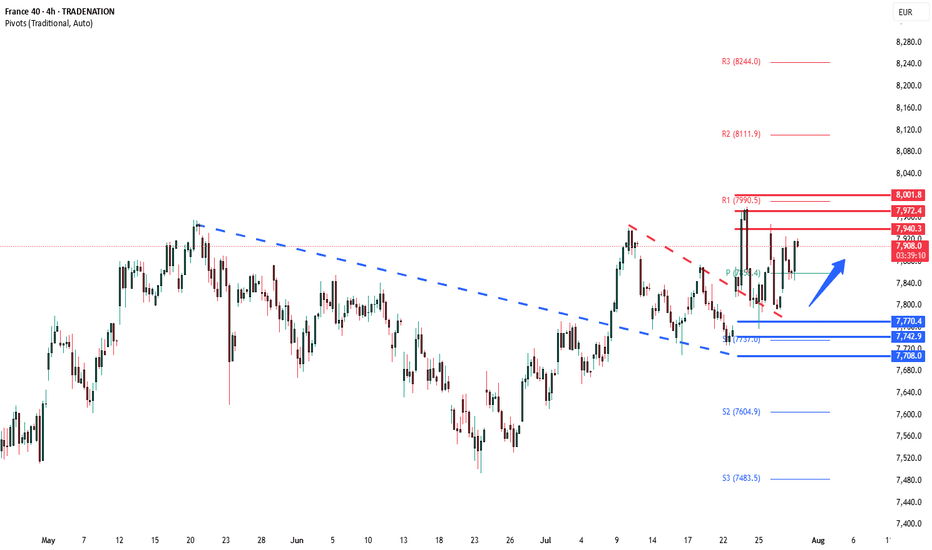

CAC40 Bullish breakout retestThe CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and now serves as critical support.

7740 – Secondary support, guarding against deeper downside.

7700 – Key psychological and technical level; a breach would suggest trend weakness.

Resistance:

7940 – Immediate upside target from the breakout pattern.

7970 – Minor resistance within an extended bullish leg.

8000 – Major psychological resistance and potential profit-taking zone.

Trading Scenarios:

Bullish Scenario:

A corrective pullback toward the 7770 level, followed by a bullish reversal, would confirm support and potentially set the stage for an advance toward 7940, with scope to extend to 7970 and 8000 in the medium term.

Bearish Scenario:

A daily close below 7770 would invalidate the bullish breakout and suggest a short-term trend reversal. This would open the door to a retracement toward 7740, with extended downside risk to 7700.

Conclusion:

The CAC 40 remains technically bullish as long as price holds above the 7770 support level. Traders should watch for confirmation of support on pullbacks to position for a continuation higher. A decisive break below 7770, however, would shift sentiment to neutral-to-bearish, triggering a deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

"FRA40/CAC40 HEIST! Bullish Loot Before Bear Trap – Act Fast!"💰 FRA40/CAC40 "FRANCE40" INDEX HEIST – THIEF TRADING STYLE MASTER PLAN 🏴☠️🚀

🔥 Steal the Market Like a Pro – Bullish Loot & Escape Before the Trap! 🔥

🤑 GREETINGS, FELLOW MONEY MAKERS & MARKET ROBBERS!

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

This is your VIP invite to the ultimate FRA40/CAC40 heist! Based on the 🔥Thief Trading Style🔥, we’re locking in a bullish raid before the bears set their trap. Time to swipe the loot & escape like a pro!

📜 THE HEIST BLUEPRINT – TECHNICAL & FUNDAMENTAL RAID PLAN

🎯 ENTRY POINT: "THE VAULT IS OPEN!"

📈 Long Entry: The market’s handing out free cash—swipe bullish positions at any price!

🔄 Pro Thief Move: Use buy limit orders within 15-30 min timeframe for pullback entries.

🎲 DCA/Layering Strategy: Deploy multiple limit orders to maximize loot & minimize risk.

🛑 STOP LOSS – SAFETY NET FOR THIEVES

SL at Nearest Swing Low (4H TF): 7650.00 (Adjust based on your risk, lot size & entry layers).

⚠️ Warning: Bears are lurking—don’t get caught in their trap!

🏆 TAKE PROFIT – ESCAPE BEFORE THE POLICE ARRIVE!

🎯 Primary Target: 8060.00 (or exit early if the market turns sketchy).

🚨 Danger Zone: Yellow MA Zone (Overbought, Reversal Risk, Bear Trap!)

📡 FUNDAMENTAL BACKUP – WHY THIS HEIST WILL WORK

💰 France40 is riding bullish momentum due to:

Strong Macro Data (Eurozone recovery signals)

Institutional Buying (COT Report Insights)

Geopolitical Calm (For Now… Stay Alert!)

Index-Specific Strength (Tech & Luxury Stocks Leading)

🔗 For full analysis (Fundamentals, COT, Intermarket Trends, Sentiment Score):

👉 Check the Liinkk 🔗! 👈

🚨 TRADING ALERT – NEWS & POSITION MANAGEMENT

📰 High-Impact News = Market Chaos! Protect Your Loot:

❌ Avoid new trades during major news drops.

🔐 Use Trailing Stops to lock profits & dodge sudden reversals.

💥 BOOST THE HEIST – SUPPORT THE MISSION!

🚀 Hit the "Boost" button to strengthen our robbery squad!

💰 More boosts = More profitable raids!

🎉 Let’s dominate the market daily with the Thief Trading Style!

🔐 DISCLAIMER (LEGAL SAFETY NET)

This is NOT financial advice—just a strategic raid plan. Trade at your own risk. Markets change fast; adapt or get caught!

🤑 Stay tuned for the next heist… The vaults won’t rob themselves! 🐱👤💨

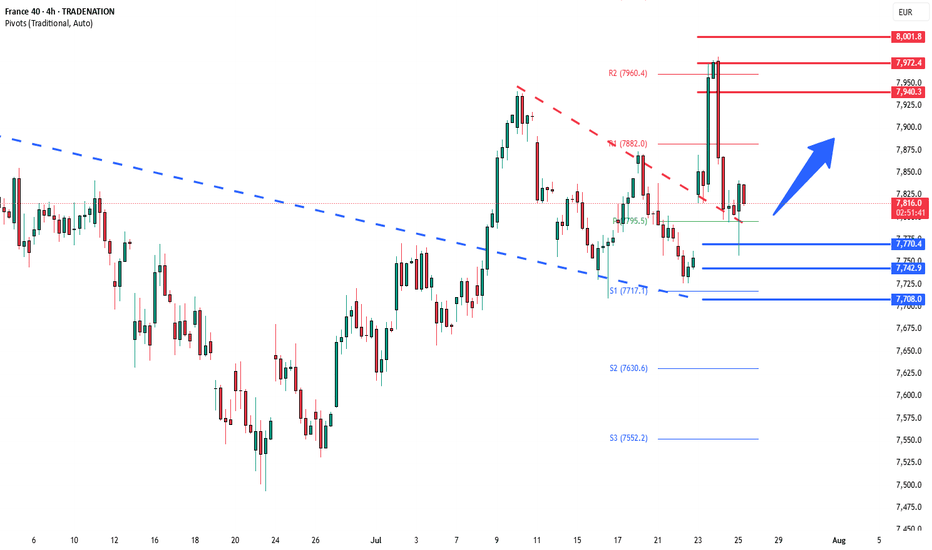

CAC breakout retest support at 7770The CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and now serves as critical support.

7740 – Secondary support, guarding against deeper downside.

7700 – Key psychological and technical level; a breach would suggest trend weakness.

Resistance:

7940 – Immediate upside target from the breakout pattern.

7970 – Minor resistance within an extended bullish leg.

8000 – Major psychological resistance and potential profit-taking zone.

Trading Scenarios:

Bullish Scenario:

A corrective pullback toward the 7770 level, followed by a bullish reversal, would confirm support and potentially set the stage for an advance toward 7940, with scope to extend to 7970 and 8000 in the medium term.

Bearish Scenario:

A daily close below 7770 would invalidate the bullish breakout and suggest a short-term trend reversal. This would open the door to a retracement toward 7740, with extended downside risk to 7700.

Conclusion:

The CAC 40 remains technically bullish as long as price holds above the 7770 support level. Traders should watch for confirmation of support on pullbacks to position for a continuation higher. A decisive break below 7770, however, would shift sentiment to neutral-to-bearish, triggering a deeper correction.

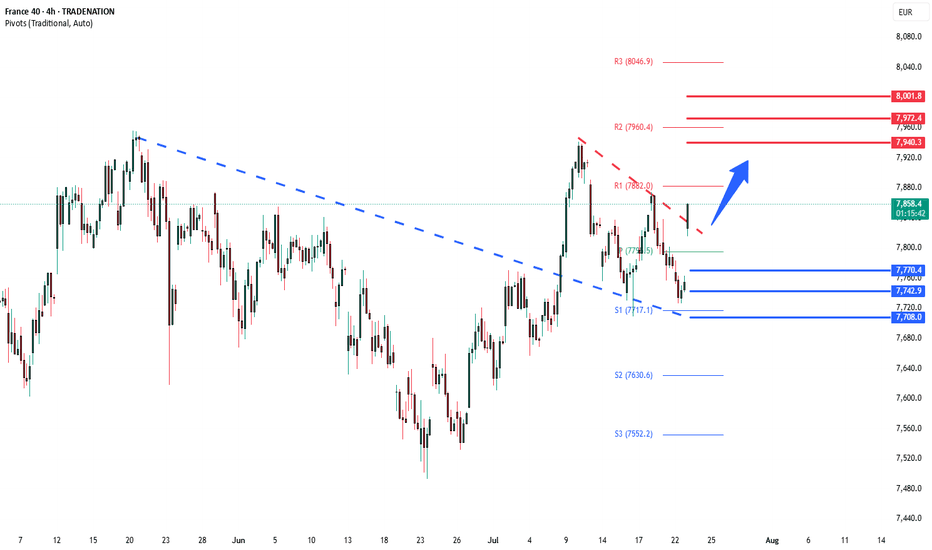

CAC40 Bullish consolidation breakout The CAC40 price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a consolidation breakout.

The key trading level is at the 7770 level, the previous consolidation price range. A corrective pullback from current levels and a bullish bounce back from the 7770 level could target the upside resistance at 7940, followed by the 7970 and 8000 levels over the longer timeframe.

Alternatively, a confirmed loss of the 7770 support and a daily close below that level would negate the bullish outlook, opening the way for a further retracement and a retest of the 7740 support level, followed by the 7700 levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 Bullish breakout retest support at 7770The CAC40 price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a consolidation breakout.

The key trading level is at the 7770 level, the previous consolidation price range. A corrective pullback from current levels and a bullish bounce back from the 7770 level could target the upside resistance at 7940, followed by the 7970 and 8000 levels over the longer timeframe.

Alternatively, a confirmed loss of the 7770 support and a daily close below that level would negate the bullish outlook, opening the way for a further retracement and a retest of the 7740 support level, followed by the 7700 levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

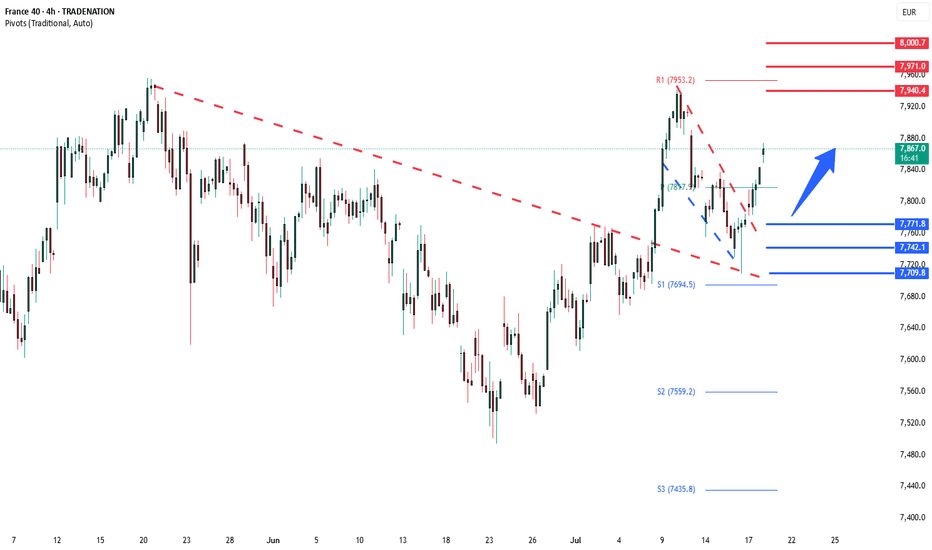

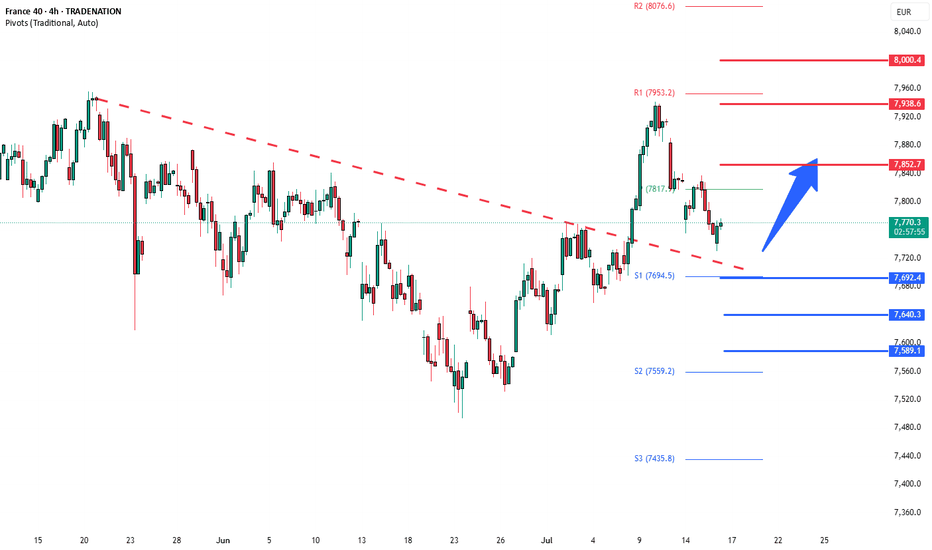

CAC40 Bullish breakout retest support at 7690The CAC40 remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 7960 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7690 would confirm ongoing upside momentum, with potential targets at:

7850 – initial resistance

7940 – psychological and structural level

8000 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 7690 would weaken the bullish outlook and suggest deeper downside risk toward:

7640 – minor support

7590 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the CAC40 holds above 7690. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

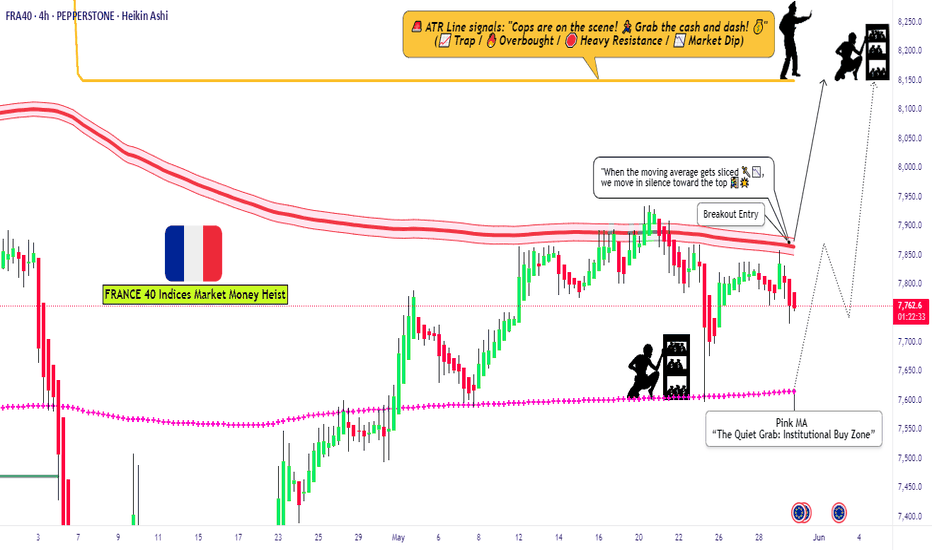

FRANCE 40 Heist in Progress | Bullish Reversal Zone Spotted.💼 CAC40 Market Heist: Thief Trading Blueprint for Smart Traders (Swing/Day Trade Edition) 💼

🌍 Bonjour, Hola, Hallo, Marhaba, Ola, Hello! 🌍

Welcome to all Market Hustlers, Silent Snipers, and Profit Seekers! 🤑💸🎯

We're back with a precision-built Thief Trading Plan — this time targeting the FRANCE40 / CAC40 Index, using a combination of street-smart technicals and sharp macro insights.

🧠 Game Plan: The “Market Heist” Strategy

This strategy revolves around a Long Entry setup aiming for the high-risk Red Zone. Price is pushing into potential overbought territory, with signs of consolidation and trend exhaustion. That’s exactly where reversal opportunities and big moves live — right before the herd wakes up. 🐂💰

🔓 Entry Plan – "The Vault’s Open"

📍 Enter on bullish setups – recommended through:

Recent 15/30 min support levels or

Swing low/high based buy limit zones

💡 Pro Tip: Set alerts at those critical swing levels so you’re always one step ahead.

🛑 Stop Loss – "Stay Out of Jail"

🎯 Suggested SL: Near the recent 3H swing low (~7600 zone)

🧩 Adjust SL based on:

Risk tolerance

Lot size

Multiple entries

Trading strategy preference

🎯 Take Profit – "The Great Escape"

📌 Primary TP: 7830.00

🔐 Trailing SL advised to secure profits during the climb

🚨 If market shifts or trap signs emerge, exit early and protect the bag.

⚔️ Scalpers vs Swingers – Choose Your Crew

Scalpers: Only ride the long waves. Use momentum & micro breakouts.

Swing Traders: Follow the blueprint. This is your time to rob the trend cleanly. 🕶️📈

🧩 Market Insight & Fundamentals

This bullish momentum is backed by key drivers:

Economic releases

Institutional positioning (COT Reports)

Sentiment & intermarket flows

Geopolitical & macro factors

📌 Always update your narrative. Markets shift fast. Stay informed. Stay sharp.

⚠️ Important Trading Notice – News Risk & Management

🚫 Avoid fresh entries during high-impact news events

🔄 Use trailing SLs to lock gains

🧠 Be aware of volatility traps

❤️ Support the Strategy – Hit Boost & Join the Crew

If this strategy made sense to you, smash that Boost Button.

You're not just supporting a post — you're fueling a Thief Trader movement where smart, fearless traders take what’s theirs from the market. 🚀💰

🎉 Keep winning, stay alert, and I’ll see you in the next heist! 🧠💸🐱👤

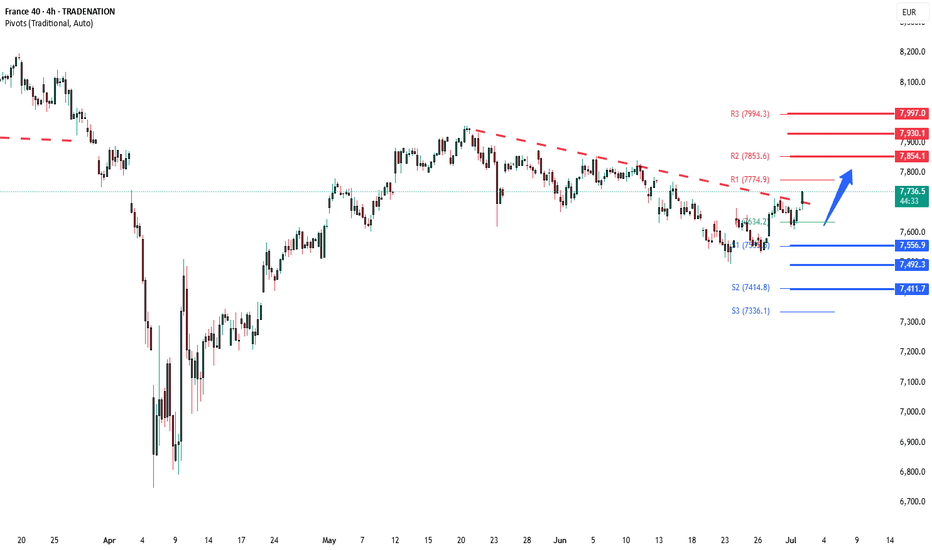

CAC40 Bullish breakout supported at 7560Key Support and Resistance Levels

Resistance Level 1: 7850

Resistance Level 2: 7930

Resistance Level 3: 7995

Support Level 1: 7560

Support Level 2: 7490

Support Level 3: 7410

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

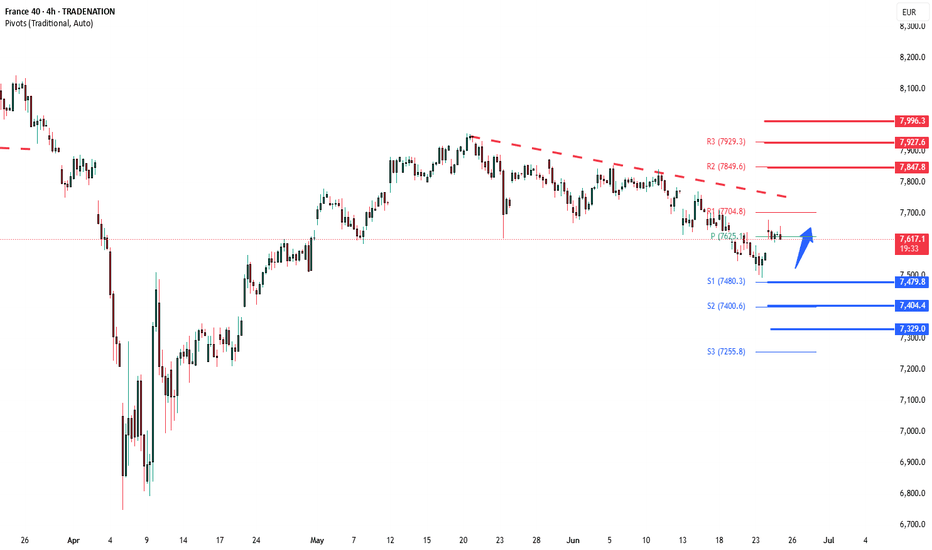

CAC40 corrective pullback support at 7480Key Support and Resistance Levels

Resistance Level 1: 7850

Resistance Level 2: 7930

Resistance Level 3: 7995

Support Level 1: 7480

Support Level 2: 7400

Support Level 3: 7330

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

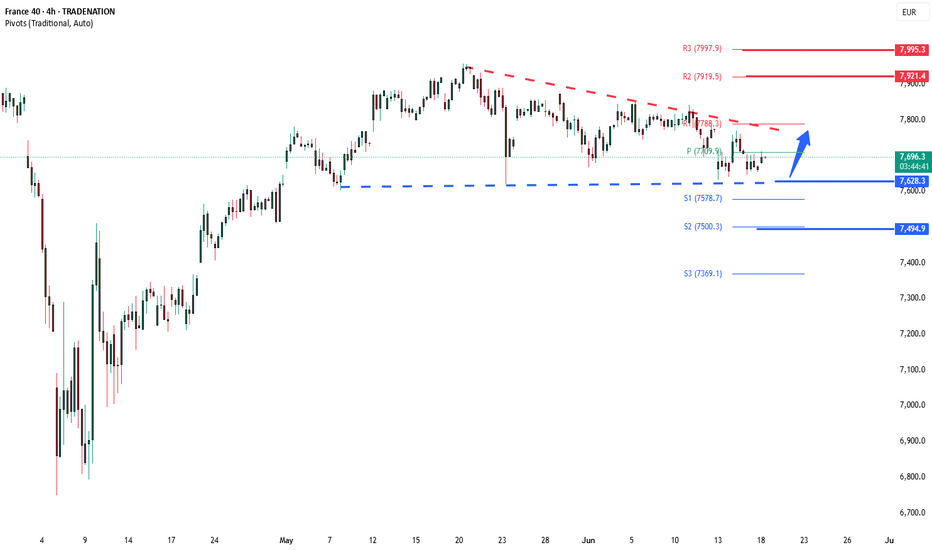

CAC40 protracted coiling consolidation support at 7630Key Support and Resistance Levels

Resistance Level 1: 7788

Resistance Level 2: 7920

Resistance Level 3: 7995

Support Level 1: 7630

Support Level 2: 7578

Support Level 3: 7500

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

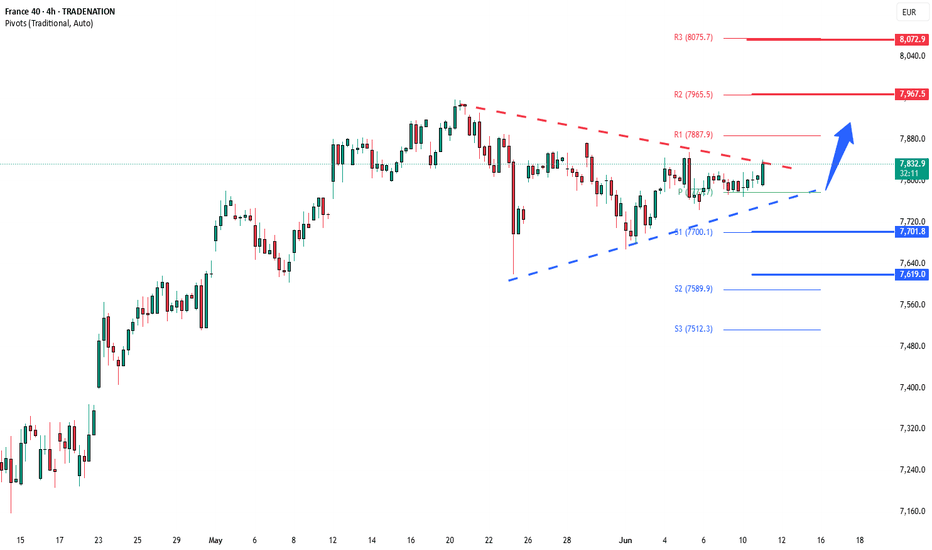

CAC40 INTRADAY coiling pattern- energy buildupKey Support and Resistance Levels

Resistance Level 1: 7890

Resistance Level 2: 7970

Resistance Level 3: 8070

Support Level 1: 7700

Support Level 2: 7620

Support Level 3: 7510

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

"FR40 TIME-BOMB TRADE: PROFIT BEFORE THE CLOCK RUNS OUT!"🔥 FRANCE 40 HEIST: STEAL THE TREND LIKE A MARKET BANDIT! 🚨💰

Locked & loaded for the FR40 (FRANCE 40) heist? This slick blueprint cracks the code to loot profits—blending killer technicals with macro intel. Ride the bullish wave, but dodge traps near the Overbought Zone. Bears lurk, so secure your bag before the reversal hits! 🐻💨

🎯 ENTRY: STRIKE LIKE A PRO THIEF

Long the breakout near 7900.0 (or) ambush pullbacks at 7620.0 or above.

Set stealth alerts to catch moves in real-time. 🕶️🔔

🛡️ STOP LOSS: ESCAPE ALIVE

Hide stops under the last 4H swing low/wick—no reckless bets!

Adjust for your risk—survivors play smart. ⚡

💸 TAKE PROFIT: VANISH WITH THE LOOT

Main Target: 8150.0 (or bail early if momentum fades).

Scalpers: Trail stops & ghost out with quick wins. 🏃♂️💨

📡 WHY THIS HEIST WORKS

FRANCE 40's on fire: Fundamentals + COT data + macro tides align.

Sentiment’s bullish, but stay sharp—links below for the full intel. 🔍🌐

⚠️ WARNING: NEWS = POLICE SIRENS

Avoid new trades during high-impact news. 📢

Lock profits with trailing stops if you’re already in. 🔐

🤝 JOIN THE TRADING MAFIA

Smash LIKE, drop a comment, & let’s dominate the US100! �

Ready for the next big move? Stay tuned. 👀

Happy hunting, chart pirates! 🏴☠️📉

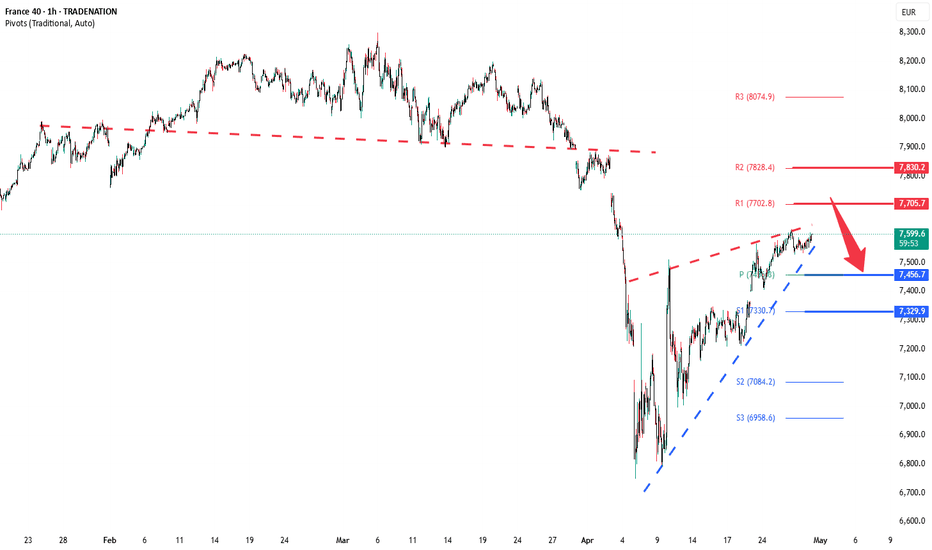

CAC40 INTRADAY rising wedge capped at 7705The CAC40 index shows a bearish sentiment, with the overall trend remaining negative. Recent price action suggests a short-term oversold rally that could face resistance near the 7705 level — a key previous consolidation area.

Key Resistance: 7705

A failure to break above this level could lead to renewed selling pressure.

Bearish Scenario:

If the price is rejected at 7705, downside targets include:

7500 (initial support)

7456

7330 (longer-term target)

Bullish Scenario:

A confirmed breakout and daily close above 7705 would invalidate the bearish outlook and open the door for a rally toward:

7830

7900

Conclusion:

The outlook remains bearish unless CAC40 can break and hold above 7705. Watch this level closely for directional clues.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

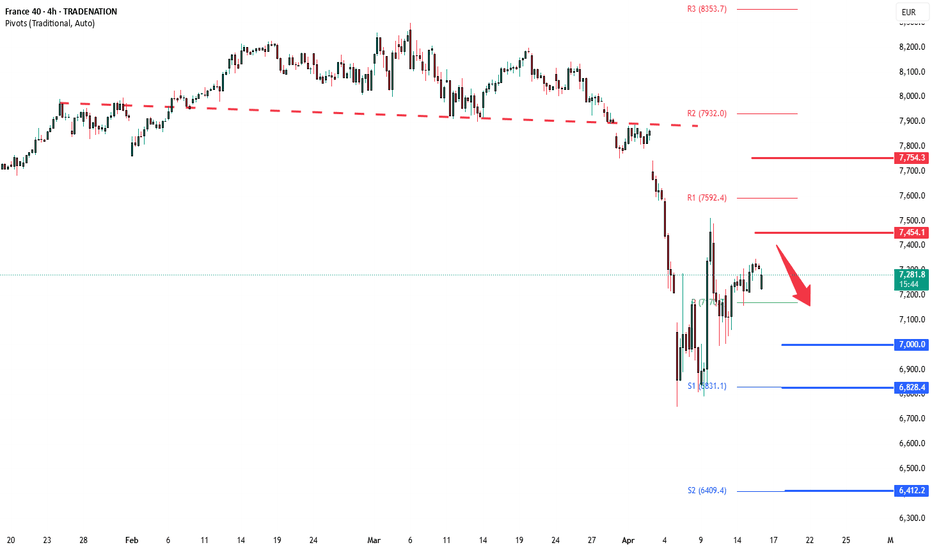

CAC40 IMPORTANT resistance retest at 7454

The CAC40 continues to exhibit bearish sentiment, aligning with the prevailing downward trend. Recent price action suggests that the index experienced an oversold rally, which was subsequently rejected near a key resistance zone — the previous intraday consolidation level around 7454.

This area now serves as a critical pivot point. A failure to break above 7454, followed by renewed selling pressure, would likely confirm a bearish reversal, with downside targets at:

7170 – Near-term support

7000 – Medium-term support

6828 – Long-term support level

However, if price breaks and closes firmly above 7454 on a daily basis, the bearish scenario would be invalidated. In that case, the DAX40 could extend gains toward:

7592 – Immediate resistance

7754 – Major upside target

Conclusion

The bias remains bearish below 7454, with rallies into that level offering potential short opportunities. A daily close above 7454, however, would shift sentiment and open the door for bullish continuation toward higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

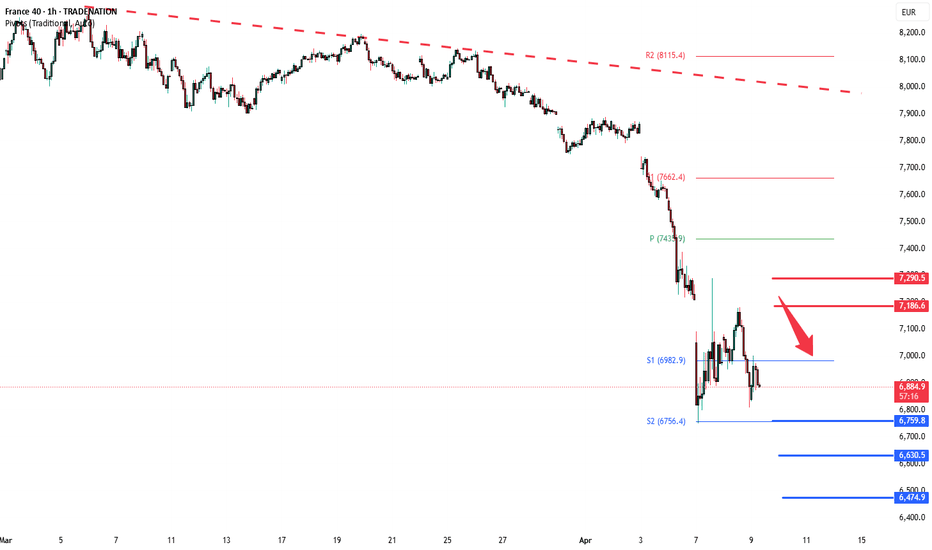

CAC40 INTRADAY oversold boumce back capped at 7186The CAC 40 continues to exhibit bearish sentiment, in line with the prevailing downtrend. Recent price action has confirmed a break below a key consolidation support zone, reinforcing the downside bias.

Key Technical Levels:

Resistance Zone: 7000 (short-term), 7186 (major resistance / former consolidation zone)

Support Levels: 6760 (initial target), 6630 (intermediate), 6474 (longer-term support)

Bearish Scenario:

The loss of support at 7186 has shifted the bias to the downside. A potential oversold rebound may occur, but unless price reclaims and holds above 7000 on a daily closing basis, rallies are likely to face selling pressure. A bearish rejection at 7186, if retested, would confirm the continuation of the downtrend toward the stated support levels.

Bullish Alternative:

A confirmed breakout above 7000, with a daily close above this level, would challenge the current bearish outlook. In such a case, the index may regain bullish momentum, opening the path for a retest of 7186, followed by 7290.

Conclusion:

The technical outlook for the CAC 40 remains bearish unless a decisive breakout above 7000 occurs. Traders should watch for rejection patterns near 7000–7186 for potential short entries, while a daily close above 7000 would be a key trigger for a trend reversal and a shift in sentiment.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

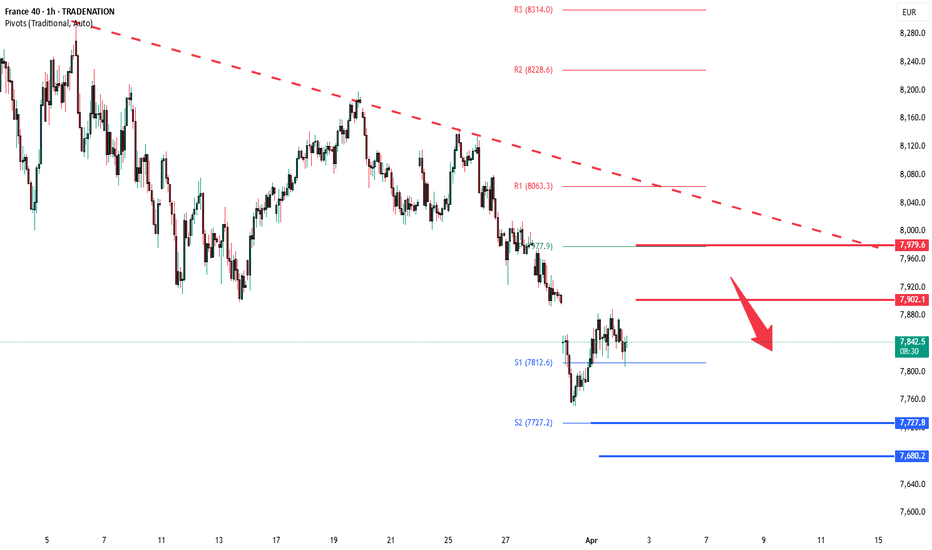

CAC40 capped by resistance at 7,900The CAC40 index is exhibiting bearish sentiment, aligning with the prevailing downtrend. The recent price action suggests an oversold bounce, which may be temporary before the downtrend resumes.

Key Level: 7,900

This level represents the previous intraday consolidation zone and serves as a crucial resistance point.

Bearish Scenario: If the index faces rejection at 7,900, it could resume its decline, targeting 7,728, followed by 7,680 and 7,552 as long-term support levels.

Bullish Scenario: A confirmed breakout above 7,900 with a daily close beyond this level would invalidate the bearish outlook, potentially leading to rallies toward 7,980 and 8,060.

Conclusion:

The CAC40 remains in a bearish trend unless a strong breakout above 7,900 confirms a shift in momentum. Traders should watch for rejection or confirmation at this key level to determine the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

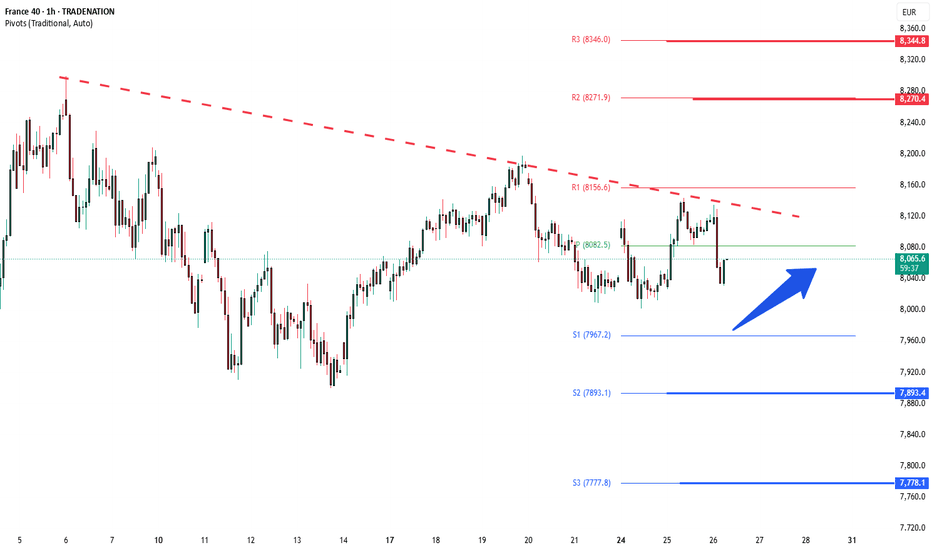

CAC40 INTRADAY Bullish sideways consolidation The CAC 40 Equity Index remains in a prevailing uptrend, with recent intraday price action indicating a corrective pullback toward a key support level.

Key Levels to Watch:

Support Levels: 7967 (critical level), 7893, 7778

Resistance Levels: 8160, 8270, 8344

Bullish Scenario:

A bullish bounce from the 7967 support level, previously a resistance zone, could trigger renewed buying momentum. If confirmed, the next upside targets are set at 8160, 8270, and 8344 over a longer timeframe.

Bearish Scenario:

A daily close below 7967 would weaken the bullish outlook, potentially leading to a further retracement toward 7893, with an extended decline targeting 7778.

Conclusion:

The overall market sentiment remains bullish, but the 7967 level is a pivotal support zone. A successful retest and rebound from this level could drive the next leg higher, whereas a confirmed breakdown would shift the outlook to bearish, favoring deeper corrections. Traders should monitor price action closely around these levels for confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

CAC40 The Week Ahead 24th March '25CAC40 bullish & overbought, the key trading level is at 7900

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

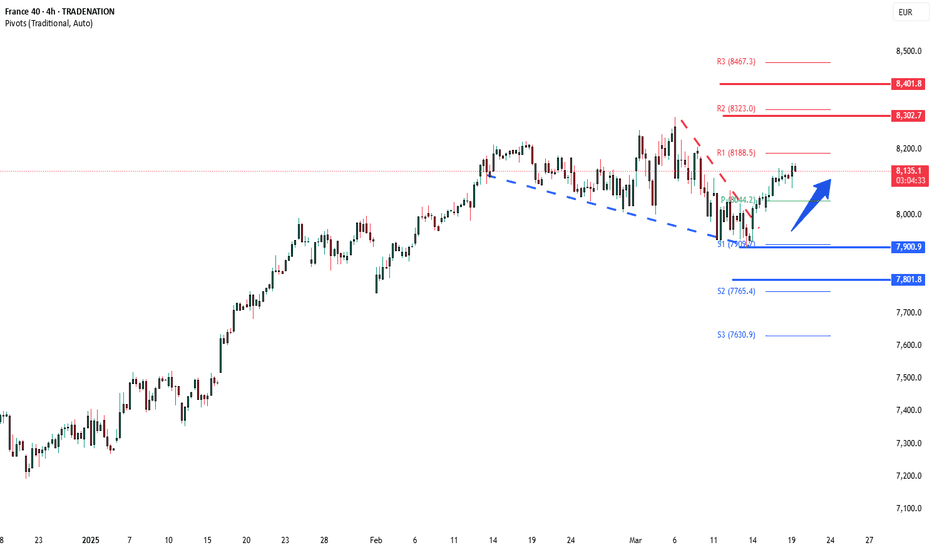

CAC40 INTRADAY Bullish Breakout supported at 8050. The CAC40 equity index remains in a bullish technical structure, underpinned by the prevailing uptrend. Recent intraday price action has shown a breakout above a sideways consolidation pattern, suggesting renewed bullish momentum towards the previous resistance area.

Key Levels:

Support: The critical support level is at 8050, which corresponds to the previous consolidation price range. A corrective pullback to this level, followed by a bullish bounce, could reinforce the uptrend.

Resistance: On the upside, the next resistance levels are positioned at 8190, 8300, and 8400, representing potential profit targets over a longer timeframe.

Bearish Scenario: A decisive break below the 8050 support level and a daily close beneath this mark would invalidate the bullish outlook. Such a move could initiate a deeper retracement, targeting the 7900 support level, followed by 7800 if selling pressure intensifies.

Conclusion: The prevailing sentiment remains bullish as long as the 8050 support holds. Traders should monitor any corrective moves toward this level for potential buying opportunities. A confirmed loss of 8050 would signal caution, as it may trigger further downside pressure.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

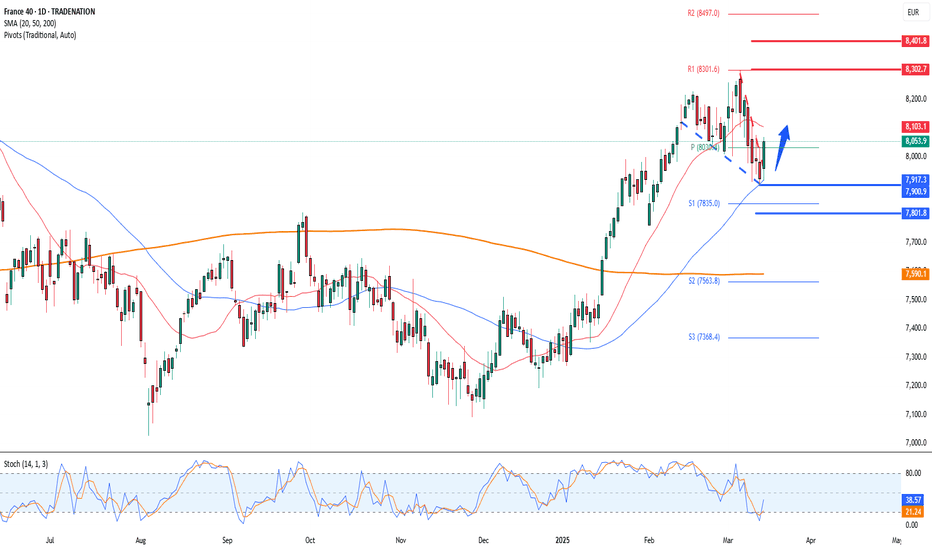

CAC40 (FR40) The Week Ahead 17th March '25CAC40 INTRADAY bullish & oversold, key trading level is at 7917

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.