Freesignals

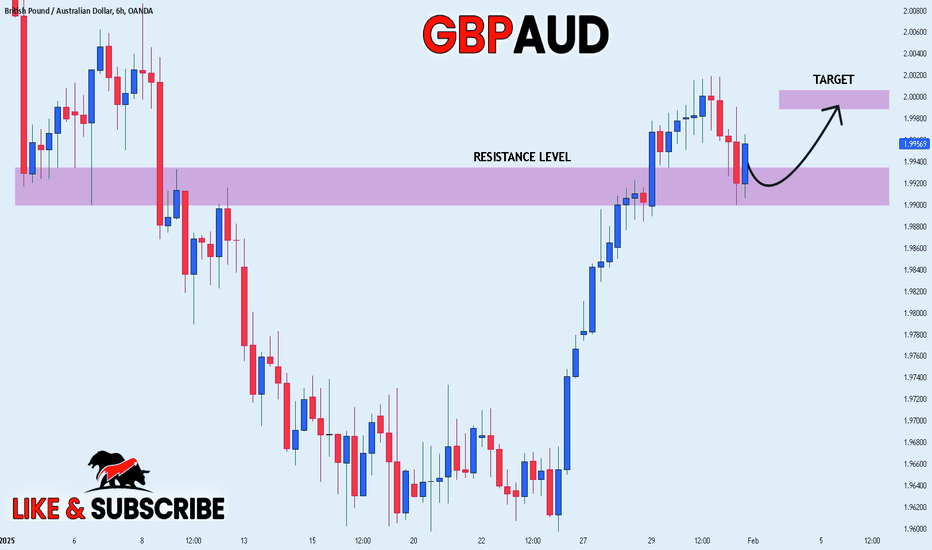

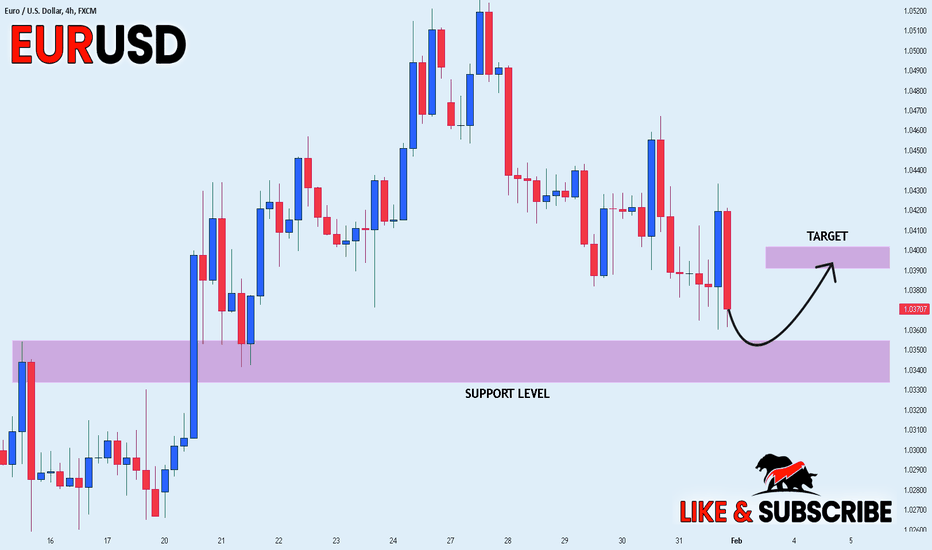

EUR_USD SUPPORT AHEAD|LONG|

✅EUR_USD is approaching a demand level of 1.0340

So according to our strategy

We will be looking for the signs of the reversal in the trend

To jump onto the bullish bandwagon just on time to get the best

Risk reward ratio for us

LONG🚀

✅Like and subscribe to never miss a new idea!✅

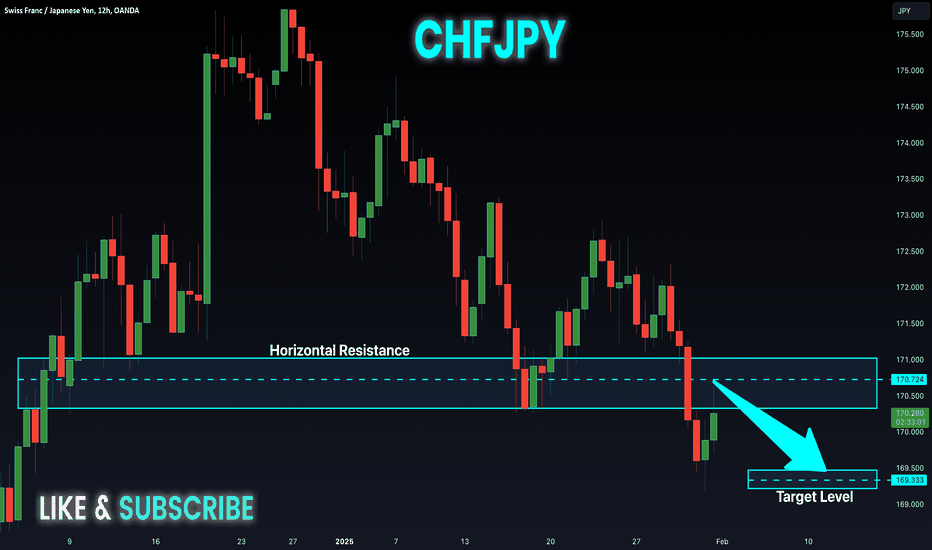

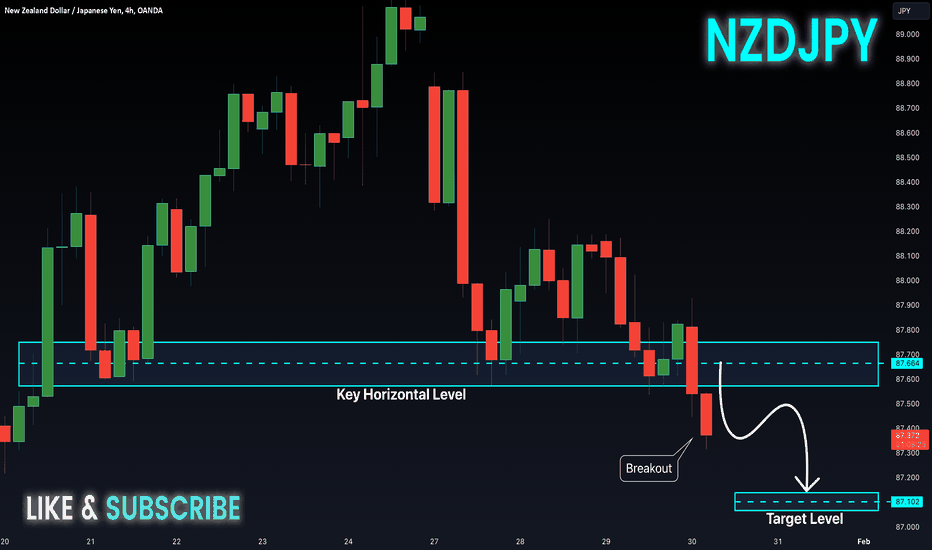

NZD-JPY Bearish Breakout! Sell!

Hello, Traders!

NZD-JPY is going down

Now and broke the key

Horizontal level of 87.700

Which is now a resistance

And the breakout is confirmed

So we are locally bearish biased

Now and we will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

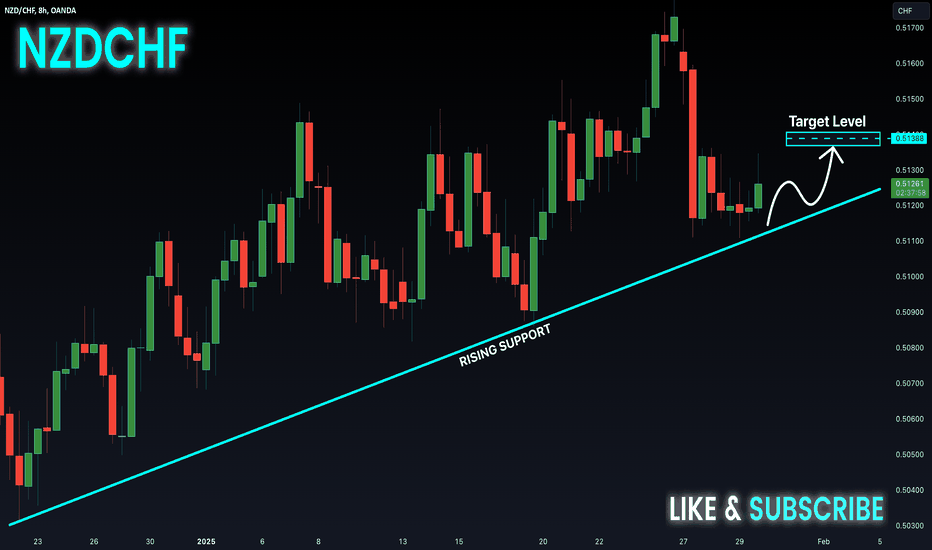

NZD-CHF Risky Long! Buy!

Hello,Traders!

NZD-CHF is trading along

The rising support line and

We are already seeing a

Bullish rebound after the

Retest of the rising support

So we are locally bullish

Biased and we will be

Expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

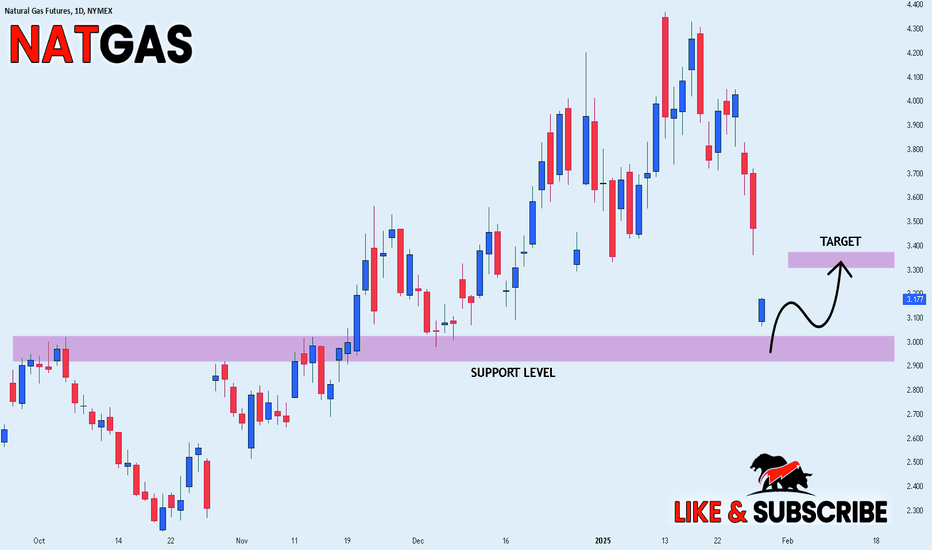

NATGAS GAP CLOSURE|LONG|

✅NATGAS gapped down massively

And the price has almost reached

The strong horizontal support

At the round level of 3.00$

And as Gas is objectively oversold

We are already seeing some

Gap closure moves and we

Will be expecting a further

Move up until the gap is

Closed completely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

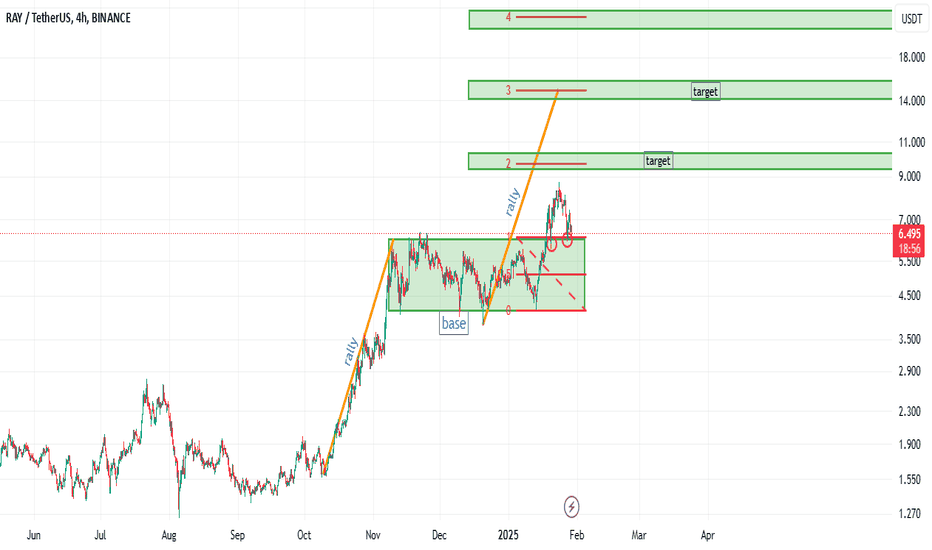

Ray review analysis: can we wait for the second wave of rise?hello friends

Due to the good price growth of this currency, it has been placed in a range, and with the breaking of that range, a double bottom pattern has been created on the ceiling of the range, which can be expected to move up to the specified limits.

We can enter into the transaction with capital and risk management.

*Trade safely with us*

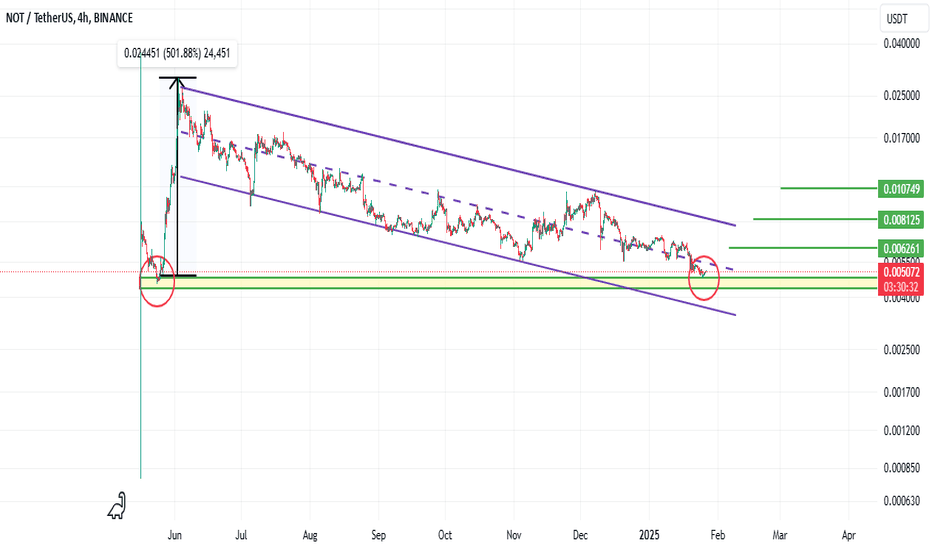

Notcoin analysis: the best support area...hello friends

According to the correction of the price, the price is now in an important support range, which by taking into account the stabilization and not breaking of this support, the price can move up to the specified goals, of course, with capital management...

*Trade safely with us*

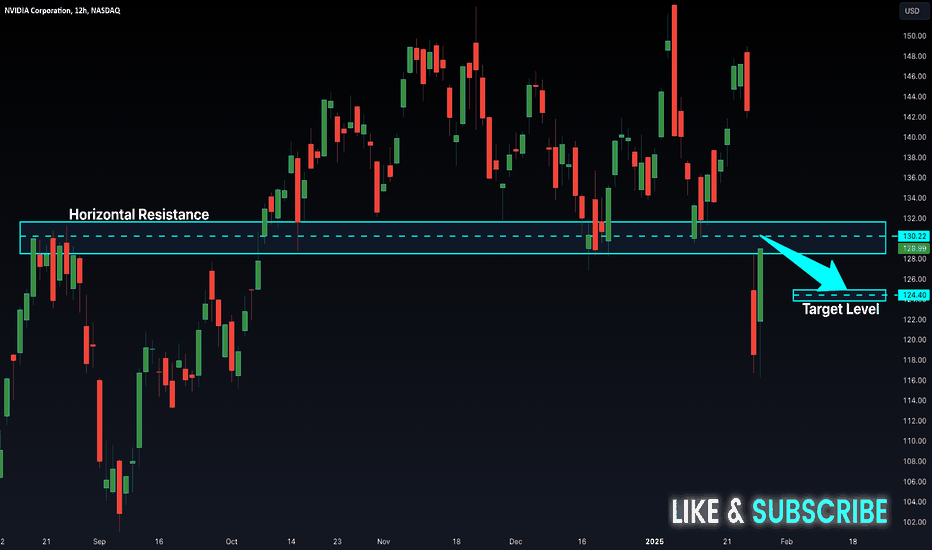

NVIDIA Retesting The Resistance! Sell!

Hello,Traders!

NVIDIA gapped down massively

On the DeepSeek news and

Went further down after the

Opening, but then a gap closing

Move started and the price is now

Retesting the horizontal resistance

Around 130/132$ which also

Happens to be the gap's opening

Level so based on technical analysis

We might be expecting a local

Bearish pullback from the resistance

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

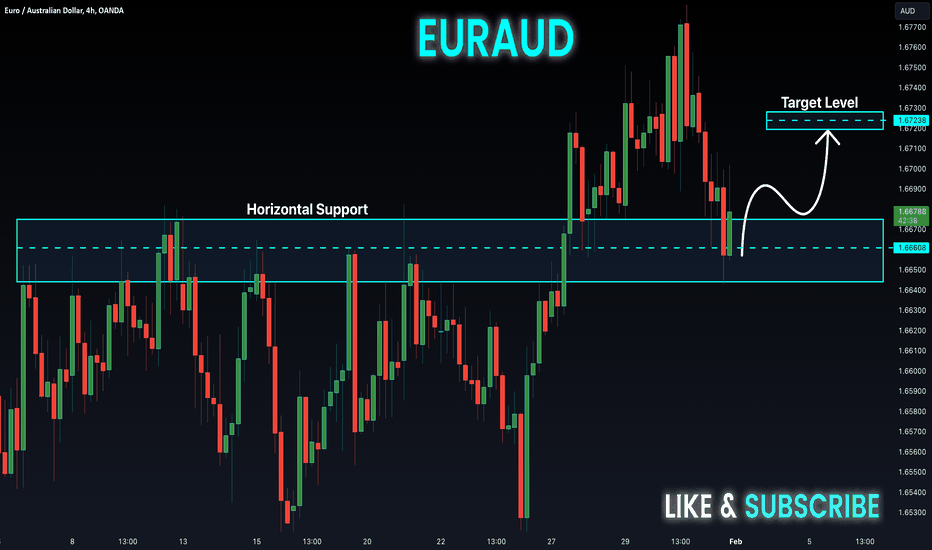

EUR_GBP BULLISH CORRECTION AHEAD|LONG|

✅EUR_GBP is set to retest a

Strong support level below at 0.837

After trading in a local downtrend from some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 0.8391

LONG🚀

✅Like and subscribe to never miss a new idea!✅

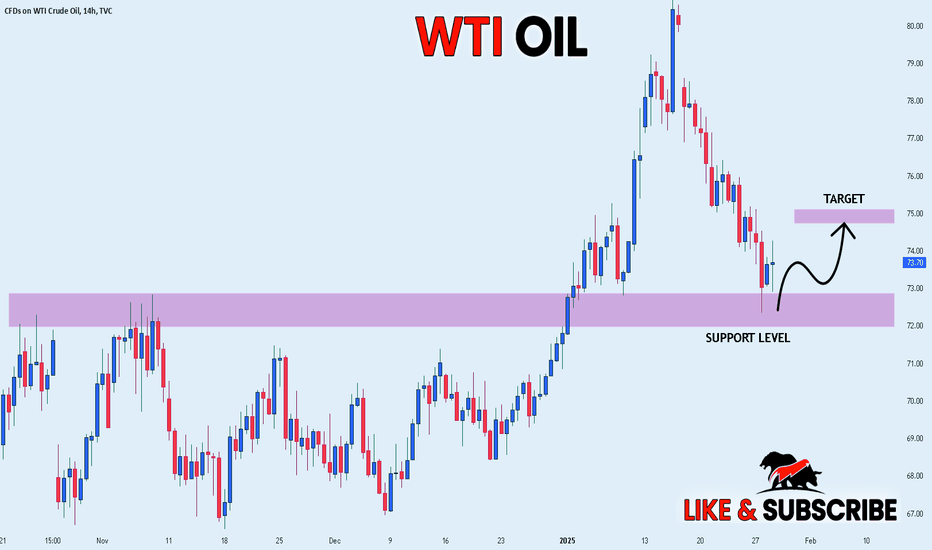

CRUDE OIL Will Go UP! Buy!

Hello,Traders!

CRUDE OIL made a massive

10% bearish correction but

Then it hit a horizontal support

Of 72.89$ and a bullish rebound

Is already happening so we

Are bullish biased and we will

Be expecting a further move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!