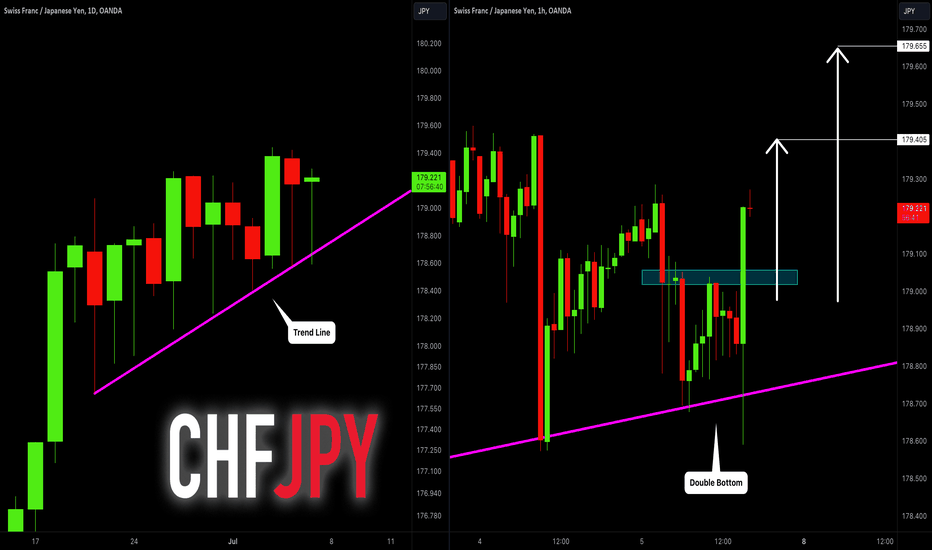

CHFJPY: Classic Trend-Following 🇨🇭🇯🇵

On a today's live stream with my students,

we discussed CHFJPY.

Even though the momentum is slowing down,

the pair still remains bullish.

After a test of a solid rising trend line on a daily,

we see a strong positive bullish reaction.

I think that the pair will go higher.

Goals: 179.4

❤️Please, support my work with like, thank you!❤️

Freesignals

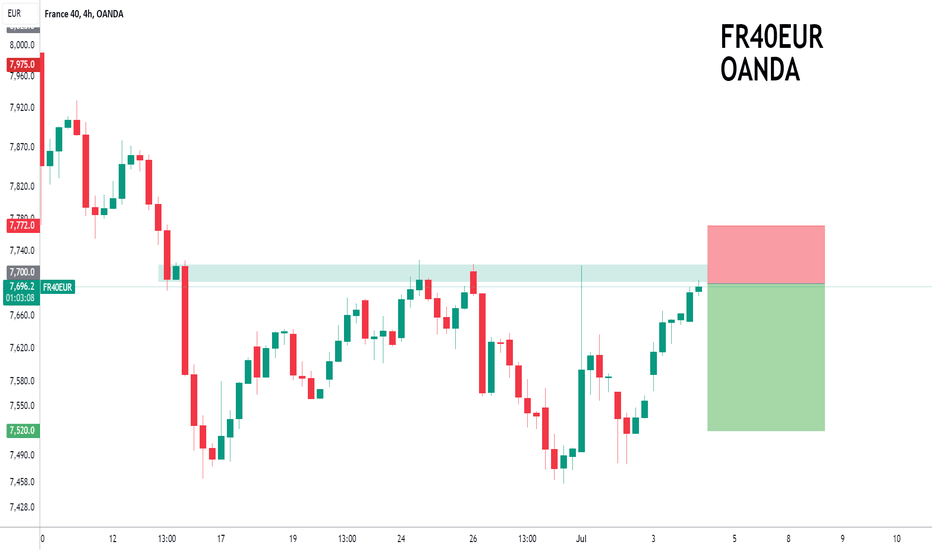

FR40 to find sellers at current resistance?FRA40 - 24h expiry

Indecisive price action has resulted in sideways congestion on the intraday chart.

Pivot resistance is at 7700.

We expect a reversal in this move.

Risk/Reward would be poor to call a sell from current levels.

A move through 7625 will confirm the bearish momentum.

We look to Sell at 7700 (stop at 7772)

Our profit targets will be 7520 and 7485

Resistance: 7700 / 7750 / 7775

Support: 7600 / 7550 / 7525

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

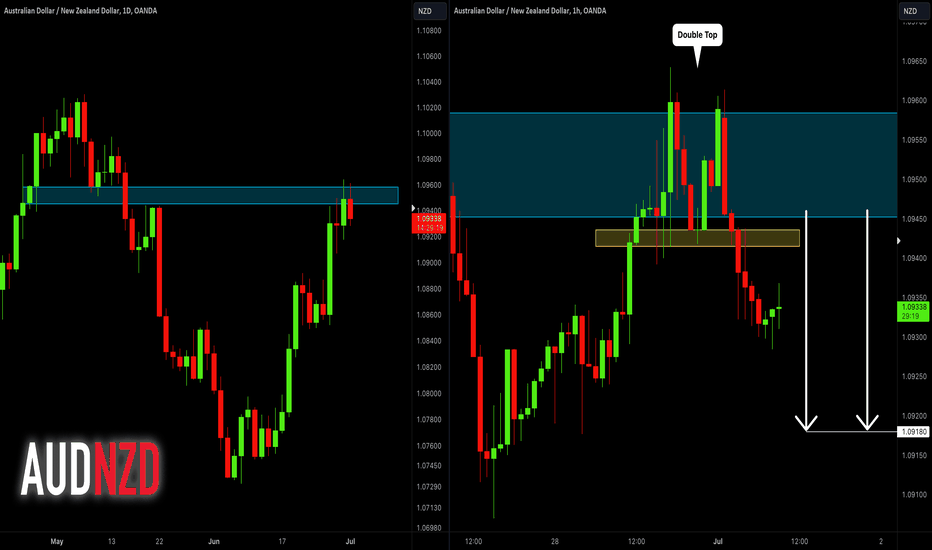

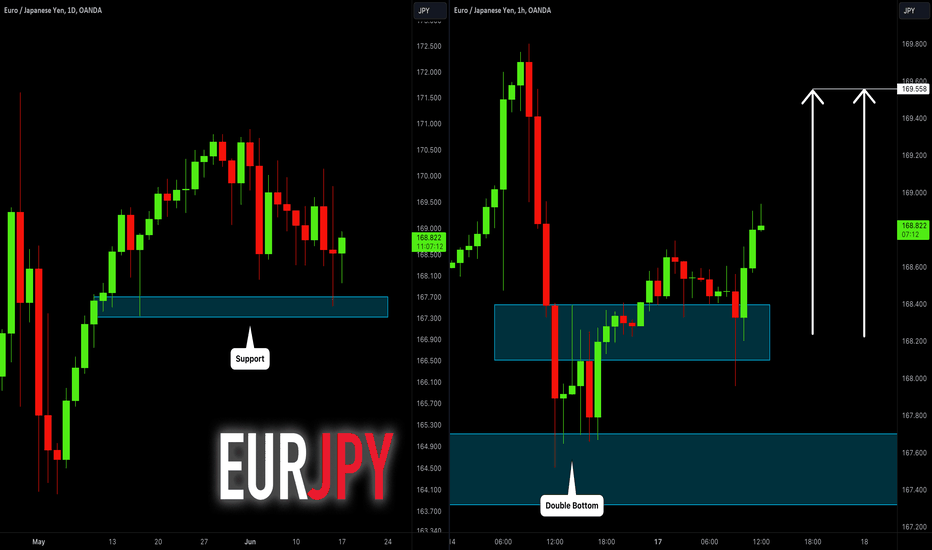

EURJPY: To The New Highs 🇪🇺🇯🇵

EURJPY broke and closed above a key daily resistance.

Retesting the broken structure, the price formed a double bottom

formation on that and violated its neckline then.

That confirms a strong bullish sentiment on the market.

The price will most likely rearch 172.0 level soon.

❤️Please, support my work with like, thank you!❤️

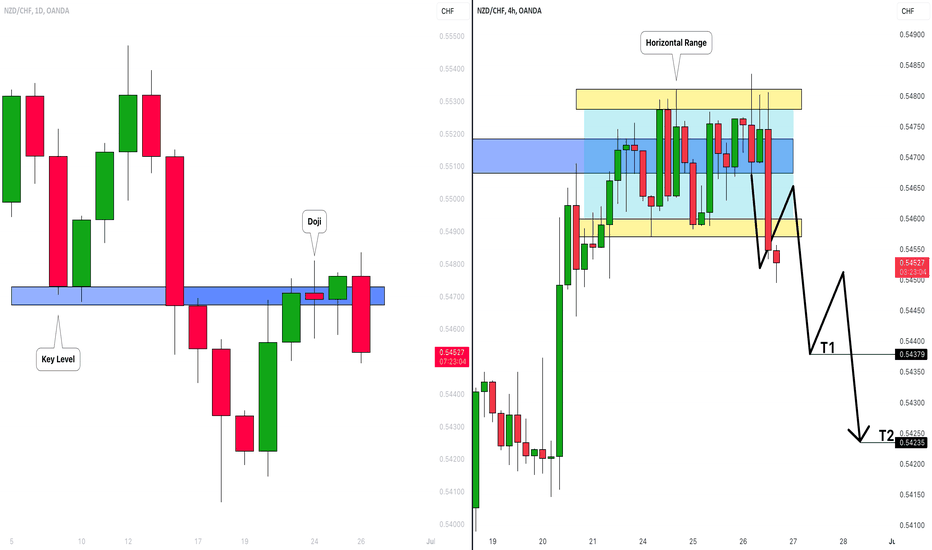

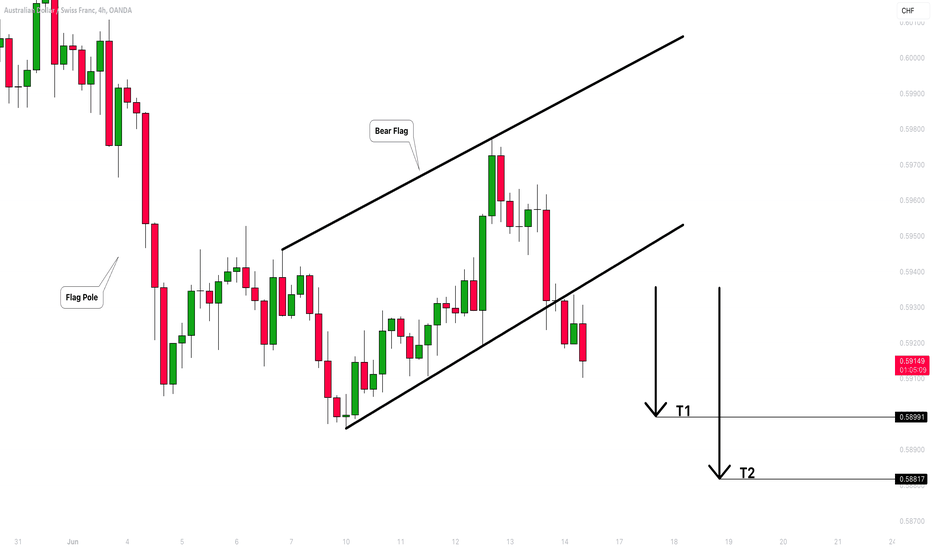

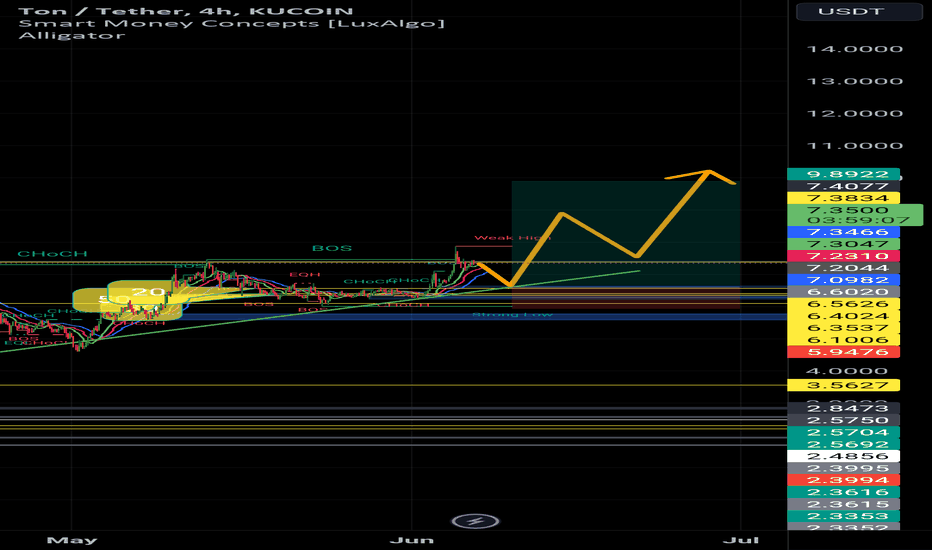

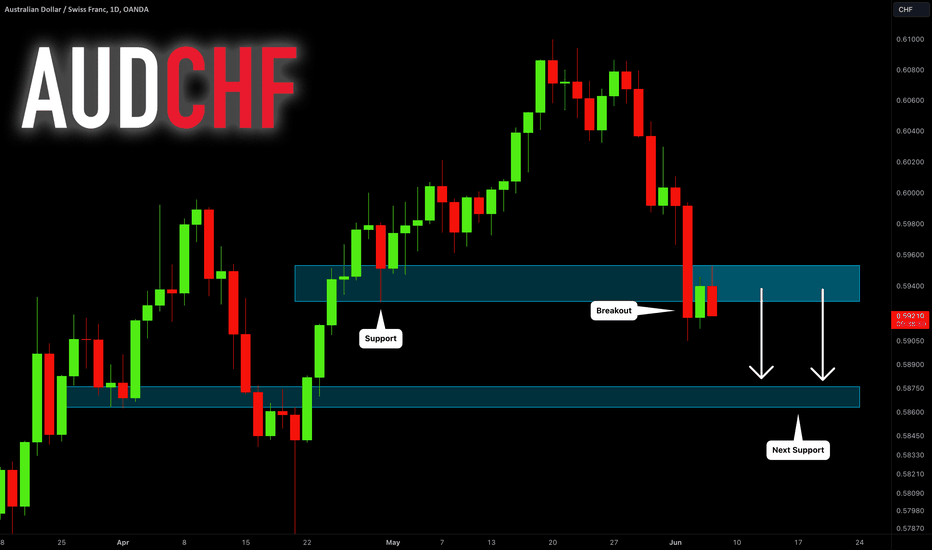

AUDCHF: Bearish Outlook Explained 🇦🇺🇨🇭

AUDCHF formed a bearish flag pattern on a 4H time frame,

after quite a strong bearish movement.

Breakout of the support of the flag is an important bearish signal.

The pair may keep falling now.

Goals: 0.5899 / 0.5880

❤️Please, support my work with like, thank you!❤️

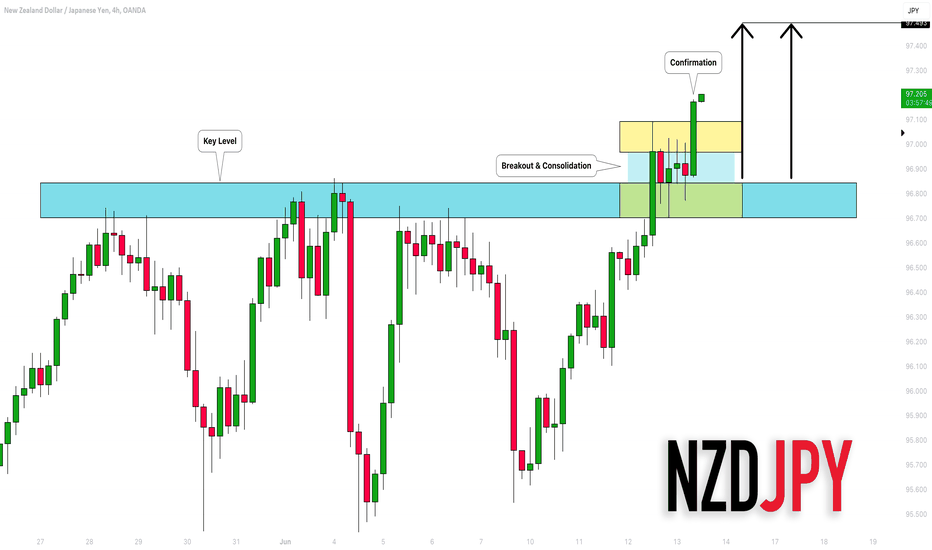

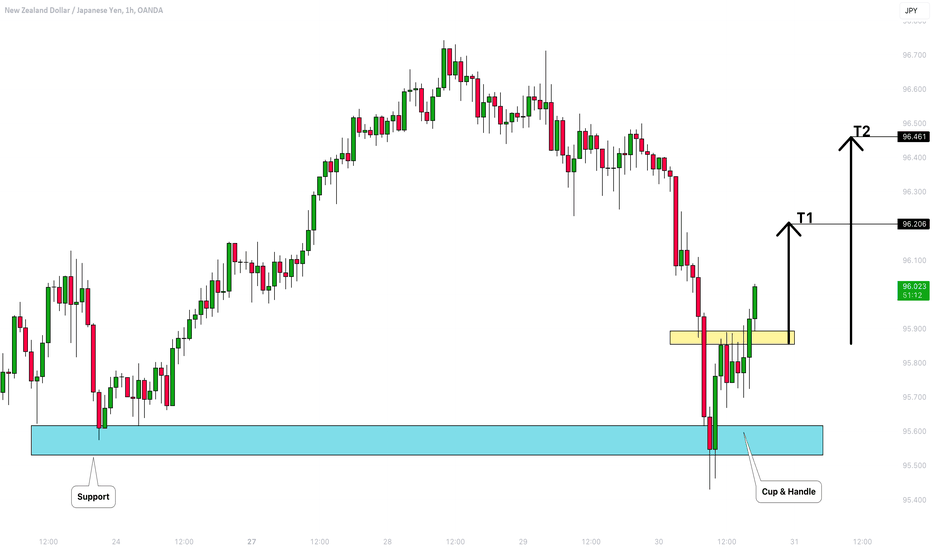

NZDJPY: Time to Buy 🇳🇿🇯🇵

NZDJPY broke and closed above a key daily structure resistance.

After a breakout, the market started to consolidate within a narrow range on a 4h time frame.

A retest of a broken structure triggered an impulsive bullish movement

and a violation of a resistance of the range.

It gives us a strong bullish confirmation.

I think that the pair will reach 97.5 level soon.

❤️Please, support my work with like, thank you!❤️

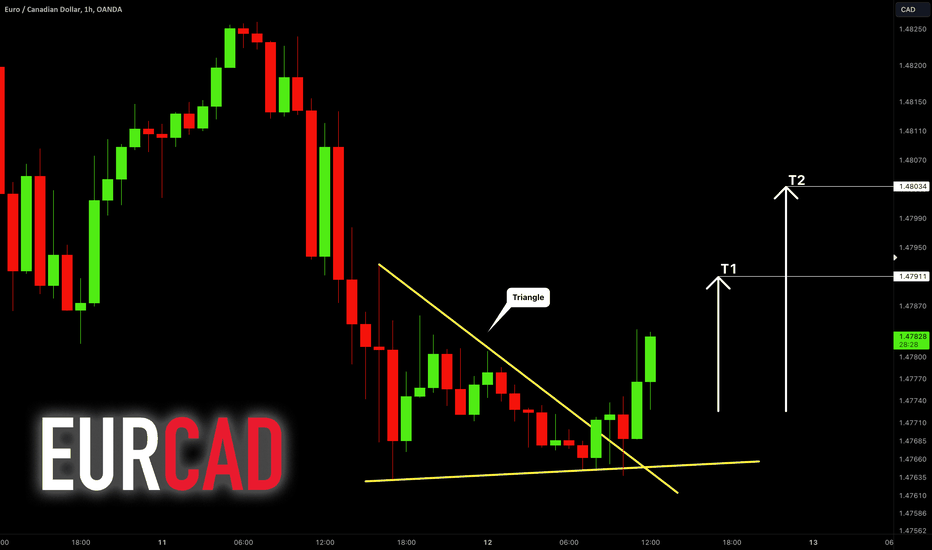

EURCAD: One More Oversold Pair 🇪🇺🇨🇦

One more EURO pair that looks oversold to me is EURCAD.

The price formed a triangle pattern on an hourly time frame.

Its resistance was broken and an hourly candle close above that.

We may see a correctional movement now.

Goals: 1.4790 / 1.4803

❤️Please, support my work with like, thank you!❤️

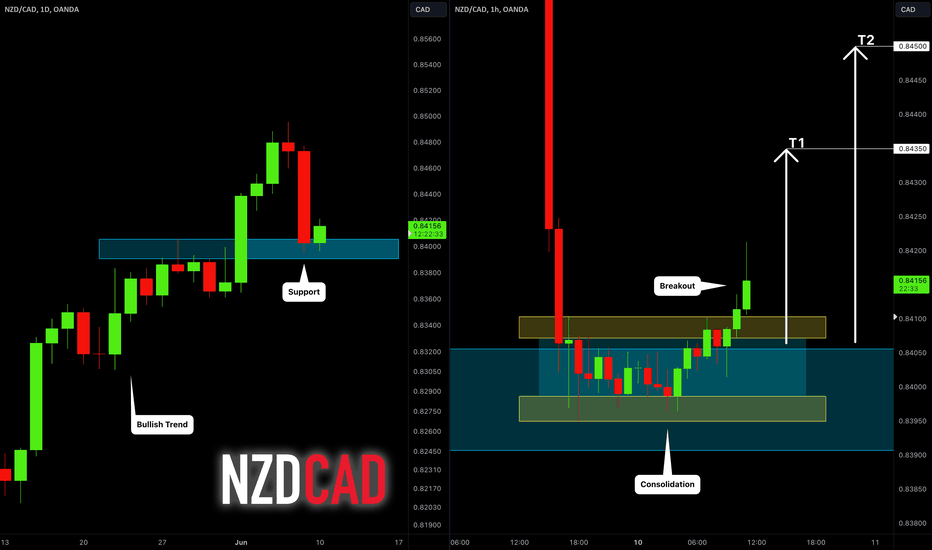

NZDCAD: Bullish Trend Continues 🇳🇿🇨🇦

Last week, NZDCAD corrected to a key daily horizontal structure support.

This morning, we see clear sign of strength of the buyers -

a bullish breakout of a narrow horizontal range on an hourly time frame.

It looks like the pair returns to a global bullish trend and a correction is over.

Goals: 0.8435 / 0.845

❤️Please, support my work with like, thank you!❤️

AUDCHF: Bearish Outlook Explained 🇦🇺🇨🇭

On the today's live stream, we discussed AUDCHF.

The pair broke a solid horizontal daily demand zone yesterday.

It turned into a supply area.

Taking into consideration that the market is under a strong bearish

pressure for 3 weeks, we may see a downward movement again.

Next support - 0.5875

❤️Please, support my work with like, thank you!❤️

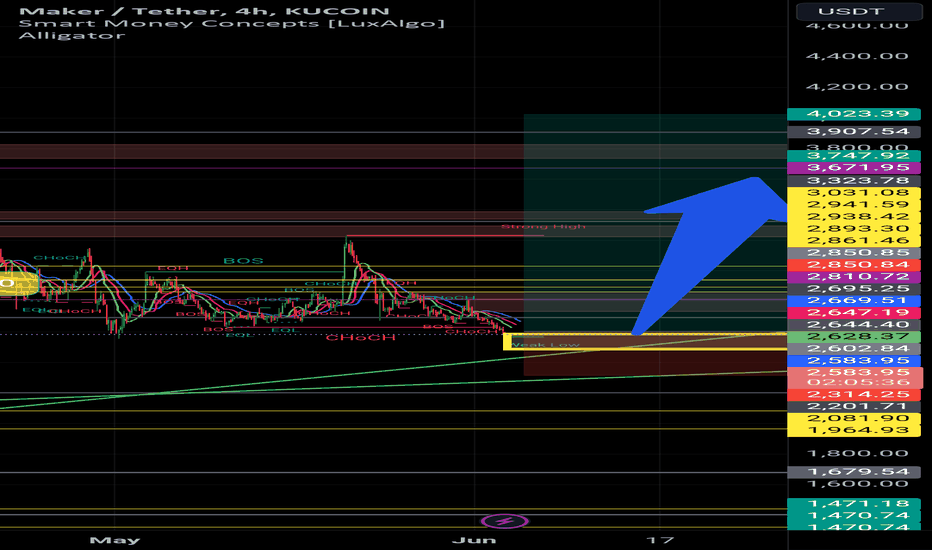

Maker (mkr)Mkr usdt

Time frame 4 hours

Risk rewards ratio >5👈👈👈

First target 3.200 $

Second target 4.000 "$

Yellow box js more important erea to start pump . Green line is supported line that must be watched.

Also we can refer to two bottom pattern

Finally, this Yellow box is my entrance erea surely.

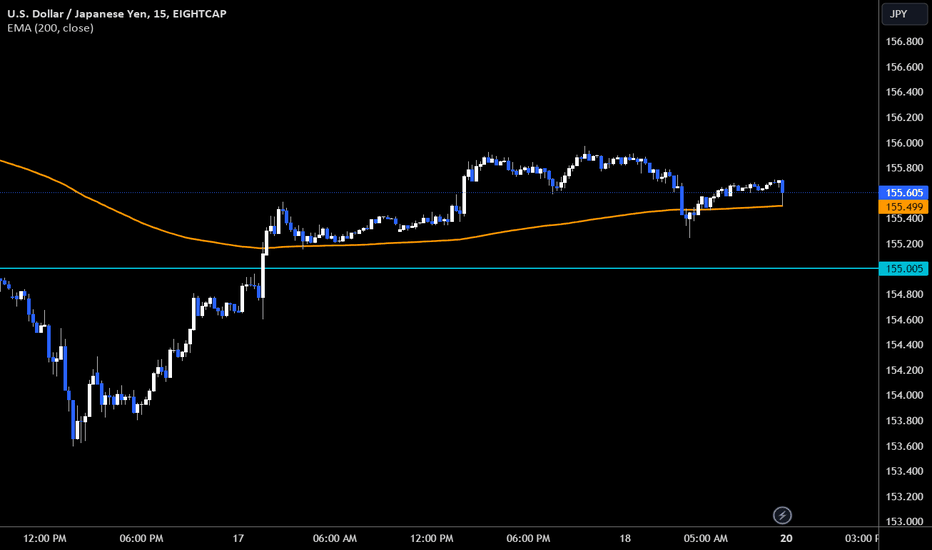

USDJPY Forecast for the WeekThe USD/JPY pair is experiencing volatility this week, driven by economic indicators and central bank sentiments. Initially pressured by lower-than-expected April inflation data, the US dollar saw potential for Fed policy easing, though Fed representatives have remained cautious. Weak preliminary Japanese GDP figures further contributed to uncertainty, potentially delaying Bank of Japan interest rate hikes. Technically, the pair is within a long-term ascending channel, with resistance at 156.25 and support at 153.12. Technical indicators suggest an uptrend continuation, but traders are closely monitoring central bank actions and key levels for further direction.

Resistance levels: 156.25, 159.37, 162.50.

Support levels: 153.12, 150.00.

Long positions can be opened above the 156.25 mark with targets of 159.37, 162.50 and stop-loss around 154.00.

Short positions should be opened below the level of 153.12 with the target of 150.00 and stop-loss around 155.20.