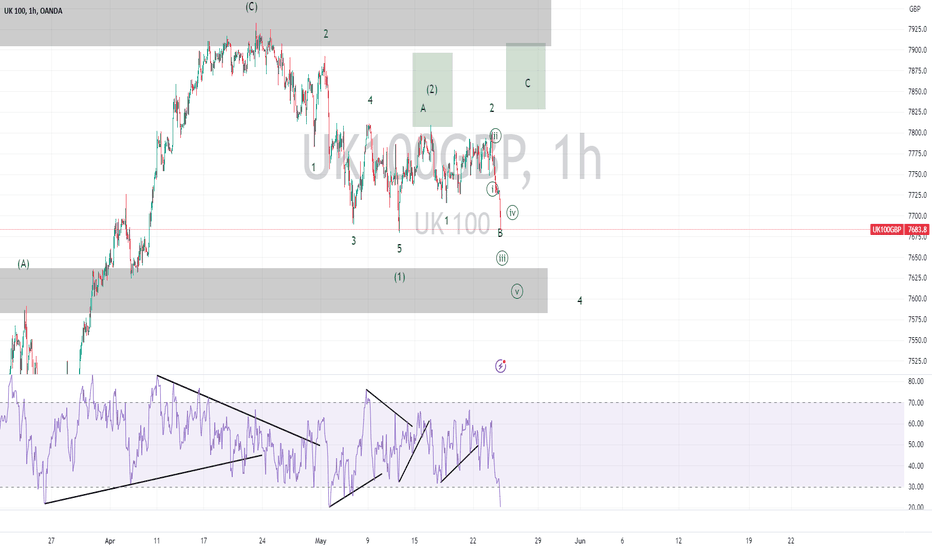

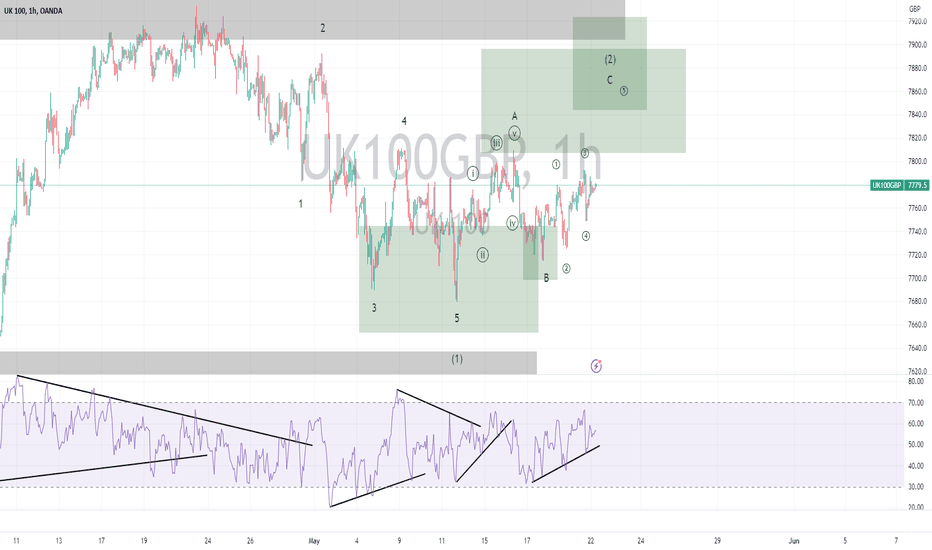

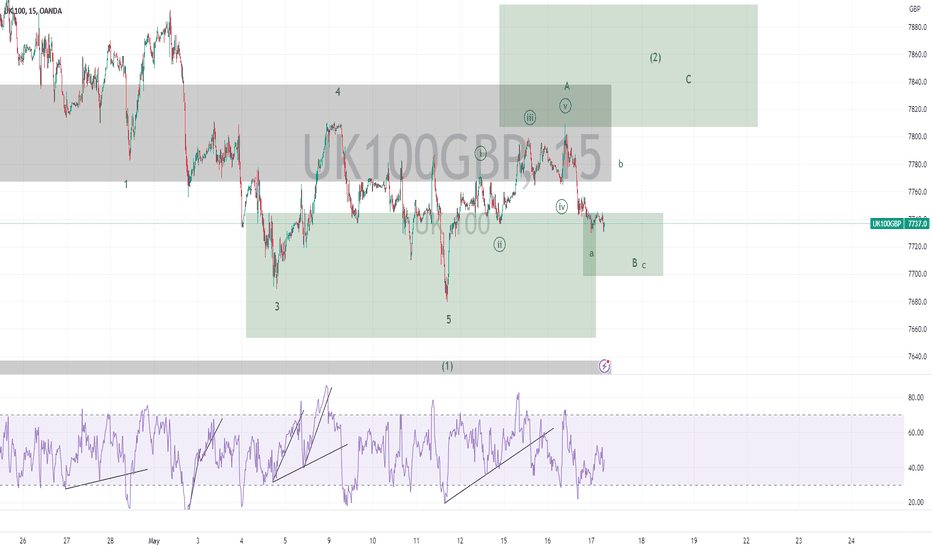

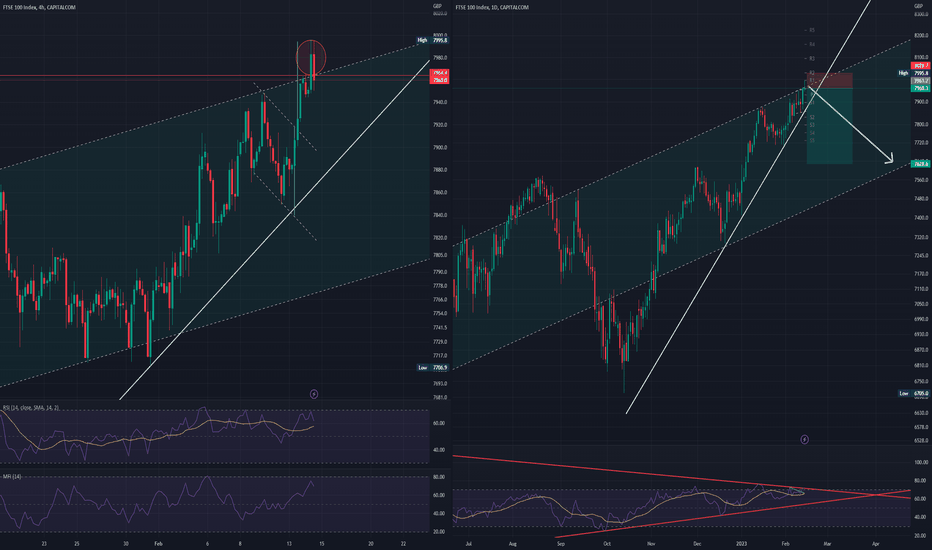

FTSE Elliott Wave Analysis for Wednesday 24/05/2023Trading day preparation. We discuss several scenarios that could play out. The FTSE is giving us a messy structure for the moment. It is hard to see potential entries for a trade. We define an area to go long and an area to go short but we need more data in order to confirm.

FTSE

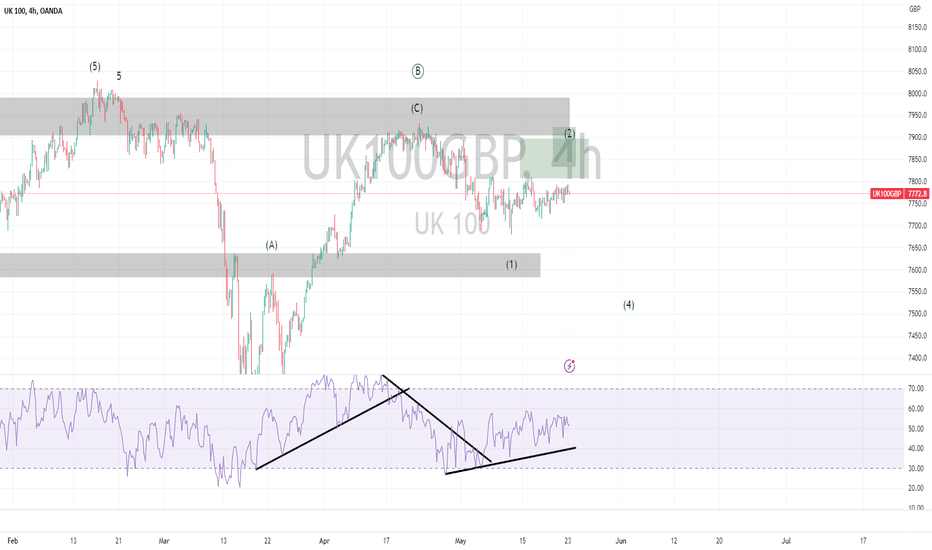

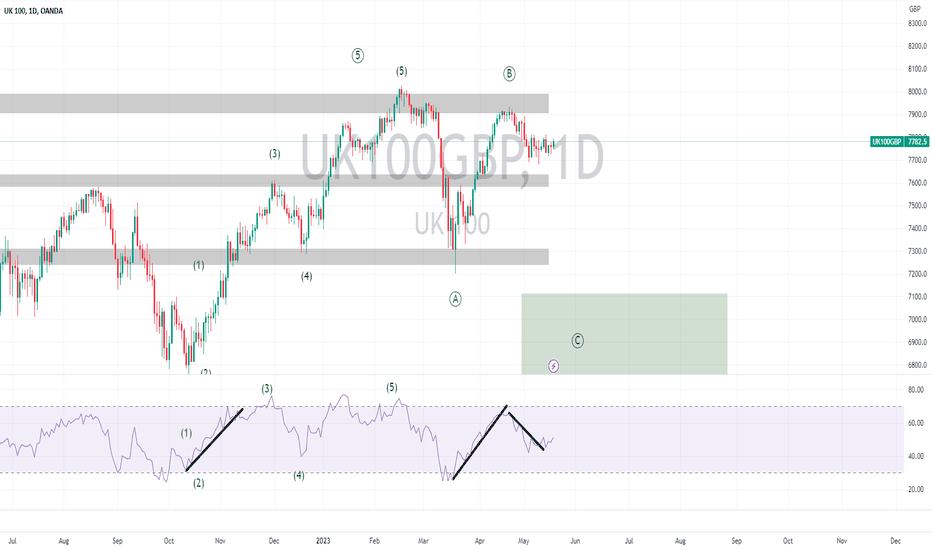

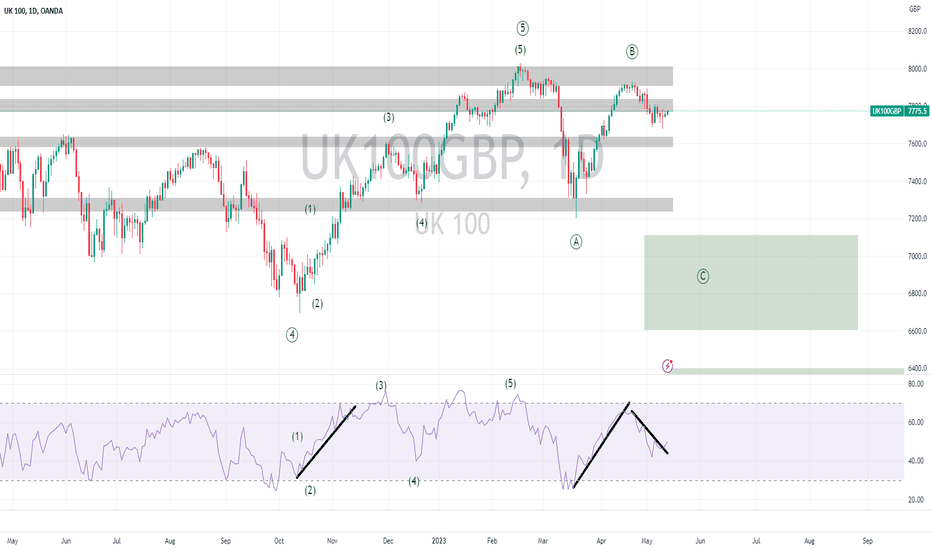

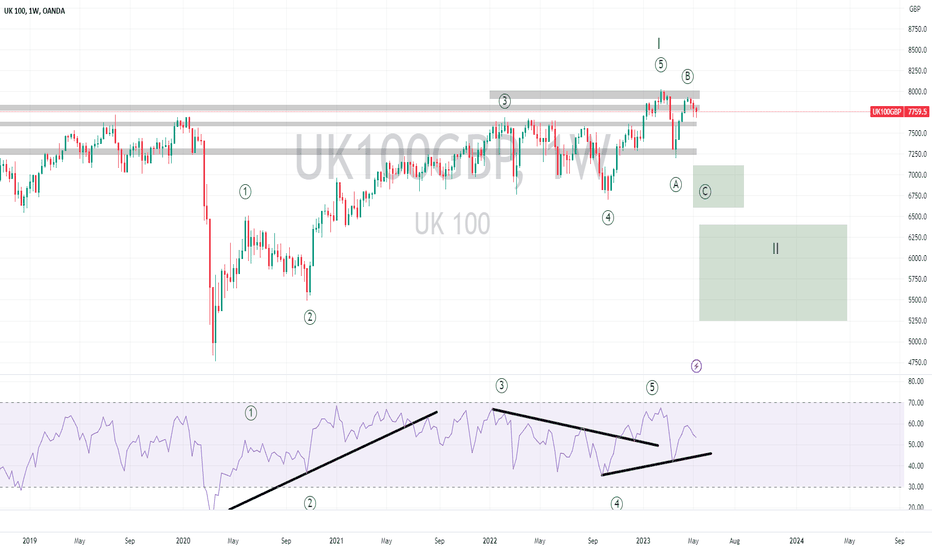

FTSE Elliott Wave Analysis for Sunday 21/05/2023A pullback in the higher timeframe seems likely. We have 5 waves up as an impulse in the weekly, daily, and 4h timeframe. However, as divergence in the weekly is not really outspoken, a new high is still possible. Investors should wait for the pullback to buy. Traders should analyze the lower timeframe.

FTSE Elliott Wave Analysis for Sunday 14/05/2023A pullback in the higher timeframe seems likely. We have 5 waves up as an impulse in the weekly, daily, and 4h timeframe. However, as divergence in the weekly is not really outspoken, a new high is still possible. Investors should wait for the pullback to buy. Traders should analyze the lower timeframe.

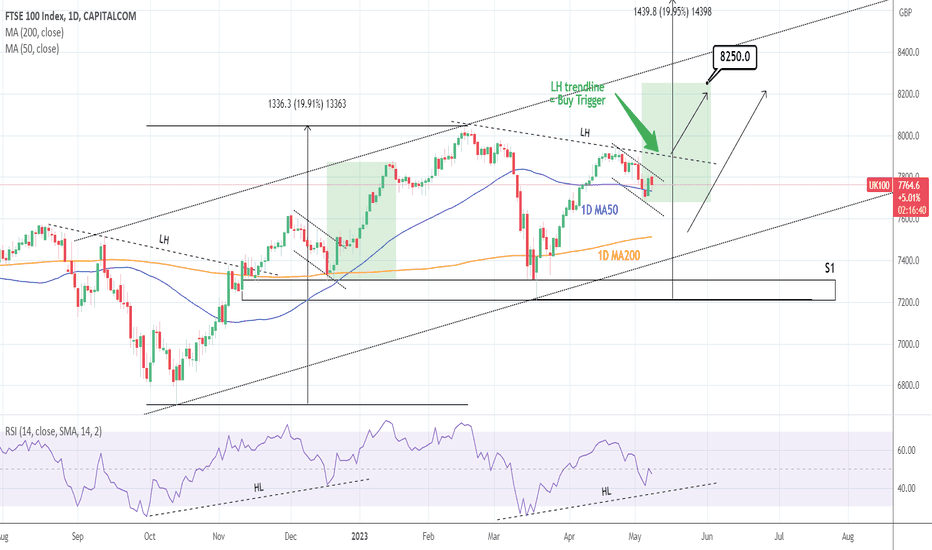

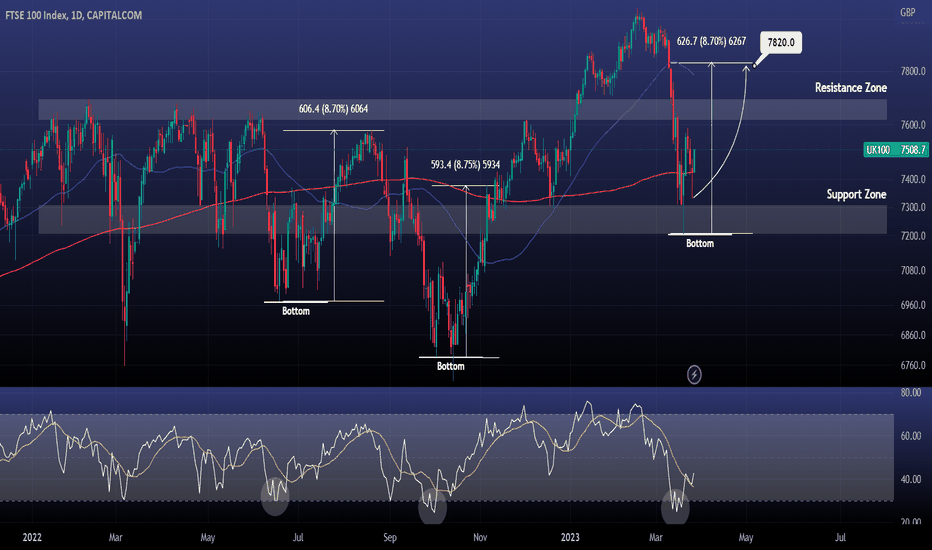

UK100:FTSE Rebounds on Double Bottom and Positive UK GDP Data

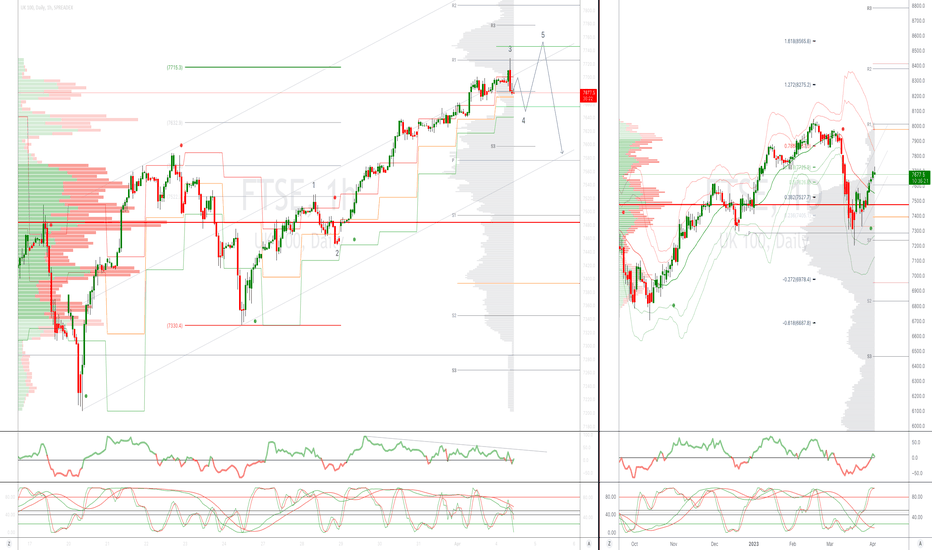

The FTSE has shown signs of a potential price increase after a Double Bottom pattern and Divergence were identified on the 4-hour timeframe. This movement is likely to continue in the direction of the current trend. The recent growth in value can be attributed to positive data from the UK, which showed a 0.1% increase in quarterly GDP in Q1. In addition, both Industrial Production and Manufacturing Production expanded by 0.7% in March.

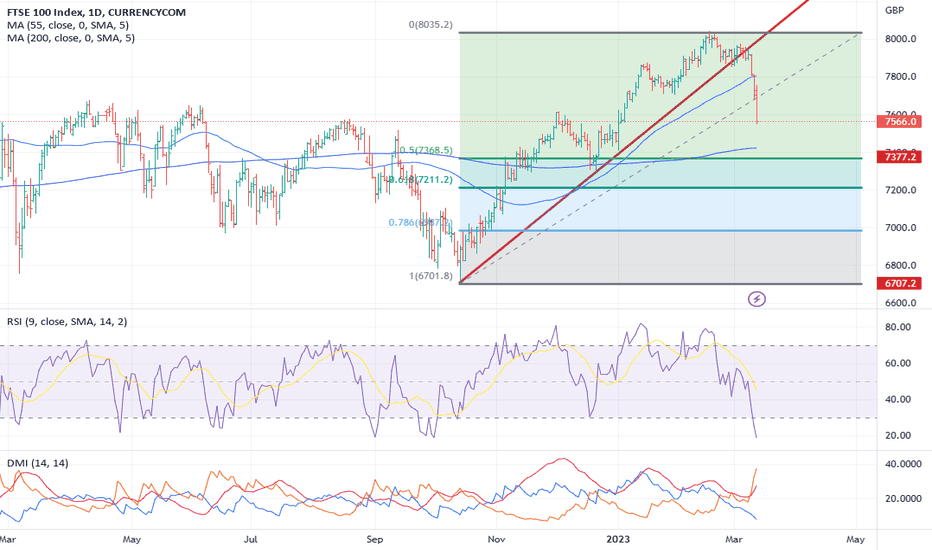

FTSE: About to give a strong longterm buy signalFTSE100 has been trading inside a Channel Up since the October 13th 2022 bottom, currently pulling back after a rejection on the internal LH trendline. This has turned the 1D timeframe neutral (RSI = 48.285, MACD = 4.950, ADX = 49.378) and with the price on the 1D MA50, those are the conditions for a buy.

The Buy signal trigger however would be the index crossing over the LH trendline, as it did on a similar pattern on November 10th 2022. We will buy either on that trigger or on the 1D MA200. In both cases TP = 8,250.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

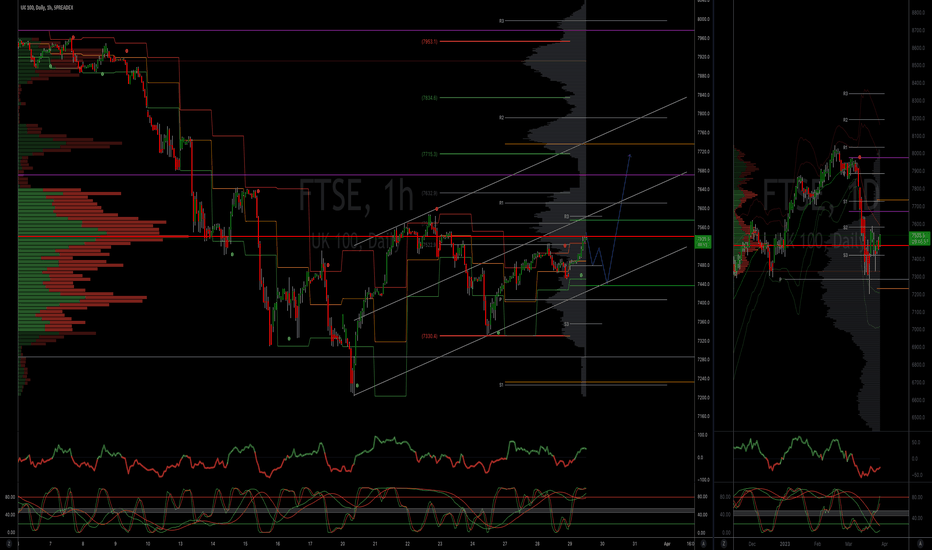

UK100 to start a selloff?UK100 - 24h expiry -

We are trading at overbought extremes.

Short term MACD has turned negative.

A break of 7800 is needed to confirm follow through negative momentum.

Short term bias has turned negative.

We look for losses to be extended today.

We look to Sell a break of 7799 (stop at 7838)

Our profit targets will be 7701 and 7681

Resistance: 7835 / 7860 / 7880

Support: 7809 / 7780 / 7750

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

FTSE to breakdown from a wedge?UK100 - 24h expiry -

Previous support located at 7740.

Previous resistance located at 7800.

We are trading close to the end of an ascending Ending Wedge Formation.

We expect a reversal in this move.

A move through 7740 will confirm the bearish momentum.

We look to Sell a break of 7740 (stop at 7820)

Our profit targets will be 7560 and 7550

Resistance: 7800 / 7820 / 7850

Support: 7740 / 7700 / 7550

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Has FTSE formed a swing low?UK100 - Intraday -

Previous support located at 7600.

Previous resistance located at 7650.

Price action has continued to trend strongly lower and has stalled at the previous support near 7500.

Price action looks to be forming a bottom.

Risk/Reward would be poor to call a buy from current levels.

A move through 7650 will confirm the bullish momentum.

We look to Buy at 7521 (stop at 7456)

Our profit targets will be 7681 and 7711

Resistance: 7650 / 7700 / 7750

Support: 7600 / 7500 / 7400

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

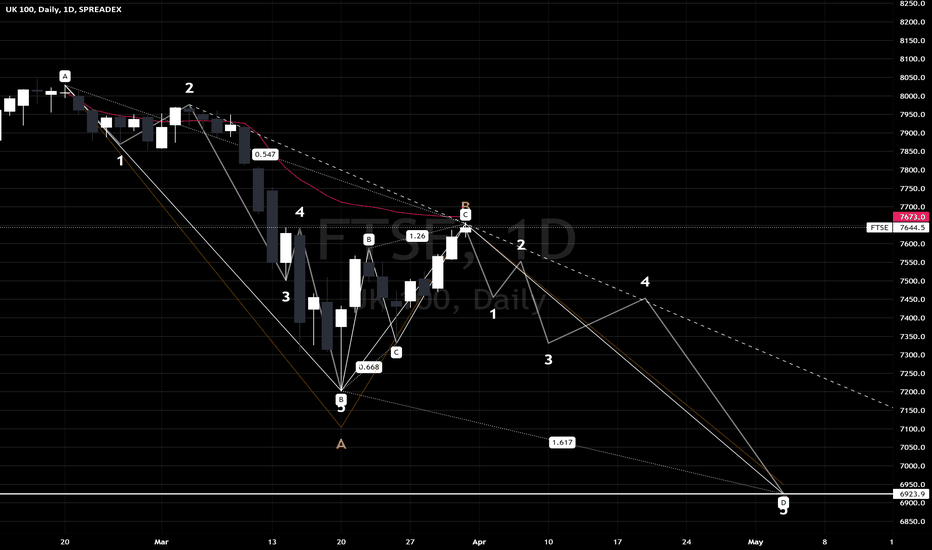

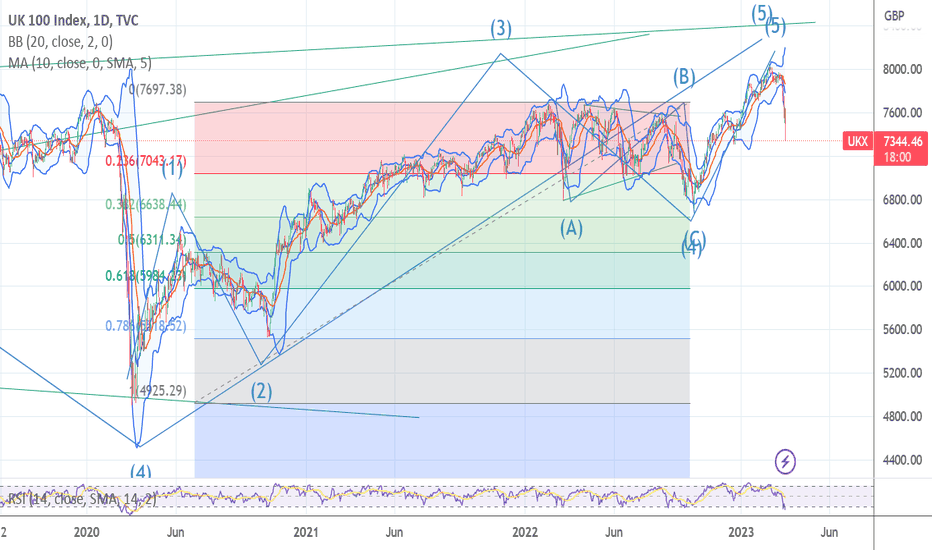

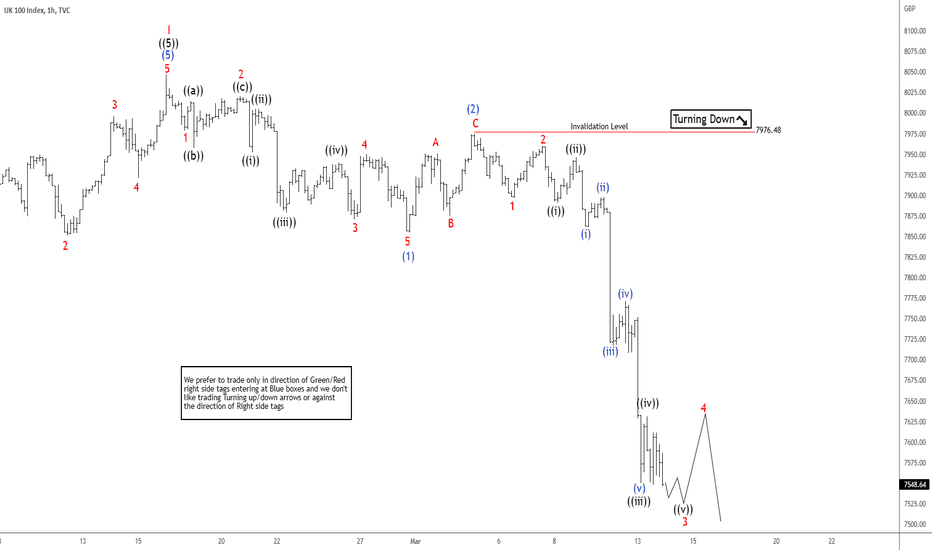

Impulsive Elliott Wave Decline in FTSE Calling More DownsideFTSE ended cycle from 3.16.2020 low with wave I at 8047.06. The Index is now in the process of correcting this 3 year rally in wave II. The internal subdivision of wave II is unfolding as a zigzag Elliott Wave structure. A zigzag structure is a 5-3-5 structure with ((A))-((B))-((C)) as the label. Wave ((A)) and ((C)) in this case subdivides into 5 waves impulse. In the 1 hour chart below, FTSE is still within wave ((A)) of II with subdivision as 5 waves. Down from wave I, wave 1 ended at 7978.61 and wave 2 ended at 8020.13.

The Index then resumes lower in wave 3 towards 7870.39, and wave 4 ended at 7949.97. Final leg lower wave 5 ended at 7854.82 which completed wave (1). Rally in wave (2) ended at 7976.48 with subdivision as a zigzag structure. Up from wave (1), wave A ended at 7950.69 and pullback in wave B ended at 7875.03. Wave C higher ended at 7976.48 which completed wave (2). The Index resumes lower in wave (3). Down from wave (2), wave 1 ended at 7897.45 and rally in wave 2 ended at 7959.77. Expect the Index to extend lower 1 more time to end wave 3, then it should rally in wave 4 and extends lower again. Near term, as far as pivot at 7976.48 high stays intact, expect rally to fail in 3, 7, or 11 swing.

During periods of volatility markets mean revert to long term maDisclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.