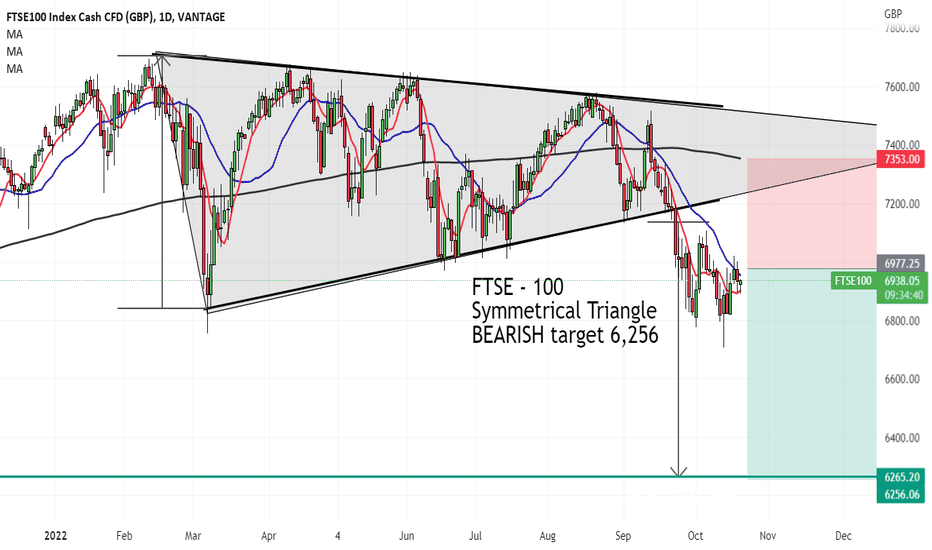

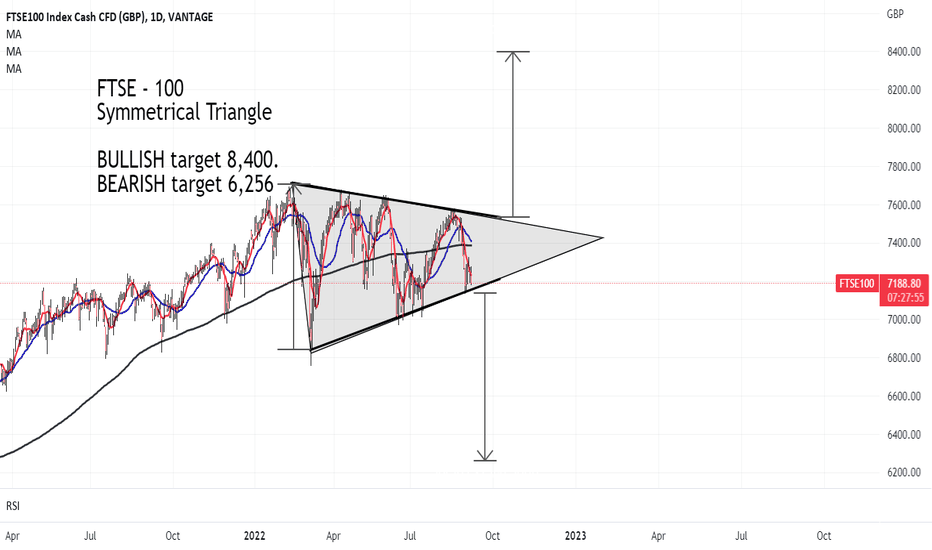

FTSE100 next down drop thanks LIZ!FTSE - 100

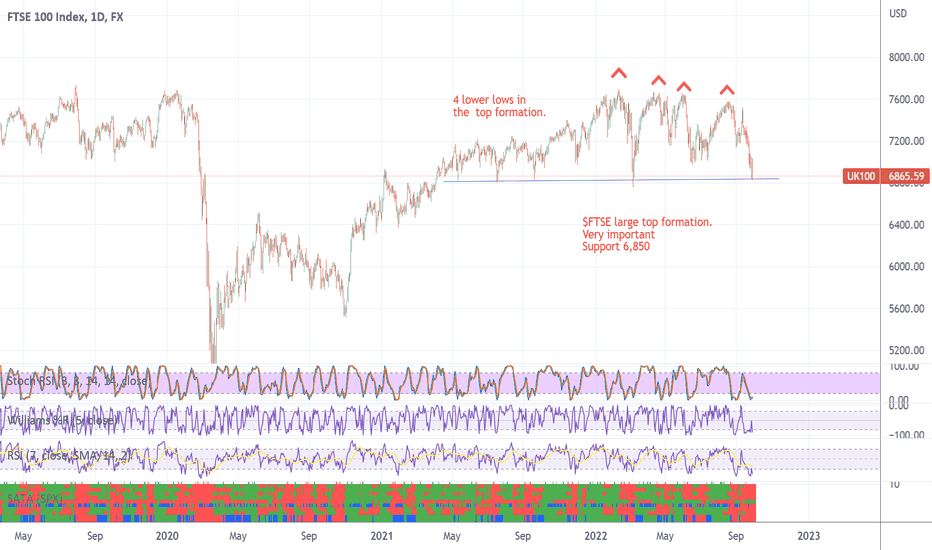

Symmetrical Triangle

Price broken down and showing momentum picking up

RSI is below 50 and is making lower highs - BEARISH

BEARISH target 6,256

Ftse100

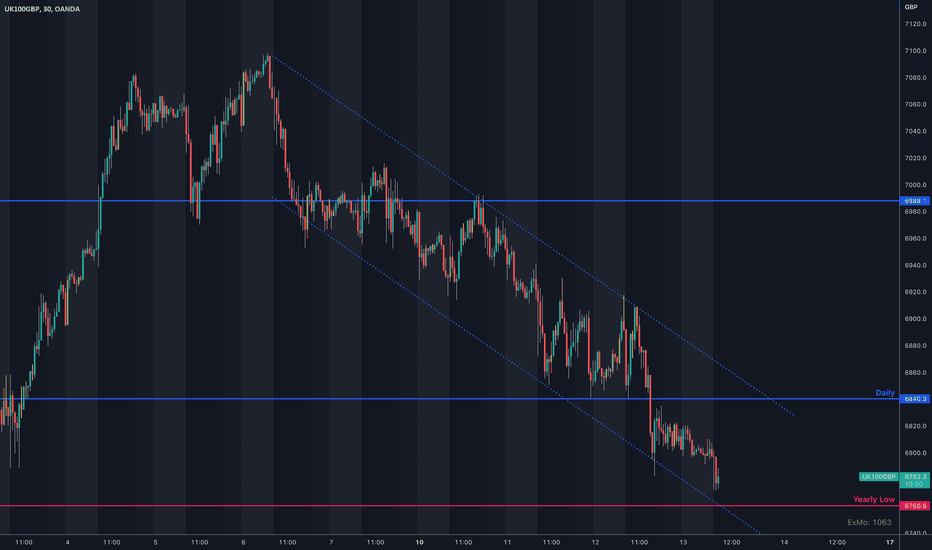

FTSE approaches Yearly Low Watching FTSE 100 as it approaches the yearly low @ 6760. The market has been slightly more resilient than its counter parts due to the decentralised nature of the companies that make up the index, however breaking the low would be a significant moment and could spell further downside.

There are levels to watch below this but we need to reference the Covid drop and recovery so I would anticipate a large flush down on a level break before we stabilise.

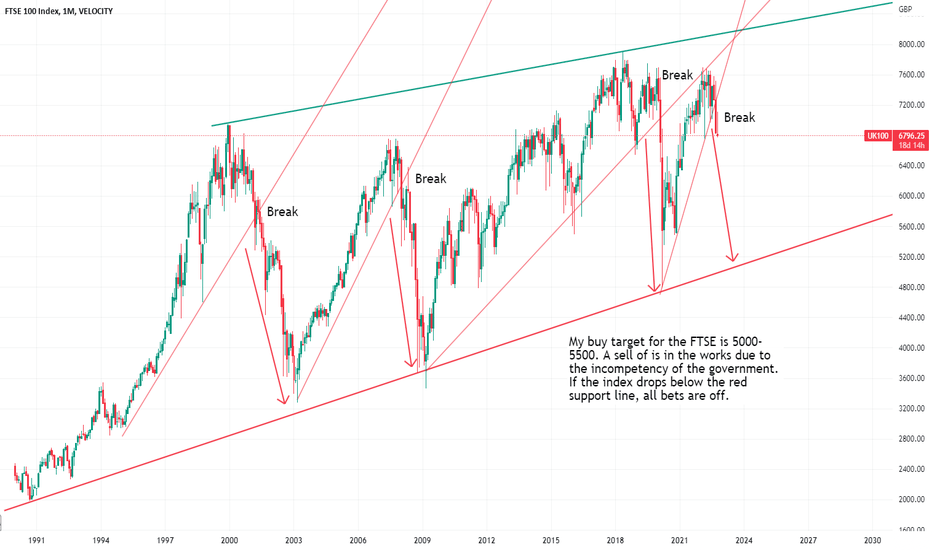

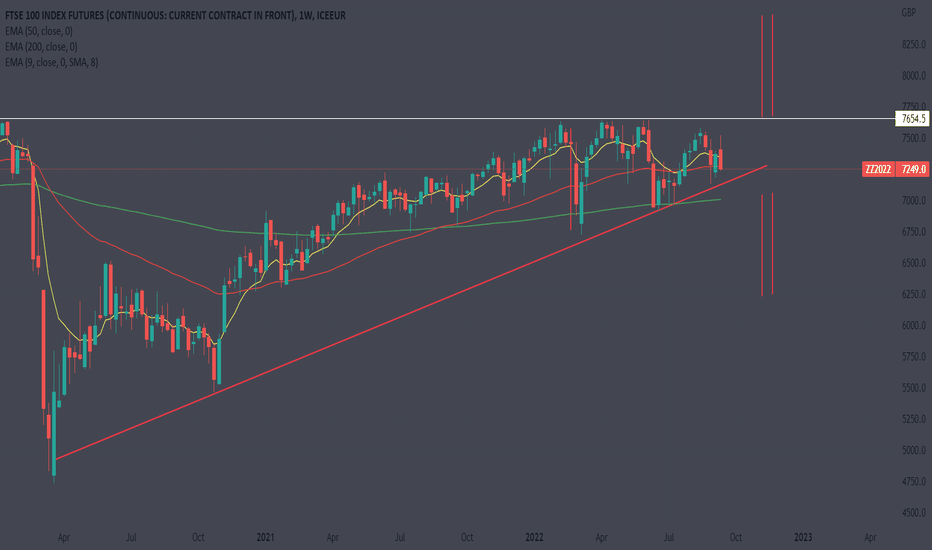

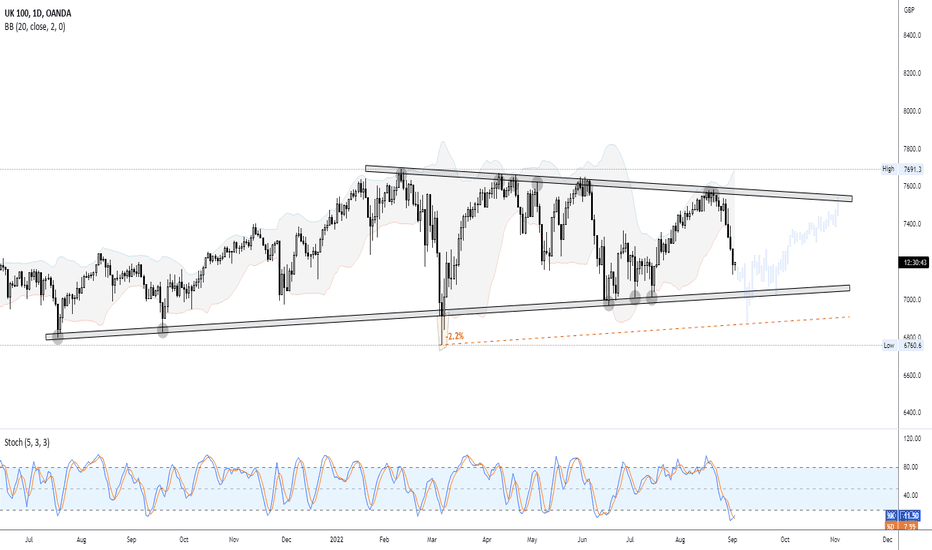

Short UK stocks until the red line support is met.Every time the short term support line is broken the FTSE100 index has always reverted down to the red long term support trendline.

Therefore, it is sensible to assume that this will be the case again. A buy target of 5000-5500 is reasonable, however if the index drops below 5000, all bets are off.

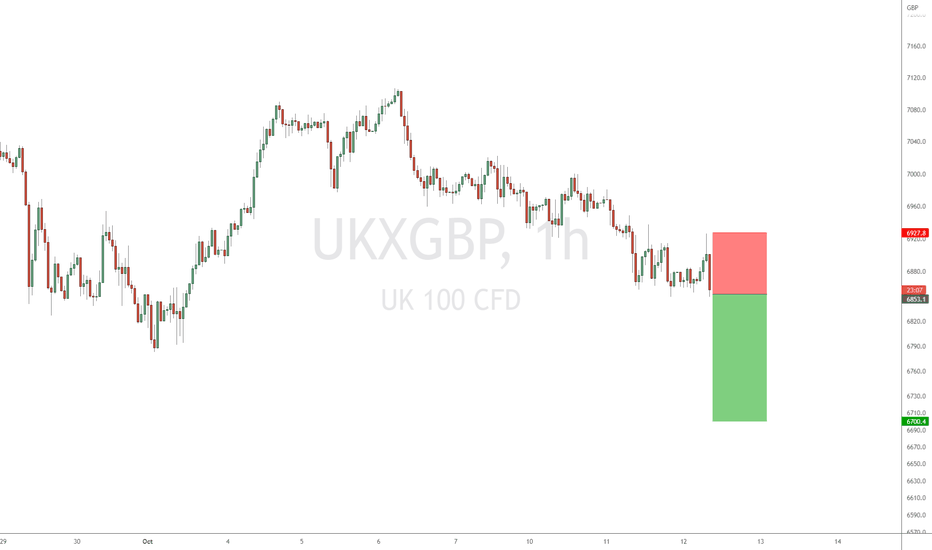

Joe Gun2Head Trade - Will the major support at 6822 hold?Trade Idea: Selling FTSE100

Reasoning: Intraday Bullish Flag on CADCHF

Entry Level: 6853

Take Profit Level: 6700

Stop Loss: 6928

Risk/Reward: 2.04:1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

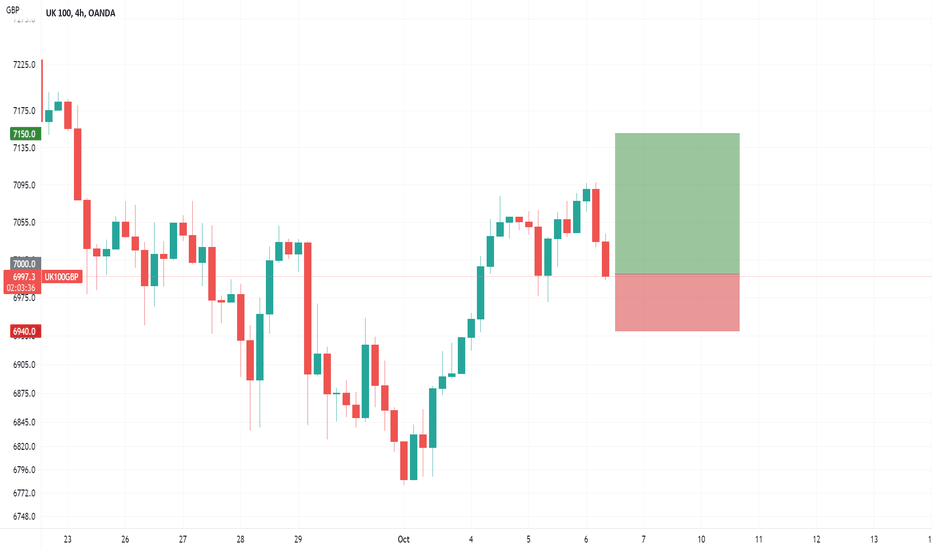

Buying UK100 at market.UK100 - Intraday - We look to Buy at 7000 (stop at 6940)

Previous support located at 7050.

Previous resistance located at 7100.

Price action looks to be forming a bottom.

Risk/Reward would be poor to call a buy from current levels.

Our profit targets will be 7150 and 7170

Resistance: 7100 / 7150 / 7170

Support: 7050 / 7000 / 6950

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

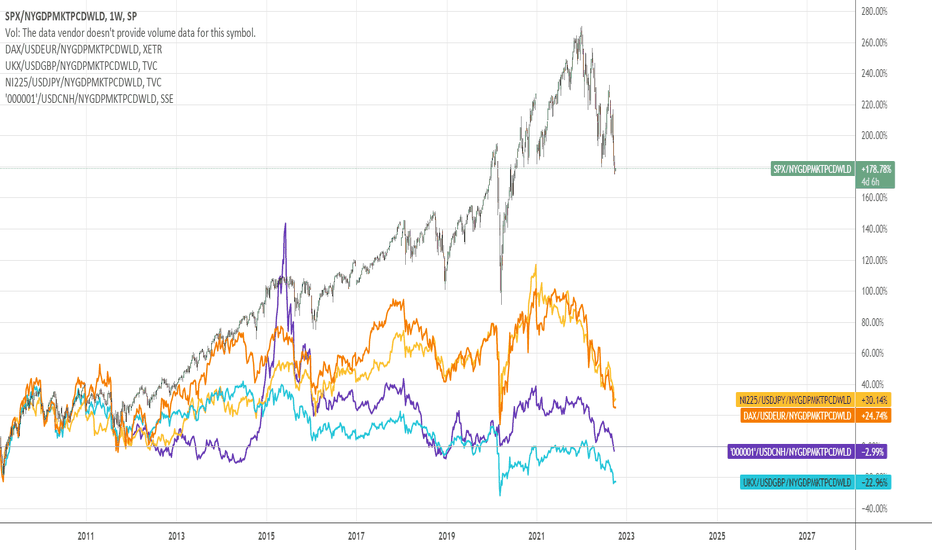

MAJOR INDICES in USD / WORLD GDPFormula: (Major Indices/USDxxx)/World GDP (Gross Domestic Product)

Indices: USA, Germany, Japan, UK, China. (all converted to USD)

After the 2008-2009 bottom, USA performed much better than other countries. So, what's next? We can expect other countries to perform better even a bit from now on. But that dosen't mean that the stock markets will rise. It's a bit confusing, because there are high differences between them, as seen. If we focus on USA, we can say that the stock market is expensive. But others don't tell the same. We will see...

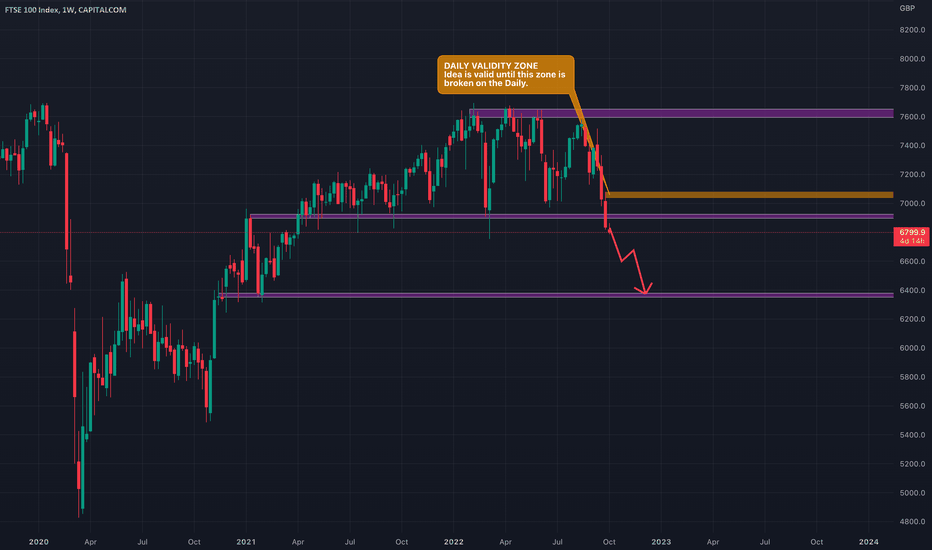

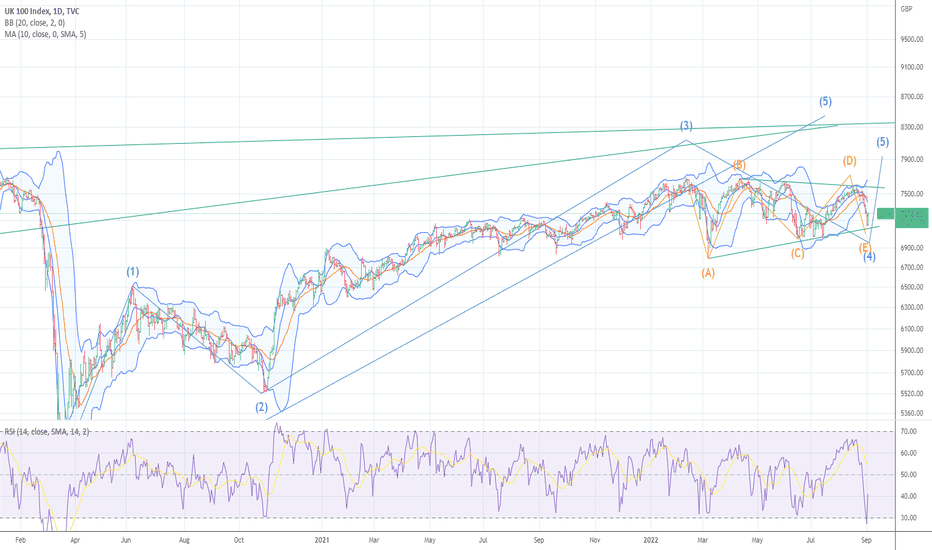

FTSE broke out of weekly rangeHi Everyone!✋🏽

UK100 closed below the lower boundary of the range that started to build up in April '21. It can easily fall to the next weekly breakout that is approx. the same distance as the size of the range. Every countertrend on the lower timeframe is an opportunity to go short until the start of the Daily impulse wave is taken back by the buyers on the Daily chart - currently marked as the validity zone.

ANYWAY, a lot of Qs about the direction of the price. But it doesn't matter. WE JUST REACT!

Trade safe! ⚪️⚫️

----------------------------------------------------------------------------

Thanks for reading my analysis!🤘🏽

Remember that trading is a risky business.

SIZE your TRADES according to your risk aversion!

----------------------------------------------------------------------------

Please remember to support the idea with a BOOST or COMMENT

with your highly appreciated opinion!

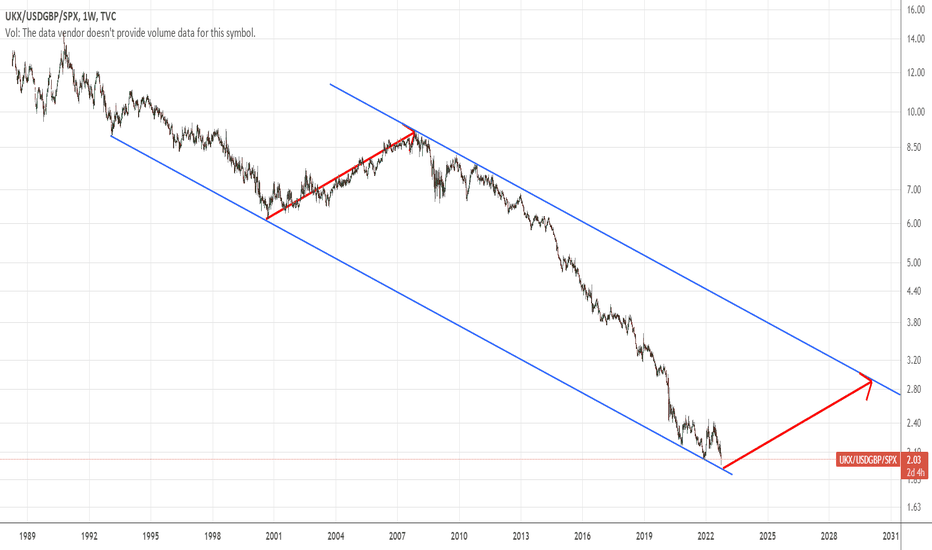

Europe&Japan to perform better than USA from now on, 3-UKComparision of "FTSE (UKX) in USD dollars" to "SPX".

I am publishing the same for all (please see my other analysis): Germany, UK, Japan.

I ignore all the fundamentals and only make technical analysis. Fall of EUR&GBP&JPY and their stock market's negative divergence compared to USA (SPX) is about to end, I believe.

Important: This doesn't mean that the equities&indices are going to rise from now on. My analysis only says: Europe&Japan will perform better than USA. Just because they are very cheap.

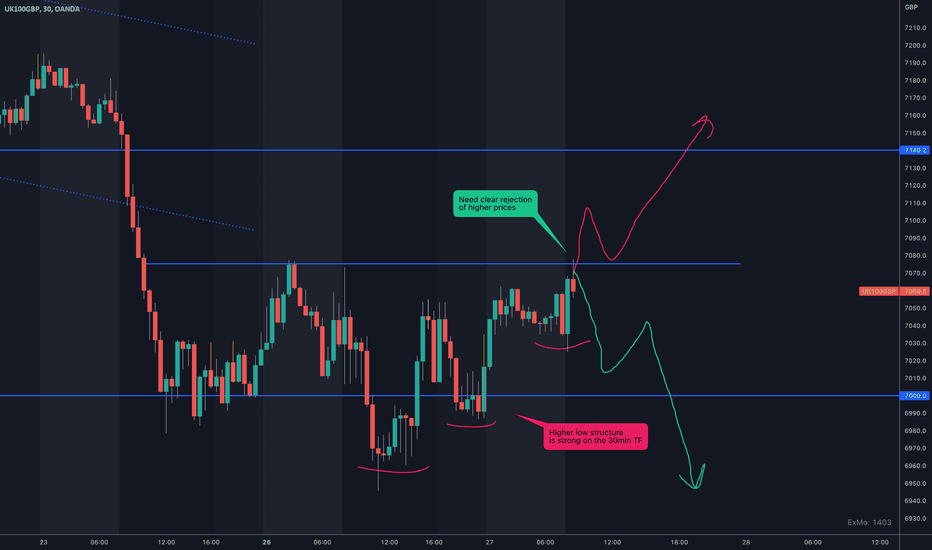

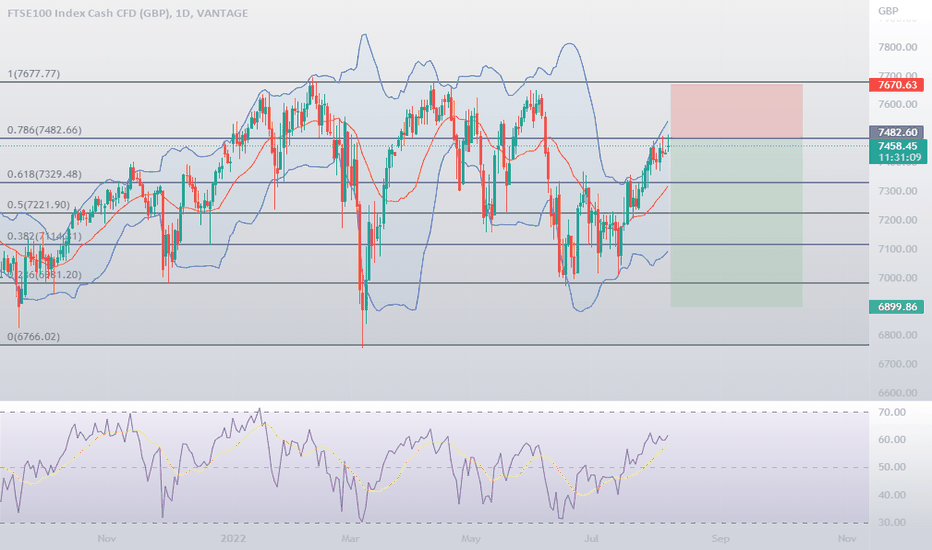

Watching both directionsLONG CASE

FTSE has found its footing from the lows of yesterday and has started to build a 30min higher low structure, with the most recent higher low coming very quickly after the recent swing higher. Would need to see a clear break of the 7080 level and a backtest of support with a bullish close before taking a position.

SHORT CASE

Price action has been beat over the past week and the recent budget announcement has done little to quell fears of further inflation. The technical perspective is this resistance line at 7080 which is the only local level we have until ~7200. Would need to see a clear rejection of higher prices followed by a bearish close.

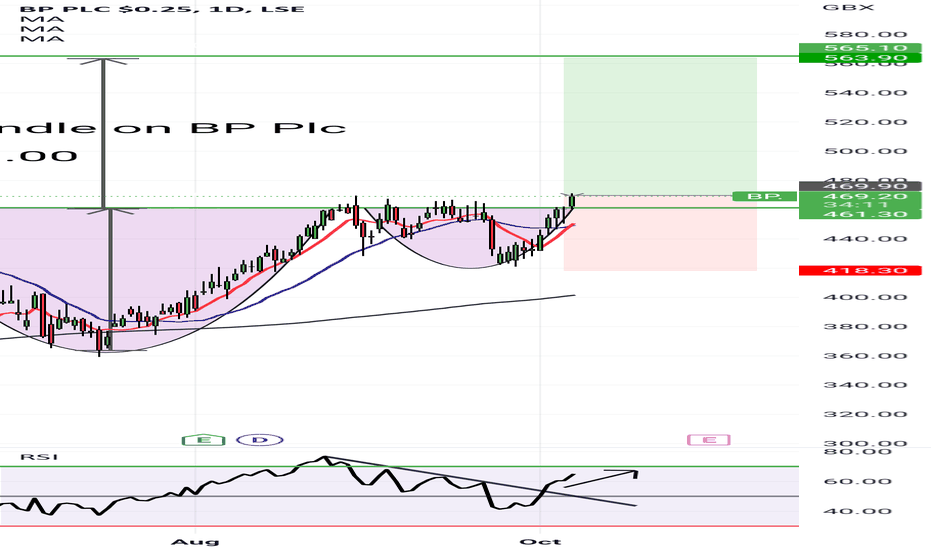

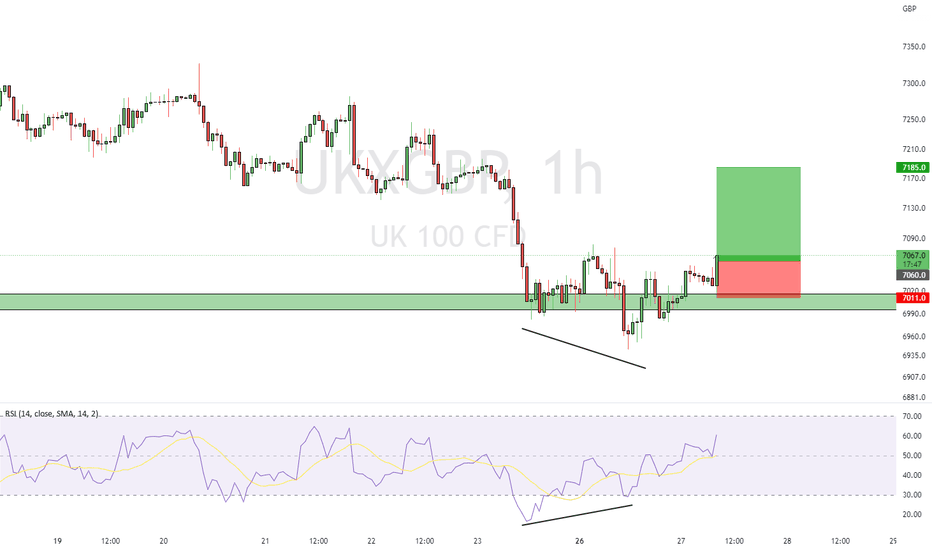

Jamie Gun2Head Idea - Buying FTSETrade Idea: Buying FTSE

Reasoning: Holding major support on the daily timeframe, RSI oversold too. On hourly chart, RSI divergence and market opening strong today. Looking for a corrective move higher.

Entry Level: 7060

Take Profit Level: 7185

Stop Loss: 7011

Risk/Reward: 2.55:1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

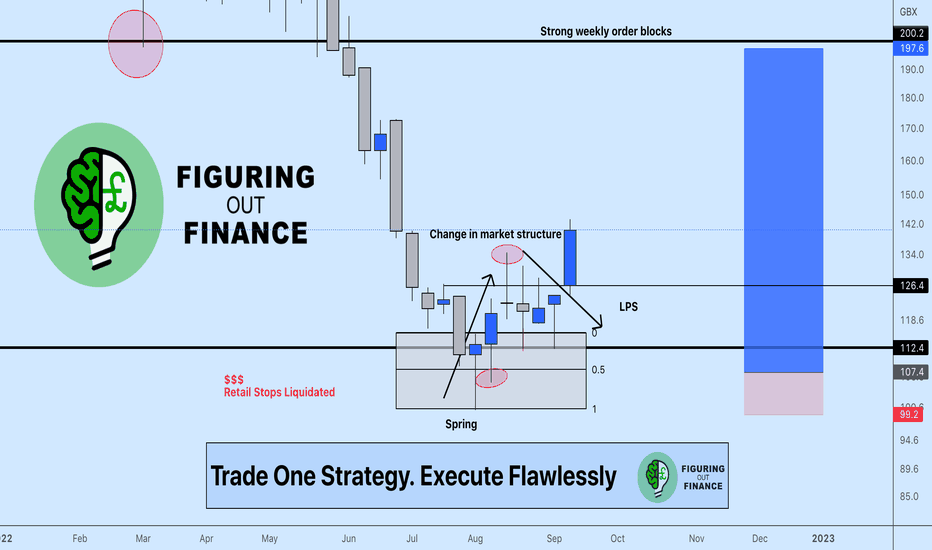

Smart Money Concepts in action - 30% profit, runningGood Day.

In principle, Smart Money Concepts/Order Block Strategies/Wyckoff (to name just a few), aim to do one thing - identify where Banks & Financial Institutions are stacking their buy or sell orders, anticipate Retail Trader stops being liquidated, and jump on board to ride the wave with the Smart Money.

OTB (On The Beach) is a UK-based travel operator, a sector that's been beat-down heavily in recent weeks - and recently re-visiting its Covid Lows. Perfect opportunity for Smart Money to manipulate the market, trap sellers and liquidate early buyers who sold off in fear.

BFI's do this every week - rinse and repeat.

Our Strategy anticipates the 'washout', and enters on c.50% fib of the Spring.

Let me know what you think of the trade set-up above - we anticipate holding on for a good deal longer, for a 2-3X return.

Best,

Figuring Out Finance

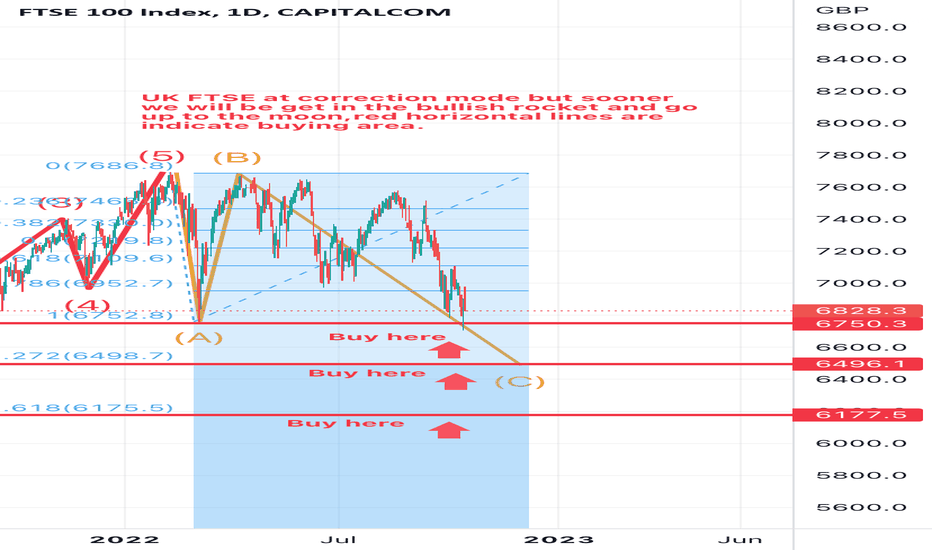

FTSE 100 Symmetrical Triangle Break up or downFTSE - 100

Symmetrical Triangle

As the previous trend was UP, there is definitely a better chance at the price breaking up and out of the Symmetrical Triangle formation which will head to the first target 8,400.

However, if the price breaks down, it will head to 6,256

Which way do you say it will go

GU Leadership day. Sunack vs TrussToday at 1130 we expect the results of the conservative leadership race. Sunack vs truss.

Truss is the obvious favourite to win but she is bad for GBP. her polices are inflationary and she can't understand that lowering taxes and increasing the money supply will further cause inflation. the UK economy is already expected to see 13-16% inflation by April 23. honestly the UK is on its way for a serious economic downturn in my opinion., complete lack of leadership investment and now either way we go 90% of the British public don't want either of these running the show. but then again who else would do it. we don't exactly have a leader in the Labour Party either. anyway going off topic.

I expect as we are approaching the floor GU has never broken below I expect buying pressure. there's also the 4th touch trend line support in the same area and we have had continued selling pressure prior to the news. is this going to be a sell the rumour buy the news. more than likely in my opinion. for that to happen you would need Sunack to win. although this may be against the odds I could see this happening.

ill be buying at 1.14190 and closing at 1.15850 if not sooner depending on outcome

THE WORLDS LAST RALLY FTSE 100 THE chart posted is that of the uk ftse 100 we seem to have ended it s decline in what looks to be a 4th wave wave E on news . if this is right we should see a strong rally once this rally peaks I will tell you the next year looks very NEGATIVE .best of trades WAVETIMER

SHORT FTSE 100Short FTSE 100 @ 7450

TP: 6900

SL: Around 7700

The UK has many problems involving the PM, energy, cost of living crisis, recession, inflation and a devaluing currency. Normally GBP weakness was beneficial for the equity index however, the correlation has broken down. THE BOE has admitted that we face 5Q's of recession ahead and I cannot see how that is positive for stocks. I have therefore sold into this rally and will look for sub 7k lvl to TP.

This trade could take a few months but I am happy to sell into this rally.

Good luck! ;)

UK Recession voices and FTSE100UK inflation in double digit and it never been easy to cool down inflation above 5% or sticky for long, Winter approaching and peoples rising hands against Energy, Electricity bills while or easy money gone. Globally we can face hard time for two years while central banks saying everything ok.

Now world is more synchronize compare to 2000 and any bad news from any country effects whole markets.

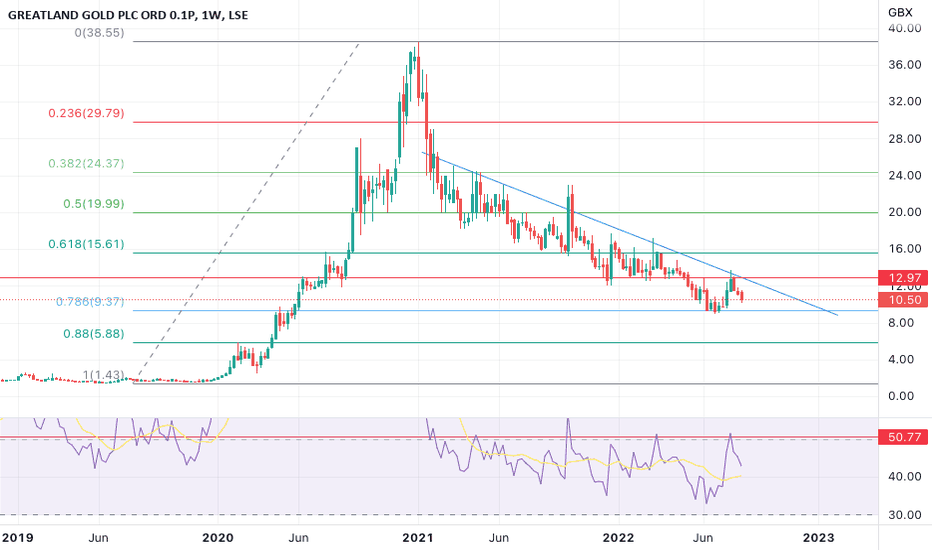

GGP Deep DiveHere's a macro macro (1 week chart) deep dive on GGP:

- No fundamentals here, just looking at the chart zoomed way out.

- Price bounced from the 0.786 fibonacci retracement (1 week chart). A good place for an entry, but only in hindsight now.

- Looking for this level to hold ~ 9.44, and on the lower time frames it looks as though price action is trying to form a swing higher low ~10.00.

- One might want to take an entry here in the hope that this higher low plays out and we get a reversal. But we need to go to lower time frames though as to whether or not here would be good for an entry.

- There is an overhead diagonal resistance also, blue line, which is something to keep an eye on.

- Also there is clear resistance, dead centre on the RSI, which makes sense as that price action has been bearish and therefore RSI oscillating below ~50. It would be interesting to see that resistance broken down and for price action to break above the 50 line.

1 hour and 4 hour:

- The price action and ichimoku cloud indicator shows that price action is bearish. On the 1 hour there is even a bear flag forming.

If i was in a position here:

- I would feel that I might have weathered most of the down move, and a relief rally to the upside was on the cards.

If i was taking a position here, 2 options:

(1) take an entry here, and hope the higher low plays out. A stop-loss would sit below, 9.44 (and as such, your price target should reflect this in its risk/reward ratio.

(2) wait for confirmation of an entry on the lower time frames. This might look like a bullish divergence on the 4 hour, or price action unfolding long enough sideways, that you get price action and the lagging span (ichimoku) both above the cloud on the 1 hour (and for a better quality trade) the 4 hour.

Price targets

- On a quick glance, the most immediate price target for me would be 12.82, then 15.32 after that.