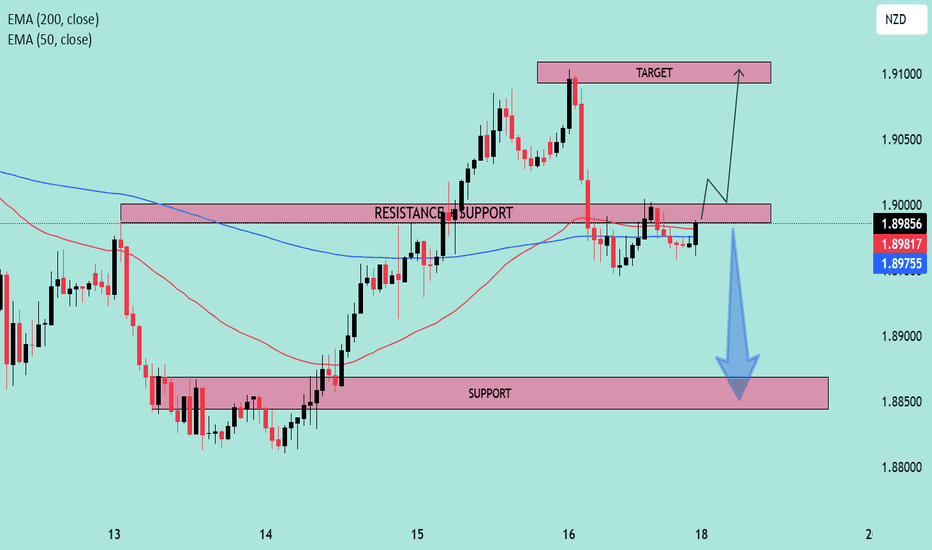

EURNZD at Key Decision Zone | Breakout or Breakdown?📊 Pair: EURNZD

🕒 Timeframe: Likely H1 or H4

📅 Date: May 18, 2025

🔍 Technical Analysis

🔁 Key Zones

🔴 Resistance-Turned-Support (RTS):

1.8975 – 1.8990

This area was previously a resistance level that price broke above, and is now acting as a critical support zone (flip zone). Price is currently retesting this area.

🎯 Target Zone (Resistance):

1.9085 – 1.9110

This is the next projected bullish target if price successfully rebounds from current support.

🛑 Major Support Zone:

1.8840 – 1.8860

Strong buying interest was seen here previously, acting as a safety net in case of bearish rejection from the current level.

🔄 EMA Confluence

📘 EMA 200 (Blue): 1.8975

📕 EMA 50 (Red): 1.8981

Price is hovering around the EMAs, indicating a moment of decision. A decisive move above these EMAs could trigger bullish momentum. 📈

🔮 Scenario Outlook

🟢 Bullish Scenario (Preferred Setup)

✅ Confirmation above 1.8990

➡️ Retest and continuation could push price toward the 1.9100 target zone.

🔼 Momentum supported by prior breakout and higher lows.

📌 Entry Idea: Above 1.8995

🎯 Target: 1.9100

🛡️ Stop: Below 1.8950

🔴 Bearish Scenario

❌ If price fails to hold the 1.8970–1.8990 zone, a breakdown could follow.

⬇️ Likely move toward 1.8850 support zone.

🚨 Watch for bearish engulfing or rejection candles near resistance.

🧠 Summary

Price is at a key decision point.

✅ Bullish bias is slightly stronger due to market structure (higher highs & higher lows).

⚠️ But a clean break below support would shift focus to the downside.

📈 Strategy: Wait for confirmation ⚖️

Bullish: Break + retest of 1.8990

Bearish: Breakdown below 1.8950 and close under EMAs