Fundamental Analysis

$BTCUSD, rally into rate cuts?BITSTAMP:BTCUSD has been coiling for some time now in a right angled descending broadening wedge.

A measured move of this cone so far would place BTC at right around ~$100k.

This aligns well with historical performance of BTC heading into a cutting cycle. If we rally into September and have a selloff following the cuts (sell the news), I wouldn't be shocked. This is a pattern that has happened in multiple years of the previous QE/QT Cycle (2016/2017, 2019/2020).

The real fireworks will be in 2025 if things go according to the FED's schedule

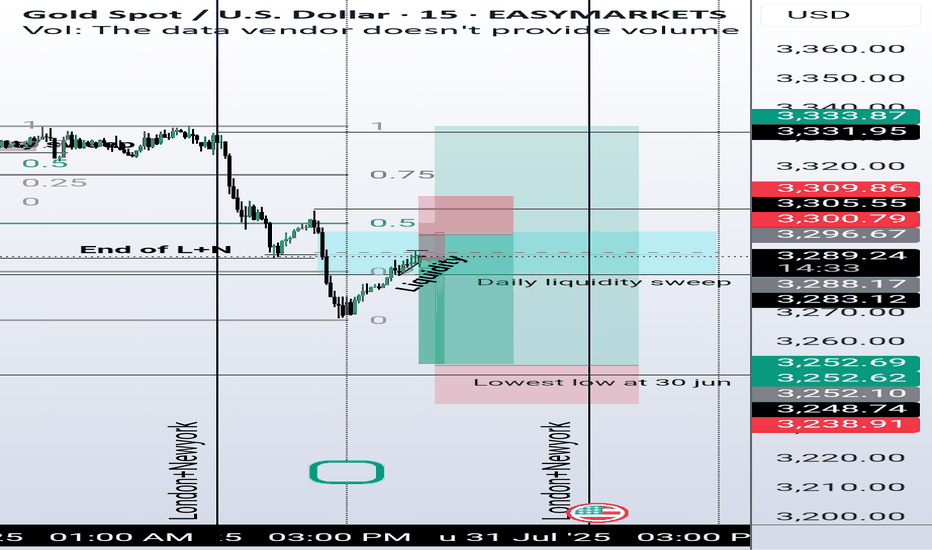

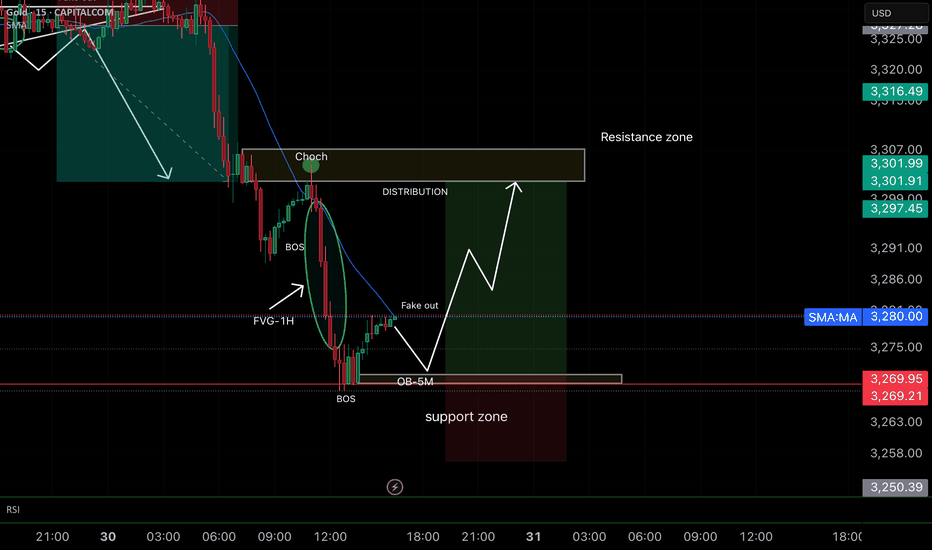

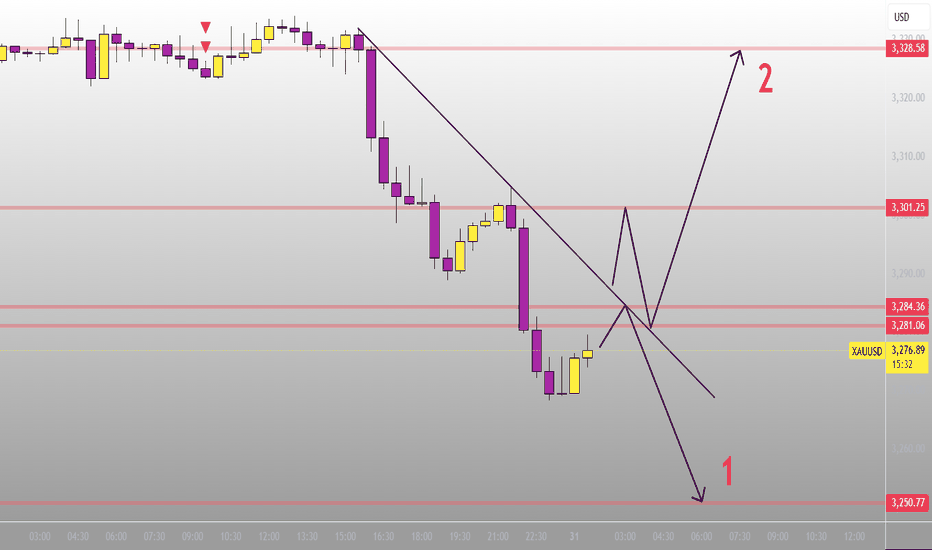

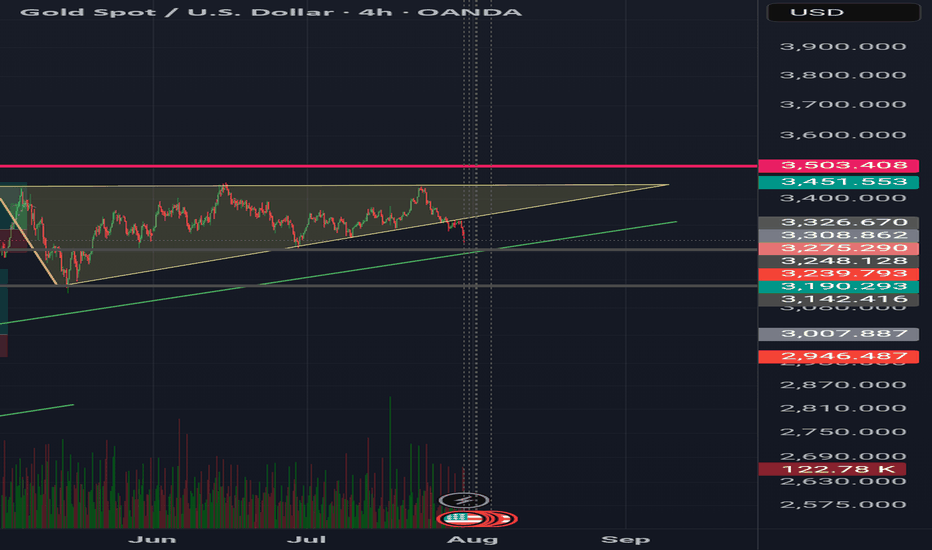

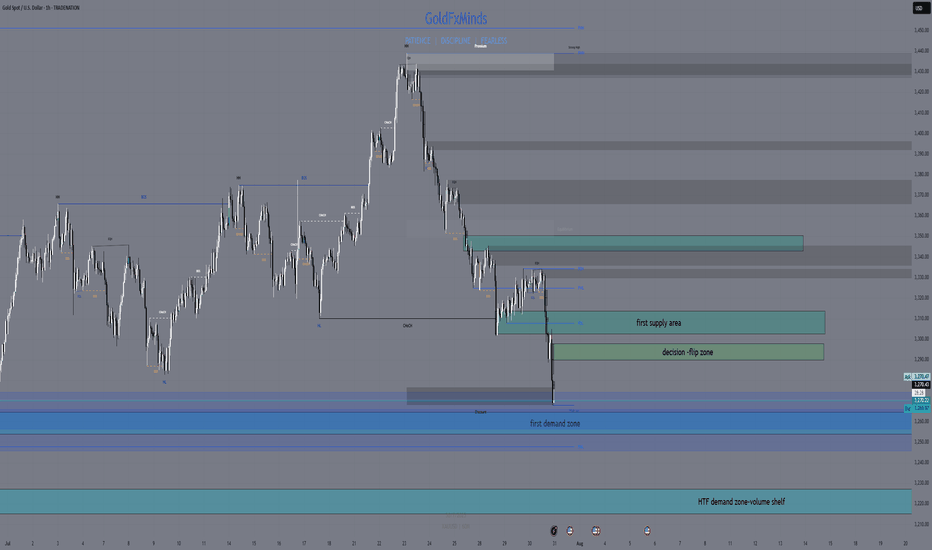

Daily Analysis- XAUUSD (Thursday, 31st July 2025)Bias: Bearish

USD News(Red Folder):

-Average Hourly Earnings m/m

-Non-Farm Employment Change

-Unemployment Rate

-ISM Manufacturing PMI

Notes:

- No rate cut imposed, no decision made on September rate cut

- Looking for continuation to the downside

- Potential SELL if there's

confirmation on lower timeframe

- Pivot point: 3310

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

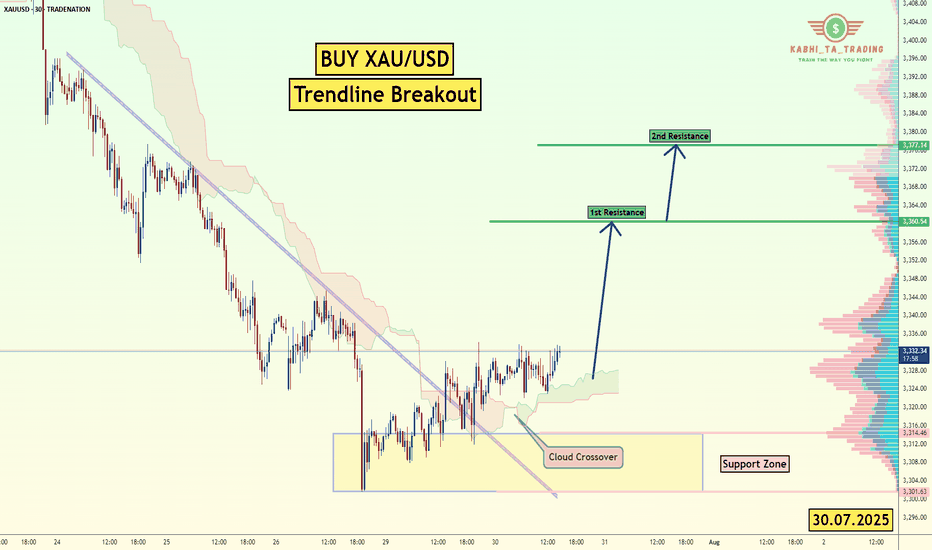

XAU/USD Trendline Breakout (30.07.2025)The XAU/USD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Trendline Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 3360

2nd Resistance – 3377

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

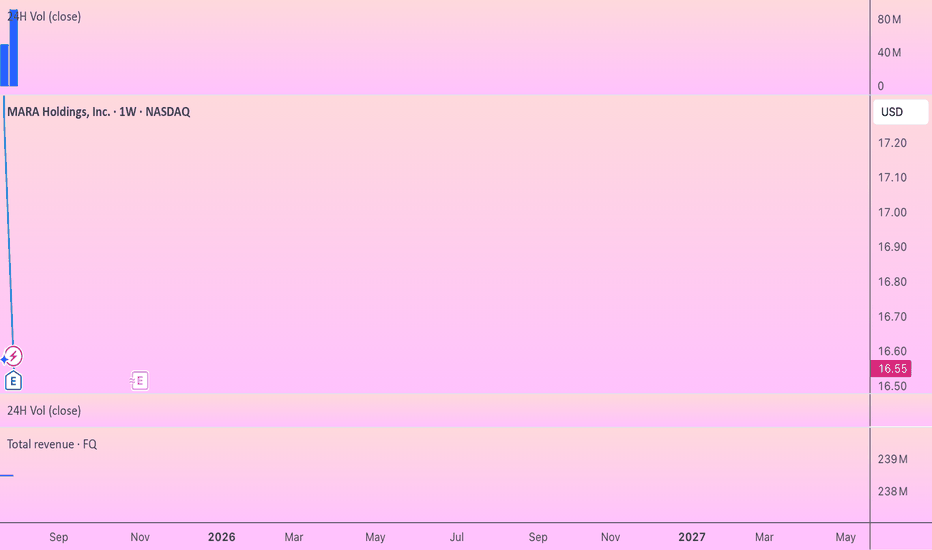

MARA: Mining Bitcoin, Diluting ShareholdersMarathon's Q2 results were great. Revenue up 64% to $238M, adjusted EBITDA exploding 1,093% to $1.2 billion, and swinging from a $200M loss to an $808M profit year-over-year. Those are eye-popping numbers that deserve scrutiny. The massive EBITDA jump and profit turnaround are largely driven by Bitcoin's mark-to-market gains, not operational improvements.

What continues to concern me is the dilution story. That $940.5 million raise they just completed might provide "strategic dry powder," but it's coming at the expense of existing shareholders. The company has been aggressively issuing equity, and while the recent numbers look impressive, a significant portion of that value creation is paper gains tied to crypto appreciation.

They're making progress on vertical integration, but a meaningful chunk of their hashrate still relies on third-party hosting arrangements. The all-in mining costs remain a key metric to watch—strong Bitcoin prices can mask underlying operational inefficiencies.

The timing of these results is also worth noting. MARA, like other miners, benefited enormously from Bitcoin's run to new highs and the broader institutional adoption wave we've seen with ETFs and corporate treasury strategies. But as CEO Fred Thiel himself has warned, there are signs of frothiness in the market reminiscent of previous crypto bubbles.

The AI and HPC initiatives still read like a work in progress. While the company talks a good game about diversification beyond pure Bitcoin mining, material revenue contributions from these ventures remain elusive.

Here's my take: MARA's Q2 numbers reflect the perfect storm of operational scale meeting a Bitcoin bull market. The company has undoubtedly grown its mining capacity and BTC holdings significantly. But the headline-grabbing profitability is heavily dependent on crypto valuations staying elevated.

For investors considering MARA at current levels, the key question isn't whether they can deliver strong numbers in a Bitcoin bull market—they've proven they can. It's whether the business model is resilient enough to generate attractive returns if Bitcoin faces a meaningful correction. Given the company's ongoing dilution, operational leverage to BTC prices, and rich valuation multiples, I'd argue there's limited margin of safety built into the current stock price.

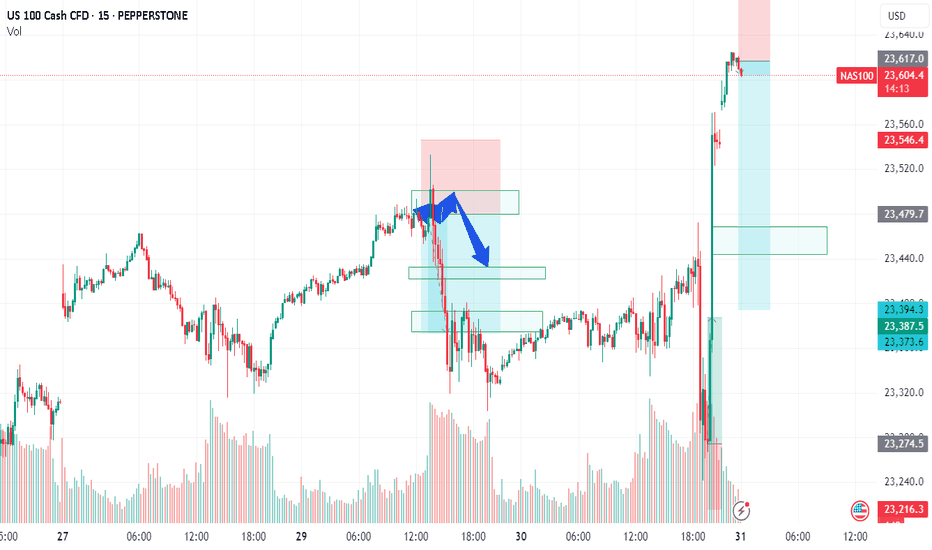

NAS - LET'S MAKE MILLIONS Team, last night NAS I was expect the FALL BACK as I predicted rate un-change will get NASTY on both DOW AND NAS.

So I have a set up entry LONG, i didnt expect the NAS flying to the moon.

both target hit so fast in 15 minutes

However, today is another opportunity to SHORT NAS on the current market at 23613-23625

STOP LOSS AT 23720

Once the NAS pull back toward 23580-65 - BRING STOP LOSS TO BE

TARGET 1: at 23540-20

TARGET 2: at 23480-65

LETS GO

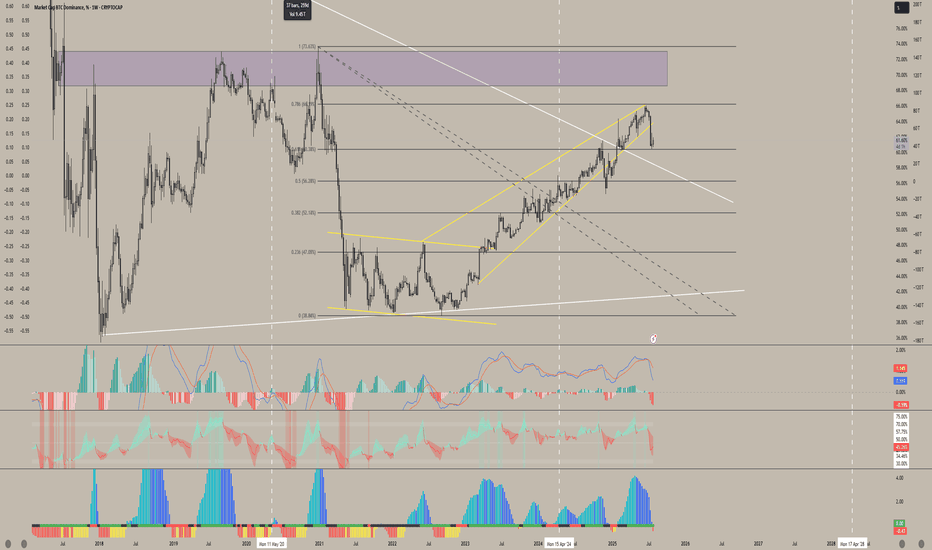

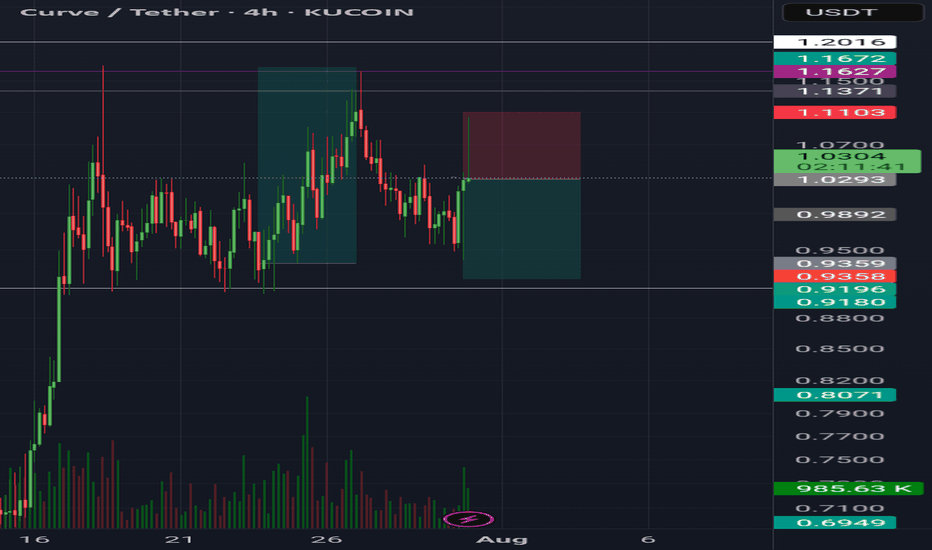

BTC.D FIB Lvl RejectionI'm liking the recent pullback in Bitcoin dominance - we're finally getting a taste of those altcoin gains we last saw around December. Each time dominance hits a key level on the Fibonacci retracement, we tend to see a pullback, and this recent rejection near the 0.786 level is no exception. It's a recurring pattern worth keeping an eye on.

That said, I still believe there’s a chance for one final rally in Bitcoin dominance - a potential shakeout before the real altseason begins. Historically, when Bitcoin breaks out of consolidation and pushes to new all-time highs with strong displacement, dominance tends to dip shortly after. So if BTCUSD continues to range at these current levels, I wouldn’t be surprised to see dominance spike again before we get the real altcoin momentum everyone’s waiting for.

This can also relate to what I've been reviewing in my previous charts published on my page

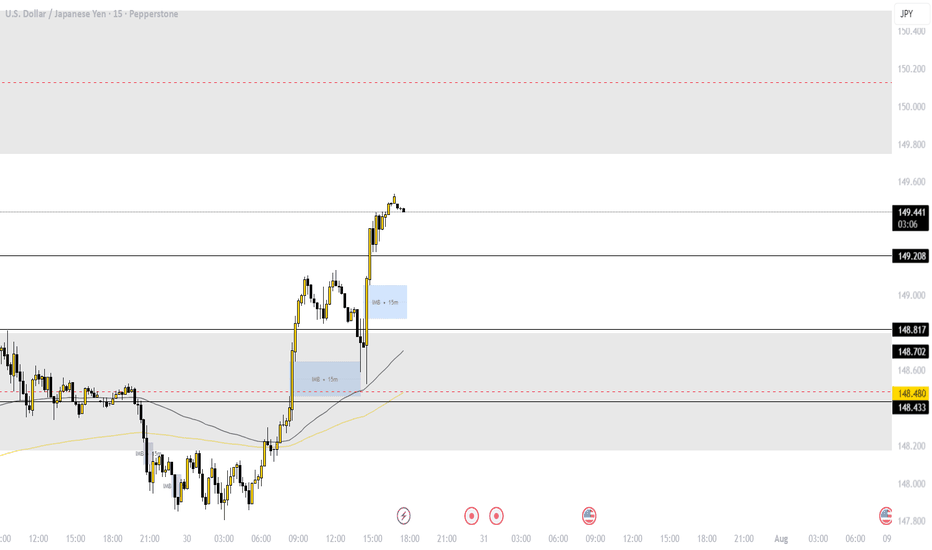

SMC ✅ Strengths:

• Previous mitigation of institutional interest zones (1H FVG).

• BOS (Break of Structure) indicating bullish intent.

• Entry located at the 5M OB, which coincides with support and fake out (consistent with liquidity re-entry).

• TP is aligned with the previous resistance and distribution zone, which provides a good RR (2.23).

Good luck Traders

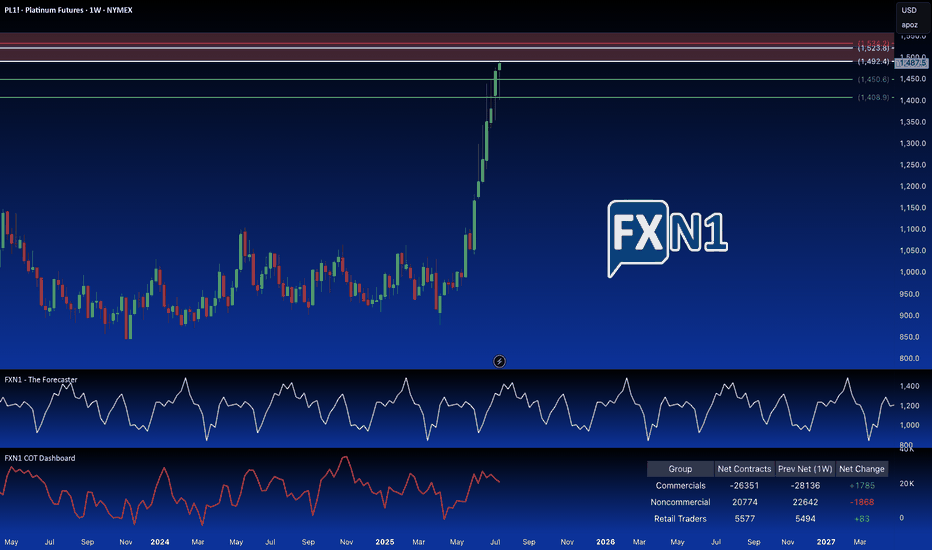

Platinum: Breaking the Supply Barrier?I'm adding a second Platinum position. Price has hit a strong weekly supply area, also a significant monthly supply zone. I'm anticipating a reversal here, as non-commercial holdings are decreasing, and seasonal patterns suggest a potential trend change. To further capitalize on potential upside, I've placed a pending order above the primary supply zone, at a slightly higher, but still relevant. These are older, established and fresh supply zones.

(Note: Reducing the chart size may help to better visualize the long-term significance of these overlapping areas.)

✅ Please share your thoughts about PL1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

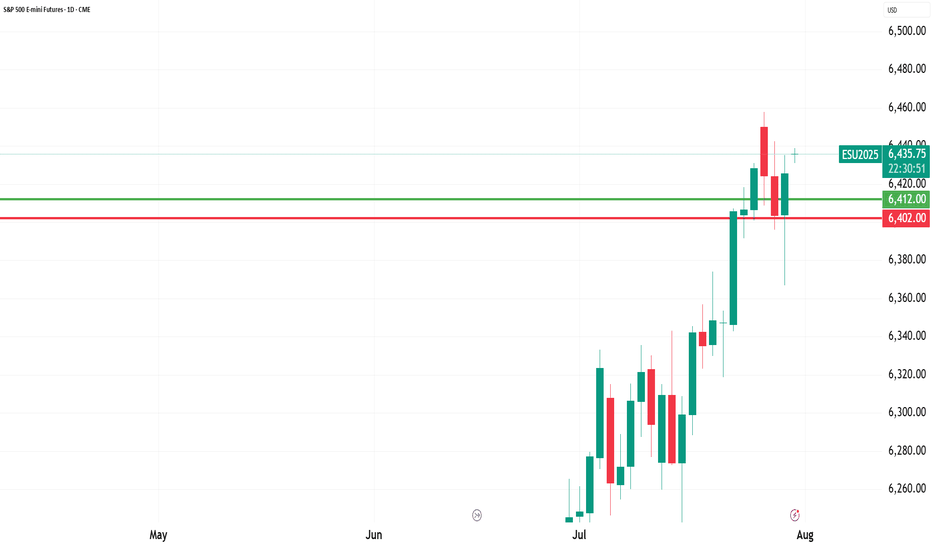

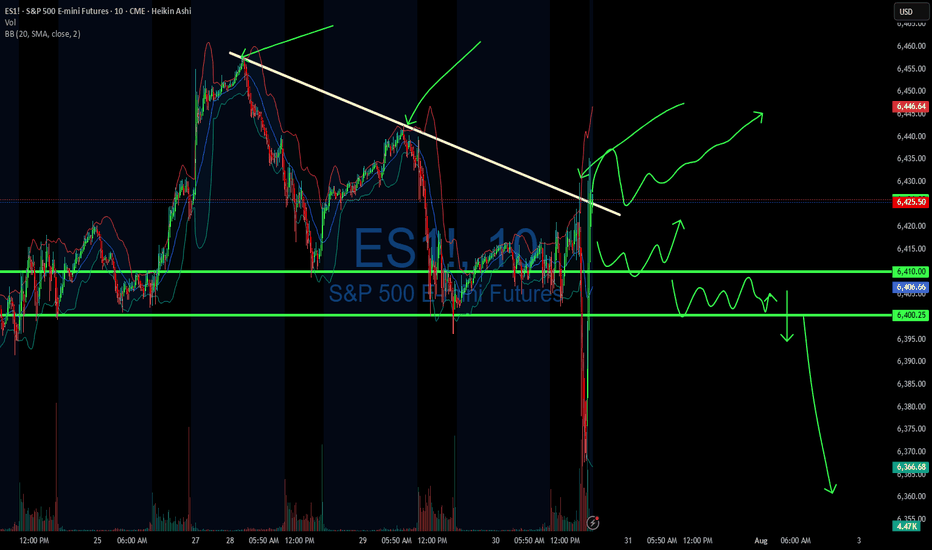

07/30/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +960

Sleep: 5 hours

Overall health: still struggling with sleep due to heat waves

VX Algo System Signals from (9:30am to 2pm)

— 8:30 AM Market Structure flipped bearish on VX Algo X3!✅

— 9:45 AM Market Structure flipped bullish on VX Algo X3! ✅

— 10:30 AM Market Structure flipped bullish on VX Algo X3!❌

— 11:30 AM Market Structure flipped bearish on VX Algo X3!❌

— 12:00 PM VXAlgo NQ X1DD Buy Signal, ✅

— 12:30 PM Market Structure flipped bullish on VX Algo X3!✅

What’s are some news or takeaway from today? and What major news or event impacted the market today?

I have started to noticed that the last 3 days, we have been getting false triggers on market structure signals and it almost feels MM are trying to do it to break people's algo that trade on that.

This is a good reminder that no matter how successful the signal has been for the last 30 days, you still need to have risk management. additionally, it's also a good way to test people's faith and trick new traders in going back to doing random things because it makes them think market can behave randomly and nothing works.

this is why i always tell people to religiously test out a system for 30 days before giving up.

News

*FEDERAL RESERVE SKIPS RATE CUT, KEEPS FED FUNDS RATE AT 4.50%

What are the critical support levels to watch?

--> Above 6410= Bullish, Under 6400= Bearish

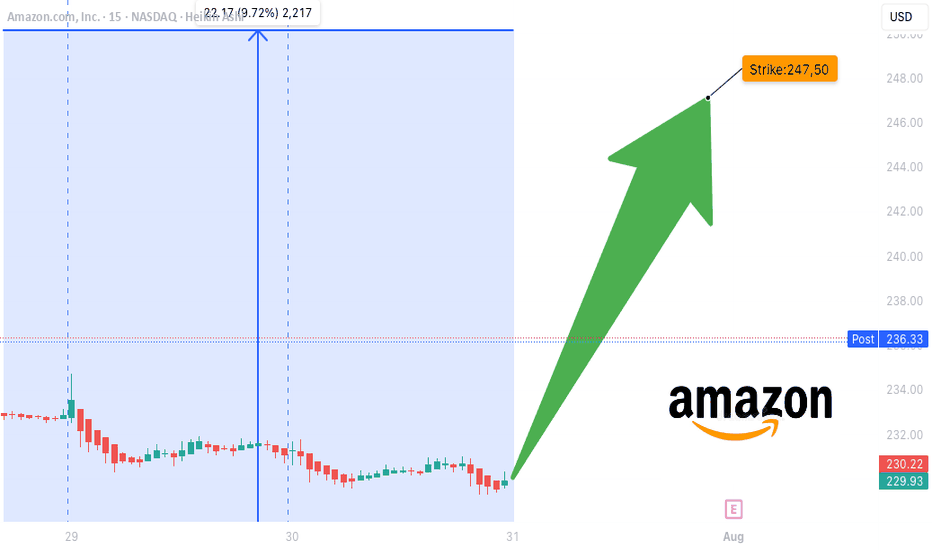

AMZN Earnings Play — July 30 (AMC)

## 🚀 AMZN Earnings Play — July 30 (AMC)

**💵 High Conviction Call Trade | 85% Confidence**

📈 **Amazon (AMZN)** — Cloud + Consumer Power Combo

🧠 Setup driven by earnings momentum, bullish flow, and macro strength.

---

### 🔍 FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +8.6% TTM

✅ **Margins**: Profit 10.1%, Op 11.8%, Gross 49.2%

🎯 **EPS Beat Streak**: 8/8 with avg. surprise of +34.7%

🔮 **Consensus Target**: \$252.03 (+9.4% upside)

📌 AWS + AI + Cost control = 🔥 upside setup

🟢 **Score: 9/10**

---

### 📊 OPTIONS FLOW SIGNAL

💰 **High OI**: \$232.50, \$240, \$247.50 calls

📈 **Call/Put Ratio**: Bullish Skew

🛡️ **Put Hedging** ≠ Bearishness

📉 Expected Move: \~5%

⚖️ **Gamma Bias**: Bullish above \$240

🟢 **Score: 8/10**

---

### 📉 TECHNICAL SETUP

📍 Price: \$231.01

📈 20D MA: \$226.21 (Support)

📉 RSI: 66.71 (momentum building)

🔒 Resistance: \$242.52 (watch for breakout)

🟢 **Score: 8/10**

---

### 🌐 MACRO TAILWINDS

🧠 AI & Cloud Momentum 🚀

💹 Consumer spending rebound

🔧 Regulatory risk mitigated via diversification

🟢 **Score: 8/10**

---

## 🎯 TRADE IDEA

🟩 **AMZN 08/01 \$247.50 Call**

💸 Entry: \$0.86

🎯 Target: \$2.58 (200%)

🛑 Stop: \$0.43 (50% loss)

⏰ Entry: **July 30 — Pre-close**

📏 Max Risk: \$86

💰 Max Reward: \$258

🧠 IV Crush Defense: Exit 2H post-ER

---

## ⚡️ WHY THIS WORKS

✅ 8-straight beat streak

✅ Fundamentals + Technicals = aligned

✅ Flow + Macro confirm direction

📈 Setup = asymmetrical upside

---

🎯 Tag your earnings sniper crew

📈 #AMZN #EarningsTrade #OptionsFlow #AmazonStock #CloudAI #OptionsStrategy #EarningsPlays #TradingView #SwingTrade #CallOptions #VolatilityTrade #EarningsMomentum

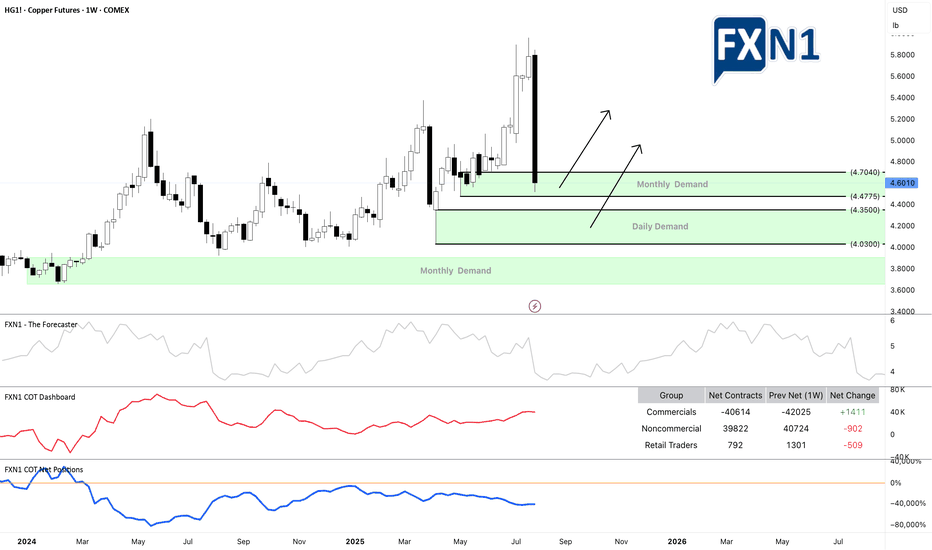

Copper: Trump Signs Tariffs on Imports Amid National Security...President Donald Trump signed a proclamation on Wednesday that imposes tariffs on copper imports, citing concerns over national security.

The White House announced that the new policy will introduce a 50% tariff on semi-finished copper products and other copper-derived goods that are highly dependent on the metal.

These tariffs are scheduled to come into effect on August 1, as outlined in a White House fact sheet.

In terms of market dynamics, copper is currently within a monthly demand zone, with a daily demand area also identified for setting pending orders. The potential impact on prices could be twofold: a possible upward movement driven by the discount effect on the metal, or continued decline following President Trump's announcement.

What are your thoughts on how these tariffs might influence copper prices moving forward?

✅ Please share your thoughts about HG1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

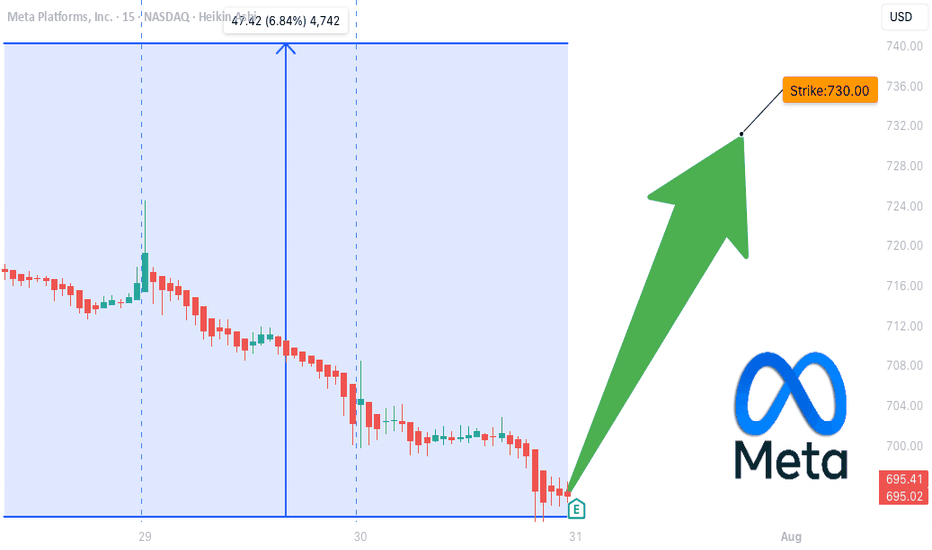

META Earnings Trade Setup — July 30 (AMC)

## 🧠 META Earnings Trade Setup — July 30 (AMC)

📈 **META (Meta Platforms Inc.)**

💥 **Confidence**: 85% Bullish

💡 **Play Type**: Pre-earnings call option

📊 **Fundamentals + Flow + Setup = High Conviction Swing**

---

### 📊 FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +16.1% YoY

✅ **Profit Margin**: 39.1%

✅ **Gross Margin**: 81.8%

📈 **8/8 EPS Beats** — Avg Surprise: +13%

🧠 **Digital Ad Rebound + AI Integration = Growth Engine**

🟢 **Score: 9/10**

📌 Bottom line: Elite execution + consistent guidance beats

---

### 🔥 OPTIONS FLOW CHECK

💰 **Call Walls**: \$720 / \$730

📈 **Call/Put Skew**: Bullish tilt

🔎 **IV Rank**: 0.65 — High enough for a move, not extreme

📈 **Market Expectation**: \~6% move

🟢 **Score: 8/10**

📌 Institutional flow leans long — smart money eyes upside

---

### 📉 TECHNICAL SETUP

📍 **Price**: \~\$700

📉 RSI: 34.34 → OVERSOLD

📉 20D MA: \$713.27 (near-term bounce target)

📌 Support: \$692.50 | Resistance: \$720

🟡 **Score: 7/10**

📌 Post-consolidation rebound setup into earnings

---

### 🌎 MACRO CONTEXT

💡 Growth + AI names in focus

📢 Communication Sector → Risk-On Rotation

📌 META riding digital ad/AI secular trends

🟢 **Score: 8/10**

📌 Macro tailwinds match company strengths

---

## 🎯 TRADE IDEA

**META 08/01 \$730 CALL**

💵 Entry: \$10.00

🎯 Target: \$30.00 (300% ROI)

🛑 Stop: \$5.00 (50% loss cap)

⏰ Entry: Pre-close on July 30 (AMC earnings)

📏 Size: 1 Contract (Risk \$1,000 max)

### ⚖️ Risk/Reward

* Max Risk: \$1,000

* Target Profit: \$3,000

* IV Crush Protection: **Exit within 2 hours post-earnings**

---

## 📌 WHY IT WORKS

✅ Meta beats 8 straight quarters

✅ Fundamentals elite

✅ Bullish options stack

✅ Oversold tech setup

⚠️ Risk? Always — but *structured speculation wins* 📐

---

📣 Tag someone who trades earnings like a sniper 🎯

\#META #EarningsPlay #OptionsTrading #IVCrush #CallOptions #TechStocks #AIStocks #TradingView #DigitalAds #SwingTrade #StructuredRisk

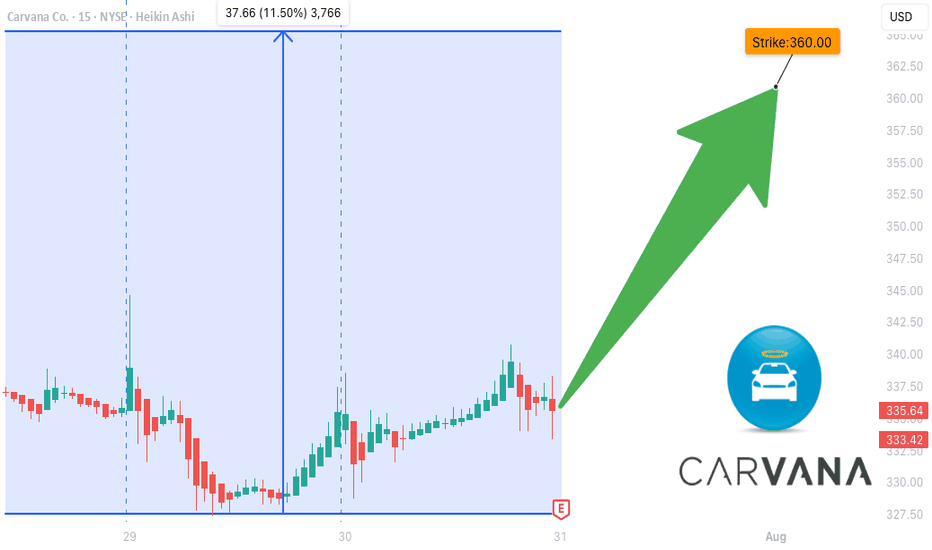

CVNA EARNINGS TRADE IDEA — July 30 (AMC)

## 🚗 CVNA EARNINGS TRADE IDEA — July 30 (AMC)

**Carvana (CVNA)**

📊 **Bullish Confidence**: 85%

📈 **Earnings Play Setup**

💣 Big Volatility + Strong History = Explosive Potential

---

### ⚙️ FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +38.3% YoY

🔁 **8/8 EPS Beats** (114.5% avg surprise)

🟡 **Profit Margin**: 2.7% (Thin but improving)

⚠️ **Debt-to-Equity**: 344.78 (High leverage risk)

💬 **Sector Rotation**: Growth favors high-beta names

💡 **Beta**: 3.60 → Big post-earnings swings likely

---

### 📊 OPTIONS FLOW HEATMAP

🔥 Heavy Call Volume @ \$360–\$370

🟢 Bullish OI Stack

📉 Put/Call Skew: CALL DOMINANT

💥 IV Elevated = Lotto ticket pricing

---

### 📈 TECHNICALS

💵 Price: \$336.50

🧱 Resistance: \$343.68

📉 RSI: 44.5 (Neutral – Room to Run)

📊 200D MA: \$252.21 → Long-term bullish positioning

---

### 🔥 TRADE IDEA:

**CVNA 08/01 \$360 CALL**

🎯 **Entry**: \$11.25

🚀 **Target**: \$33.75 (200% ROI)

🛑 **Stop**: \$5.60

📊 **Size**: 1 contract

⏰ **Entry Timing**: Pre-Earnings Close (AMC play)

---

### 📉 RISK / REWARD

* 🟥 Max Loss: \$11.25

* 🟩 Profit Target: \$33.75

* ⚖️ RR Ratio: 1:3

* 💼 Portfolio Risk: 2–3%

---

### 🧠 STRATEGY INSIGHTS

✅ Historical beat rate = STRONG

✅ Bullish options skew = CONFIRMED

⚠️ High debt = risk, but momentum > fear

📌 Tip: If IV crushes post-earnings, exit fast. This is a *structured speculative play* — not a hold-and-hope.

---

📢 "Speculation is fine. Structure it."

💬 Tag a trader who *YOLOs with stop losses* 👇

\#CVNA #EarningsPlay #OptionsTrading #TradingView #HighBeta #LottoPlay #RiskManaged #CallOptions #BullishSetup #IVCrushProof #EcommerceStocks #EarningsSeason

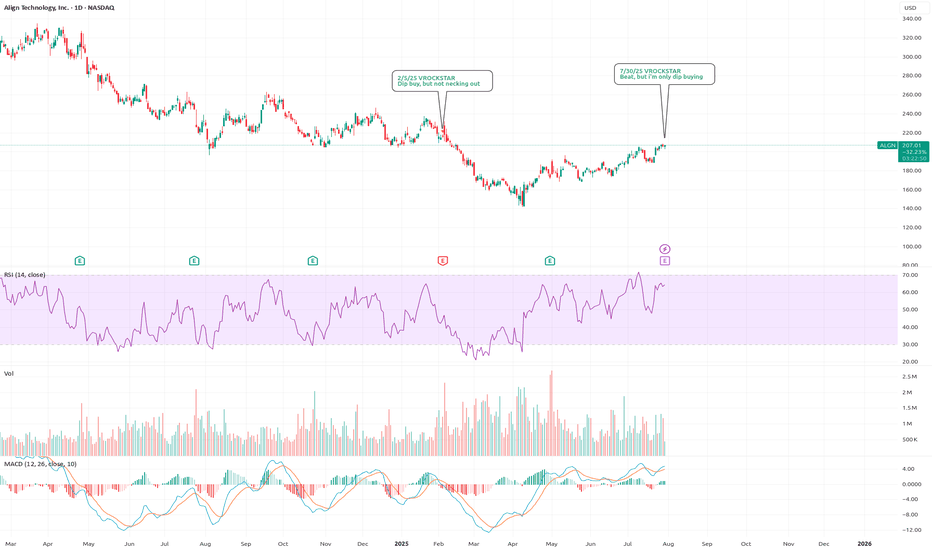

7/30/25 - $algn - Beat, but i'm only dip buying7/30/25 :: VROCKSTAR :: NASDAQ:ALGN

Beat, but i'm only dip buying

- 20x PE for growth, leadership position, 5% fwd fcf gen... great

- consumer names on mgn doing just fine as we over spend from the mar/apl pullback

- a higher cost discretionary purchase? hrm. tough to say.

- i think result is +ve and stock is higher. it's health-care-adjacent and not an insurance company or pharma (cough NYSE:NVO ) at-risk industry

- any decent result but smaller either "beat" or w/e on the mgn that sends this back toward $180... has me dip buying (though that's not my expectation, just my reaction function - and unless there's a real stink bomb inside the print)

V

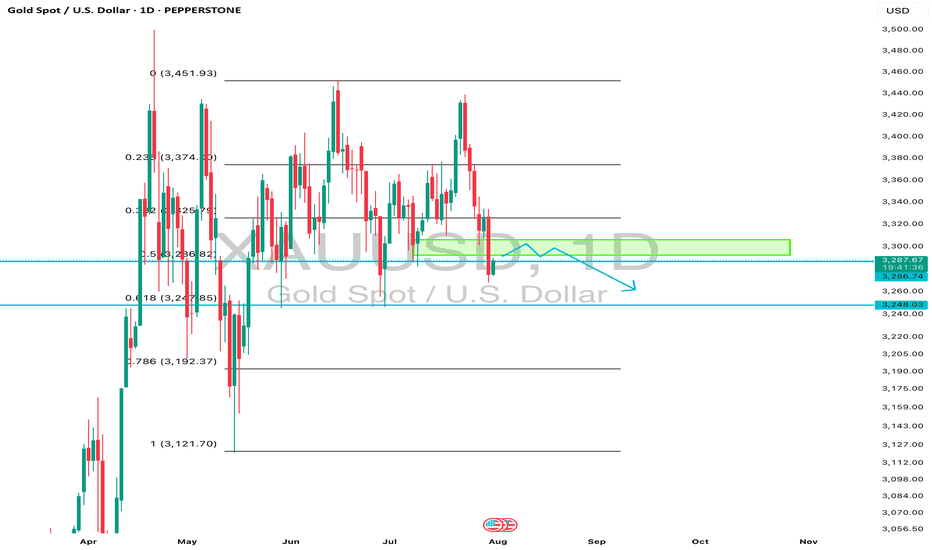

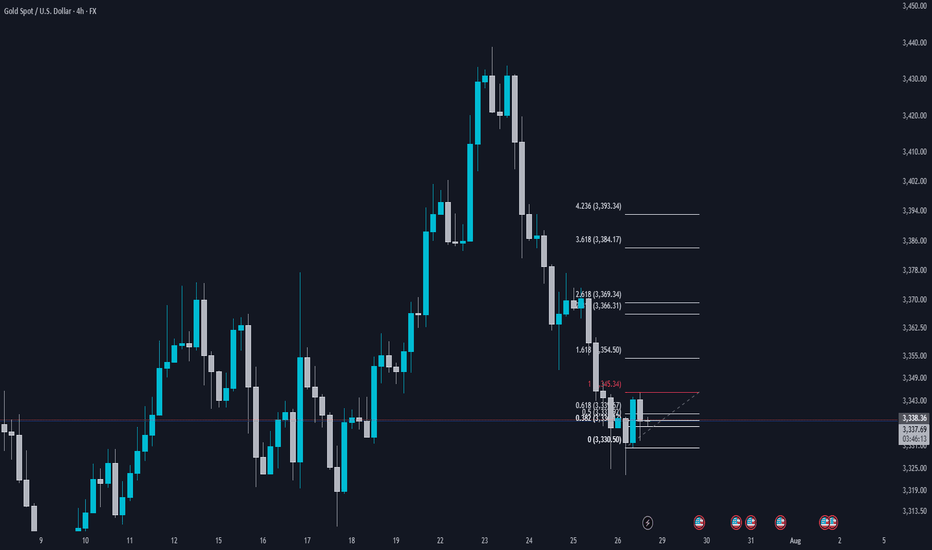

XAUUSD Market Update – July 30 Late NY Recap🔸Macro Context

Markets are still digesting Powell’s ongoing speech with no clear pivot signals. While FOMC tone remained cautious, no dovish surprise emerged. Trump’s upcoming comments keep geopolitical risks elevated. USD remains firm. Gold is reacting within key HTF demand as intraday volatility cools off.

🔸Bias Overview

Weekly Bias:

• Bearish rejection from the major supply wick 3439–3350

• Structure still below 3345, maintaining downside pressure

• Weekly RSI cooling off — no bullish divergence yet

Daily Bias:

• Lower high locked below 3345

• Price reentered the imbalance toward 3272

• Clean structure remains bearish unless we reclaim 3302

H4 Bias:

• Lower high formed at 3314

• Current price testing HTF Extreme Demand Base (3289–3272)

• Still bearish unless we see a confirmed M15 or H1 BOS from demand

🔸Key Structural Zones

🔺Above Price (3272):

• 3289–3294

Decision Block – M30 OB + FVG. First sign of momentum shift if reclaimed.

• 3302–3314

Supply Reversal – H1 OB + previous BOS zone. EMA alignment adds pressure.

• 3345–3350

Major Rejection Zone – H4 origin of last leg down. Strong resistance area.

🔻Below Price (3272):

• 3254–3264

Imbalance + OB – H4 FVG + clean demand zone. Buy setup only on deep flush + reversal PA.

• 3227–3214

HTF Demand Base – Daily OB + historical volume shelf. Final structural floor before deeper downside opens.

🔸Battle Plan

▶ Scenario 1 – Bearish Breakout

If 3272 fails with momentum and no reversal signs, expect continuation into 3254–3264.

No long trades unless BOS confirms.

▶ Scenario 2 – Reactive Long from Demand

If price gives a strong reaction from 3272 with BOS on M15 or H1 and clears 3294, then a recovery into 3302 is possible. Only valid with confirmed PA + EMA shift.

▶ Scenario 3 – Choppy Rejection from 3294

If price tests 3294 but fails, watch for rejections back toward 3272. Scalpers can fade reactions if no bullish structure forms.

🔸Final Thoughts

Price is once again testing our Extreme Demand Base from July 28 (3289–3272). The zone remains valid — but execution depends entirely on confirmation. Bears still in control unless we reclaim 3302 cleanly.

No need to rush. Best RR setups are found at clean structural edges.

Patience = profits.

—💬 Drop your thoughts in the comments.

❤️ Like if you appreciate the precision.

🔔 Follow GoldFxMinds for more sniper-level updates.

With you all the way,

— GoldFxMinds

📊 Analysis based on Trade Nation TradingView charts.