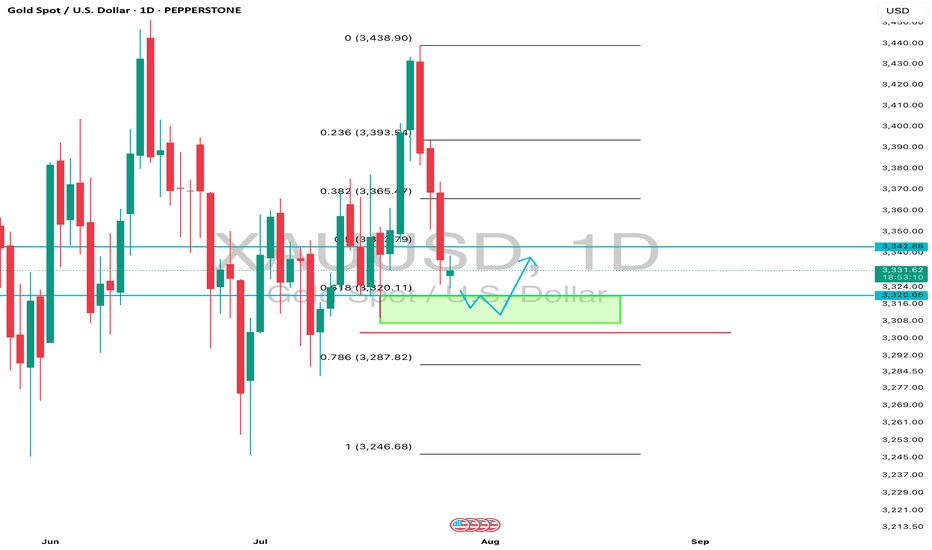

Daily Analysis- XAUUSD (Monday, 28th July 2025)Bias: Bullish

USD News(Red Folder):

-None

Notes:

- Price gap down and filled up the gap

- Looking for price to tap 0.618 fib level

- Potential BUY if there's

confirmation on lower timeframe

- Pivot point: 3300

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

Fundamental Analysis

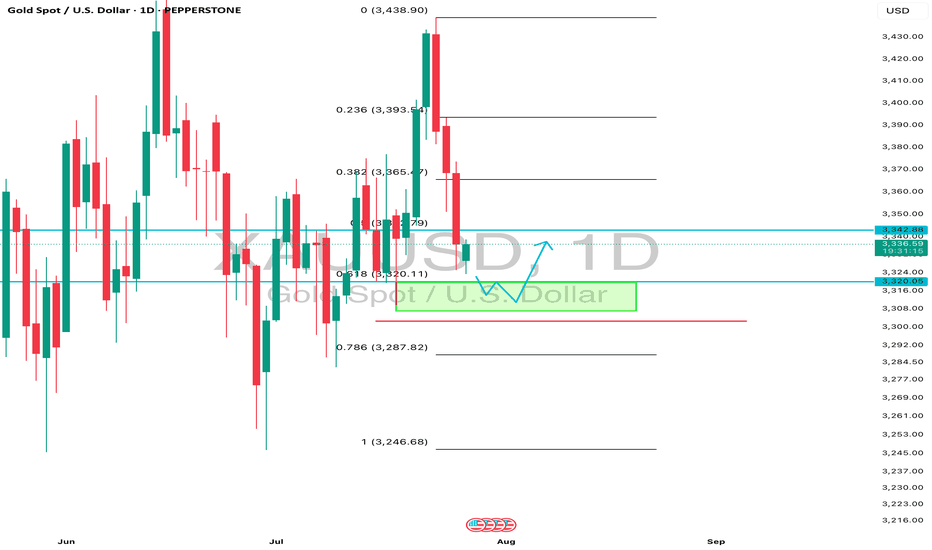

Daily Analysis- XAUUSD (Monday, 28th July 2024)Bias: Bullish

USD News(Red Folder):

-None

Notes:

- Price gap down and filled up the gap

- Looking for price to tap 0.618 fib level

- Potential BUY if there's

confirmation on lower timeframe

- Pivot point: 3300

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

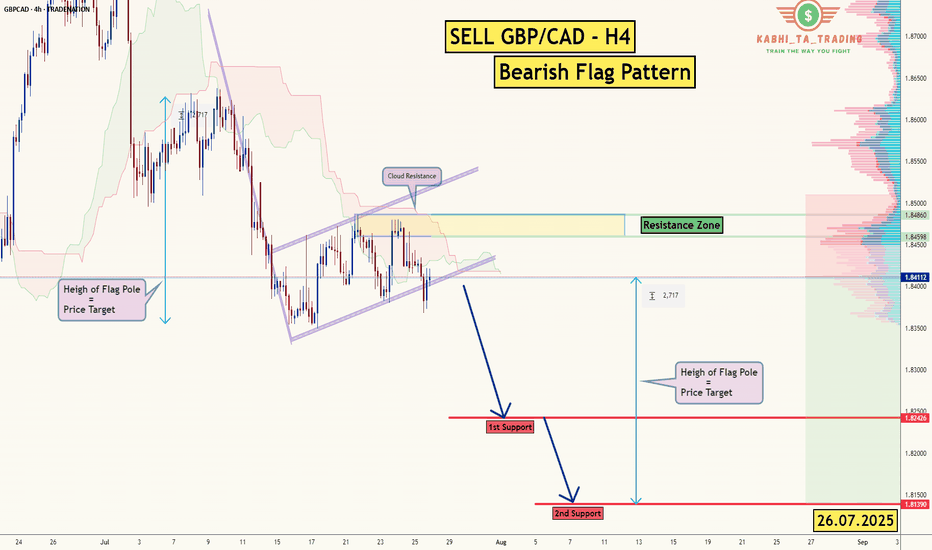

GBP/CAD - H4 - Bearish Flag (26.07.2025)The GBP/CAD Pair on the H4 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming Days.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.8242

2nd Support – 1.8139

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

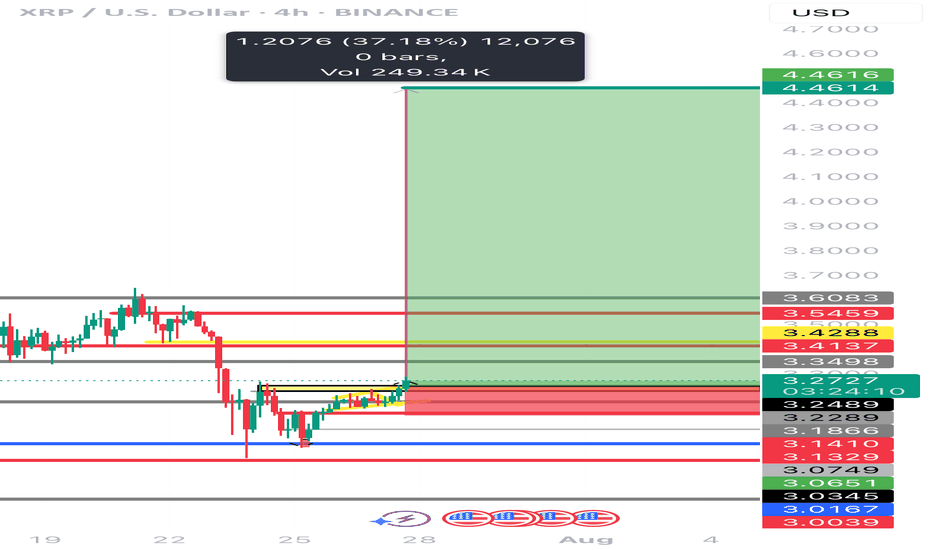

Can XRP Run 30% next week While we seen a clear cool of from XRP bullish movement in the last week are we now looking at an aggressive opportunity for the this sssest class shoot up %30 to create a new ATH of $4 and possibly beyond? Interesting times ahead with some strong news heading into next week XRP Army will have to wait and see what news comes out and will that influence XRP’s price point. The asset class sits around $3.28 at the time of this article post.

Cheers FC / EDub / AJ

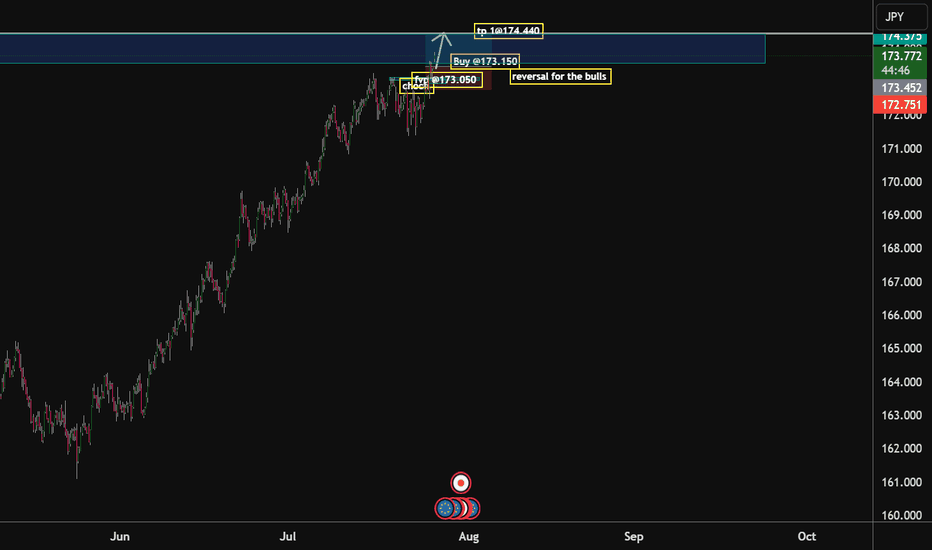

Eur/jpy Bulls to dominate @174.440 Handle As we begin a new week, I see the bulls coming in and grabbing the unmitigated liquidity @174.440 handle. My advice to fellow traders is that if the ECB stays hawkish or the BOJ remains dovish, EUR/JPY has room to stretch higher.

Watch Euro inflation numbers, BOJ yield curve control updates, and U.S. data spillovers.

Buy @ 173.15

TP 1.~174.440

ETH Buy Idea📈 Setup Summary:

Ethereum (ETHUSD) is breaking out of a multi-week consolidation with rising volume and strong bullish momentum. Price has reclaimed key moving averages, and sentiment has shifted favorably across crypto markets.

📊 Entry & Risk:

• Entry Price: $3,860 - 3870

• Stop: $3,470

🧠 Macro Catalyst: Spot ETH ETFs Are Coming

• The SEC is reviewing multiple Ethereum Spot ETF applications from BlackRock, VanEck, ARK/21Shares, and others.

• Market expects approvals Q3–Q4 2025, mirroring the prior surge seen in BTC after IBIT and similar ETFs launched.

• A successful launch could unlock institutional ETH flows, driving significant upside.

🟢 Adding ETF tailwind to technical breakout = high-conviction swing trade.

🚀 Momentum Signals:

• RSI & MACD bullish cross on daily

• Increasing volume on breakout

• ETH outperforming BTC (ETHBTC ratio turning up)

• Crypto market as a whole showing risk-on tone

DISCLAIMER : The content and materials featured are for your information and education only and are not attended to address your particular personal requirements. The information does not constitute financial advice or recommendation and should not be considered as such. Risk Management is Your Shield! Always prioritise risk management. It’s your best defence against losses.

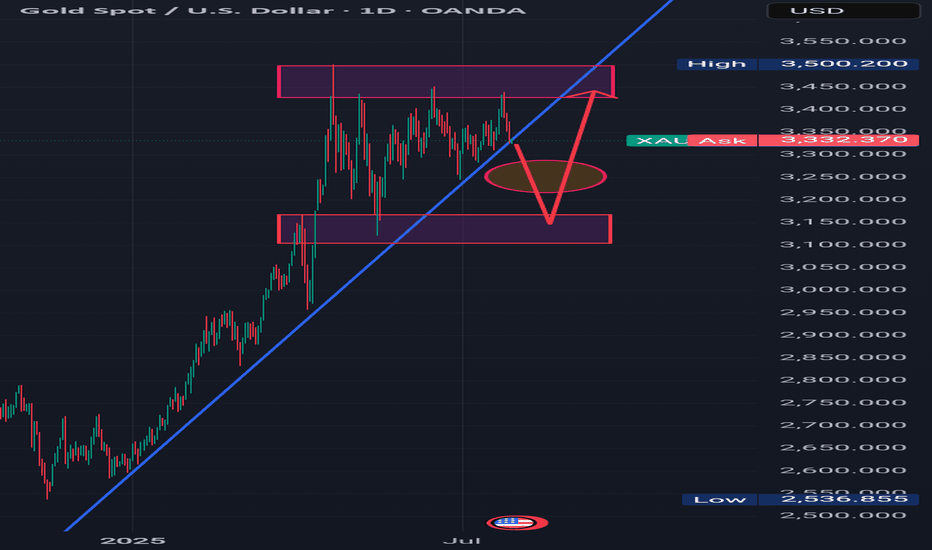

Bullish or Bear trapHello Traders 👋

What are your thoughts on XAUUSD

Looking at the daily timeframe I anticipate manipulation by market players on gold.

Is likely that market players will stop Hunt Traders who have their stop losses at the different lows which is indicated with a red circle.

For every buyer there must be a seller and for every seller there must be a buyer.Where they are no sellers in the market the institutions will want to trigger stop losses in order to buy,which is known as stop hunting.That is to takeout previous buyers in the market and generate liquidity to buy.

And this stop hunting usually happens in a ranging market.

Looking at the structure of gold we can see that gold is ranging,

We can see a low or support of the range which was previously resistance and turned support for the ranging market.

I see the market using sell liquidity to liquidate buyers and react at the support or low of the range and move up to the range of the resistance

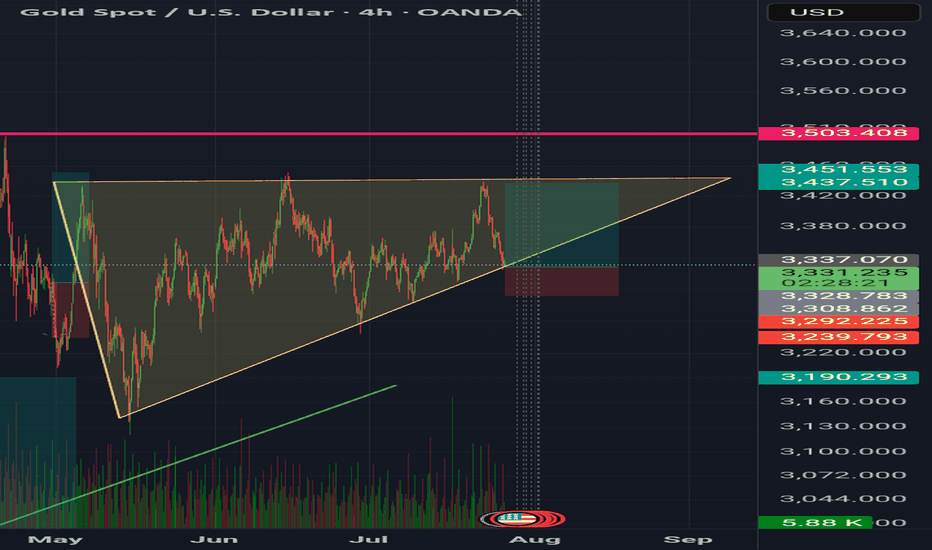

GoldXau usd daily analysis

Time frame 4 hours

Gold is moving up and down in the yellow triangle, you can see on the chart

I think Gold move up to 3450 $ and if we have no positive news, it will drop to the down side. This analysis has good benefit and Risk rewards ratio is 3

On the other hand if Gold break the 3320 $ my analysis is faild and must listen to the economic news

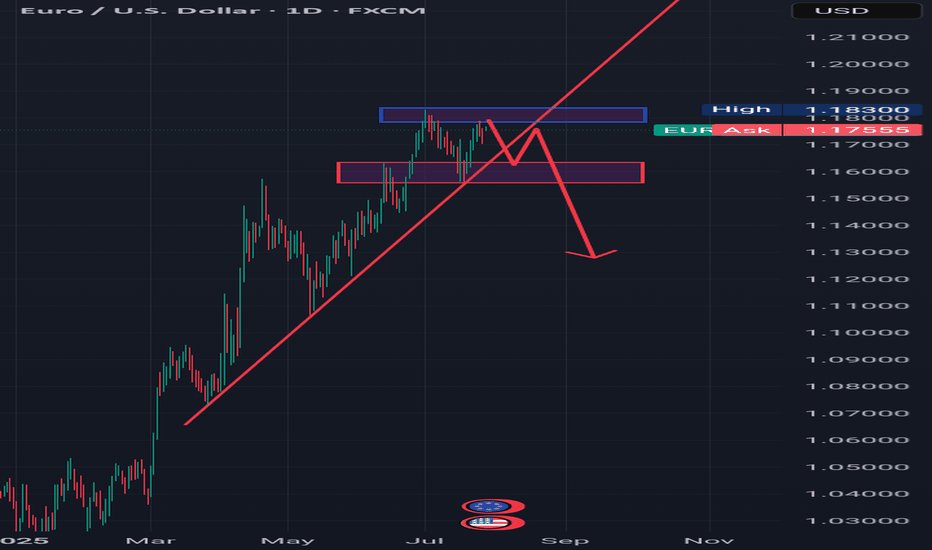

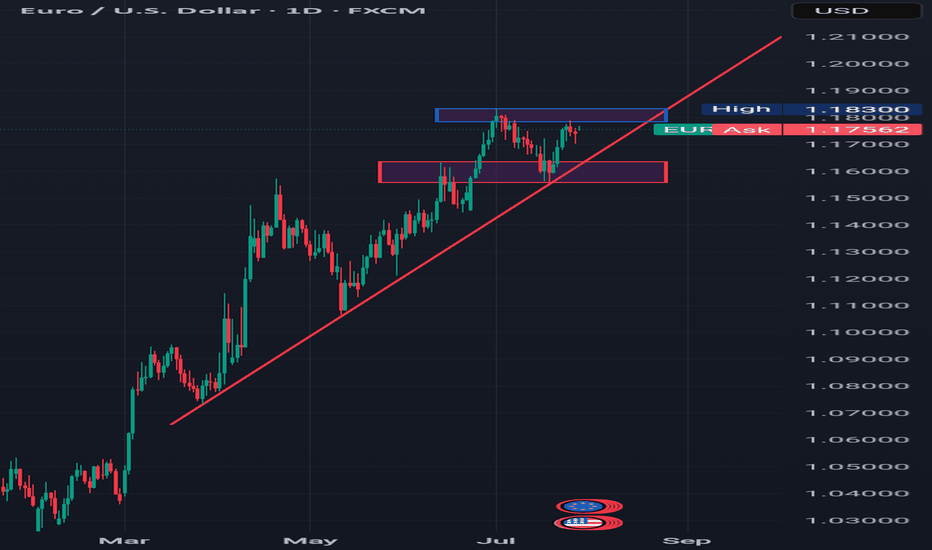

A POTENTIAL TREND REVERSAL Hello Traders 👋

What are your views about EURUSD

Looking at the daily timeframe we can see that price action didn't take out liquidity at the top which is indicated with a blue rectangle.

Am seeing price action retracing to that liquidity zone which is indicated with a blue rectangle and from there reversing to the downside.

Let's look at the fundamental analysis of EURUSD.

Trump announced the conclusion of a trade agreement with the EU:

The EU will invest $600 billion more in the US than before

15% tariff on EU goods, including cars

All EU countries will open their markets to the US

EU to purchase hundreds of billions of dollars worth of military equipment

EU to purchase $750 billion worth of energy from the US. Energy is a key part of the agreement.

PS:

It is worth monitoring the market reaction from the opening. Pay attention to the market reaction during different sessions.

Markets may react ambiguously, but against the general backdrop, the following reaction should be expected:

USD → sharp rise (dollar strengthening due to capital inflows and growth in energy exports).

EUR → down, as the EU will bear the costs of tariffs and rising imports from the US.

Gold → down (correction or decline due to the strengthening of the dollar and reduced demand for hedging).

BTC → neutral or slight decline (due to USD strength):

If the agreement stimulates the economy and liquidity, this could be a bullish factor for BTC.

………………………………………….

A POTENTIAL TREND REVERSAL Hello Traders 👋

What are your thoughts on EURUSD

Looking at the daily timeframe we can see that price action didn't take out the liquidity which is located with a blue rectangle which is also acting as the all-time high for EURUSD.

I'm seeing price retracing to reach the liquidity around that blue rectangle and then after start falling downwards.

Let's look at the fundamentals of EURUSD

Trump announced the conclusion of a trade agreement with the EU:

The EU will invest $600 billion more in the US than before

15% tariff on EU goods, including cars

All EU countries will open their markets to the US

EU to purchase hundreds of billions of dollars worth of military equipment

EU to purchase $750 billion worth of energy from the US. Energy is a key part of the agreement.

PS:

It is worth monitoring the market reaction from the opening. Pay attention to the market reaction during different sessions.

Markets may react ambiguously, but against the general backdrop, the following reaction should be expected:

USD → sharp rise (dollar strengthening due to capital inflows and growth in energy exports).

EUR → down, as the EU will bear the costs of tariffs and rising imports from the US.

Gold → down (correction or decline due to the strengthening of the dollar and reduced demand for hedging).

BTC → neutral or slight decline (due to USD strength):

If the agreement stimulates the economy and liquidity, this could be a bullish factor for BTC.

………………………………………….

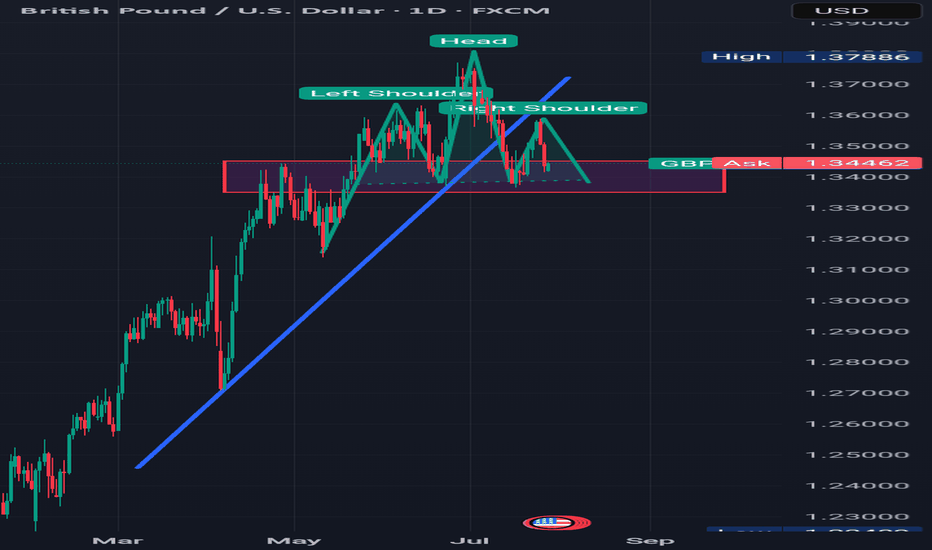

A POTENTIAL TREND REVERSALHello Traders 👋

What are your views about GBPUSD

Looking at a daily time frame we can see that press action has broken a rising trend line and also we are seeing a potential head and shoulder pattern.

For further clarification we need to see if the price action can break a demand zone which is indicator with a red rectangle.

This will give us a strong conviction that the dollar is already buying and GBPUSD is set for further downside.

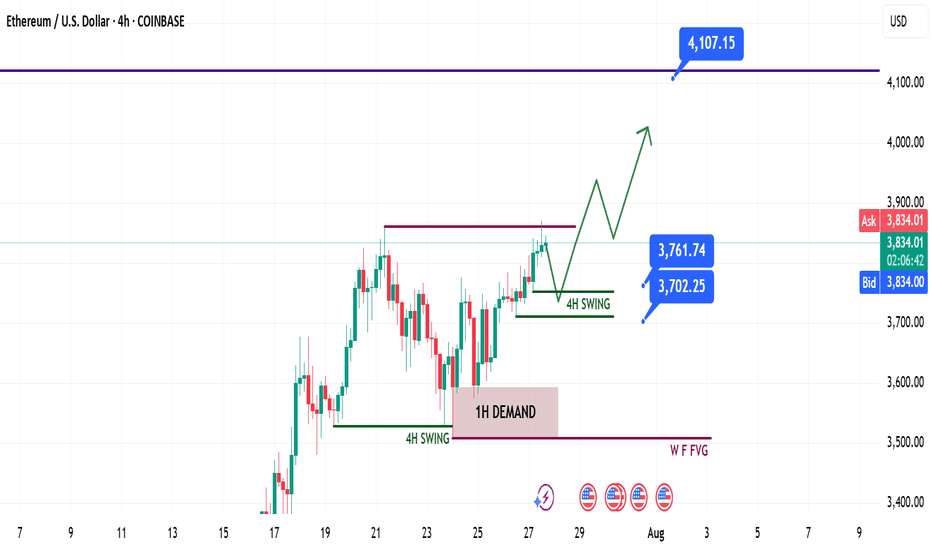

Ethereum Weekly Recap & Gameplan | 27.07.2025📈 Market Context:

ETH followed the broader crypto market momentum led by Bitcoin, supported by institutional demand and positive macro policies in the U.S.

Last week’s plan played out cleanly — we saw strong gains from the 1H demand zone.

🧾 Weekly Recap:

• Price swept 4H swing liquidity and formed a 1H bullish BOS

• Created a solid 1H demand zone, from which price bounced strongly

• Momentum remained bullish as forecasted in last week’s post

📌 Technical Outlook:

→ Expecting a short retracement into 4H liquidity levels around 3761$ or 3702$

→ Then a continuation move towards ATH zone

🎯 Setup Trigger:

What I’m watching:

✅ Sweep of 4H liquidity

✅ Bullish BOS on 15M–30M

→ This will serve as the confirmation for long entries

📋 Trade Management:

• Stoploss: Below the confirmation swing low

• Target: 4100$

💬 If you found this helpful, don’t forget to like, comment, and follow — I share setups like this every week!

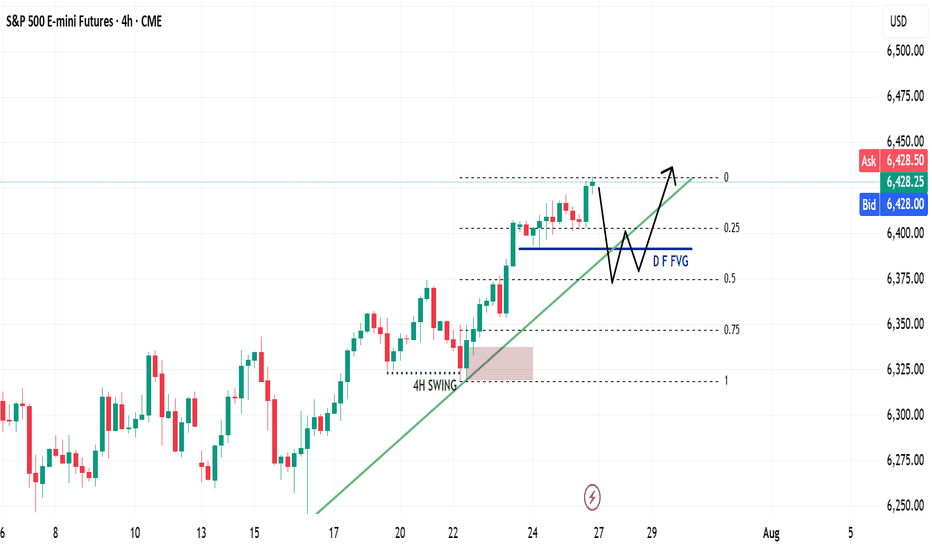

ES Weekly Recap & Gameplan – 27.07.2025🧭 Market Sentiment

The overall sentiment remains bullish, supported by:

• Declining inflation figures

• Trump’s pivot toward aggressive rate cuts

This shift reinforces a risk-on environment across U.S. indices.

🔙 Previous Week Recap

• ES continued its price discovery journey

• Price ran the 4H swing liquidity and shifted market structure

• A clean 1H demand zone was established post-MSS, leading to a strong move toward new ATH

• A bullish trendline has also formed as a visual representation of this momentum

• I anticipated a deeper retracement last week but adjusted my execution based on the ICT SMT concept — see previous week’s ES plan for details

📊 Technical Analysis

Looking forward:

• My expectation is a continued bullish price discovery

• Watching for price to tap into and potentially deviate below the Daily Fair Value Gap (D-FVG)

• This zone also aligns with the 0.5 Fibonacci equilibrium level, which I consider a discounted entry zone

• Confluence of liquidity + trendline + FVG + Fib makes this an ideal location for new long setups

⚙️ Setup Trigger & Trade Plan

Entry Strategy:

• Wait for a clear 1H–4H market structure shift

• Look for demand zone formation within the discount zone

• Execute long trades after confirmation and retracement into this zone

Trade Management:

🎯 Target: New All-Time Highs

⛔ Stoploss: Swing low beneath 1H–4H demand structure

🗨️ If you found this analysis helpful, don’t forget to like and drop a comment below — I’d love to hear your thoughts and setups for the week!

📥 Follow me for more weekly breakdowns and real-time updates throughout the trading week.

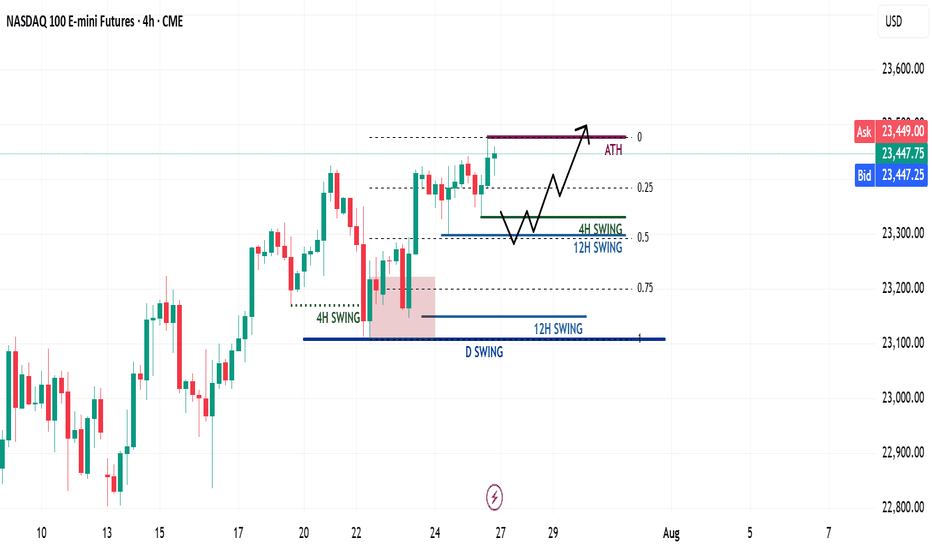

NQ Weekly Recap & Gameplan – 27.07.2025🧭 Market Sentiment

The overall sentiment remains bullish, supported by:

• Lower inflation data

• Trump’s policy shift toward aggressive rate cuts

This creates a strong risk-on environment across U.S. indices.

🔙 Previous Week Recap

• NQ continued its price discovery phase

• Price swept 4H swing liquidity and triggered a market structure shift

• A new 1H demand zone was formed after MSS

• Price revisited the 1H demand and launched toward new all-time highs (ATH)

• While I anticipated a deeper retracement, ES provided the cleaner pullback

• I executed longs on both ES and NQ using SMT divergence (ICT SMT concept)

📊 Technical Analysis

My bias remains bullish as long as the higher timeframe structure holds.

For the upcoming week:

• Watching for either the 4H or 12H swing high to get swept

• Ideally, a retracement toward the 0.5 Fib level, which aligns with my bullish discount zone

• A clean liquidity sweep into this zone could act as a launchpad for the next leg higher

⚙️ Trade Setup & Execution Plan

Entry Strategy:

• Wait for a new 1H–4H Market Structure Shift

• Identify the new demand zone post-MSS

• Look for price to return to the zone for a long opportunity with LTF confirmation

Trade Management:

🎯 Target: New ATH

⛔ Stoploss: Swing low of the 1H–4H demand zone

📌 Chart will include Fib levels, MSS zones, and execution trigger areas.

Let me know your thoughts or share your plan below.

Happy trading!

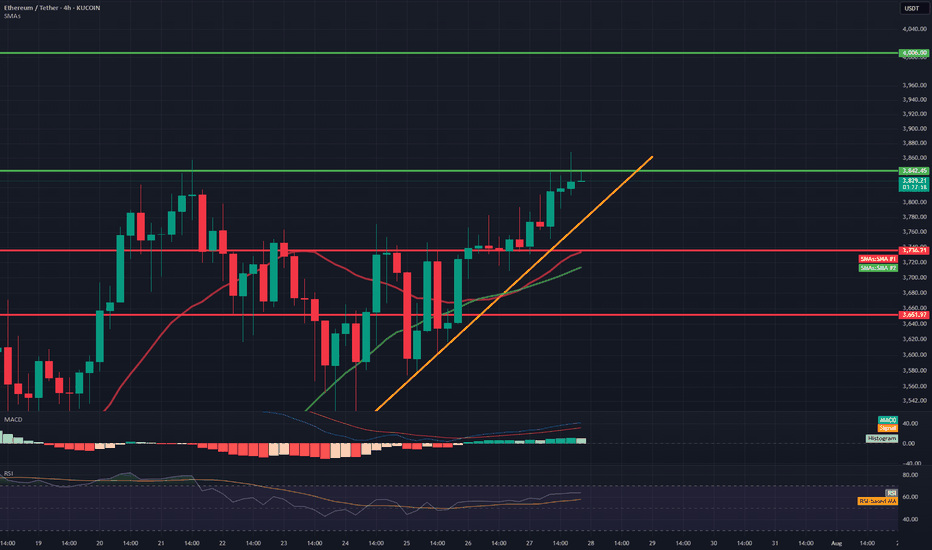

ETH/USDT 4H Chart📊 General Context

Ethereum is rising in a strong short-term uptrend, supported by a rising trendline (orange).

Current price: 3831 USDT

We are approaching a significant resistance level around 3842–3850 USDT (green line).

Technical support is located around 3760 USDT (previous consolidation level and 50/200 SMA).

🔍 Technical Levels

Resistance:

3842–3850 USDT – local high, currently being tested.

4006 USDT – key psychological level and the last local high on the chart.

Support:

3762 USDT – previous resistance, currently turned into support (may be tested in a correction).

3650 USDT – strong technical support, confirmed several times in the past.

SMA50 and SMA200 – currently just below the price, also acting as dynamic support.

📈 Technical Indicators

MACD:

The histogram is rising and positive → bullish momentum.

The MACD line crosses the signal line from below → a buy signal.

RSI (14):

Currently: around 64 → not yet overbought, but close to the overbought zone.

Slightly rising trend, but may suggest impending market overheating with further gains.

🧭 Trend

Short-term: strong uptrend (trend line, green candles, breakout from consolidation).

Medium-term: higher lows and higher highs – the uptrend is maintained.

The price is holding above the 50 and 200 SMAs – confirming bullish sentiment.

⚠️ What to watch next?

A 4-hour candle close above 3842 USDT → confirmation of a breakout, a potential attack on 4000–4010 USDT.

A break of the trend line (orange) → a possible correction to 3760 or even 3650 USDT is possible.

An RSI rise above 70 → an overbought signal, a possible pullback or consolidation.

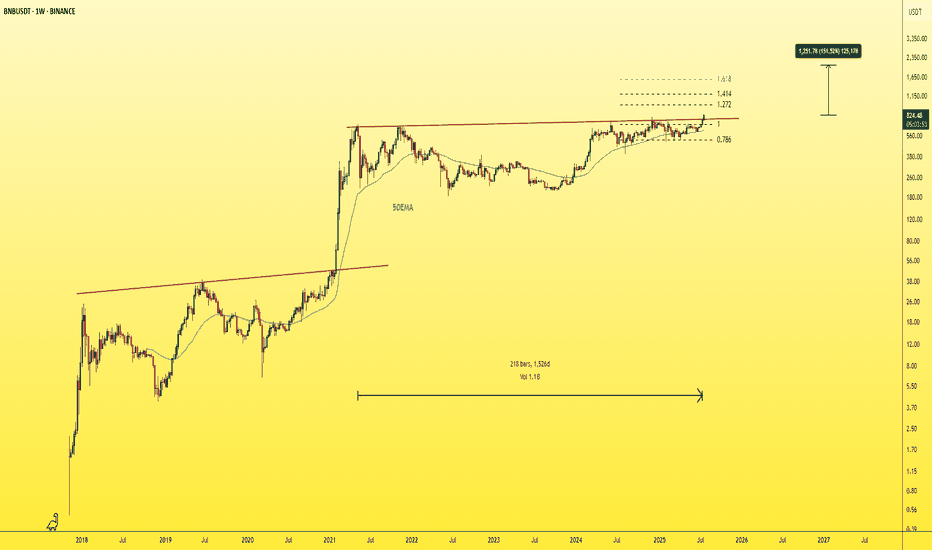

BNBUSDT - New ATH!"The strongest resistance level on the chart has just been broken — which was represented by the previous ATH — after nearly four attempts.

This exact pattern occurred before in 2021, and what followed was a parabolic rally.

The same scenario is unfolding now!

You’ll soon see BNB trading in four digit

When the crowd doubts — the smart money loads up.

Expect a parabolic rally once sentiment flips.

Best Regards:

Ceciliones🎯

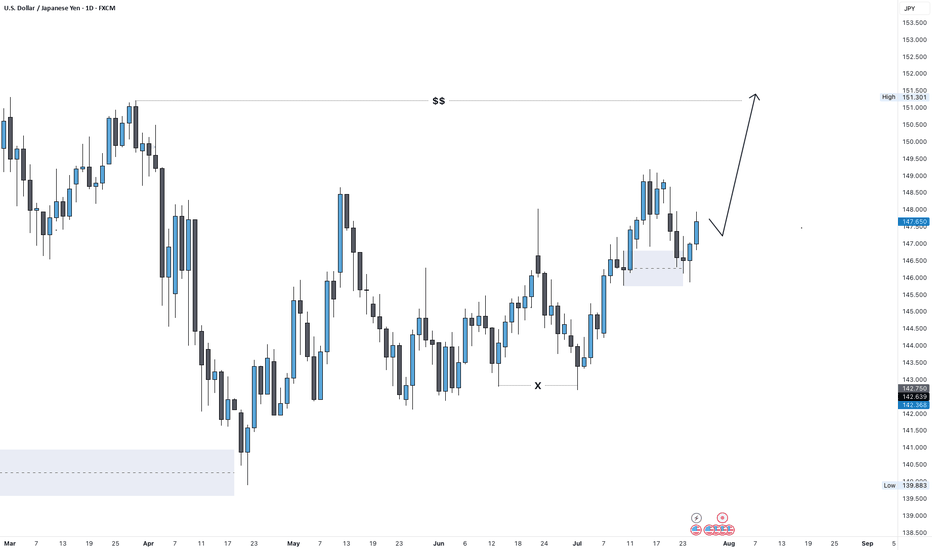

USD/JPY Outlook: Bullish Target Set at 151.0 USD/JPY Weekly Forecast – July Week 4

Last week, USD/JPY retested a weekly Fair Value Gap and closed with strong bullish pressure, confirming demand. Now, the next key liquidity level sits around 151.00 — just above the previous major highs.

On the daily timeframe, we may see a bearish retest toward 147.00 early in the week. From there, supported by both Federal Reserve sentiment and a bullish dollar, price could launch a strong bullish move to sweep the 151.00 highs.

Bias: Bullish

Key Zones:

• Support / Retest: 147.00

• Target: 151.00

• FVG Reaction: Confirmed on weekly close

The setup aligns with dollar strength and clean bullish structure.

—

Weekly forecast by Sphinx Trading

Drop your view in the comments.

#USDJPY #ForexForecast #SmartMoney #LiquidityTargets #SphinxWeekly #DollarStrength #PriceAction #FVG

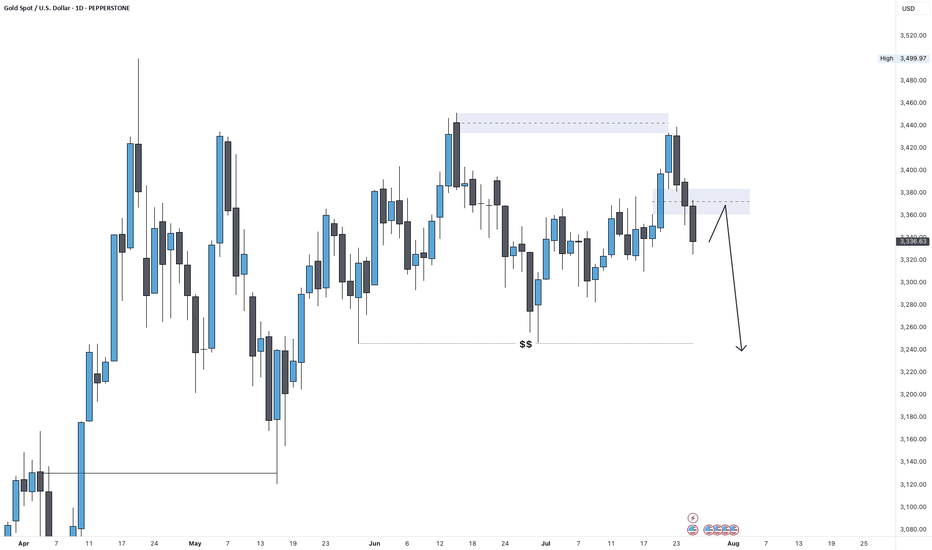

Gold Outlook: Bearish Continuation in Play Toward 3,250Gold Weekly Forecast – July Week 4

Gold closed last week with a strong bearish weekly candle, rejecting from the 3,440 supply zone and closing below the key Fair Value Gap at 3,360. This confirms downside pressure, especially in the context of a strengthening dollar.

For this week, we may see a bullish opening early in the week toward 3,370, followed by a deeper bearish move targeting the major low and liquidity pool at 3,250.

Bias: Bearish

Key Zones:

• Resistance / Retest: 3,370

• Target: 3,250

• Supply Rejection: 3,440

Momentum favors further downside unless bulls reclaim key levels.

—

Weekly forecast by Sphinx Trading

What’s your bias on Gold this week?

#Gold #XAUUSD #SmartMoney #FairValueGap #BearishBias #SphinxWeekly #LiquiditySweep #GoldForecast

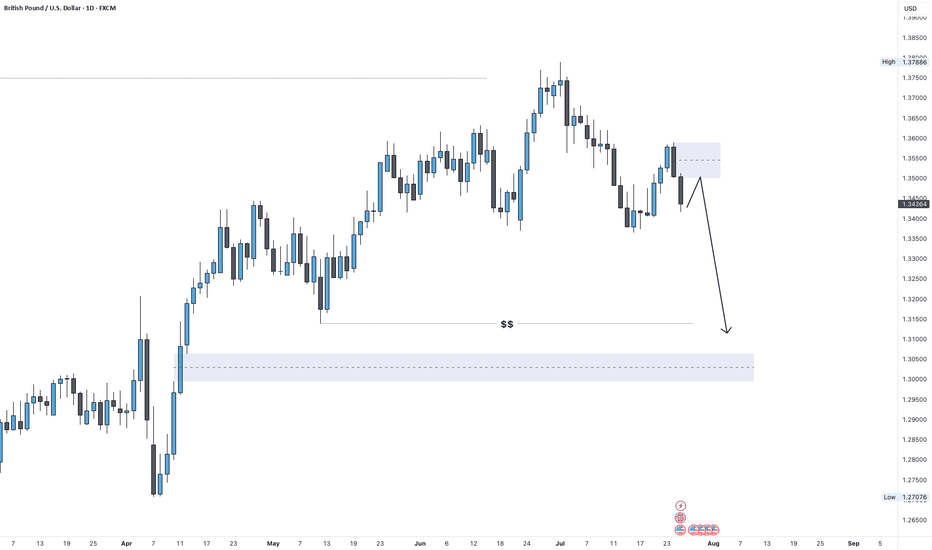

GBP/USD Outlook: Bearish Swing in Play After Weekly FVG RetestGBP/USD Weekly Forecast – July Week 4

Last week, GBP/USD retested a weekly Fair Value Gap near 1.35900 and responded with a strong bearish engulfing candle — showing clear rejection from the imbalance zone.

With the dollar expected to strengthen this week, we could see a small bullish retracement early in the week toward 1.35000, followed by a bearish swing move targeting at least the 1.31000 support zone.

Bias: Bearish

Key Zones:

• Resistance / Retest: 1.35000

• Target: 1.31000

• FVG Supply: 1.35900

Structure and macro direction both point to GBP weakness continuing.

—

Weekly forecast by Sphinx Trading

Share your bias in the comments.

#GBPUSD #Cable #ForexForecast #SmartMoney #SphinxWeekly #FairValueGap #DollarStrength #PriceAction

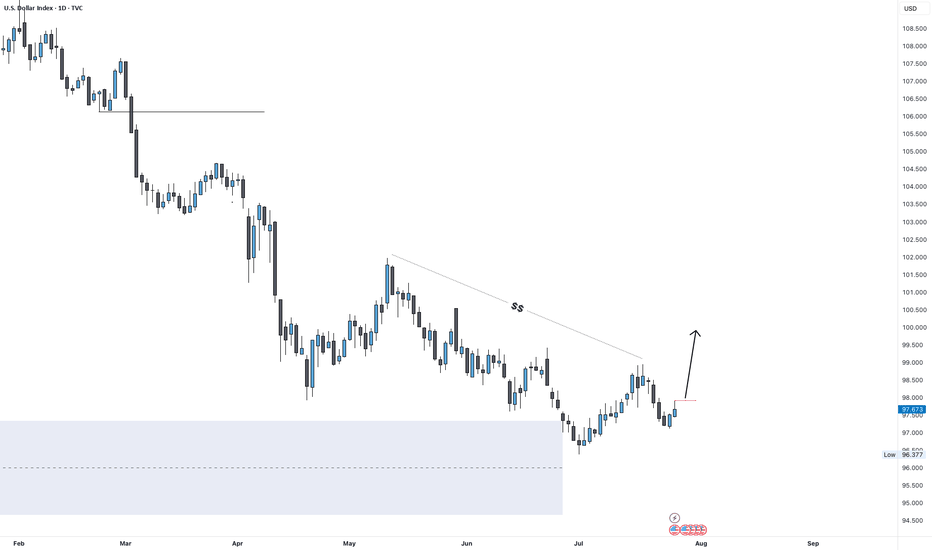

DXY Outlook: Can Fed Hold Spark a Move Toward 100?DXY Weekly Forecast – July Week 4

After reaching 96.50 early this month, DXY began showing bullish signs. Last week, price retested the extreme demand zone at 97.00 and closed with a bearish weekly candle that held some bullish pressure at the base.

This week, all eyes are on the Federal Reserve meeting. If the Fed holds rates steady, the dollar could strengthen further. A weekly close above 97.90 would confirm the breakout and open the door to a run toward 100.00 — a key psychological and technical level.

Bias: Bullish (if 97.90 breaks)

Key Zones:

• Demand: 97.00

• Breakout Level: 97.90

• Target: 100.00

This could be the beginning of a fresh bullish leg — especially if macro conditions align with technical structure.

—

Weekly forecast by Sphinx Trading

Let me know your bias in the comments.

#DXY #DollarIndex #ForexForecast #SphinxWeekly #SmartMoney #FOMC #USD #InterestRates