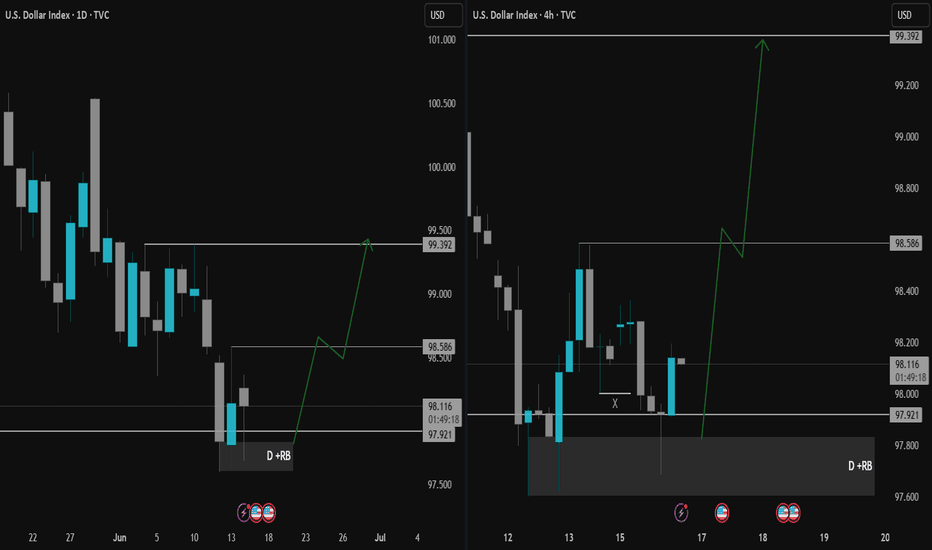

DXY Market Outlook: Eyes on 99.392Hello Traders,

DXY found buyers at the 97.921 level we tracked last week and managed to close daily candles above this level. We can now refer to this area as a rejection block (D + RB). This week, the block was retested and encountered rejection from buyers.

With this buyer reaction, our target is the peak level of the consolidation that brought the price here (99.392).

There's a minor level to watch along the way: 98.586. However, considering the key level where the price reacted and the weekly chart showing no major obstacles ahead, we believe that targeting the peak of the consolidation that initiated the last decline (99.392) is the more suitable approach.

Taking news data into account—and more importantly, geopolitical factors and unexpected developments—we still acknowledge the possibility of the price sweeping the low again. However, we don’t expect this to invalidate the overall scenario. With news catalysts, we anticipate the price reaching the target within the week.

Until the next update, wish you many pips!

Fundedtrader

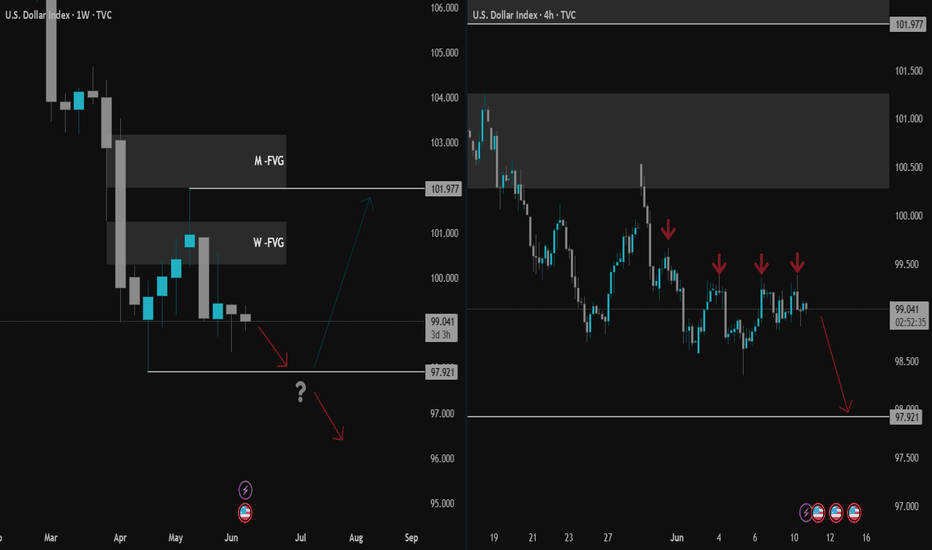

Stuck in the Zone: DXY Tests Balance Between 98 and 99Hello Traders,

After a sharp and uninterrupted decline in the DXY, price found support at the 97.921 level. Sellers then regained control from the weekly bearish Fair Value Gap (W-FVG), pushing price back into the 99 zone.

In this zone, neither sellers nor buyers have managed to assert dominance—suggesting that these levels may act as a pause or balance point. Given the extended drop, a temporary correction could follow if buyers gain traction after one last push.

For now, the bearish USD narrative remains intact. With upcoming catalysts like China/US talks and tomorrow’s CPI release, a renewed move toward 98 is likely to accelerate.

Whether this leads to further selling or a corrective phase will be assessed afterward.

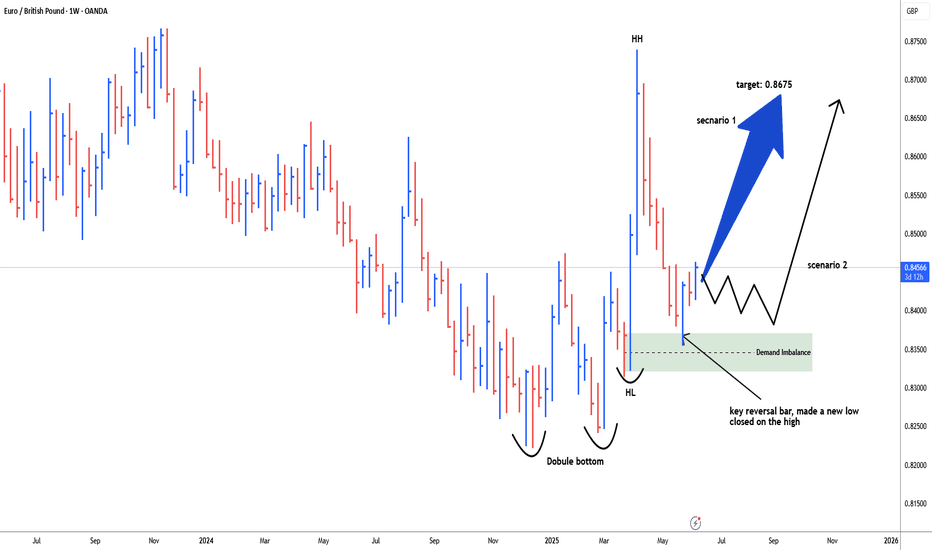

EURGBP possible long for 0.8675 even highereurgbp weekly chart formed double bottom. eurgbp retraced back to 0.8356 and hold the previous HL (higher low)0.8317, weekly key reversal bar formed , made a new low closed on the high. indication for long for coming days and weeks. stop loss below 0.8317, target 0.8675.

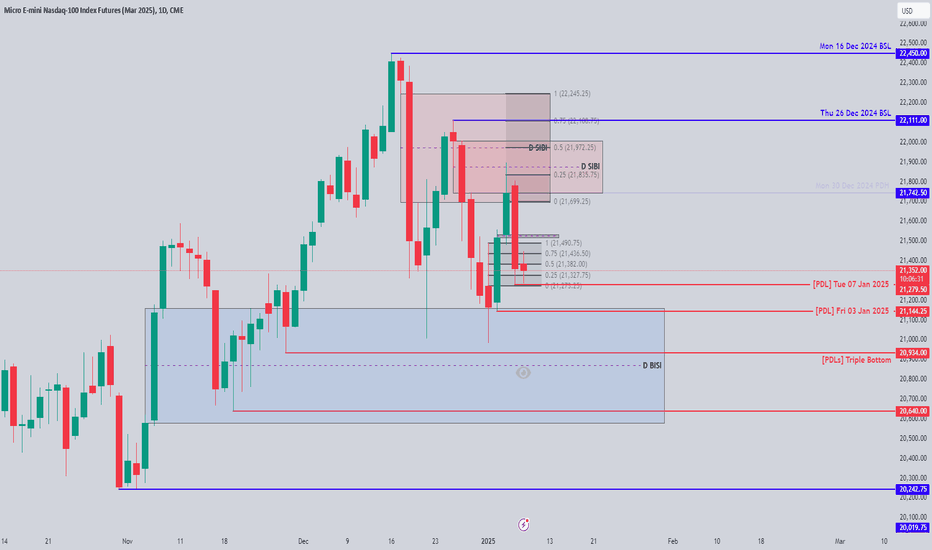

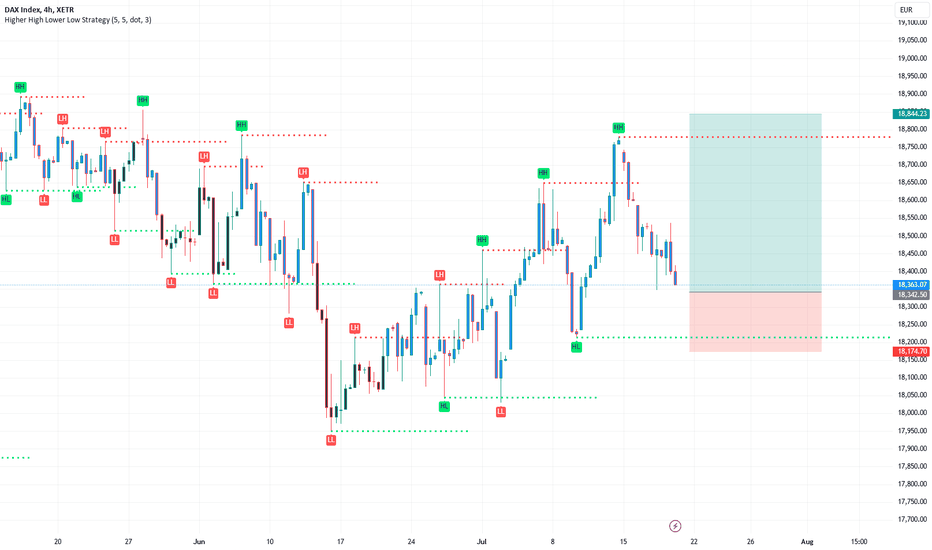

HTF Directional Bias for MNQ

I have a Bearish Bias in play before the 07:00 Pre Session aiming to reach for the Fri 03 Jan 2025 at 21,144.25 and price could come as low as the 20,934.00 level which has the clean triple bottom SSL.

The reason why I am Bearish is because price has made a recent rally into the D SIBI and found rejection at the 50% CE level on Mon 06 Jan 2025. Then on Tue 07 Jan 2025 price left that D SIBI to trade lower through the Volume Imbalance and into the discount wick of the candle from Thu 02 Jan 2025.

Since it is a very heavy news release I do expect it to make a nice move lower since there is a bunch of SSL resting below the PDL's and price could reach as low as the discount D BISI 50% CE level at 20,871.25

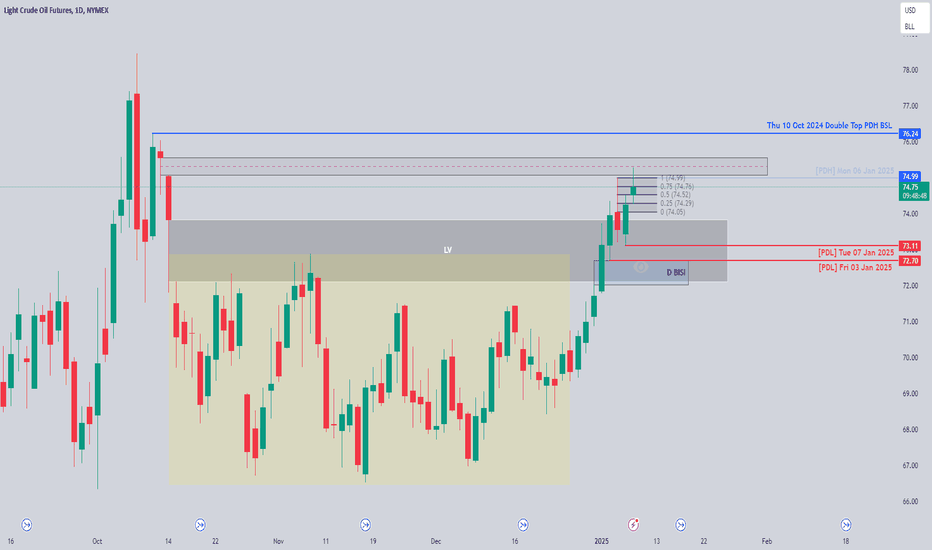

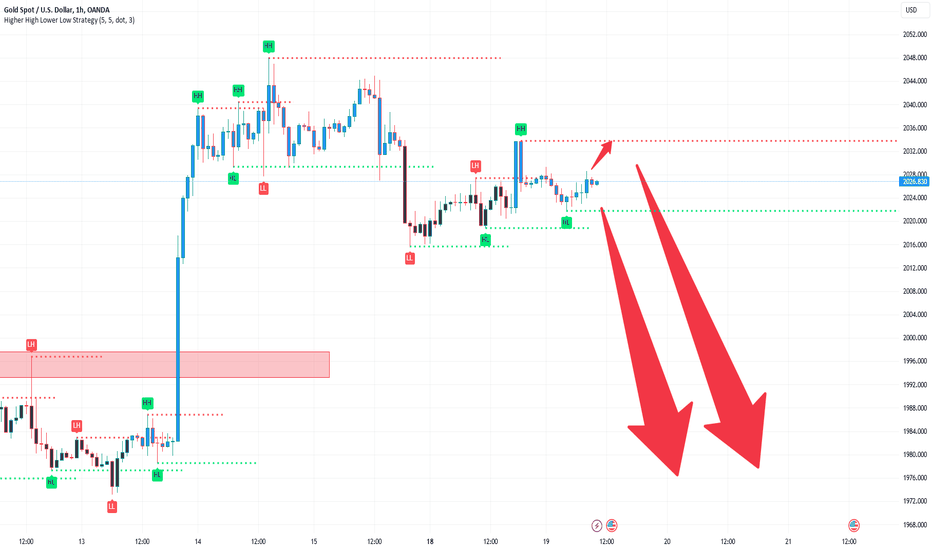

HTF Directional Bias for CL

I like the fact that price traded higher into a premium and found rejection off the Volume Imbalance 50% CE level as it clears the BSL above the PDHs.

Currently price is trading inside the wick from the Mon 06 Jan 2025 and looks to have reached as low as the 25% quadrant level.

My bias for CL is Bearish as I am looking at the two PDLs in discount above the D BISI which should act as a draw for price to reach lower and clear that SSL at 73.11 and 72.70 From there I could expect price to dip into the D BISI and reject possibly off the high or 50% CE level.

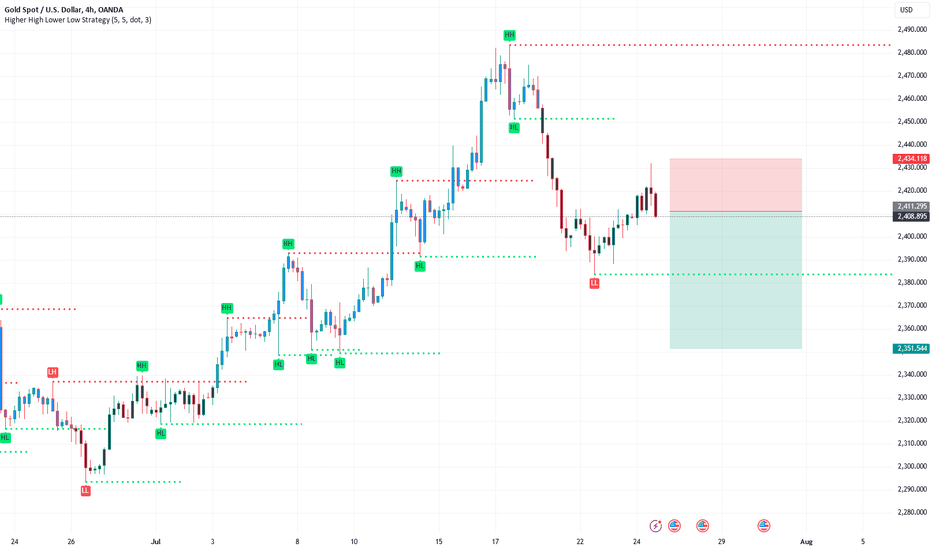

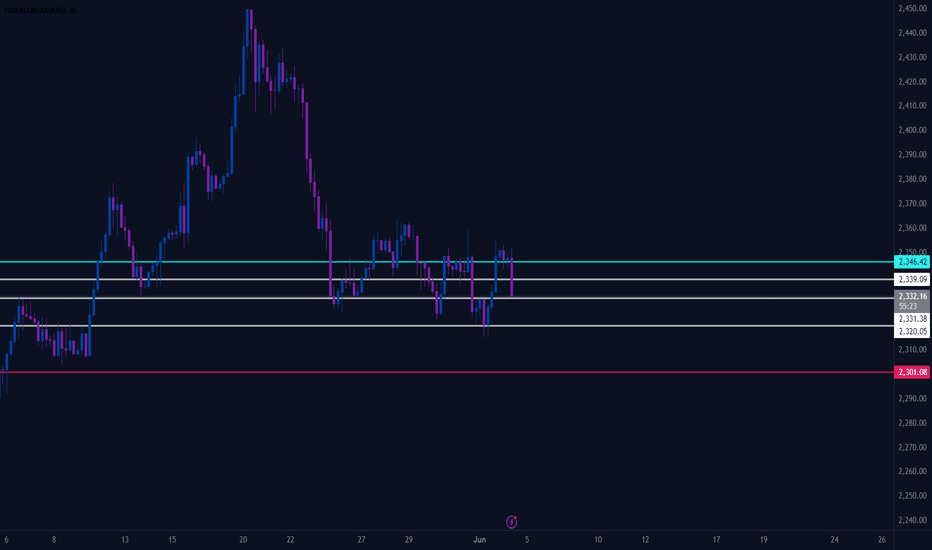

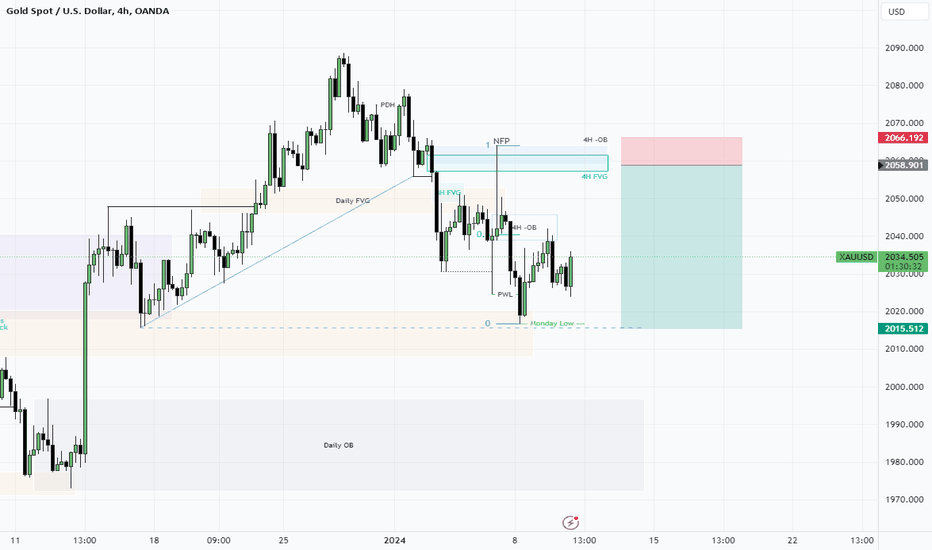

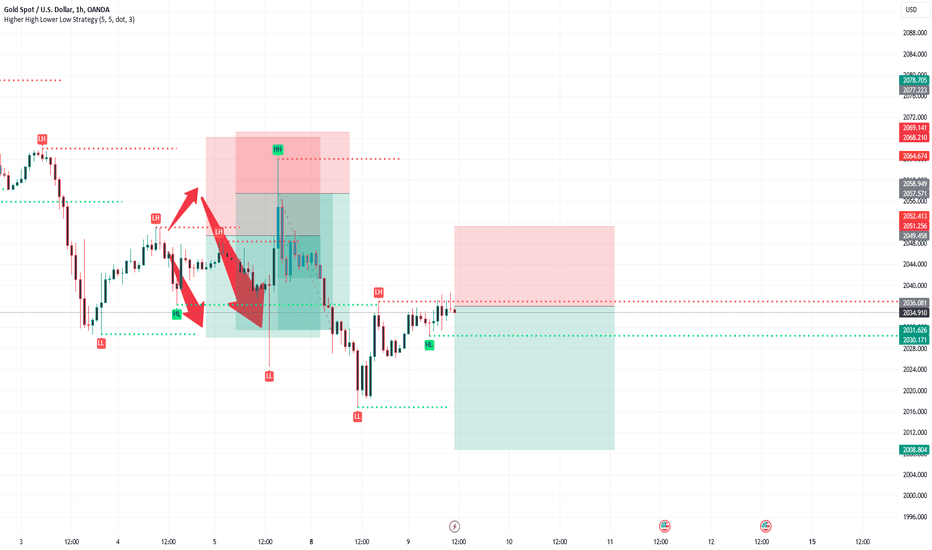

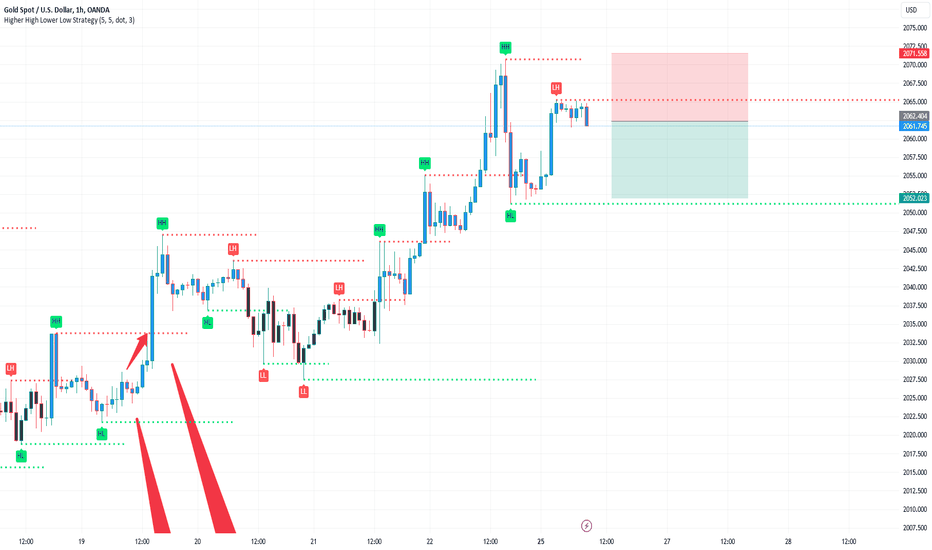

Gold : Buyers need weak data from USAFOREXCOM:XAUUSD

🌘Gold buyers trying with 2346 Support level which is in the past used as support and resistance level.

🟣Gold goes up past week because of GDP and Unemployment calims weak datas.

🔵The expectation todays JOLTs Job Openings from 8.488 decrease to 8.350 also

JOLTs Job Quits 3.329 decrease to 3.200.

🟡Decrease more than forcast Job Openings could effect to Consumer Confidence and Wage growth and Disposable Income.

🟢By the way Investors should consider to Quit job data because downtrend in Quit job

shows doubt in the labor market.

⚪Weaker conditions in the labor market may push FED to take less Hawkish stance on Intrest Rates.

🔶 Supoort levels: 2331 , 2321 💤Weak rsistance: 2339 🔷Resistance level: 2346

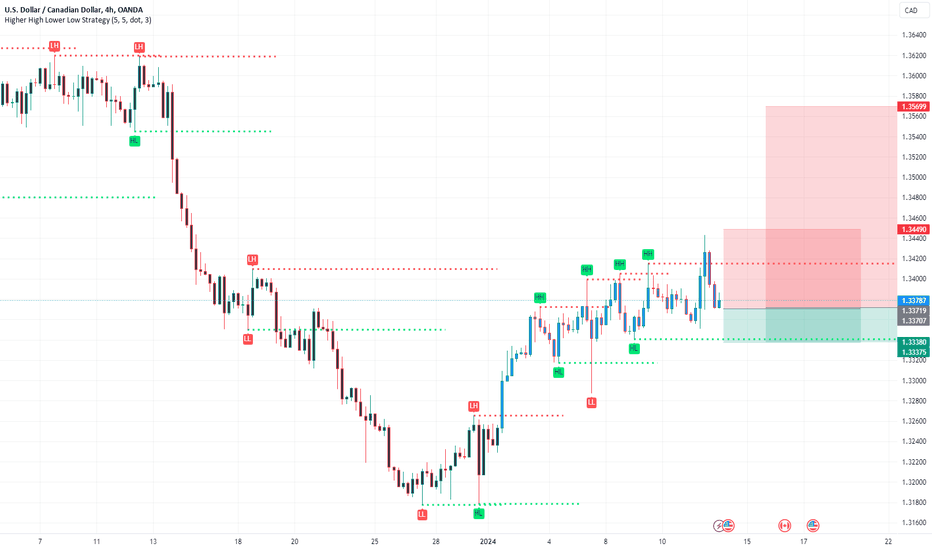

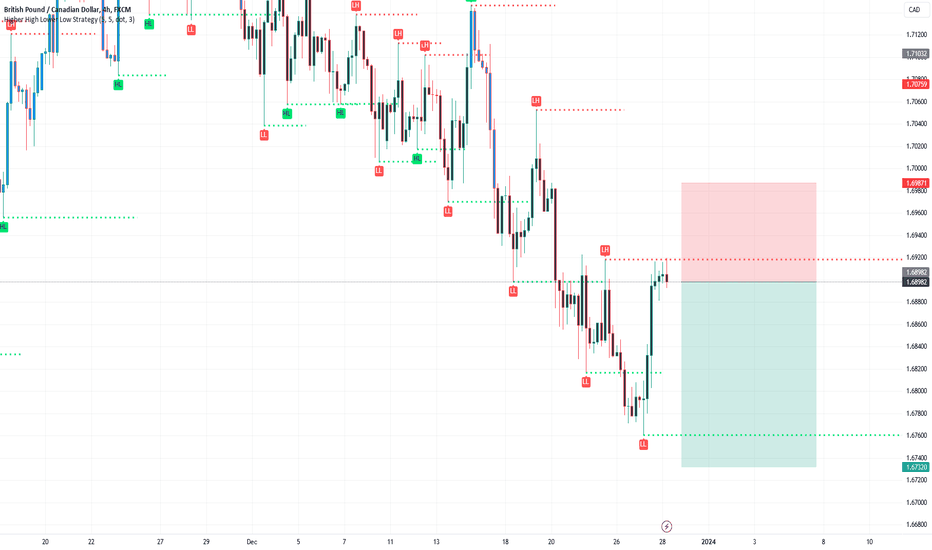

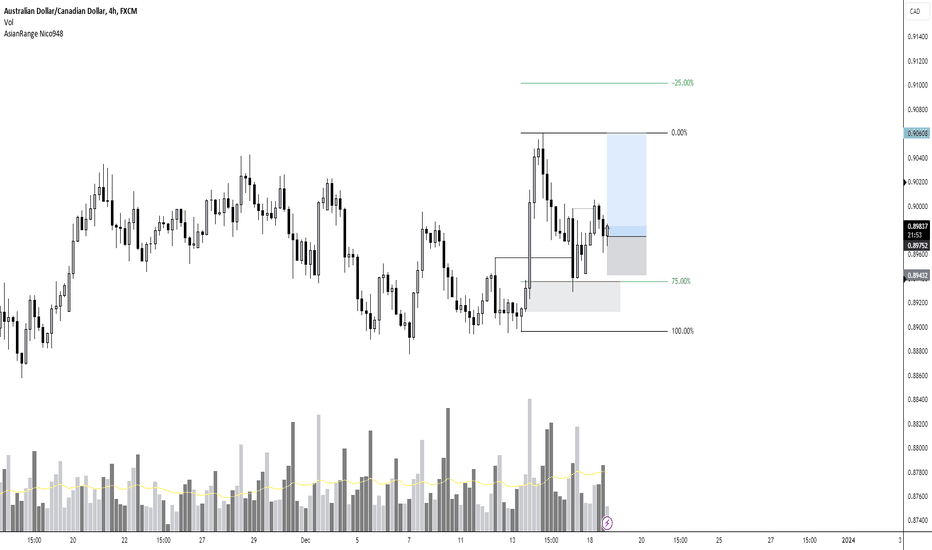

Last Trade of 2023 - AUD/CAD LongMight be the last trade of the year for me. Swing trade on the H4/H1 timeframe confirming the bullish structure with a candle's close above the previous highs. Retest on the H4 OP of the bullish impulse, imbalance closed. Change of structure on the H1 and entry on the retracement. (H4 Bearish candle with rejection and high volumes = high effort, small result for sellers).

Retested 75% quarter of the dealing range (Quarter's theory), targeting the next high. Good luck traders and happy holidays