Fundedtrader

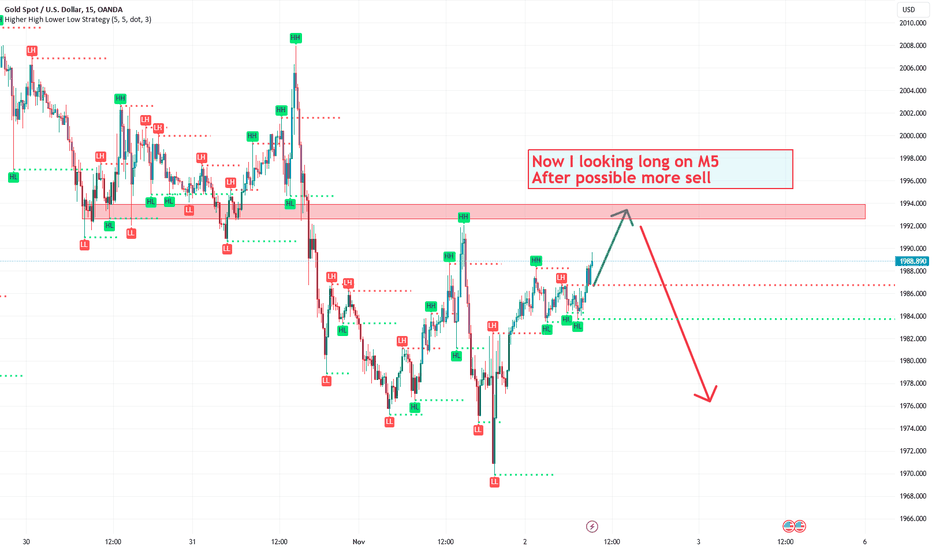

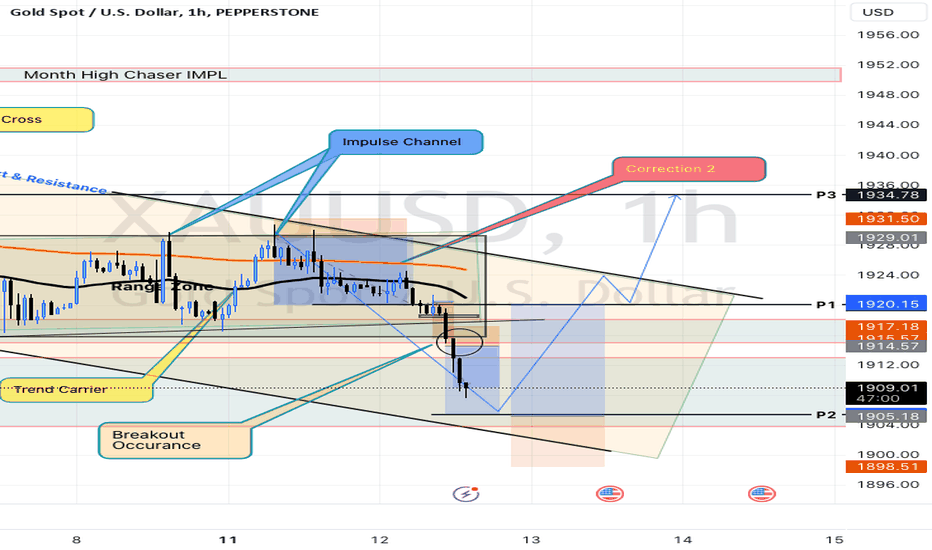

XAUUSD 1HR Analysis Update & Trade IdeaXAUUSD 1HR Analysis Update & Trade Idea

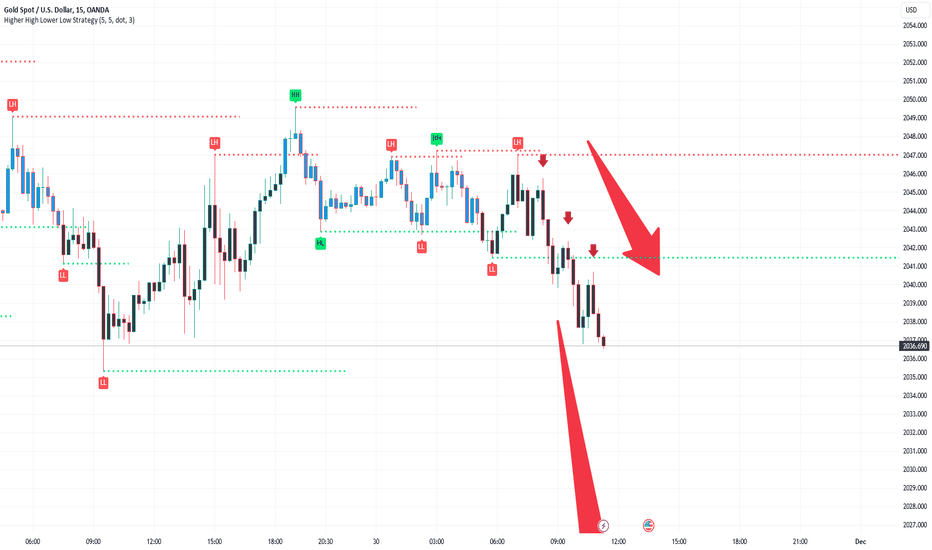

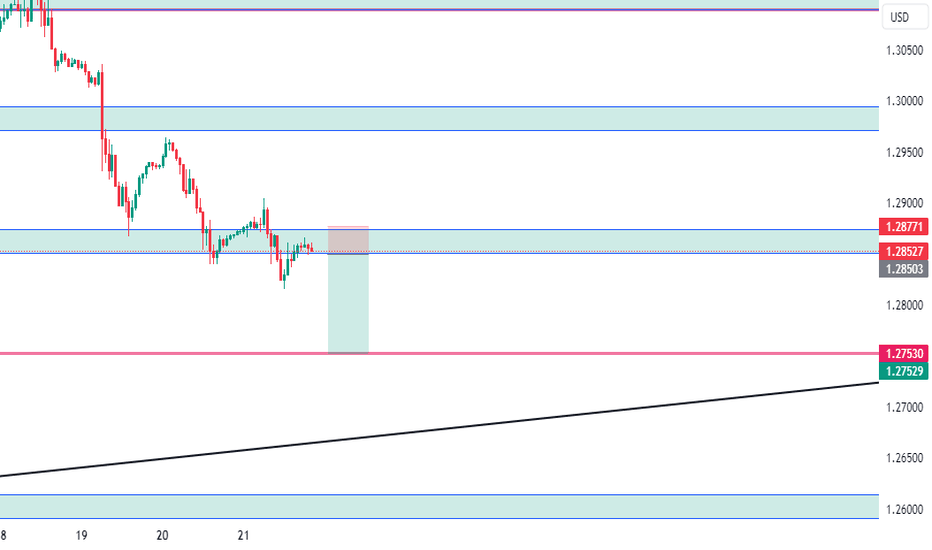

After catching sells down from the top of the 1927-29 area we are now looking for the correct confirmations around 1905-07 to enter longs back up to the key area of 1934 and maybe even chase the months high at 1954 as we saw last time there is a lot of support around the 1890-1900 zone which would need an event such as CPI to break it, so I guess we will see what happens tomorrow but for now we will see what price action develops like today.

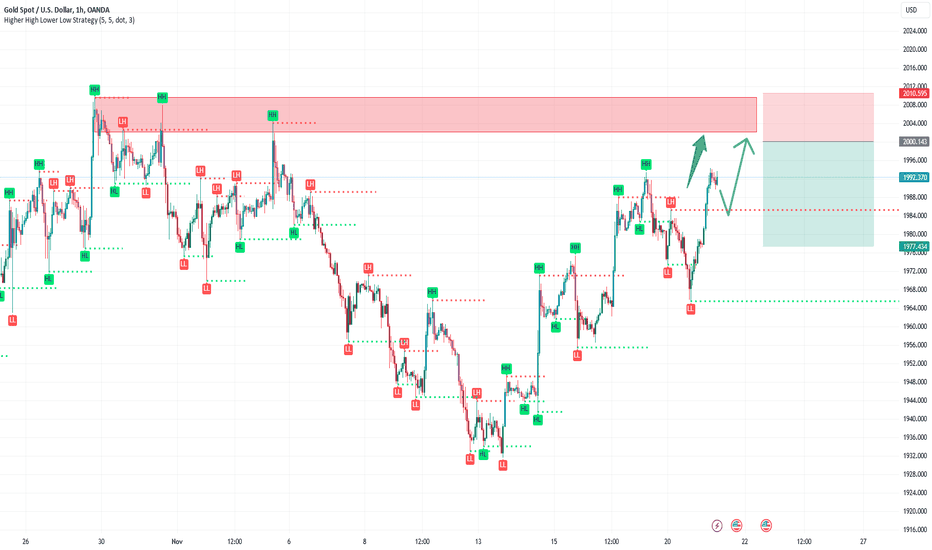

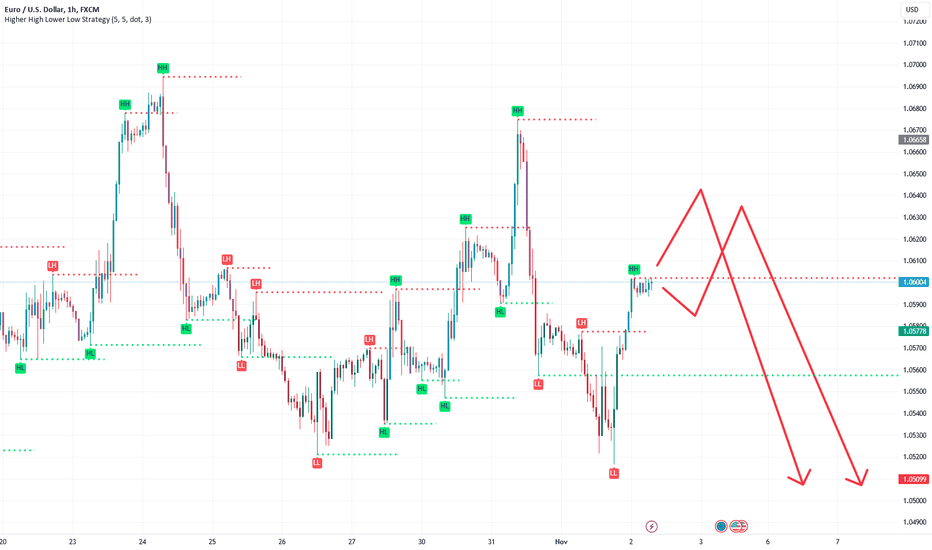

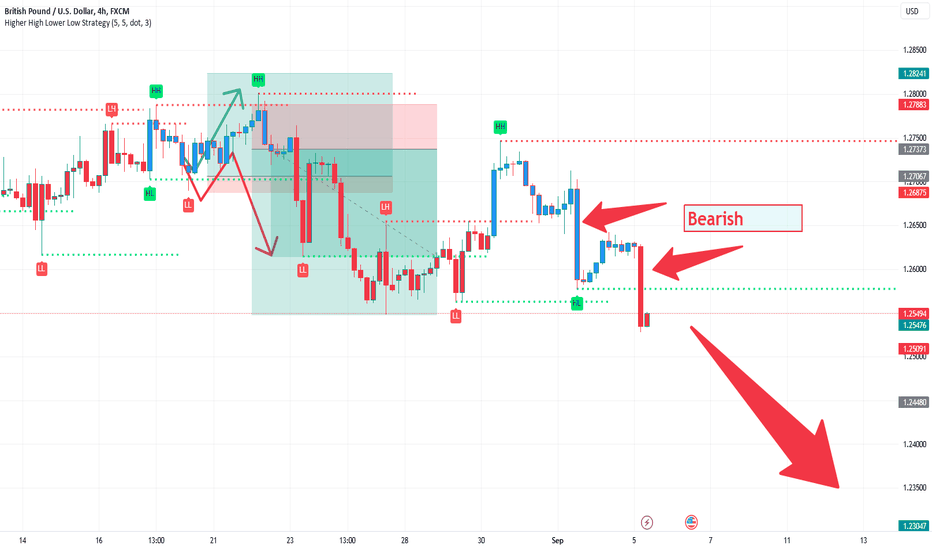

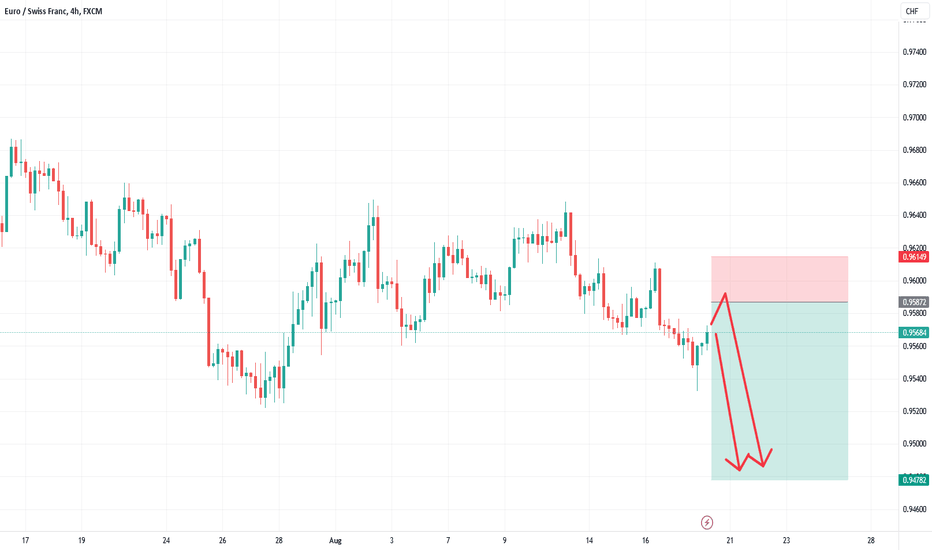

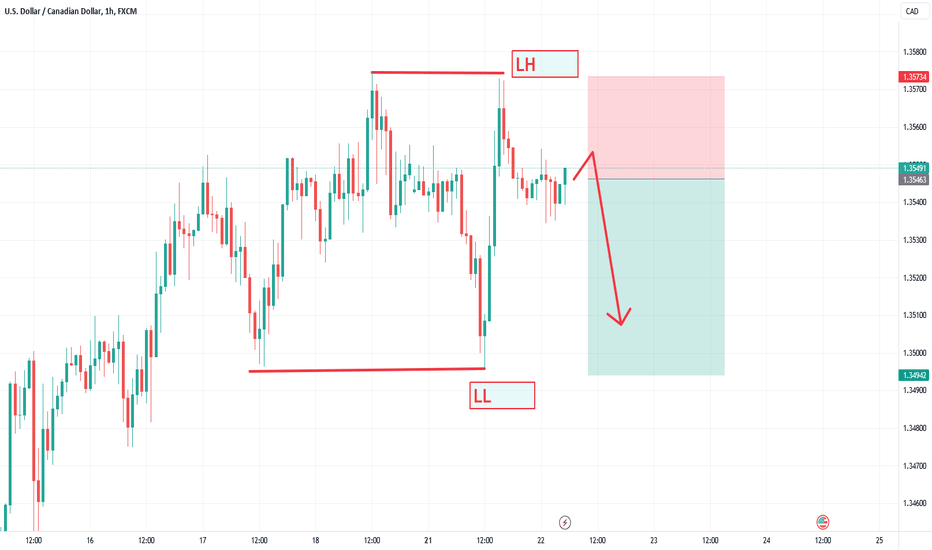

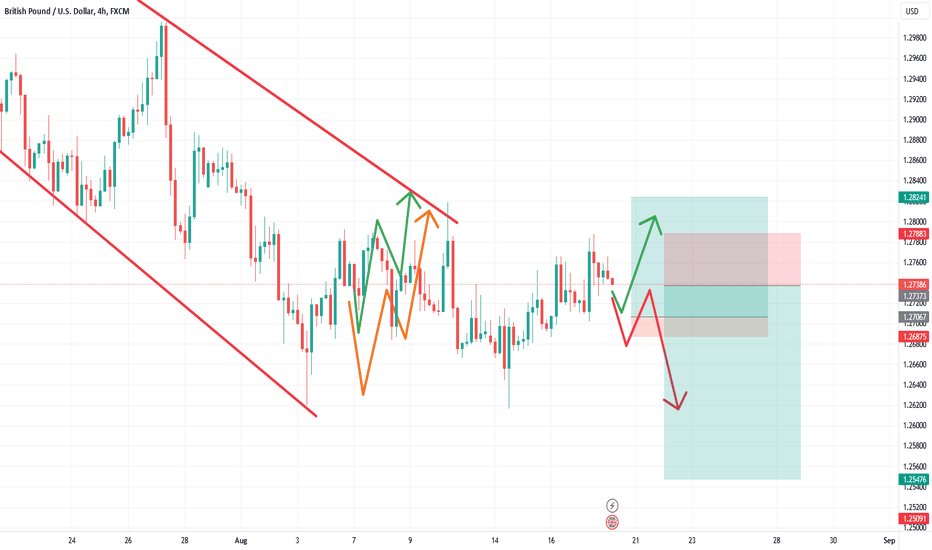

GBPUSD WITH 100 PIPS BEARISHThe pair has been on a clear trend all through this week and may likely continue in the early part of next week before a possible reversal,

The price is projected to leave the 50/618 FIB level and any bearish engulfing candle will be a confirming ,

However, According to DANCOLNATION CAPITAL Trading strategy, we shall take our partial profit at 100% retracement with 100 pips at 1.2800 price because of any failure to make a new low signals the change in trend.

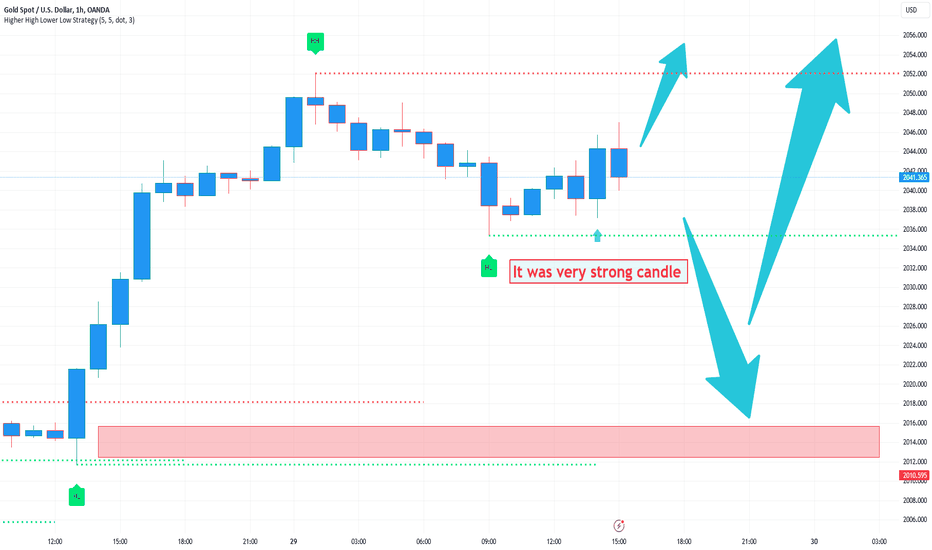

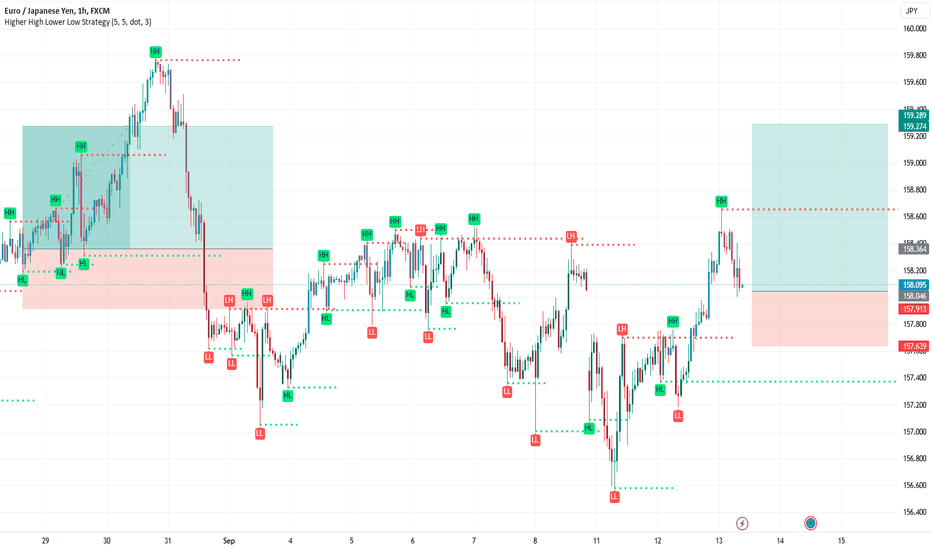

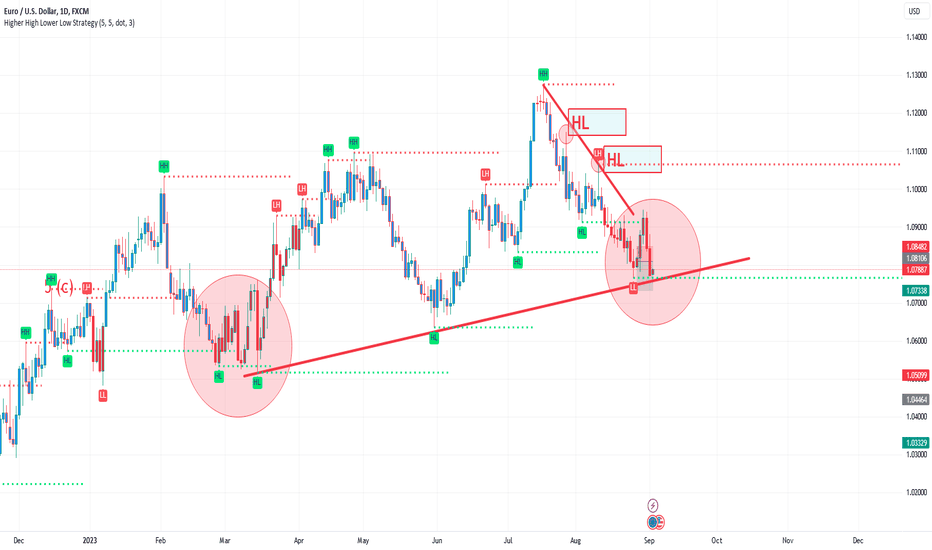

Gold analysis for the week of July 9, 2023.Last week I mentioned I wanted to see a bullish week with an sweep of buy side liquidity in the form of previous weeks High as an upside objective. That objective was met perfectly, price did exactly as explained, price fell into an 1hr +FVG forming the low of the week drawing to LWH sweeping the liquidity resting above it.

This week I'm still bullish gold, with great confidence given the fact that the DXY is bearish. Bearish dollar means bullish gold. I'm anticipation at some point this week possibly

Tues/Wed, for the low of the week to form below current price. We do have some high impact news on Wed, in the form of CPI, that I think helps price get to the buy side liquidity.

I go into more detail of potential entries and targets. Have a great week trading.