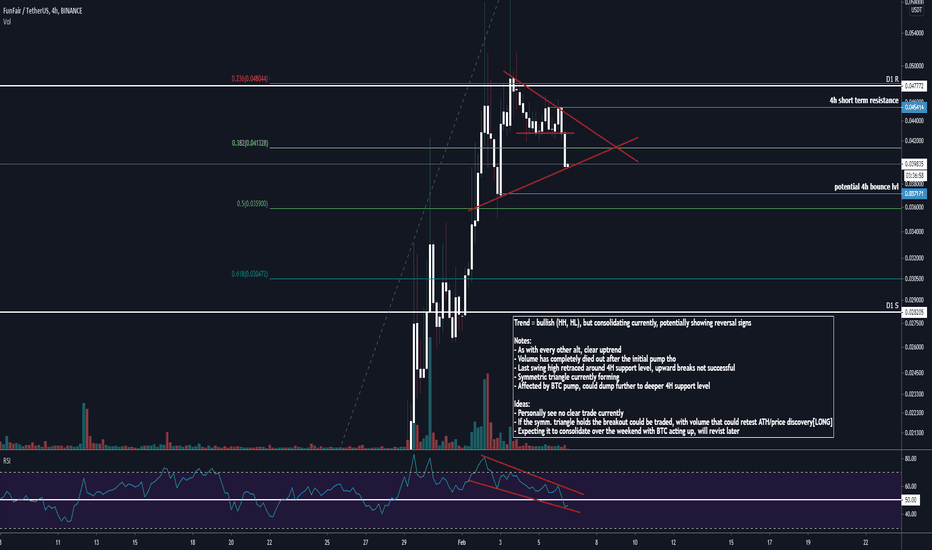

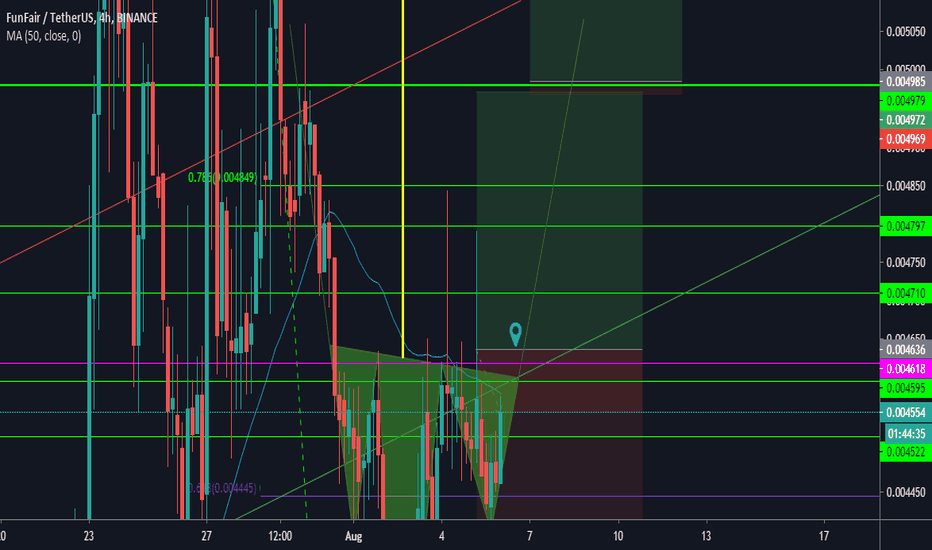

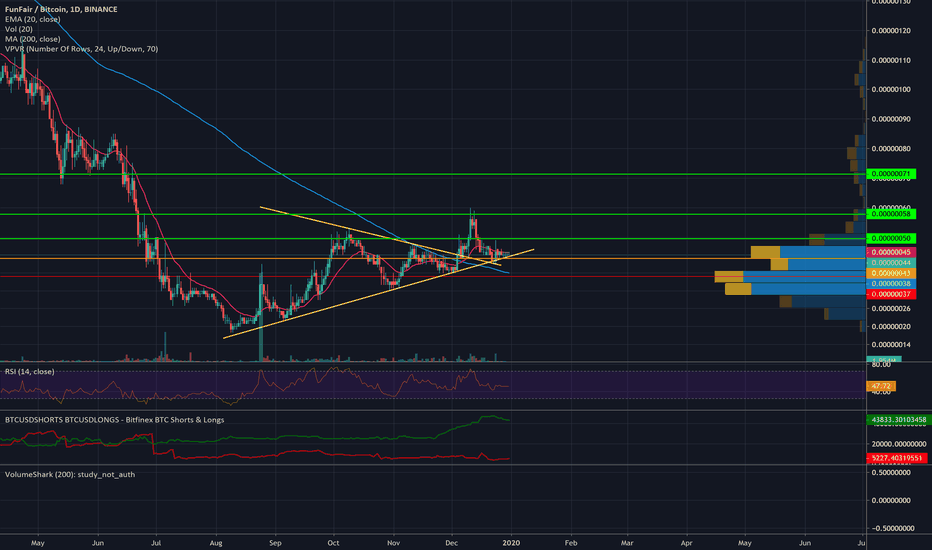

FUNUSDT - Consolidation with potential symm triangle break upTo keep myself accountable and keep practicing my TA I'll be charting the top 100 crypto's by marketcap over the coming fews days. Any feedback and tips are welcome.

Trend = bullish (HH, HL), but consolidating currently, potentially showing reversal signs

Notes:

- As with every other alt, clear uptrend

- Volume has completely died out after the initial pump tho

- Last swing high retraced around 4H support level, upward breaks not successful

- Symmetric triangle currently forming

- Affected by BTC pump, could dump further to deeper 4H support level

Ideas:

- Personally see no clear trade currently

- If the symm. triangle holds the breakout could be traded, with volume that could retest ATH/price discovery

- Expecting it to consolidate over the weekend with BTC acting up, will revist later

FUNUSDT

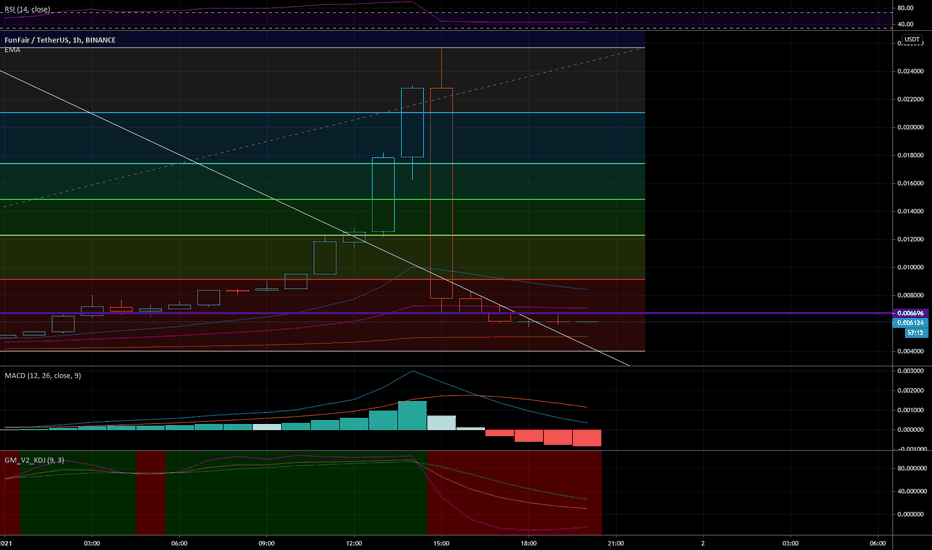

FUN/USDT headed to fun time fair land: Break the resistance Hello Traders,

I’m catching a ride on this roller coaster, got a one way ticket to the moon.

If we can break the .008984 range, we should be good to head to the next level, which is where I have my first TP set at, $.009906.

Volume has strengthened, RSI its showing bullish strength and HL’s.

Good luck to you!

WELCOME TO JUPITER!! THE WORLDS FIRST HUMANS TO GAMBLE IN SPACEELAUNCH MISSION TO JUPITER!! WE'RE SLOWLY BUILDING UP FOR THE BEST IN CLASS NIUMVERO UNO LAUNCH OF GREAT SUCCESS! DON'T BLINK AS YOU MIGHT GET FOMOD INTO A DUMPSTER! DON"T SLEEP AS YOU MIGHT GO BROKE!! DON"T SAY NOTHING! BUY!!! THIS IS NOT FINANCIAL ADVICE!!! THIS IS JUST A MISSION TO A NEW PLANET!!! OOOOHHHH RAHHHH

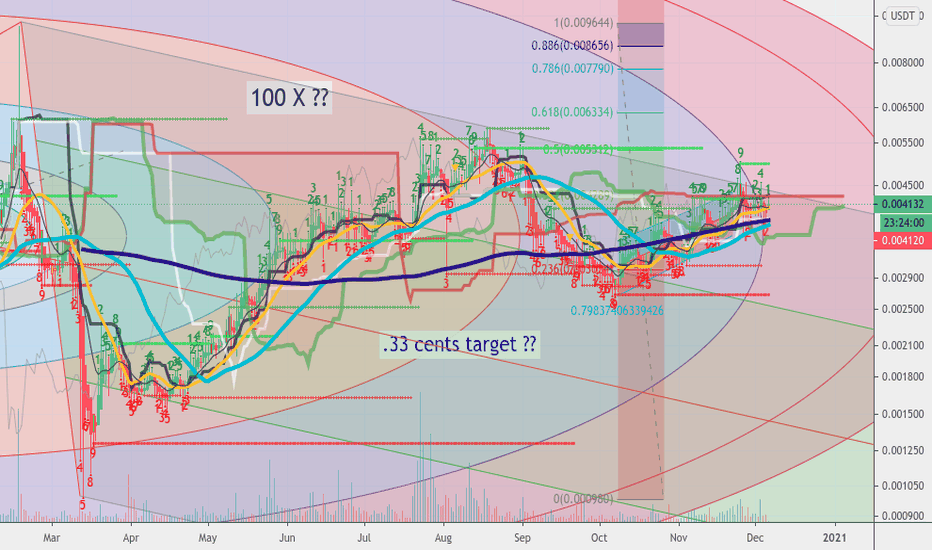

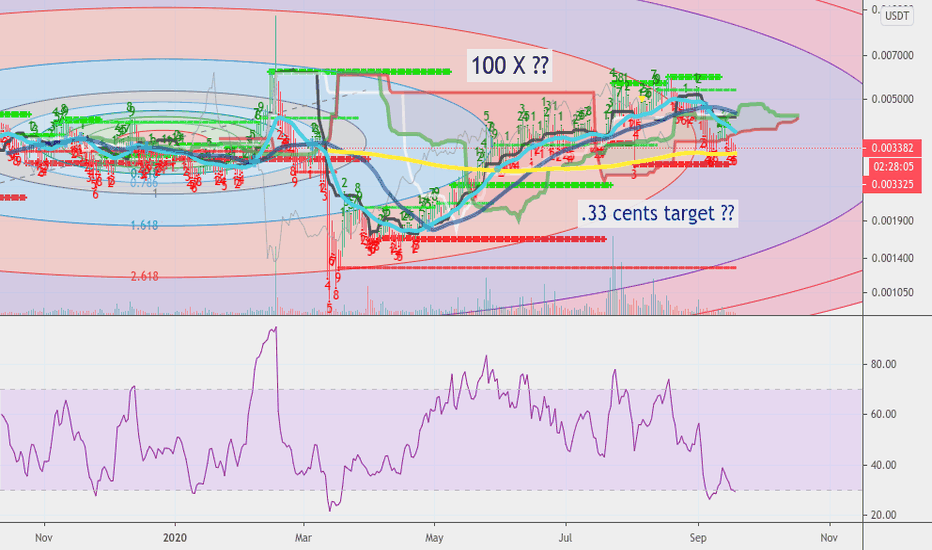

You Like Numbers Kid ? FUN/USDT #funfair $FUN #cryptoThe numbers on this coin FUN are very interesting - apparently the All Time High is 33 cents . And at the time I'm writing this post here the Coinmarketcap ranking for this coin is exactly 333 ! That's extremely unusual , I think . Last month the price was .003 which is exactly 100x up to the ATH of 33 cents . Also , this is a Crypto gambling company . If anyone is into " Number Theories " or mathematics you might be interested to give this coin a look . Most of the volume appears to be on Binance though .

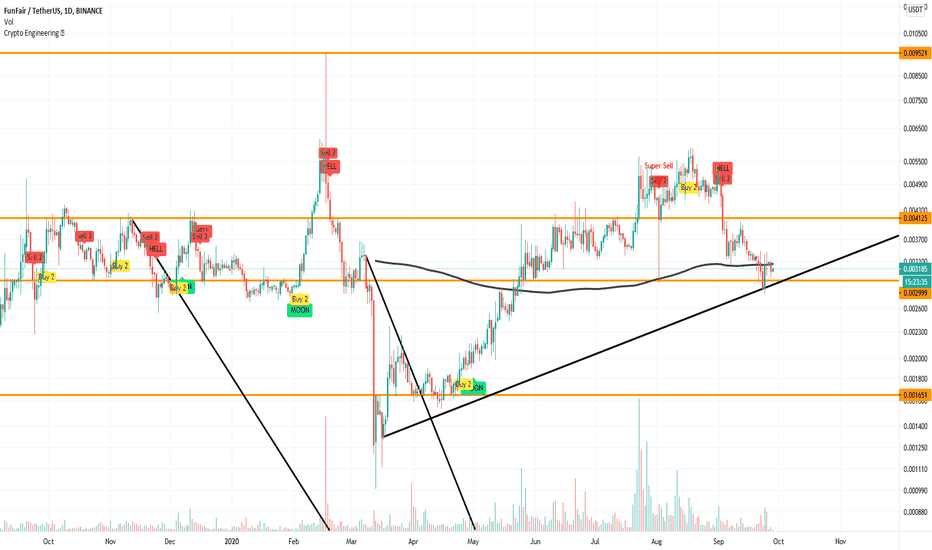

FUNUSDT AnalysisI am currently bullish about FUN while EngineeringRobo remains bearish.

If you are currently holding FUN, you should continue to hold and sell at the Resistance level (0.0041).

If you are looking to buy FUN, your options are:

- Wait for EngineeringRobo Buy signals

- You could buy now as the candles have touched the MA200 line

- You are a little more conservative, you could buy at the support level (0.002) or at the uptrend line.

At whatever level you choose to buy, look out for EngineeringRobo sell signals!

If you are interested in using EngineeringRobo, DM me!

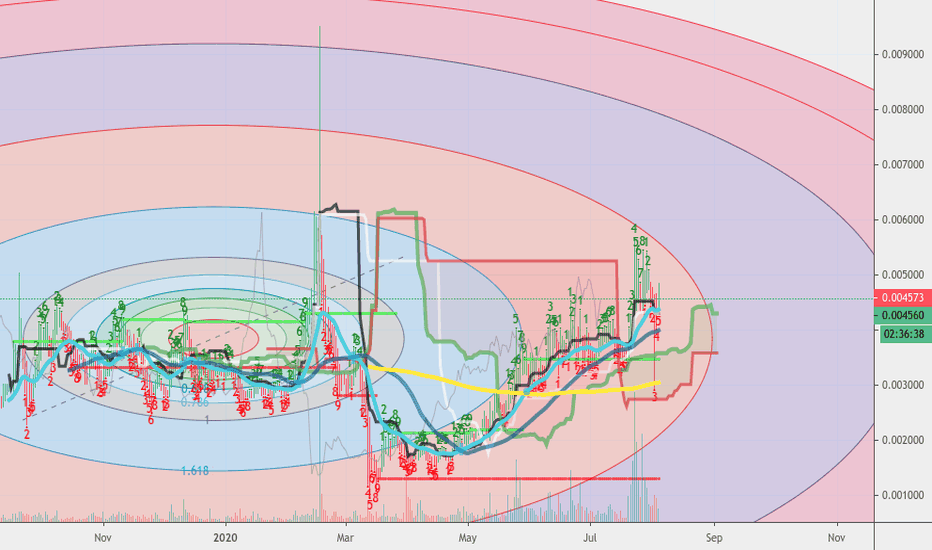

Possible 100x Bullrun contender ? FUN/USDT #crypto #100x $FUNMany of us here don't really expect a Bullrun until late 2023 or 2024 - assuming we are in a lengthening Bitcoin cycle ( which I agree that we are . ) But when that happens posslibly some coins will do quite well .Here we see FUN from Binance tether chart . You can see the price right now is .0033 cents , or about 3 cents . But if we check the All Time High of FUN we see it was .33 cents . That's EXACTLY 100x , or 100 times up from where it is now . OK, I'm not psychic and I can't say what will happen in a few years - but when Bitcoin revisits its' All Time High of 20k again , many Alts will be on sale and that might be a good time to look at FUN as perhaps a longer term hodl . Also you can see we are in that pretty Fib Circle indicator here - but it seems to fit . Also we are now coming down through that Ichimoku cloud and could possibly come down a bit more .

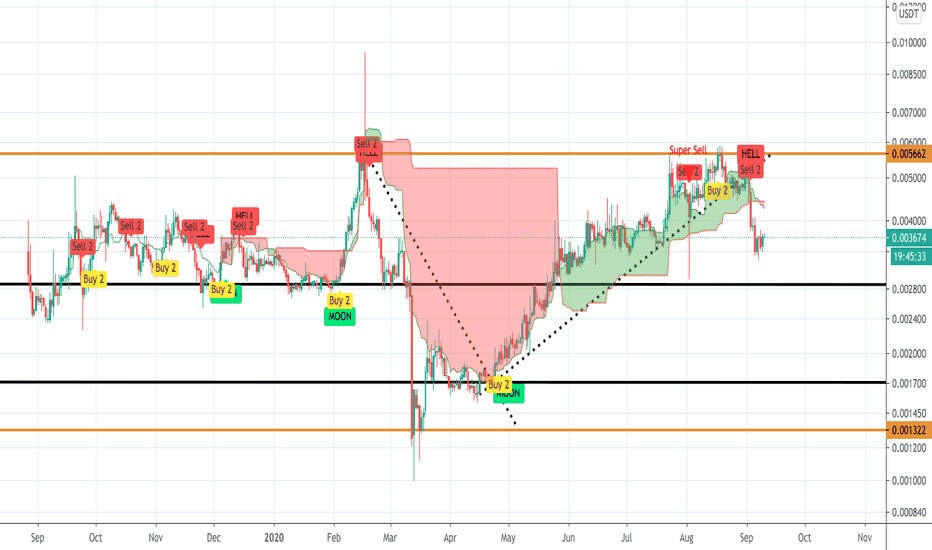

FUNUSDT AnalysisAs of now, I'm BEARISH since there are 3 SELL signals present from EngineeringRobo.

So, I don't think this is a good time to buy.

If you want to buy again, you can wait for EngineeringRobo's buy signals to be present or wait for candles to open-close above resistance level (0.0056) for 1D.

Also, you can buy when candles are touching the support line (0.0028).

After you buy, please watch out for EngineeringRobo's sell signals and consider selling it.

FUNBTC - Weekly 50MA SqueeZeWeekly Squeeze, waiting chart waiting on the momentum to kick in. If you zoom out on the chart you can see the fibonacci retracements. Anyhow, been seeing lots of movement in the alt sector & if you like your cheap satoshis this could be a fun one ;)

coinmarketcap.com

Prices as of 8/31/2020

$0.005022 USD (5.98%)

0.00000043 BTC (5.99%)

0.00001153 ETH (3.71%)

Market Cap

$32,889,128 USD

2,812 BTC

75,479 ETH

Volume (24h)

$1,002,584 USD

85.73309154 BTC

2,301 ETH

Circulating Supply

6,548,879,189 FUN

Total Supply

10,999,873,621 FUN

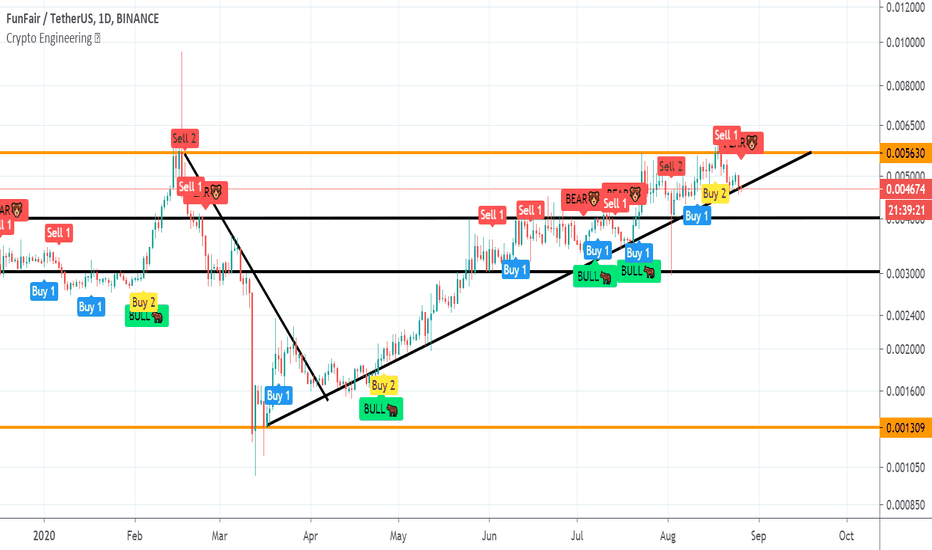

FUNUSDT AnalysisI am bearish about FUNUSDT. The trend has started to go down and the candle is sitting at the bottom of the upward trend line. In addition, there are both Sell 1 and Bear signals, indicating that it is time to sell it. We must also sell if the chart goes 1D open & close below the uptrend line or the support line.

If we want to buy FUNUSDT, we can wait for Engineering Robo's Buy 2 and Bull signals to say we can buy it. There are some other scenarios in which we can choose to buy it:

1. We can buy it when the risk/reward ratio is greater than 2.

2. We can buy at support = 0.004008 usdt or at the uptrend line.

3. We can buy when resistance turns to support (1D open & close above resistance) = 0.005664usdt

FUNUSDT analysisBuy 2,bull signal say we can buy. Here is my analysis:

1. We can buy when risk/reward ratio is greater than 2, we can buy

2. We can buy at support = 0.00455usdt or at the uptrend line

3. We can buy when resistance turns to support (1D open & close above resistance) = 0.005675usdt

Since there is an existing sell1 signal, either sell 2 or bear signal is required for sell decision. We must also sell if the chart goes 1D open & close below the uptrend line or the support line.

Magic Circle ? FUN/USDT #fibcircle #funfair #crypto #fibonacciHere we have that colorful indicator called the Fib Circle on Trading View ( which you will find in the left hand panel indicators above the paintbrush tool and scroll down . ) I don't think FUN is a buy now but I'm looking to see when this might be in a buy zone later this year . From the way this fib circle is laying it appears that there will definitely be some downside that will break us down into that purple circle . This purple circle is fairly wide so when the upside comes it could be quite nice seeing our candlesticks heading to the outer upper edge of our purple circle perhaps in October or November . This is one to keep an eye on - but again , I don't think this is a buy zone right now . It may be in a month or two .

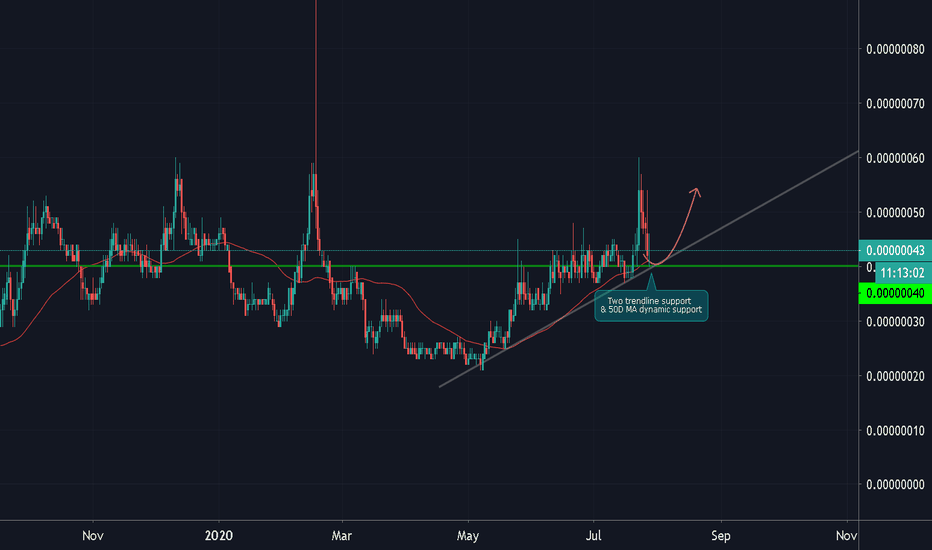

FUN/BTC (Testing Key Support Area)FUN/BTC

-The price has pullback to the previous breakout point

-It touches the 50D MA dynamic support, two important trendlines

-FUN needs to hold this level for the next 2-3 days

-If Bitcoin will start moving sideways

-This coin has the potential to recover and hit the 50 sat area

-Bearish side, a daily candle below ascending trendline will signal a downtrend

FUN/BTC (Pullback to old resistance?)FUN/BTC

-Our team caught the breakout of this coin over 20% profit

-The price has retraced back to the average

-This area of confluence is important for the midterm action

-As it will decide how high the trend can go

-The 48-45 sat range was an area of resistance before

-But in the coming days will take the challenge to flip into new support

-I recommend buying only if there is a signal of bullish reversals

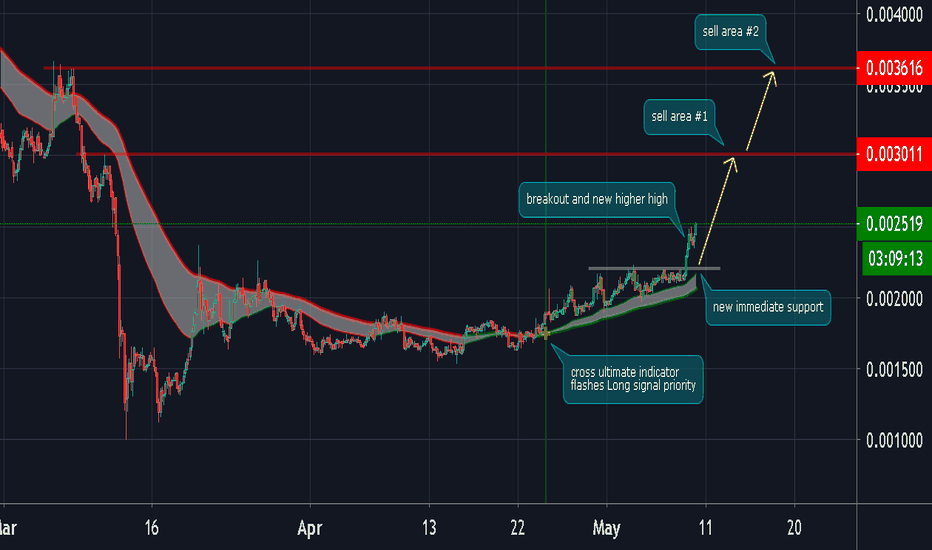

FUN/USDT (Consolidating before Breakout?)FUN/USDT

-on May 13th, cross ultimate indicator signal Buy priority

-the price rallied over 60% up

-today, FUN is consolidating and is forming a bullish triangle

-the best safe approach here is to enter the breakout>close

-upside potential is up to the swing top at 5684s

-key stoploss should be placed under 3500s

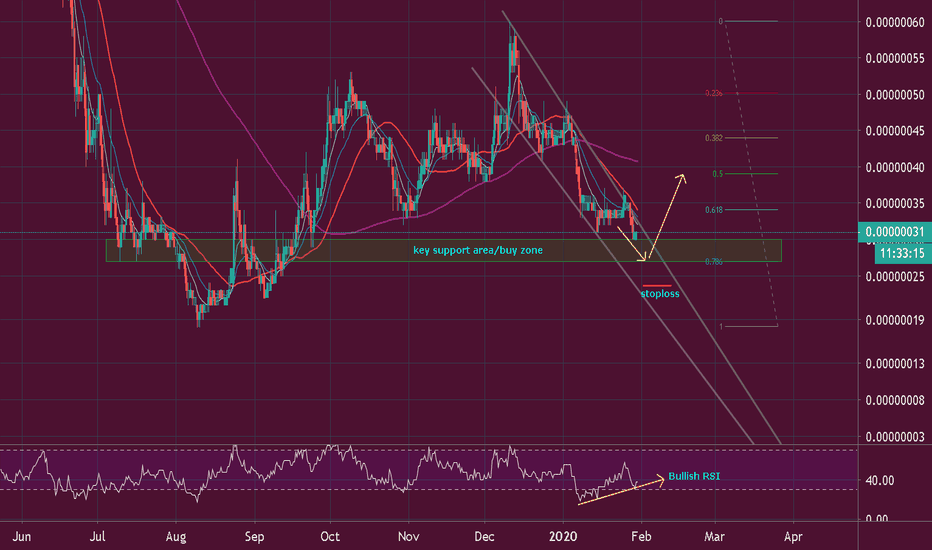

$FUN : Last Chance ?Cross-over of ascending trendline / support

Already retest 200 Daily MA

Not a Financial Advice

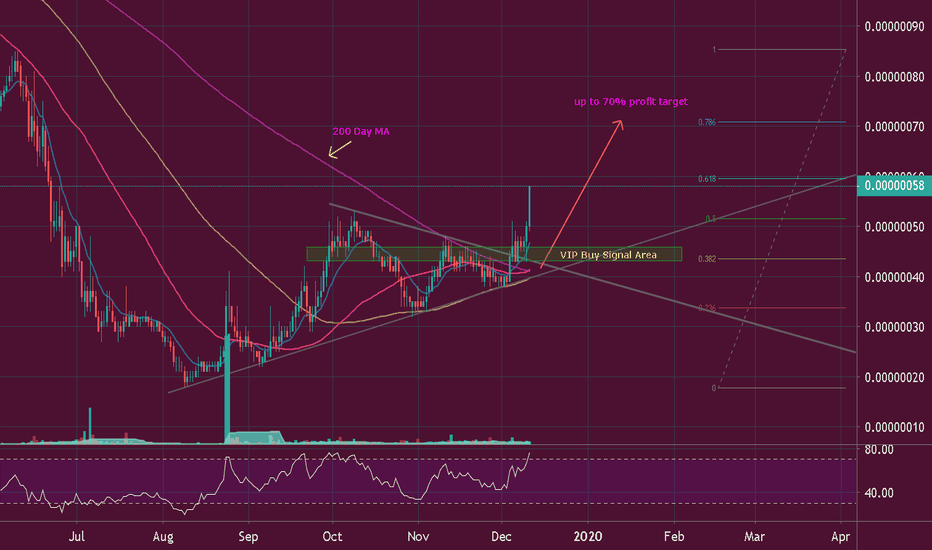

FUN/BTC TA Update (Bull Market Started?)FUN/BTC

Last Dec 5, we posted buy signal for FUN after breaking above the down-line resistance and 200 Day MA. Price has reached our Take Profit Target 4 at this stage.

See link here: