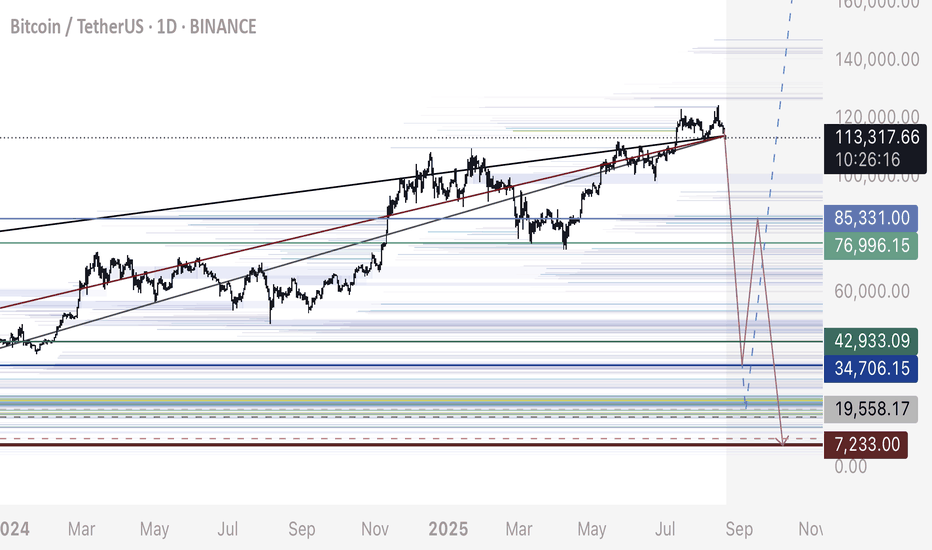

BTC - Following Crash PlanBTC has been following my analysis of predicting a potential crash here.

We can use DXY to anticipate when a significant liquidity grab / flash crash will occur.

Since DXY is retesting a major breakdown on the weekly - monthly, it would be wise to watch for volatility today on Bitcoins price, noting these liquidity regions if we are about to enter a bull run ranging out 3-5 years.

Targets and potential corrective patterns marked on this chart.

Happy trading.

Futurestrade

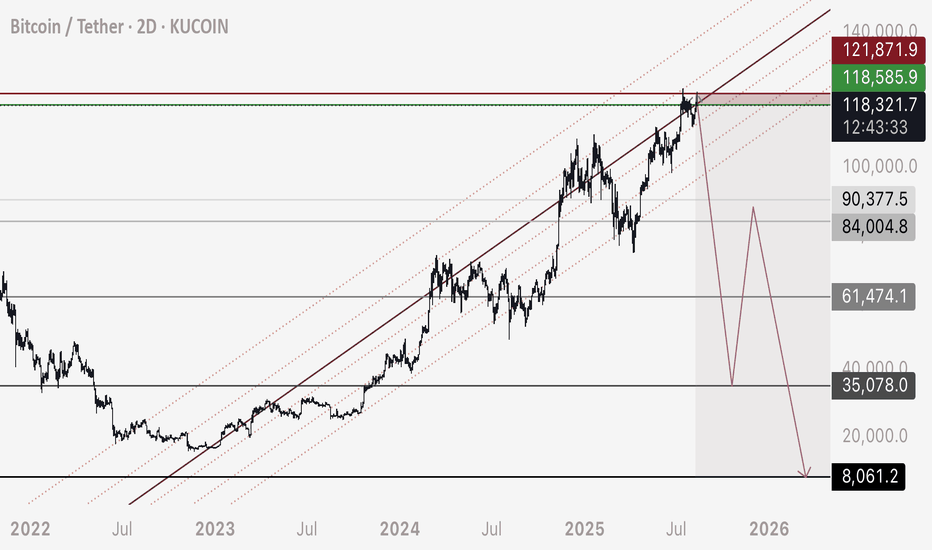

BTC - Short Plan UpdateAs per previous warning of the possibility of upwards liquidity grab first, here are updated details and a better entry for this trade.

Entry - 118,500-119,000

Stop Loss - 122,000

Target 1 - 62,000

Target 2 - 35,000

Target 3 - 8,000

- Note that per my plan we would drop to 35,000 and retrace (long) back up to 84,000 to 90,000 to form a 3 wave corrective drop.

- Note that the ultimate bottom could also sit between 17,000 to 19,000, however per my years of work, I believe 7,000 to 8,000 will be hit.

NOTE THIS IS NOT FINANCIAL ADVICE NOR IS IT A SUGGESTION ON HOW TO MANAGE YOUR MONEY. THIS IS MY PERSONAL TRADE ONLY.

Happy Trading.

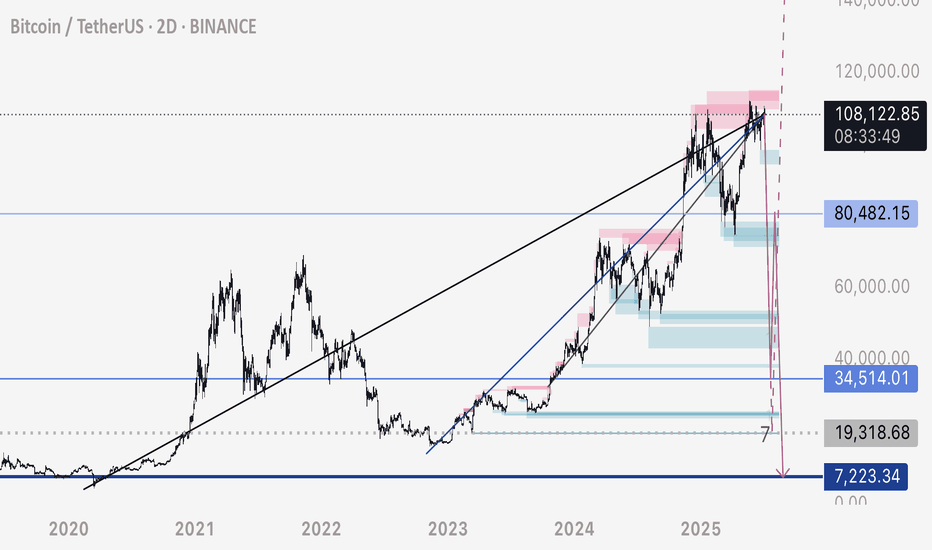

BTC - Zoomed Out ScenarioAs predicted DXY has broken down a major monthly bearish trendline - currently finishing a bearish retest before further free fall.

If this plays out we have 2-3 years of a weakening / correcting dollar, and a strengthening investment in assets such as Bitcoin.

This means an extended bull market spanning 2-4 years on Bitcoin and equities.

However - there is a mass amount of liquidity to the uber lows towards 10,000 on BTC.

Market is showing manipulated intention to hit these lows by keeping the price below this bearish cross section - and that’s why bitcoin hasn’t been moving up yet.

This tells me this is more likely than we all think to play out.

I’m trading the following:

Short - 108,200 to 35,000

Long - 35,000 to 80,000

Short - 80,000 to 10,000

Will update accordingly if the plan changes.

Happy trading.

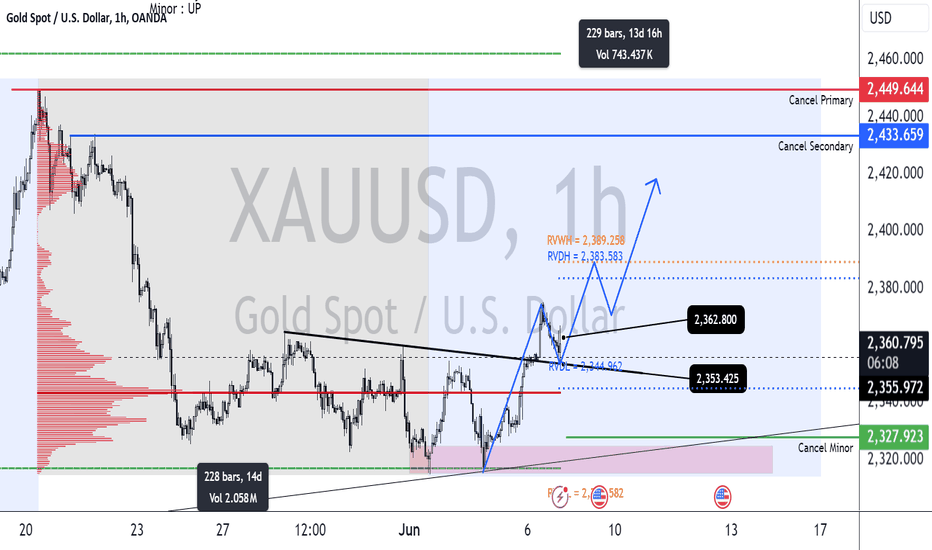

XAU/USD Swing TrendXAU/USD Swing Trend

- Primary : Down Trend

- Secondary : Down Trend

- Minor : Down Trend

I think now It may be at the end of leg C of 4. and Finished 13 day of Down Trend Already.

However, Trade with the trend, when my Minor Trend looked up, I then waited for the price to adjust down to the EMA line and to the +1 SD line as well.

Therefore, the Buy Position has been opened. The target is to make a profit in the area of 2400, which is the Supply Zone. And place SL when the price breaks the POC of Volume below.

TFEX S50 : Swing TrendTFEX S50 : Swing Trend

Case Study : Entry short when the price moves up to the resistance level and makes a Reversal Pattern.

When the Minor Trend returns to Down Trend Bias, aligned with the Primary Trend, it is the entry point for a Short Position. So can take profit at the support Poc of Regression Trend Line.

DOGE 126.4% profit potential 20x longHello traders,

Here is a descending channel that is currently retesting the breakout as well as a strong support. 3 targets on the chart, I suggest covering your stop loss at the first target or moving your stop to even. Please DM me if you have any question regarding this trade. If you like futures leverage trades like this please leave a comment and let me know.

Have a green week!

SAVVY