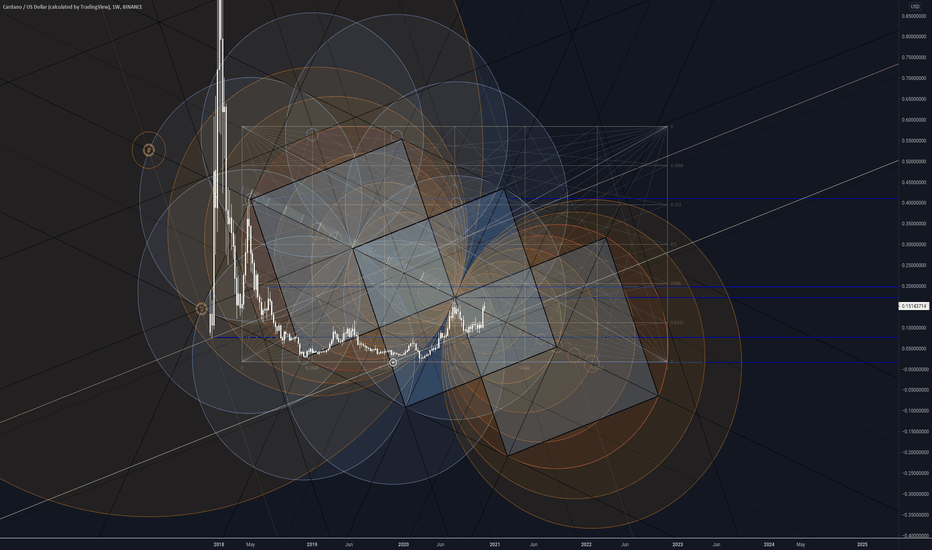

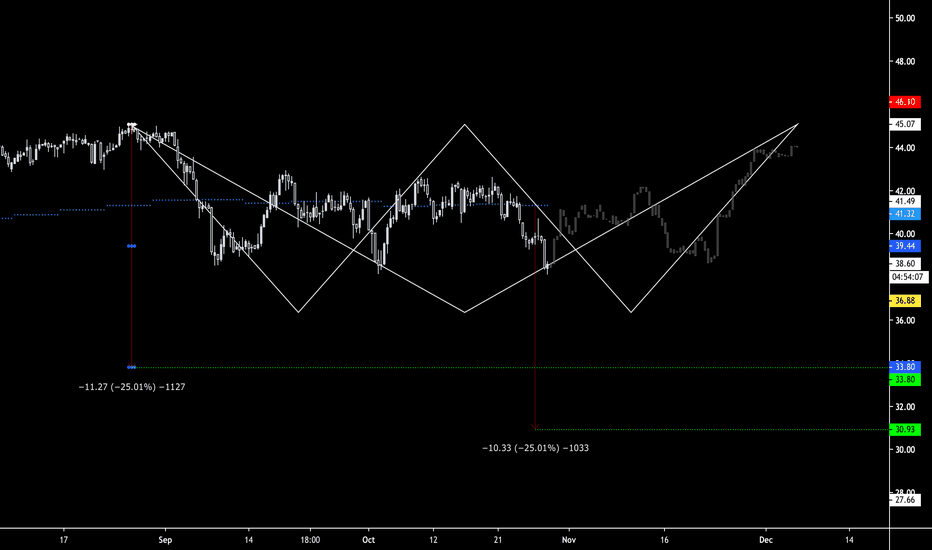

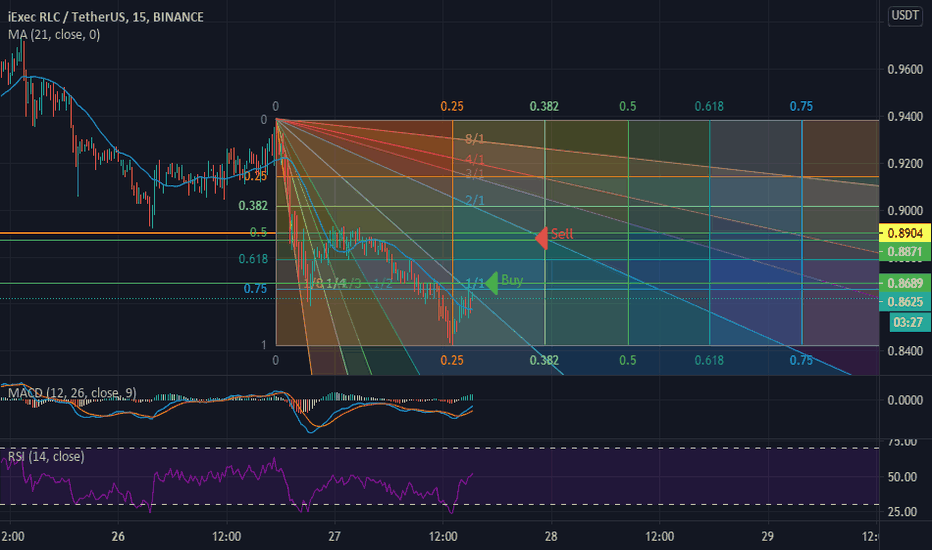

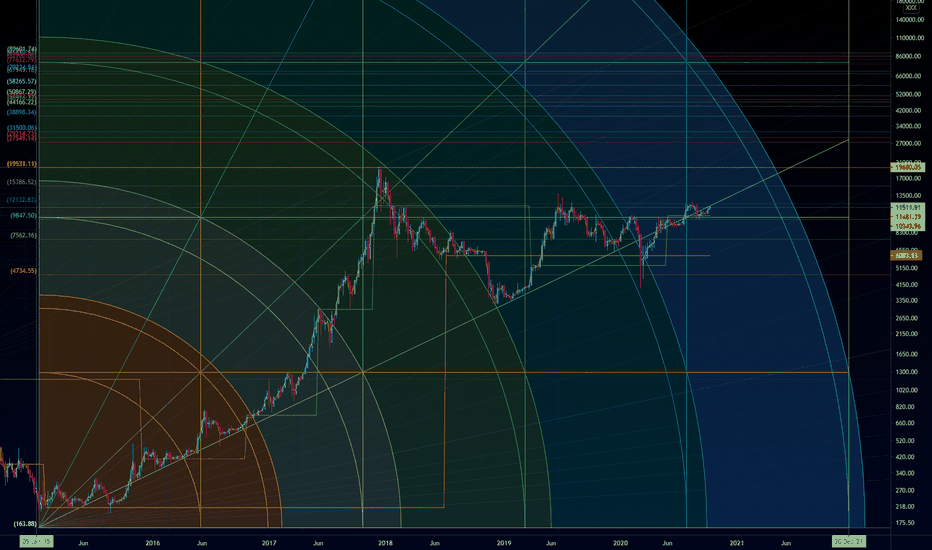

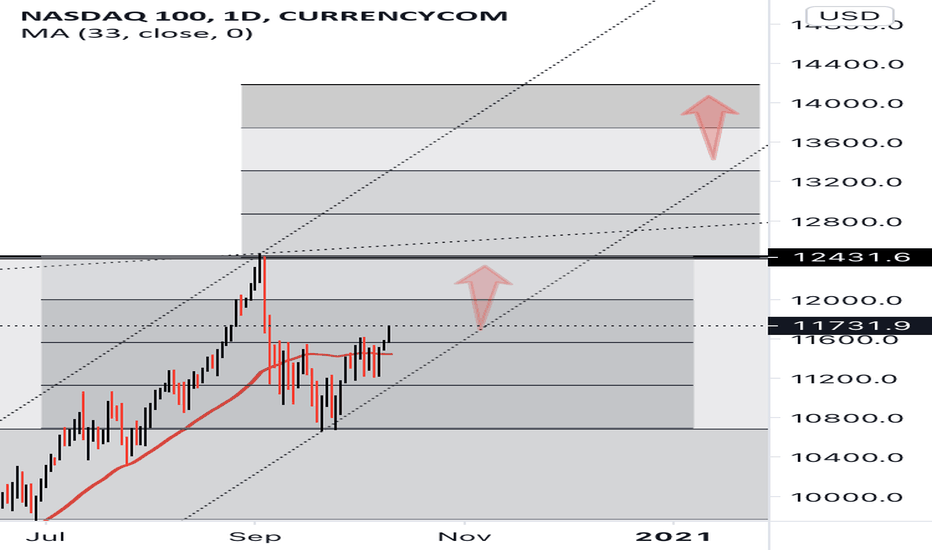

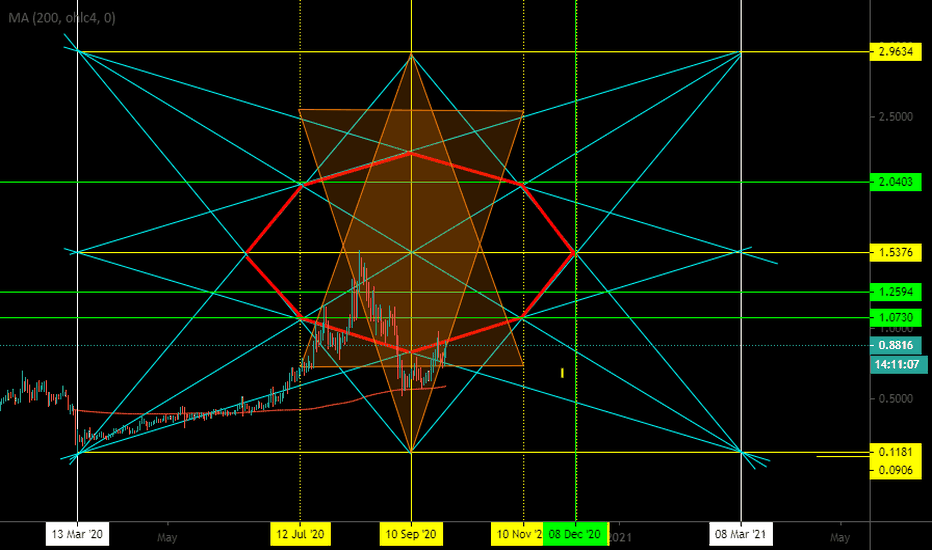

Gann Box

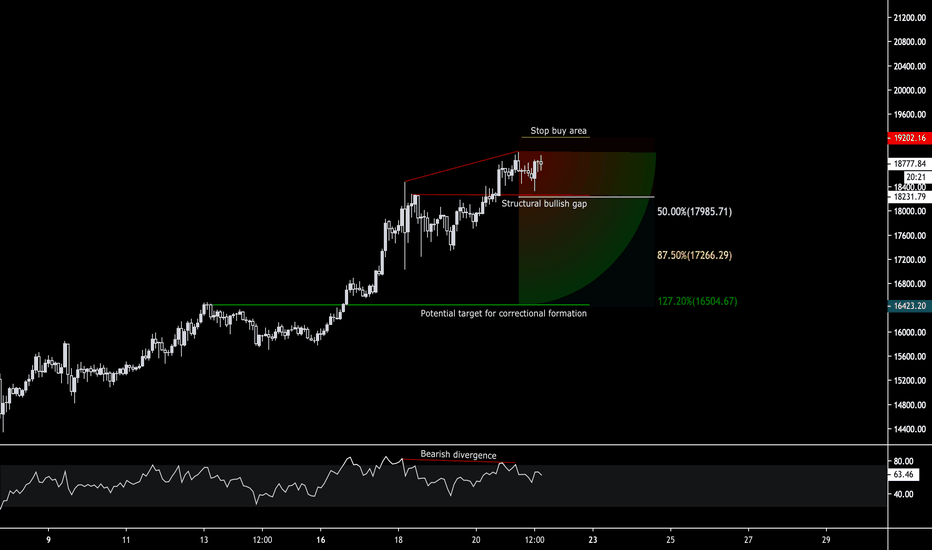

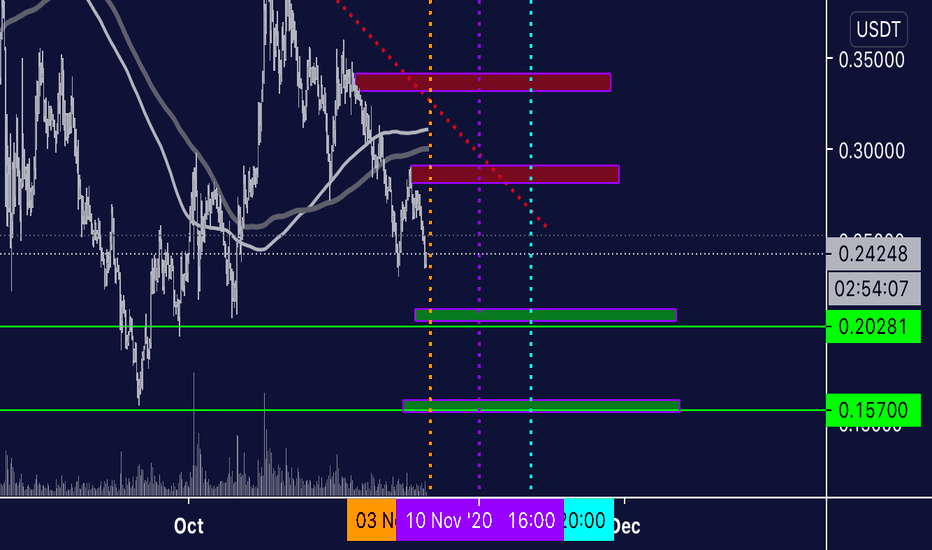

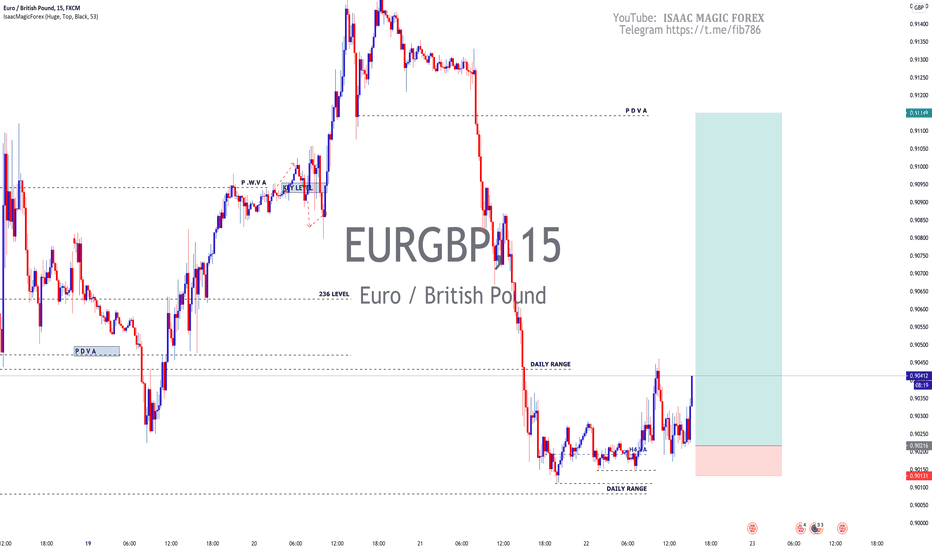

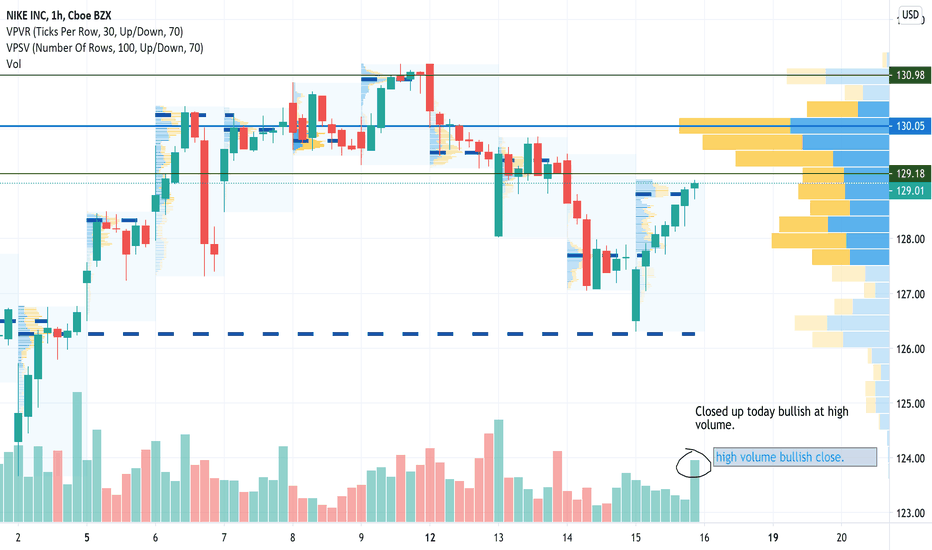

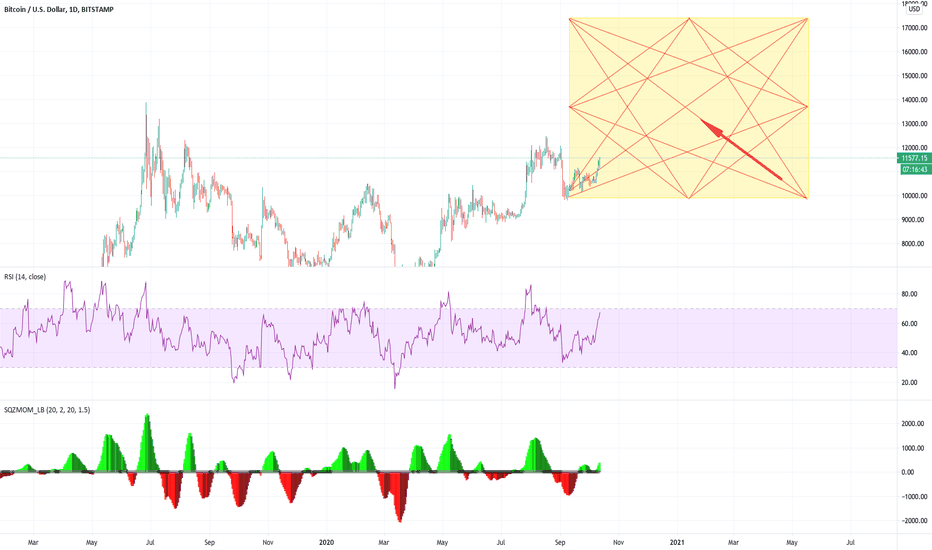

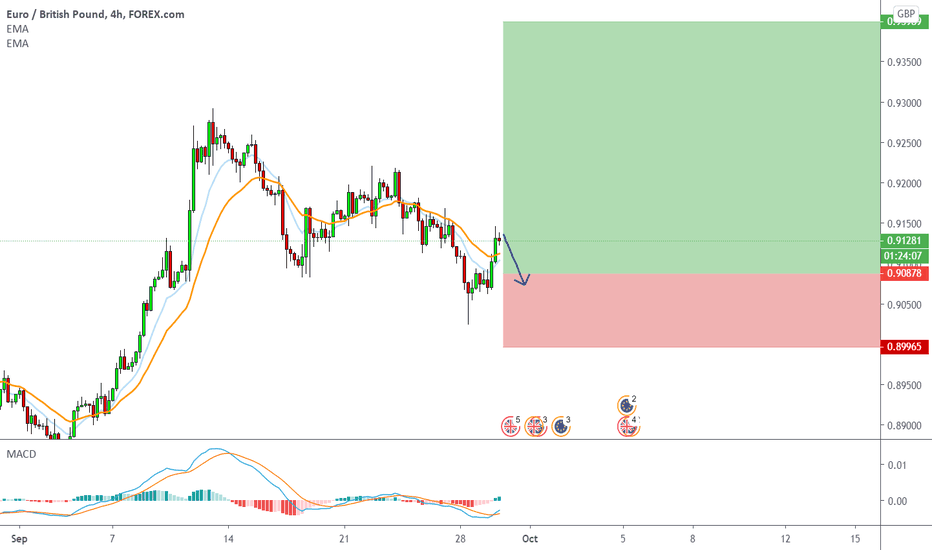

BTCUSD: A Potential FadeReasons to consider getting out of short risk exposure if the highlighted area fails:

Bearish Divergence

Break of Structural Gap

Overextended state

These reasons might trigger some traders to short or sell this pair; however, in terms of probability, the market still favours bullish bias, evidenced by the context to the left.

The break of the highlighted bullish structural gap area can serve as a warning for short risk exposure. If that happens and higher timeframes close below that area, that can be considered as a decent indication towards further downside for short risk exposure.

Constructive discussions are always welcome, just drop a line in the comments section.

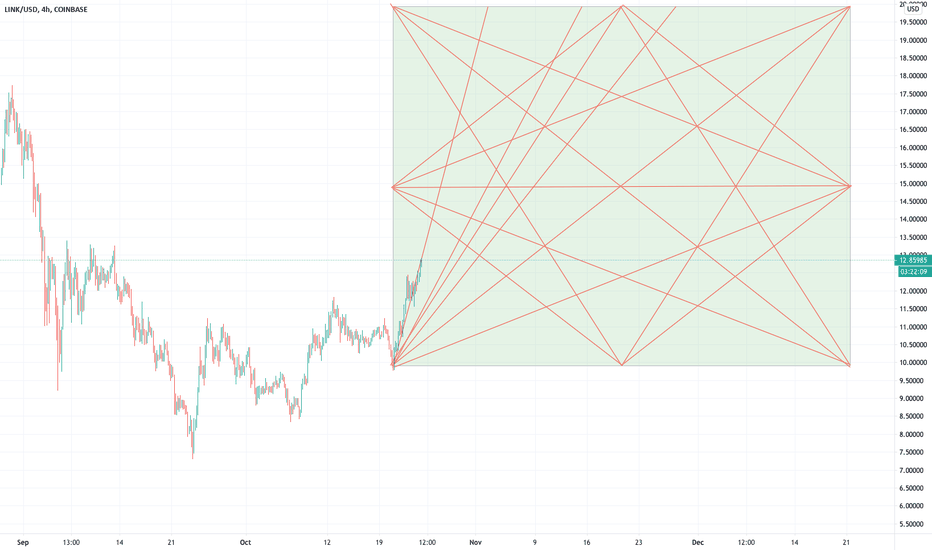

UNIUSD | PerspectivesChart squared via Thales to last major LHL swing (left most teal triangle). Right triangle was then replicated and placed at first major dip after the local high, which highlighted the angular trend through October 14. Using Fib Channels you can construct a perspective Gannbox (right most grid formation). Backtested idea by then duplicating and offsetting a second Gannbox (left). Watching how price action reacts to this geometry. Not Trading Advice.

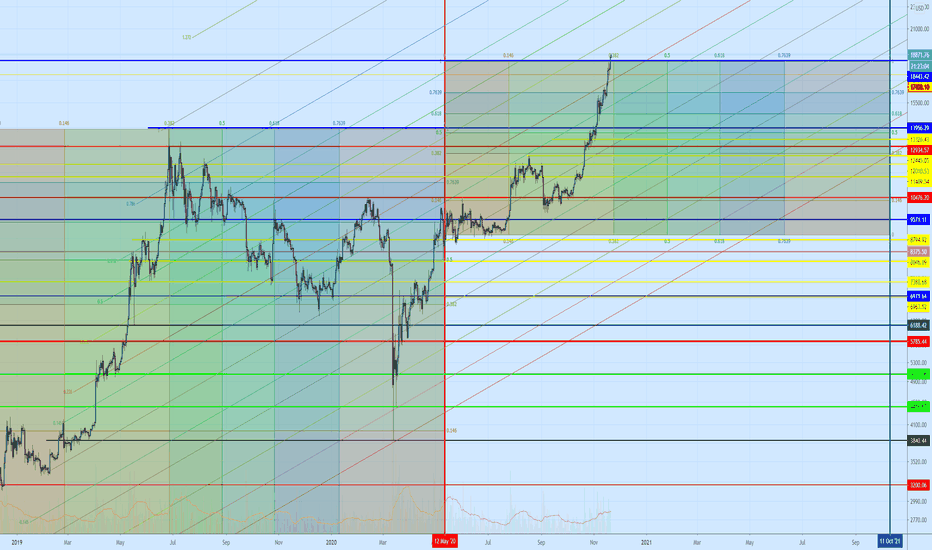

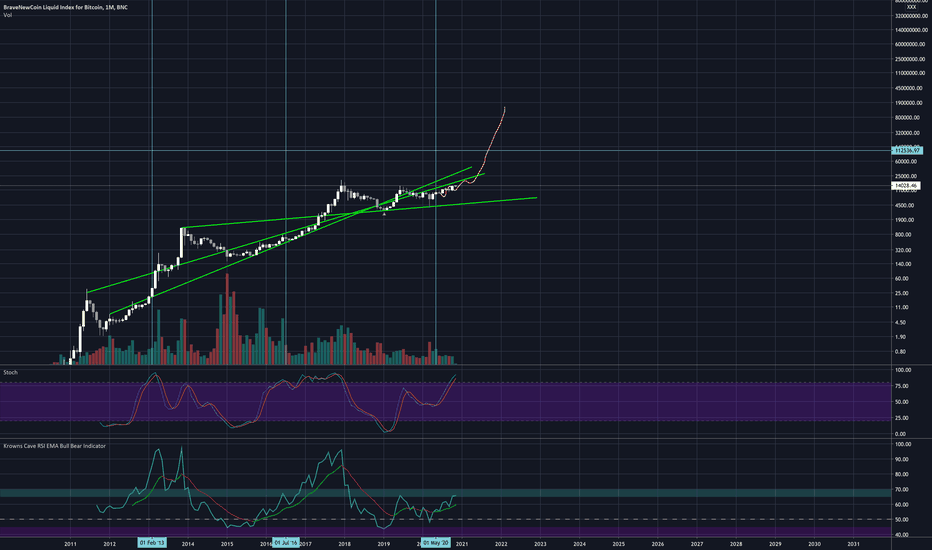

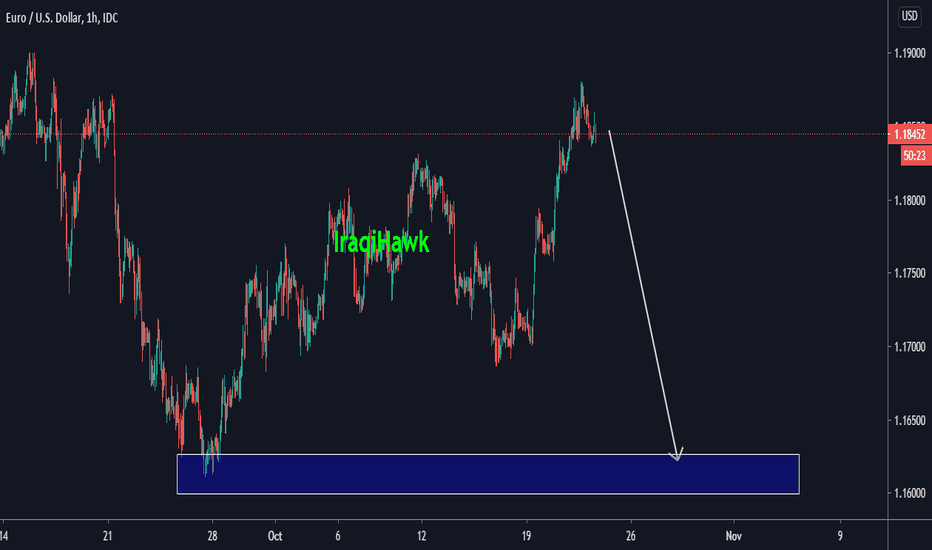

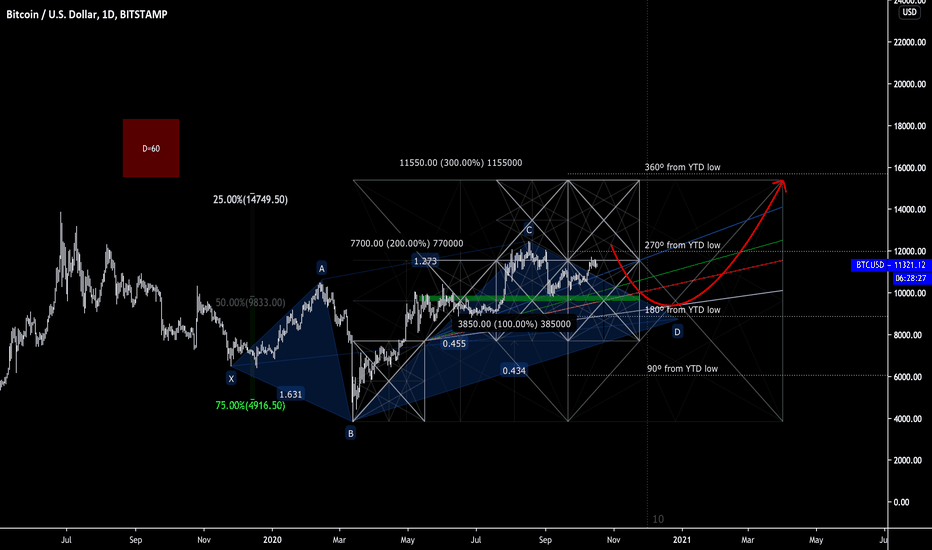

BTCUSD: Daily Chart BreakdownI am getting a feeling that there could be a 5-0 correctional harmonic formation in its maturity phase, currently. It can also be viewed as an inverse head and shoulders pattern. The highlighted harmonic pattern is the 5-0 pattern with the X being the 1. TV doesn't have a tool for 5-0 patterns, so the Cypher tool is used which lacks one leg. The highlighted projection of price is regarded as a rough estimation of this pattern's completion. The pattern is usually seen during a post correctional phase, where there was a rather hard sell-off (a strong upthrust in a bearish version), which was followed by a V type recovery. When this V type recovery is being corrected as much as 38.20%-50.00%, that's where you anticipate entering into short risk exposure.