Gaps

The revolutionThe globalist clones that all think the same way in power for 30 years or more (that's subjective, depends where we put the threshold) know they are threatened and will stop at nothing to hold onto power.

Europe, NA, could add the South Africa rainbow nation too. Complete failure.

Here is what happened in 2017 during the french elections:

Volatility is going to go up up up. Hey even DEM to USD was rather constant 1926-1933 at 4.2 then it dropped quickly to 2.6. Then not too much change.

Stock market went up up up under Hitler euphoria (all opposed him from the start in 1946). Literally the only dictatorship I know of. What usually happens to price?

What about Chile?

"The aim is to make Chile not a nation of proletarians, but a nation of entrepreneurs." - Augusto Pinochet. (Today Chile has the 3rd rate of entrepreneurship in the world).

When Pinochet took power he inherited the socialist failures, and had hyperinflation then after a few years there was the "Chilean miracle" ye right "miracle", no just someone that cared about his country and moved to fix it. He wasn't a dictator to hold onto power (if he was even one), but someone that was fair and wanted to fix the country that socialists destroyed (and to this day it's one of the world countries with least wagecucks - and gets flooded by central american migrants/grasshoppers).

So we can't really compare those. Pinochet was the solution, the western propagandist dictators are the problem they are the Allendes running a slowly declining country.

Ye usually under dictators economies do well to be honest. They might devalue the currency, when the dictator first steps in biased investors might crash prices, but over time things seem to go well not gonna lie. When dictators are fair and care about their country, not when they are Kim Jong Un ruining his country and blaming it all on the USA.

Only difference between North Korea and US+EU is NKR puts a gun on the head (usually heart) of people to force them to believe the propaganda.

The west uses censorship and controlling all the media and lies but no gun to the head, shame to all the morons that willingly believe the propaganda.

They also want to use economic incentives (a nation of big companies wagecucks that can get fired and never find a job, a cashless society that can freeze accounts, etc).

Europe is looking more like the Soviet Union in the late 80s than anything else. If the Soviets could not stop it, how can western low Testosterone losers?

There is 1 difference: The west is "diverse", and as Jeff Bezos knows so well, a diverse workforce cooperates and unionizes much less.

Still, divide to conquer is crumbling, both the "left" and "right" are so fed up and mad they are teaming up.

Here is a list of some of the dictator laws in France of the last 5 years:

And there is much more. They'll never run out of excuses:

- Any terrorist act to enable mass surveillance

- Any disease to enable movement restrictions

- Any conspiracy theory to enable censorship

- Any violence at protests to enable control

- Any cop death threat to enable Derek Chauvins

- And so on...

I also want to add 1 thing about the collapse:

30 years ago the USA were the first trading partner of the entire world.

Today who's left? France and the UK. Seriously. Oh and North American countries (US neighbours).

For real the entire planet was blue (US partners) and now it's entirely red (China) with the exception of 2 lapdogs in blue: France and England XD

The US are going to number 2. They'd be almost there or even there already if it wasn't for all the debt and exporting their inflation.

Revolutions and end of an era. Mark my words 🔥🔥🔥

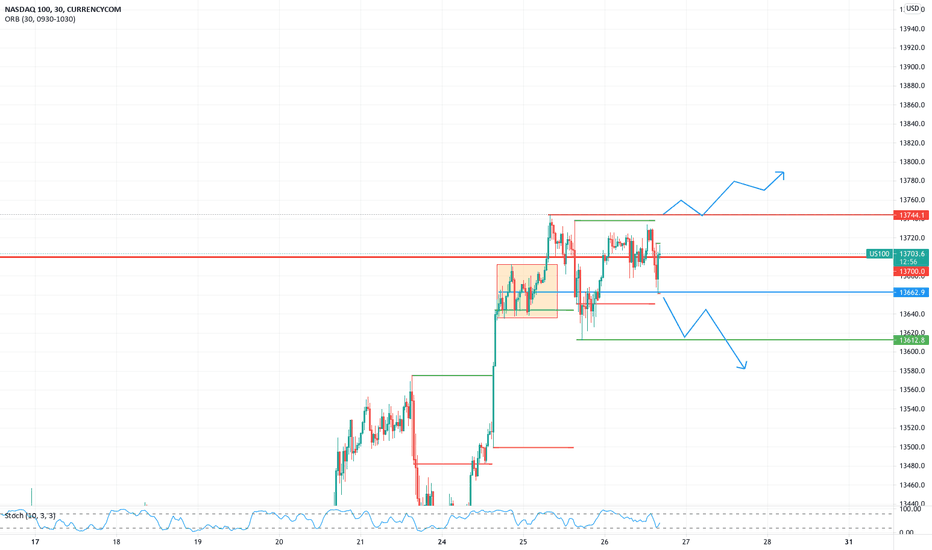

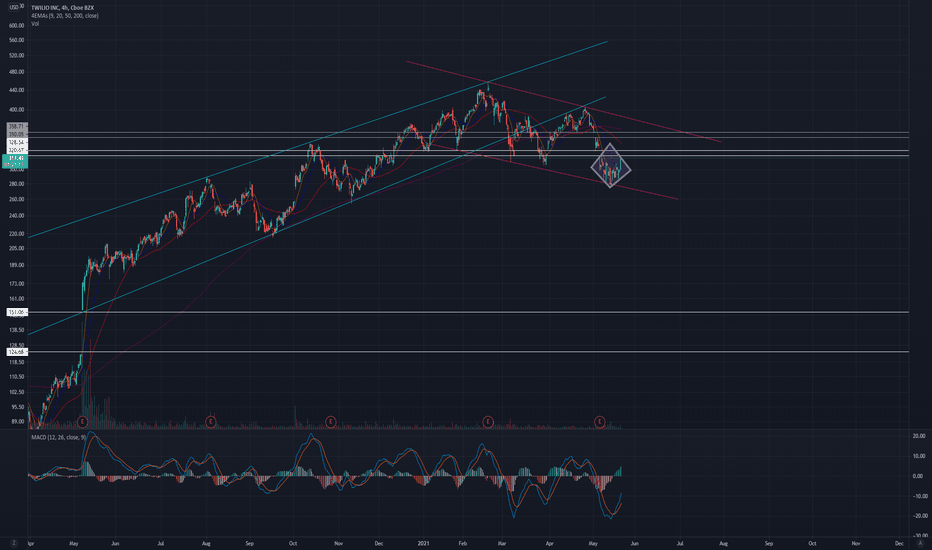

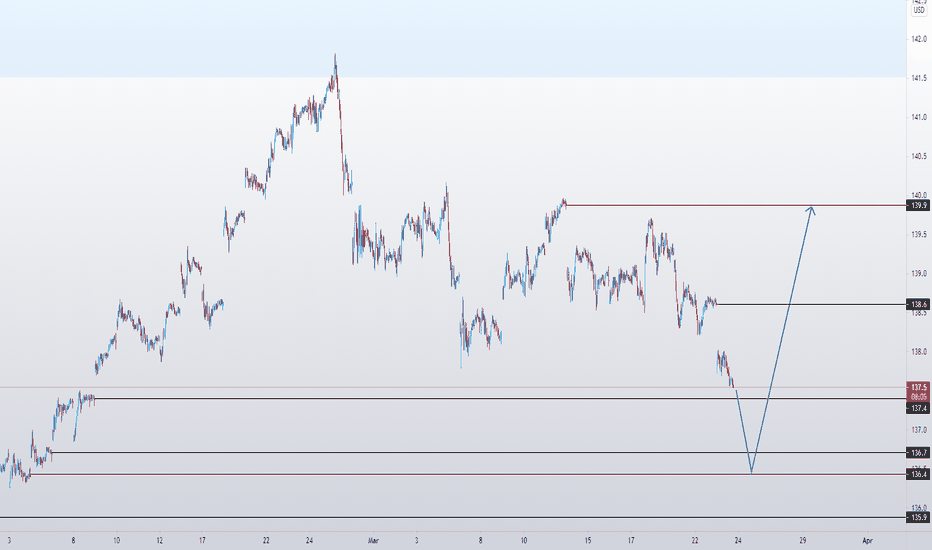

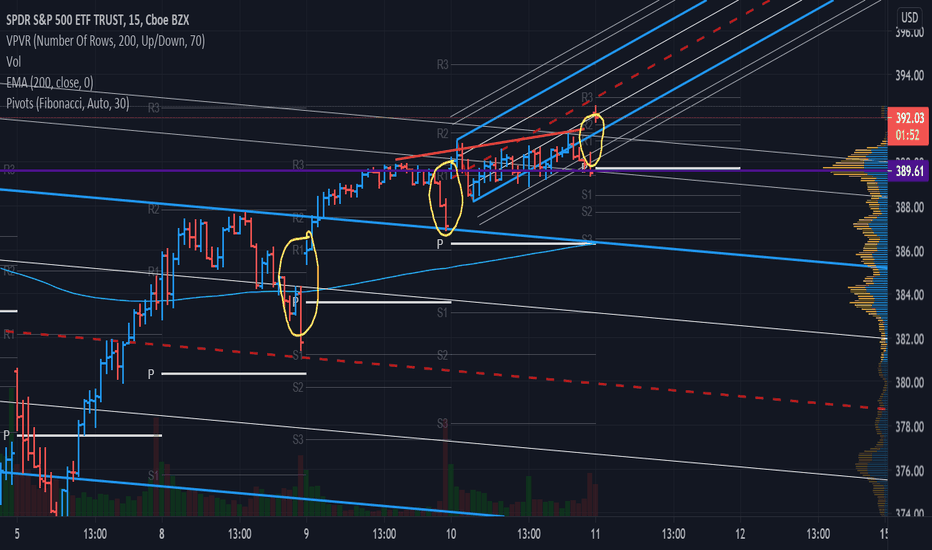

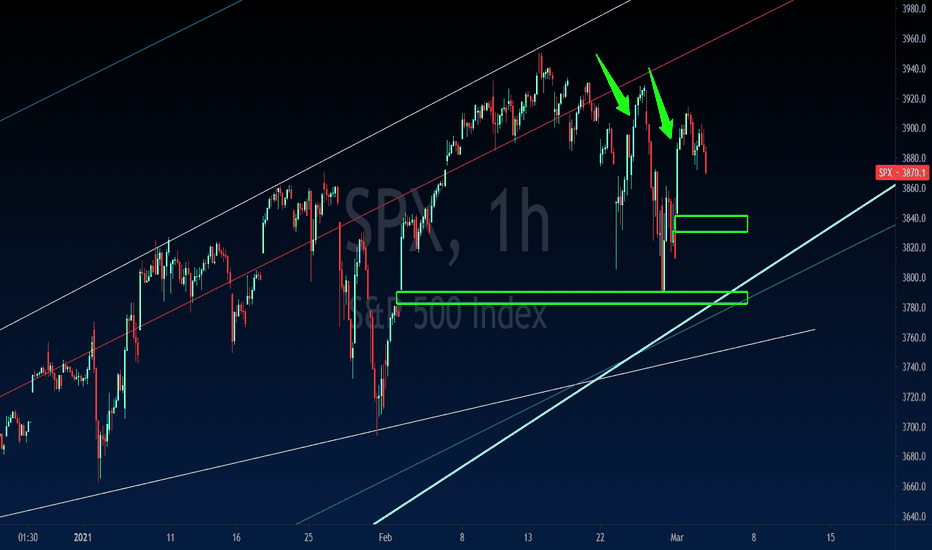

Compression, Expansion, Trend - US100Started on the NDX, looking for possible targets to the downside.

End of month is upon us, bank holiday Monday too, traders look to square their positions, funds look to rebalance.

Not trading inside the ranges, looking for a clear break, retrace and continuation pattern

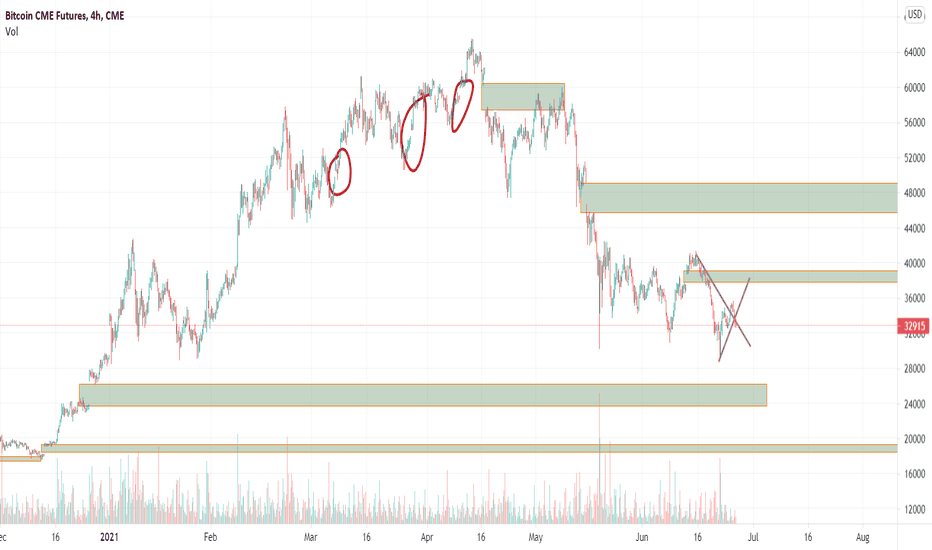

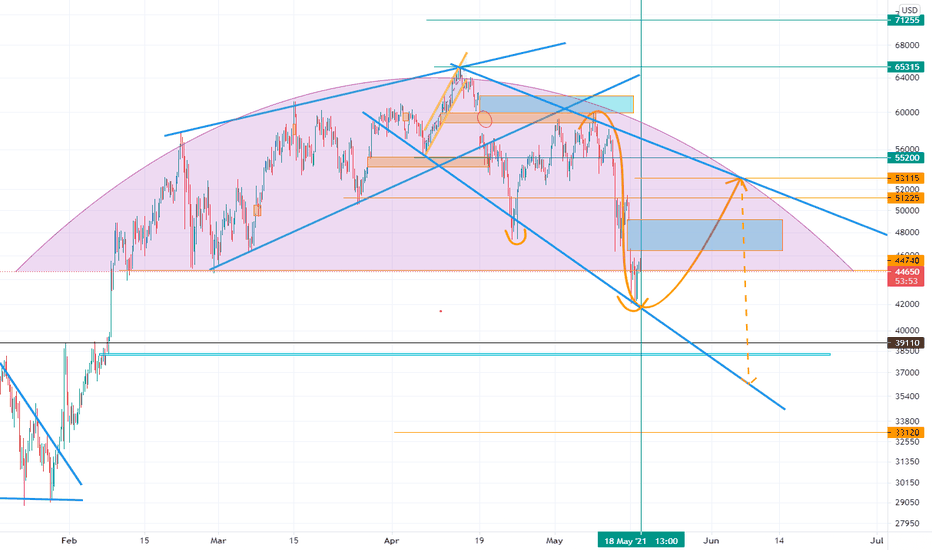

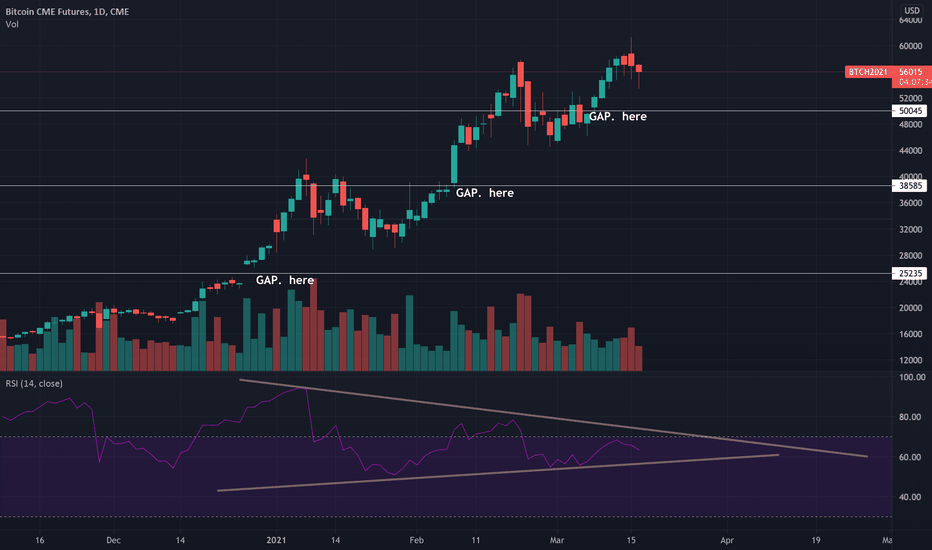

BTC1! new 48k gapBTC1! failed to close the top CME gap at 60k of the double gaps before dropping significantly. This I interpret as bearish, but the silver lining is that price will return to 60K in the future. Currently a new significant gap was formed at 48k,and probable that price action will close this gap soon since price action has formed long absorption wicks at 42k and an HTF bullish engulfing candle.

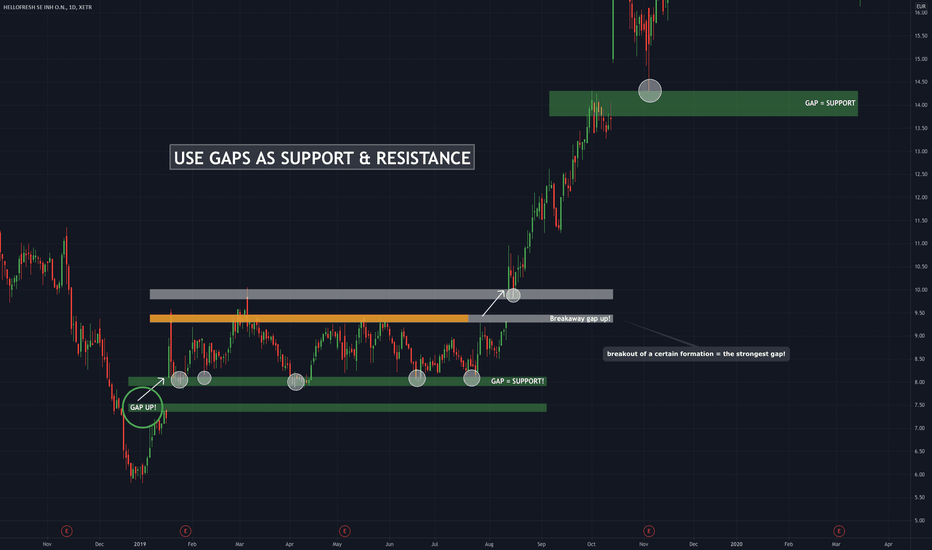

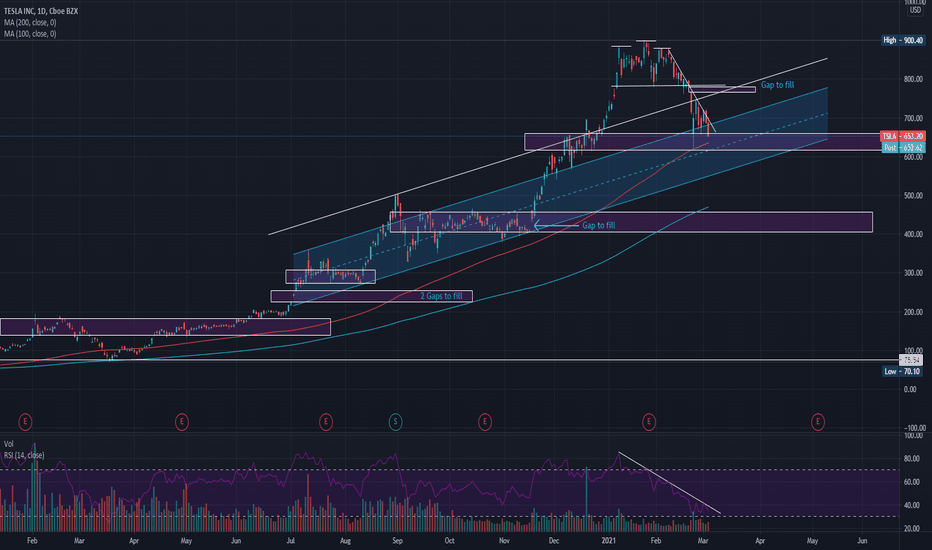

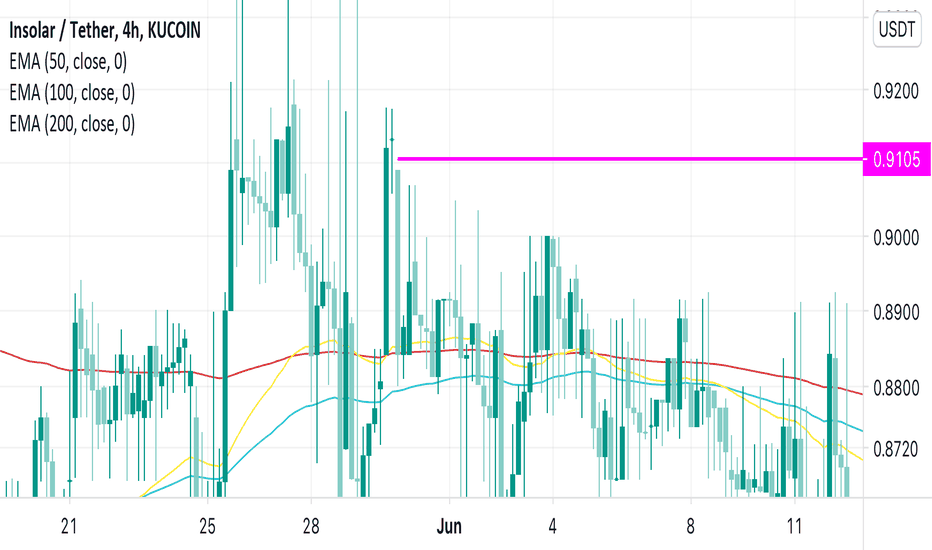

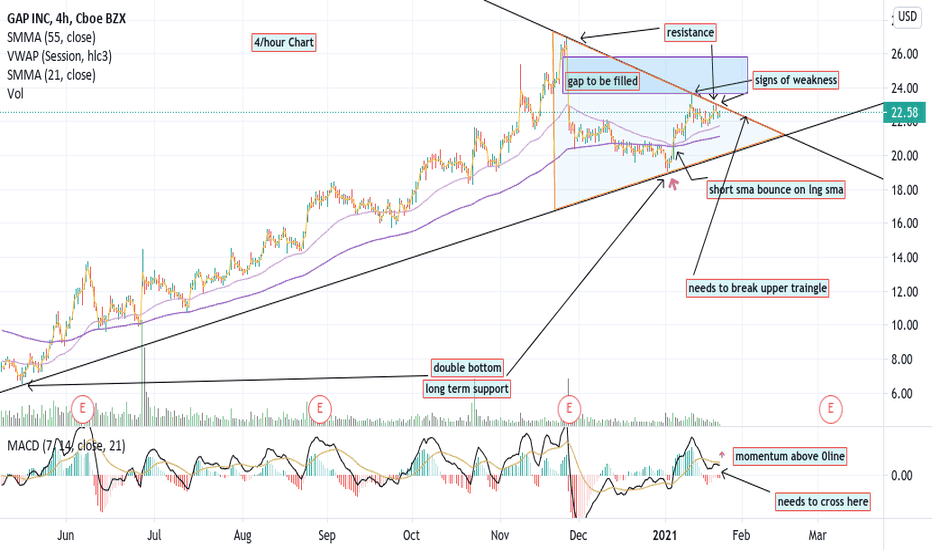

USE GAPS AS SUPPORT & RESISTANCE! Today's tutorial covers the topic of GAPS:

** what is a gap? **

- Gaps occur when a stock moves up (or down) significantly during pre- and postmarket hours, so that there is a major difference between closing and opening price. A lot of times this gap will get "filled" over time, which means that the market is often attracted by a gap.

** A gap up is filled to the downside **

** A gap down is filled to the upside **

-> ** KEEP IN MIND GAP FILLS DO NOT HAVE TO HAPPEN! **

In this tutorial I'll show you how you can ** use GAPS as support & resistance **:

--> Look at the chart:)

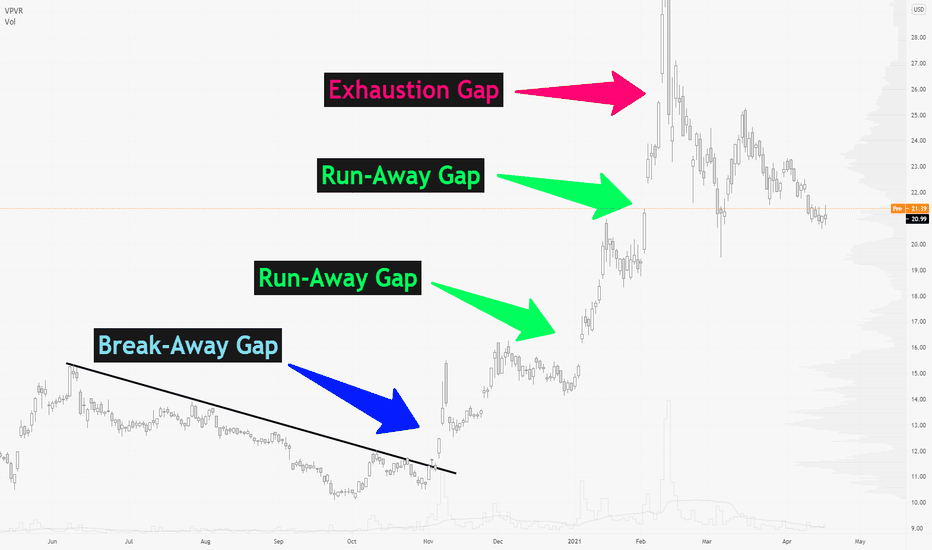

Gap TheoryThe gap theory is short and simple. Not everything needs to be lengthy and laborious. "Everything should be simple as possible, but not any simpler"

Break-Away Gap

Once a new cycle has begun and you see a breakaway gap in the STARTING of a move, you get confirmation of this new cycle. HOLD.

Run-Away Gap

Once the trend is continuing for some time and then you see a second gap, this is a confirmation that you are somewhere in the MIDDLE of the move, so you know a further movement in price is expected. HOLD.

There is a possibility that you can get multiple runaway gaps.

Exhaustion Gap

After a move in price had already happened, a gap that signals the END of the move happens. If this is your 3rd gap on the, you should look very closely to distinguish if it is a runaway gap or exhaustion gap. SELL.

How do you tell the difference between the exhaustion gap and the runaway gap?

Easy, if after the gap happens the price shoot straight up without closing the gap in the next few days ---> runaway gap. HOLD.

if after the gap happens the price is closing the gap in the next few days ---> exhaustion gap. SELL.

If you like it, follow and like so it will be saved in your saved ideas for future reference.

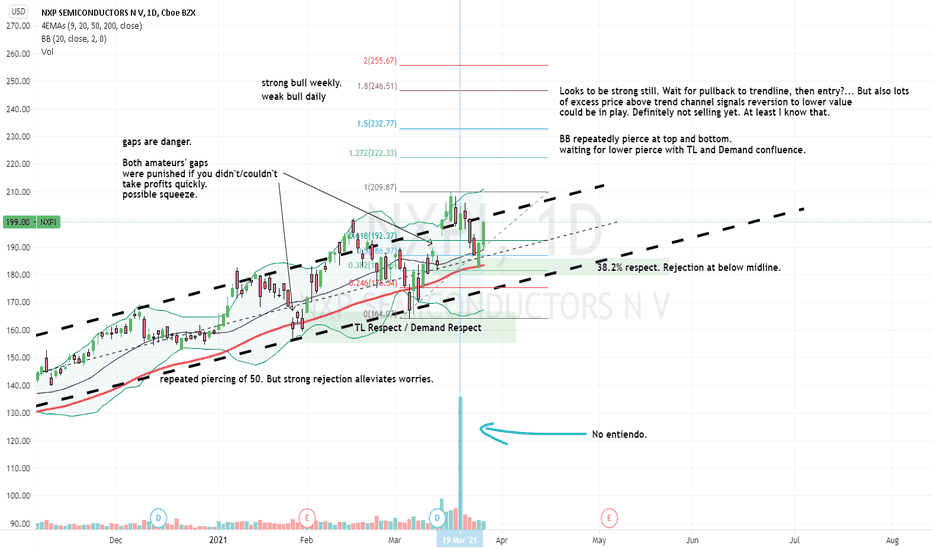

The interesting case of NXPI.It is now 4 hours into the day and I have analyzed a grand total of 10 stocks. I am clearing a lot of clutter out of my head though. If they ever pass a law that keeps U.S. markets open over weekends... I would worry for a lot of people's sanity. Chiefly my own.

Can someone explain to me what a Gann is? And what you do with it? Or give me some leads at least?

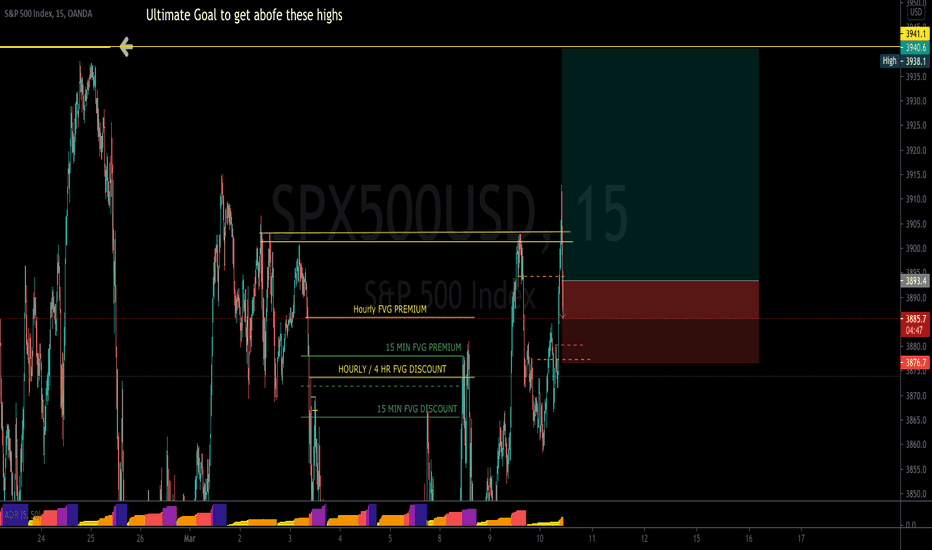

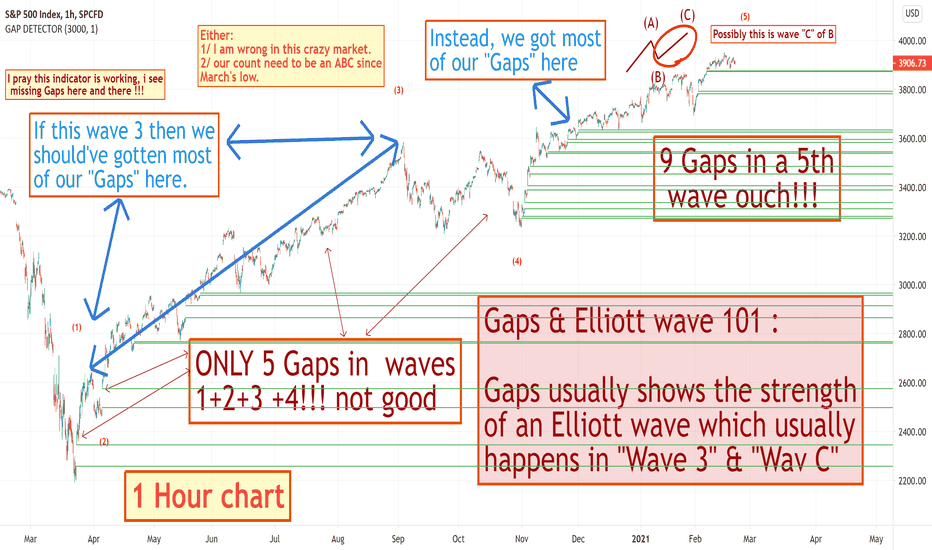

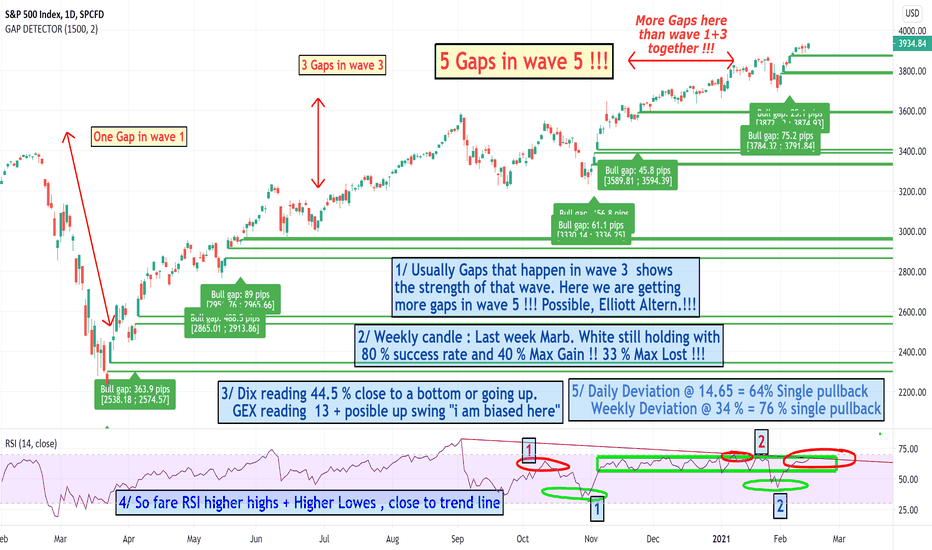

SPX's Elliott wave, possible change of count. Gaps behavior Usually we get Gaps in a 3ed Elliott wave or in "C" wave which show the strength of that wave

In our case , since March low we are getting more gaps in wave 5 than waves 1+2+3+4 !!!! not

good indicator that we have the right count !!! it is very possible that March's low is basically

still corrective and this is wave "B" and we re in wave "C" of it. Therefore, it is very probable

that our wave 5 is acutely a wave c of B. Then we will correct in wave C and break March's

low. Or i could be wrong ; -).

wish you all the best.

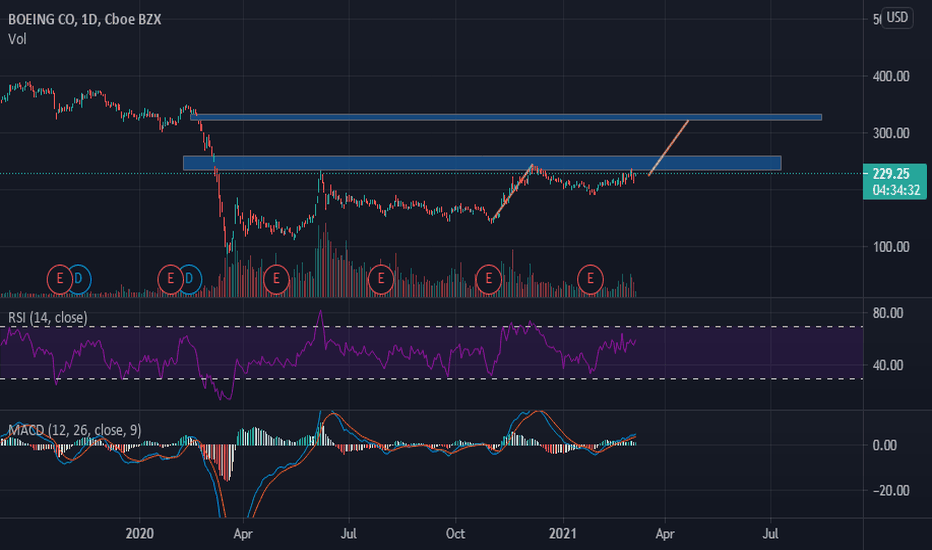

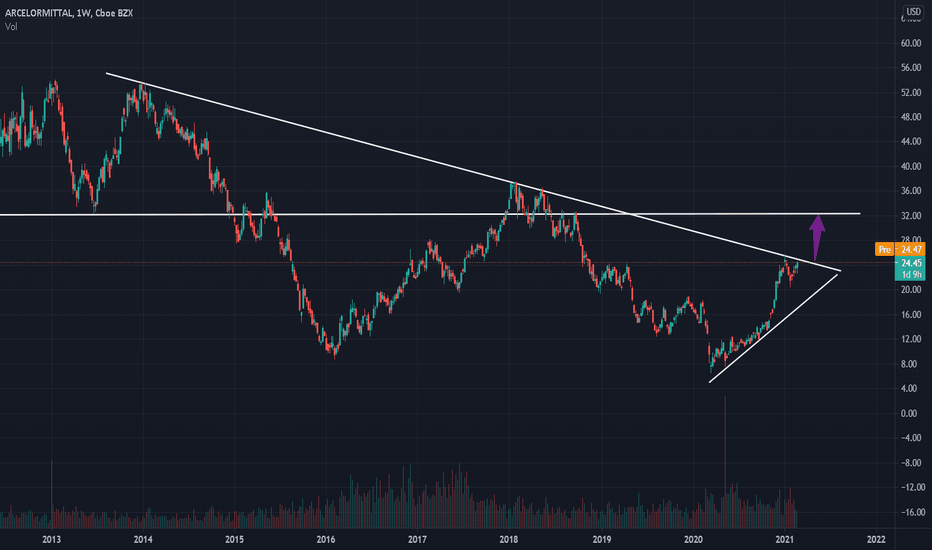

MT - Sleeping GiantMT is typically the slower brother to that of Mr. X, but that's about to change.

Why?

- Reducing costs, plan to lay off about 20% of workforce in coming years

- >$1B in Buyback planned

- Spot prices of steel have are at 7-10 year highs and continue to rise

- Demand will skyrocket once Biden's infrastructure stimulus revealed, and once economy opens back up

- Other commodity price increases also pushes the price of steel up

$MT is the largest steel manufacturer, and unlike others, it is active in the whole value chain, from exploration and development to mining, concentration, pelletizing, rail transport and port operations. With operations that span Europe, the Americas, Africa and Asia.

It supplies over half of it's raw materials - allowing them to cost average down higher ore prices, thus expanding their margins on finished product.

Technically:

- 2 gaps to fill, 2nd gap brings us to $25.47 - I think those get filled next week.

- PT: $30-35 by end of April

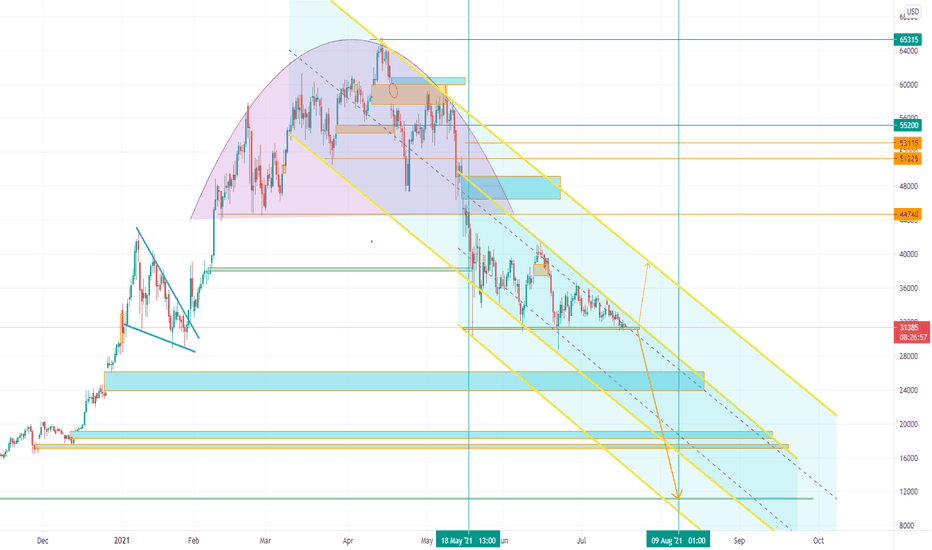

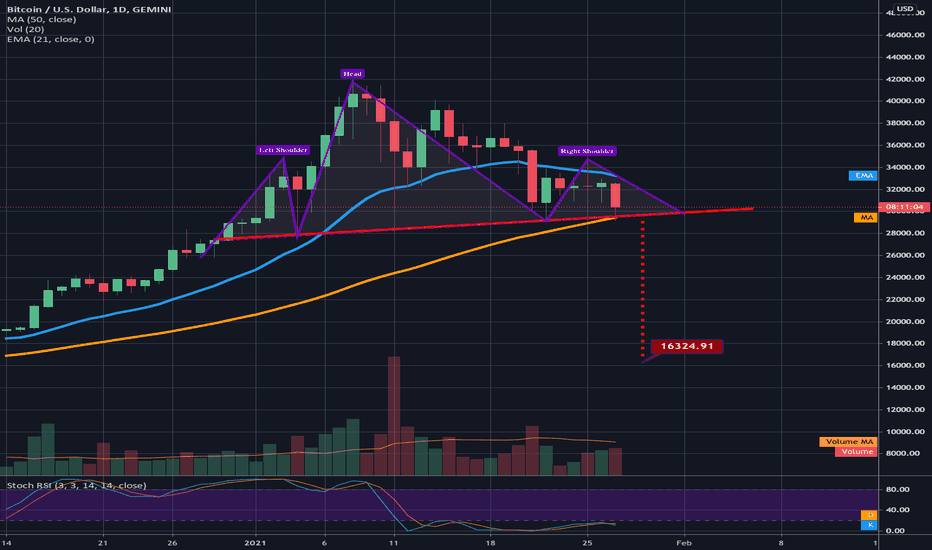

A bigger h&s with an even lower breakdown target appearsWe now have a bigger h&s with a more traditional horizontal neckline in play that if we were to trigger has a breakdown target around the mid 16,000s. Of course we must await confirmation...but this could potentially trigger a very deep correction....one item of bearish onfluence is there is a me futures gap around this range so a correction this deep is not impossible. Currently low probability we would go that far even if we did close candles below this neckline but worth considering all the same. As of now nothing is confirmed and a fakeout is still very possible. As always await confirmation.