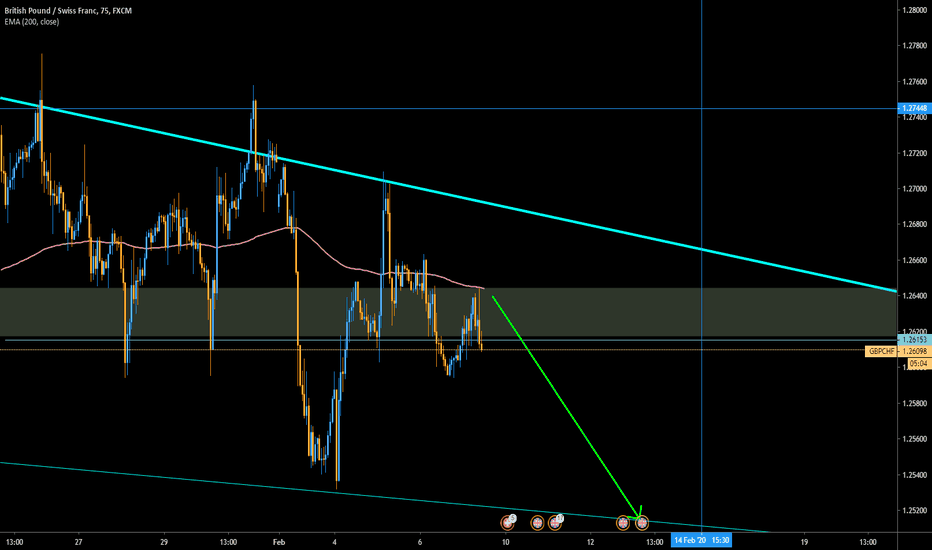

GBP-CHF

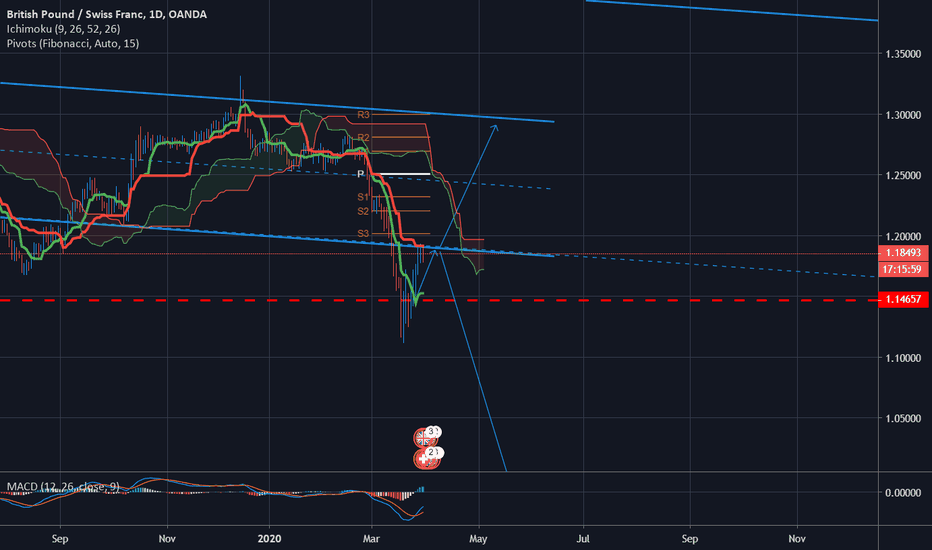

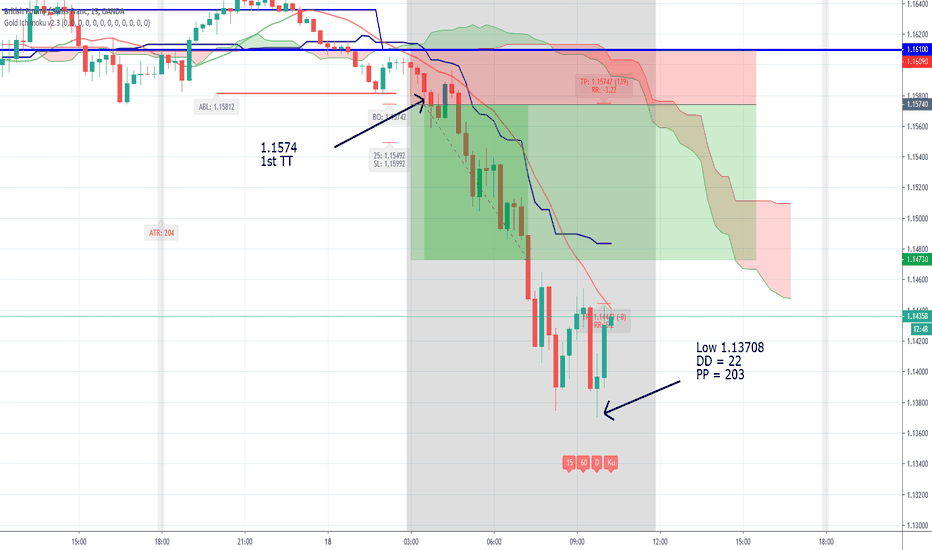

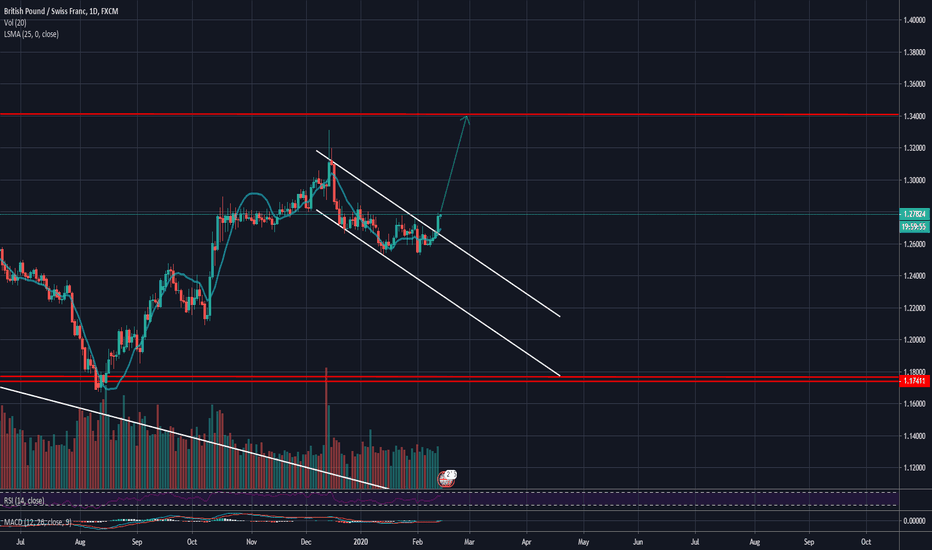

Swing short Judging by my indicators and the candle formation I can see this pair running out of steam.

The bears are creeping in for a beautiful swing short.

Once we hit the TP we intend to ride the recovery wave back to the top for a weekly swing long.

Happy trading all!!

Stay inside, wash your hands and get tho's pips!

P.A.E.N

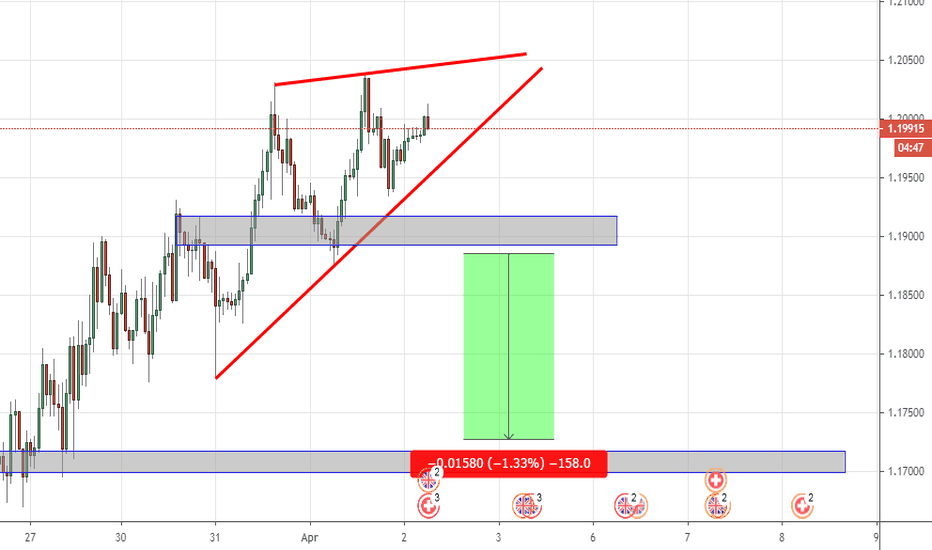

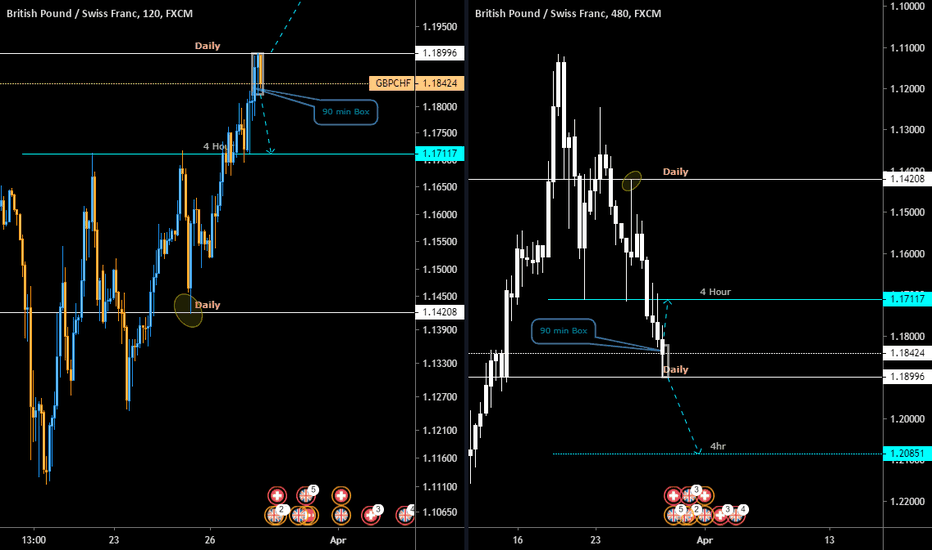

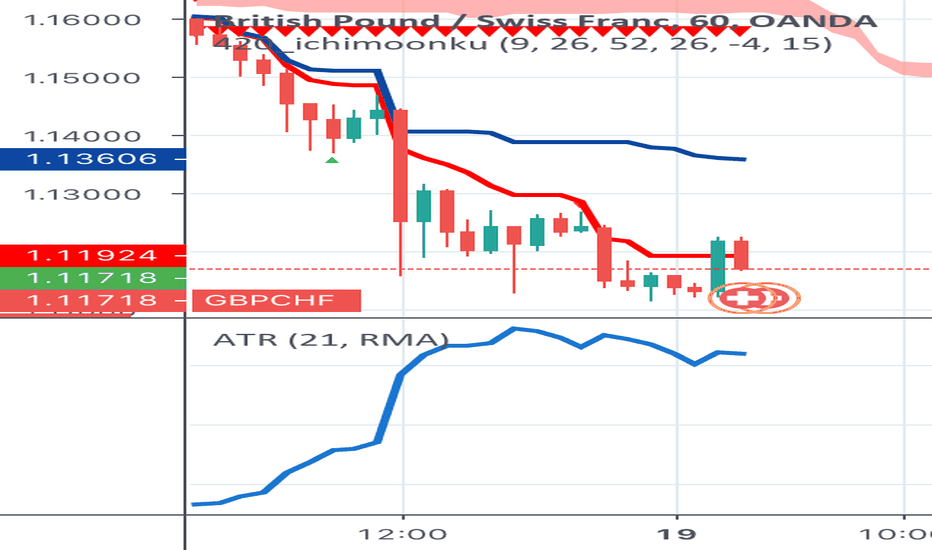

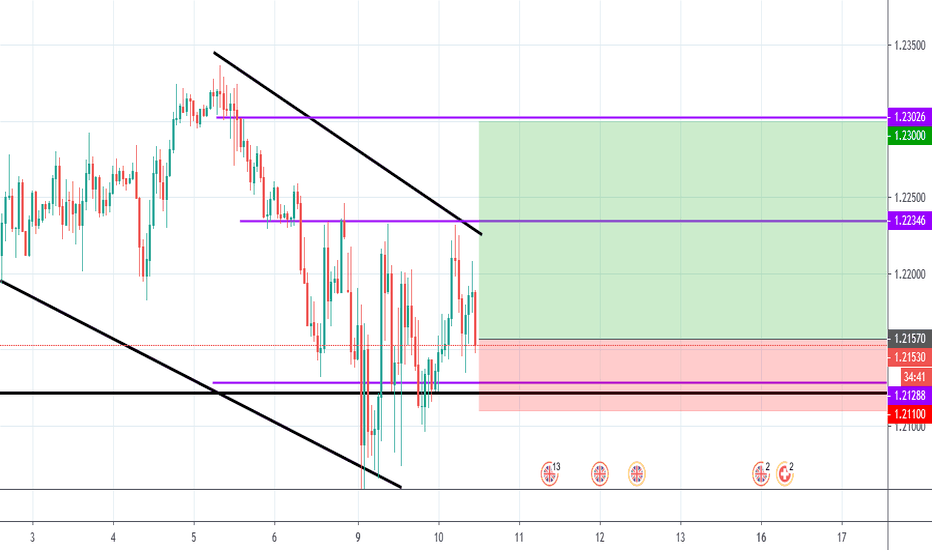

GBPCHF - INTRADAY - 31. MAR. 2020Welcome to our weekly trade setup ( GBPCHF )!

-

1 HOUR

Bearish market open and pressure.

4 HOUR

Prices broke 1.19000 and instantly started to pullback.

OVERALL

Break and close of psychological turning area done, freefall with pretty high chances now!

-

FOREX INTRADAY

SELL GBPCHF

ENTRY LEVEL @ 1.18700

SL @ 1.19230

TP @ 1.17940

Max Risk. 0.5% - 1%!

(Remember to add a few pips to all levels - different Brokers!)

Leave us a comment or like to keep our content for free and alive.

Have a great week everyone!

ALAN

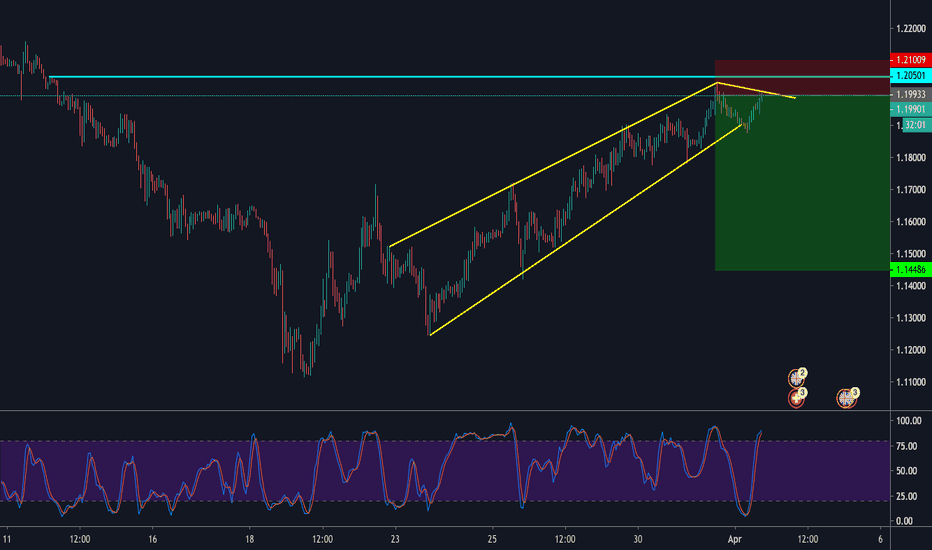

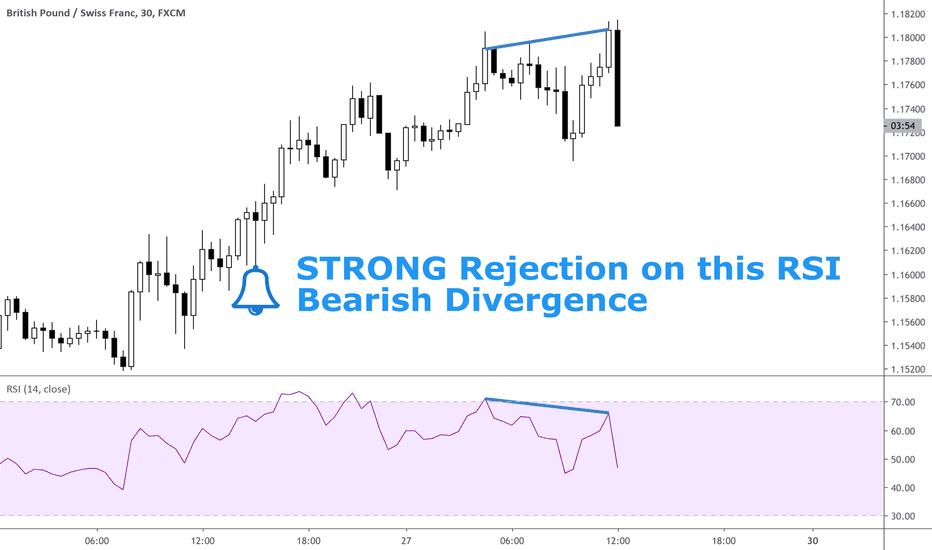

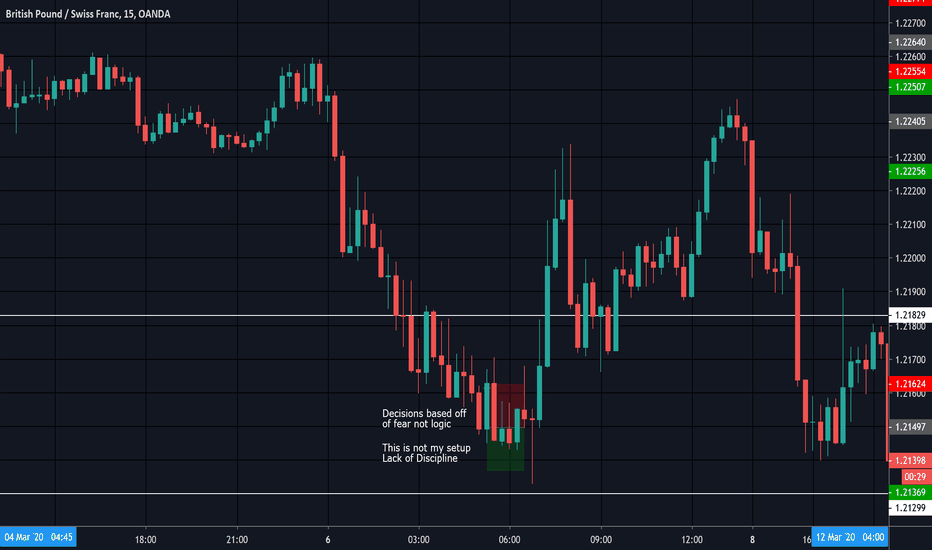

GBPCHF RSI Bearish Divergence! [QUICKUPDATES]Hey all, the Trading Guru is back with another entry on a new series called 'Quick Updates'.

We just got a very strong rejection on GBPCHF after the price made an RSI Bearish Divergence. This means that a temporary top might have been printed, and a new bearish downtrend can start.

--- What is The Quick Update Series All About? ---

I am starting a new tag (quickupdates) where I quickly share great opportunities based on TA for shorter timeframes, such as 4h, 1h, and 15m. It will not contain just a short explanation, in order to keep the velocity up and make sure you get to see the opportunities as fast as possible.

Follow me for consistent high quality updates, with clear explanations and charts.

Please like this post if you learned something to support me.

- Trading Guru

--------------------------------------------------------------

Disclaimer!

This post does not provide financial advice. It is for educational purposes only!

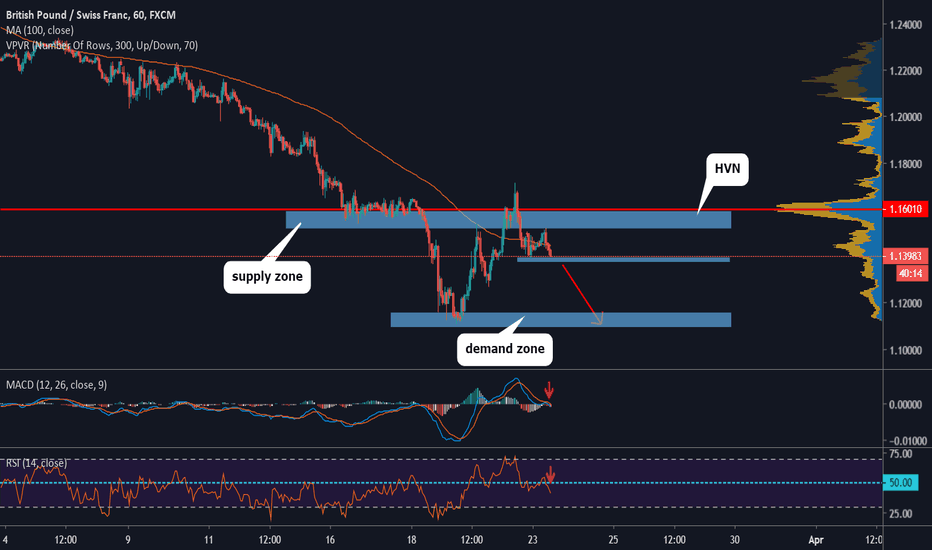

GBPCHF SHORT TRADEGBPCHF is based below supply zone at level 1.1569

and below HVN at level 1.1601 which indicates that pair is in distribution phase

Price is below SMA 100 H1 frame

MACD shows bearish momentum

RSI is below level 50

we r waiting to break support level 1.3880 to open short trade to target demand zone at level 1.1115

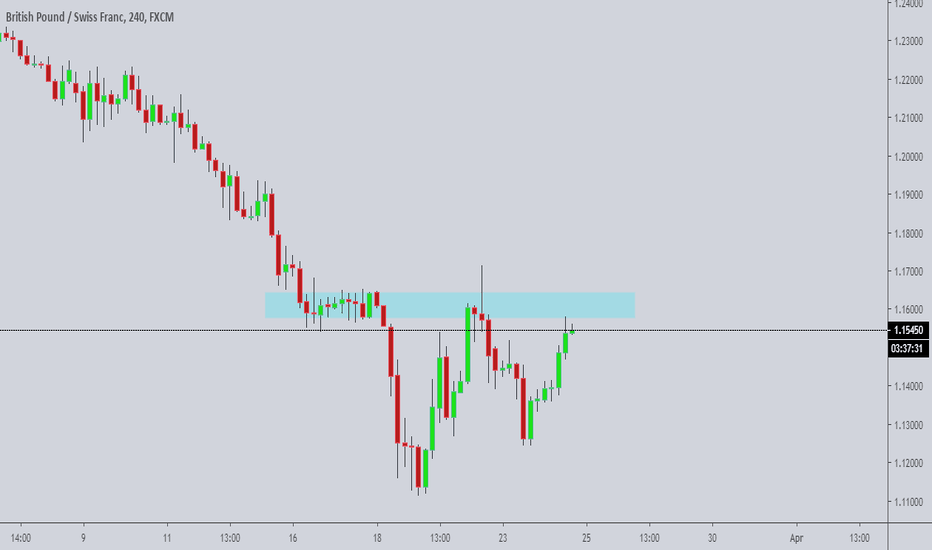

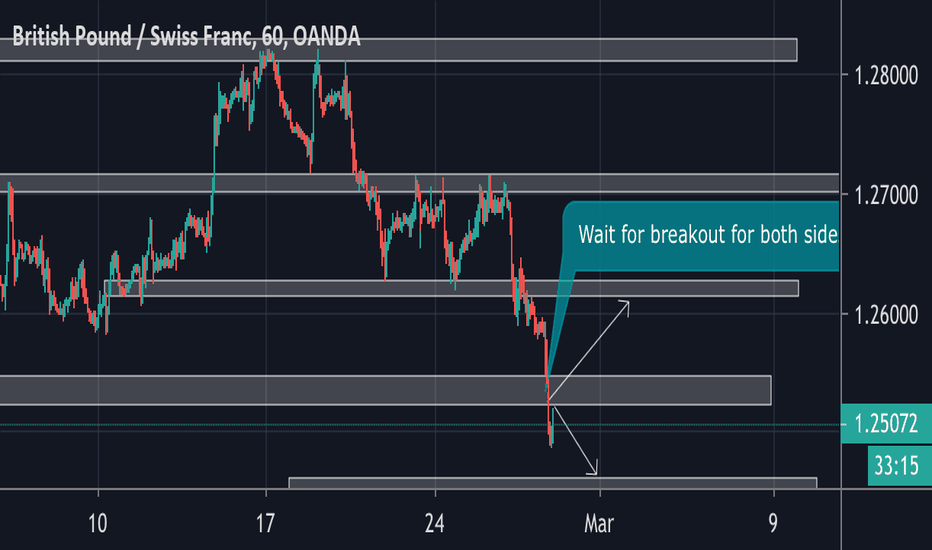

GBPCHF Consolidating Range for tradingGBPCHF is consolidating for sometime we might see more consolidation in GBPCHF if anyone want to trade one can trade at support zone and resistance with stoploss . after break consolidation range on either side one can trade on breakout side for longer term perspective.

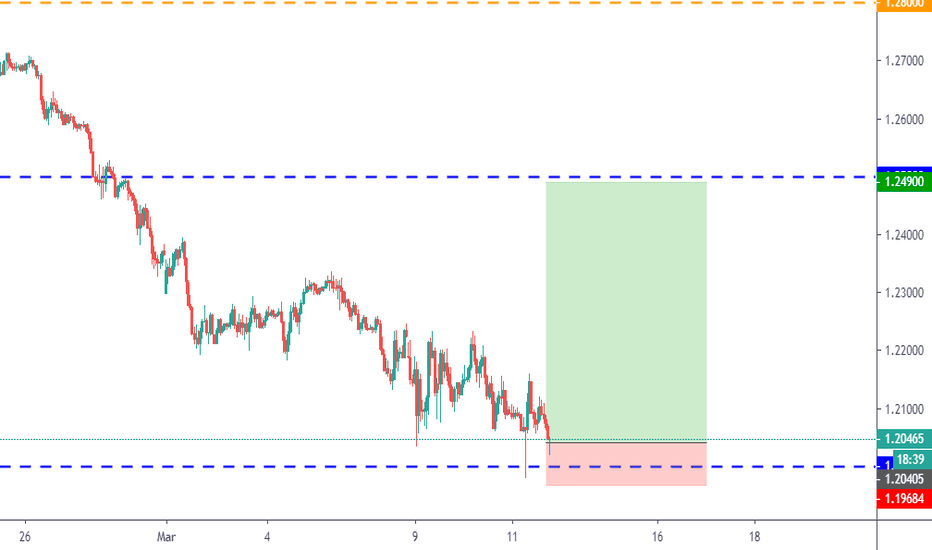

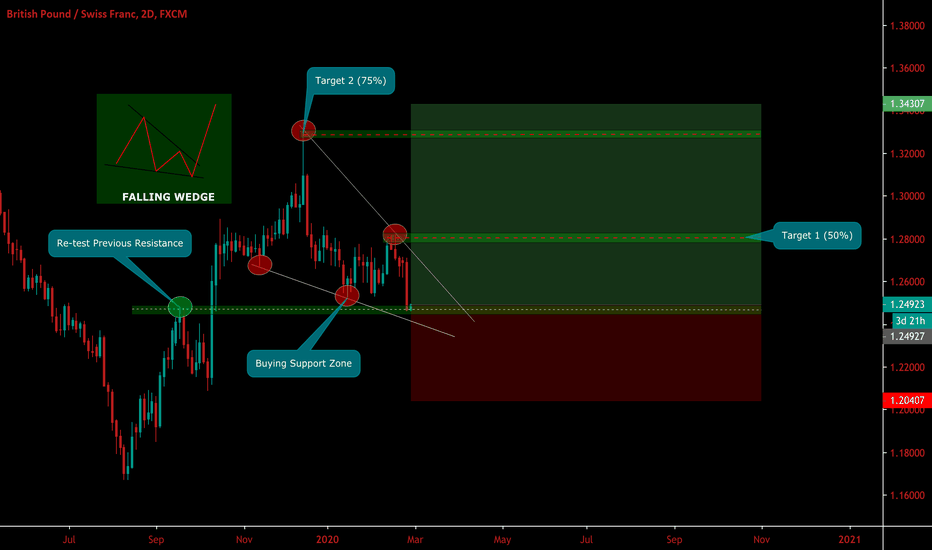

GBP/CHF - FALLING WEDGE - BUYPOTENTIAL TRADE: GBP/CHF

I am looking to enter long on this currency pair for the following reasons:

- Falling wedge chart pattern is very evident.

- Re-test of the previous resistance structure

- Buying the descending trend-line.

- Buying support zone has been slightly violated. Discounted price for bulls.

If you found this idea useful, leave a like and follow me for more analysis and trading signals.

If you have any questions, feel free to ask in the comment question. I respond to all comments!

You must always use correct risk management when following any analysis.

Happy Trading!

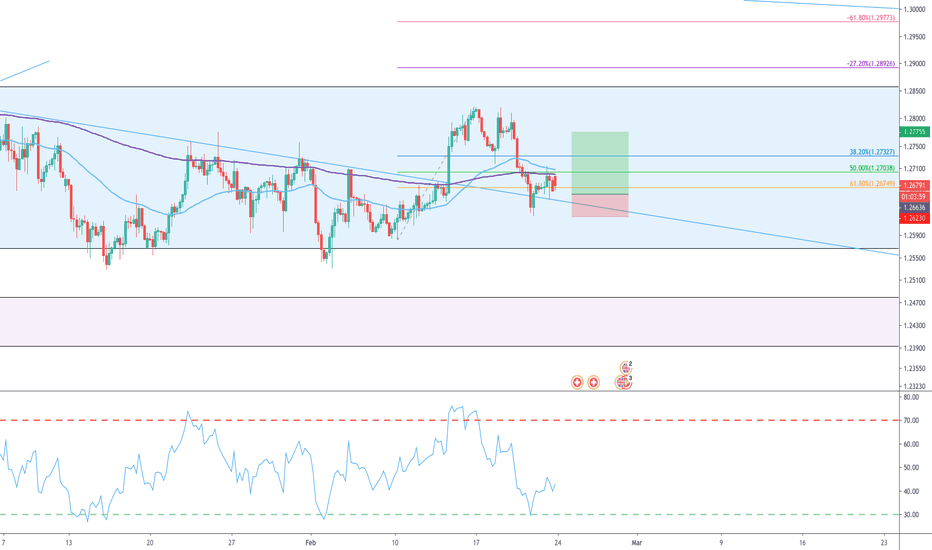

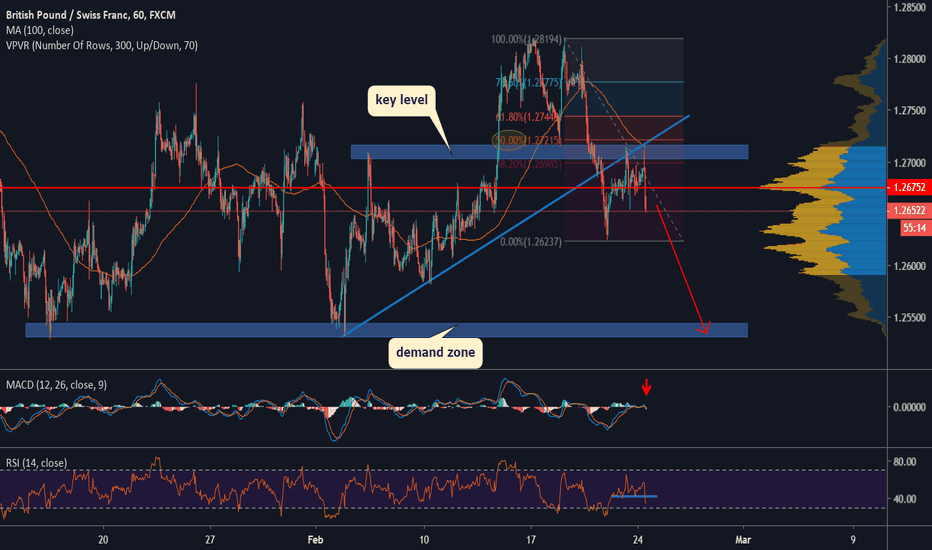

GBPCHF SHORT TRADEGBPCHF retested broken uptrendline

Price rejected from key level and 50% Fibonacci level of preceding bearish wave at 1.2713

Below SMA 100

MACD shows bearish momentum

RSI is in downtrend

Price is based below HVN at level 1.2675 which indicates that pair is in distribution phase

It's expected for price going down towards demand zone at level 1.2531

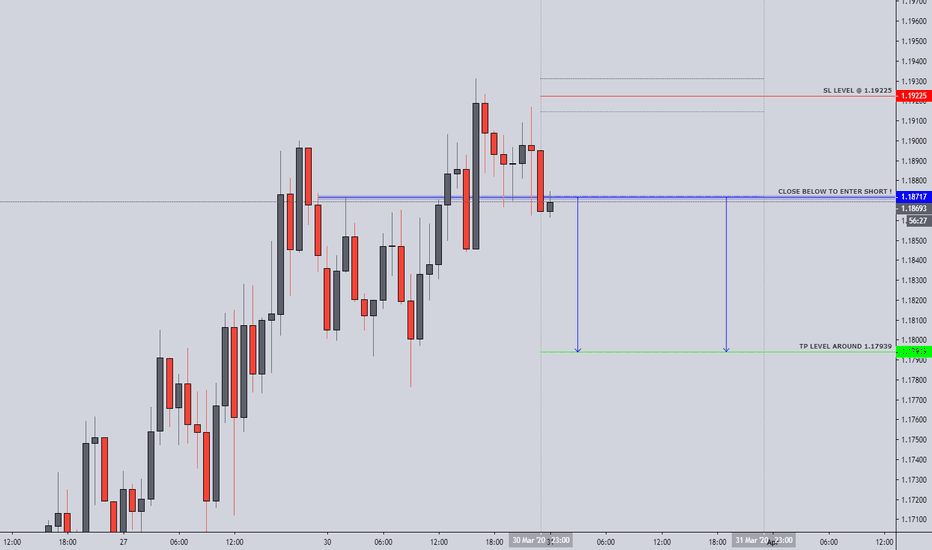

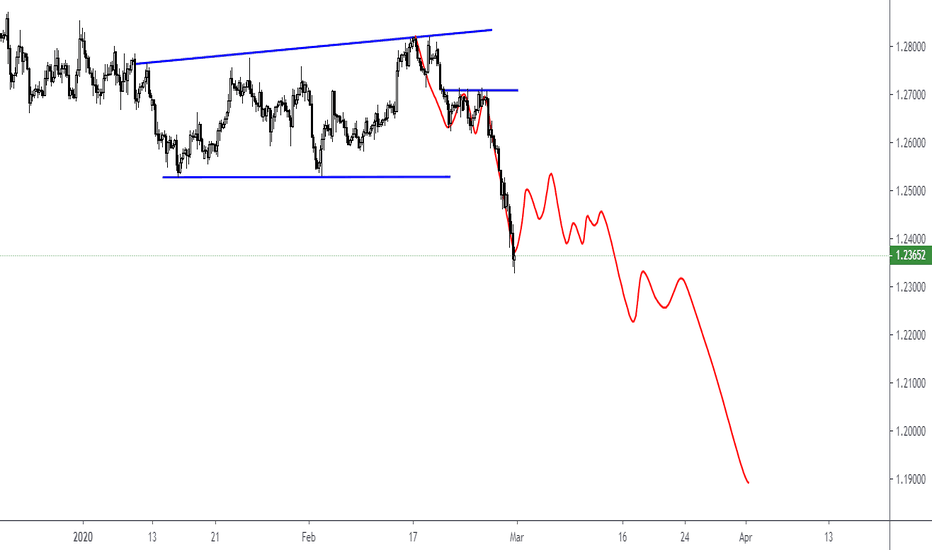

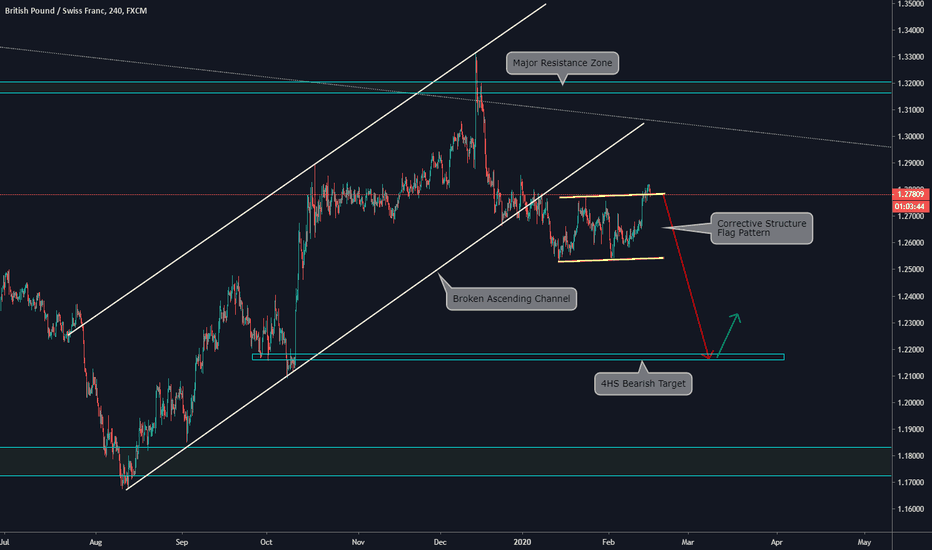

GBPCHF Possible Short Scenario by ThinkingAntsOkUse this as a guide to develop your setup.

Main items we can see on the 4HS chart:

a)The main ascending channel has been broken

b)After the Breakout, a corrective structure was formed

c)Currently, we can see a Flag Pattern (continuation structure)

d)We expect a continuation of the bearish movement towards the next support zone