GBP-CHF

My wife says im a PIG...She needs to stop looking in the mirror ;p

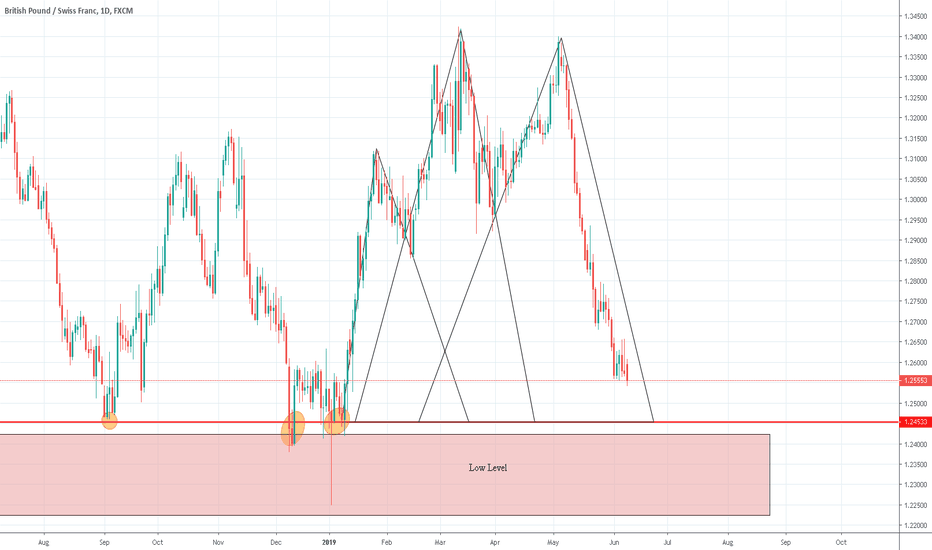

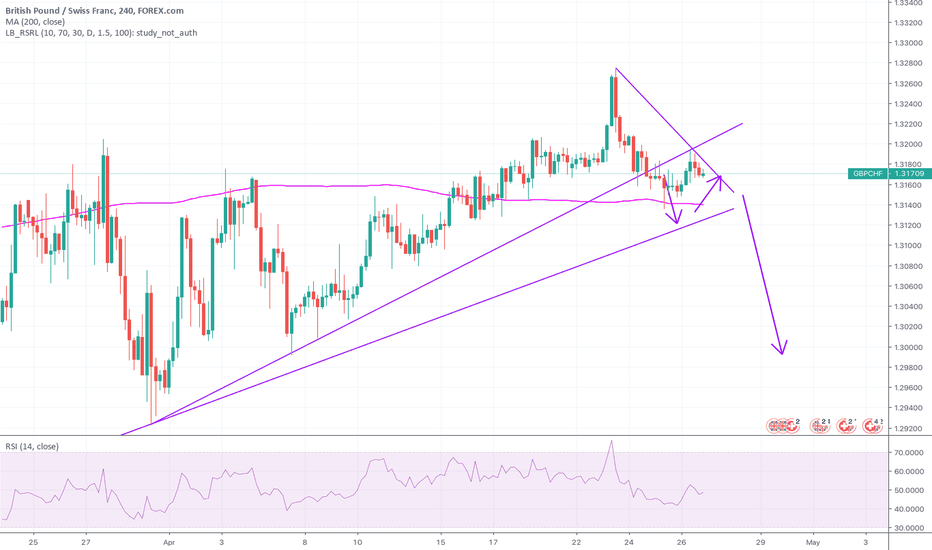

Take note of this key resistance turned support zone that price is currently at as I wont spoon feed you forever! So we are expecting bullish movement from this area.

This is a good area and is obviously where big banks have set orders previously, so start thinking like a big investor and start making money instead of working a dead end job to earn money just to waste it in forex because you think you are better than the markets and are looking to get rich quickly.

Our own personal strategy allows us to catch a few pips on the bounce of these zones and also catch the big move if it happens, if you would like to learn more about our strategy then give us a message.

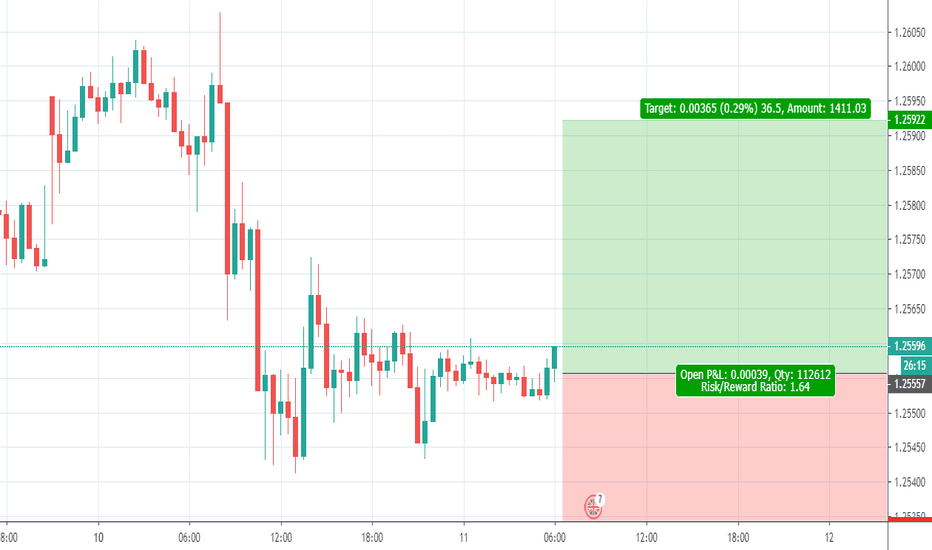

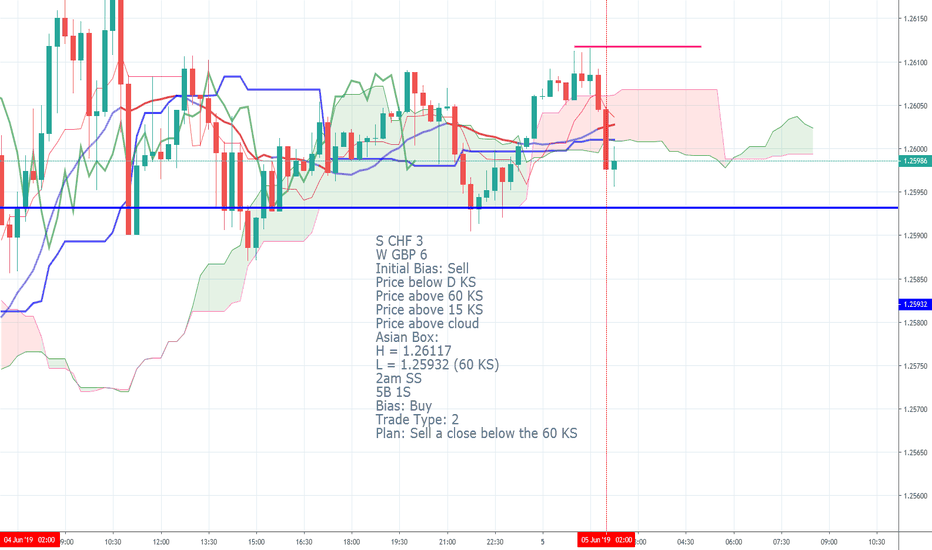

GBPCHF SS Short + 60 Pip PotentialPrice is below the Daily and the 15 KS as well as the cloud, but above the 60 KS. This is a Type 2 trade with a High probability and good RRR.

Entry = enter short on a CLOSE, not a penetration, below the 60 KS at 1.25932

Stop = approx 1.2610

Risk = 20 pips

Profit target = 1.2530 ( The projected daily low )

Reward = 60 Pips

RRR = 3-1

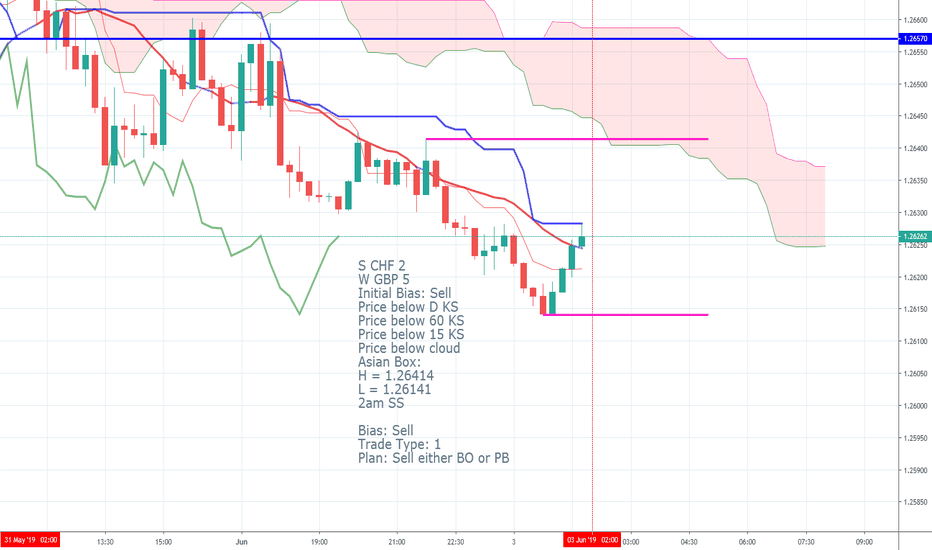

GBPCHF SS Short + 90 Pip PotentialPrice is below the Daily, 60 and 15 KS as well as the cloud. This is a Type 1 trade with a High probability and good RRR.

2 Potential entries (it is one or the other, not both)

Entry = 1.2641

Stop =1.2661

Risk = 20 pips

Profit target = 1.2551

Reward = 90 Pips

RRR = 4.5 -1

2nd Entry = 1.2608

Stop =1.2638

Risk = 30 pips

Profit target = 1.2551

Reward = 57 Pips

RRR = 2-1

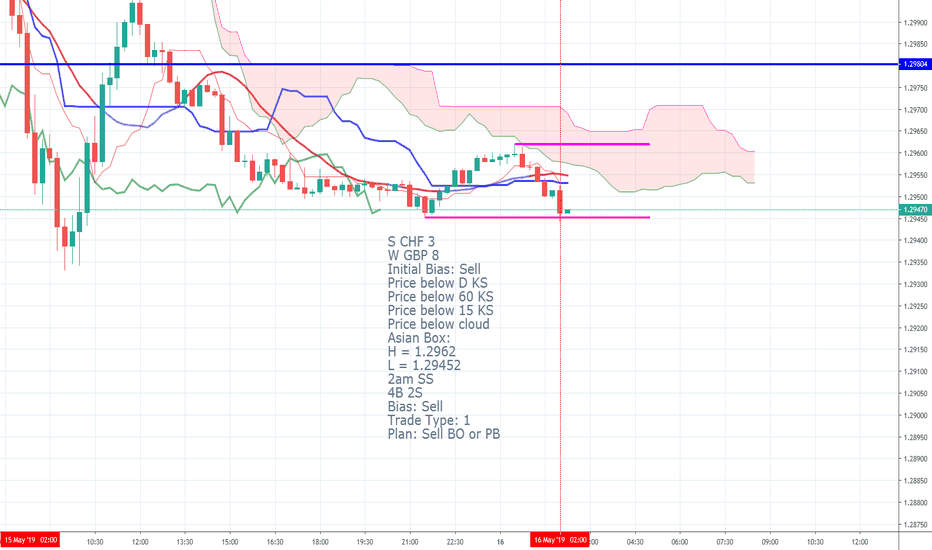

GBPCHF SS Short + 90 Pip PotentialPrice is below the Daily, 60 and 15 KS as well as the cloud. This is a Type 1 trade with a High probability and good RRR.

2 Potential entries (it is one or the other, not both)

Entry = 1.2962

Stop = 1.2982

Risk = 20 pips

Profit target = 1.2872 ( The projected daily low )

Reward = +90 Pips

RRR = 4.5-1

2nd Entry = 1.2937

Stop =1.2967

Risk = 30 pips

Profit target = 1.2872 ( The projected daily low )

Reward = 65

RRR = 2.1 -1

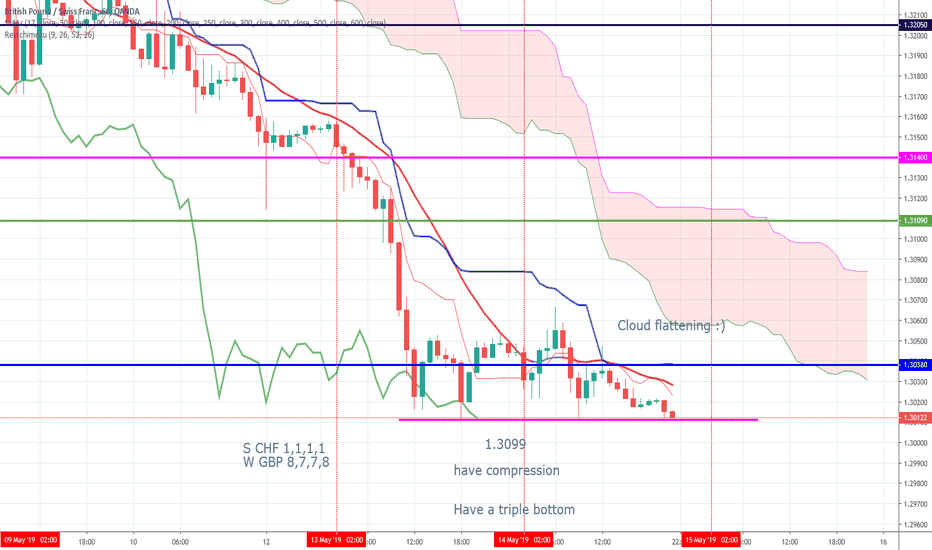

GBPCHF Potential Homerun LongGBP has been weak for several days and CHF Strong. this pair has now formed a triple bottom with compression at 1.3099. Although the cloud remains thick, it is flattening. There is a high probability that this pair can explode up to The Daily Senkou A at 1.3109 (the Green line)

Entry = 1.30115 (accouting for spread)

Stop =1.29915

Risk = 20 pips

Profit target = 1.3109 ( The Daily Senkou A )

Reward = 98

RRR = 4.9 -1

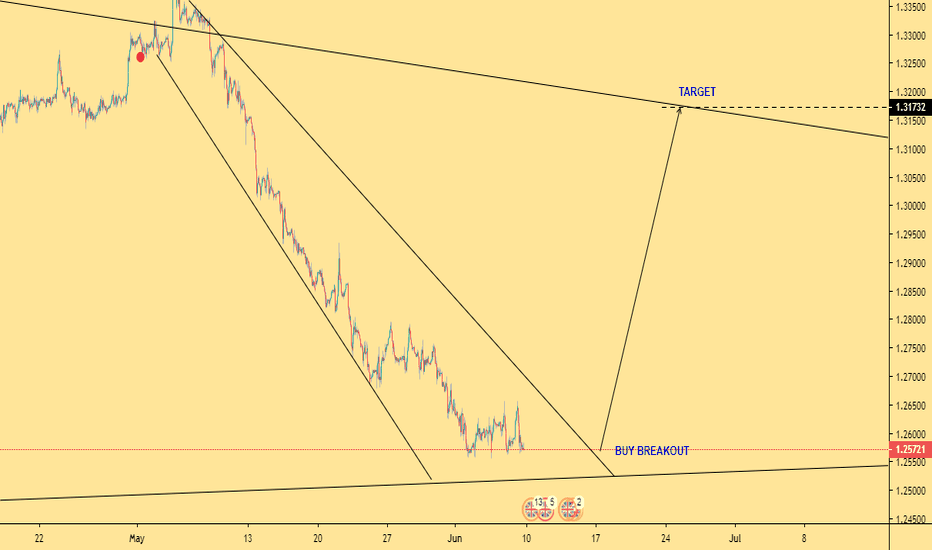

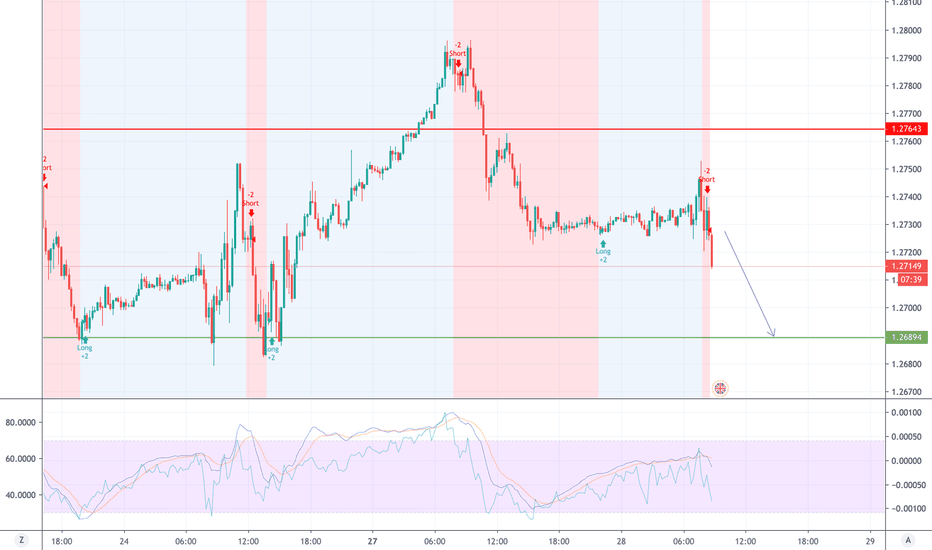

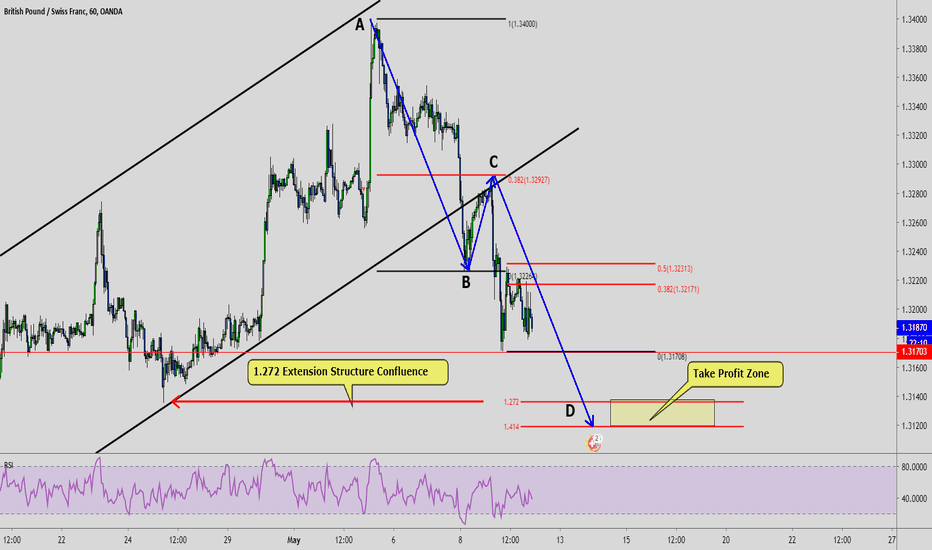

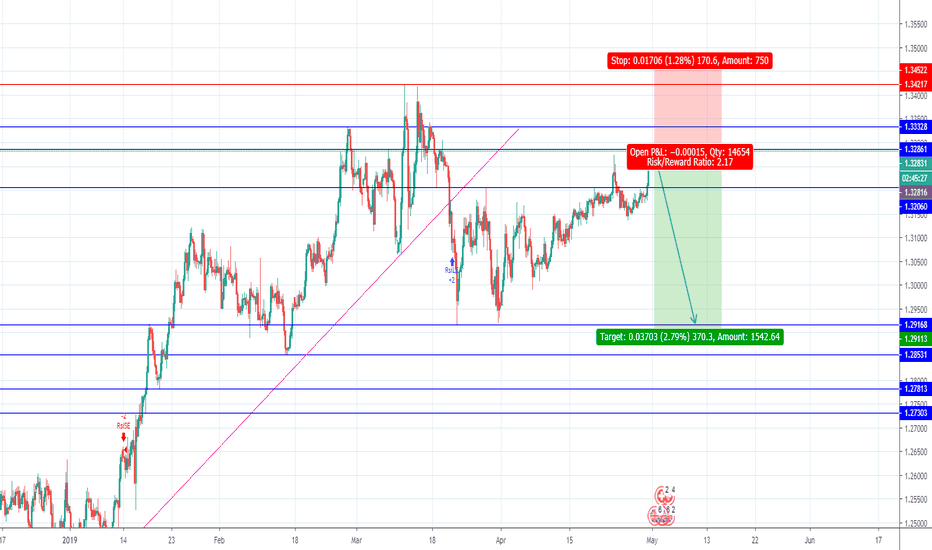

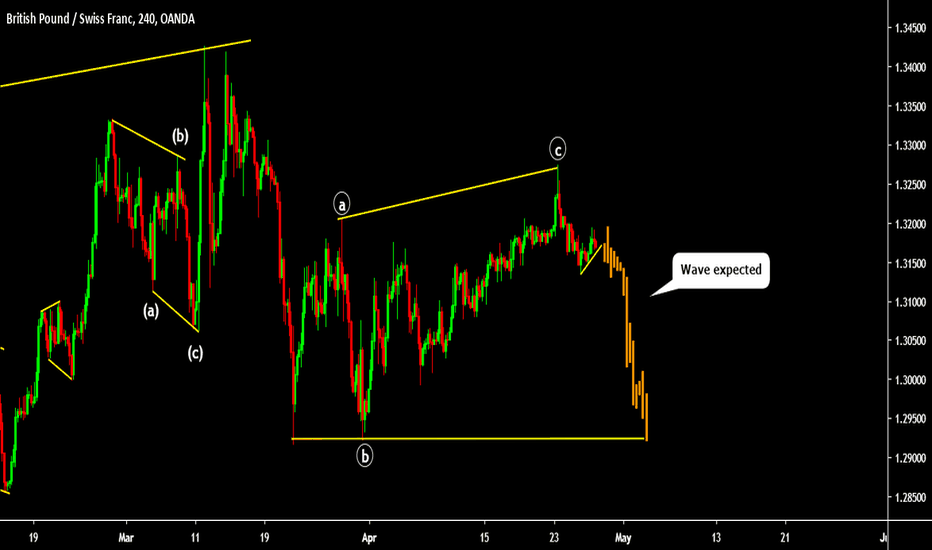

SHORT GBPCHF Continues Downward to Test 1.272 Extension AB=CDGBPCHF is continuing to fall as predicted in my previous idea:

After reversing off of the .5 fib retracement, I expect the pair to continue downward to the 1.272 extension of the most recent bearish impulse leg.

We also have a potential ABCD Pattern forming, with the D point converging with the 1.414 extension of the recent bearish impulse leg.

Trade:

Sell at market

Stop above .5 retracement

Take Profit at 1.272 Extension

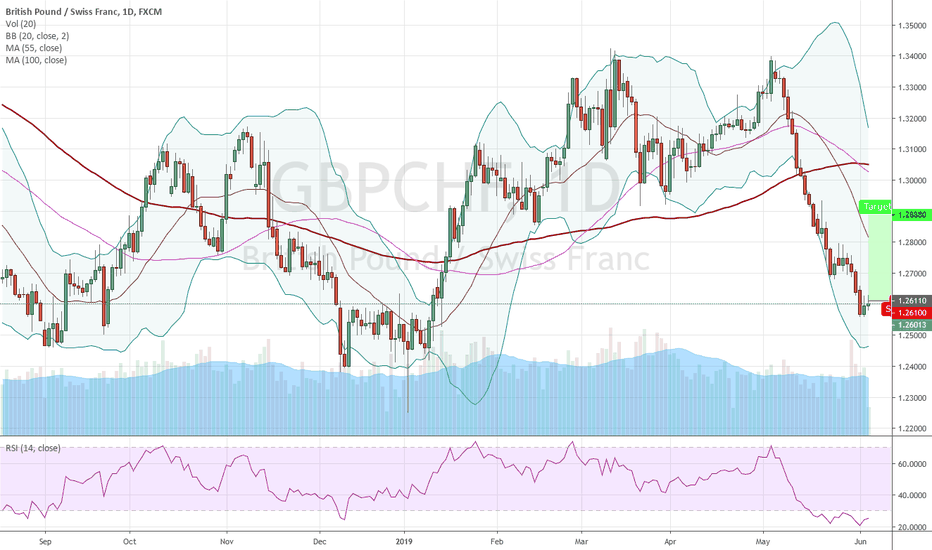

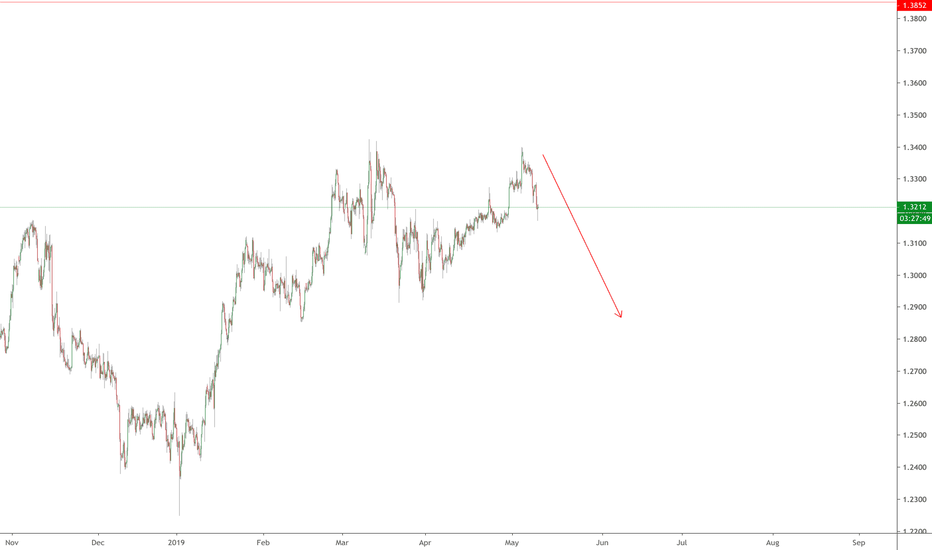

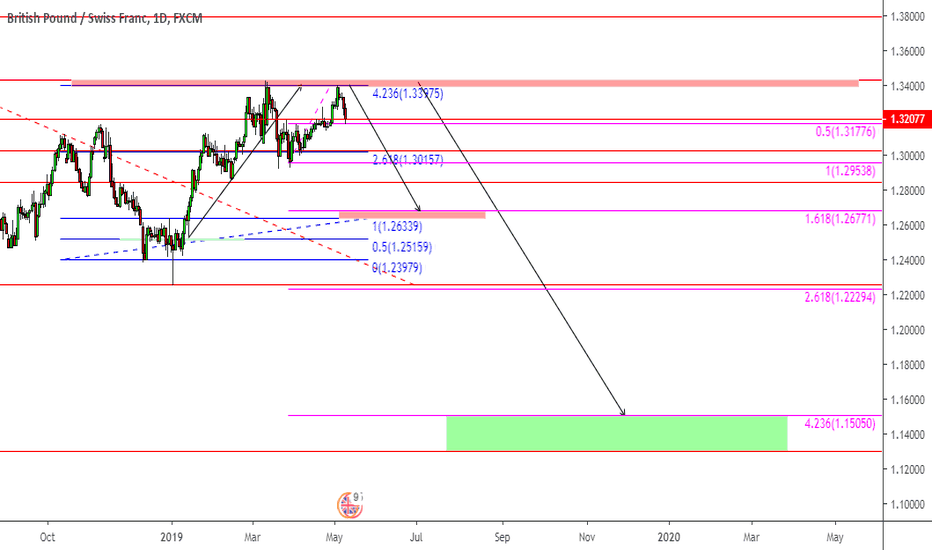

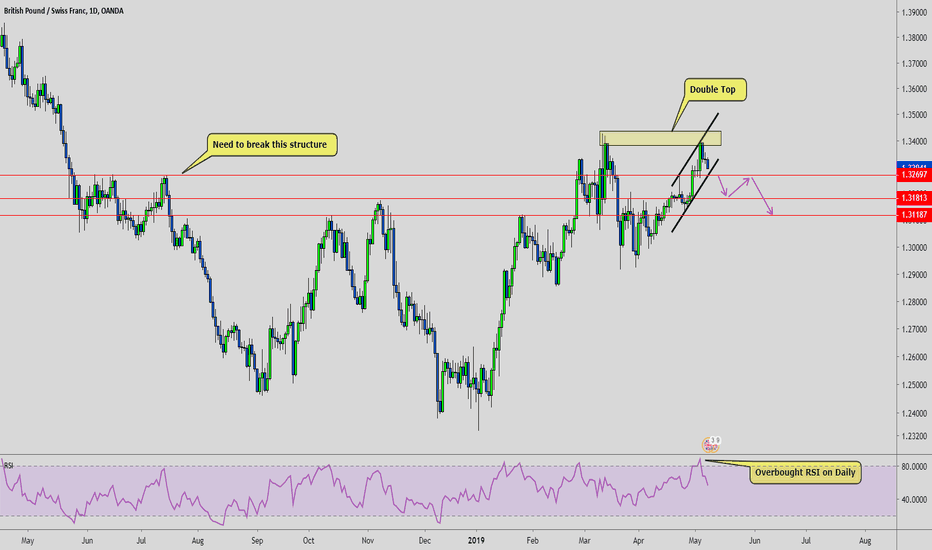

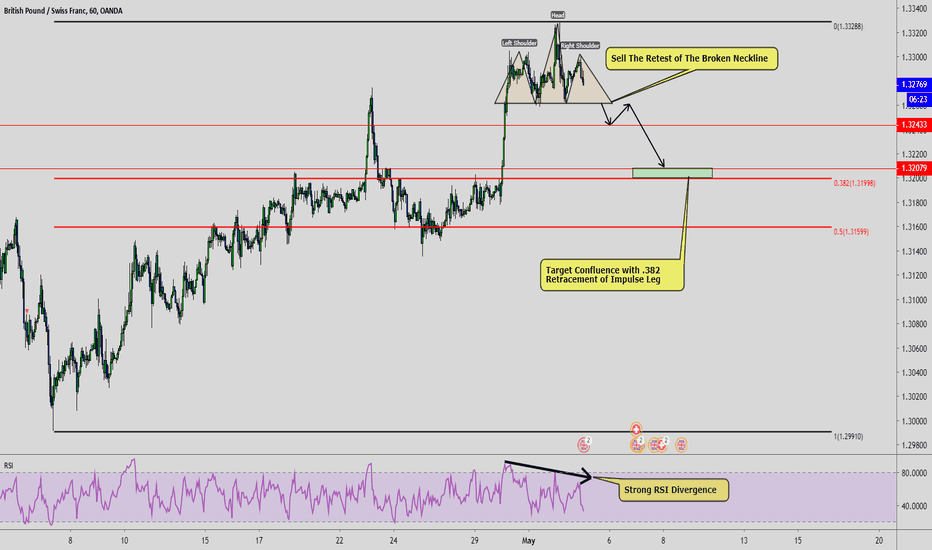

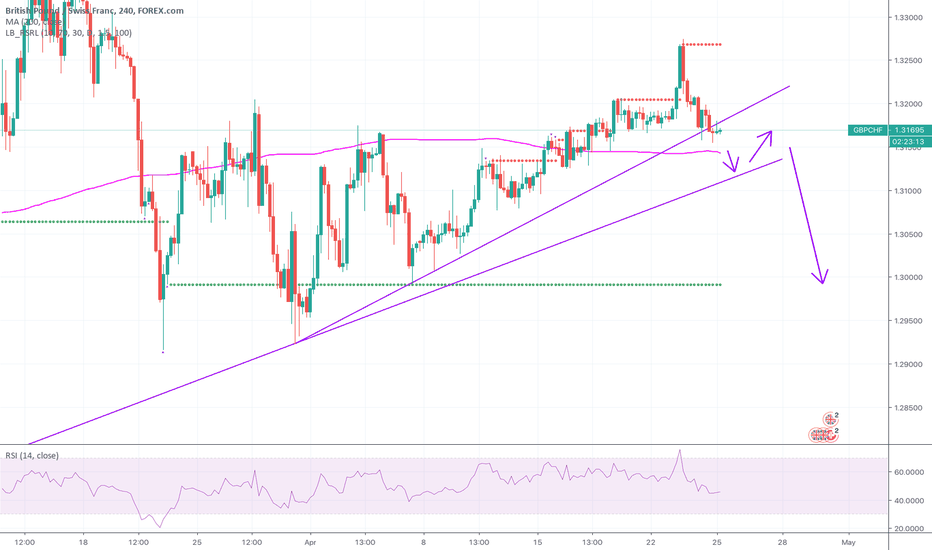

GBPCHF Head and Shoulders Near Completion + RSI DivergenceThe Pound Swiss has almost formed a head and shoulders reversal pattern coupled with clear RSI Divergence

If price action continues downward, I will sell the retest of the broken neckline, with my target at the .382 retracement of the impulse leg--a level with structure confluence.