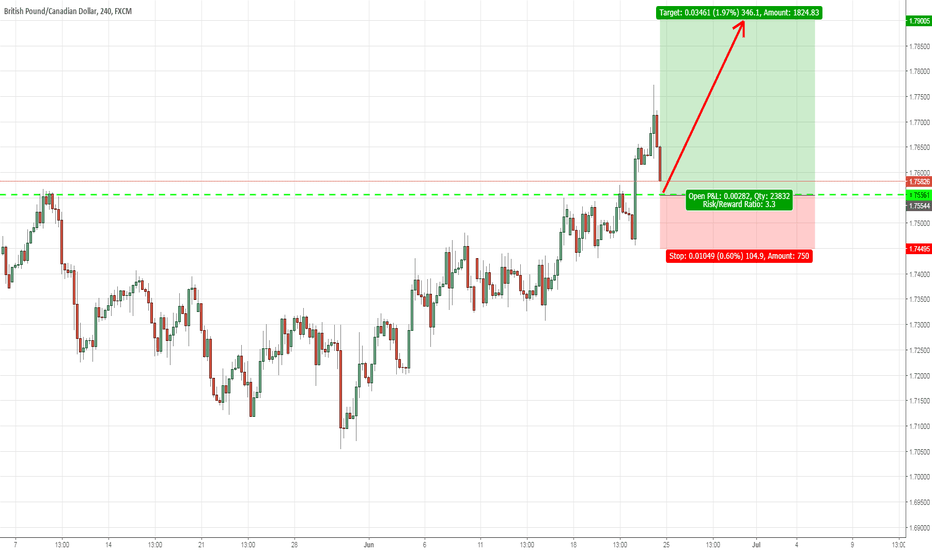

Long GBP/CADFundamentals:- the bar on interest rates changed slightly for the U.K. when another member of the MPC voted to hike rates; making the vote 3-0-6. Although we still don't expect a rate hike this year it does bring the tightening of monetary policy into a more realistic curve upward. This could bring the GBP back from its recent sell off against some of the weaker currencies. The Canadian dollar strengthened on Friday along with the Oil price as Opec and Non-OPEC countries met do discuss plans to hike oil production. An increase in production will eventually decrease the value and in turn commodity linked currencies such as the Canadian dollar. In Canada it's self a drop in m/m CPI and m/m retail sales could also bring a near term weaker CAD.

Technicals:- The 4 hour chart shows buyers breaking the resistance line on Thursday then the Oil meetings bringing the price back down to should now become support. The concern is the large pin bar candle which would suggest a much bigger reversal. However, in light of the reason for the spike I am letting it ride. I am looking to jump in on the support level and place stops below the previous candles low on the GBP announcment on Thursday last week. This price also is in confluence with 61% fibonacci pull back.

Looking at the weekly chart below we can see that the uptrend is still underway from 28/05/2018 when we had a pin bar reversal and is still pushing up with larger green candles

And the monthly chart also points to the continuation of the uptrend from September last year.

Gbpbuy

GBPNZD likely to stay in ChannelGbpNzd is nearing the lower range of its upwards channel. Based on the indicators there's still enough buying pressure and trend strength left for GbpNzd to go up. And a break of the lower range isn't very likely.

Take profit: 1.89>1.92

Stop loss: 1.87.

If the lower range does break then switch to sell for 400-500 pips target

Long & Short GBP/USDPutting my head on a block with this one as there are a few variables to consider in the time that I expect this move to happen but as it stands at the moment the fundamentals are starting to point to the USD long positions starting to fizzle out by Mid 2016 I fully expect the USD to be a neutral currency. The GBP did have dovish comments from Mark Carney (governor of the BoE) last week but at the same time unemployment fell and we had an up tick in inflation.Although this is not enough to cause a sustained rally in the GBPUSD pair it is certainly worthy of an adjustment to retest previous support as resistance from back in April last year. Because of the neutral status expected in the US dollar I expect the 14000 to be a floor on the GBP/USD but i would expect a retest of this price before the second halve of the year hence my double prediction here! keep the stop loss tight for the upside trade but give a little more for the downside as the fundamentals still point to the downside for the time being. Want to know more about how I trade bankonadam.com