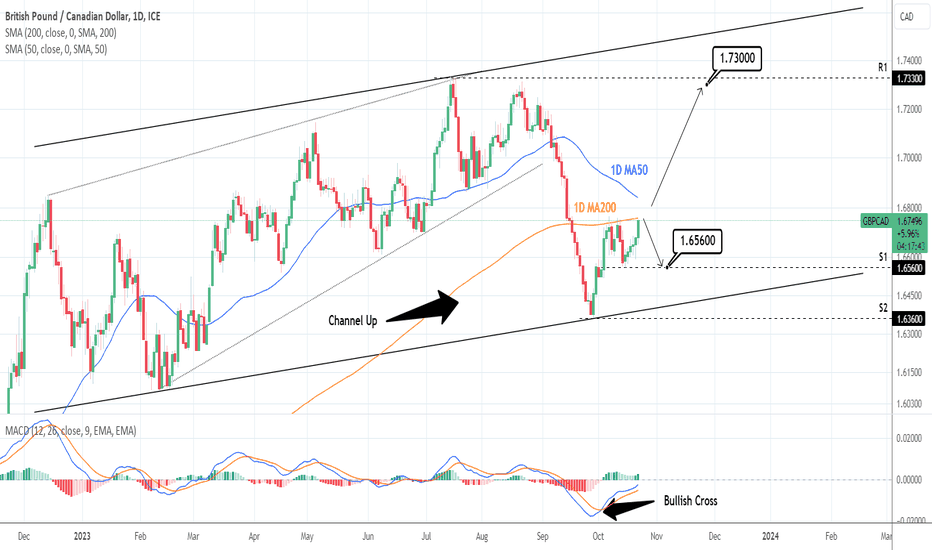

GBPCAD: Neutral but pay attention to the breakout.GBPCAD is on a neutral 1D technical outlook (RSI = 54.553, MACD = -0.005, ADX = 25.095) as the price has been ranged between the 1D MA200 and the S1 level (1.65600) for the majority of October. If it closes a candle over the 1D MA200, we will buy and target the R1 level (TP = 1.73300), since the 1D MACD is already on a massive Bullish Cross. Until that candle close though, due to the neutral technicals, we are selling to the S1 level (TP = 1.65600). Low risk on both ends.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Gbpcadtrading

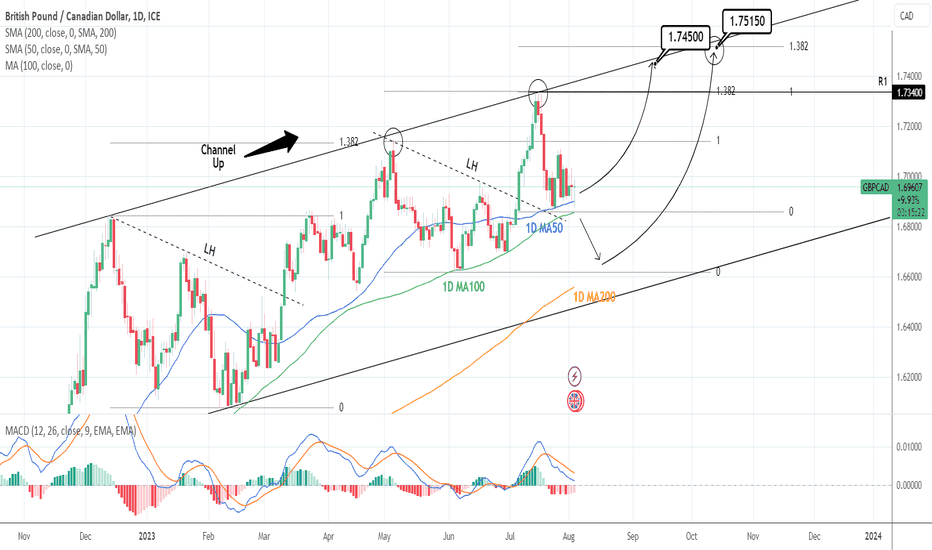

GBPCAD: Double long term Buy opportunity.GBPCAD is testing the 1D MA50 as Support on neutral 1D technicals (RSI = 49.135, MACD = 0.001, ADX = 29.493). This is an early buy signal. However since the long term pattern is a Channel Up, the downside potential extends as low as its bottom of the HL trendline. Throughout its formation, the 1D MA100 has constantly provided Support, more specifically three times since February 16th.

Consequently, if a 1D candle is closed under the 1D MA100 (again it will be the first time inside this eight month Channel Up), we will add a second buy position near the 1D MA200. The current buy (1D MA50) targets the top of the Channel Up (TP = 1.74500), the lower buy targets the 1.382 Fibonacci extension (TP = 1.75150).

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

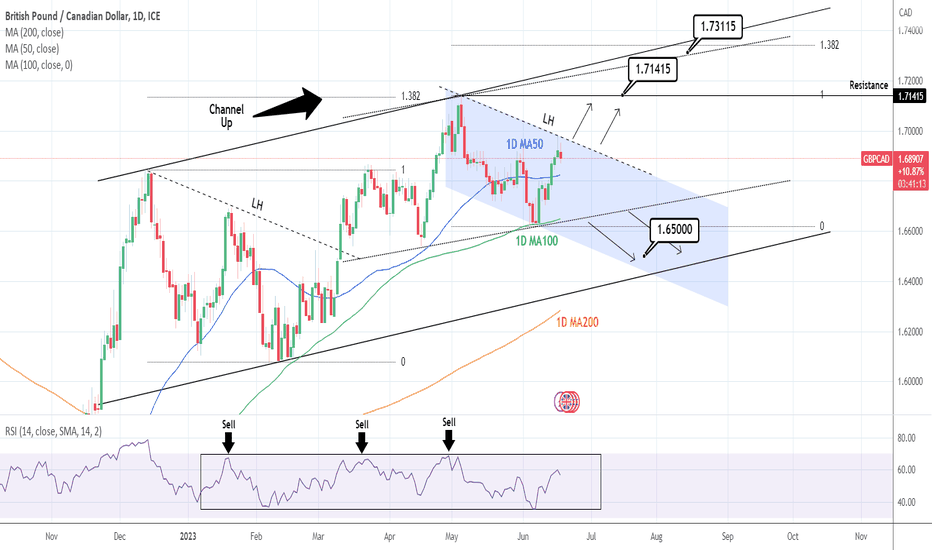

GBPCAD: In neutral zone. Engage only on those levels.GBPCAD got rejected on a LH trend line of a short term Channel Down pattern inside a wider, long term Channel Up. As the 1D technicals are borderline green (RSI = 56.107, MACD = 0.0002, ADX = 32.690), we will proceed with a buy position only if the price closes the candle over the LH and target the Resistance (TP = 1.71415) and similarly sell only under the 1D MA100 and the dotted line and target the 1D MA200 (TP = 1.6500). Observe the RSI's top to book profit earlier if needed.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##