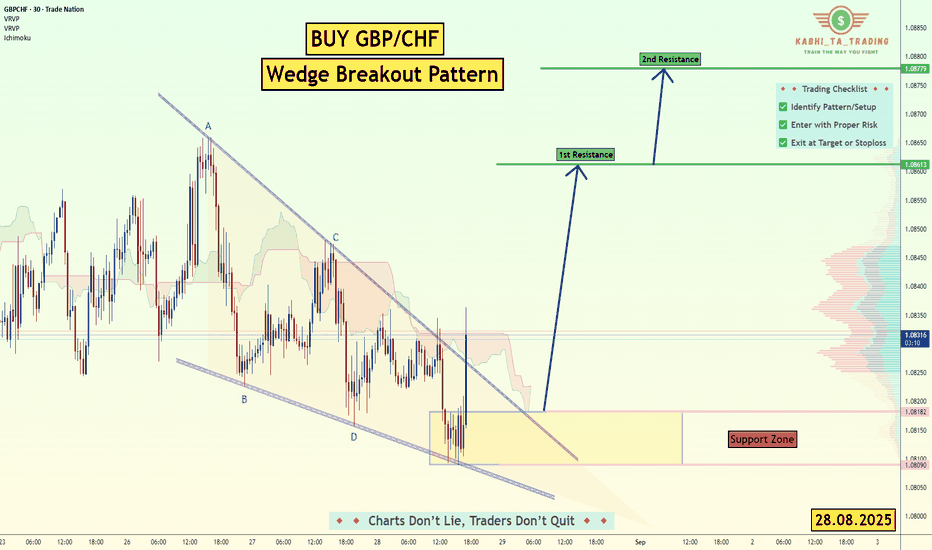

GBP/CHF - Wedge Breakout (28.08.2025)The GBP/CHF pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Wedge Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 1.0862

2nd Resistance – 1.0877

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF

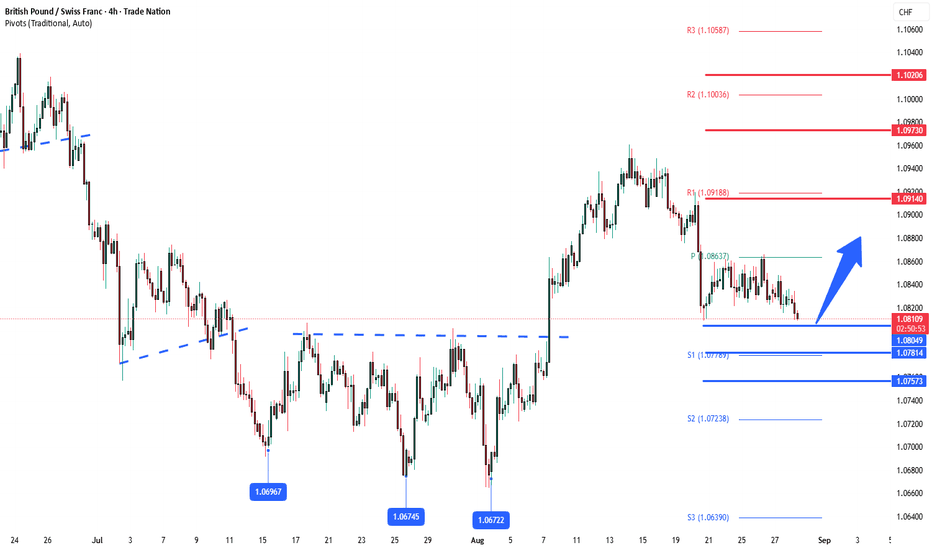

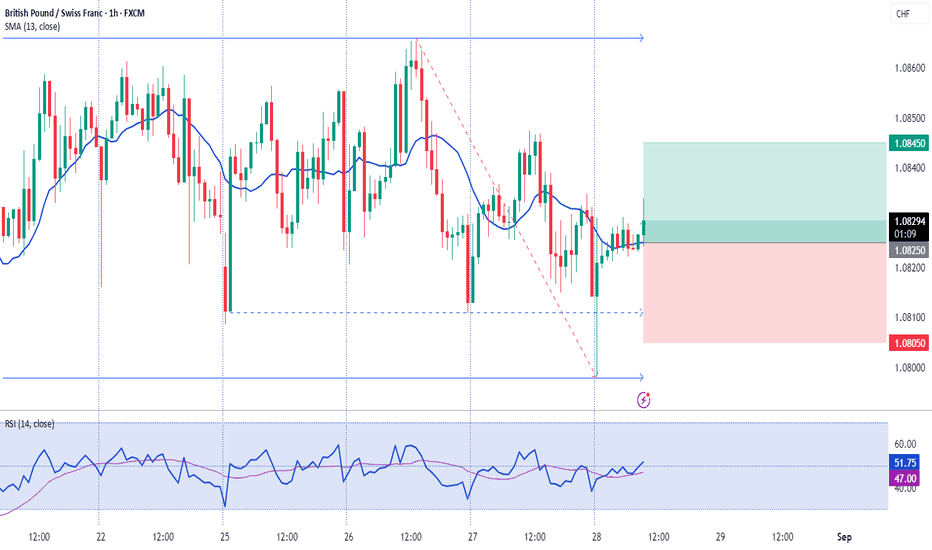

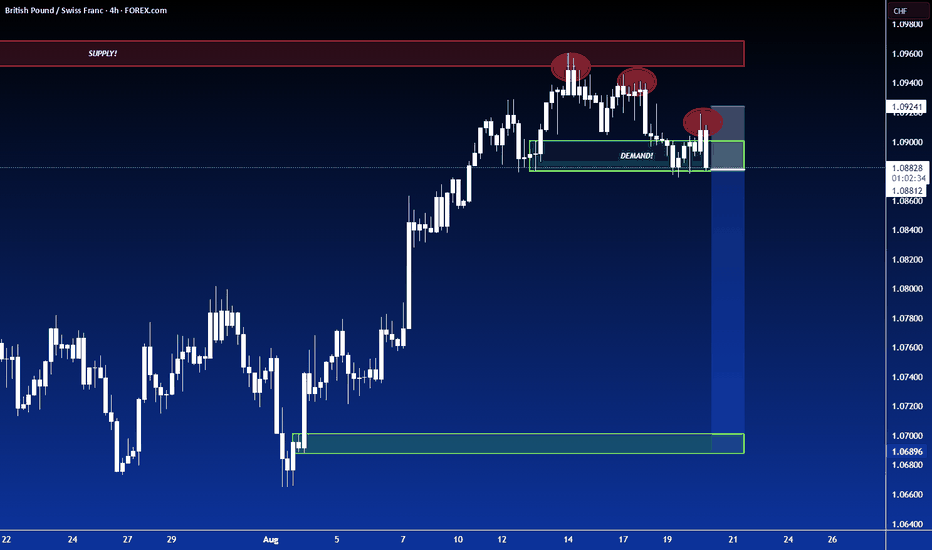

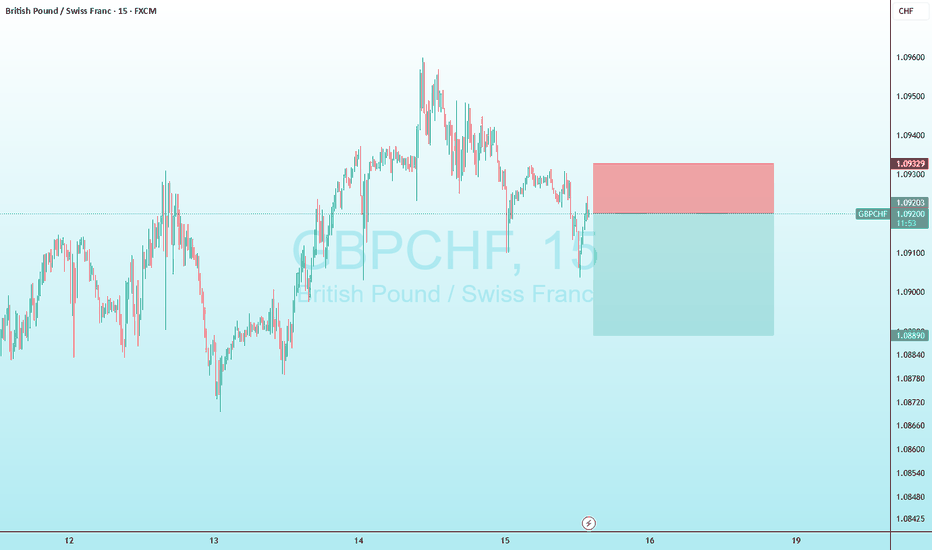

GBPCHF support retest at 1.0800The GBPCHF remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 1.0800 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.0800 would confirm ongoing upside momentum, with potential targets at:

1.0914 – initial resistance

1.0970 – psychological and structural level

1.1020 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.0800 would weaken the bullish outlook and suggest deeper downside risk toward:

1.0780 – minor support

1.0760 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the GBPCHF holds above 1.0800. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

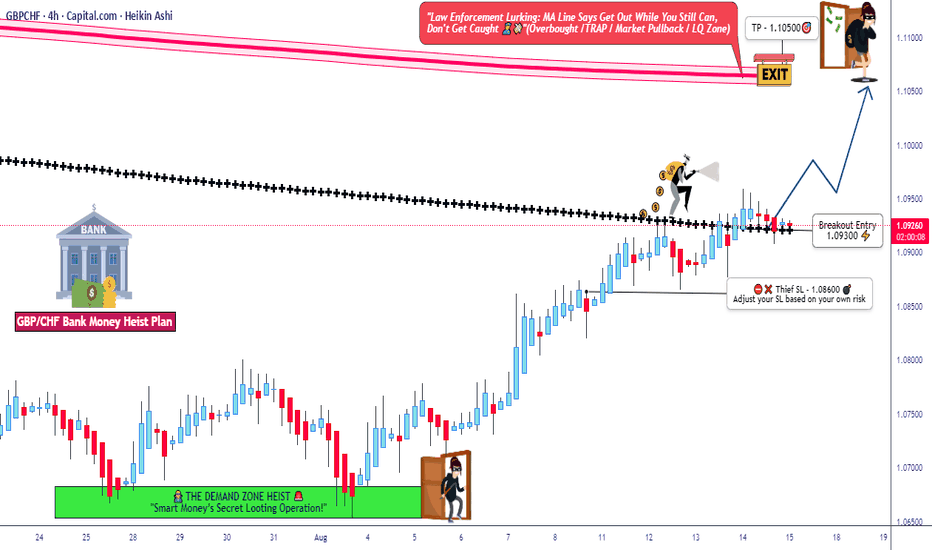

GBP/CHF: Big Move Loading! Secure Your Entries Fast!💰 GBP/CHF "POUND vs SWISS" BANK HEIST 💰

🔥 THIEF TRADING GANG – LAYER UP & LOOT THIS BREAKOUT! 🔥

🎯 PLAN: BULLISH RAID 🎯

🚨 ENTRY: AFTER BREAKOUT @ 1.09300 (OR ANY PRICE – THIEF STYLE!)

🛠️ THIEF STRAT: MULTIPLE LIMIT ORDERS (LAYERED ENTRIES) – Stack them like stolen cash! 💵💵💵

(Adjust layers based on your risk appetite – OG Thieves know how to play this game!)

⛔ STOP LOSS: 1.08600 (THIEF SL – Adjust based on your heist strategy!)

🎯 TARGET: 1.10500 (Take profits & escape before the cops come! 🚔💨)

🔫 WHY THIS TRADE?

📈 BULLISH BREAKOUT CONFIRMED! (Price stealing liquidity & running!)

💣 LAYERED ENTRIES = SMARTER HEIST! (No FOMO, just calculated robbery!)

🤑 LOW RISK, HIGH REWARD! (Perfect for Thief Traders who love stealing pips!)

⚠️ WARNING – THIEF TRADER RULES:

✅ USE TRAILING STOP IF PRICE RUNS! (Lock in profits like a pro bandit!)

✅ AVOID NEWS TIME! (Cops (whales) will trap you! 🚨)

✅ BOOST & LIKE IF YOU’RE MAKING MONEY! (More boosts = More heists! 🚀)

🔥 HIT THE LIKE & BOOST BUTTON IF YOU’RE READY TO LOOT! 🔥

🚀 THIEF TRADING GANG – WE STEAL, WE WIN, WE REPEAT! 🚀

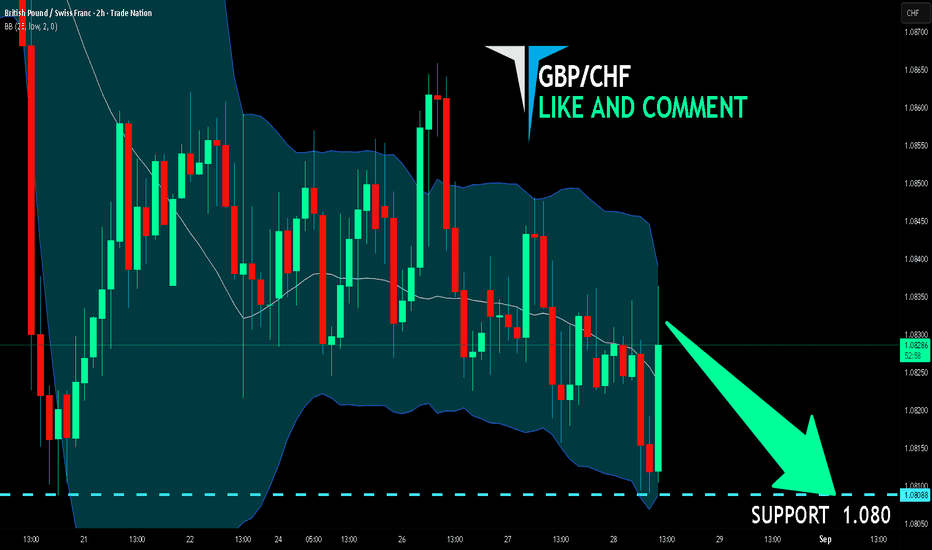

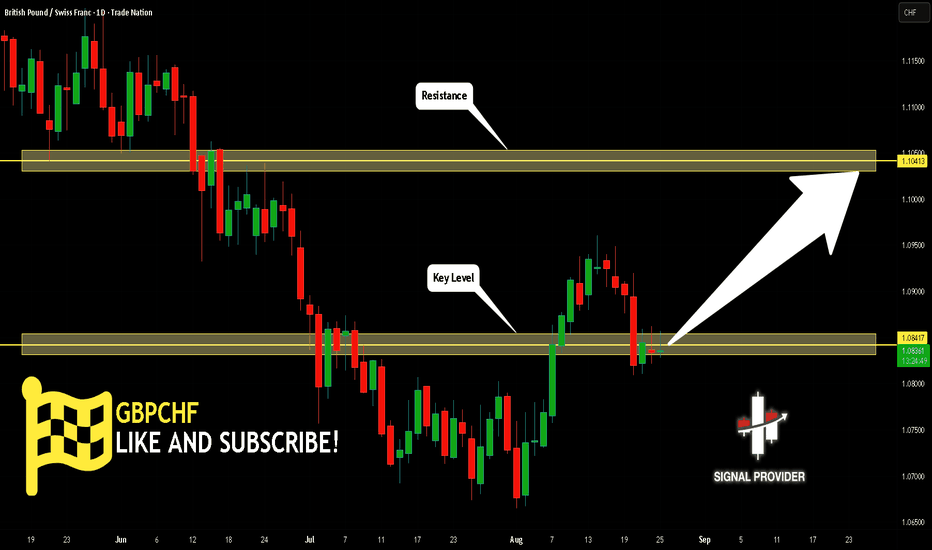

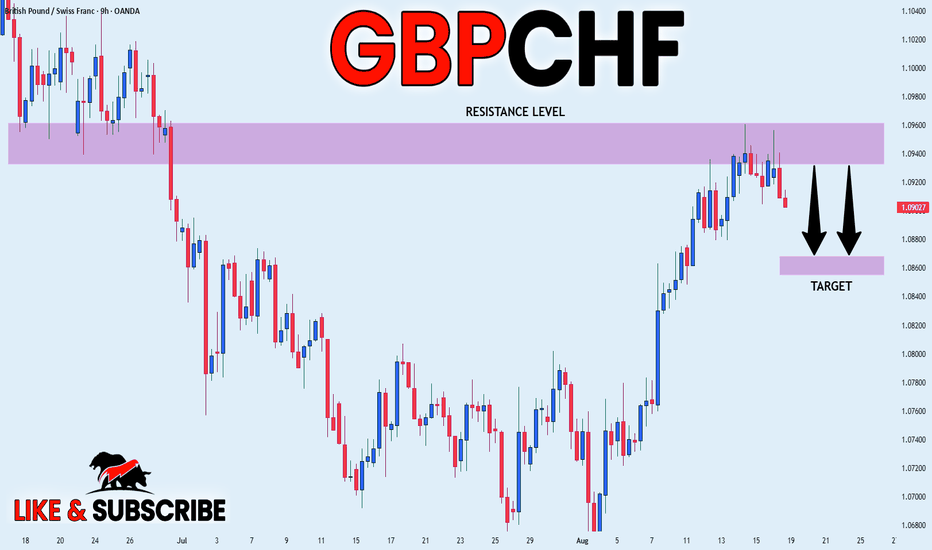

GBP/CHF SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are going short on the GBP/CHF with the target of 1.080 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

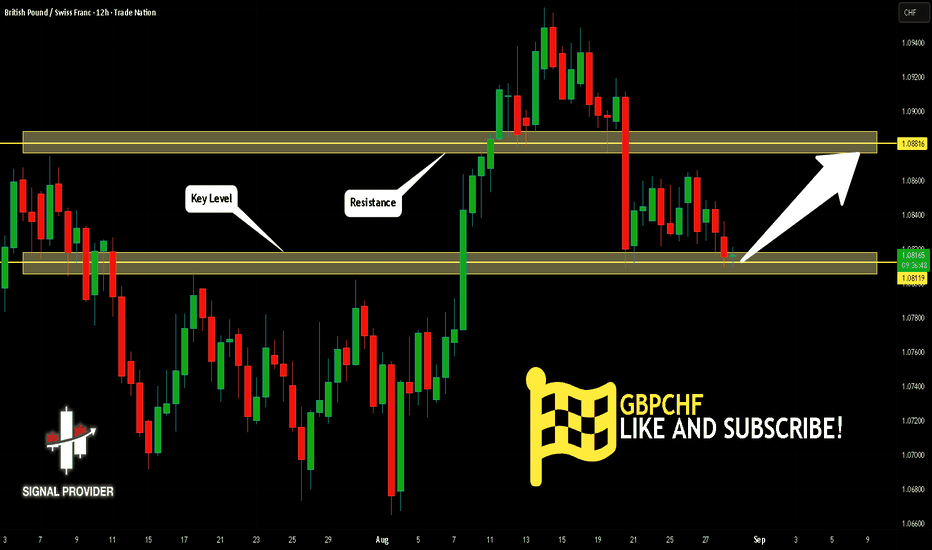

GBPCHF Will Go Higher From Support! Long!

Please, check our technical outlook for GBPCHF.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 1.081.

The above observations make me that the market will inevitably achieve 1.088 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

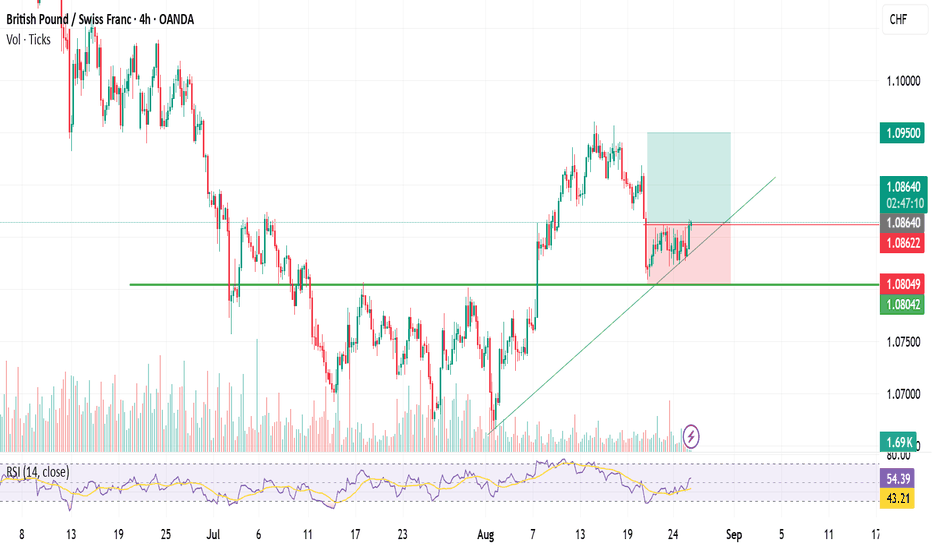

GBPCHF Will Move Higher! Buy!

Please, check our technical outlook for GBPCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 1.084.

The above observations make me that the market will inevitably achieve 1.104 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

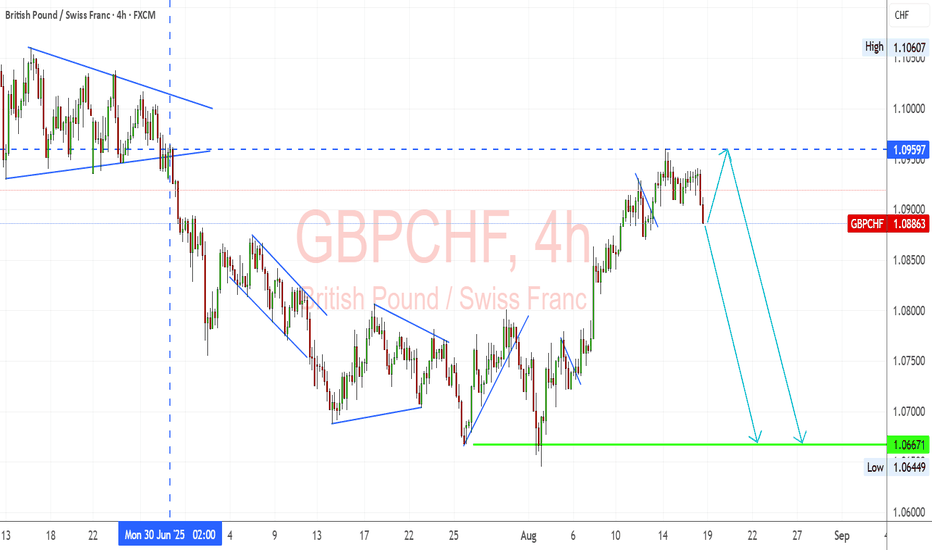

GBPCHF Bulls Lose Steam Reversal Setup in PlayGBPCHF’s recent rally toward 1.0950–1.0960 resistance has started to stall, with the pair struggling to maintain upward momentum. After multiple rejection attempts near this level, price action suggests that bulls are running out of strength. With the pound under pressure from weaker UK growth prospects and the Swiss franc benefiting from its safe-haven appeal, the setup is tilting toward a bearish retracement.

Current Bias

Bearish – GBP/CHF is failing to sustain gains above resistance, with momentum indicators signaling downside risk.

Key Fundamental Drivers

GBP: The pound is weighed down by softer UK inflation data, weak growth outlook, and BoE rate-cut expectations.

CHF: Safe-haven demand persists for the franc amid tariff risks and geopolitical uncertainties, while the SNB’s cautious stance on intervention limits excessive CHF weakness.

Diverging fundamentals favor CHF over GBP.

Macro Context

Interest Rates: The BoE is preparing markets for potential cuts later this year, while SNB maintains a steady stance with its anti-inflation credibility intact.

Economic Growth: UK risks stagnation with sluggish GDP; Switzerland maintains relative stability despite weaker export flows.

Commodity/Flows: Not a commodity-linked pair, but safe-haven capital flows into CHF during uncertainty give it an edge.

Geopolitics: Global tariff wars, recession chatter, and Middle East risks fuel defensive demand for the franc.

Primary Risk to the Trend

A sharp rebound in UK inflation or surprise hawkish BoE commentary could lift GBP. Alternatively, any verbal intervention from the SNB warning against “excessive CHF strength” could slow the downside.

Most Critical Upcoming News/Event

UK CPI (this week) – A stronger print could provide temporary GBP relief.

SNB commentary – Markets will monitor for intervention rhetoric if CHF strengthens aggressively.

Leader/Lagger Dynamics

GBP/CHF is a lagger, often following broader risk sentiment and CHF strength seen in EUR/CHF and USD/CHF. It tends to amplify GBP weakness when sterling underperforms but rarely leads market direction independently.

Key Levels

Support Levels: 1.0800, 1.0700, 1.0667

Resistance Levels: 1.0959, 1.1060

Stop Loss (SL): 1.1000 (above rejection zone)

Take Profit (TP):

TP1: 1.0800

TP2: 1.0700

TP3: 1.0667

Summary: Bias and Watchpoints

GBP/CHF leans bearish as the rally into the 1.0950–1.0960 resistance zone loses momentum, with downside targets at 1.0800 → 1.0700 → 1.0667. A protective stop above 1.1000 safeguards against false breakouts. Watch UK CPI for GBP volatility and SNB rhetoric for potential intervention risks. As a lagger pair, GBP/CHF will likely follow broader CHF strength, particularly if EUR/CHF resumes its downside. For now, momentum favors a pullback, but traders should stay alert for fundamental surprises.

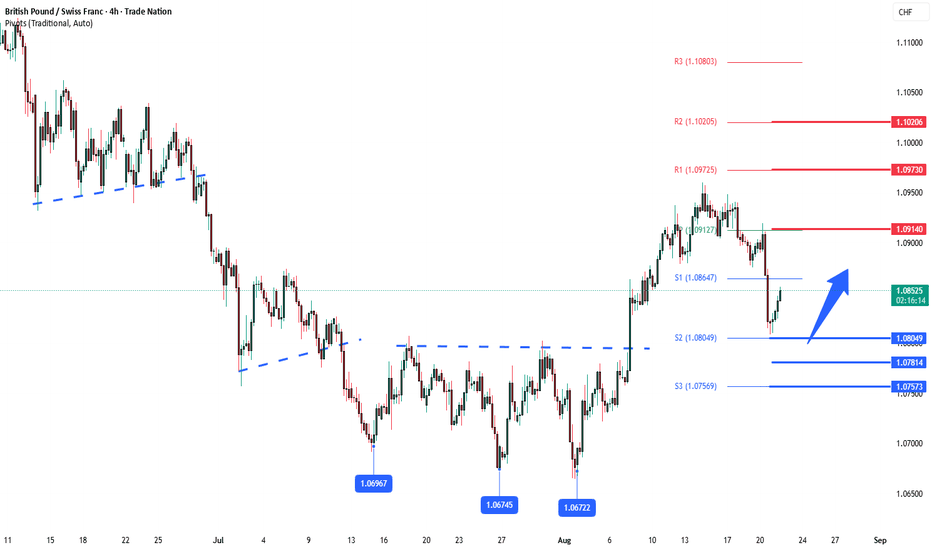

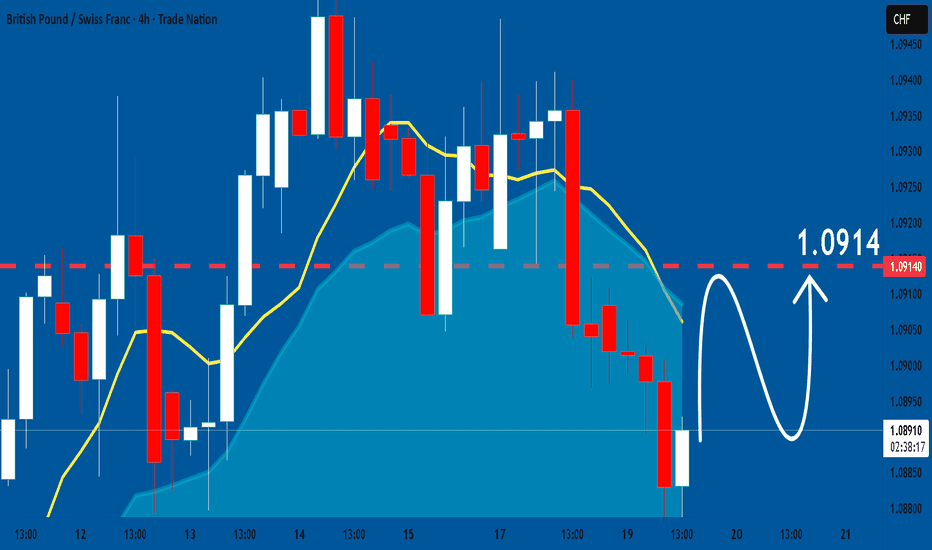

GBPCHF triple bottom trend reversal retest The GBPCHF remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 1.0800 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.0800 would confirm ongoing upside momentum, with potential targets at:

1.0914 – initial resistance

1.0970 – psychological and structural level

1.1020 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.0800 would weaken the bullish outlook and suggest deeper downside risk toward:

1.0780 – minor support

1.0760 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the GBPCHF holds above 1.0800. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

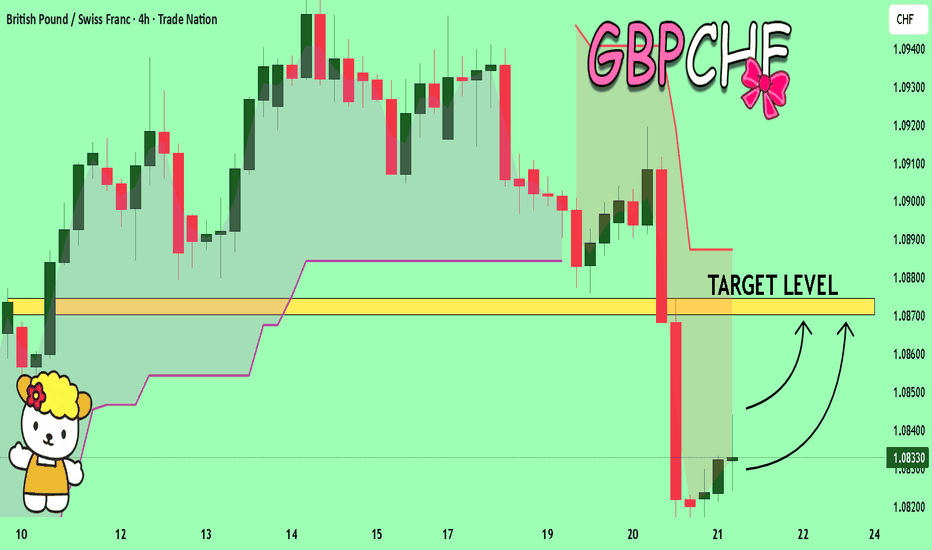

GBPCHF Massive Long! BUY!

My dear subscribers,

My technical analysis for GBPCHF is below:

The price is coiling around a solid key level - 1.0833

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.0870

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

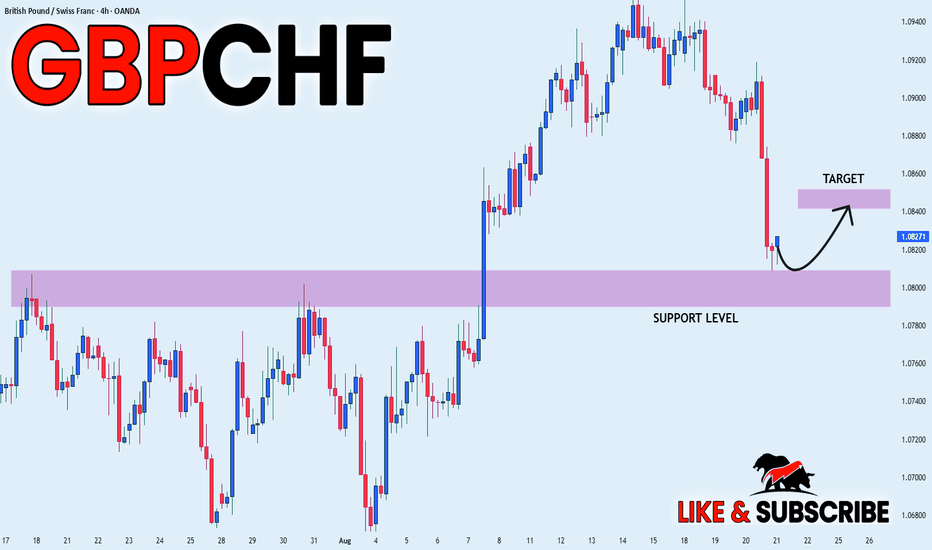

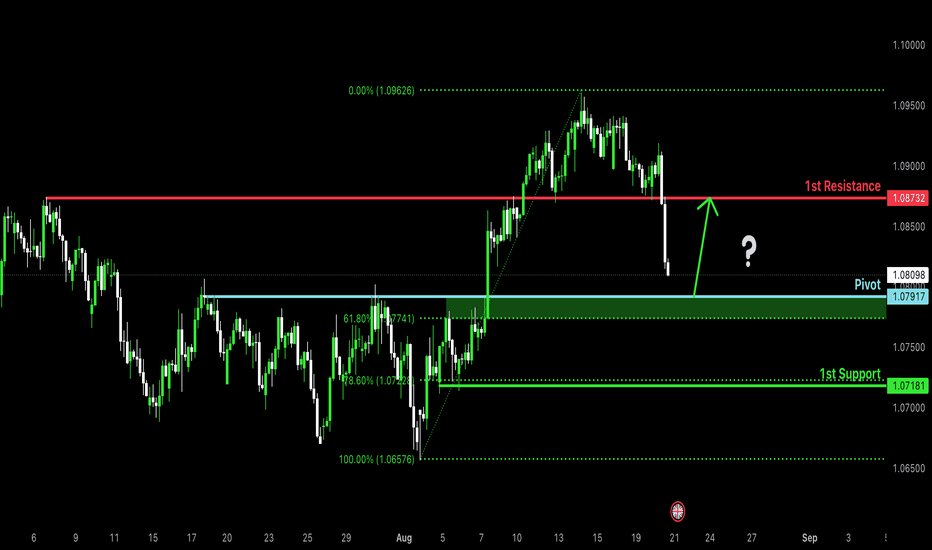

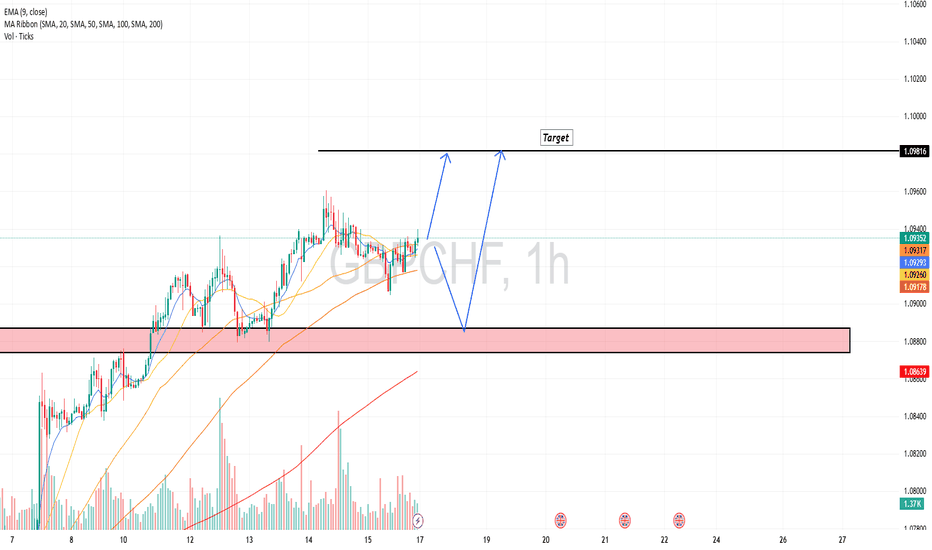

Bullish bounce off pullback support?GBP/CHF is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 1.0791

1st Support: 1.0718

1st Resistance: 1.0873

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

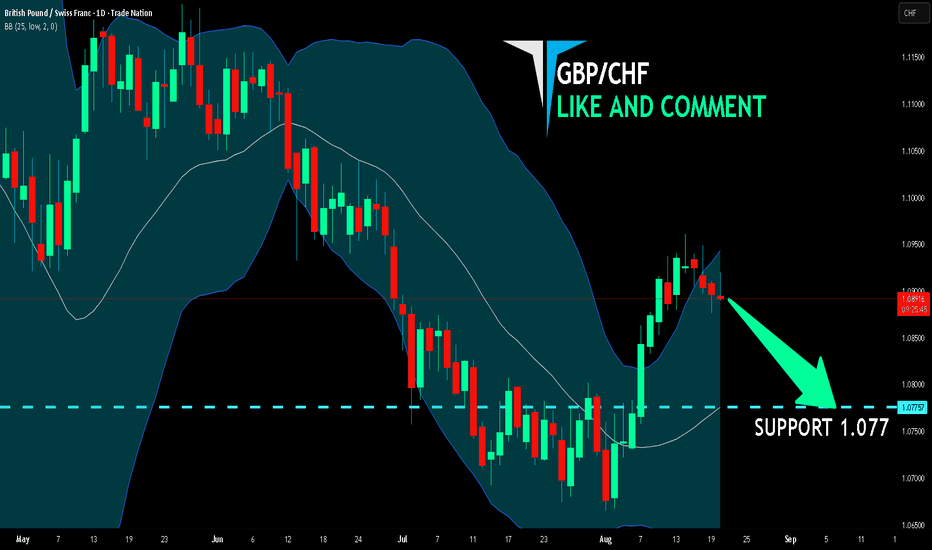

GBP/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the GBP/CHF pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 1.077 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCHF: Forecast & Technical Analysis

The analysis of the GBPCHF chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

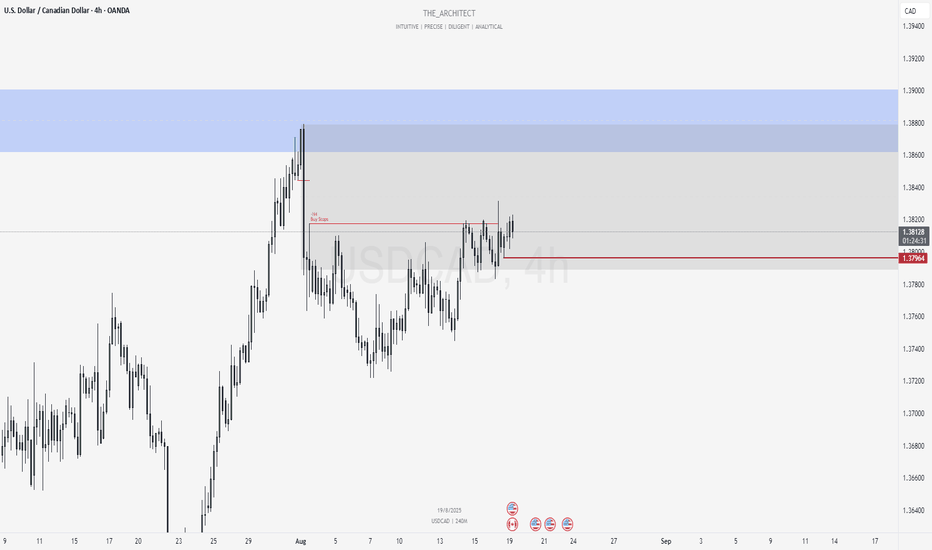

August 11, Forex Outlook: Key Market Expectations for the Week!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

USDCAD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

GBP_CHF WILL GO DOWN|SHORT|

✅GBP_CHF made a retest of the

Strong horizontal resistance level of 1.0960

The established a double-top pattern

And as you can see the pair is already

Making a local pullback from

The level which sends a clear

Bearish signal to us therefore

We will be expecting a

Further bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

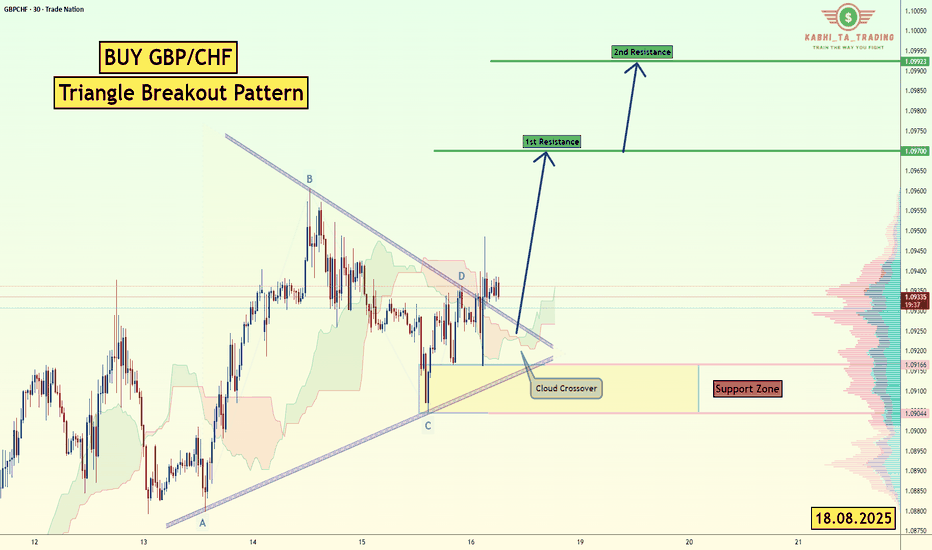

GBP/CHF - Triangle Breakout (18.08.2025) The GBP/CHF pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 1.0970

2nd Resistance – 1.0993

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBCHF Will Fly from a Old support LevelIn This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

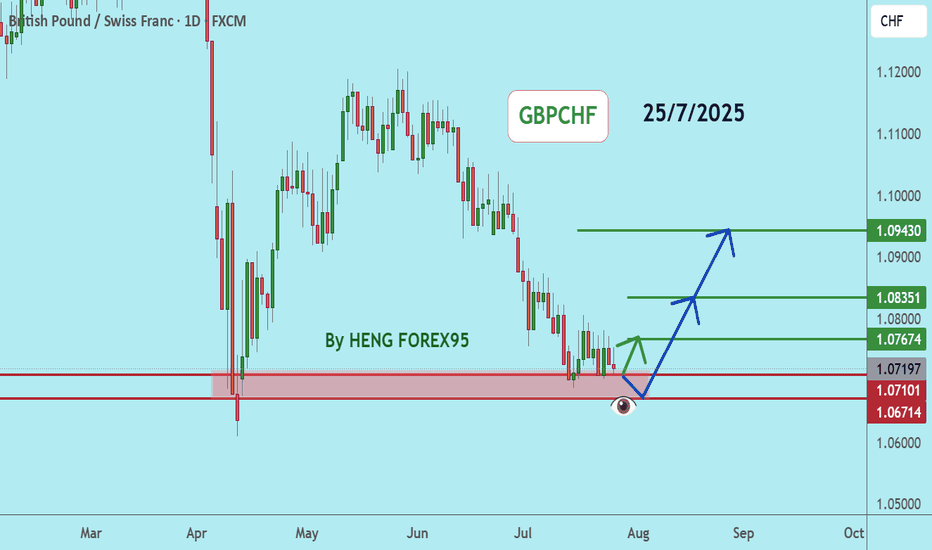

GBPCHFGBPCHF price is near the main support zone 1.07101-1.06714. If the price cannot break through the 1.06714 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

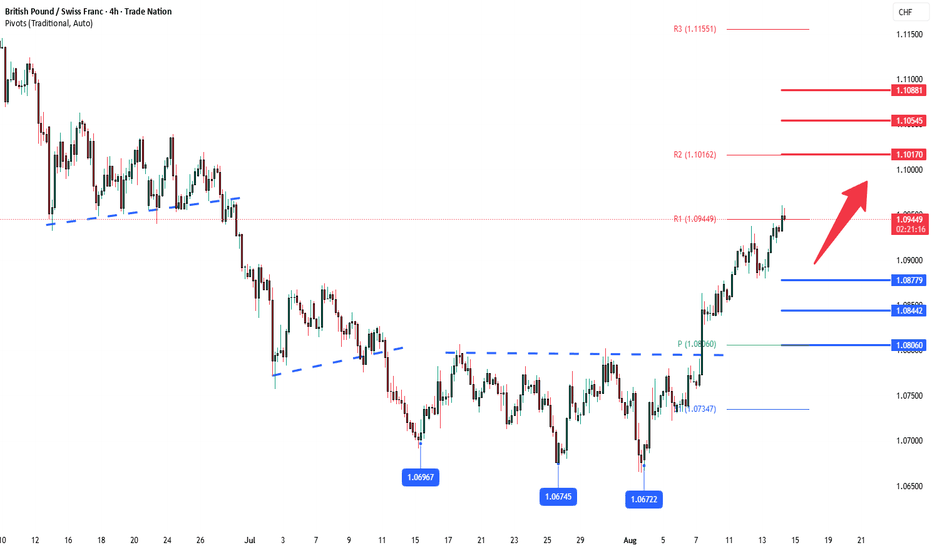

GBPCHF triple low reversal support The GBPCHF remains in a bullish trend, with recent price action showing signs of a continuation rally within the broader uptrend.

Support Zone: 1.0877 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.0877 would confirm ongoing upside momentum, with potential targets at:

1.1017 – initial resistance

1.1054 – psychological and structural level

1.1088 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.0877 would weaken the bullish outlook and suggest deeper downside risk toward:

1.0844 – minor support

1.0800 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the GBPCHF holds above 1.0877. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.