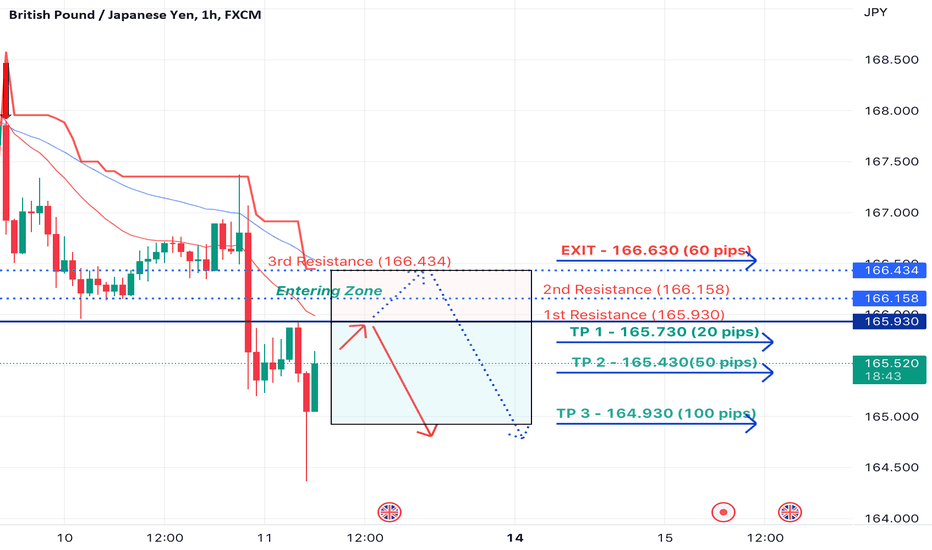

GBPJPY - Daily Trade Idea - 11-Nov-22GBPJPY (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

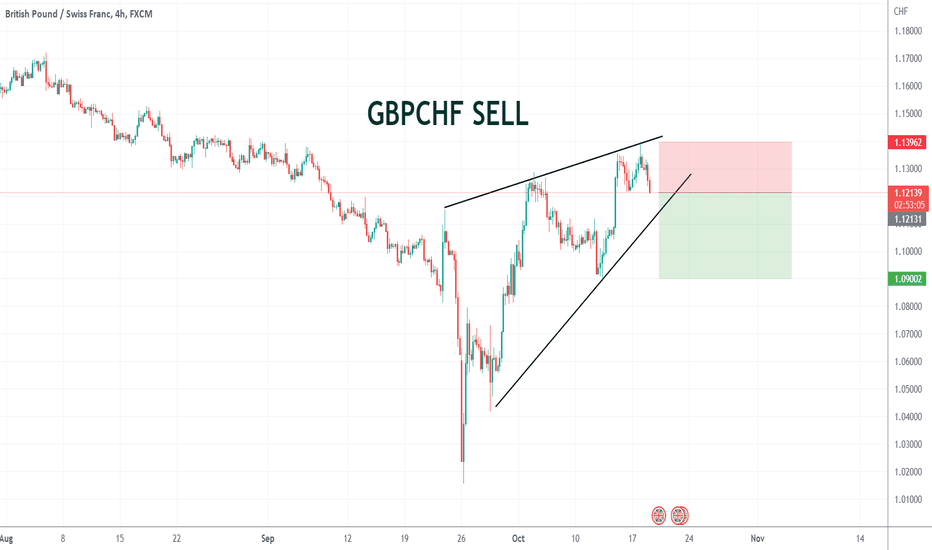

Gbpchfshort

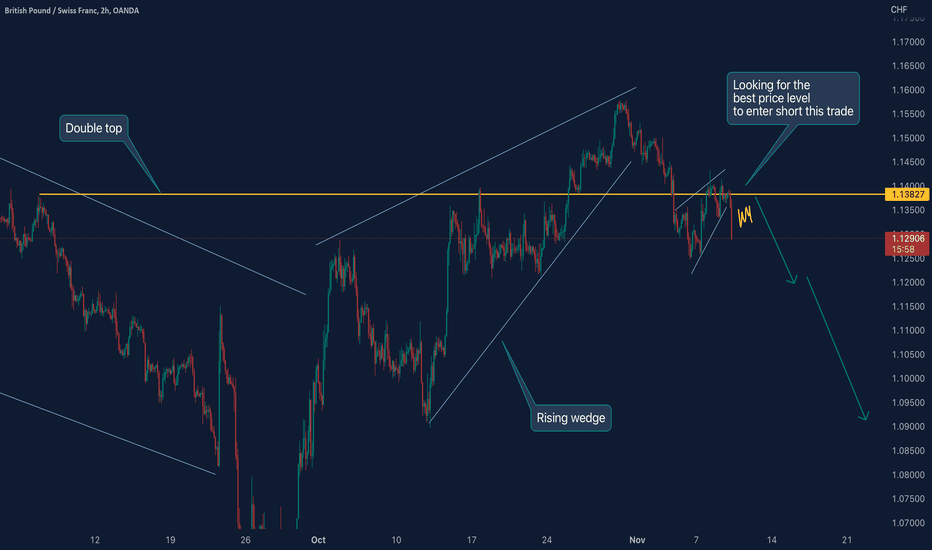

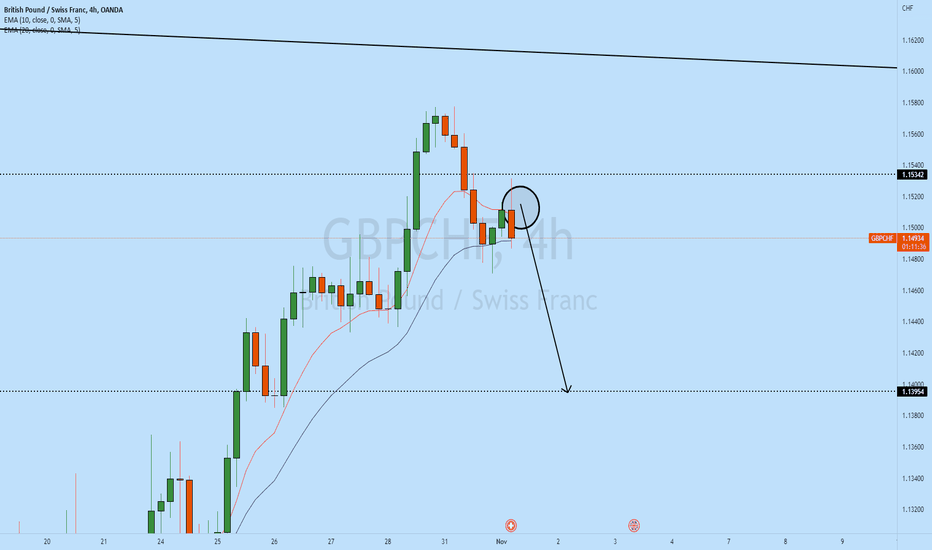

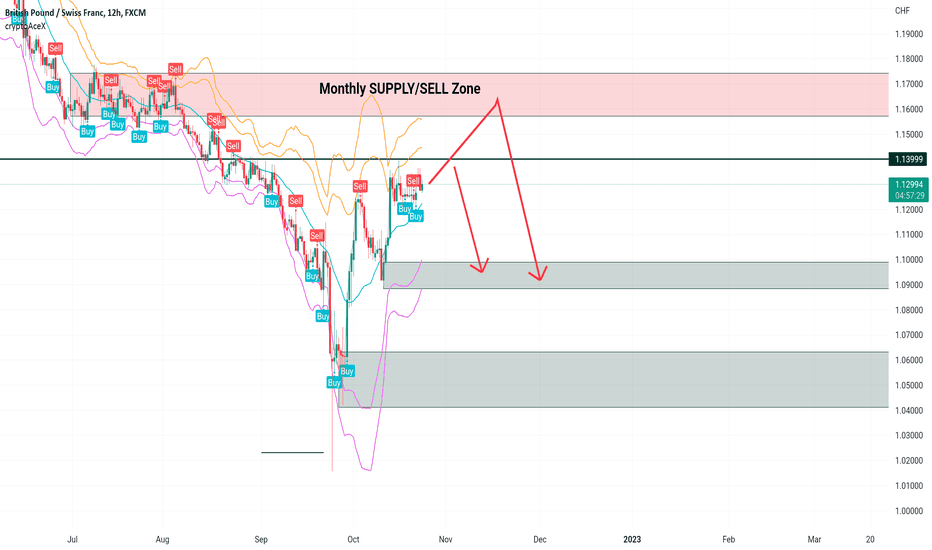

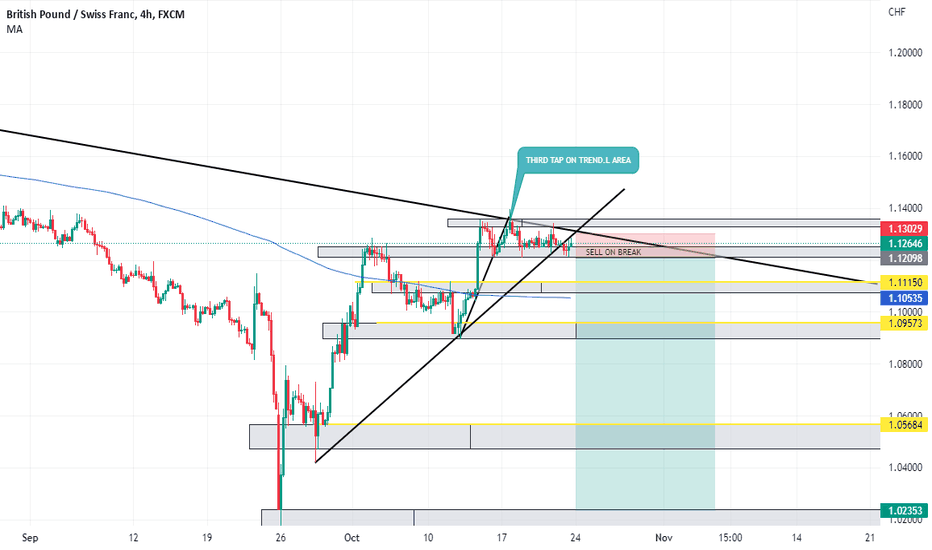

GBPCHF: Market Reversal followed by BEARISH Price ActionHello, everybody and welcome to Cybernetics Trading Lab, today we are going to analyse the GBPCHF, translating the market information by using a full technical analysis on different time frames, giving you a personal opinion about the next most likely market movement and helping you to spot and manage market opportunities.

Top Down Technical Analysis:

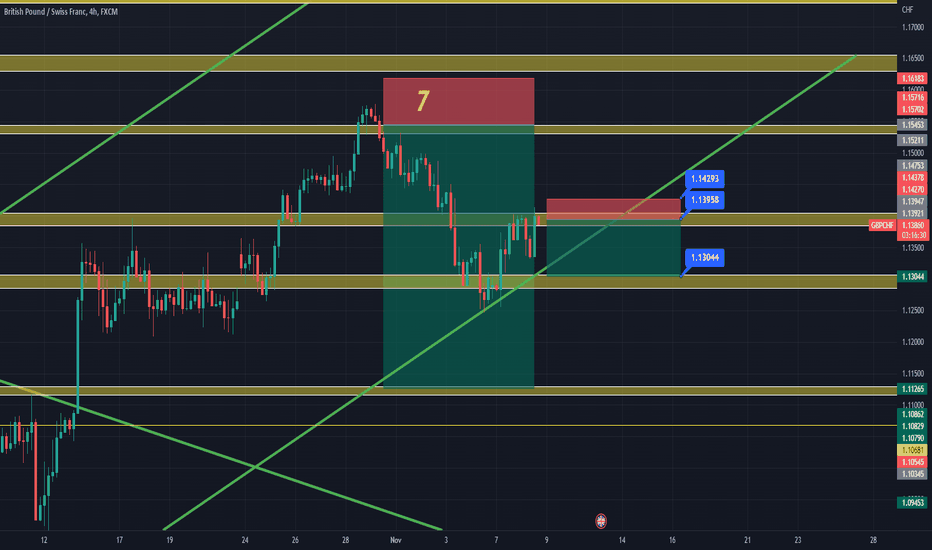

In October 2022, we could see a strong bullish impulse and in that time out bias was quite bullish considering about 800 pip of move.

We were looking for a correction phase before the potential next movement, which it never happened.

Eventually the market approached on the level around 1.1400, correctively, forming a rising wedge, which usually is a potential reversal pattern, if it make sense with the overall price action.

At the end of October, a strong reversal impulse changed and confirmed the new bearish bias! The price currently is correcting the previous move, and it could proceed its downward movement targeting the level 1.1200 and 1.0900.

When, where and why would we step into the market?

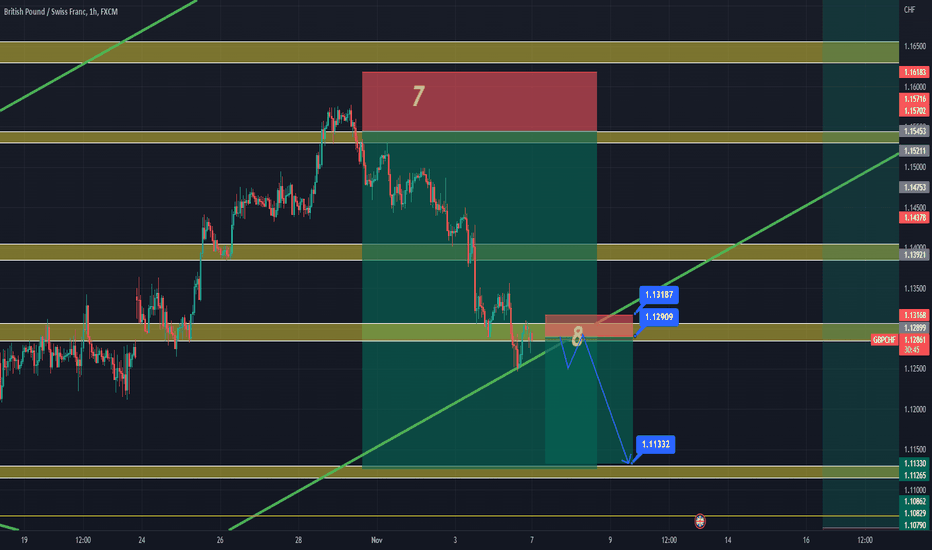

We missed the first entry on the breakout of the LTF structure, so we will be looking for a second entry if a bearish price action will form during the current day.

The overall bias is bearish, enough HTF and LTF confluences are a confirmation to short this market!

If you enjoy this trade idea, please support our work with a thumb up and don’t forget to follow our social medias!

Sincerely,

Cybernetics Trading Lab

DISCLAIMER

Please note the views are not investment advice and should be used only for educational purpose.

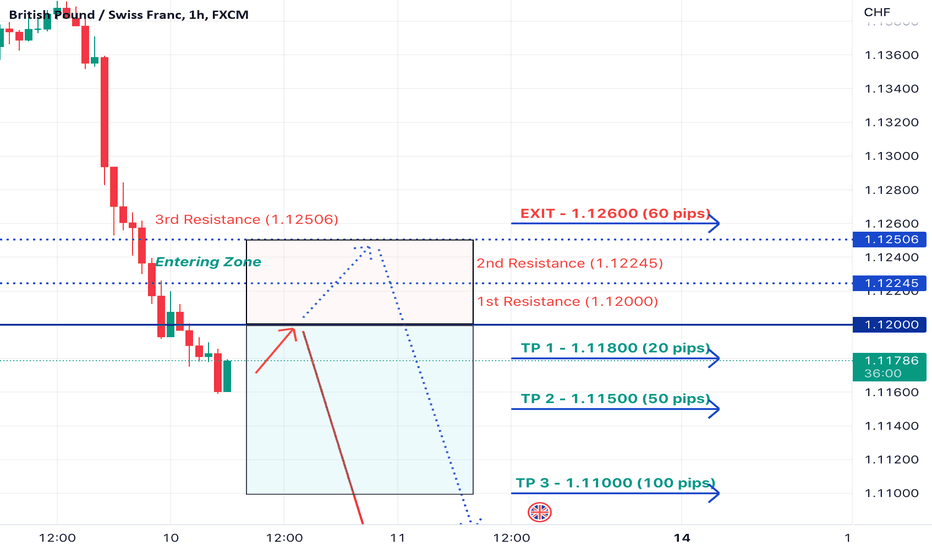

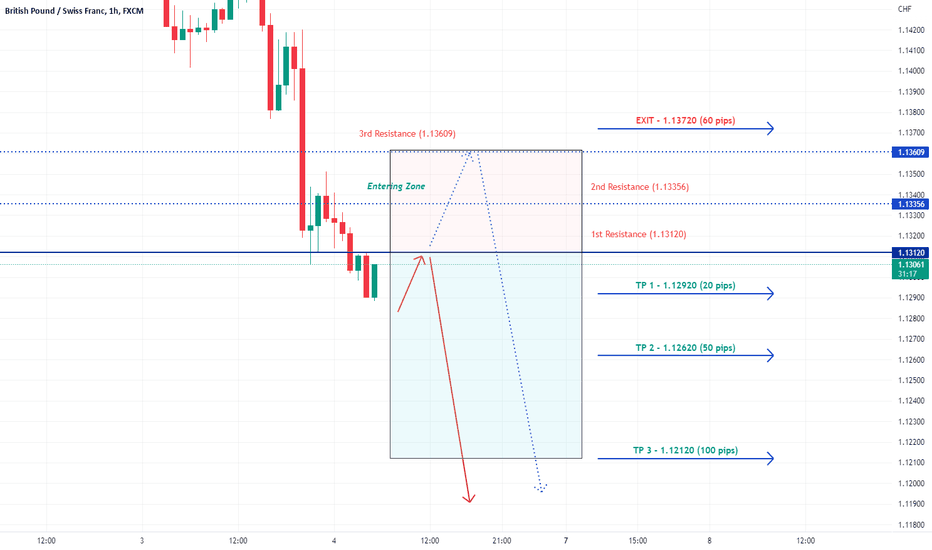

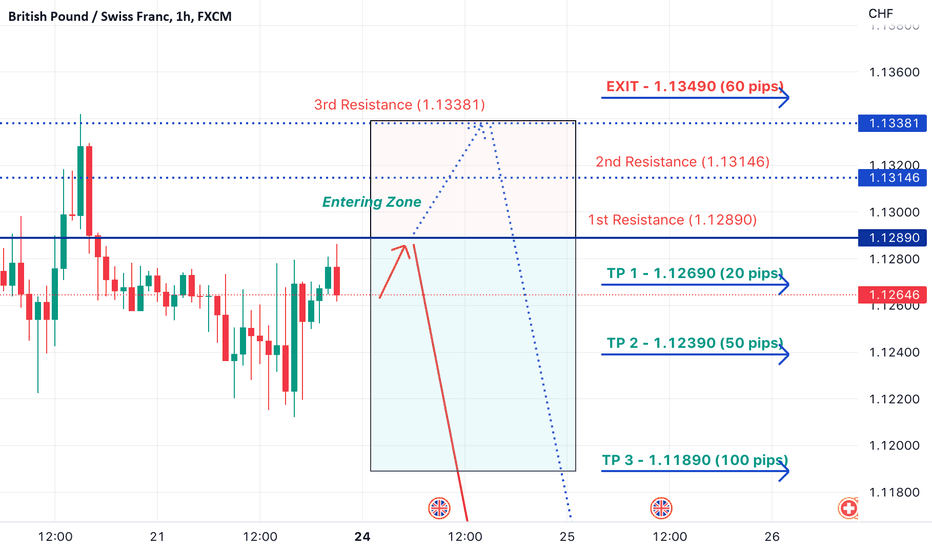

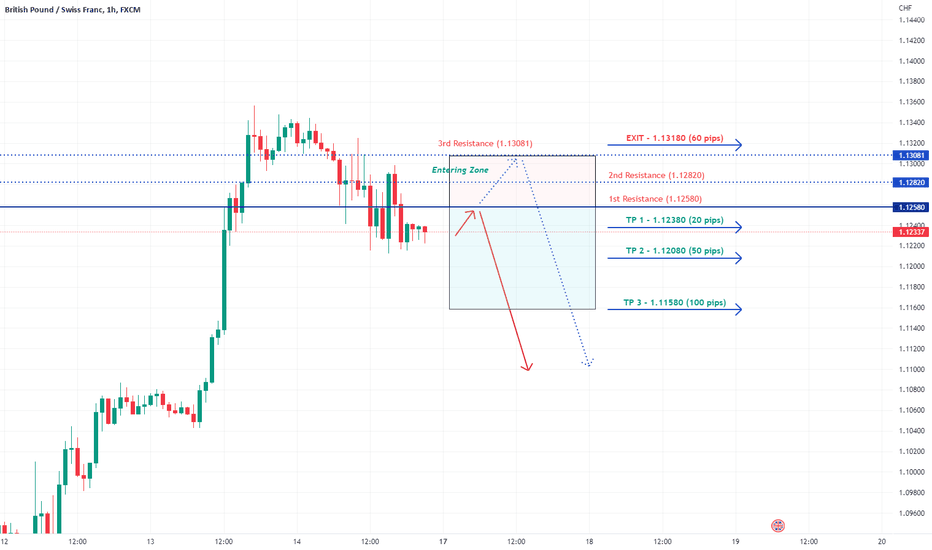

GBPCHF - Daily Trade Idea - 10-Nov-22GBPCHF (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

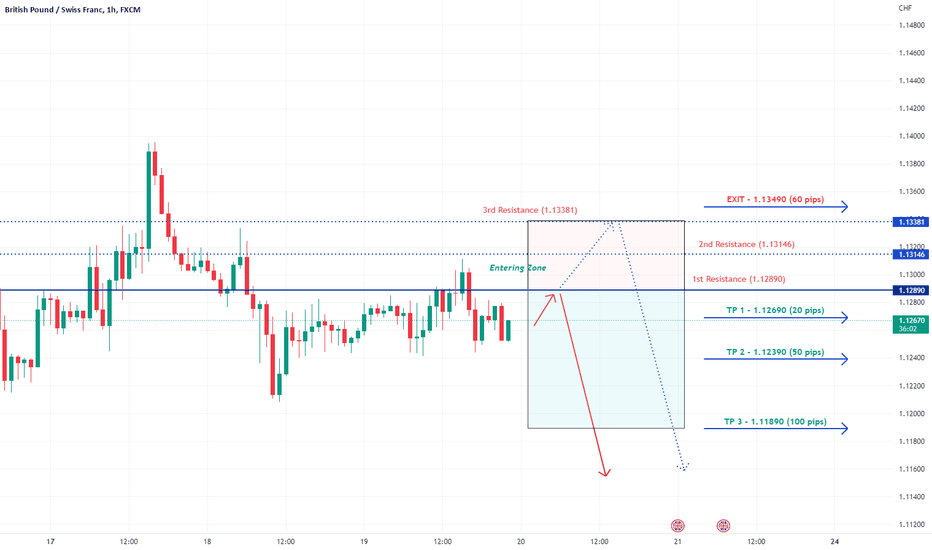

GBPCHF - Daily Trade Idea - 4-Nov-22GBPCHF (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

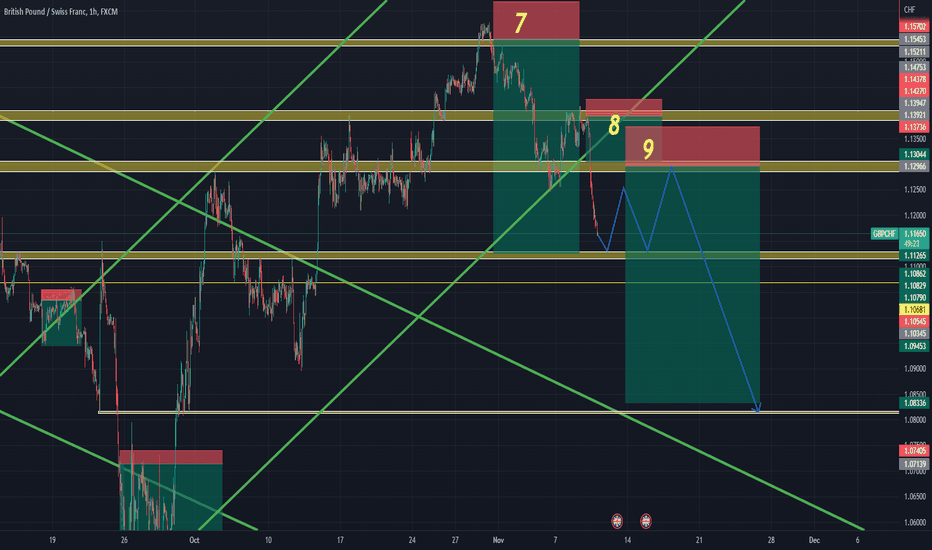

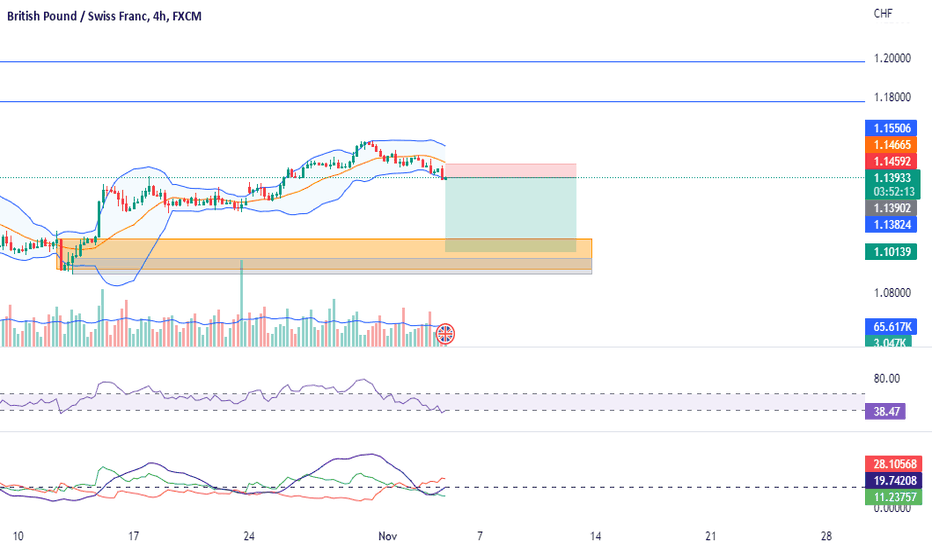

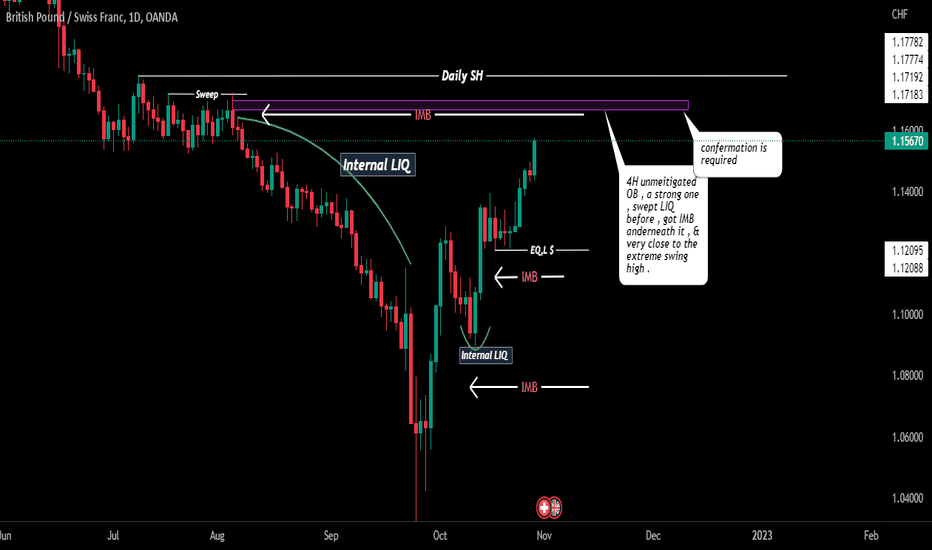

20 reason for sell GBPCHF1: Structure analysis time frame: 4 HOURS

2: Profit target time frame: DAILY

3: Trade type: SWING

4: Entry Time Frame: H4

4.1 Entry TF Structure: bearish

4.2 entry move: IMPULSE

5: Support resistance base: H4 FAIR VALUE GAP AND ORDER BLOCK

6: FIB: 100% BREAKOUT AREA

7: candle Pattern: MOMENTUM CONTINUATION

8: Chart Pattern: HEAD & SHOULDER

9: Volume : SUPPORTIVE

10: Momentum UNCONVENTIONAL Rsi: BELOW 40 SUPER BEARISH

11: Volatility measure Bollinger bands: JUST BEGIN WALKING ON THE BAND

12: strength ADX: BEAR

13: Sentiment ROC: SUPER BEARISH

14: final comments: SELL NOW EVERTHING CONFIRM

15: decision: SELL

16: Entry:1.1390

17: Stop losel: 1.1461

18: Take profit: 1.1010

19: Risk to reward Ratio: 1:6

20:Excepted Duration: 4 DAYS

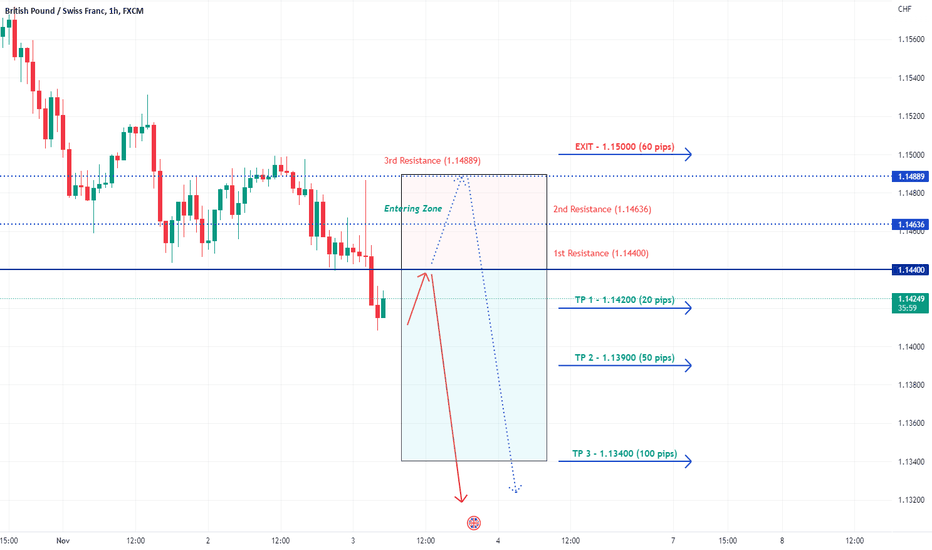

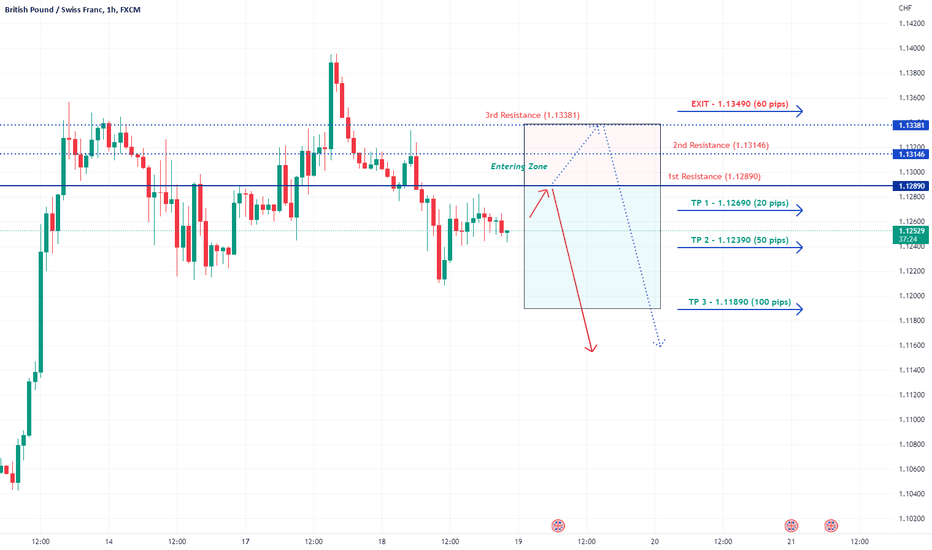

GBPCHF - Daily Trade Idea - 3-Nov-22GBPCHF (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

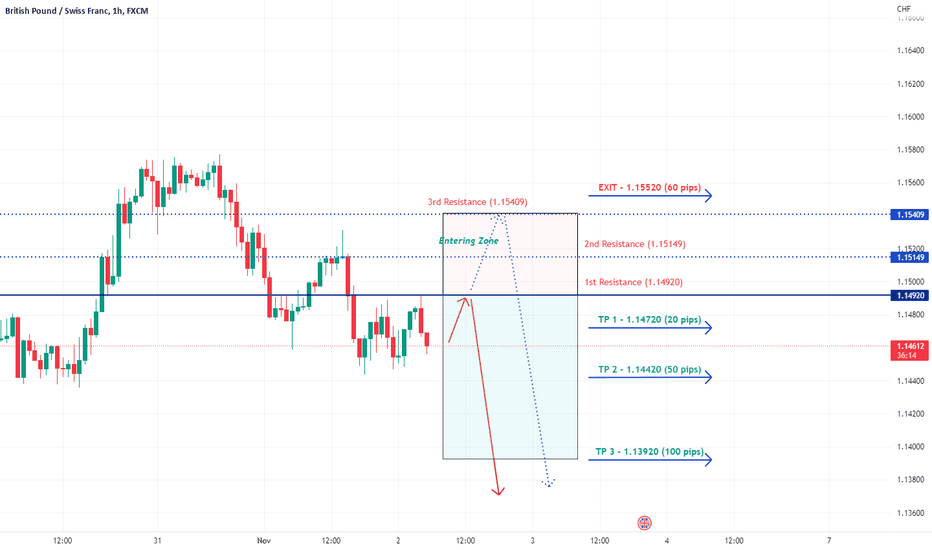

GBPCHF - Daily Trade Idea - 2-Nov-22GBPCHF (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

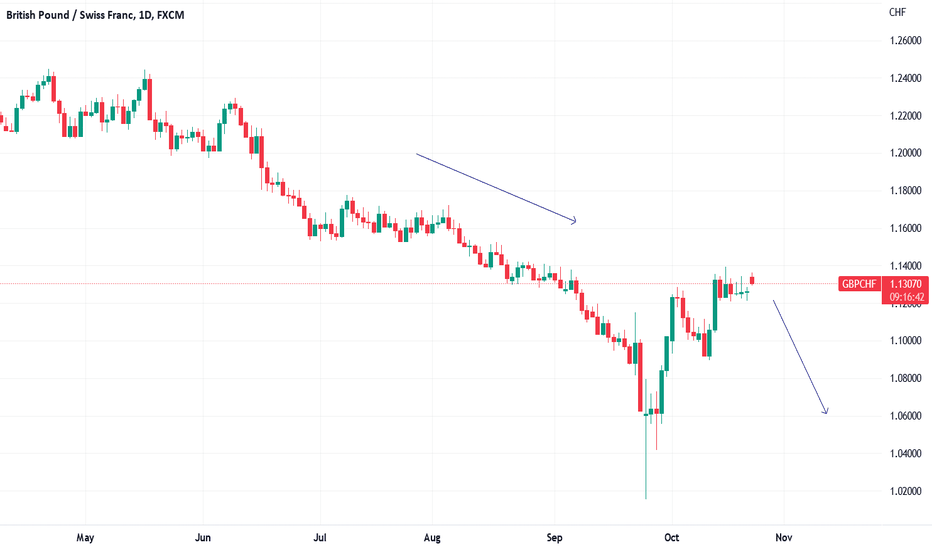

GBPCHF top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

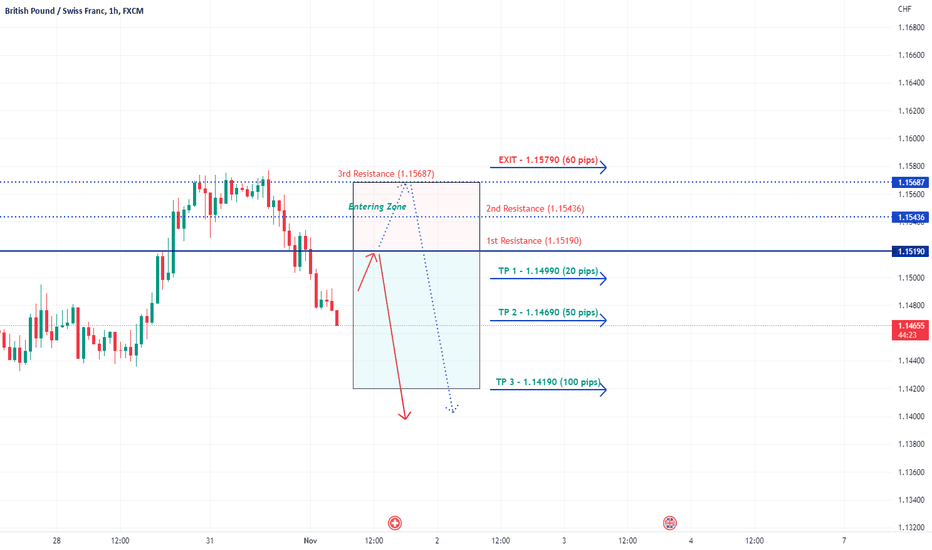

GBPCHF - Daily Trade Idea - 1-Nov-22GBPCHF (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

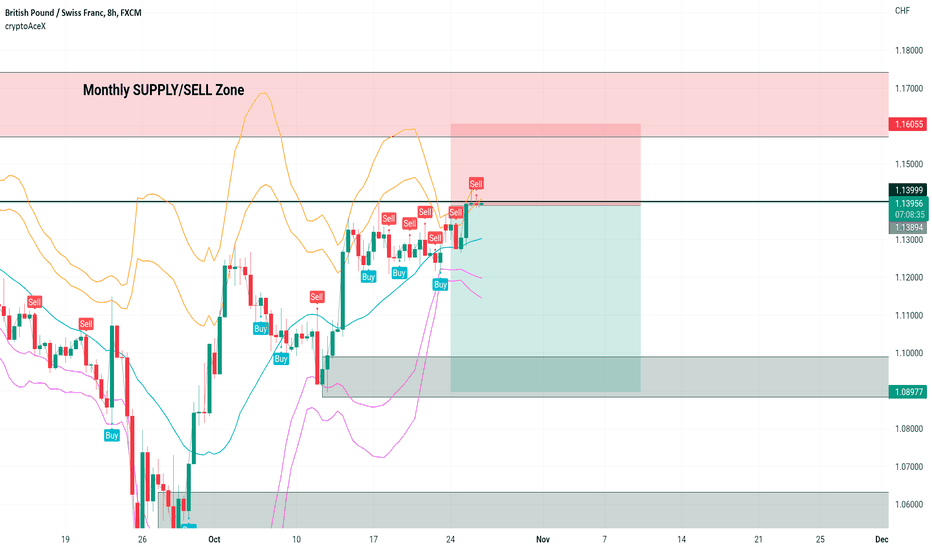

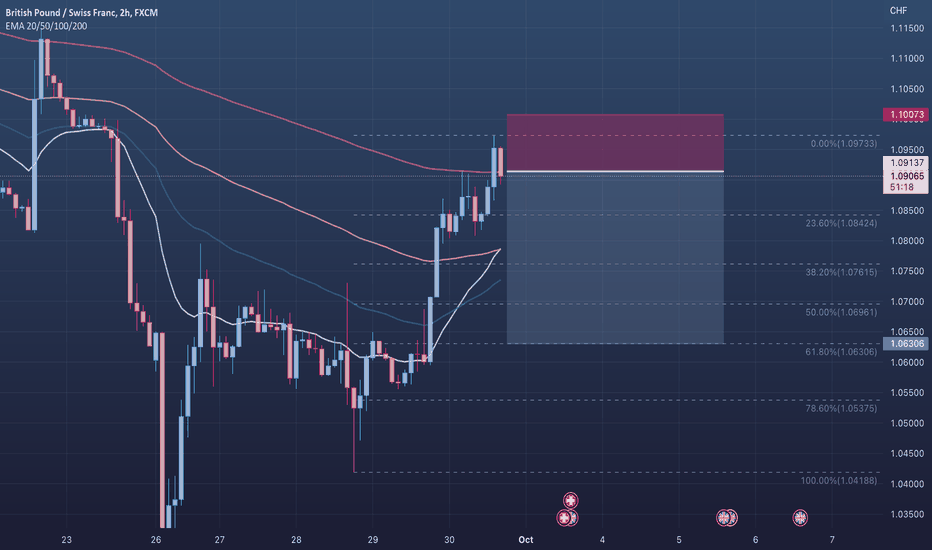

GBPCHF SELL Trade Triggered Quick update on the GBPCHF trade idea from yesterday we got the move as expected above 1.14 and my indicator has give a SELL signal on the 8hR chart as explained in the post these where the conditions I was waiting to happen.

Please read related post to understand the setup

Looking To SELL GBPCHF Above 1.14 Possible SELL setup on this pair as we appproach 1.14 which is a previous low that was taken out by the current downtrend, we also have a Monthly SUPPLY/SELL zone that starts around 1.16 so we could see a quick impulse move up to this area.

What I will be looking for is for my Trend Reversal King indicator to give me a SELL signal on any time frame from the 6hr to the daily chart at or above 1.14 I will be looking to target the 12Hr DEMAND/BUY area between 1.10 -1.09 for first easy target and if there is a break of 1.09 we can target further down towards 1.06.

Stop loss will depend on what price the trigger signal occurs and will be posted alongside the trade update.

Another way to enter this position is wait for a MACD Divergence signal to occur above 1.14 on the higher timeframes.

The 1.10-1.09 area will also provide a good buying opportunity to run back up towards and above the 1.16 level lets see how this plays out

GBPCHF: Daily trendline holding for a potential REVERSAL!Hello, everybody and welcome to BIGPAPA Forex, today we are going to be analysing the GBPCHF pair, translating the market information by using a full technical analysis on different time frames, giving you a personal opinion about the next most likely market movement and helping you to spot and manage market opportunities.

GBPCHF - Daily Trade Idea - 24-Oct-22GBPCHF (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

GBPCHF - Daily Trade Idea - 20-Oct-22GBPCHF (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

GBPCHF - Daily Trade Idea - 19-Oct-22GBPCHF (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.

GBPCHF SELL LONGThe British Pound vs. Swiss Franc cross is a lower volatility pair that is tempered by the currencies' economic and geographic proximity. The British Pound is one of the premier reserve currencies and represents the world's largest financial center. In turn, the Swiss Franc is used as a reserve currency around the world and is currently ranked rarely 5th or 6th in value held as reserves after the United States dollar, the euro, the Japanese yen, the pound sterling and the Canadian dollar.

GBPCHF - Daily Trade Idea - 17-Oct-22GBPCHF (SHORT)- If all the resistance holds in place.

If we see the Resistance broken out then we could see the shift in the trend.

I marked the TP 1 (20 pips), TP 2 (50 pips) , TP 3 (100 pips) and EXIT (SL - 60 pips) on the chart.

(THIS IDEAS VALID NEXT 24 HOURS)

Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session due to News Impact and only enter if we have the final confirmation for entry.

- Rejection Candle Formation - Red Candle after the Green Candle.

- Stochastic - Overbought Area

- Timing of entry Prior / during UK / US Market Session.