gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Gbpjpyforecast

GBPJPY Trade Setup Analysis – Bullish Momentum Brewing🔍 Technical Overview

Pair: GBPJPY

Chart Type: Candlestick

Indicators Used:

EMA 50 (Red) ➖ Short-term trend

EMA 200 (Blue) ➖ Long-term trend

🧱 Key Levels

🟣 Resistance Zone: 195.300 – 196.000

🟪 Intermediate Resistance/Support Flip: 193.000 – 193.700

🟦 Support Zone: 191.500 – 192.300

📈 Bullish Structure Observed

Support Bounce 🔁

Price found strong support around the 192.300 level (confluence of support zone + EMA 200 bounce) 💪

Break Above Resistance Flip 🔓

Price recently broke above the mid-zone (~193.300), flipping it into a potential new support. This indicates bullish pressure is increasing. ⚡

EMA Crossover Confirmation ✅

Price is now trading above both the EMA 50 and EMA 200 – a bullish alignment.

🔮 Projection & Trade Bias

📍 Current Price: 193.744

📈 Bullish Target: Resistance zone at ~196.000

📉 Invalidation: Break and close below 192.200

💡 Expected Move:

A retest of the 193.300 zone could offer a high-probability buy entry, targeting a full move to the top resistance range. 📦

⚠️ Risk Management Note

Always apply:

🎯 Defined entry + stop-loss (SL) below 192.000

💰 Risk:Reward at least 1:2

🛡️ Adjust size according to volatility

🧠 Summary

The pair is showing bullish structure recovery with confluence at key EMAs and a resistance-turn-support breakout. A rally toward the 196.000 region is highly likely if current structure holds. 📊🔥

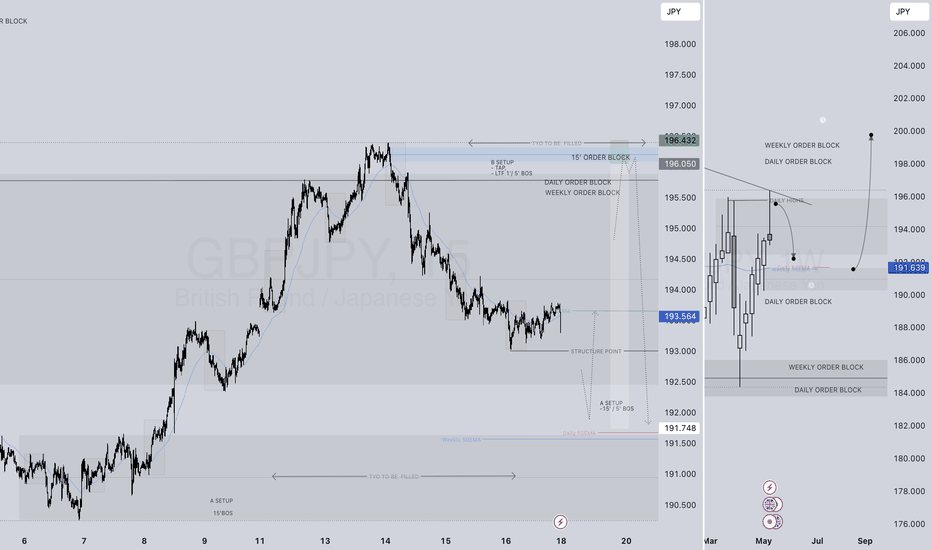

GBPJPY: Will Price Touch a Major Psychological Point Of 200? The GBPJPY currency pair is currently struggling to break through the 194 region as the Japanese yen (JPY) consolidates, making the future price trajectory uncertain. This situation has significantly complicated trading JPY pairs.

Analysing historical price behaviour in similar circumstances can provide insights into potential future movements, but it’s crucial to conduct thorough research before engaging in trading. Past performance doesn’t guarantee adherence to chart trends.

The Japanese yen (JPY) also exhibits a negative correlation with the US dollar (USD). Given our bullish stance on the DXY index in the coming days, we anticipate substantial pressure on the JPY, potentially leading to a significant decline. It’s also worth considering the GBP, which has surged to prominence as one of the most sought-after currencies since the market opened earlier today.

In the meantime, we recommend setting two take-profit targets: one at 197 and another at 199. These levels are likely to witness substantial bearish volume entering the market.

We wish you successful trading and emphasise the importance of adhering to safety protocols.

We appreciate your unwavering support and encourage you to contribute by liking, commenting, or sharing our ideas.

Team Setupsfx_

❤️🚀

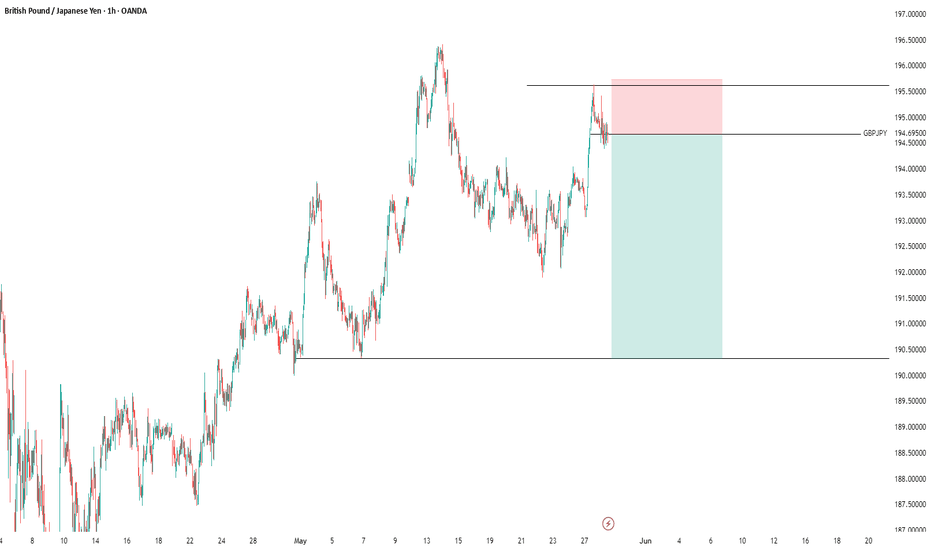

GBPJPY - Expecting Bullish Continuation In The Short TermH1 - Strong bullish move.

Higher highs on the moving averages of the MACD.

No opposite signs.

Expecting further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

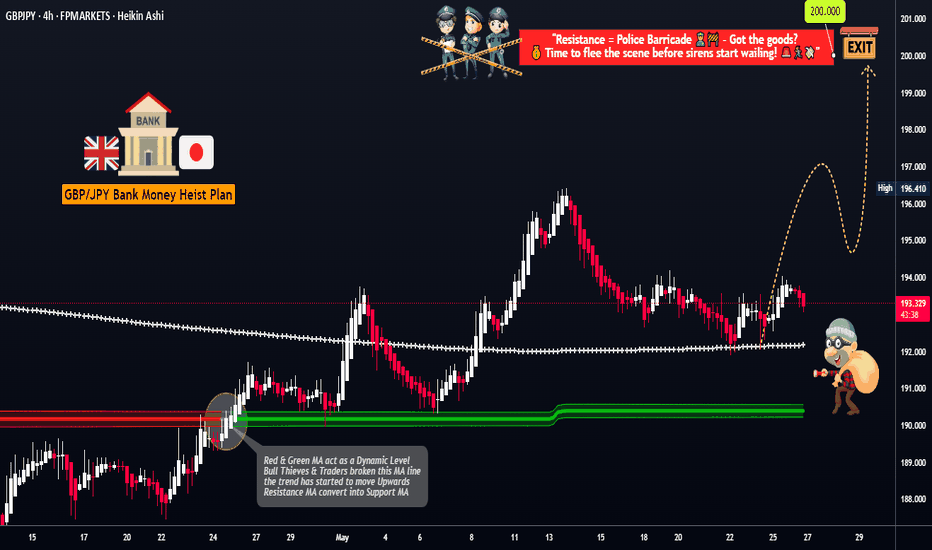

STEAL THIS TRADE! GBP/JPY Long Setup(Thief Trader’s Secret Plan)💰 Thief Trader’s GBP/JPY Heist Alert – Stealthy Long Setup Loading!

🌍 Greetings, Profit Raiders!

Hola, Konnichiwa, Ni Hao, Privyet, Hallo, Bonjour!

📢 Attention Market Bandits & Chart Pirates—the GBP/JPY Beast is ripe for plunder! Time to execute the next Thief Trader Masterplan.

🎯 Entry Zone – Loot the Dip!

Current price = Open vault. Fire longs now or snipe pullbacks (15M/30M charts recent swing low level).

Pro Thief Move: Stack buy limits near swing lows/highs. Chart alerts = your secret weapon. 🔫

🛑 Stop Loss – Guard the Treasure!

Swing Thieves: Hide SL below 4H swing low (~190.000).

Day Raiders: Adjust SL to your risk size & order count. No free rides!

🎯 Profit Target – Escape with the Gold!

Take the 200.000 bag or exit early if momentum fades.

🔪 Scalpers vs. Swingers – Choose Your Weapon!

Scalpers (Quick Strikes): Longs only. No distractions.

Swing Traders (Patient Hunters): Trail stops & lock in gains.

🌪️ Market Pulse – Bullish Winds Blowing!

Price battling MA Resistance? No panic. Bulls still rule thanks to:

Fundamentals + Macro Trends

COT Data + Sentiment Shift

Quant Scores & Intermarket Alignments

(Check Linkss for the full heist blueprint.)

⚠️ News Trap Warning!

Upcoming high-impact events? Freeze trades or tighten stops. Trailing SL = your escape route.

🚨 Join the Thief Trading Crew!

Like 👍 or Boost 🚀 this idea to fuel our next raid.

Thief Trader Tactics = Daily Market Domination. Your support keeps the heists alive! 💰❤️

🤑 Stay Locked In – The Next Big Score is Coming…

Timing is everything. Watch the charts. Strike hard. Exit smarter.

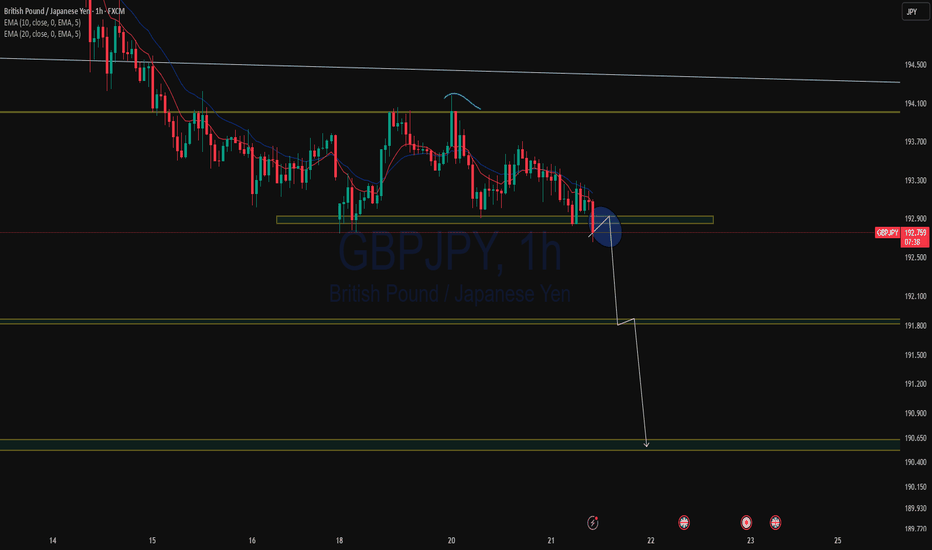

GBPJPY bulls has given up?Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

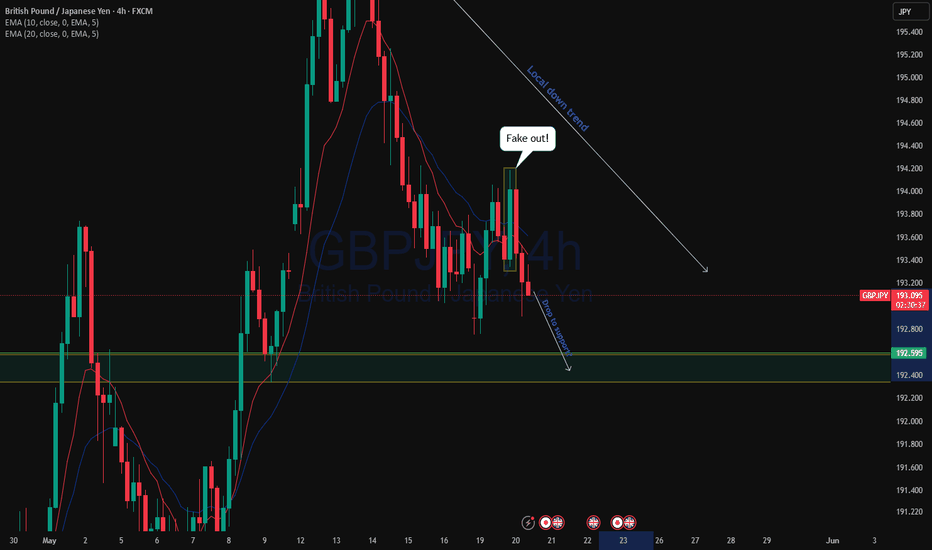

GBPJPY fake out has given momentum to drop?GBPJPY has just got rejected with 4h bullish candle with more than 1.5ATR to the key level giving probability to drop to next area of support. As the price has done this fake move, we may see possible drop to daily support and may continue to drop to possible 80 pip.

As the price has got rejected from a monthly high, we may see further downside

A sell trade is high probable!

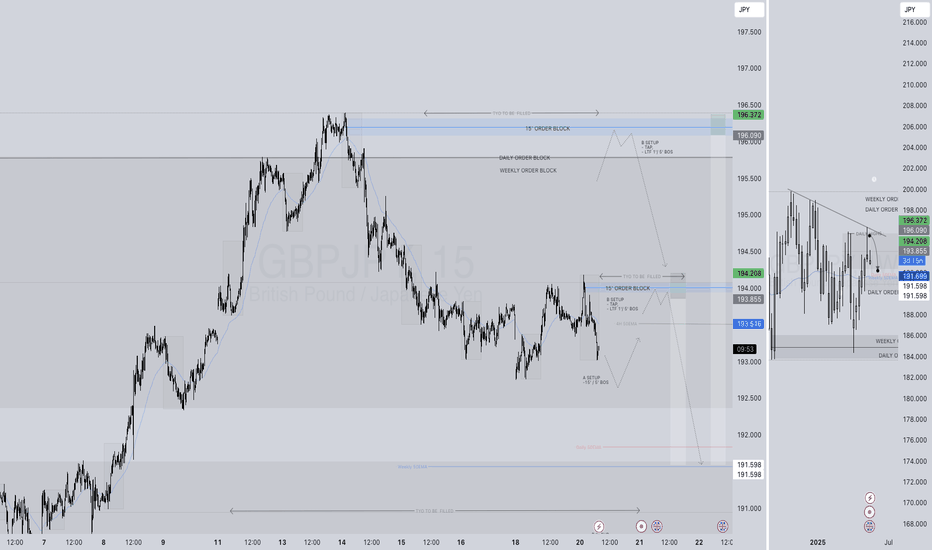

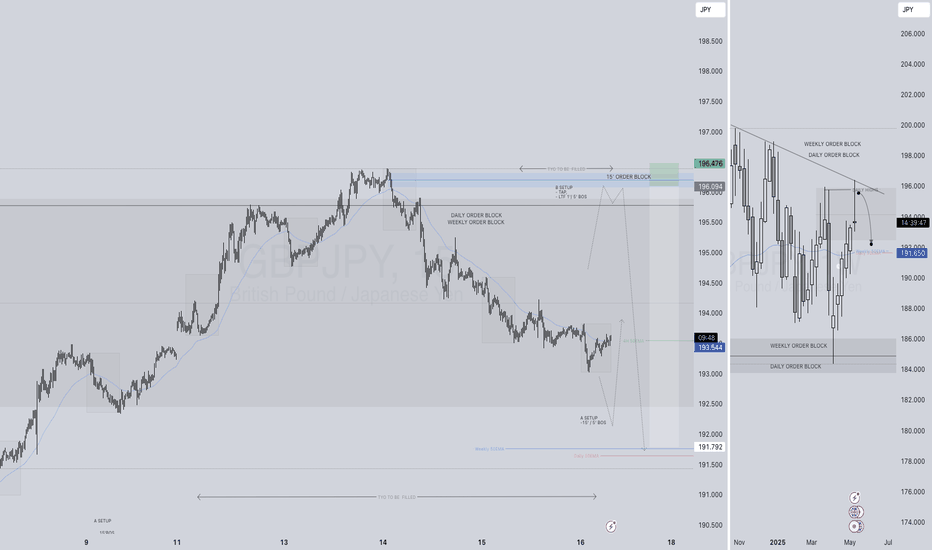

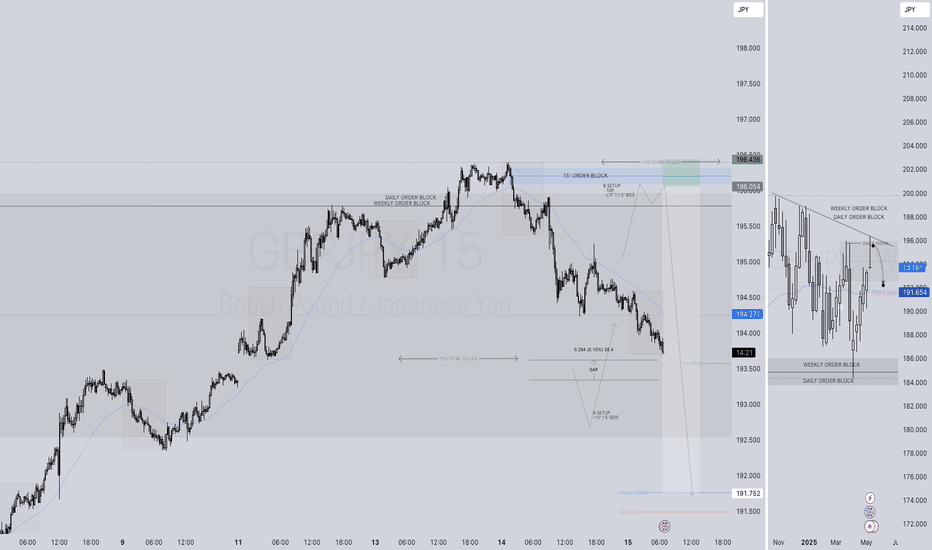

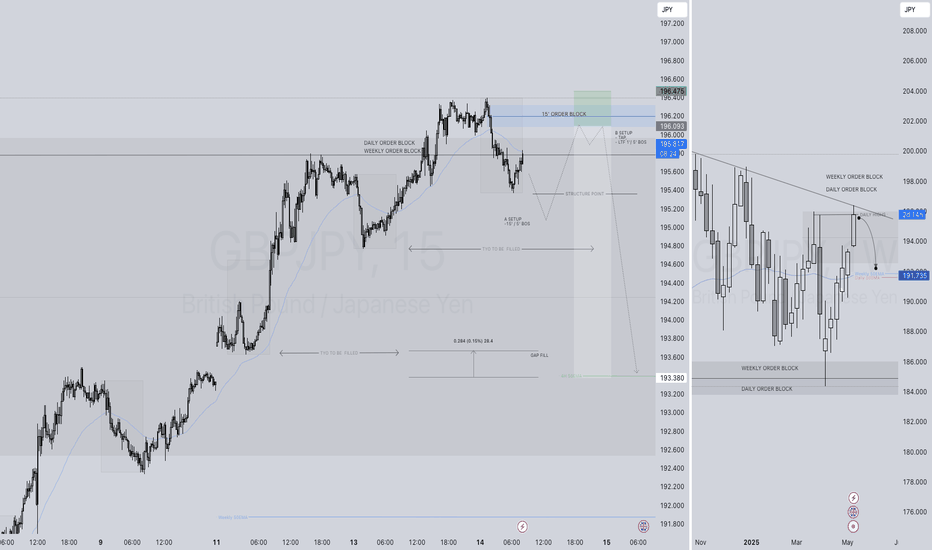

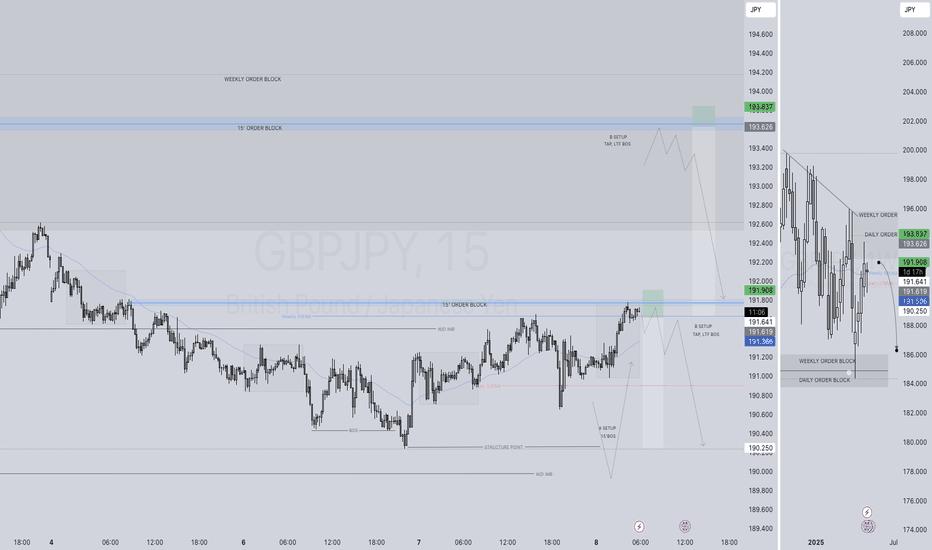

A SHORT SHORT B4 LONG LONG GBPJPY SHORT FORECAST Q2 W21 D20 Y25 A SHORT SHORT B4 LONG LONG LONG

GBPJPY SHORT FORECAST Q2 W21 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

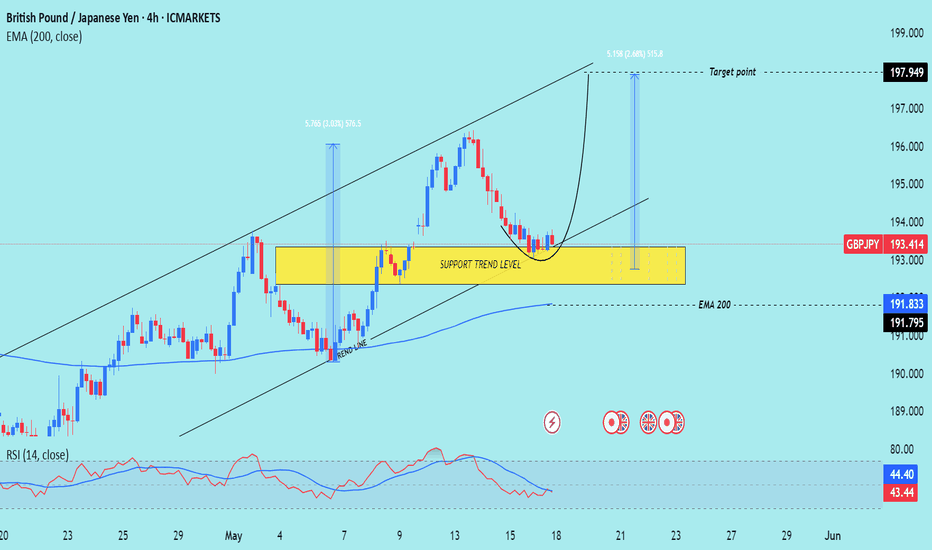

GBP/JPY) bullish trend analysis Read The ChaptianSMC trading point update

Technical analysis setup for the GBP/JPY pair on a 4-hour timeframe. Here's the breakdown of the trading idea:

---

Key Concepts Highlighted:

1. Support Trend Level (Yellow Zone):

The yellow zone marks a strong confluence area:

Horizontal support from previous price reactions.

Trendline support that has held multiple times.

Close to the 200 EMA (at 191.833), which acts as dynamic support.

2. Bullish Reversal Pattern:

The chart shows a rounded bottom/cup-like structure forming at support—often a sign of accumulation before a reversal.

Price is expected to bounce from this support zone and move higher within the ascending channel.

3. Target Point Projection:

The projected move is around 515.8 pips, targeting the 197.949 level.

This target aligns with the upper boundary of the ascending trend channel.

4. RSI (Relative Strength Index):

RSI is around 43–44, near oversold territory, suggesting potential bullish momentum if a bounce occurs.

Mr SMC Trading point

Conclusion:

This setup suggests a potential long (buy) opportunity:

Entry near the 193.0–193.5 zone (support/trendline confluence).

Stop loss likely below the 200 EMA (~191.5 area).

Target arounSMC trading point update

Technical analysis setup for the GBP/JPY pair on a 4-hour timeframe. Here's the breakdown of the trading idea:

---

Key Concepts Highlighted:

1. Support Trend Level (Yellow Zone):

The yellow zone marks a strong confluence area:

Horizontal support from previous price reactions.

Trendline support that has held multiple times.

Close to the 200 EMA (at 191.833), which acts as dynamic support.

2. Bullish Reversal Pattern:

The chart shows a rounded bottom/cup-like structure forming at support—often a sign of accumulation before a reversal.

Price is expected to bounce from this support zone and move higher within the ascending channel.

3. Target Point Projection:

The projected move is around 515.8 pips, targeting the 197.949 level.

This target aligns with the upper boundary of the ascending trend channel.

4. RSI (Relative Strength Index):

RSI is around 43–44, near oversold territory, suggesting potential bullish momentum if a bounce occurs.

Mr SMC Trading point

Conclusion:

This setup suggests a potential long (buy) opportunity:

Entry near the 193.0–193.5 zone (support/trendline confluence).

Stop loss likely below the 200 EMA (~191.5 area).

Target around 197.95, offering a good risk/reward ratio.

The idea is based on trend continuation, a bounce from confluence support, and RSI support for bullish reversal.

Pales support boost 🚀 analysis follow )

IT DEPENDS WHAT HAPPENS 1ST! GBPJPY SHORT FORECAST Q2 W21 Y25IT DEPENDS WHAT HAPPENS 1ST! GBPJPY SHORT FORECAST Q2 W21 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDJPY and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY SHORT FORECAST Q2 W20 D16 Y25GBPJPY SHORT FORECAST Q2 W20 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Higher time frame bearish structure

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY SHORT FORECAST Q2 W20 D15 Y25GBPJPY SHORT FORECAST Q2 W20 D15 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Gap fill

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

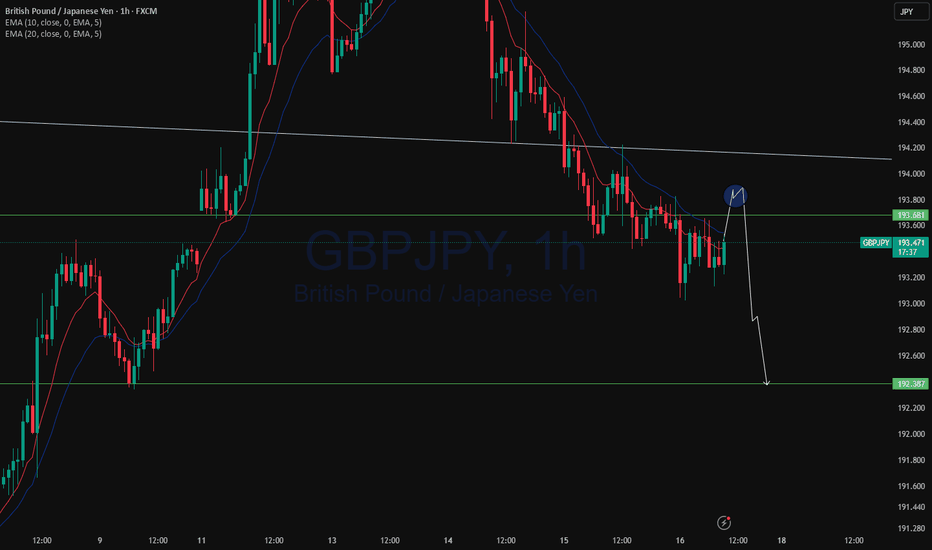

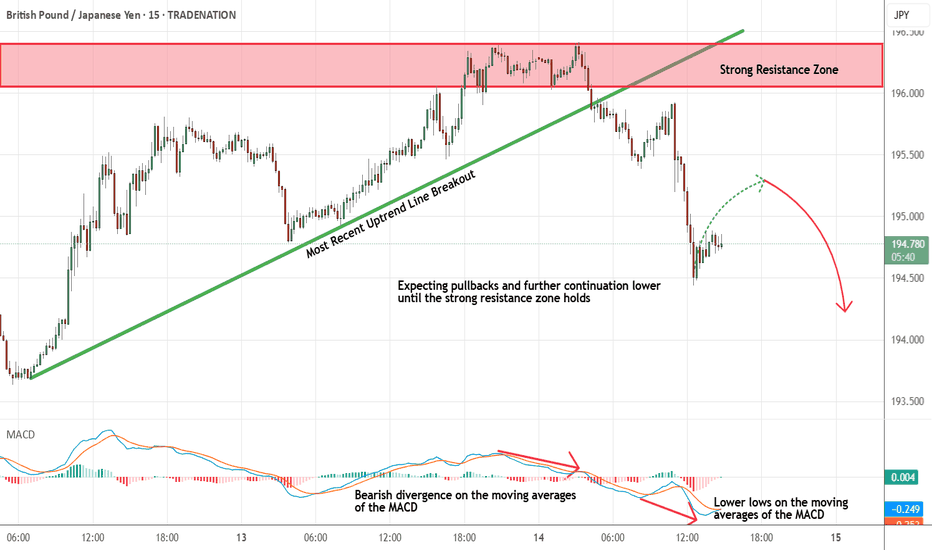

GBPJPY - Looking To Sell Pullbacks In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

Lower lows on the moving averages of the MACD.

No opposite signs.

Expecting pullbacks and bearish continuation until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

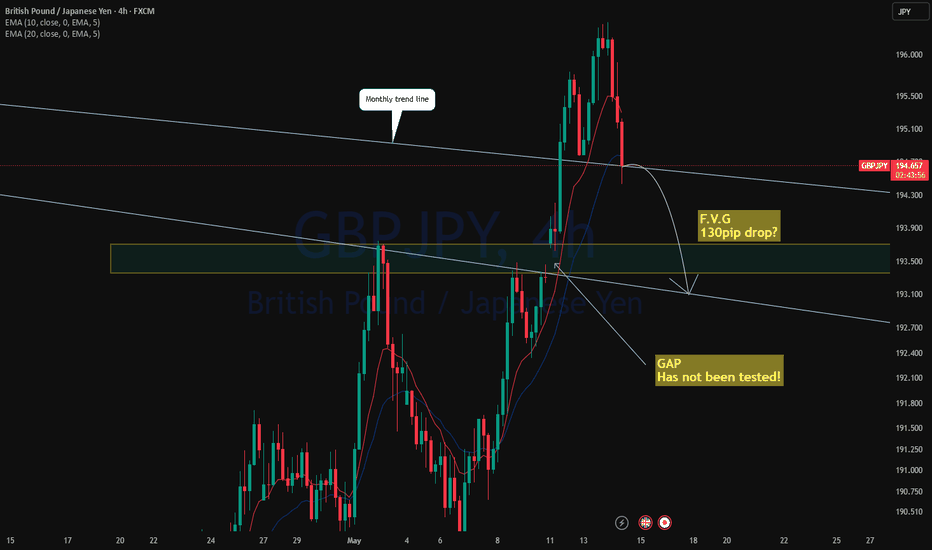

GBPJPY breaking the F.V.G?GBPJPY after breakout of the monthly long term trend line has got rejected for potential retest of the support. As the market has left a gap untested at 193.50 level, there is a high probability for the price to drop and retest and fill that gap. Currently price is approaching a fair value gap.

As first trade closed in profit, looking for another sell entry at 1h candle close!

GBPJPY SHORT FORECAST Q2 W20 D14 Y25GBPJPY SHORT FORECAST Q2 W20 D14 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Gap fill

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

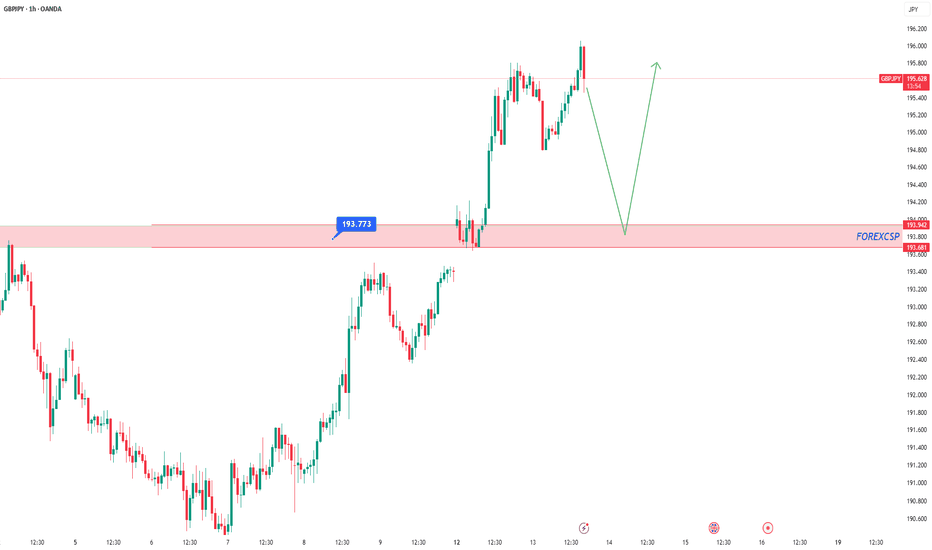

GBPJPY..LONGAnalysis complete

scenarios outlined. The zone could be a decision point for [ OANDA:GBPJPY ]. Price reaction here may define the next move.

*** If price breaks and pulls back to retest, a reversal setup might emerge.

--------------------

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

GBPJPY SHORT FORECAST Q2 W20 D13 Y25GBPJPY SHORT FORECAST Q2 W20 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Gap fill

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

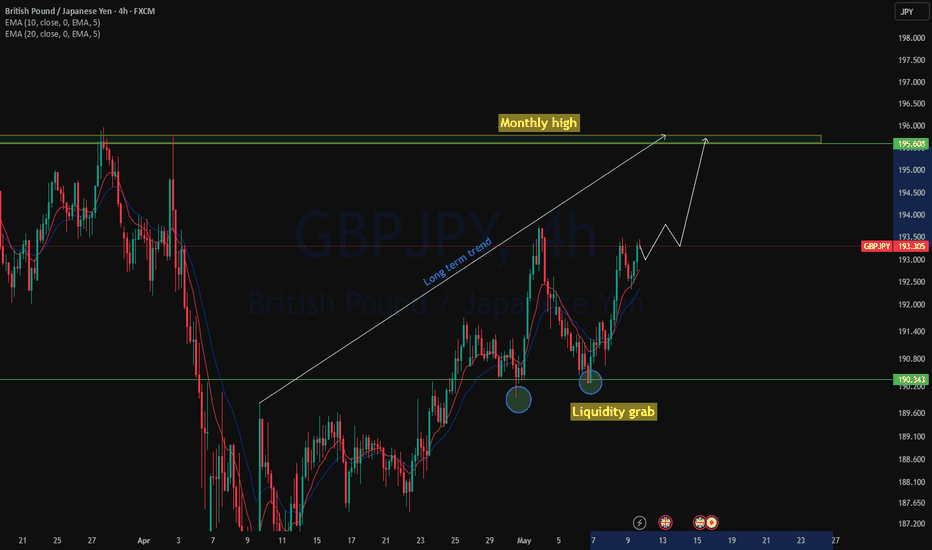

GBPJPY 230 pip up?GBPJPY Multiple timeframe analysis and possible trade setup :

Monthly : Sharp rejection from a long term monthly support after a false breakout

Weekly : Previous week candle close with bullish pin bar and possible bounce back to the monthly high

Daily : There was daily support false breakdown @190 level then return back up with strong momentum

4H : Possible trade setup, bullish on slight pullback to the downside, possible target @195.60

If you enjoy this analysis like and any questions do not hesitate to ask in the comments

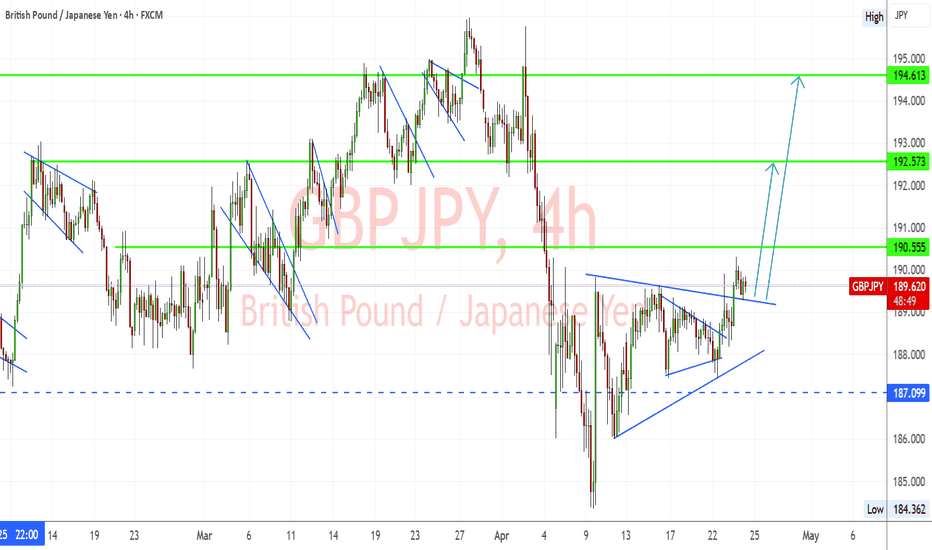

GBPJPY Bullish Breakout – Watch for Momentum Towards 194.60GBPJPY has broken out of a descending wedge and is now retesting the breakout zone near 189.50–189.80. This area aligns with previous structure support and the wedge's upper boundary. Price action indicates bullish momentum is resuming.

🔑 Key Levels:

Current Price: 189.66

Breakout Level: ~189.50

Resistance Targets:

TP1: 190.55 (recent resistance high)

TP2: 192.57

TP3: 194.61 (key supply/weekly resistance zone)

✅ Bullish Confluence:

Breakout from falling wedge pattern

Strong retest of breakout zone with consolidation

Higher low formation and bullish engulfing attempt

No major resistance until 190.50, providing clean upside

🧠 Fundamental Context:

CBI Report (UK): Sentiment and investment outlook among UK manufacturers is deteriorating, but the pound has shown resilience likely driven by broader risk-on market sentiment.

BOJ Outlook (Japan): IMF suggests BOJ is likely to delay further rate hikes due to global uncertainty from US tariffs, maintaining a dovish bias. This weakens the yen’s fundamental strength.

Market Mood: With Japan facing delayed policy tightening and UK's inflation still above target, GBPJPY favors the bullish case in the short term.

💡 Trade Idea:

Bias: Bullish above 189.30

Entry: On retest confirmation around 189.50

Target 1: 190.55

Target 2: 192.57

Target 3: 194.61

Stop Loss: Below 188.80

📌 Note: Keep an eye on US data and BOJ tone shifts. Any risk-off shift in global markets could affect yen strength unexpectedly.

GBPJPY SHORT FORECAST Q2 W19 D9 Y25GBPJPY SHORT FORECAST Q2 W19 D9 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY SHORT FORECAST Q2 W19 D8 Y25GBPJPY SHORT FORECAST Q2 W19 D8 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X