Gbpjpysignals

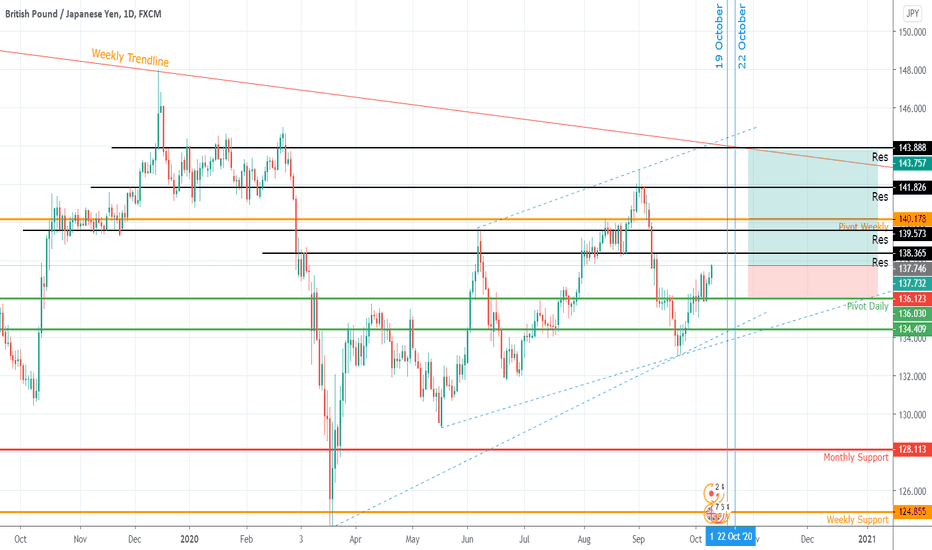

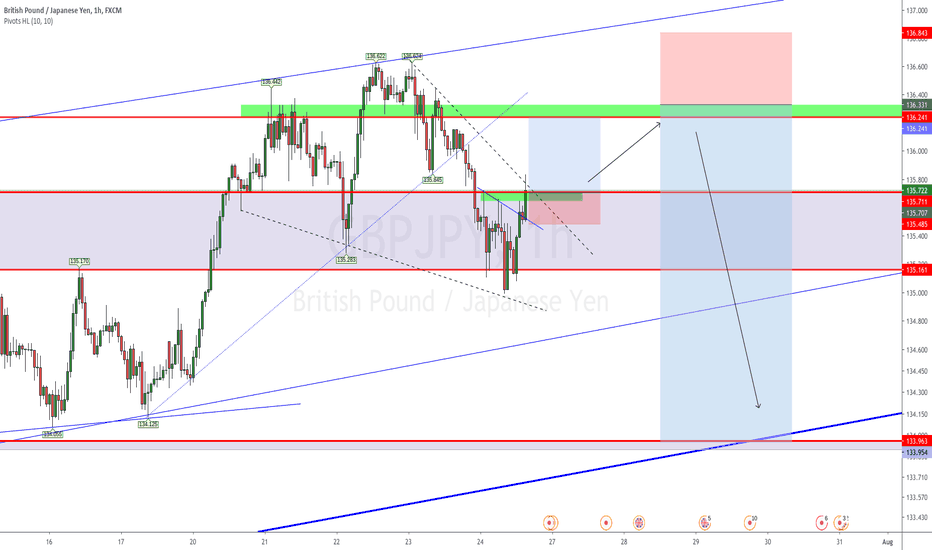

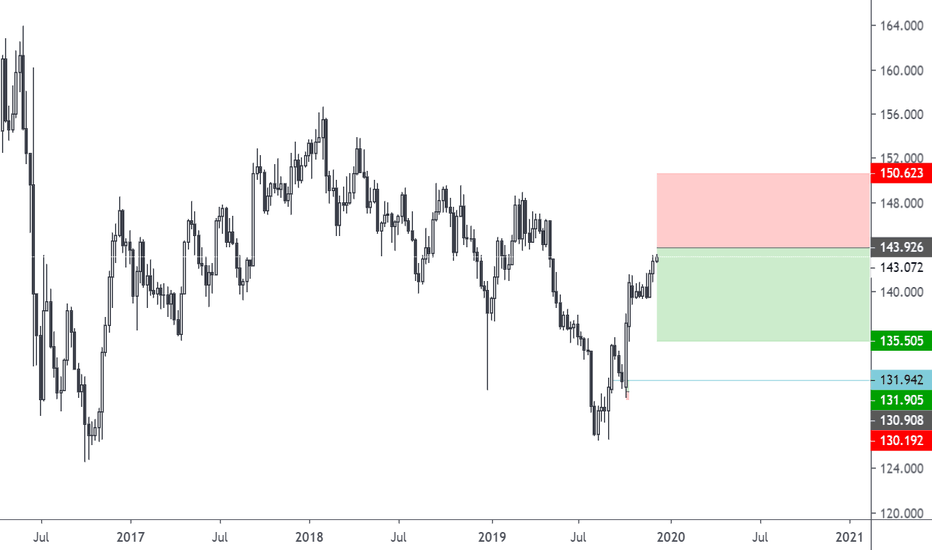

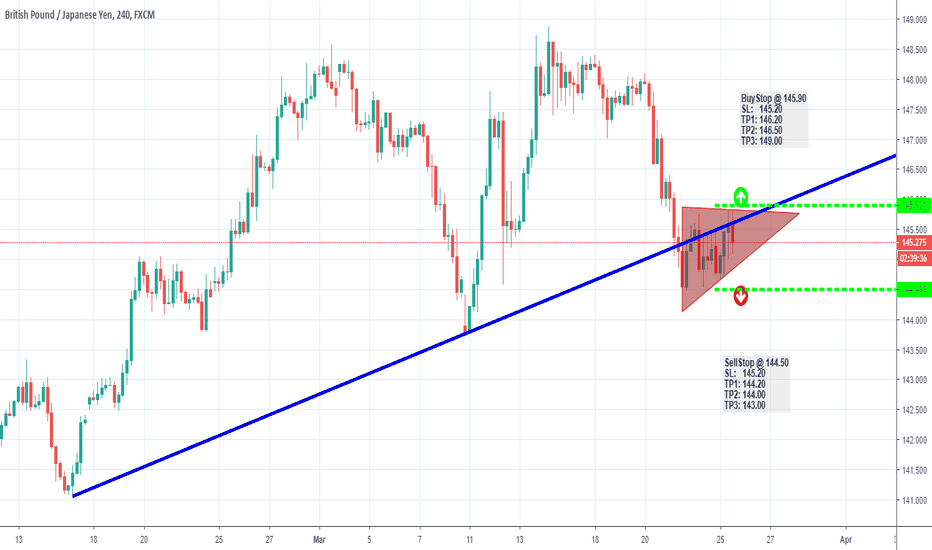

GBPJPY BUY FROM KEY LEVELS !!!as we see GBPJPY had breakout on a strong resistance levels which now turn in support

we hope so a small retrace till support line and after that we start buying from this strong key levels

with a low risk and higher rewards trade

guys push like and support us if u like our idea

follow us for more updates

GBPJPY | MY PERSPECTIVE FOR THE WEEKOver 120pips fetched in my last publication (see link below for reference purposes) as another trading opportunity arises. The British Pound surrendered much of its Thursday gain on Friday to close the week below 141.000. despite this retraction, the possibility of a rally is still paramount as I have found two windows on the chart for buying opportunity.

Tendency: Uptrend ( Bullish )

Structure: Trendline | Support & Resistance | Channel

Observation: i. Price action has been contained between upward sloping parallel lines characterized by Higher highs and higher lows to make my Bullish bias emphatic.

ii. Major Support @ 139.300 - a structure which has been a strong hold for Bullish tendencies since 2016 could open us to a Buy opportunity if price breaks down 140.000level.

Trading plan: BUY confirmation with a minimum potential profit of 250 pips.

Risk/Reward: 1:4

Potential Duration: 3 to 8 days

NB: This speculation can be considered to make decisions on lower timeframes.

Watch this space for updates as price action is been monitored.

NirvanaForex

Risk Disclaimer:

Margin trading in the foreign exchange market (including foreign exchange trading, CFDs, etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

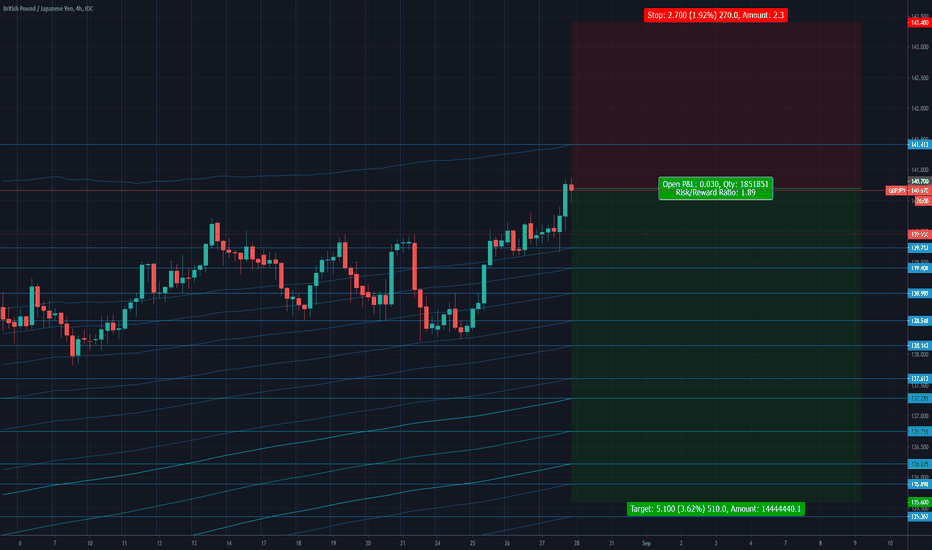

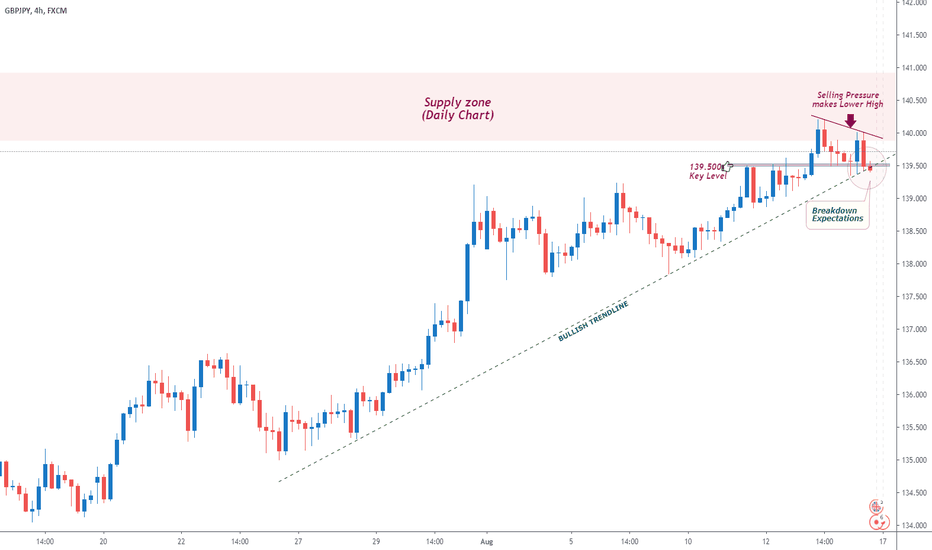

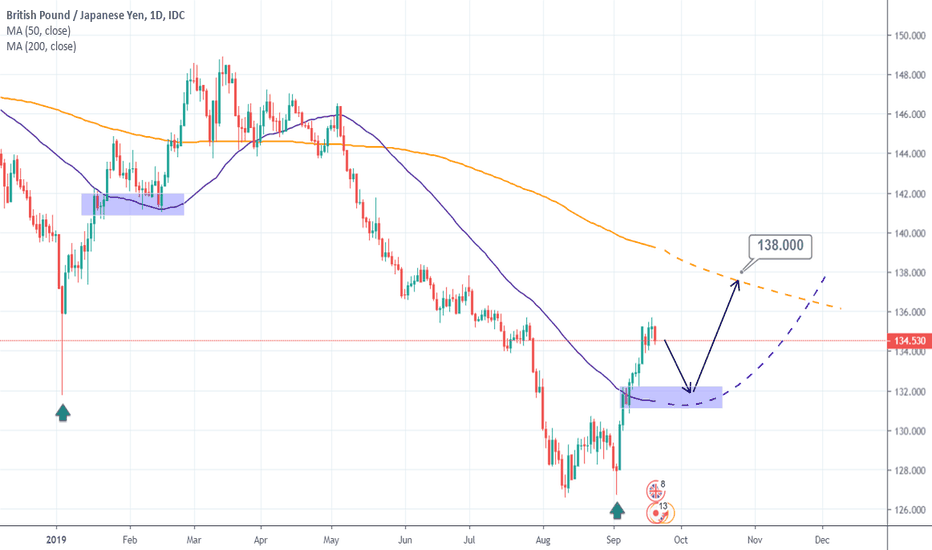

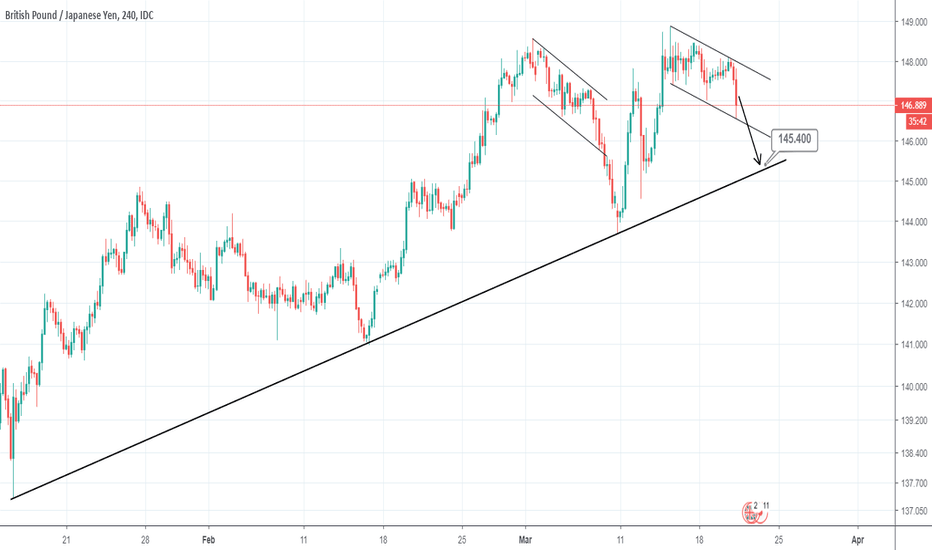

GBPJPY | MY PERSPECTIVE FOR THE WEEKWith over 500pips in our direction since my last publication on this pair (see link below for reference purposes); the GBP/JPY pair broke out of my Key level @ 139.500 on Thursday only for price to Breakdown this level to make an intraday dip to the 139.35 region on Friday which also coincides with Breakdown of trendline insinuating a temporary Downtrend in the following week(s) for me.

Tendency: Temporary Downtrend ( Bearish )

Structure: Trendline | Support & Resistance

Observation: i. The line drawn under pivot lows emphasizes the prevailing direction of price.

ii. Breakdown of 139.500 level after Selling pressure gained momentum in the last day of the week to close under.

iii. A retest/rejection of my Key level in the coming week might be a signal to look for in the coming week.

Trading plan: SELLconfirmation with a minimum potential profit of 250 pips.

Risk/Reward: 1:4

Potential Duration: 2 to 6 days

NB: This speculation can be considered to make decisions on lower timeframes.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including foreign exchange trading, CFDs, etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and NFTI takes no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

NFT&I does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

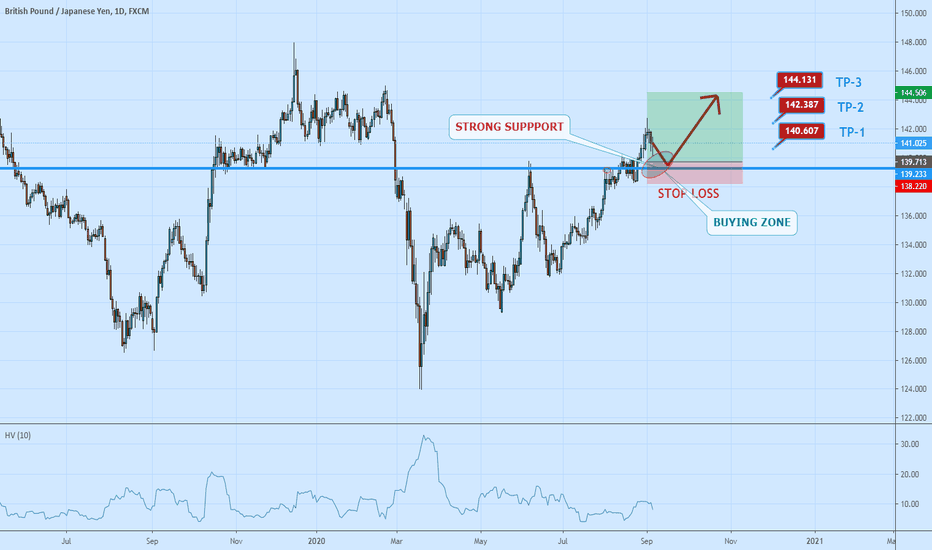

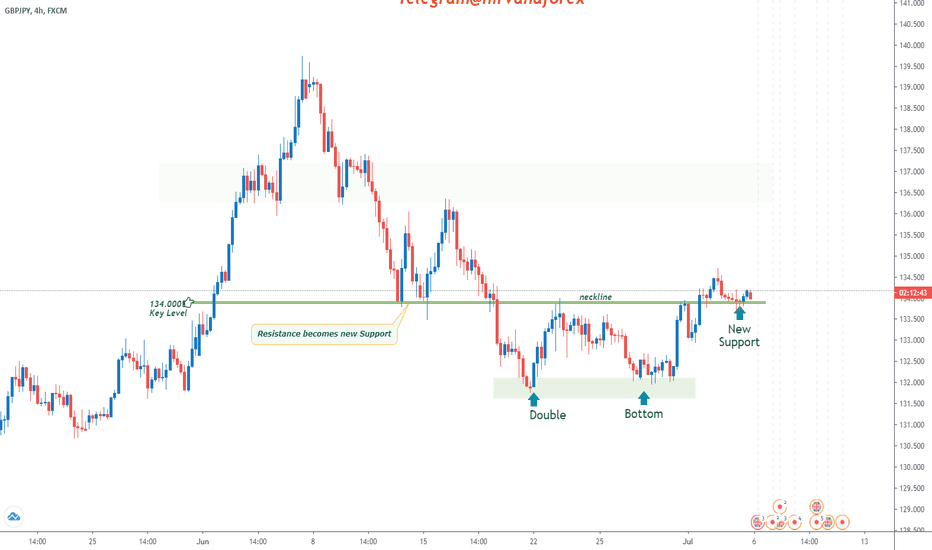

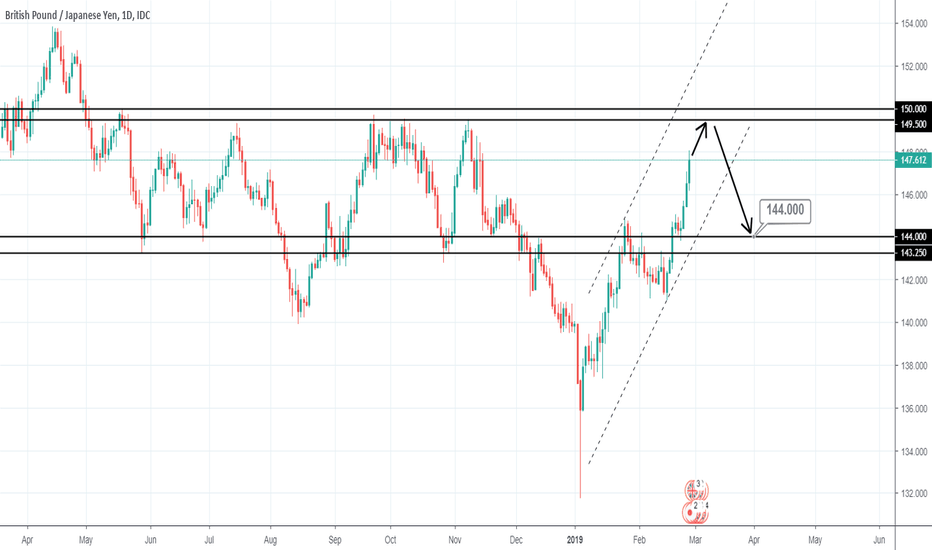

GBPJPY | WEEKLY FORECASTAfter hitting a Double Bottom in June 2020, The Pound began to build a Reversal structure this month (July 2020) as it Breakout of the neckline (134.000 level) last week.

Tendency: Temporary Uptrend ( Bullish )

Structure: Double Bottom | Support & Resistance

Observation: i. Our Double bottom describes a change in trend which emphasizes a momentum reversal from prior Bearish price action.

ii. This Reversal looks like a long term prospect but its appropriate that we take it on a week to week basis.

iii . A Breakout off of our Resistance Key Level (neckline) that has been respected since mid-June 2020 became our new Support level in the latter part of last week.

iv. As our New Support gets stronger with engulfing candle, a prospect for a Bull in coming week(s) becomes feasible.

Trading plan: BUY confirmation with a minimum potential profit of 300 pips.

Risk/Reward: 1:2.5

Potential Duration: 1 to 7 days

NB: This speculation can be considered to make decisions on lower timeframes.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including foreign exchange trading, CFDs, etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and NFTI takes no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

NFT&I does not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

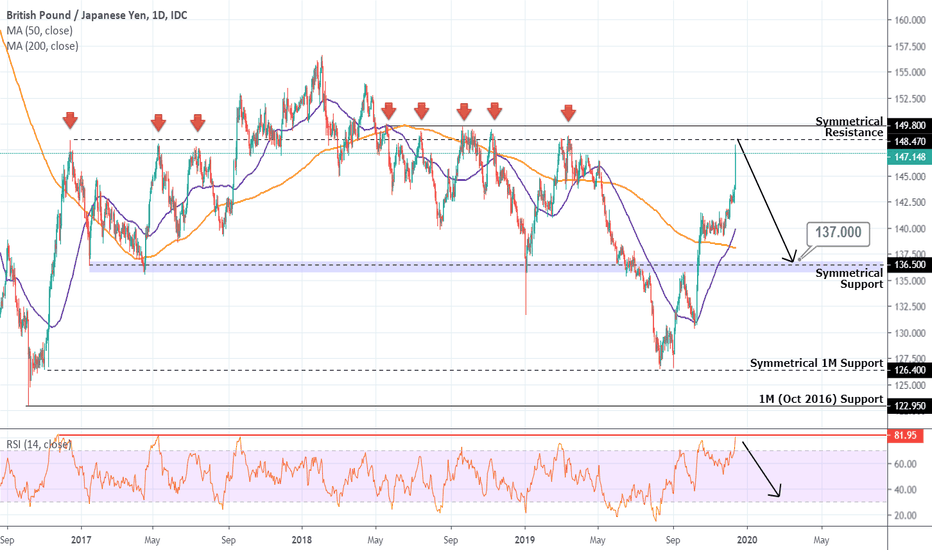

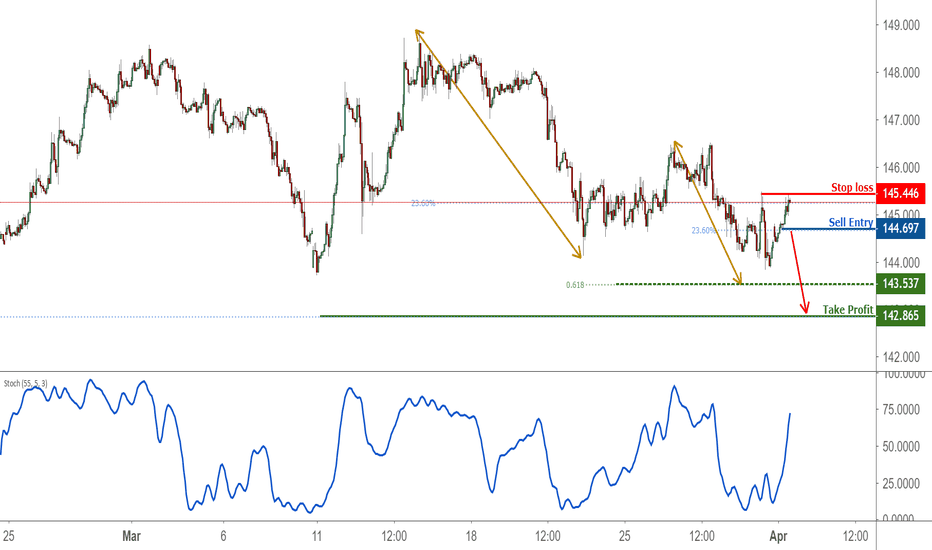

GBPJPY Sell SignalPattern: Parabolic rise on 1D.

Signal: Bearish as it is approaching a Symmetrical Resistance level (rejected the price 8 times since 2016) with the RSI on 3 year highs.

Target: 137.000 (Symmetrical Support).

*Such long term symmetries are useful and quite accurate. I have successfully implemented this approach on my last GBPJPY buy signal:

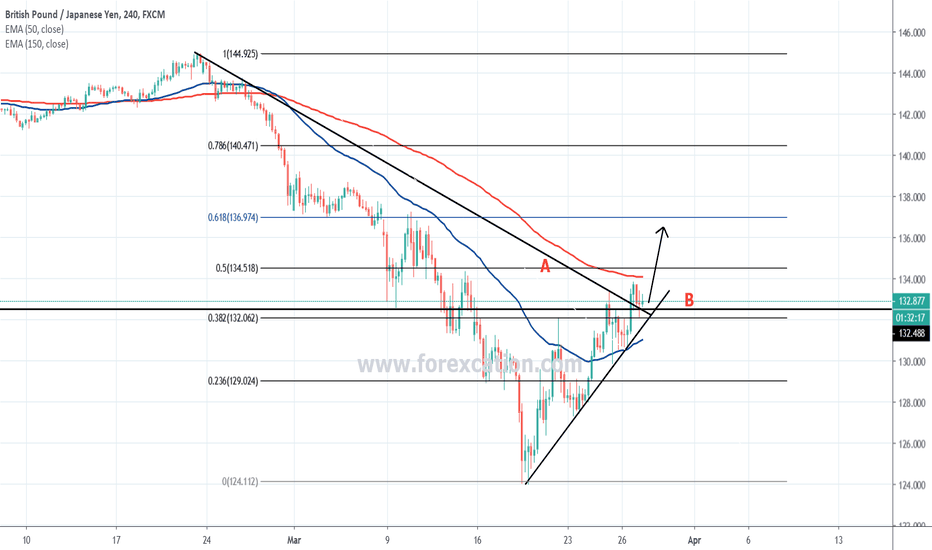

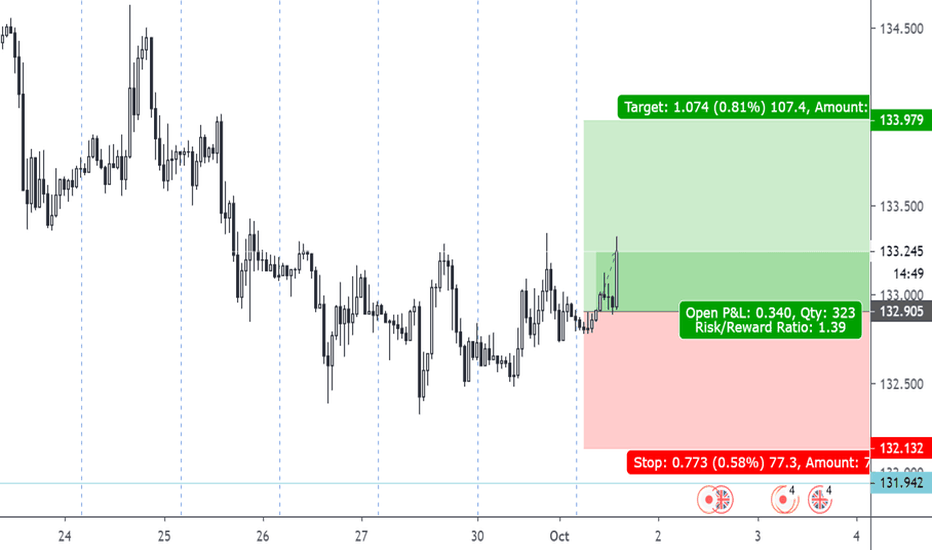

GBPJPY - SELL NowYes it is.

W Pattern formed, Overbought situation, Fibo 0.618 as resistance.

Note: Trade at your own risk.

We are providing free forex signals. You can join clicking below telegram link or comment your telegram username we will add you there.

Join with us for free signals

Telegram - t.me

Facebook - www.facebook.com

Twitter - twitter.com

Website - www.forexcaction.com

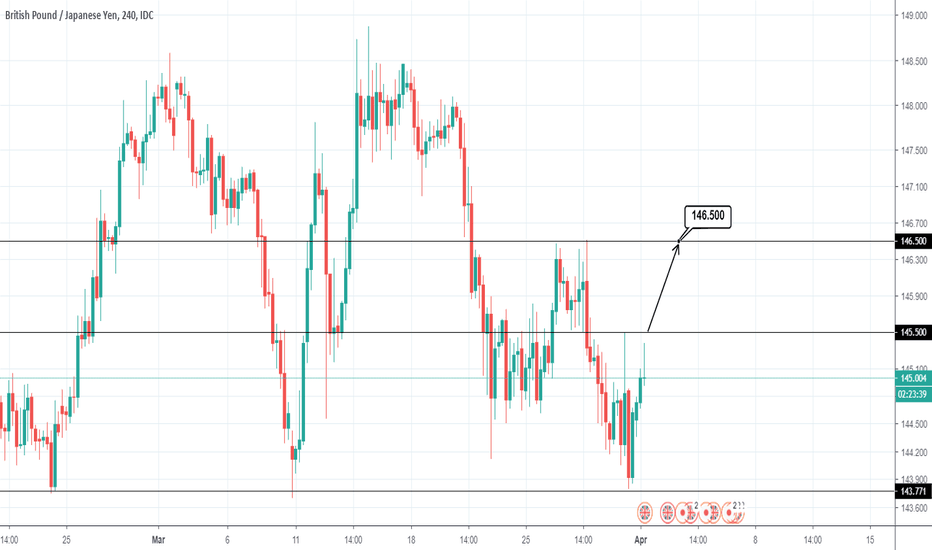

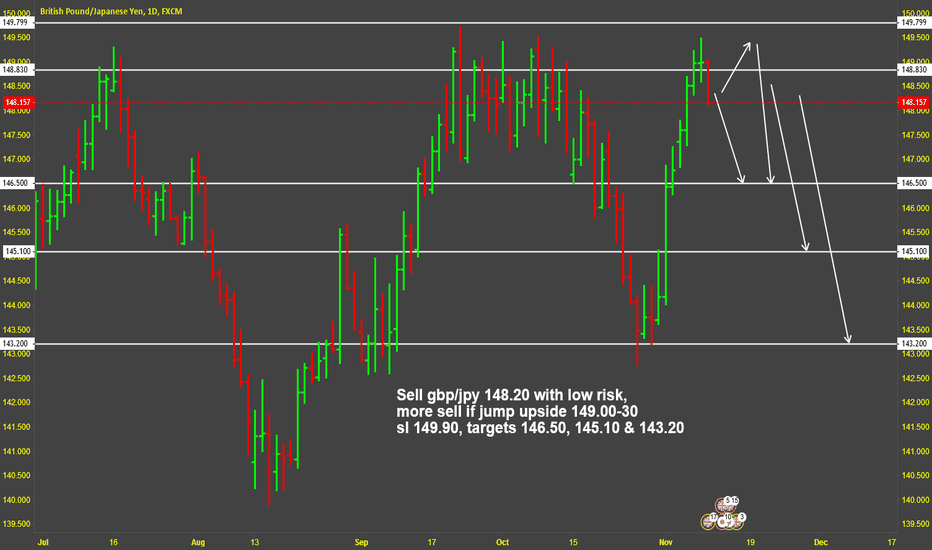

Breakout Identified in GBPJPYSignal ID: 64630

Time Issued: Thursday, 28 March 2019 17:44:15 GMT

Status: open

Entry: 143.968 - 144.836

Limit: 142.865

Stop Loss: 145.399

The Breakout Opportunities system has just sold GBPJPY at 144.284. The system recommends entering this trade at any price between 143.968 and 144.836. The signal was issued because the GBPJPY has broken its 24-hour low while our Speculative Sentiment Index was at 2.336, suggesting that the GBPJPY may have further to fall. A stop loss has been set at the 24-hour high of 146.492 and a profit target has been set at the 1 Day ATR level at 143.018. The system will move the stop to the next 24-hour high every time that 24-hour high is lower than the previous 24-hour high. Breakout Opportunities is a breakout strategy that aims to catch the significant moves that typically happen when currencies break through technical support or resistance.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.88% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.