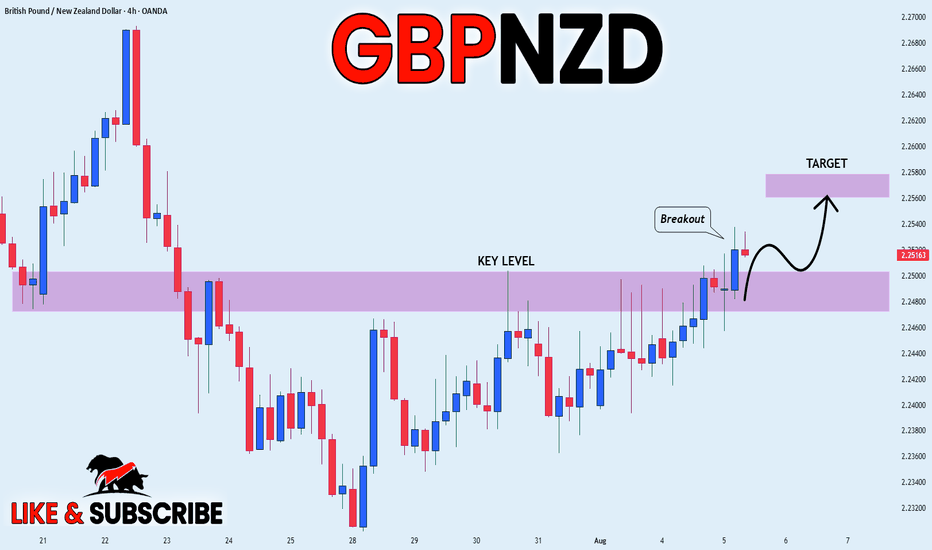

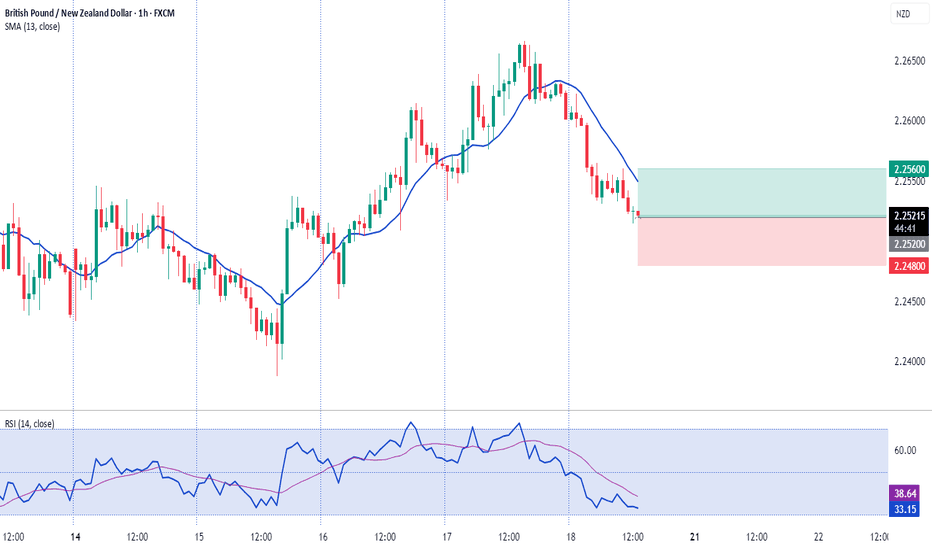

GBP_NZD BULLISH BREAKOUT|LONG|

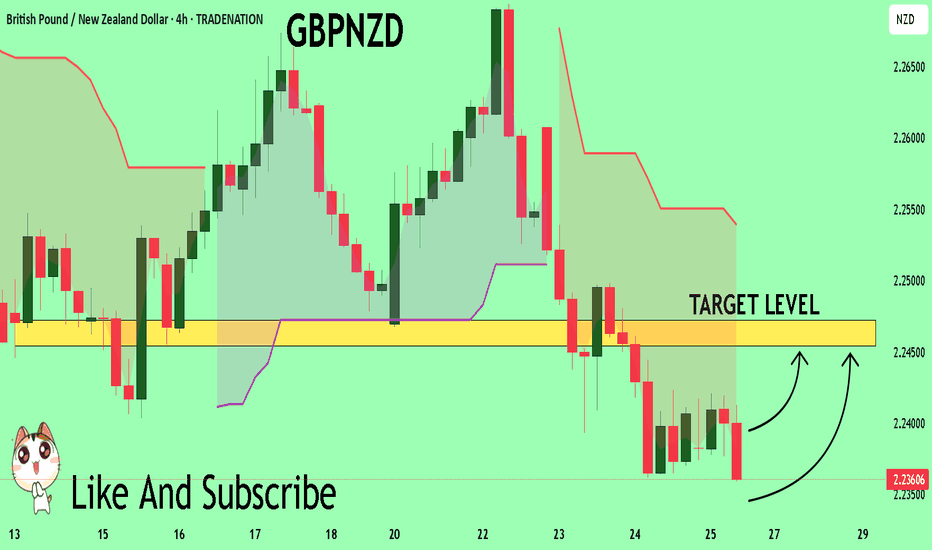

✅GBP_NZD broke the key structure level of 2.2500

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of the broken level is complete

A rebound and bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBPNZD

GBPNZD Under Pressure! SELL!

My dear friends,

Please, find my technical outlook for GBPNZD below:

The price is coiling around a solid key level - 2.2531

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 2.2463

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

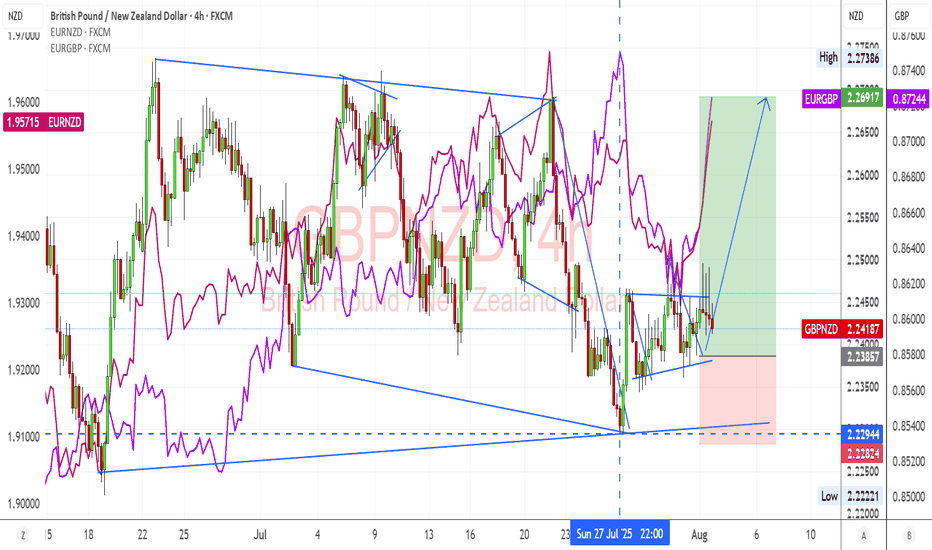

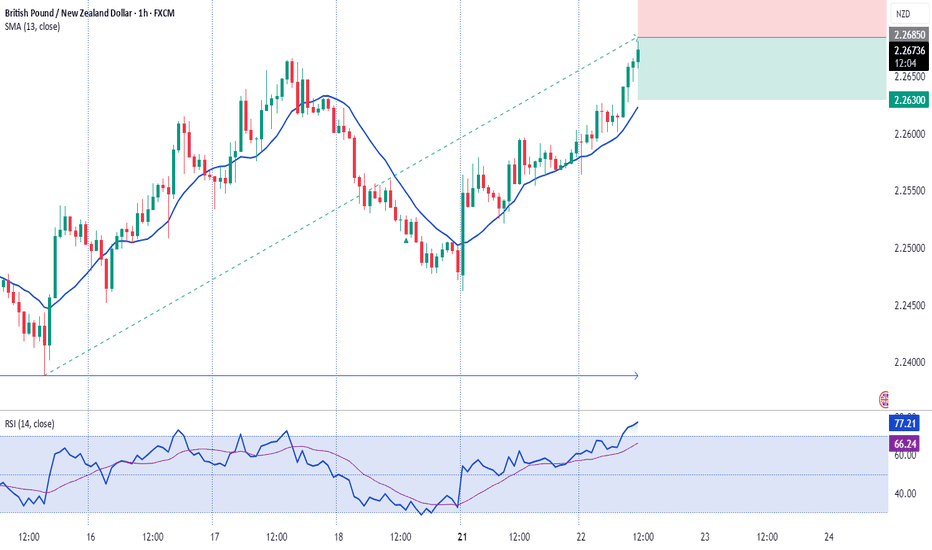

GBPNZD Breakout from Consolidation Bullish Momentum BuildingGBPNZD has broken out of its recent consolidation pattern and is showing signs of bullish continuation. Strong GBP fundamentals combined with NZD weakness from global risk-off sentiment and tariffs support this technical move.

Technical Analysis (4H Chart)

Pattern: Breakout from a descending channel with bullish follow-through.

Current Level: 2.2418, trading above the breakout level, confirming momentum shift.

Key Support Levels:

2.2294 – recent breakout support and invalidation point for bulls.

2.2222 – secondary support if a deeper pullback occurs.

Resistance Levels:

2.2500 – near-term resistance and potential target for the breakout.

2.2690 – extended bullish target if momentum continues.

Projection: Likely to continue higher toward 2.2500, with room for 2.2690 if GBP strength persists.

Fundamental Analysis

Bias: Bullish.

Key Fundamentals:

GBP: Supported by BOE’s cautious stance on inflation and the relative resilience of the UK economy.

NZD: Pressured by global tariffs, weaker risk sentiment, and limited domestic growth catalysts.

USD Factor: Fed rate cut expectations indirectly support GBP crosses against risk currencies like NZD.

Risks:

Hawkish surprise from RBNZ could strengthen NZD.

BOE dovish signals could stall GBP upside.

Key Events:

BOE meeting and UK CPI.

RBNZ policy decision.

Risk sentiment trends globally.

Leader/Lagger Dynamics

GBP/NZD is a leader among GBP crosses, with GBP strength and NZD weakness driving momentum. It also aligns with EUR/NZD upside moves, reinforcing the bearish NZD outlook.

Summary: Bias and Watchpoints

GBP/NZD is bullish, having broken consolidation with upside targets at 2.2500 and 2.2690. The main drivers are GBP’s policy support, NZD’s risk-off weakness, and global tariff concerns. Watch for BOE and RBNZ updates as potential volatility triggers.

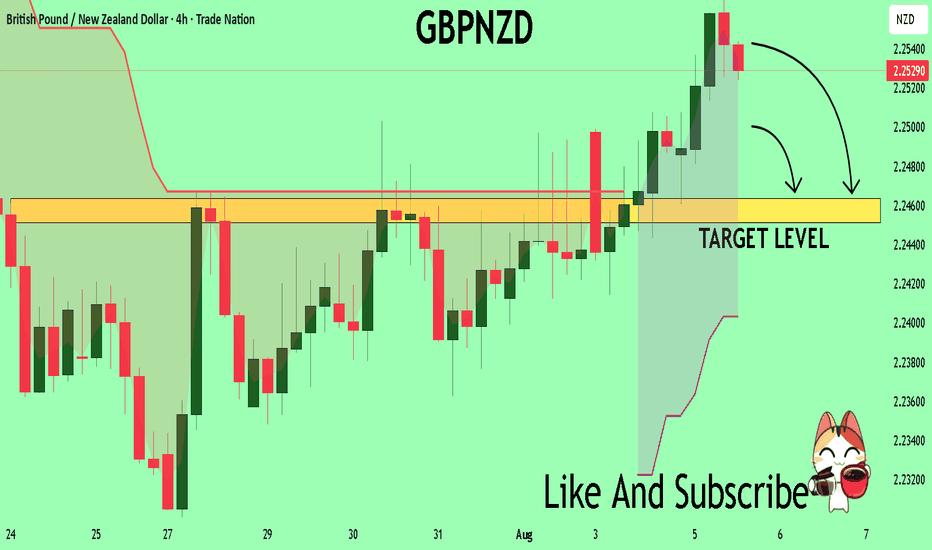

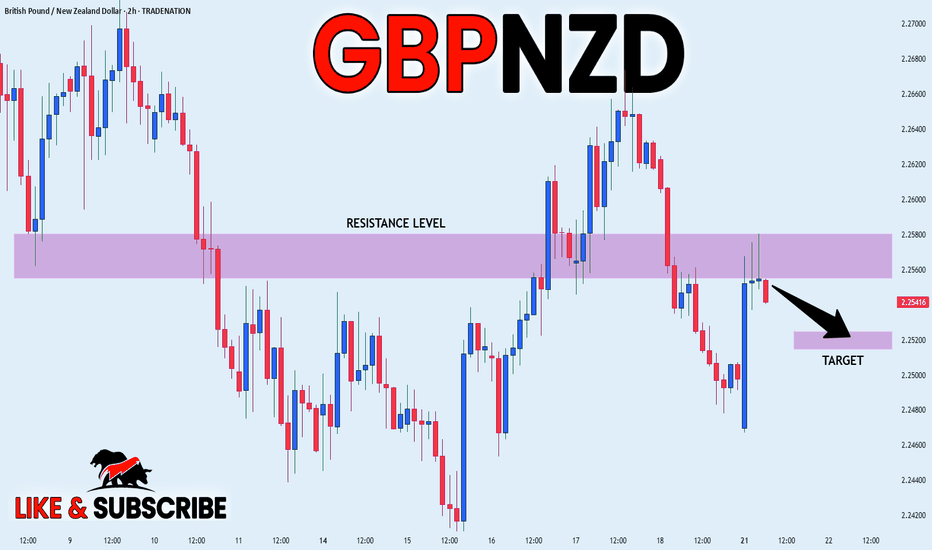

GBP_NZD BEARISH BIAS|SHORT|

✅GBP_NZD has retested

A resistance level of 2.2500

And we are seeing a bearish reaction

With the price going down so we are

Bearish biased now and we will be

Expecting the pair to go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

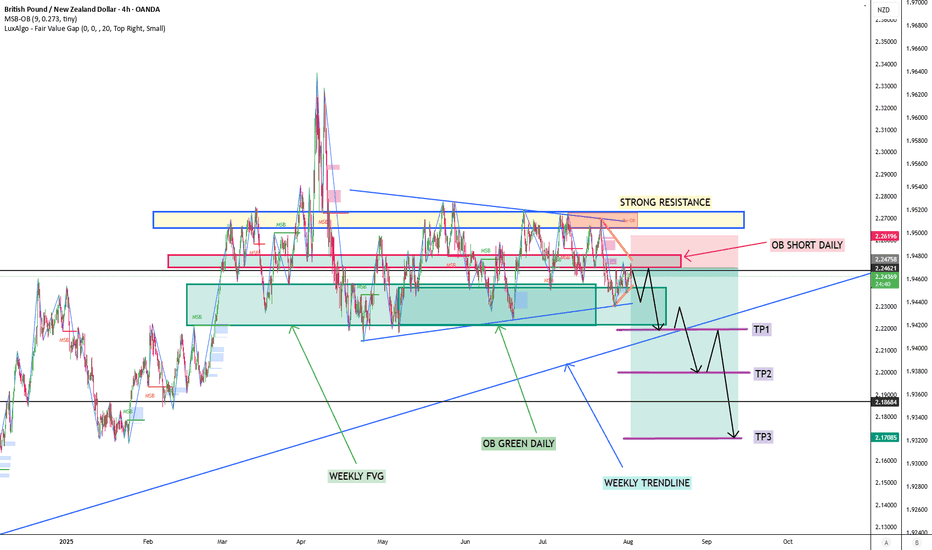

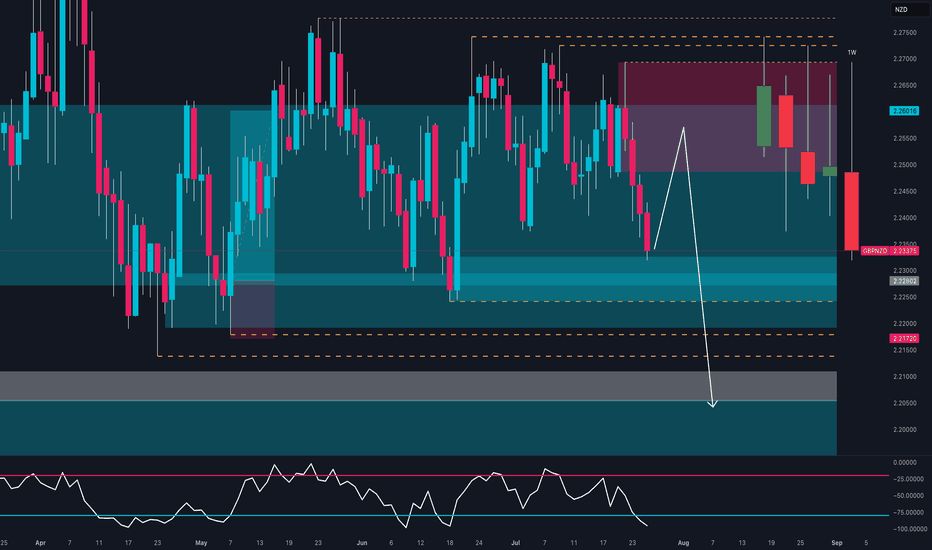

GBP/NZD POTENTIONAL SHORT OPPORTUNITYThis is an idea for GBPNZD's potential short opportunity based on what the technicals indicate.

The trend has been emphasising its bullish approach for almost three years.

Price respected almost 11 times due to the strong resistance within 150 days between 2.265 & 2.275 and bounced off bullish OB on the daily chart and FVG on the weekly chart.

An institutional sharp decline on the weekly chart, followed by a clear wedge, can support a further drop once swept by bearish daily OB. A breakout to the micro wedge (orange) within a macro wedge can also help further down move.

Given that a bearish pin bar followed by a bearish doji is a strong warning signal of potential reversal or bearish continuation that appears inside the micro wedge.

TP1 is considered the first support at the bottom, where the daily OB and the weekly FVG meet at around 2.22000 or the area close to the trendline. If the price breaks through the trendline, TP2 and TP3 will be expected to be achieved.

TP2 may be located at the micro accumulation around 2.20000, and TP3 at the following major support around 2.15000-2.17000 that previously acted as both support and resistance.

Good luck and have a great weekend.

GBPNZD: Will Keep Falling! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the GBPNZD pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

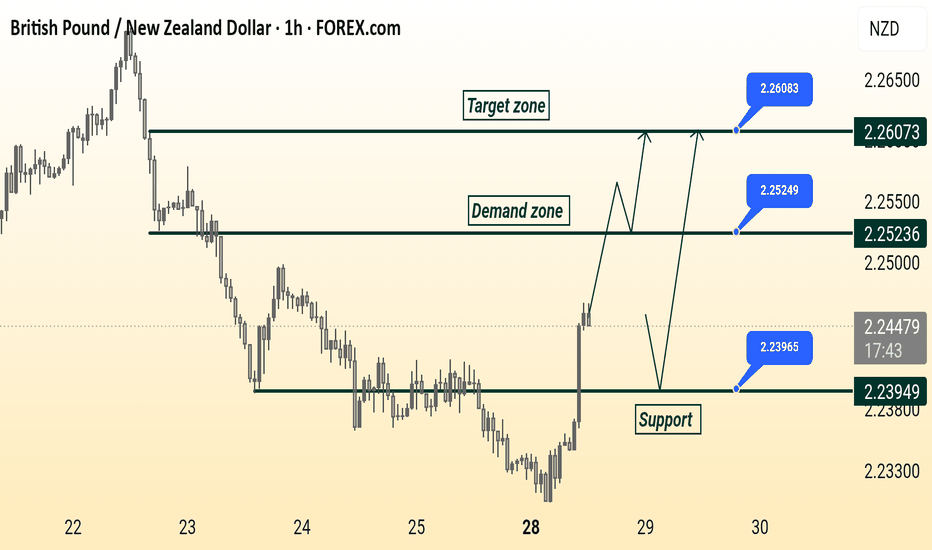

GBP/ NZD Ready Read The Captions This 1-hour chart analysis of GBP/NZD highlights key trading zones:

Support level: 2.23949

Demand zone: 2.25236

Target zone: 2.26073

The price is currently rising from support and approaching the demand zone. Two possible scenarios are shown: a breakout toward the target zone or a pullback to the support before a new upward attempt.

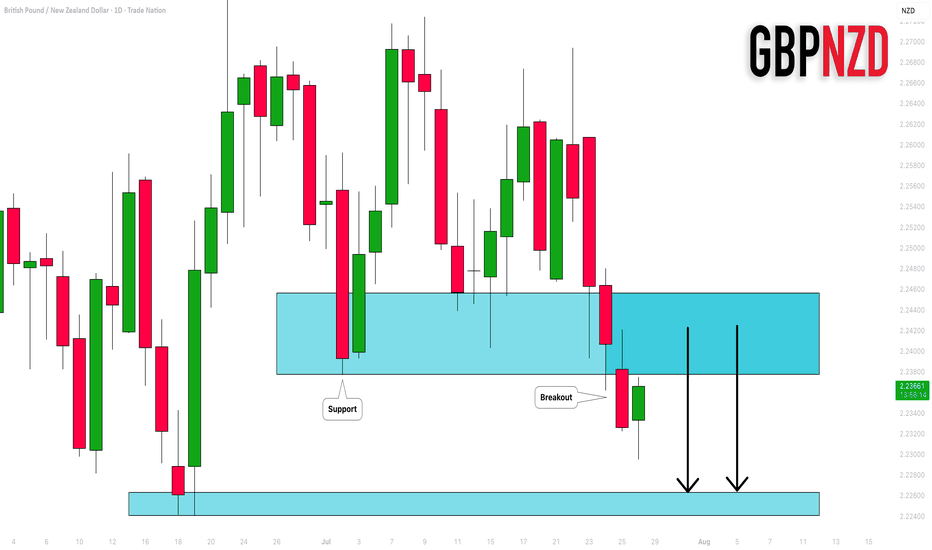

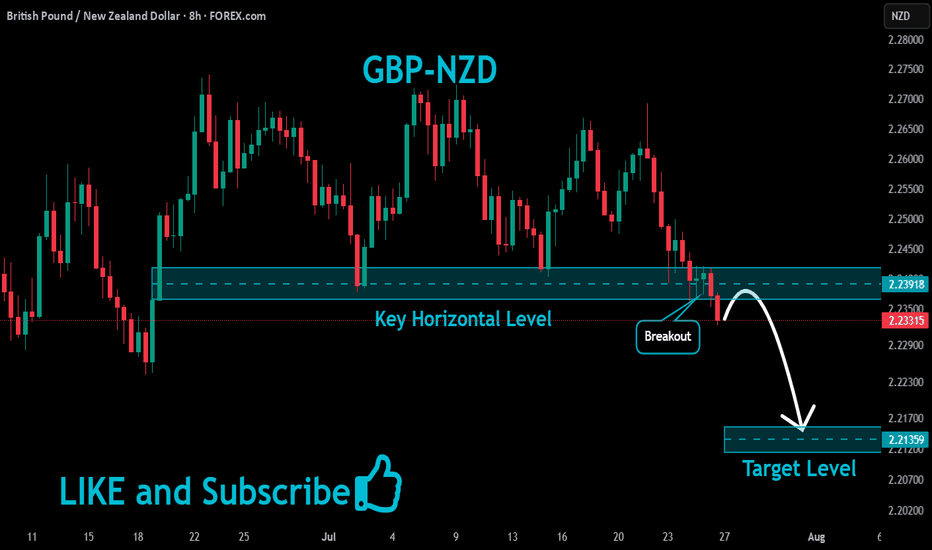

GBPNZD: Important Breakout 🇬🇧🇳🇿

GBPNZD broke and closed below a significant support cluster on a daily.

The broken structure turned into a strong resistance.

I will expect a bearish move from that.

Next support - 2.2264

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

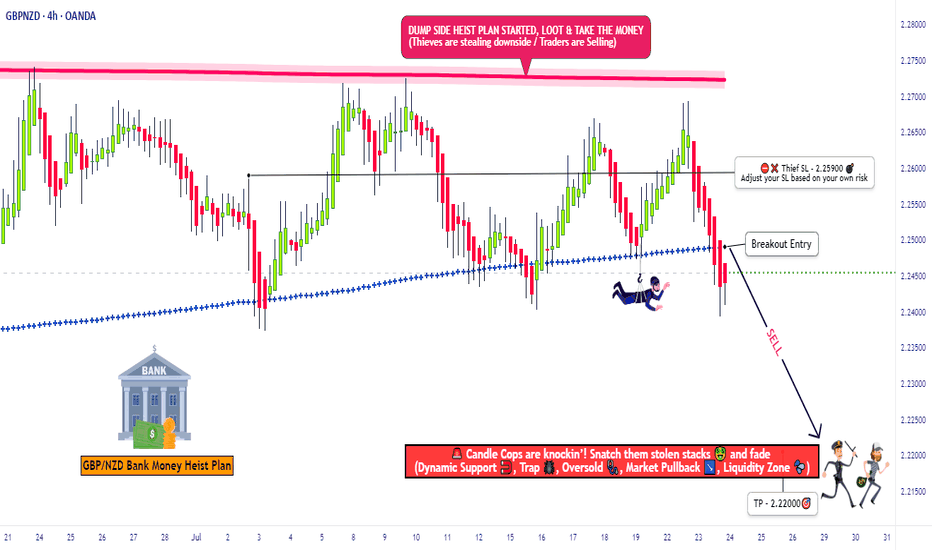

"GBP/NZD: Bearish Storm Brewing – Get Ready!🚨 GBP/NZD HEIST ALERT: "Pound vs Kiwi" Bearish Trap Setup! 🚨 (Scalping/Day Trade)

🌟 Attention, Market Robbers & Profit Pirates! 🌟

🔥 Thief Trading Strategy Activated – Time to short the GBP/NZD like a pro! This pair is setting up for a bearish heist, and we’re locking in entries before the drop. High-risk, high-reward? You bet.

🎯 TRADE PLAN (Bearish Ambush)

Entry Zone (Short) 📉:

Optimal: Sell limit orders on retests (15m/30m timeframe).

Thief’s Trick: Layer entries (DCA-style) near recent highs for max efficiency.

"Enter like a sniper, escape like a ghost." 👻

Stop Loss 🛑:

4H Swing High/Wick (Near 2.25900) – Adjust based on your risk & lot size.

"A smart thief always has an exit route." 🏃💨

Target 🎯: 2.22000 (or escape early if the trap snaps shut!)

💣 WHY THIS HEIST? (Bearish Triggers)

Technical Setup: Oversold bounce? Nah. Consolidation → Reversal trap.

Fundamentals: Weak GBP sentiment? Strong NZD data? Check the news!

Market Psychology: Bulls are getting trapped at resistance—time to fade them.

⚠️ THIEF’S WARNING

News = Volatility Bomb 💣 – Avoid new trades during high-impact events.

Trailing SLs = Your Best Friend – Lock profits & dodge reversals.

💎 BOOST THIS IDEA & JOIN THE HEIST!

🔥 Hit 👍 LIKE, 🚀 BOOST, and FOLLOW for more lucrative robberies!

💸 "Steal the market’s money—before it steals yours." 🏴☠️

🔔 Stay tuned—next heist coming soon! 🔔

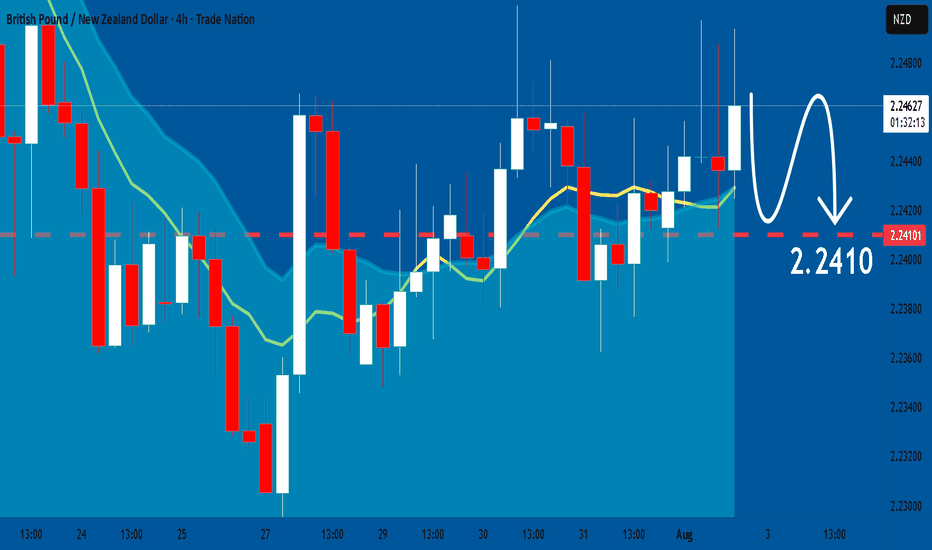

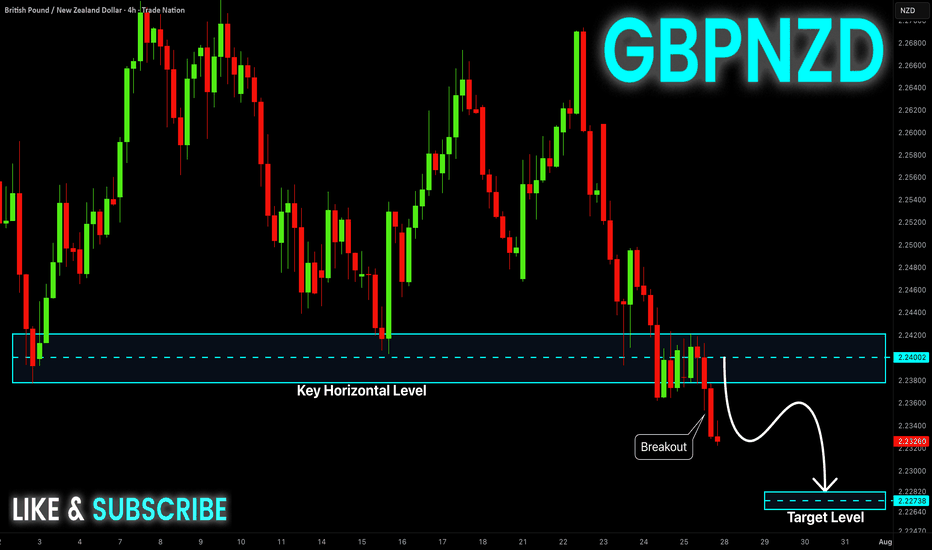

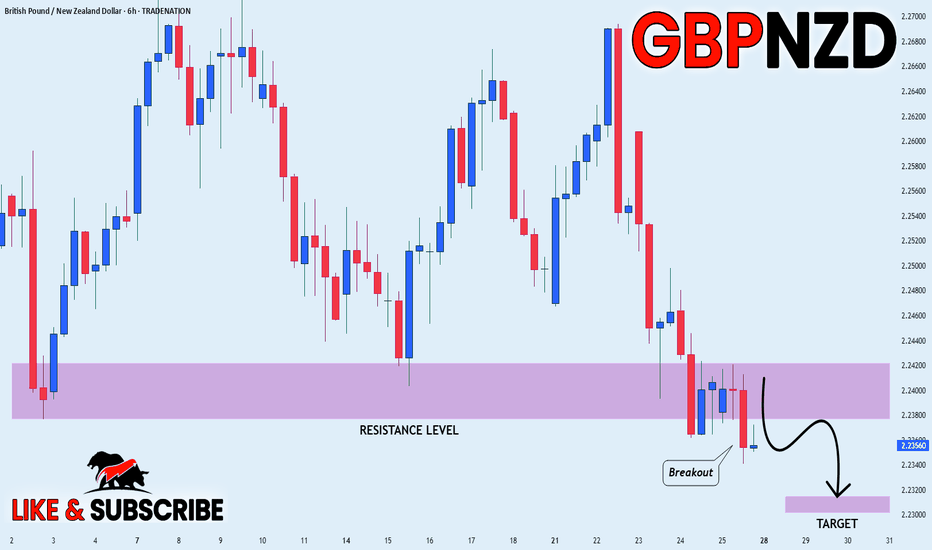

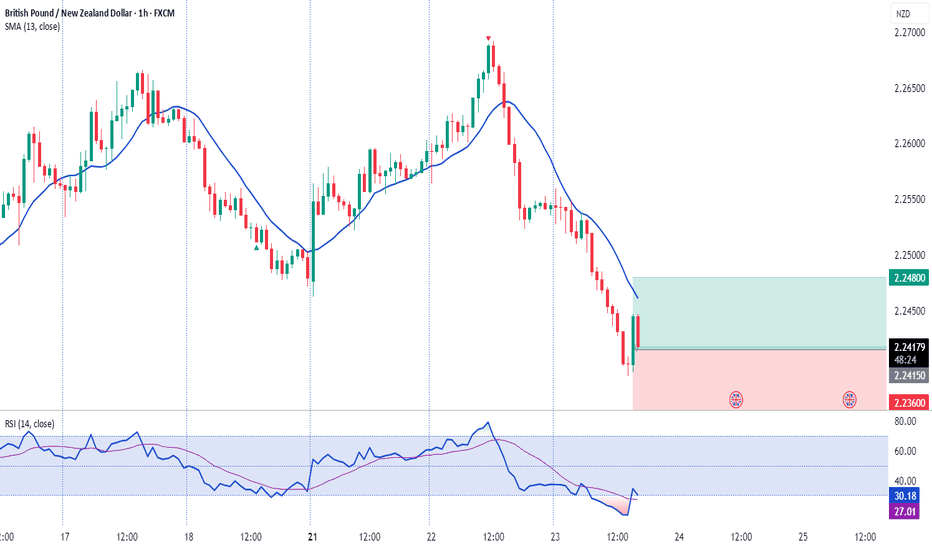

GBP-NZD Will Keep Falling! Sell!

Hello,Traders!

GBP-NZD keeps falling down

And the pair made a strong

Bearish breakout of the key

Horizontal key level of 2.2400

And the breakout is confirmed

So we are bearish biased and

We will be expecting a further

Bearish move down on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD Breakdown – Smart Money Turns Fully Bearish🧠 Macro + COT + Sentiment Context

Commitment of Traders (COT) – Asset Managers

Institutional asset managers are significantly net short on GBPNZD, with positioning at its lowest level of the year and declining sharply since May. This reflects a clear bearish stance from smart money and reinforces the current downward pressure.

Sentiment & Momentum Indicators

DPO: -54.9 → Indicates a moderately bearish momentum phase.

Wyckoff: -20.3 → Price is in a distribution phase, suggesting weakness.

Speed: 3.2 → Low acceleration, but directional bias remains bearish.

Market Mood: Neutral, but leaning into oversold territory.

Seasonality (July 1st – Sept 30th)

Historically, GBPNZD performs positively in this period:

3Y: +1.7%, 5Y: +1.6%, 10Y: +2.3%, 15Y: +2.8%

However, in 2025, price is diverging sharply from seasonal norms. The pair is trading against historical patterns, suggesting a seasonal anomaly where institutional flow is dominating historical behavior.

🧱 Technical Outlook (Daily Chart)

GBPNZD had been consolidating in a clear range between 2.2170 support and 2.2750 resistance since May. The pair has now broken down with a strong, full-bodied weekly candle, closing below the 2.2320 demand zone.

Key Technical Zones:

Supply zone (2.2494–2.2659) → A clear rejection zone that initiated the current selloff.

Demand zone (2.2170–2.2300) → Has been tested twice already, increasing the probability of a clean breakdown.

RSI (Daily) → Currently neutral, with a sequence of lower highs and no bullish divergence in sight — indicating weak momentum.

✅ Conclusion & Trade Plan

Directional Bias: Bearish (Short)

Although seasonality typically supports bullish price action for GBPNZD in Q3, the current context is decisively bearish. Institutional positioning, price structure, and sentiment all confirm a potential shift in direction, reinforced by a confirmed weekly breakdown.

Bearish Targets:

📍 First: 2.2170 (recent support test)

📍 Second: 2.2000–2.1900 (April swing low)

📍 Extension: 2.1750 (base of previous accumulation zone)

Invalidation Criteria:

A weekly close above 2.2490 (supply zone breached)

Bullish RSI divergence + weekly recovery candle

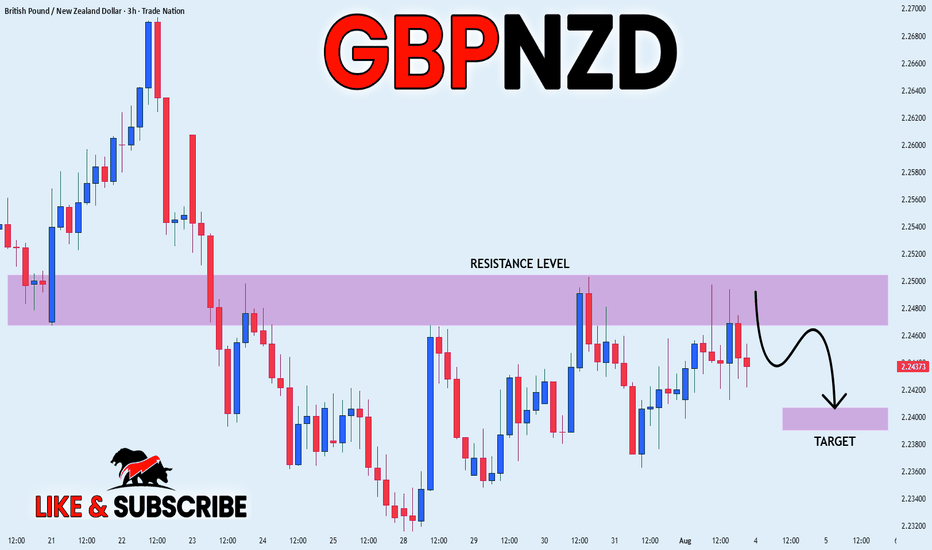

GBP_NZD BEARISH BREAKOUT|SHORT|

✅GBP_NZD is going down currently

As the pair broke the key structure level of 2.2400

Which is now a resistance, and after the pullback

And retest, I think the price will go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD Will Explode! BUY!

My dear friends,

My technical analysis for GBPNZD is below:

The market is trading on 2.2361 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.2454

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

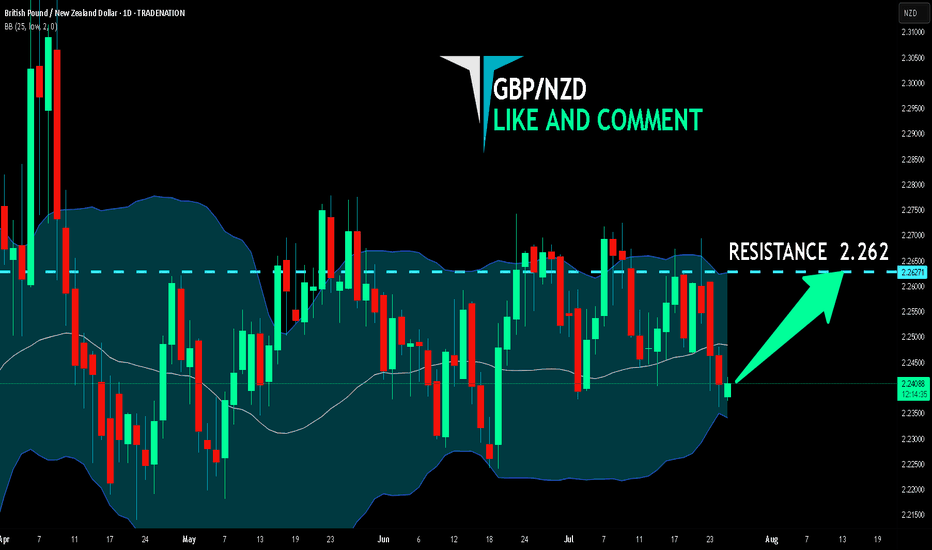

GBP/NZD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

We are going long on the GBP/NZD with the target of 2.262 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

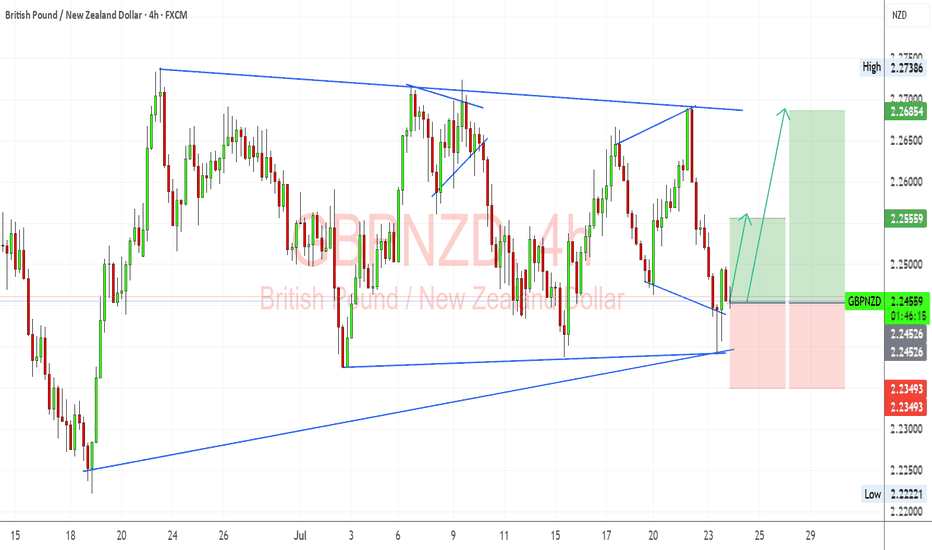

GBPNZD Analysis — 4H Chart ReviewI’m watching GBPNZD for a potential bullish continuation after a successful retest of the long-term ascending trendline. Price rejected near the lower boundary of the symmetrical triangle and showed bullish momentum right off that support. My structure suggests potential upside targets at 2.25559 (minor resistance) and 2.26854 (upper triangle boundary/major resistance zone).

🔍 Fundamental Context:

🇬🇧 GBP Fundamentals:

UK CPI came in softer than expected, and BoE rate cuts are slowly being priced in for late 2025.

However, BoE still sounds relatively hawkish compared to RBNZ due to inflation persistence in services.

Strong UK wage growth and sticky inflation give GBP some near-term yield support.

🇳🇿 NZD Fundamentals:

RBNZ remains on hold, but dovish tilt noted in recent communications.

NZD under pressure from falling dairy prices and weak global growth sentiment (especially China).

Risk-off flows and Fed hawkishness keep NZD vulnerable as a high-beta currency.

⚠️ Risks to the Setup:

A surprise hawkish turn from RBNZ or better-than-expected NZ data could boost NZD.

Renewed UK political instability or weak retail sales data may pressure GBP.

Broader market risk sentiment — NZD may strengthen if risk-on returns and US yields drop.

🗓️ Key News/Events to Monitor:

UK Retail Sales (July 25)

RBNZ Governor Orr Speech (if scheduled)

US PCE (for global risk impact)

Chinese macro data (indirect NZD driver)

🔁 Leader/Lagger Perspective:

GBPNZD often leads EURNZD during GBP-specific catalysts (BoE speeches, UK CPI).

It lags NZDUSD and NZDCAD when risk sentiment or commodity cycles dominate.

📌 Summary: Bias and Watchpoints

I'm bullish on GBPNZD in the short term, especially after a strong trendline retest and recovery off the 2.2450 zone. Fundamentals support GBP resilience over NZD due to relatively hawkish BoE stance and weaker New Zealand data. The main risk to this setup would be a dovish BoE surprise or strong NZ commodity-led rebound. I'll be watching UK Retail Sales and general risk sentiment closely. This pair can act as a leader during UK-specific news but becomes a lagger when risk flows dominate broader NZD direction.

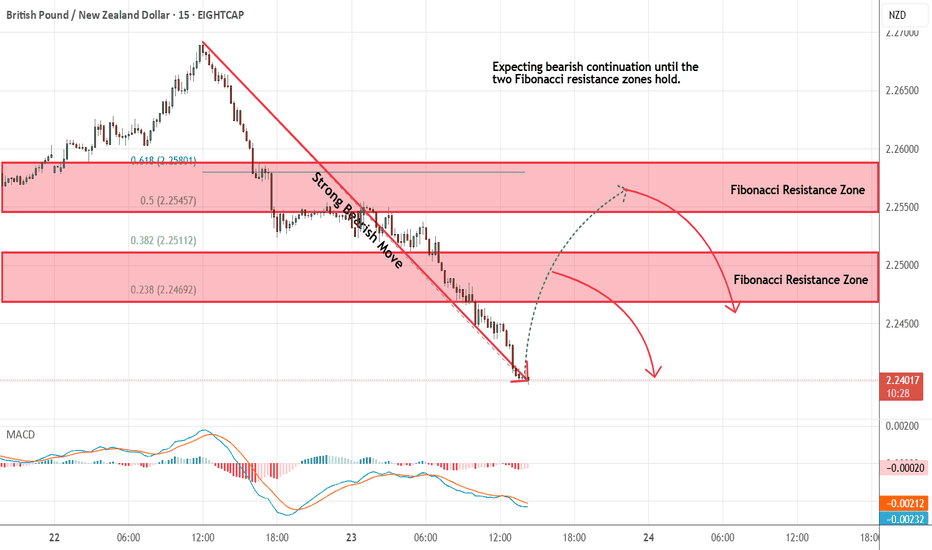

GBPNZD - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-----------------------------------------------------------------------------------------------------

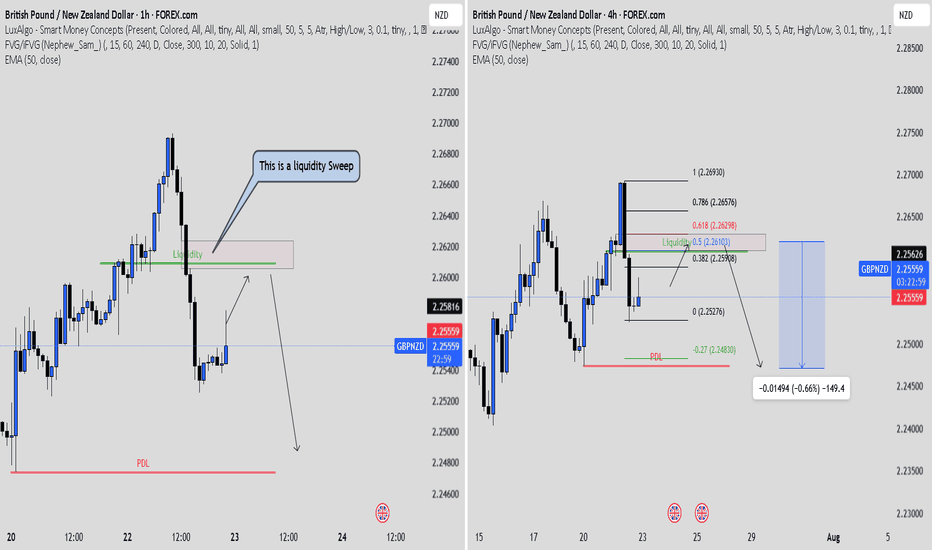

The Layout tool that Changed the Game for MeTradingView’s layout tool has really helped me stay focused. Using the 1-hour on the left and the 4-hour on the right gave me clarity. The 1H showed many Fair Value Gaps, but it was hard to know which one to trust.

The 4H chart made it easier. It showed one clean FVG lining up with the 50 to 61.8 Fib zone. That is the area I will wait for.

If price returns to that zone and I see a clear bearish confirmation candle, I will take the trade with confidence.

This layout tool has improved my analysis. I will make a short video soon to show how I use it. Big thanks to TradingView for building tools that make trading simpler and smarter.

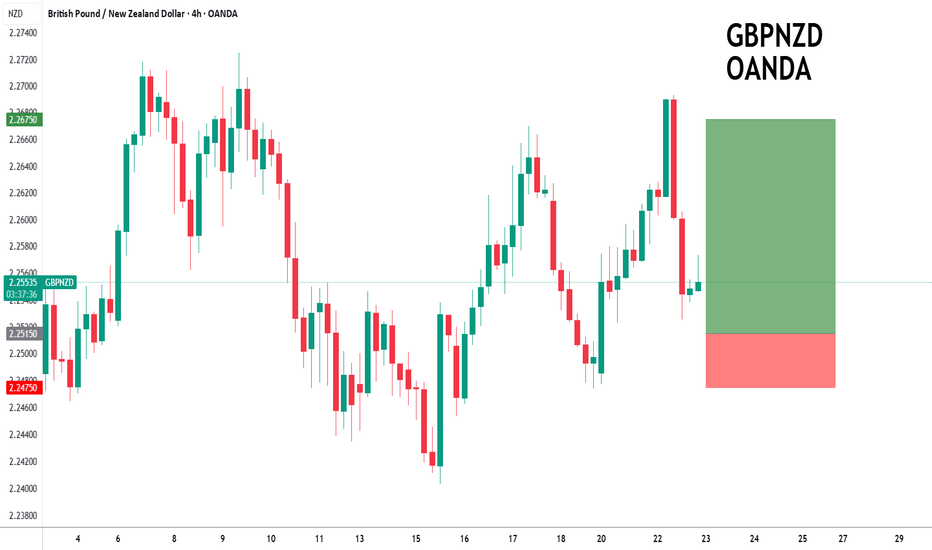

GBPNZD to form a higher low?GBPNZD - 24H expiry

The medium term bias remains bullish.

Price action looks to be forming a bottom.

Preferred trade is to buy on dips.

Bespoke support is located at 2.2515.

Risk/Reward would be poor to call a buy from current levels.

We look to Buy at 2.2515 (stop at 2.2475)

Our profit targets will be 2.2675 and 2.2710

Resistance: 2.2660 / 2.2720 / 2.2770

Support: 2.2510 / 2.2420 / 2.2375

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

GBP_NZD LOCAL SHORT|

✅GBP_NZD made a retest of the

Local horizontal resistance level of 2.2580

And as you can see the pair is already

Making a local pullback from

The level which sends a clear

Bearish signal to us therefore

We will be expecting a

Further bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.