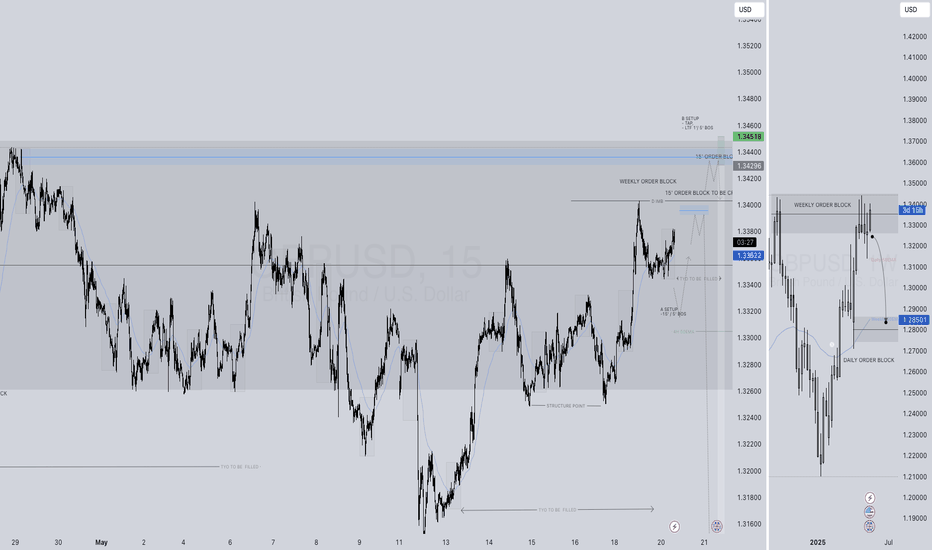

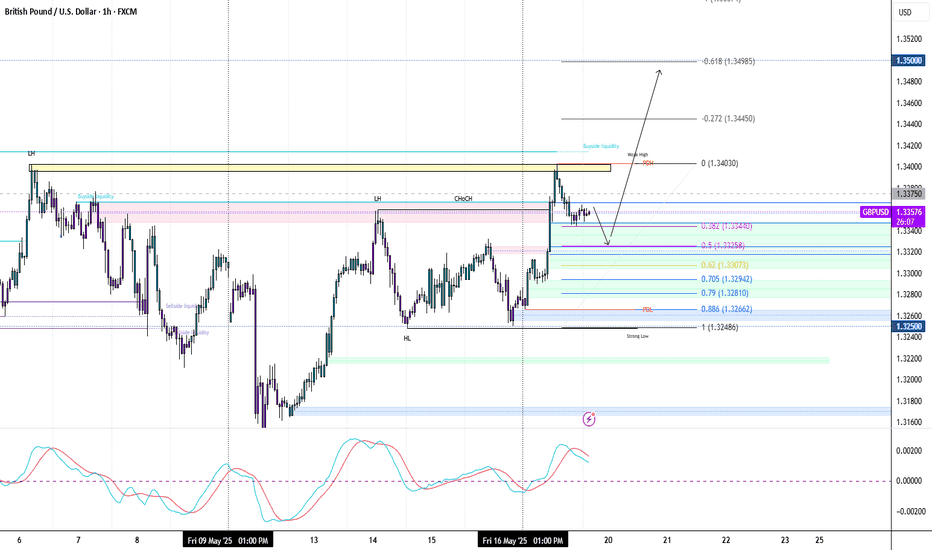

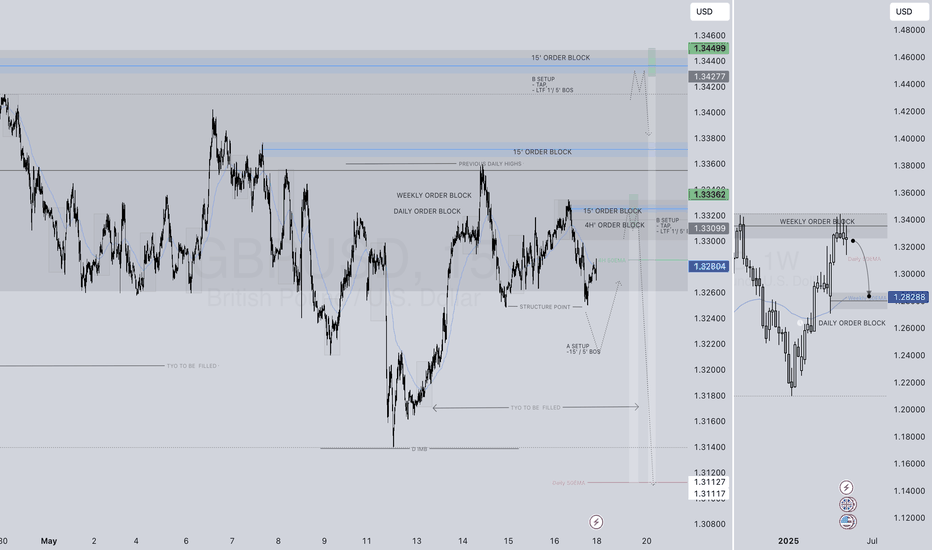

GBPUSD SHORT FORECAST Q2 W21 D20 Y25GBPUSD SHORT FORECAST Q2 W21 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPUSD

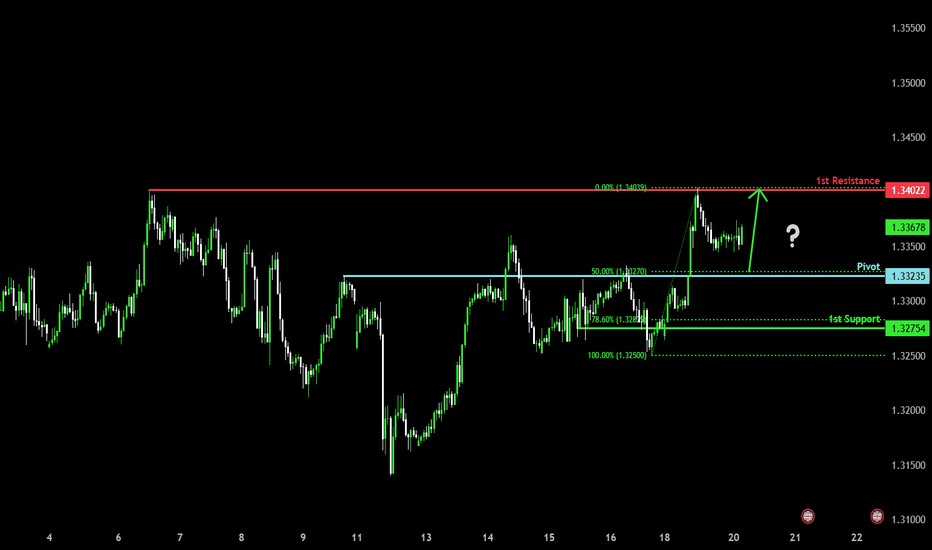

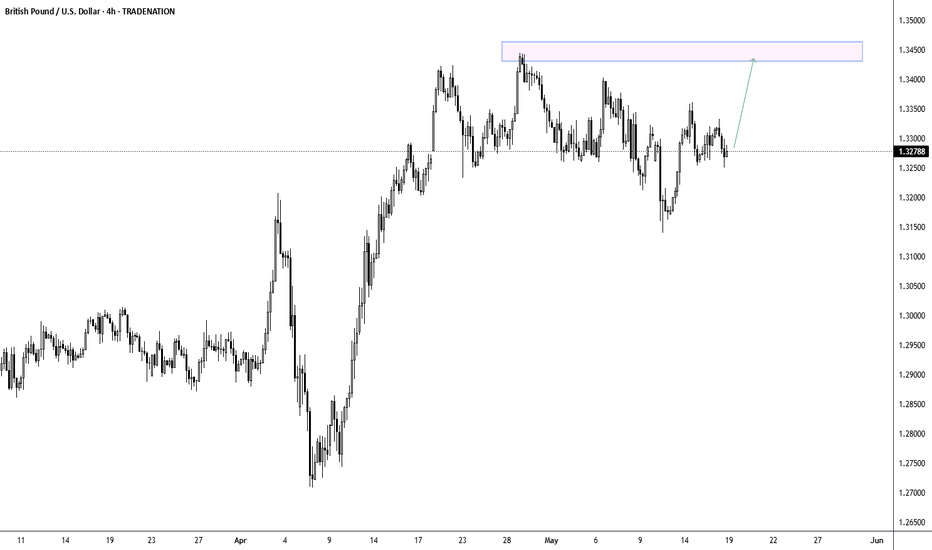

Bullish bounce for the Cable?The price is falling towards the pivot which is a pullback support and could bounce to the 1st resistance.

Pivot: 1.3323

1st Support: 1.3275

1st Resistance: 1.3402

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

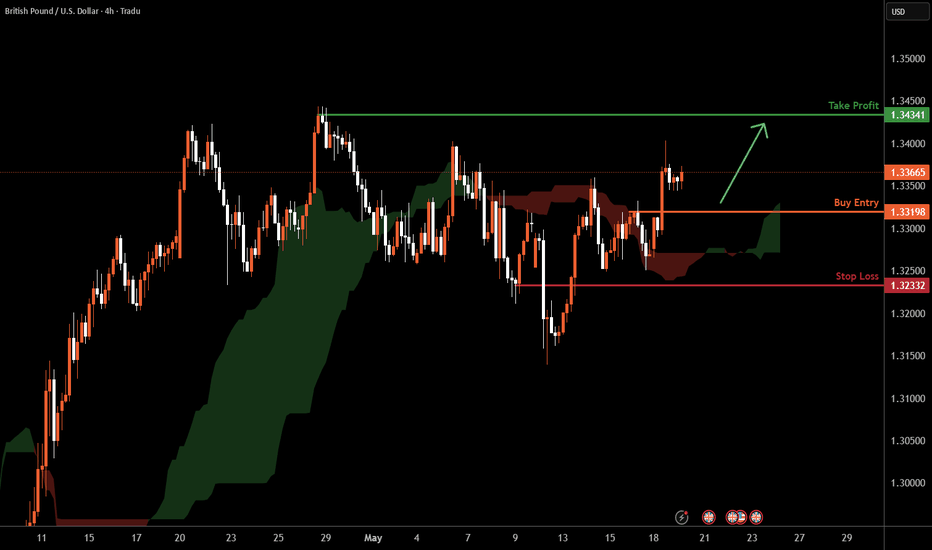

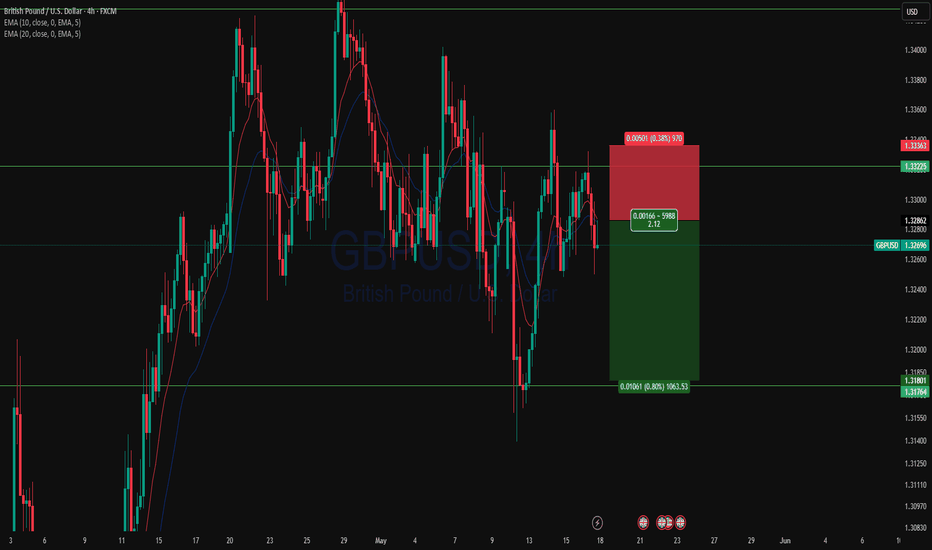

GBPUSD H4 I Bullish Bounce Based on the H4 chart analysis, the price is falling toward our buy entry level at 1.3319, a pullback support.

Our take profit is set at 1.3434, a swing high resistance.

The stop loss is placed at 1.3233, a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GBPUSD: Bulls Are Gearing Up For The Next RallyBullish Confirmations:

- Double bottom formed at QP at end of last week

- Creating HLs and HHs

- Bullish Choch

- Multiple bullish FVGs (showing bullish momentum)

- Multiple bullish breaker blocks

🟢ENTRY 1.33578

SL 1.331

TP1 1.33778

TP2 1.34078

TP3 1.34578

There's a chance we may get a deeper pullback. If so no big deal, we'll just catch a better entry.

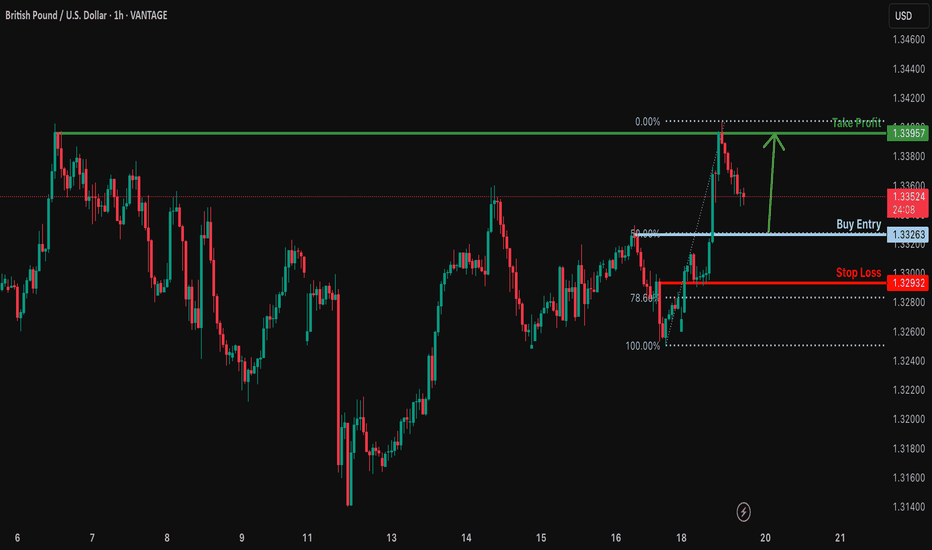

Bullish bounce off 50% Fibonacci support?GBP/USD is falling towards the support level which is a pullback support that lines up with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.3326

Why we like it:

There is a pullback support level that lines up with the 50% Fibonacci retracement.

Stop loss: 1.3293

Why we like it:

There is an overlap support level that is slightly above the 78.6% Fibonacci retracement.

Take profit: 1.3395

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

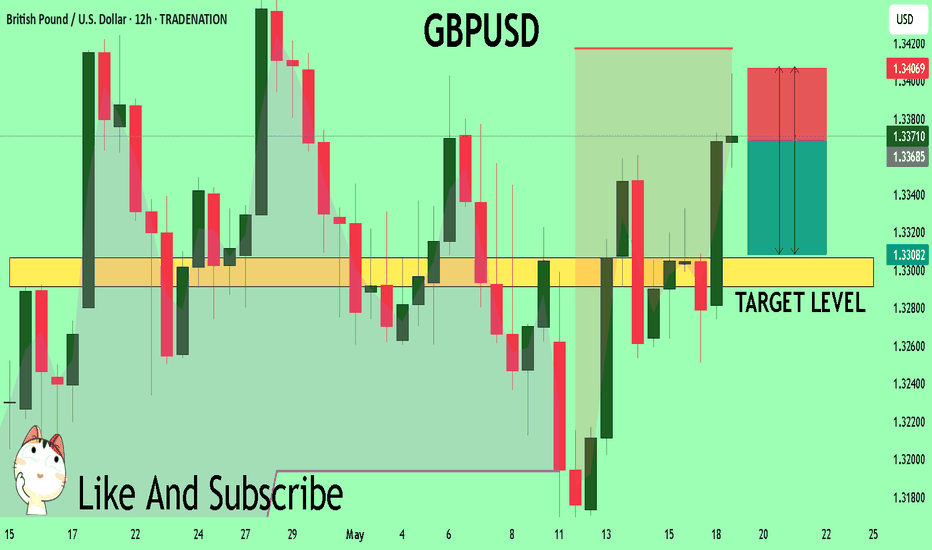

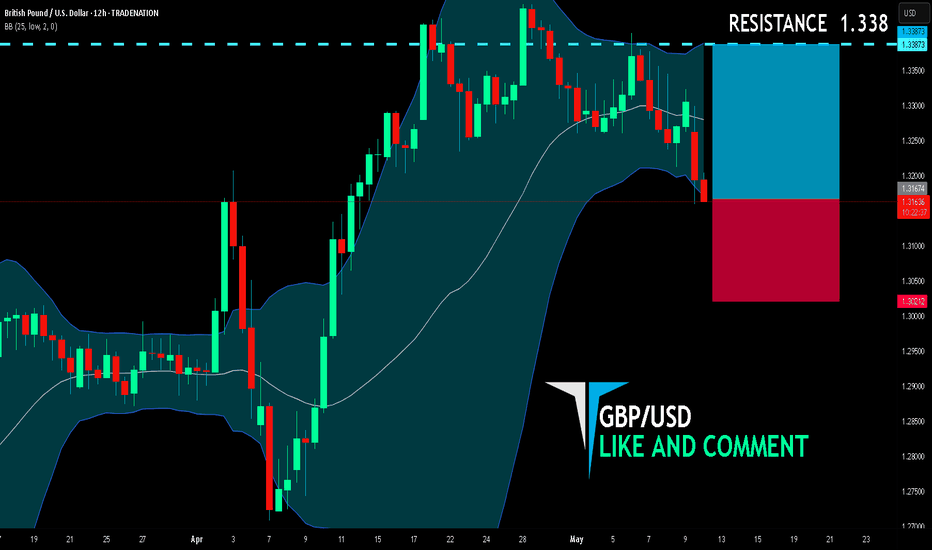

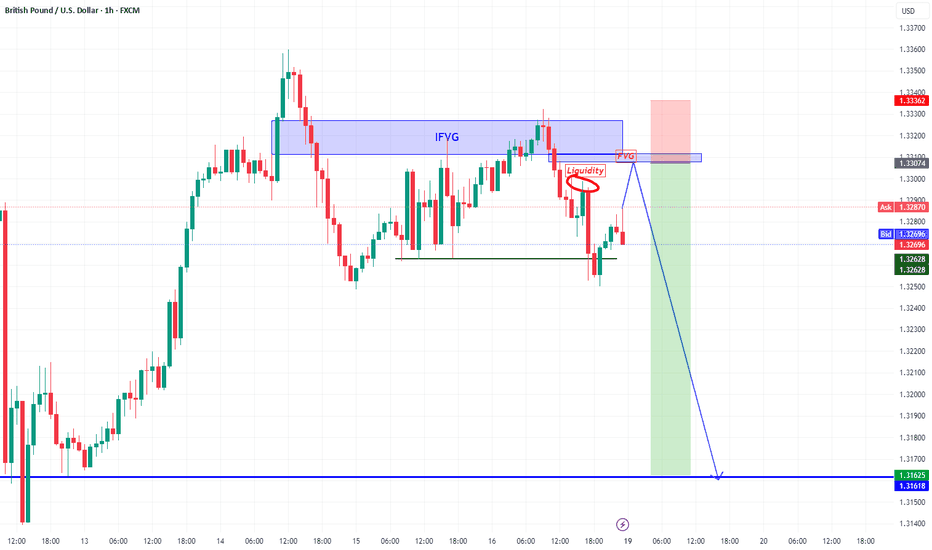

GBPUSD Buyers In Panic! SELL!

My dear friends,

My technical analysis for GBPUSD is below:

The market is trading on 1.3368 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.3306

Recommended Stop Loss - 1.3406

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

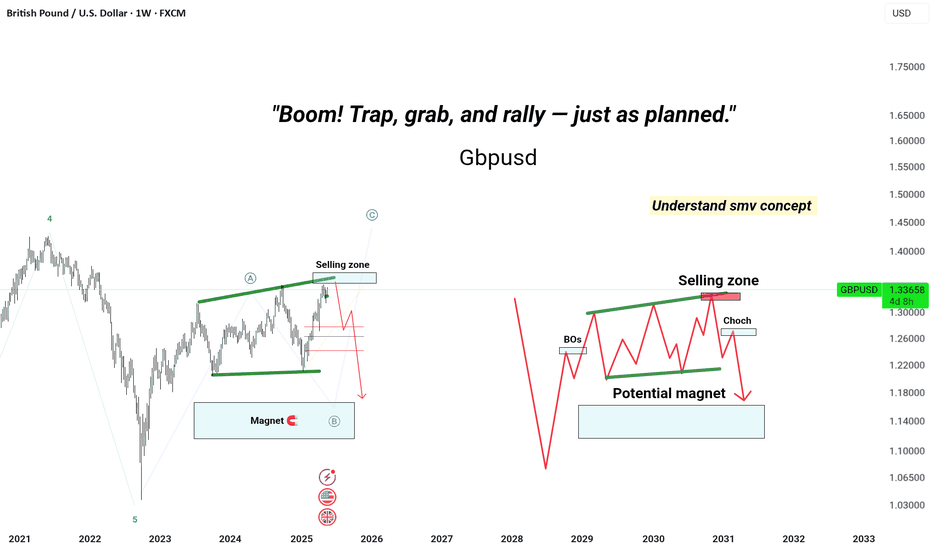

7. "Boom! Trap, grab, and rally — just as planned."

**"She walked right into the selling zone like she owned the chart.

But baby, this ain’t a fairy tale — this is Elliott Wave.

Wave C? Dead on arrival.

CHOCH triggered? Game on.

Retail's still dreaming of 1.40 —

We're already targeting the magnet zone with sniper precision.

She teased the breakout, we caught the fakeout.

This ain't luck. It's strategy wrapped in savage.

Trade less. Win more.

Stay sexy, stay sharp."**

GBPUSD Will Move Lower! Sell!

Please, check our technical outlook for GBPUSD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 1.338.

Considering the today's price action, probabilities will be high to see a movement to 1.331.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBP/USD BUYERS WILL DOMINATE THE MARKET|LONG

GBP/USD SIGNAL

Trade Direction: long

Entry Level: 1.316

Target Level: 1.338

Stop Loss: 1.302

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPUSD and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

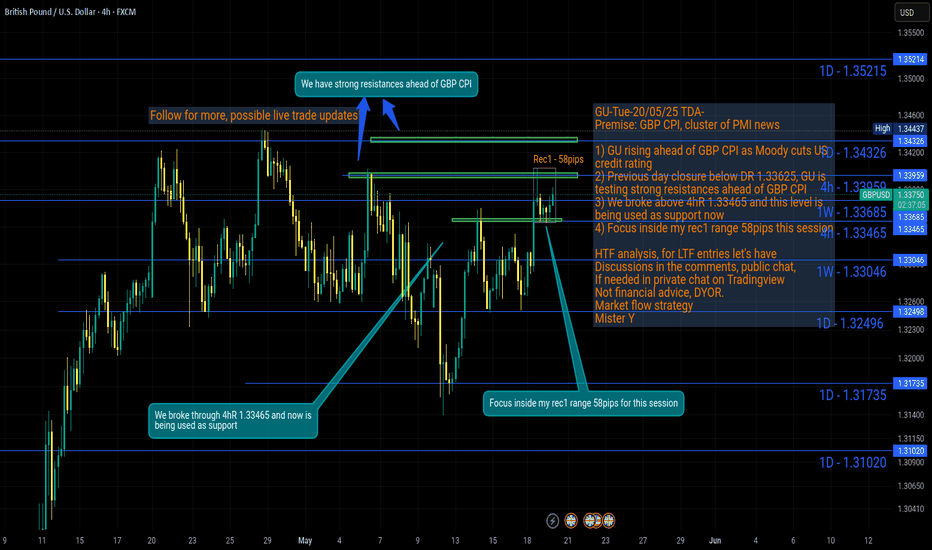

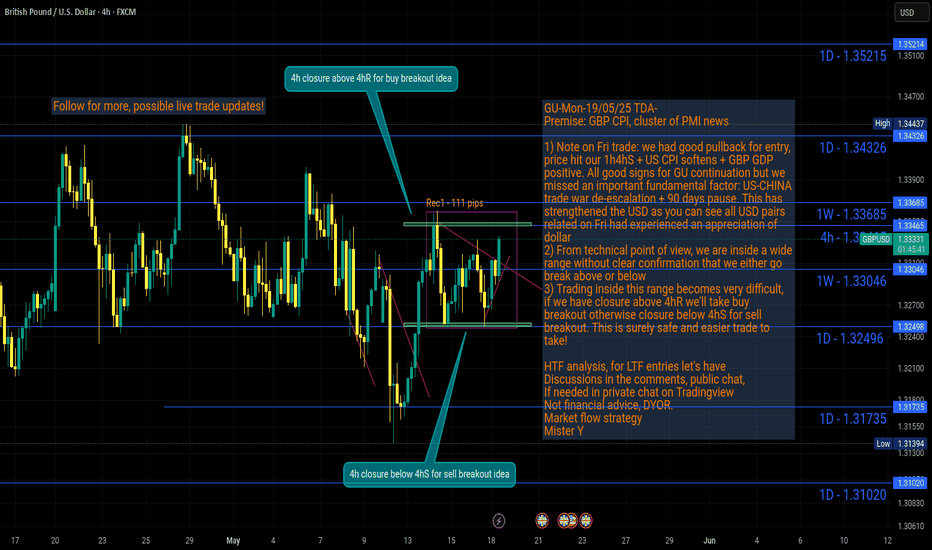

GU-Mon-19/05/25 TDA-Closure above for buy and below for sell!Analysis done directly on the chart

Follow for more, possible live updates!

Before trade analysis

During trade analysis

After trade analysis

All important steps to fully understand

technically and fundamentally why price

moved this, that way.

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

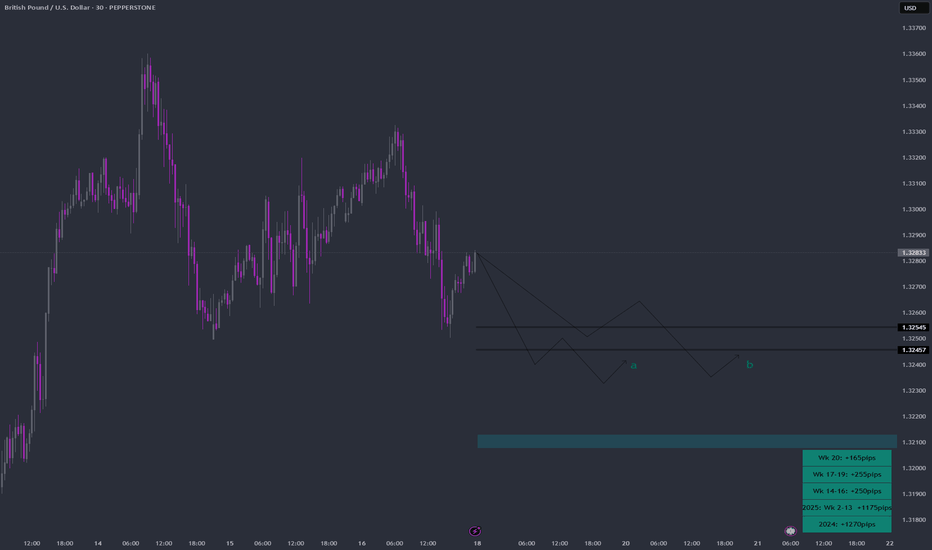

GBP/USD - Triangle Breakout (16.05.2025)The GBP/USD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 1.3389

2nd Resistance – 1.3441

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

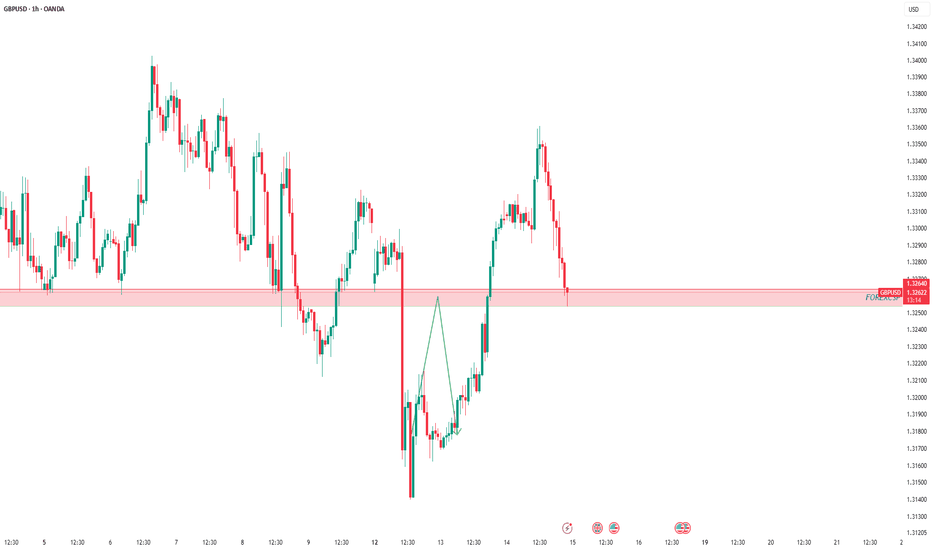

GBPUSD pullbackOANDA:GBPUSD

As shown in our pinned analysis, this level was previously considered for a short trade. But after being broken, according to our plan, it has now turned into a buy zone.

We are ready to enter a long position,

but if the price drops below and holds, this level will lose its validity and the analysis will be invalid.

Follow us for more trades analysis!

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

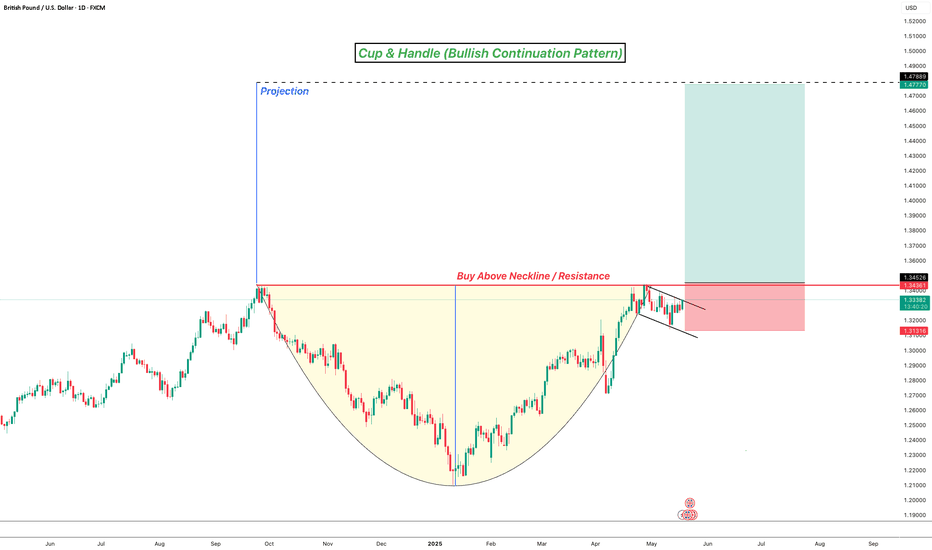

Cup & Handle - Bullish Continuation PatternFX:GBPUSD continues its bullish trend, printing higher highs and higher lows. Currently price has formed a Cup & Handle pattern signalling potential bullish continuation!

Following the analysis, buys should only be triggered once neckline / resistance has been broken!

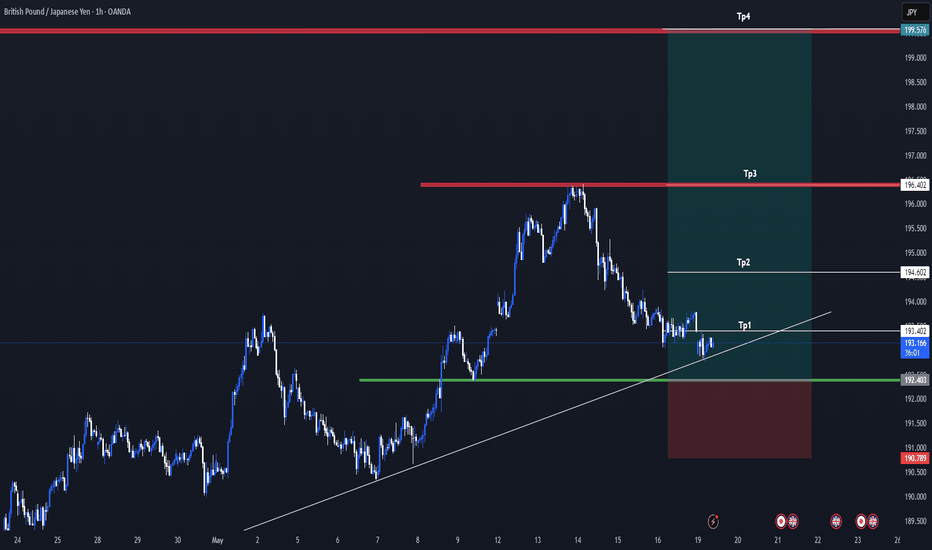

GBPJPY Signal : 1H / 4H Beautiful buy !!!Hello Traders! 👋

What are your thoughts on GBPJPY ?

Symbol : GBPJPY H1

Market price : 193.20

BUY limit : 192.40 - 192.00

Tp1 :193.40

Tp2 : 194.60

Tp3 : 196.40

Tp4 : 199.60

Sl : 190.80

Don’t forget to like and share your thoughts in the comments! ❤️

Remember this is a position that was found by me and it is a personal idea not a financial advice, you are responsible for your loss and gain.

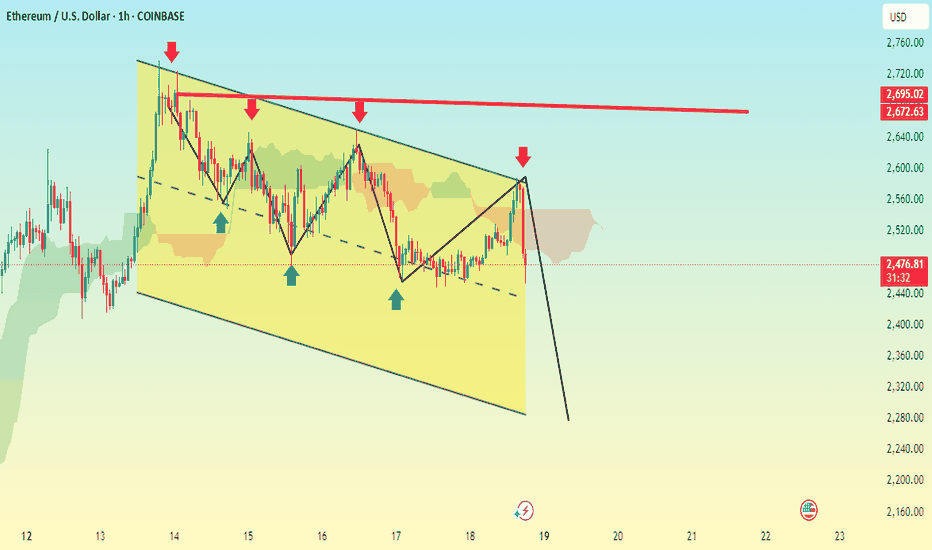

ETHEREUM BEARISH ZONEBased on the chart we provided, which shows a descending channel and a bearish pattern on Ethereum (ETH/USD) on the 1-hour timeframe, it seems like you're anticipating a breakdown from the channel support. The chart also shows a projected drop with a strong bearish move marked by a thick black arrow.

Here are some potential Take Profit (TP) levels based on technical support zones and the chart structure:

Suggested Sell TPs (short position):

1. TP1: $2,420 — Just above the recent swing low, potential initial support.

2. TP2: $2,360 — Mid-range of the previous low and psychological level.

3. TP3: $2,300 — Near the bottom of the descending channel and a likely target if breakdown confirms.

4. TP4: $2,240–$2,200 — Extended TP if momentum is strong and the broader market supports the move.

Always remember:

Use proper risk management.

Monitor volume and market sentiment around the breakout.

Consider setting a stop loss just above the recent swing high (around $2,565–$2,580).

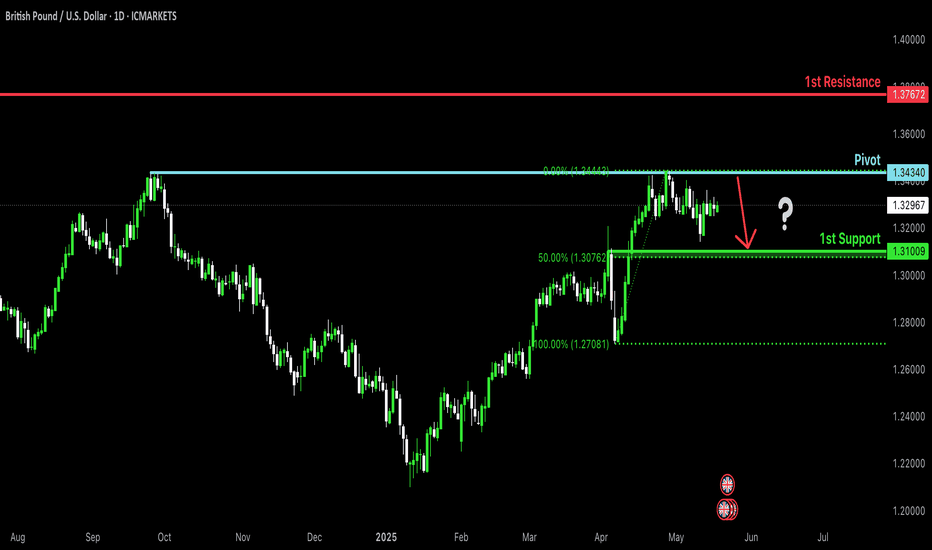

Bearish reversal off pullback resistance?The Cable (GBP/USD) is rising towards the pivot which is a pullback resistance and could reverse to the 1st support which acts as a pullback support.

Pivot: 1.3434

1st Support: 1.3100

1st Resistance: 1.3767

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBPUSD inverted head and shoulder?Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPUSD - Double Top Formation in Focus?The GBP/USD pair is currently trading at 1.3278, showing signs of consolidation within a well-established range after recovering from the early April lows near 1.2700. Price action over the past month has created a series of higher lows while repeatedly testing resistance in the 1.3400-1.3450 zone highlighted by the light blue rectangle. The higher probability scenario suggests that cable is likely to make another push toward this critical resistance area, potentially forming a double top with the early May peak around 1.3450. This technical formation would be significant for traders, as a successful breakout above this double top structure could trigger a substantial bullish move, while rejection might lead to a deeper correction. However, the current market structure and momentum favor an eventual upside resolution, with the green arrow indicating a potential target above 1.3450 if buyers can muster sufficient strength to overcome this formidable resistance level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DON'T MISS OUT ON GBPUSD SHORTS IN W21 OF Q2 Y25GBPUSD SHORT FORECAST Q2 W21 Y25

DON'T MISS OUT ON GBPUSD SHORTS IN W21 OF Q2 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPUSD Week 21 Swing Zone/LevelsNot Always.

Not always will price conform to hypothesis, but in following good RRR success is assured.

We setup week 21 levels and zone as shown with the predicted pathways.

Trade Parameters: Entry on 5 mins chart

Sl 10-15pips

TP usually dynamic but typically 5x

Follow on for trade updates.

As Always PRICE determines trades