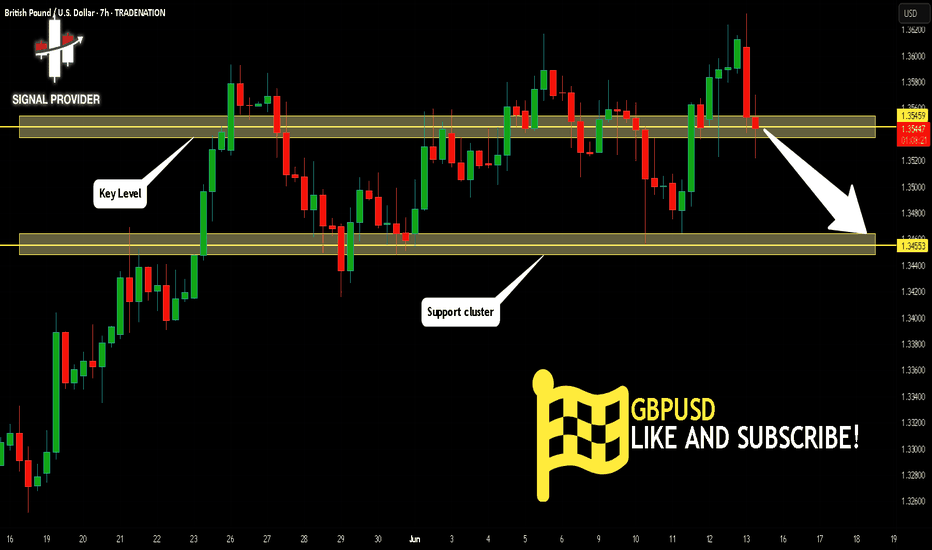

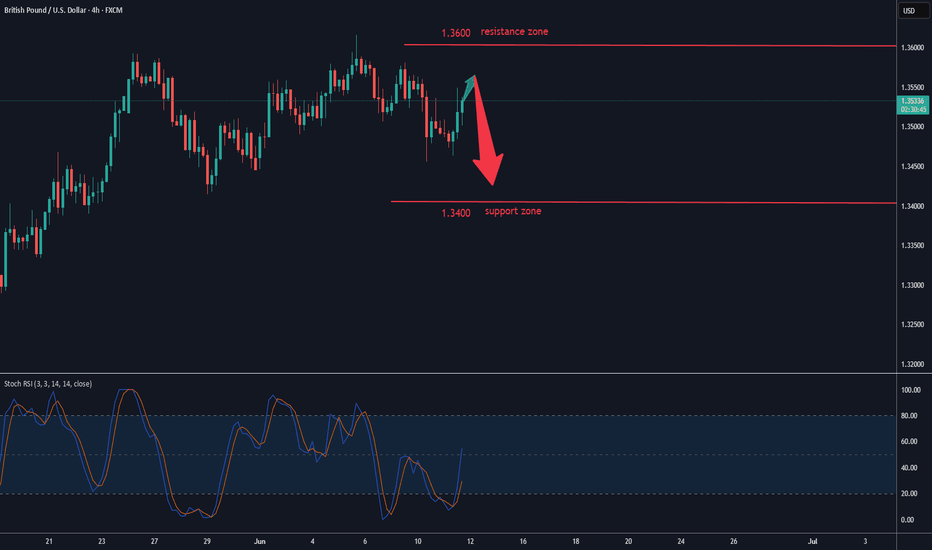

GBPUSD Is Going Down! Sell!

Please, check our technical outlook for GBPUSD.

Time Frame: 7h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 1.354.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 1.345 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPUSD

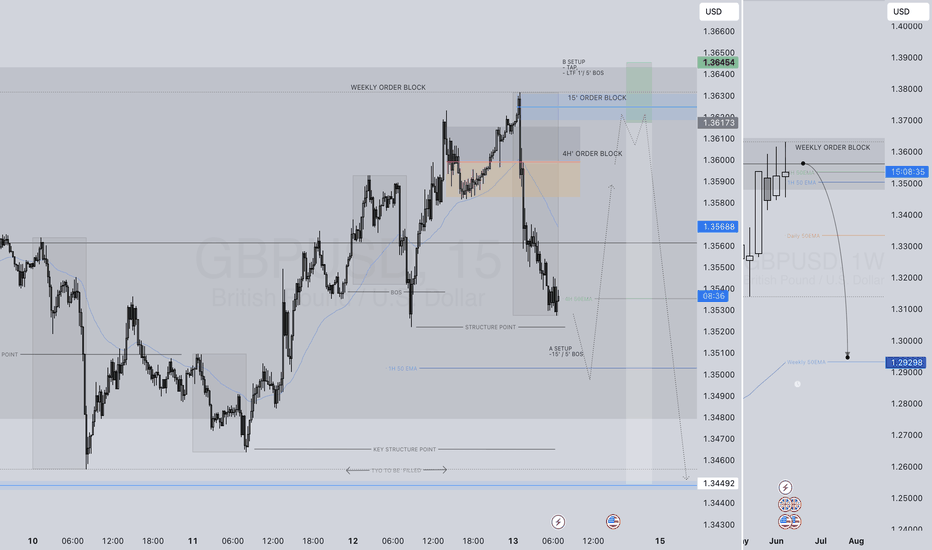

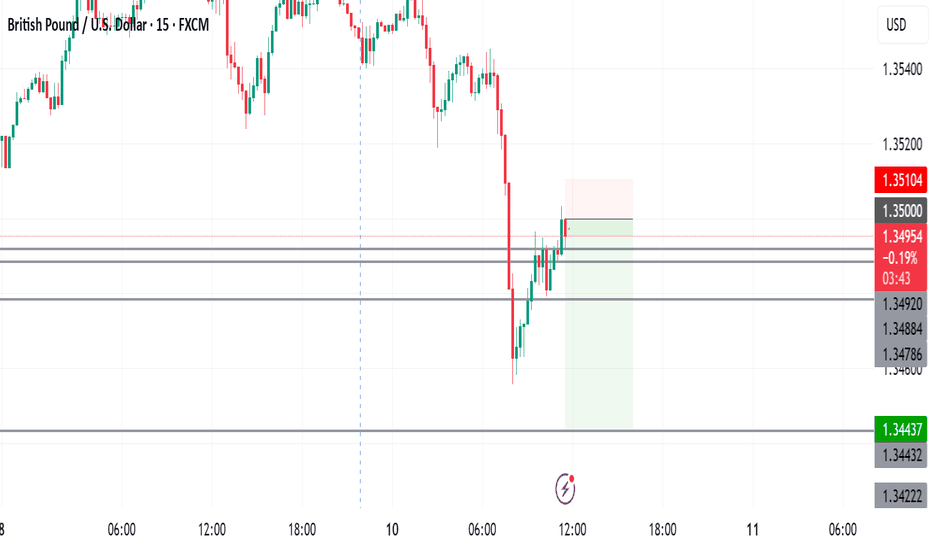

GBPUSD SHORT FORECAST Q2 W24 D13 Y25GBPUSD SHORT FORECAST Q2 W24 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block

✅15' order block

✅Intraday 15' break of structure

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

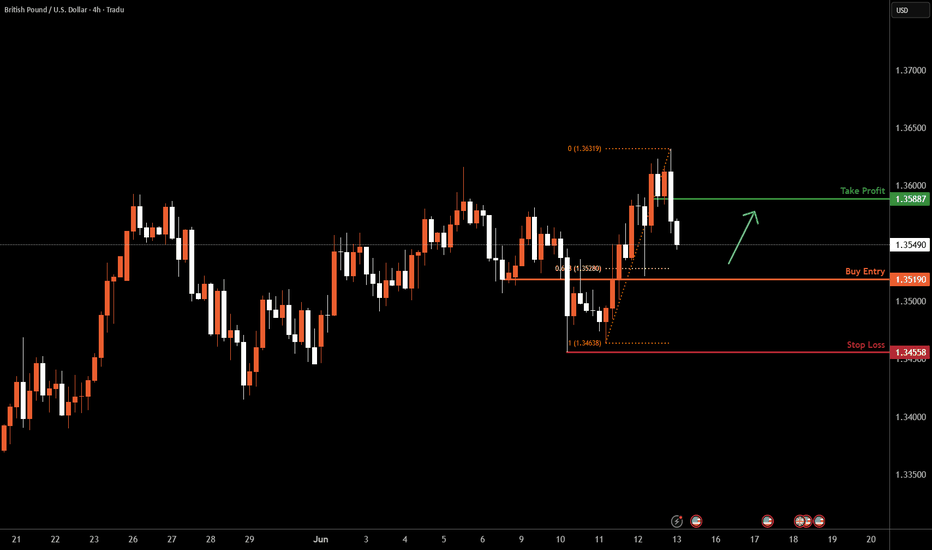

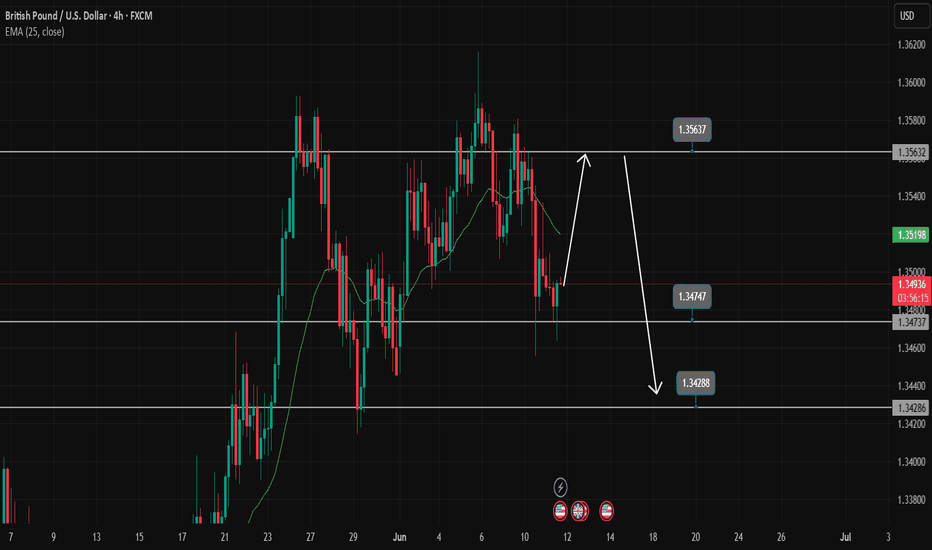

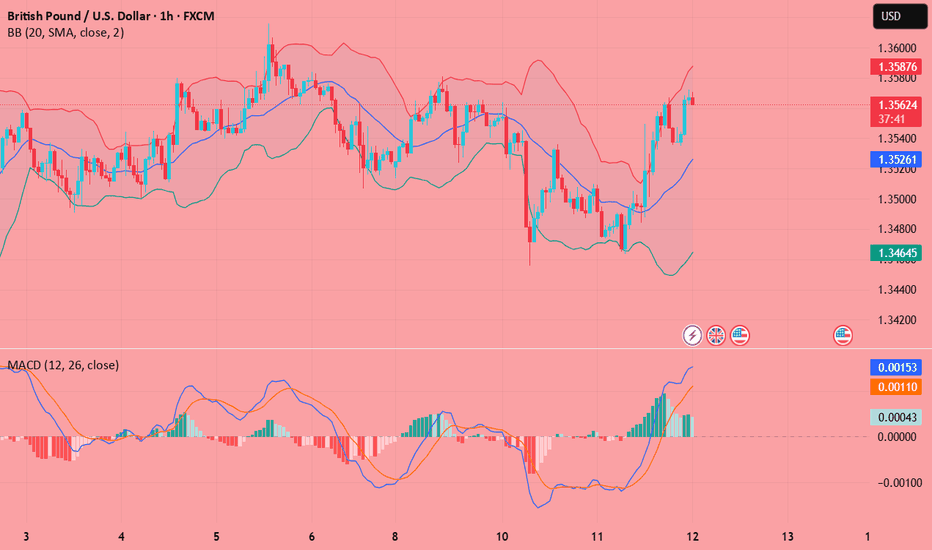

GBPUSD H4 I Bullish Bounce OffBased on the H4 chart analysis, we can see that the price is falling toward our buy entry at 1.3519, which is a pullback support that aligns closely with the 61.8% Fibo retracement.

Our take profit will be at 1.3588, which is a pullback resistance level.

The stop loss will be placed at 1.3455, a swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

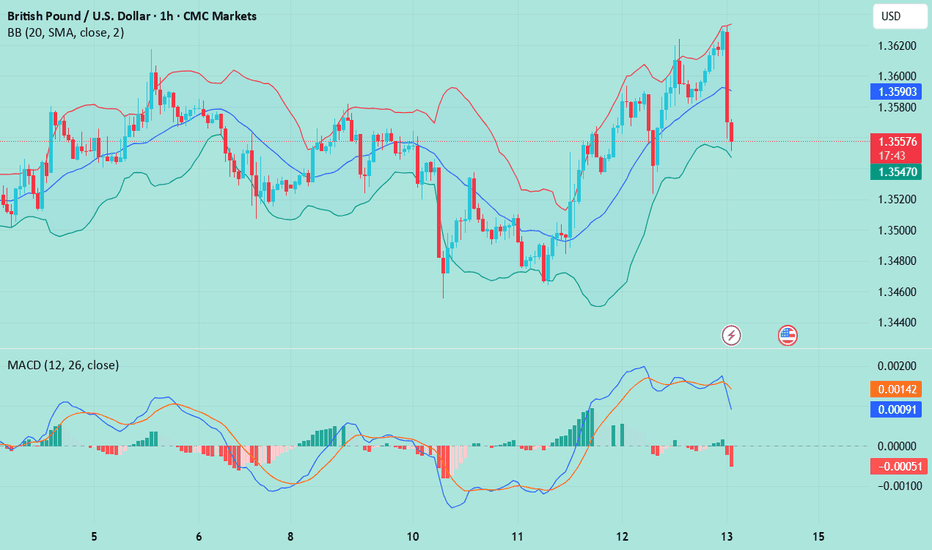

GBPUSD(20250613)Today's AnalysisMarket news:

The number of initial jobless claims in the United States for the week ending June 7 was 248,000, higher than the expected 240,000, the highest since the week of October 5, 2024. The monthly rate of the core PPI in the United States in May was 0.1%, lower than the expected 0.30%. Traders once again fully priced in the Fed's two interest rate cuts this year.

Technical analysis:

Today's buying and selling boundaries:

1.3585

Support and resistance levels

1.3685

1.3648

1.3624

1.3547

1.3522

1.3485

Trading strategy:

If the price breaks through 1.3624, consider buying in, the first target price is 1.3648

If the price breaks through 1.3585, consider selling in, the first target price is 1.3547

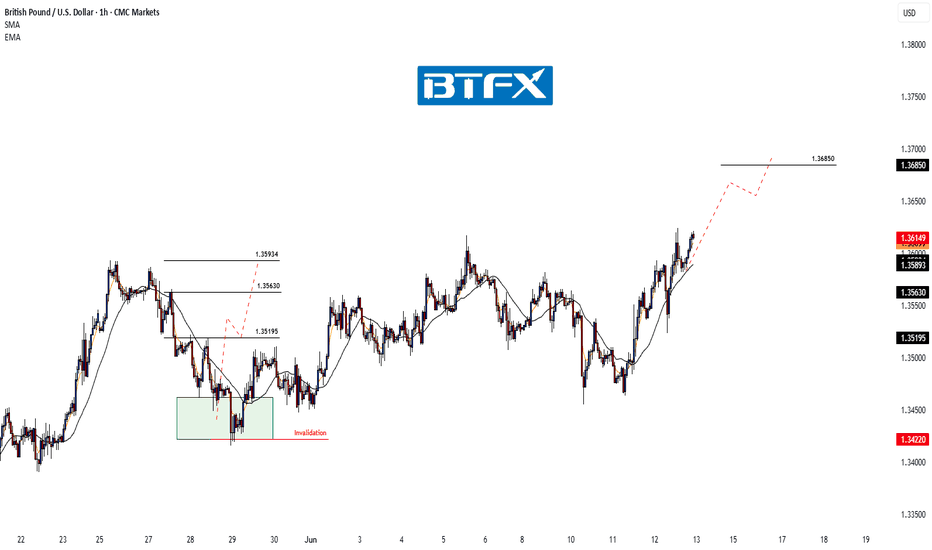

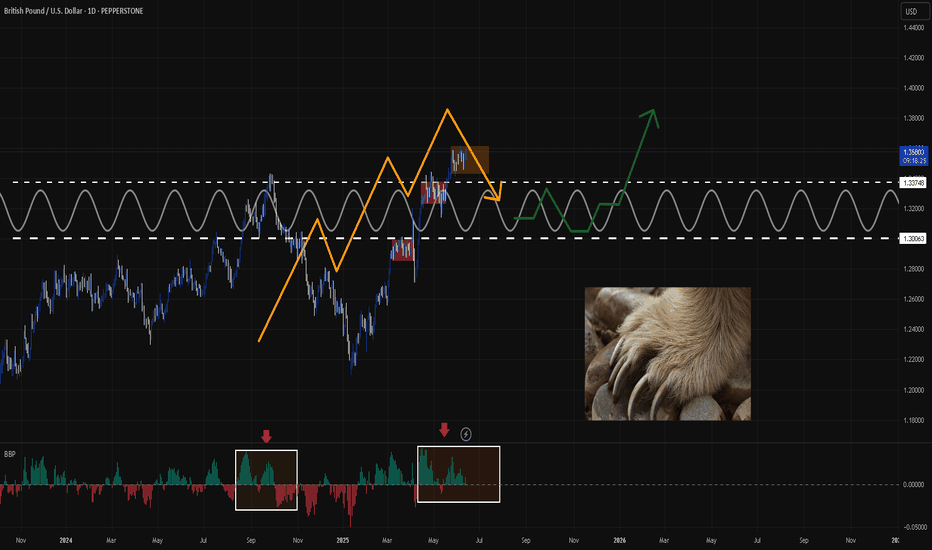

GBP/USD Rally Resumes – Bullish Targets AheadHi everyone,

As outlined in our previous GBP/USD analysis (idea linked below), the Cable confirmed its continued rally following a decisive break above the 1.35195 level. This was quickly followed by a move through our highlighted levels at 1.35630 and 1.35934.

As previously noted, the clearance of these levels strengthens our expectation for further upside, with the next key level of interest around 1.36850. We'll be watching to see how price action develops from here.

We’ll continue to provide updates on the projected path for GBP/USD as price approaches this target.

The longer-term outlook remains bullish, and we expect the rally to continue extending further from the 1.20991 January low.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

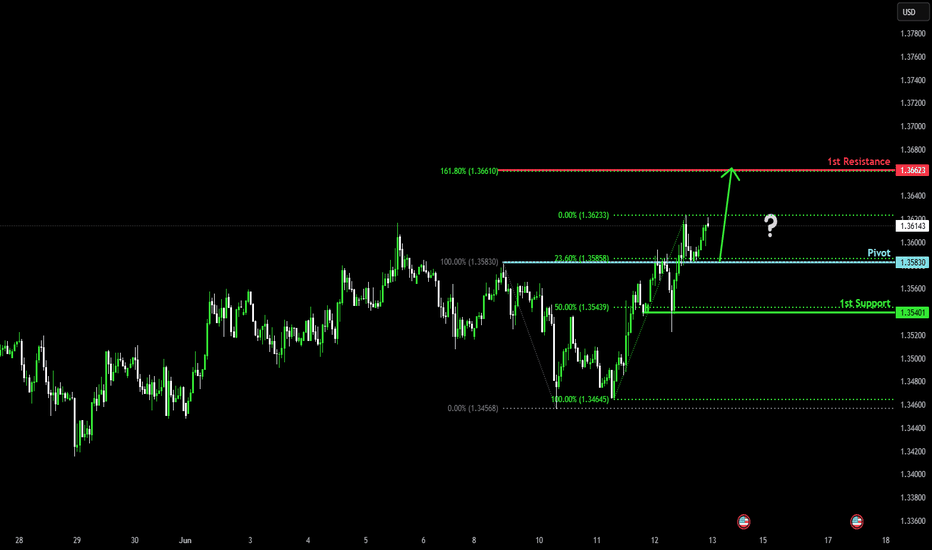

Potential bullish rise?The Cable (GBP/ISD) has bounced off the pivot and could rise to the 1st resistance.

Pivot: 1.3580

1st Support: 1.3540

1st Resistance: 1.3662

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

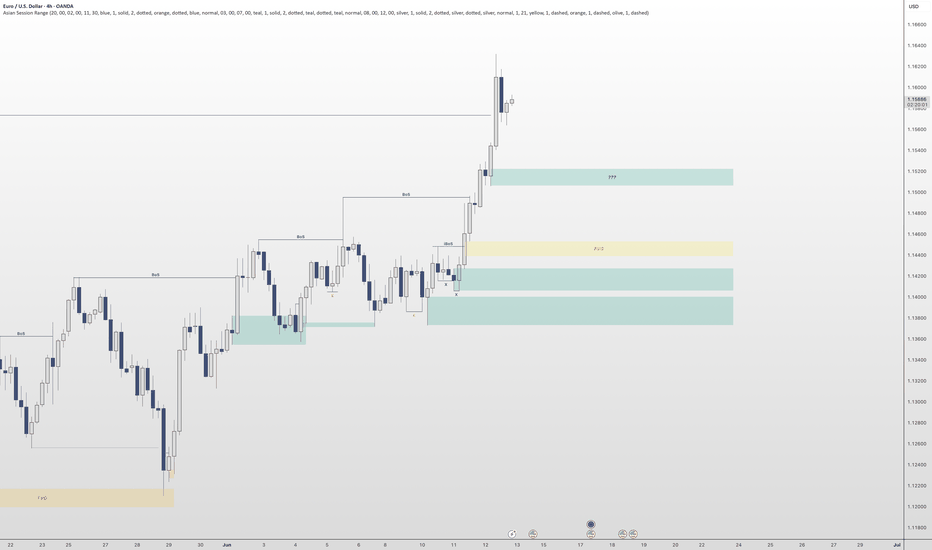

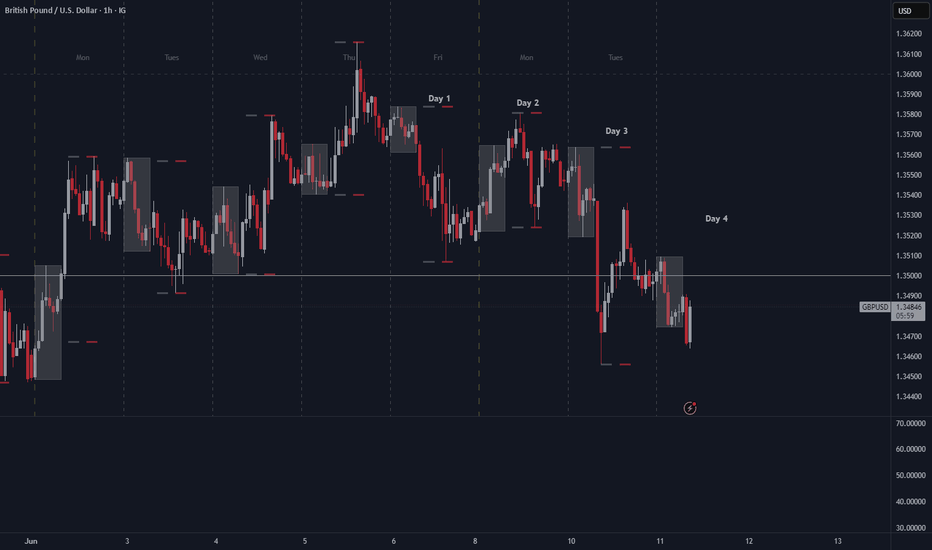

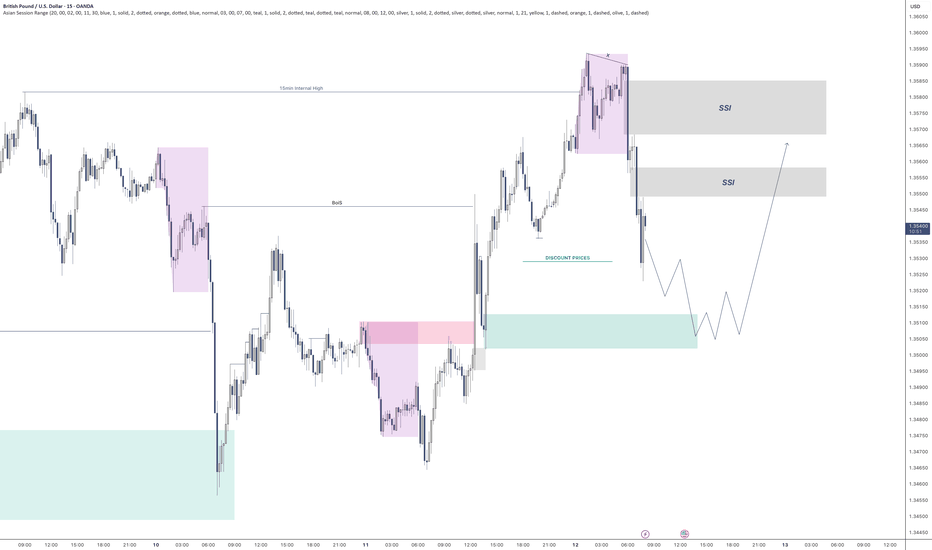

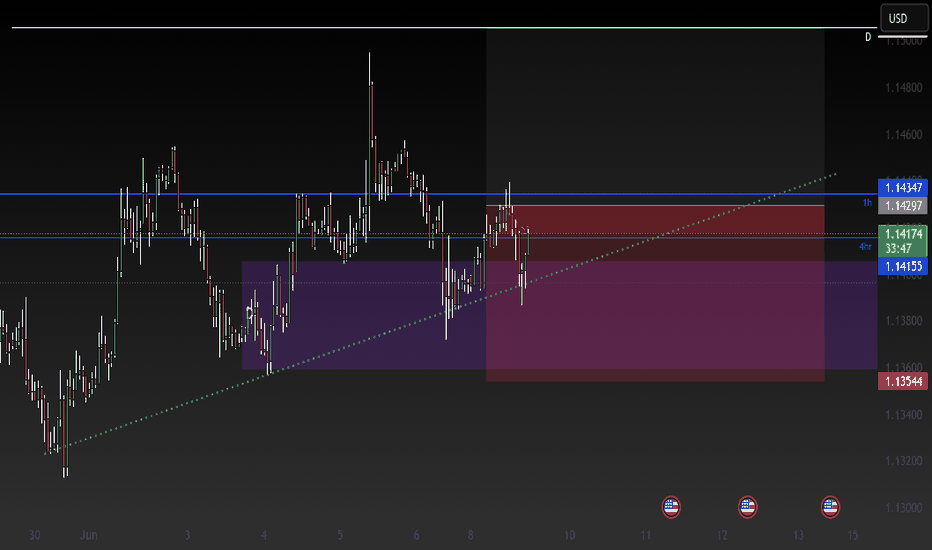

EURUSD, GBPUSD & EURGBP analysisHere's my outlook on the 3 pairs mentioned in the title. Looking for more upside momentum after we have some sort of pullback into the premium discount prices.

Once we get some15min bearish internal orderflow on the lower Time Frames I will look to enter short term sell positions before looking to take longer term buys on the way back up.

Again, if I can be of any assistance please do let me know and I will be happy to help where I can.

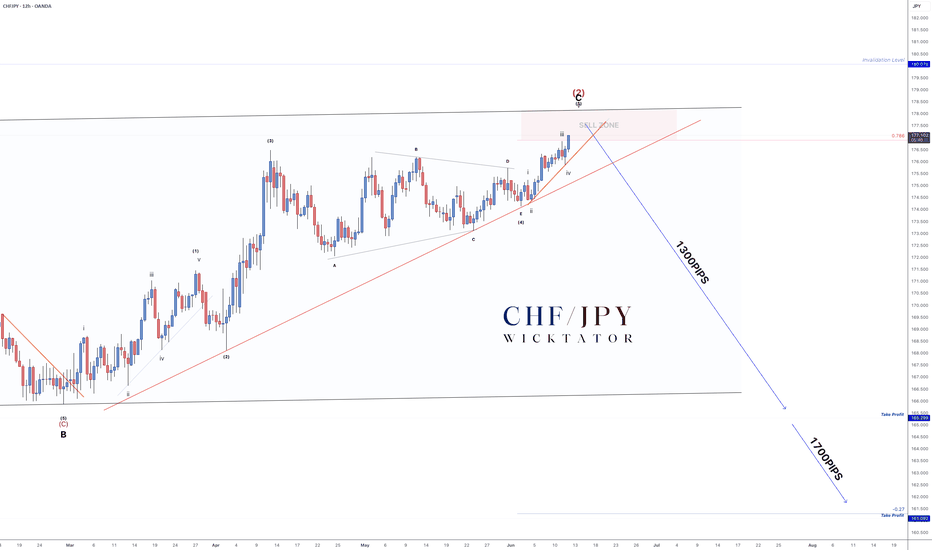

CHFJPY - How To Enter This MASSIVE 1700pip Swing Trade!As promised - here’s the lower timeframe breakdown after hitting 100+ likes.

We’re in wave 5, currently moving cleanly into the swing zone. Since wave 5 typically forms 5 subwaves, all we needed was to connect points 2 and 4 to draw our entry trendline.

Trade Idea:

- Entry on break of the orange trendline

- Stops above recent highs after entry

- Aggressive option: Enter inside the sell zone with stops above invalidation

Targets:

- TP1: 165.00 (≈1300 pips)

- TP2: 161.50 (≈1700 pips)

- Optional: Leave a runner for the longer swing move

Scroll down for the full 4H breakdown.

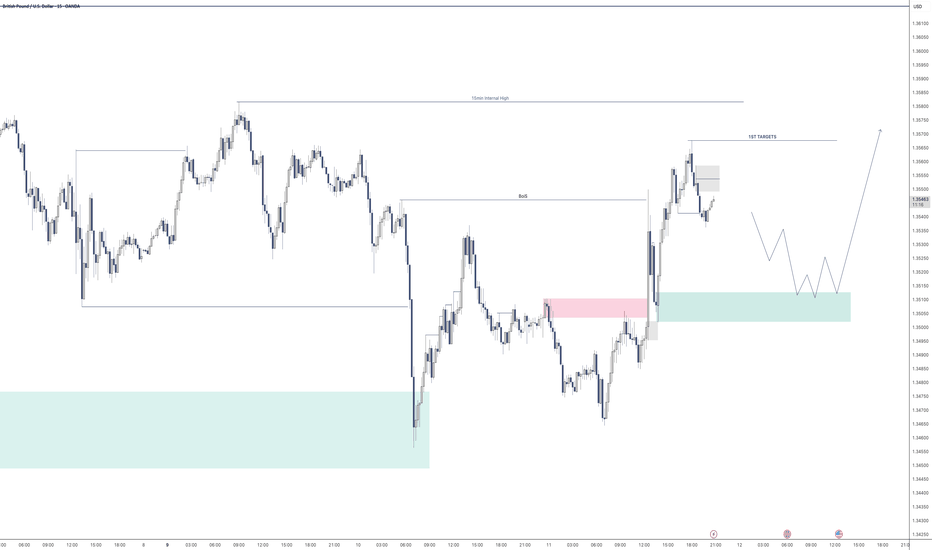

London Take 1 - GBPUSD - 12/6/2025SO this is what I see and anticipating ...more updates will follow.

PINK ZONE initially is ENTRY/KILL ZONE not entry and stoploss, screenshots after I am in the trade will update to atual short position with EP, SL & TP and my notes will elaborate.

News later at NY ...will be staying safe but looking to catch some pips

GBPUSD TECH.Hello everyone.

First of all, in this week, I feel so bearish :D

The market may seem very soon so bearish, if after we will have some downfall very soon...

I hope we will get in some profit situation, if the price will enter this "white break lined colored" channel... Because after that, the price may move many times there in that channel...

So, what we can wait in this situation is when the price will go down and starts making some sideways trend and will get horizontal trend...

Thank you!

Have a Profitable Day! ^^

GBPUSD is rising towards the resistance zone of 1.35600GBPUSD is heading towards 1.35600. If the gold price closes around this area, it confirms that the buyers have entered the market. You can set up a BUY signal now with SL placed below the candle wick. After touching 1.356, we can wait for the price reaction and set up a SELL signal again following the sideways border.

Do you agree with our view of buying 1.34900 and SL 1.34600?

Leave a comment

GBPUSD Bullish Flag breakout supported at 1.3500The GBP/USD currency pair maintains a bullish sentiment, supported by a rising trendline and sustained higher lows. The recent intraday price action suggests a corrective pullback within an overall uptrend, indicative of a consolidation phase rather than a reversal.

Key Support Level: 1.3500

This level aligns with a previous consolidation zone and is acting as a pivotal support. A pullback toward this level could offer a potential buying opportunity, especially if bullish momentum returns.

Upside Targets (on bullish continuation from 1.3500):

1.3610 – Initial resistance from prior swing high

1.3650 – Intermediate resistance level

1.3700 – Long-term target and potential top of the current bullish channel

Bearish Scenario (if 1.3500 fails):

A daily close below 1.3500 would invalidate the current bullish setup, signaling a potential shift in trend. In that case:

Immediate support at 1.3480

Deeper retracement could extend to 1.3450

Conclusion

The broader trend in GBP/USD remains bullish, with the current consolidation viewed as a potential pullback rather than a reversal. The 1.3500 level is critical — a bounce from here could resume the uptrend toward 1.3610 over time. However, a break and close below 1.3500 would weaken the bullish case and open the door to further downside. Traders should monitor price action closely around this key level for confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPUSD - Long after a structural shiftBased off of yesterdays analysis.

We can see we are fast approaching a very nice POI.

Will post below my mark up chart from yesterday so you can see below. Will now be sending most of my day on the 15min TF waiting for our structural shift to the upside.

Let's see how price plays out today.

Don't just dive into the trade. Wait for your structural shift first.

If I can offer any help please do let me know

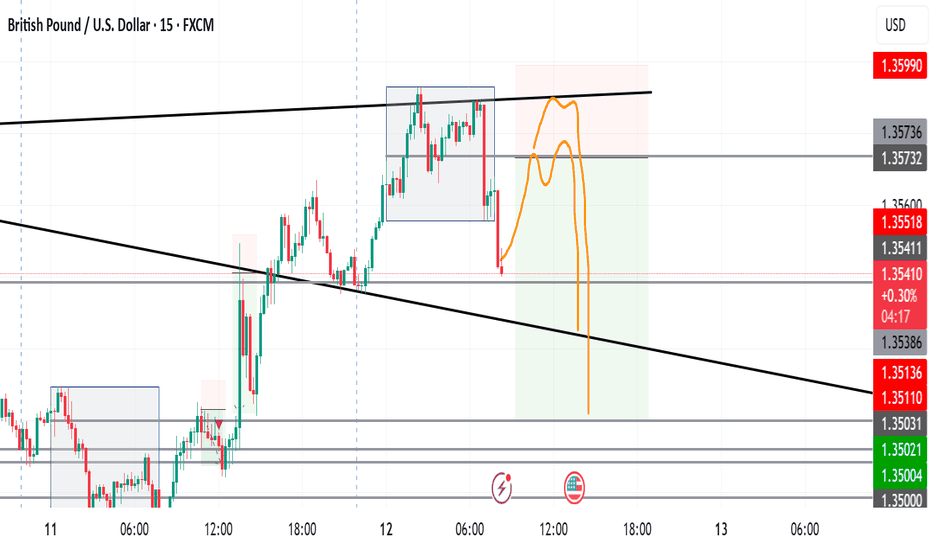

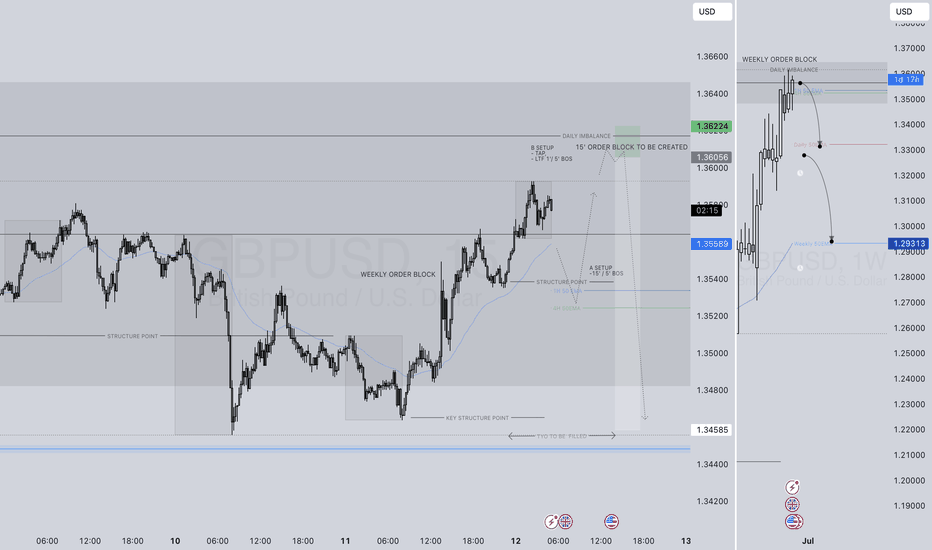

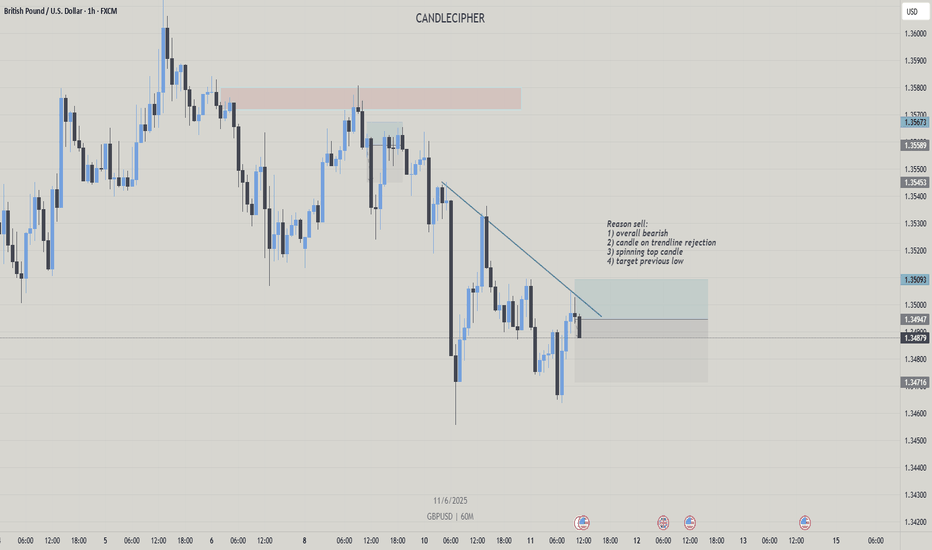

GBPUSD SHORT FORECAST Q2 W24 D12 Y25GBPUSD SHORT FORECAST Q2 W24 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block

✅15' order block

✅Intraday 15' break of structure

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

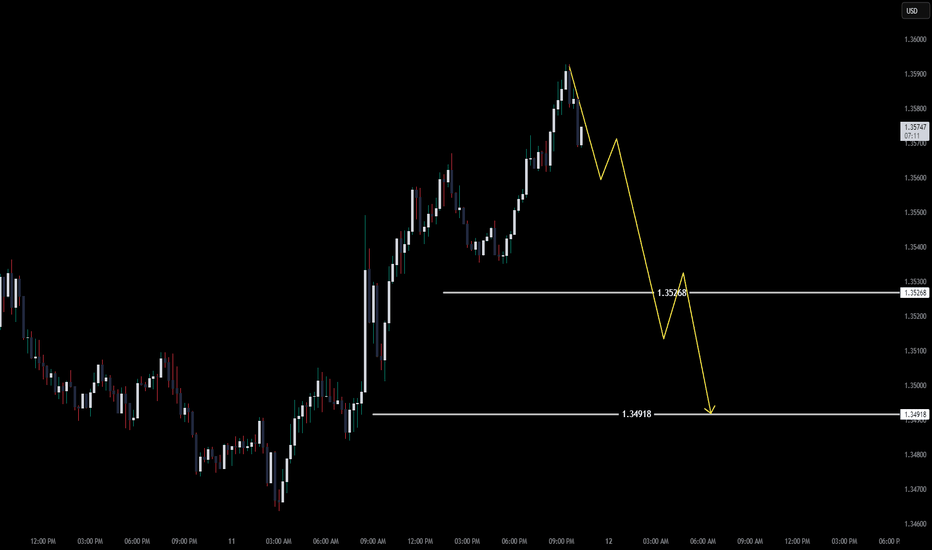

GBP/USD Short Play – Anticipating a Smooth 87-Pip DropTime of Analysis: 9:15 PM (Central US) | Current Price: 1.35736

Key Levels: 1.35268 (First Target) → 1.34918 (Final Target) | Retracement Spike: 1.35500 (NY Session)

A Strategic Short Ahead of London & NY Session Weakness

Based on observed price action and intermarket dynamics, GBP/USD is primed for a controlled descent over the next 12–18 hours, with Tokyo/Sydney sessions laying the groundwork for London’s bearish momentum. Here’s the breakdown:

1. Current Setup & Immediate Catalysts

Bearish Continuation Pattern: The pair has shown subtle rejection near 1.35800 (key intraday resistance), with weakening upward momentum. The initial 30-pip drop from the evening high suggests sellers are testing the waters.

Tokyo/Sydney Session Role: These sessions often consolidate or extend late NY moves. With USD strength creeping in (e.g., Treasury yields firming, risk-off sentiment in Asia), a slow grind toward 1.35268 is likely before London opens.

2. London Session: The Accelerator

European Liquidity Dive: London traders will likely exploit the lack of bullish defense, pushing GBP/USD toward 1.34918. Key factors:

Divergence with EUR: If EUR/GBP rallies, GBP/USD suffers compounded selling.

UK Data Lull: No major catalysts = technicals dominate.

Order Flow Clue: The drop to 1.35268 may trigger stop-loss cascades below 1.35500, fueling the next leg down.

3. New York Session: The Trap Spike

Classic NY Fakeout: After a steady decline, NY traders often "test" liquidity with a quick spike (likely 1.35500) before resuming the trend. This would:

Trap late shorts chasing the breakdown.

Provide a optimal entry for bears targeting sub-1.34900.

Fed Shadow: Any USD strength from hawkish Fed whispers (even without news) could cap rebounds.

Risk Considerations

Bullish Threat: A surprise London headline (e.g., BoE hike chatter) could stall the move, but the technical structure favors downside.

Stop Placement: Initial stops above 1.35950 (pre-9:15 PM swing high) for early entries. Adjust to 1.35780 if entering post-Tokyo open.

-------------------------------------

Final Call

"87 pips or bust." This is a high-probability, slow-burn short with defined targets. Tokyo/Sydney sets the table, London serves the main course, and NY adds the dessert spike before the next leg down.

Projected Timeline:

Next 6h (Tokyo/Sydney): Drop to 1.35268.

London Open (3AM CT): Acceleration to 1.34918.

NY Open (7AM CT): Spike to 1.35500, then resumption of selling.

Trade smart, trade ruthless.

GBPUSD(20250612)Today's AnalysisMarket news:

① The EU hopes that the trade negotiations will be extended beyond the suspension period set by Trump. ② Bessant: As long as "sincerity" is shown in the negotiations, the Trump administration is willing to extend the current 90-day tariff suspension period beyond July 9. ③ Trump will hold multiple bilateral talks during the G7 summit. ④ The total customs revenue of the United States reached a record high of US$23 billion in May, an increase of nearly four times year-on-year. ⑤ Lutnick: One deal after another will be reached.

Technical analysis:

Today's buying and selling boundaries:

1.3525

Support and resistance levels:

1.3627

1.3589

1.3564

1.3486

1.3461

1.3423

Trading strategy:

If the price breaks through 1.3564, consider buying in, the first target price is 1.3589

If the price breaks through 1.3525, consider selling in, the first target price is 1.3486

GBPUSD - Long at some pointVery similar with what we are looking for in relation to EURUSD

Will wait for a mitigation of the demand at lower price. Will wait for an internal structure break before looking to get long.

Will have a nice sleep now and will re-evaluate in the morning.

Caught 2 lovely trades on this today and hopefully I may be able to catch 1 or 2 more before the week is out.

Again, if you have any questions don't be shy to get in touch

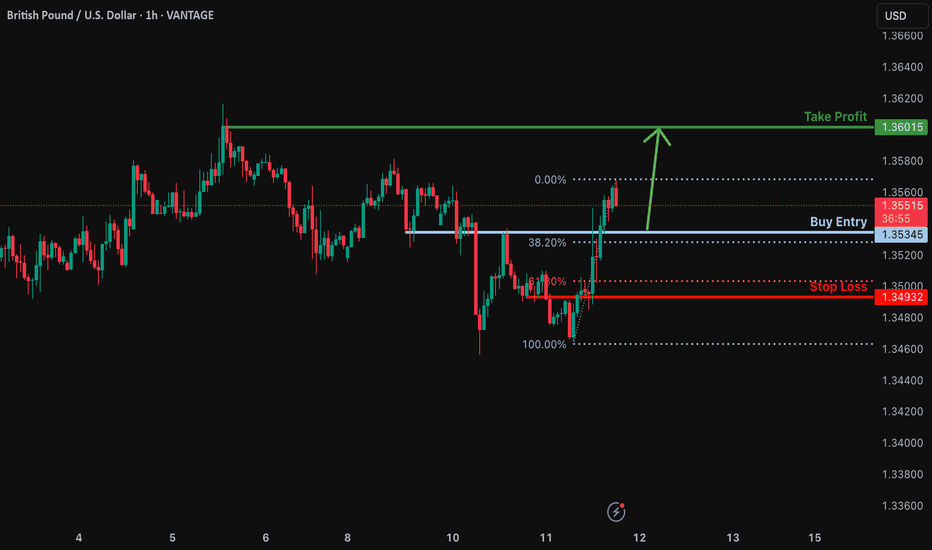

Bullish bounce off overlap support?GBP/USD is falling towards the support level which is an overlap support that aligns with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.3543

Why we like it:

There is an overlap support level that aligns with the 38.2% Fibonacci re4tracement.

Stop loss: 1.3493

Why we like it:

There is a pullback support level that is slightly below the 61.8% Fibonacci retracement.

Take profit: 1.3601

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

The British pound's rebound was blockedThe British pound staged a technical rebound after a sharp decline on Tuesday, trading near 1.35 during the North American session. A day earlier, the exchange rate had retreated amid expectations that the Bank of England (BoE) would continue to cut rates twice within the year, triggered by weak UK labor market data. However, on Wednesday, against the backdrop of the US CPI data falling short of expectations, the US Dollar Index weakened, allowing the pound to rebound. Although the exchange rate has regained the 1.35 threshold currently, if UK economic data continues to be weak, the pound may test support levels at 1.34 or lower again.

Humans need to breathe, and perfect trading is like breathing—maintaining flexibility without needing to trade every market swing. The secret to profitable trading lies in implementing simple rules: repeating simple tasks consistently and enforcing them strictly over the long term.