Gbpusdanalysis

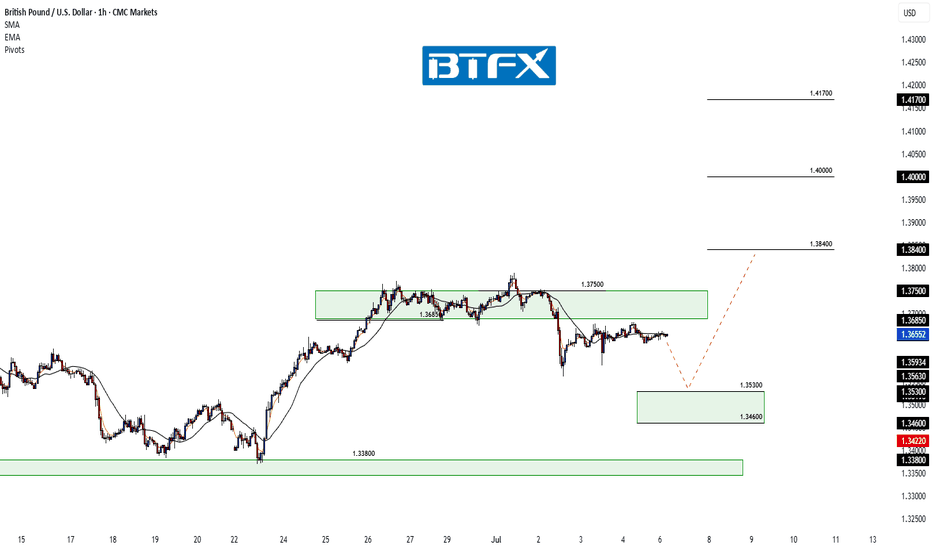

GBP/USD Pulls Back After Rejection – Buyers Eye Lower LevelsHi everyone,

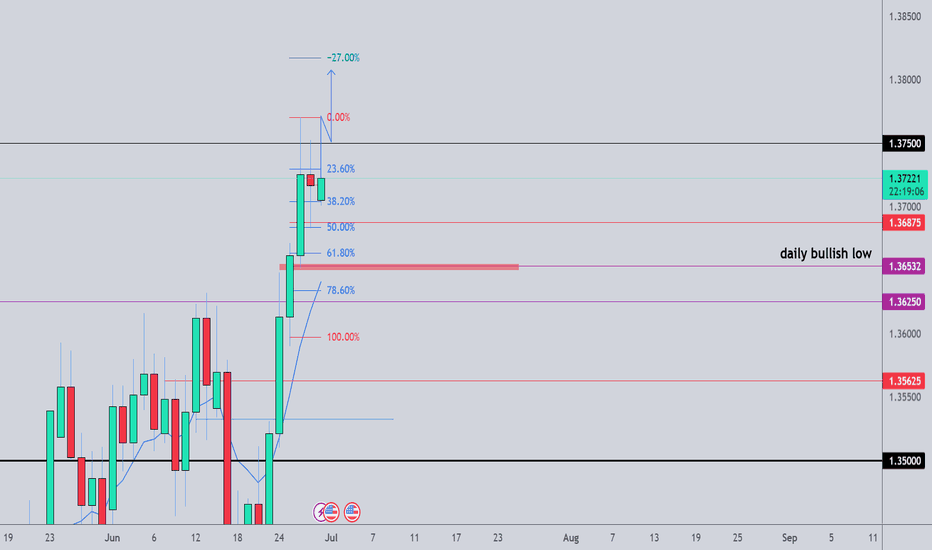

GBP/USD failed to break above the 1.37500 level and saw a rejection from that resistance, dropping further below the 1.36850 support. Since then, price has consolidated and ranged beneath this level.

Looking ahead, if price remains within this range, we anticipate a move lower to find buying interest between the 1.35300 and 1.34600 levels, which could set the stage for another push higher.

As previously noted, a decisive break above 1.37500 would renew our expectation for further upside, with the next key target around 1.38400. We'll be monitoring price action closely to see how it unfolds.

We’ll continue to provide updates on the projected path for GBP/USD as price approaches this target.

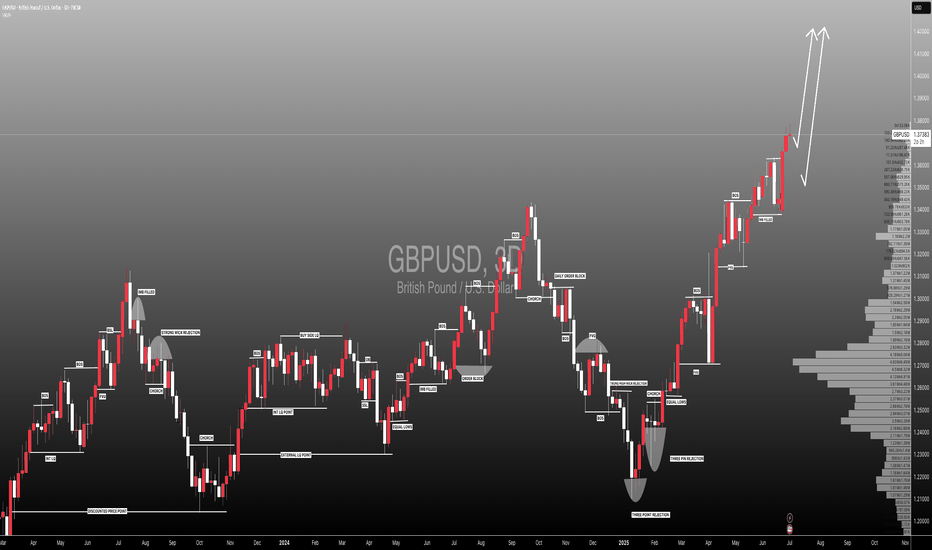

The longer-term outlook remains bullish, and we expect the rally to continue extending further from the 1.20991 January low towards 1.40000 and 1.417000.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

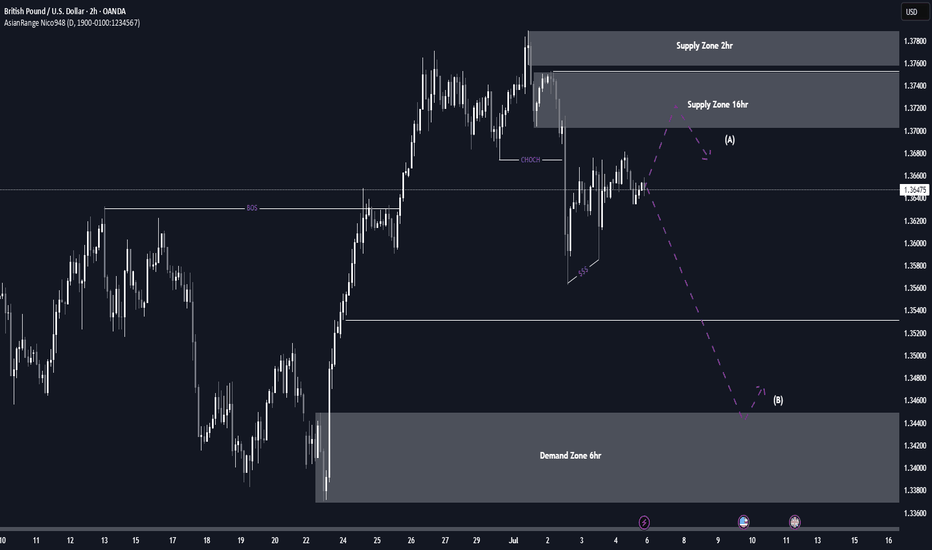

GBP/USD Potential Shorts from 1.37000This week, my analysis for GBP/USD focuses on the continuation of the bearish order flow. I currently have a clean 16-hour supply zone that remains unmitigated, where we may see a potential bearish reaction in alignment with the prevailing downtrend. If price breaks through this zone, I will shift focus to an extreme 2-hour supply zone higher up.

There are several imbalances and pools of liquidity resting below that serve as potential downside targets. Additionally, I’m noticing the formation of engineered liquidity beneath current price, which further supports the bearish outlook.

Confluences for GBP/USD Sells:

The U.S. Dollar has reacted from a strong demand zone, suggesting we could see continued bullish pressure on the dollar, which may weigh on GBP/USD.

GBP/USD has shown a clear change of character to the downside, confirming bearish market structure—this is a pro-trend trade setup.

We have both a clean 16-hour and an extreme 2-hour supply zone, offering high-probability entry points for potential shorts.

Multiple liquidity targets below, including Asia session lows and unfilled imbalances, align well with the bearish narrative.

P.S. My next potential long opportunity lies at the 6-hour demand zone near 1.34400. From there, I’ll be watching for price to slow down, accumulate orders, and potentially shift structure to the upside.

Wishing everyone a successful and profitable trading week!

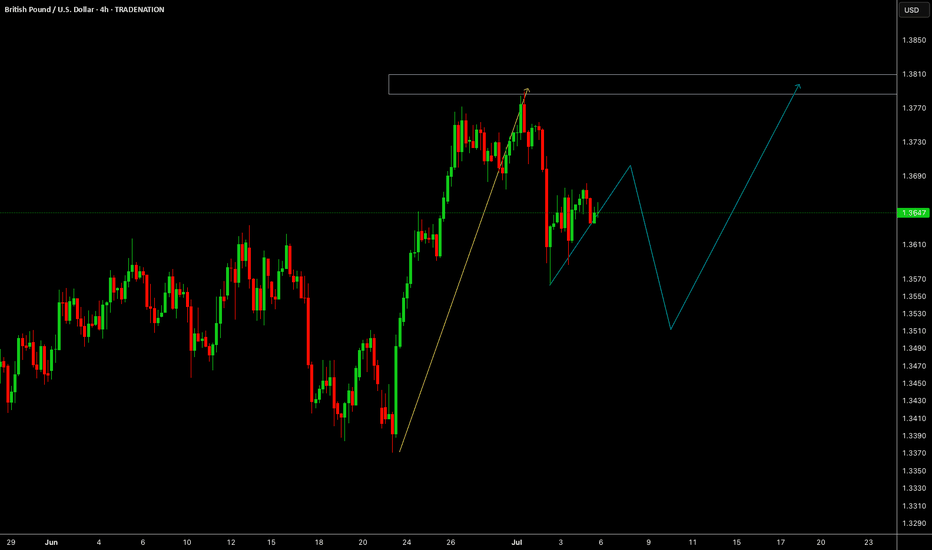

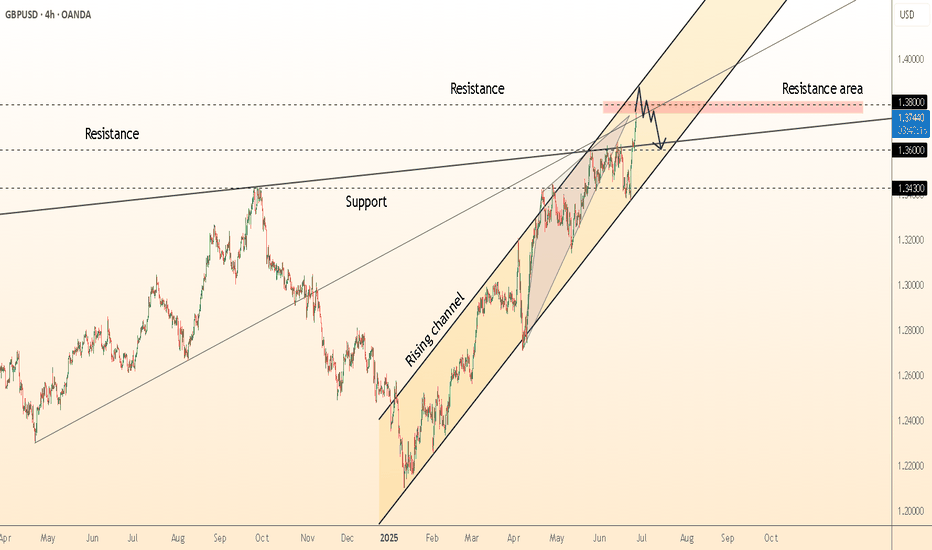

DeGRAM | GBPUSD preparing for a correction📊 Technical Analysis

● Cable is pressing the rising-channel ceiling together with the March swing-high supply at 1.378-1.380; successive long-upper-wicks plus fading 4 h RSI signal bull exhaustion at this dual resistance.

● A tiny evening-star has formed inside the pink resistance band and price is slipping back under the broken inner trend-line; first objective is the former breakout shelf / median line near 1.360, with the lower rail and April pivot at 1.343 next in view.

💡 Fundamental Analysis

● UK election blackout, soft retail-sales surprise and firmer month-end USD funding bids narrow the short-rate gap again, sapping fresh sterling demand.

✨ Summary

Short 1.374-1.380; sustain below 1.360 opens 1.343. Bear view void on a 4 h close above 1.380.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

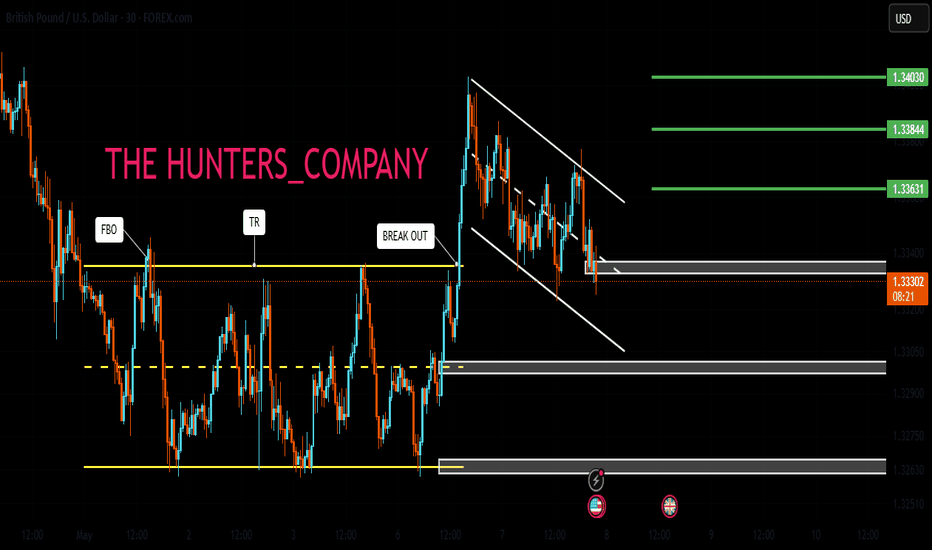

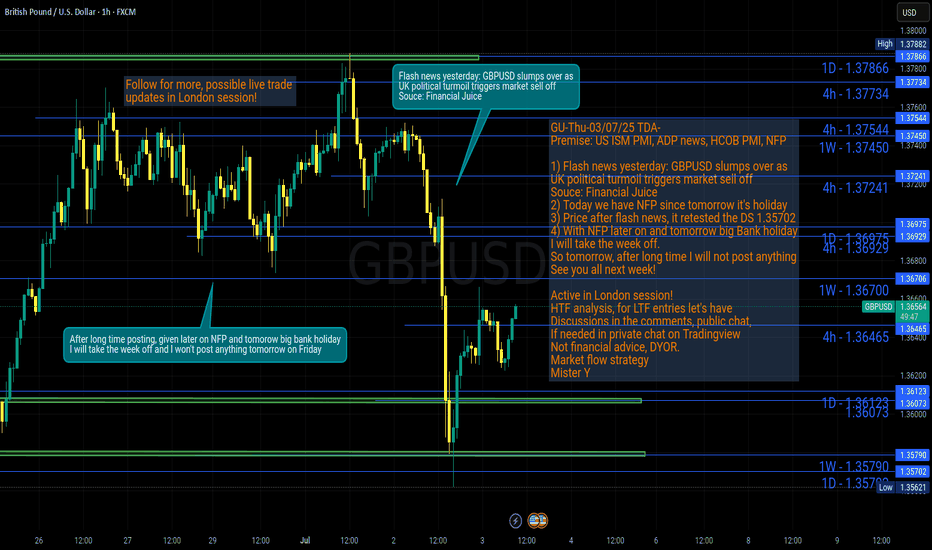

GU-Thu-03/07/25 TDA-UK political turmoil triggers market selloffAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, lot size and replicate the move

over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

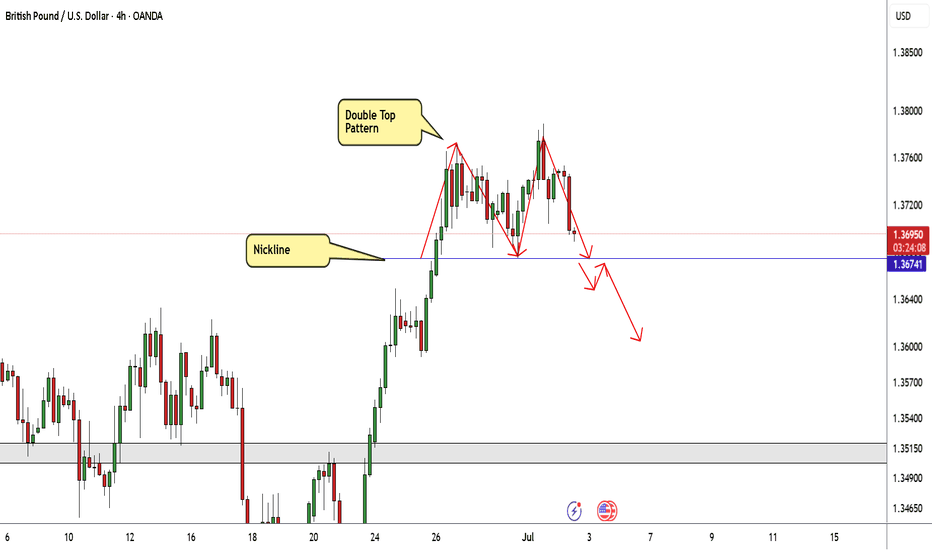

GBP/USD Made A Double Top Pattern , Short After Breakout ? Here is my opinion on GBP/USD 4H Chart , we have a reversal pattern ( Double Top ) but until now we have not a closure below neckline ,so i`m waiting for 4H Closure below it to confirm the pattern and hen we can sell it , if we have not a closure below then this idea will not be valid .

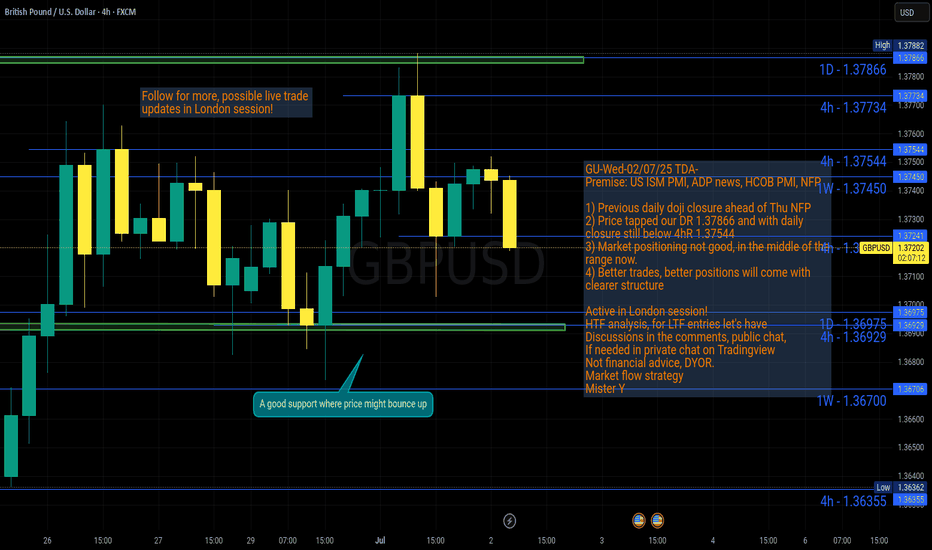

GU-Wed-02/07/25 TDA-Market positioning not the best atmAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Another factor that plays huge your trade setups, ideas is

market positioning. Your ideas might be good, but with

bad market positioning there's high chance price might

stop you out before going to your direction.

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

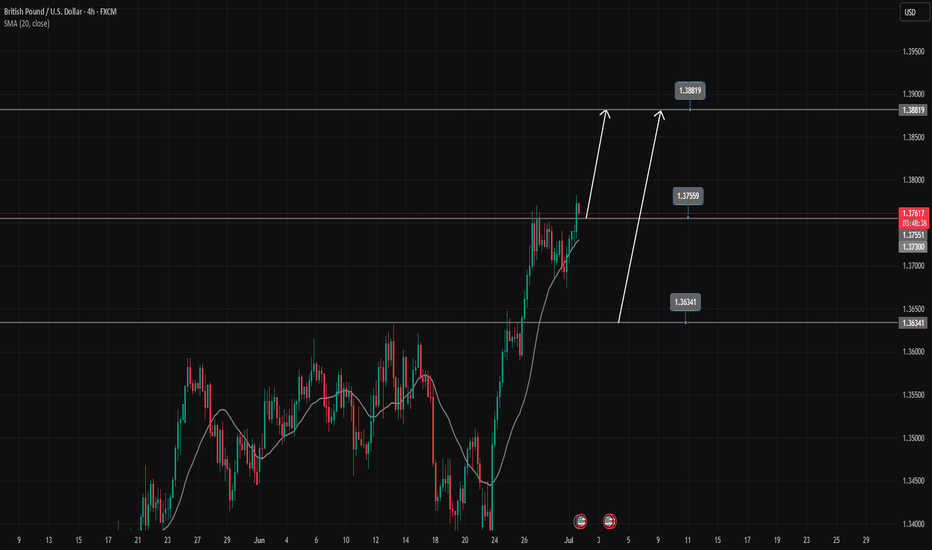

GBPUSD's strong uptrend continuesGBPUSD is in a strong uptrend, Price has just broken the resistance zone of 1.37500.

All the bullish momentum is heading towards the resistance zone of 1.388.

If there is a close of the h4 candle below the resistance zone of 1.375, there will likely be a Pullback to 1.363 to find more buying momentum towards the target at the resistance zone of 1.388

📈 Key Levels

Support: 1.375-1.363

Resistance: 1.388

📊 Recommended Trade Setups

BUY GBPUSD 1.375-1.373 Stoploss 1.37000

BUY GBPUSD 1.363-1.361 Stoploss 1.35800

SELL GBPUSD 1.388-1.390 Stoploss 1.39300

#GBPUSD: Detailed View Of Next Possible Price Move! GBPUSD exhibited a favourable movement after rejecting a pivotal level previously identified. We anticipate a smooth upward trajectory, potentially reaching approximately 1.45. Conversely, the US Dollar is on the brink of collapse around 90, which will directly propel the price into our take-profit range.

During GBPUSD trading, it is imperative to adhere to precise risk management principles. Significant news is scheduled to be released later this week.

We kindly request your support by liking, commenting, and sharing this idea.

Team Setupsfx_

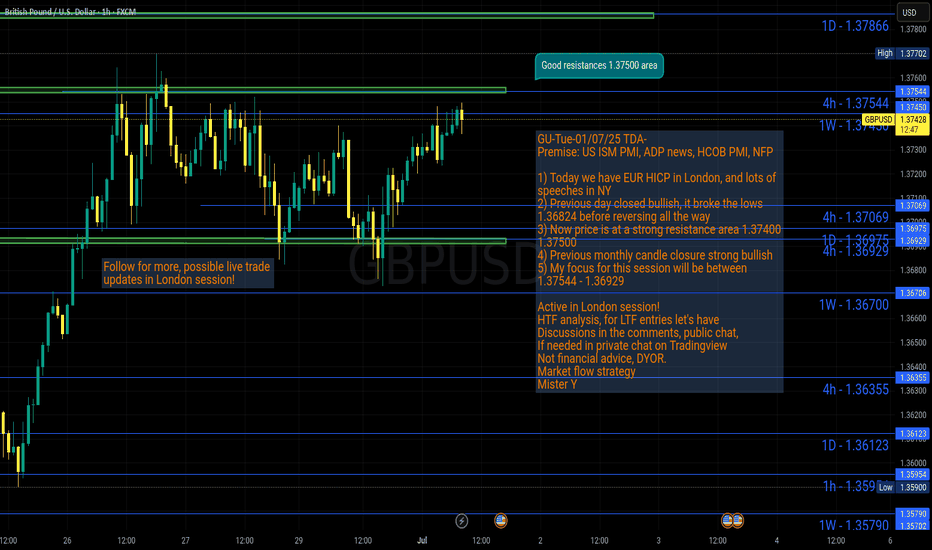

GU-Tue-01/07/25 TDA-Strong resistance area approaching 1.37500Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Timing!

You might ask yourself why sometimes your

trade idea was good but still ended up hitting your sl before it moves to your direction.

The reason is simple: Timing.

price is just not ready to push at that time

and needed extra liquidity and structure before it finally has the force to push.

Understanding when the market is ready is one of the most difficult thing for a trader to do but with experience you start to understand better and improve.

If you like the way I present and analyze, make sure to boost,

share and follow me for more future posts, ideas and useful informations.

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

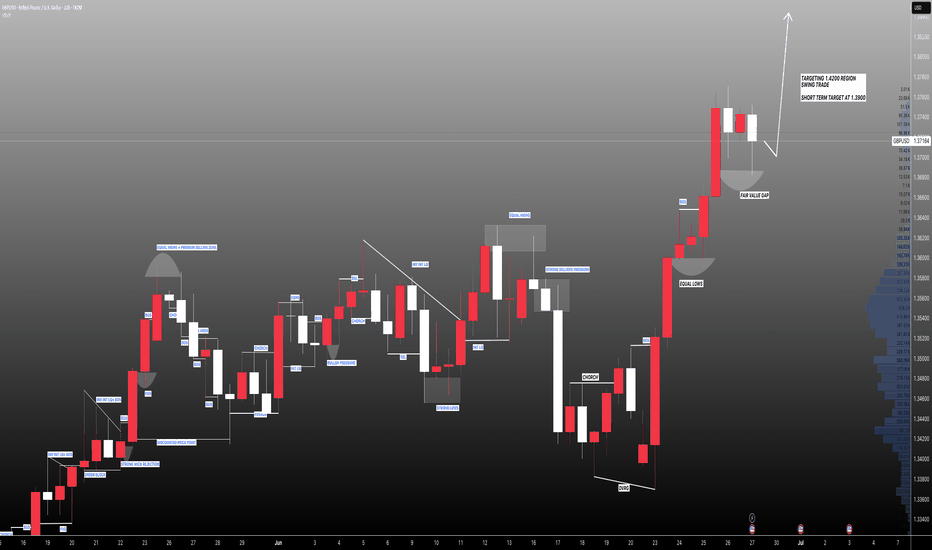

GBPUSD: Targeting 1.4200 Swing Move Target! Swing Trading GBPUSD: We’ve identified a key reversal zone where our long-term take-profit target is set at 1.4200. This is a long-term approach, but in the short term, we could target 1.3900, which is a reasonable take-profit area. Before taking any buying entry, please do your own analysis.

Good luck and trade safely!

Like

Comment

Share

Team Setupsfx_

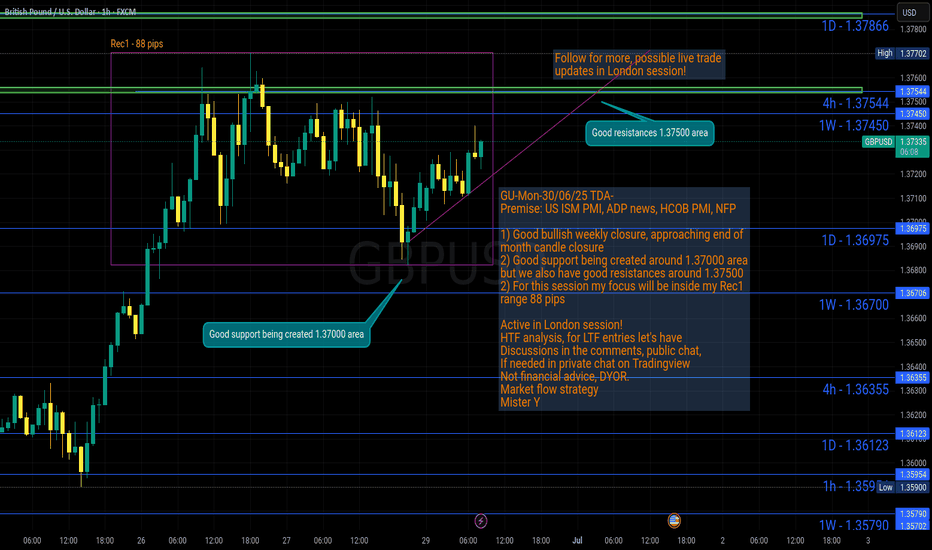

GU-Mon-30/06/25 TDA-Good support 1.37000&Good resistance 1.37500Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

The reality of life is that if you don't work for yourself,

you'll never achieve what you want.

Don't expect things to come, work for it, act on it.

Notice the difference between DOers and Dreamers.

Comment down below what do you think!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

$GU (GBPUSD) 1H AnalysisPrice swept internal liquidity before dropping into a clear 1H Fair Value Gap (FVG), which acted as a draw on liquidity. Following the mitigation, GBPUSD is now retracing toward a high-probability supply zone.

Expect potential rejection as price rebalances inefficiency and seeks sell-side liquidity.

Watch for bearish confirmation inside the supply zone — ideal for intraday shorts if the structure shifts.

Pullbacks = short opportunities.

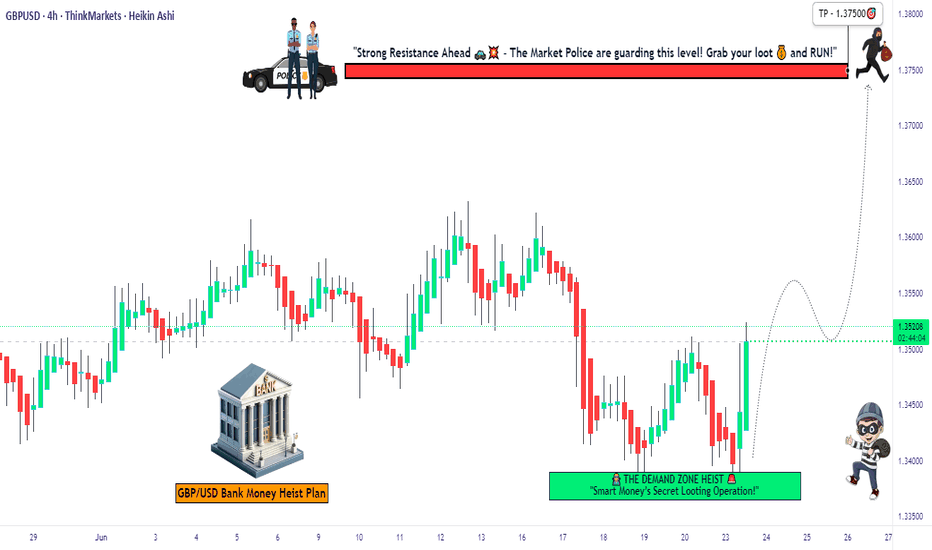

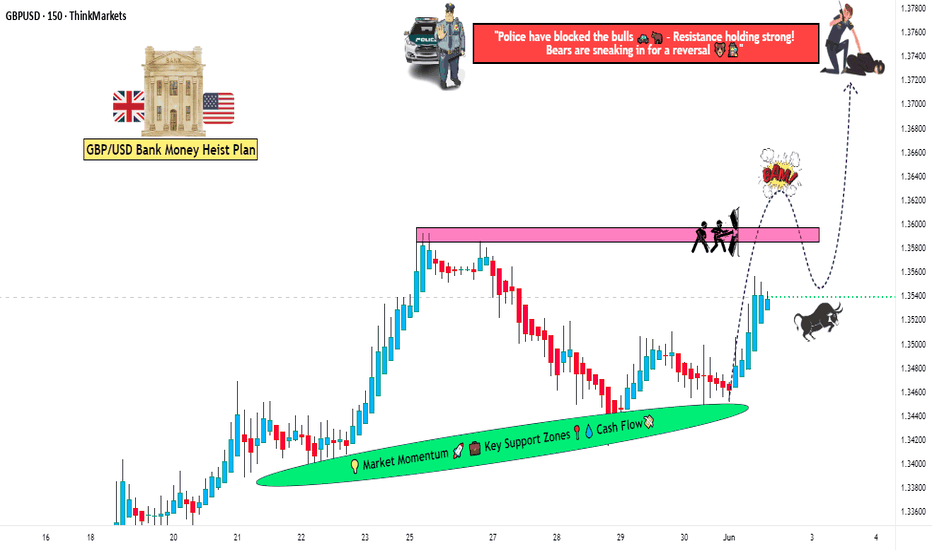

Exclusive: GBP/USD Swing Heist – Limited-Time Opportunity!🏴☠️ GBP/USD HEIST ALERT: Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Attention, Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to swipe those pips!"

🔥 THIEF TRADING STRATEGY (Swing/Day) 🔥

Based on high-risk, high-reward technical & fundamental analysis, here’s the master plan to plunder GBP/USD ("The Cable")!

📈 ENTRY (Bullish Heist Zone)

"The vault is OPEN!" – Long at any price, but for precision:

Buy Limit orders preferred (15m-30m timeframe).

Pullback entries from recent swing lows/highs = sneakiest loot grab!

🛑 STOP LOSS (Escape Route)

Thief SL: Nearest swing low (4H chart).

Adjust based on: Risk tolerance, lot size, & number of orders.

"A good thief always has an exit plan!"

🎯 TARGETS

1.37500 (or escape early if the cops 🚓 (bearish traps) show up!).

Scalpers: Only long-side raids! Use trailing SL to lock profits.

💥 WHY THIS HEIST? (Bullish Momentum)

Technicals + Fundamentals align for a potential breakout.

Overbought? Risky? Yes—but the best loot is guarded!

📢 TRADING ALERT (News & Risk Mgmt)

Avoid new trades during high-impact news (volatility = police sirens!).

Trailing stops = Your getaway car. Protect profits!

🚀 BOOST THE HEIST!

💖 Hit "Like" & "Boost" to fuel our next raid!

💬 Comment your loot tally below!

"Stay sharp, thieves—see you at the next heist! 🤑🔥"

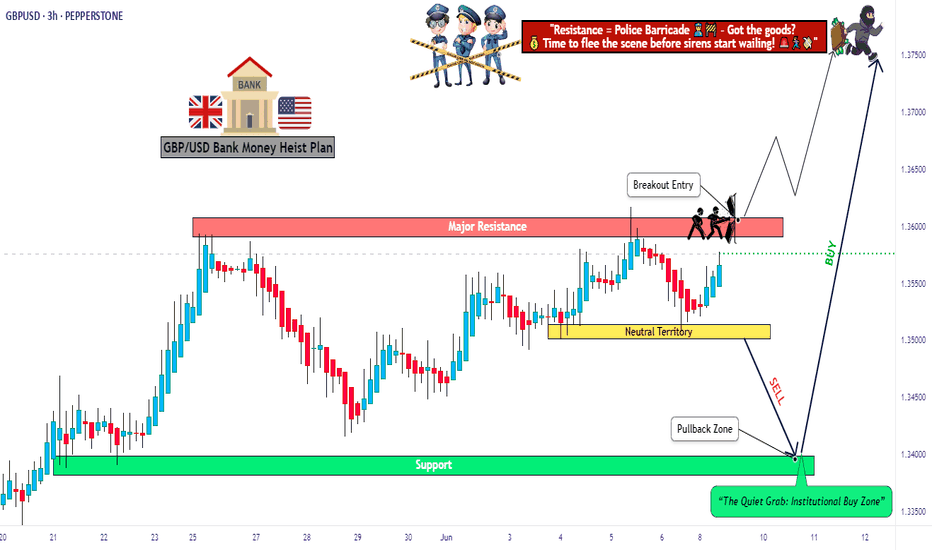

GBPUSD: The Big Short Opportunity?(Breakout Confirmation Needed)🚨 GBP/USD BANK HEIST ALERT: The Bearish Robbery Plan (Swing/Day Trade) 🚨

🔥 Steal Pips Like a Pro – Thief Trading Strategy Inside! 🔥

🌟 GREETINGS, MARKET PIRATES! 🌟

🤑 To all the Money Makers, Risk Takers & Midnight Breakers!

Based on our 🔥Thief Trading Style🔥 (a deadly mix of technical + fundamental + intermarket analysis), we’re plotting a massive bearish heist on GBP/USD ("The Cable").

This is not financial advice—just a strategic robbery plan for those who dare to trade smart.

📉 THE HEIST STRATEGY (SHORT ENTRY FOCUS)

🎯 Target Zone: 1.32300 (or escape earlier if the market turns)

⚡ High-Risk, High-Reward Play: Oversold market, consolidation, trend reversal setup.

💣 Trap Level: Where bullish traders get wrecked.

🔑 ENTRY RULES:

"The Heist is ON!" – Wait for breakout confirmation at 1.33800 before striking.

Sell Stop Orders below breakout MA OR Sell Limit Orders (15-30 min timeframe).

Retest Entry? Ideal if price retraces to recent low/high before dropping.

📌 ALERT SETUP: Don’t miss the breakout—set a chart alert!

🛑 STOP LOSS (Risk Management):

Thief SL at 1.34800 (Swing/Day Trade basis – 3H period).

🚨 Pro Tip: "Yo, rebels! You can place SL wherever you want… but if you ignore this level, don’t cry later. Your risk, your rules."

🎯 PROFIT TARGET:

First Take-Profit: 1.32300 (or bail earlier if momentum fades).

Scalpers: Ride the short side only. Use trailing SL to lock profits.

📰 FUNDAMENTAL BACKUP (Why This Heist Works)

Before executing, check:

✅ COT Report (Are big players dumping GBP?)

✅ Macro News (UK vs. USD economic strength)

✅ Intermarket Analysis (DXY, Bonds, Equities correlation)

✅ Sentiment & Seasonality (Is the crowd too bullish?)

⚠️ WARNING: NEWS & VOLATILITY ALERTS

Avoid new trades during high-impact news (unless you love gambling).

Use trailing stops to protect profits if the market flips.

💥 BOOST THIS HEIST! 💥

🚀 Like & Share to strengthen our Thief Trading Squad!

💸 More heists = More profits. Stay tuned for the next robbery plan!

🤑 See you on the profitable side, bandits! 🏴☠️

🔴 DISCLAIMER: This is entertainment, not financial advice. Trade at your own risk.

#Forex #GBPUSD #TradingStrategy #ThiefTrading #BankHeist #SwingTrading #DayTrading

💬 COMMENT BELOW: Are you joining the heist or waiting for a better setup? 🚨👇

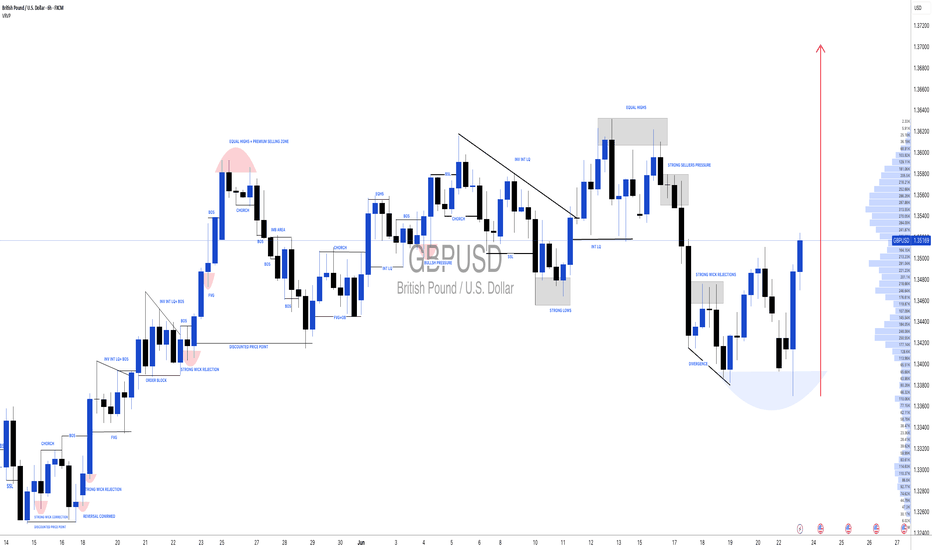

GBP/USD Robbery: Can You Grab the Cash Before the Cops Arrive?🚨 GBP/USD "The Cable" forex bank Heist Alert: The Bullish Breakout Robbery Plan (Swing & Scalp Strategy) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸

Based on the 🔥Thief Trading Style🔥, here’s our master plan to loot the GBP/USD "The Cable" forex bank. Follow the strategy on the chart—focusing on LONG entries—and escape near the high-risk Red Zone. This area is overbought, consolidating, and a potential reversal trap where bears lurk. 🏆 Take profits fast—you’ve earned it! 💪

🎯 Heist Entries:

📈 Entry 1: "The Breakout Heist!" – Wait for Resistance (1.36200) to break, then strike! Bullish profits await.

📈 Entry 2: "Big Players’ Pullback!" – Jump in at 1.34000+ buy above at any price for a safer steal.

🔔 Pro Tip: Set a chart alert to catch the breakout instantly!

🛑 Stop Loss Rules:

*"Yo, listen! 🗣️ If you’re entering with a buy-stop, DON’T set your SL until AFTER the breakout. Place it at the nearest swing low (3H timeframe) or wherever your risk allows—but remember, rebels risk more! 🔥"*

🏴☠️ Target: 1.37500

🧲 Scalpers: Only play LONG! Use trailing SL to lock in profits. Big wallets? Go all in. Small stacks? Join the swing heist!

📊 Market Pulse:

The GBP/USD "The Cable" is neutral but primed for bullish momentum. Watch:

Fundamentals (COT, Macro, Geopolitics)

Sentiment & Intermarket Trends

Positioning & Future Targets & Overall score

📌 Check our bioo linkks for deep analysis! 🔗🌍

⚠️ Trading Alert:

News = Volatility! Protect your loot:

Avoid new trades during major news

Use trailing stops to secure profits

💥 Boost This Heist!

Hit 👍 & 🔄 to strengthen our robbery crew! Let’s dominate the market daily with the Thief Trading Style. 🚀💵

Stay tuned—another heist drops soon! 🎯🐱👤

GBP/USD HEIST ALERT: Bullish Breakout or Bearish Trap?🌟 Hey! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Calling all Market Robbers & Profit Pirates!💸💰

🔥 Thief Trading Intel: Our crew’s latest heist targets GBP/USD "The Cable"—bullish breakout incoming! Long entry only. High-risk Red Zone ahead: overbought, consolidating, and ripe for a reversal. Don’t get caught in the bear trap! 🏴☠️

"Take your loot and run, trader—you’ve earned this steal!" 💪🎯

🚪 ENTRY: The Heist Begins!

📈 "Wait for MA breakout (1.36000) then STRIKE—bullish profits await!"

Option 1: Buy Stop above Pink Resistance (breakout confirmation).

Option 2: Buy Limit at swing low/high (15-30 min TF).

📌 Pro Tip: SET AN ALERT! Don’t miss the breakout.

🛑 STOP LOSS: Escape Route

🔊 "Yo, listen up! 🗣️

Buy Stop orders? NO SL until after breakout! 🚀

Rebels: Place SL wherever—but you’ve been warned! ⚠️🔥

📍 Thief SL (Smart Crew): Recent/swing low (1.35000, 4H TF).

📍 Adjust based on your risk, lot size, and orders.

🎯 TARGET: Loot & Exit!

🎯 1.37500 (or escape early if the market turns!)

⚡ SCALPERS’ QUICK GRAB

👀 Long scalps ONLY!

Big wallets? Raid now.

Small stacks? Join swing traders.

Trailing SL = Your Money Shield! 🛡️💰

📢 WHY THIS HEIST? (GBP/USD Bullish Momentum)

"The Cable" is heating up! Key drivers:

Fundamentals (COT, Macro Data)

Sentiment & Intermarket Trends

Future Targets & Score Outlook

🔗 Full intel? Bio links below! 👉👉

⚠️ TRADING ALERT: News = Danger Zone! 📰🚨

News = Volatility Spikes! Protect your loot:

❌ Avoid new trades during news.

🔒 Trailing SL = Profit Lock.

💖 SUPPORT THE HEIST CREW!

💥 SMASH THAT BOOST BUTTON! 💥

More boosts = easier money grabs!

Stronger crew = bigger heists!

Profit daily with Thief Trading Style! 🏆🚀

Next heist coming soon—stay tuned! 🤑🐱👤🤩

#GBPUSD: Bulls are in control, DXY Dropping Sharply!Hello Team,

We have identified a promising opportunity with a favourable price movement. The Pound Sterling to US Dollar (GBPUSD) pair has exhibited strong bullish volume, indicating potential further appreciation.

The current geopolitical tensions, particularly the involvement of the United States in the Iran-Israel conflict, are expected to negatively impact the US Dollar. This decline could potentially lead to an appreciation of the GBPUSD pair and other USD-denominated currencies.

It is advisable to closely monitor the price behaviour of the GBPUSD pair and consider potential investment opportunities based on its current trend.

Best regards,

Team Setupsfx

Bullish Bias Holds for GBP/USD – Focus on 1.37500 BreakHi everyone,

A strong push up from our highlighted support level at 1.33800 toward 1.36850 saw GBP/USD enter a brief period of consolidation. During the week, price action ranged between this newly established support and the 1.37500 resistance level.

Looking ahead, we anticipate a decisive break above 1.37500, which could open the way for further upside.

As previously noted, the clearance of these levels strengthens our expectation for further upside, with the next key level of interest around 1.38400. We'll be watching to see how price action develops from here.

We’ll continue to provide updates on the projected path for GBP/USD as price approaches this target.

The longer-term outlook remains bullish, and we expect the rally to continue extending further from the 1.20991 January low towards 1.40000 and 1.417000.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX