GBP/USD Analysis: Slight Bullish Bias Expected on 14/10/2024The GBP/USD pair is expected to show a slight bullish bias today, supported by a combination of key fundamental drivers and technical factors. Traders and investors in the forex market should remain vigilant as several economic data releases and geopolitical events could shape the pair’s movements. Below is a comprehensive analysis highlighting the key factors driving this potential bullish bias for GBP/USD.

1. UK Economic Outlook

One of the major drivers for a possible bullish momentum in GBP/USD is the recent strength in the UK economy. Despite some challenges in the global economic landscape, the UK has shown resilience, particularly with stronger-than-expected GDP growth and robust retail sales. UK inflation remains elevated, with the CPI figures suggesting sustained price pressure, which could prompt the Bank of England (BoE) to consider further tightening measures. A hawkish stance from the BoE, which is already maintaining higher interest rates, would support a stronger pound, adding to the bullish sentiment in the market.

2. US Dollar Weakness

The US dollar is showing signs of exhaustion after a prolonged period of strength. USD weakness is being driven by softer inflation data, with the recent CPI report showing cooling price pressures in the US economy. The Federal Reserve may lean toward a more dovish stance, refraining from further aggressive rate hikes. This has caused the dollar to lose some of its safe-haven appeal, providing room for the pound to gain ground against the greenback.

3. Geopolitical Risks and Market Sentiment

The broader market sentiment is being influenced by geopolitical tensions , especially in the Middle East and Europe. Risk-off sentiment tends to favor the US dollar, but given the recent easing of these concerns, market participants may shift back to higher-yielding assets like the pound. A relief in risk sentiment can boost the GBP/USD pair, pushing it toward higher levels.

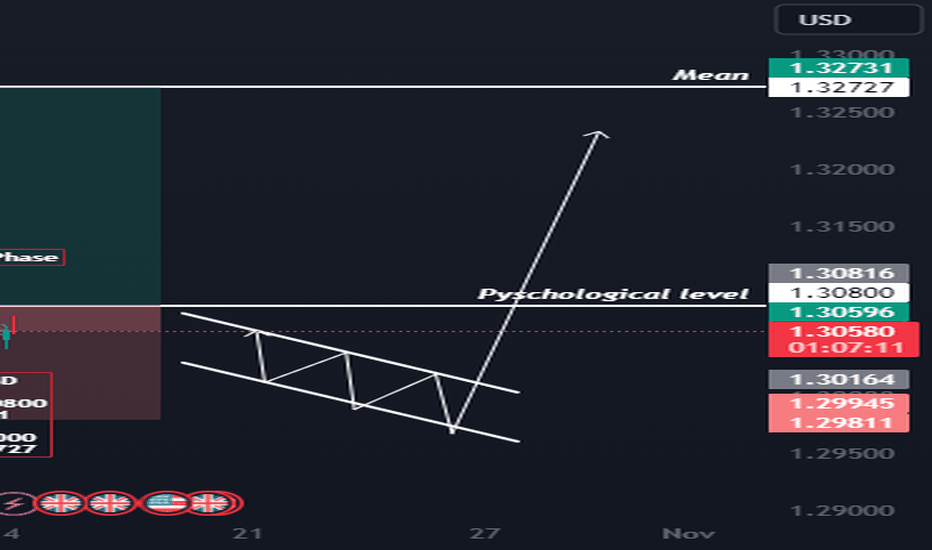

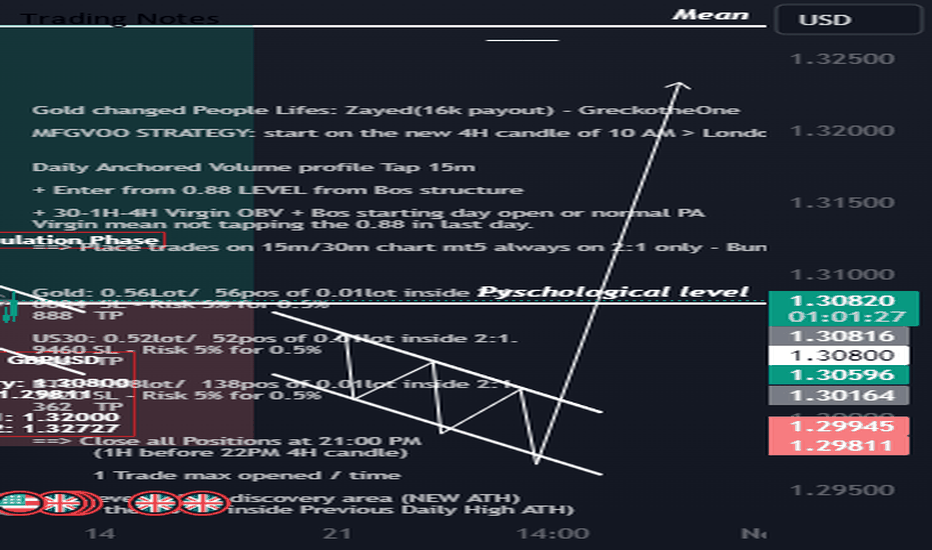

4. Technical Analysis of GBP/USD

On the technical front, GBP/USD is trading above its 50-day moving average, indicating a bullish trend in the short term. The pair has found strong support around the 1.2100 psychological level, with upward momentum suggesting a test of the 1.2250 resistance level. RSI (Relative Strength Index) is trending upwards, confirming the bullish bias, while MACD (Moving Average Convergence Divergence) also shows strengthening momentum.

5. Key Data Releases to Watch

Traders should keep an eye on upcoming data releases for further clues on the GBP/USD trajectory:

- UK Unemployment Rate: A stable or better-than-expected figure could lend support to the pound.

- US Retail Sales: Any softness in the US retail sector could further weaken the dollar.

- BoE Governor Bailey's Speech: Any comments on future monetary policy tightening could provide additional bullish support to the pound.

Conclusion

The GBP/USD is expected to exhibit a slight bullish bias today, driven by strong UK economic fundamentals, cooling US inflation, and broader market sentiment. The technical setup also favors upside potential, with the pair poised to target higher resistance levels. However, traders should remain cautious and monitor key data releases that could shift market dynamics throughout the day.

Keywords for SEO Ranking:

- GBP/USD analysis

- GBP/USD bullish bias

- UK economic outlook

- USD weakness

- Bank of England rate hikes

- UK inflation

- US inflation

- US dollar outlook

- Forex trading strategies

- Technical analysis GBP/USD

- BoE monetary policy

- Federal Reserve rate decision

- Geopolitical risks forex

- Trading GBP/USD in 2024

Gbpusdbullishbias

Bullish Bias with Key Drivers on GBPUSD market for 10/10/2024.Today, October 10, 2024, we anticipate a slight bullish bias for the GBPUSD pair, driven by several fundamental factors and market conditions. Traders looking to capitalize on today's moves in the GBP/USD pair should pay attention to these key economic drivers:

Key Drivers Supporting GBPUSD Bullish Bias:

1. UK Economic Data: Strong GDP and Employment Figures

Recently released data from the UK indicates that its economy continues to recover strongly. The GDP growth rate has exceeded market expectations, suggesting that the British economy is expanding at a faster pace than anticipated. Additionally, the UK's employment figures have shown resilience, with unemployment remaining low and wage growth supporting consumer spending.

Keywords: UK GDP growth, UK employment, British economy recovery, GBP bullish, UK wage growth

2. Hawkish Bank of England Stance

The Bank of England (BoE) has maintained a hawkish stance in recent months, signaling potential interest rate hikes to combat rising inflation. The BoE’s monetary policy outlook is a key driver for the British Pound's strength, as higher interest rates tend to support the currency. With UK inflation still above target, traders are expecting the central bank to continue tightening its policy, adding support to the GBP.

Keywords: Bank of England, BoE hawkish, UK interest rate hikes, GBPUSD support, UK inflation, British Pound outlook

3. US Dollar Weakness Amid Dovish Fed Tone

On the other side of the equation, the US Dollar has shown signs of weakness due to the Federal Reserve's more dovish tone recently. The Federal Reserve has hinted at a potential pause in interest rate hikes as inflation in the US shows signs of cooling down. A dovish Fed typically weighs on the USD, providing further upside potential for the GBPUSD pair.

Keywords: USD weakness, Federal Reserve dovish, Fed interest rates, US Dollar vs Pound, USD softening

4. Brexit Resolution and Trade Balance Improvements

In addition to economic data, the UK's post-Brexit trade balance has seen gradual improvements, and the resolution of trade agreements has eased investor concerns. As trade relations stabilize, this adds another layer of support to the British Pound. Markets are slowly pricing in this long-term structural improvement in the UK's trade outlook.

Keywords: Brexit resolution, UK trade balance, GBPUSD strength, post-Brexit trade relations

Market Sentiment & Technical Outlook

Technically, GBPUSD has found strong support around the 1.2150 level, which could act as a launching point for further gains. The Relative Strength Index (RSI) is also showing signs of a potential upward reversal from oversold levels, aligning with the fundamental drivers for the day. Traders may watch for breakouts above the 1.2200 resistance level to confirm bullish momentum.

Keywords: GBPUSD technical analysis, GBPUSD support and resistance, RSI oversold, GBPUSD trend reversal, technical outlook GBPUSD

Conclusion

Given the robust UK economic data, the hawkish stance of the Bank of England, coupled with US Dollar weakness, and an improving post-Brexit trade scenario, the outlook for the GBPUSD pair remains slightly bullish today. While geopolitical risks or unforeseen developments could impact the currency pair, the current market conditions favor upside potential for GBPUSD.

Traders should keep a close eye on upcoming US inflation data, as this could introduce volatility, but for now, the GBPUSD seems poised for moderate gains.

Keywords: GBPUSD forecast, GBPUSD outlook, GBPUSD bullish bias, GBPUSD analysis, GBPUSD trading strategy, GBPUSD live price, GBP/USD forex trading, currency pair analysis, forex today

——

This analysis provides insight into why GBPUSD may exhibit a bullish bias today, supported by both fundamental and technical factors. For more in-depth analysis, check out our latest updates and live market commentary on TradingView.

Keywords: GBPUSD live update, forex market analysis, daily forex analysis, currency trading, GBPUSD live analysis TradingView