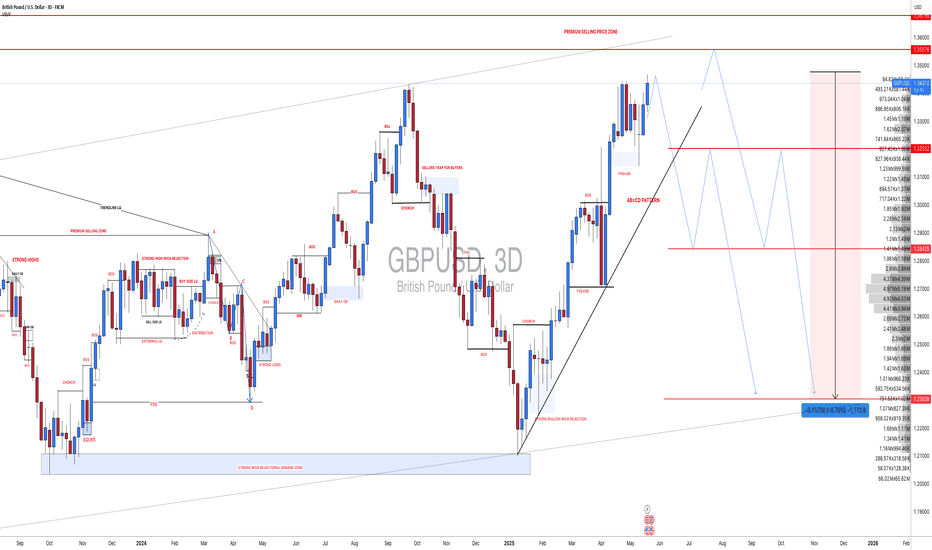

GBPUSD: Will DXY Bounce Back? |GBPUSD Swing Sell|The GBPUSD pair is currently rallying towards a potential selling zone, where sellers could push the price down. However, the main concern is the current state of the DXY, which clearly indicates another sell-off and could lead to another lower low. Please remember to use risk management while trading forex pairs.

There are three take-profit targets that can be set according to your trading plan. This analysis doesn’t guarantee that the price will move as described.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

Gbpusdsetup

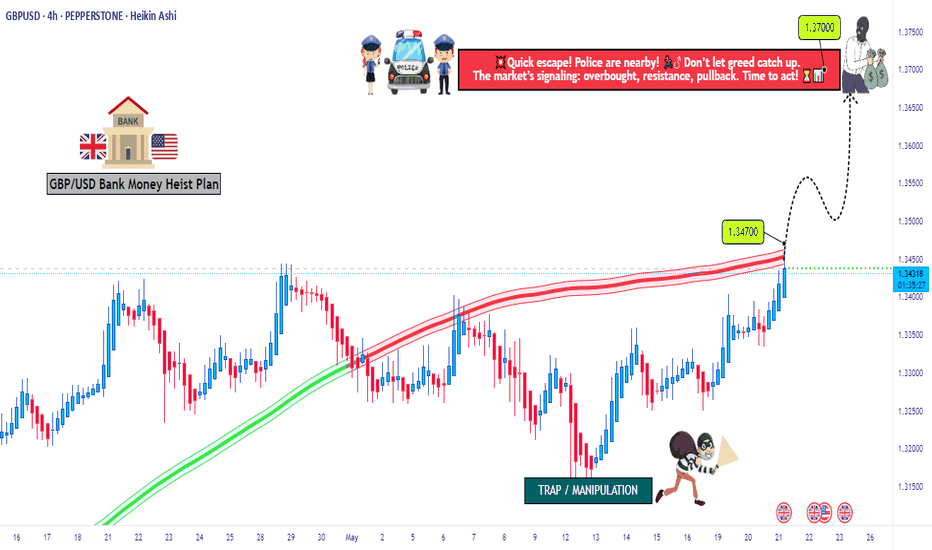

GBP/USD Cable Heist:Join the Thief Trading Style to Raid Profit!GBP/USD Cable Heist Plan - Thief Trading Style 😎💸

Greetings, wealth chasers and market bandits! 👋💰

Welcome to the Thief Trading Style, blending sharp technicals with savvy fundamentals to raid the GBP/USD "Cable" Forex Market. 📊 Follow the strategy outlined in the chart, focusing on long entries targeting the high-stakes Red Zone. 🌋 Expect an overbought market, consolidation, or trend reversal where bears might set traps. 🐻 Nail the plan, grab your profits, and treat yourself—you’ve earned it! 🎯💵🎉

Entry 📈: The heist begins! 🚨 Wait for the MA breakout at 1.34700, then strike for bullish gains. 🐂 Set buy stop orders above the moving average or place buy limit orders within a 15/30-minute timeframe at the recent swing high/low. ⏰ Don’t miss the move—set a chart alert to catch the breakout! 🔔

Stop Loss 🛑: Listen up, crew! 🗣️ For buy stop orders, hold off on setting your stop loss until after the breakout. 🚀 Place it at the recent swing low on the 4H timeframe (1.33300) for swing/day trades. 📍 Adjust based on your risk, lot size, and number of orders. Play smart, or you’re dancing with danger! 🔥😈

Target 🎯: Aim for 1.37000 or bail early if the market shifts. 🏃♂️ Scalpers, stick to long-side trades. 👀 Got deep pockets? Jump in now. 💪 Otherwise, join the swing traders and execute the plan with a trailing stop loss to secure your loot. 🔒💰

Market Outlook: GBP/USD is riding a bullish wave, fueled by key fundamentals. 🐃 Dive into the COT Report, macro data, sentiment, intermarket analysis, and future trend targets via the linkss below for the full scoop. 🔗👉

Why This Trade?: The bullish setup on GBP/USD is backed by strong technical signals, with the MA breakout confirming upward momentum. 📈 Fundamentals, including favorable COT positioning and positive macro data, suggest sustained strength in the pound. 💪 Intermarket correlations and sentiment analysis further align with a bullish outlook, making this an ideal moment to strike the Cable for potential high rewards. 🌟 The Red Zone target at 1.37000 offers a prime risk-to-reward ratio for disciplined traders. 🤑

⚠️ Trading Alert: News & Position Management 📰:

News releases can shake up prices and volatility. 🌪️ To stay safe:

Skip new trades during news events. 🚫

Use trailing stops to lock in profits and protect open positions. 🔐

Boost the Heist! 🚀: Support our plan by hitting the Boost Button to supercharge our market raids. 💥 With the Thief Trading Style, we’re stacking profits daily. 📈 Join the crew, execute the plan, and let’s make money moves! 💪🤝😺

Stay sharp for the next heist plan. Until then, keep robbing the markets! 🤑🐱👤

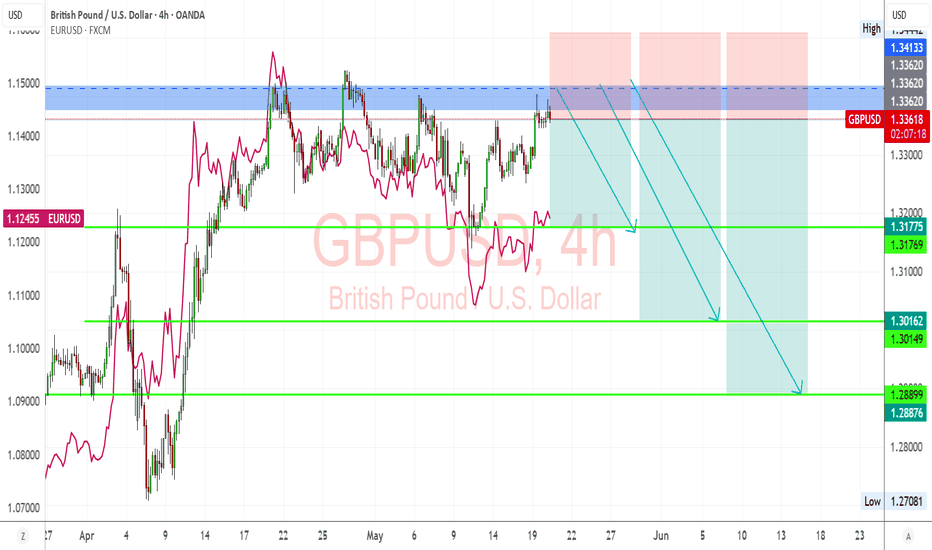

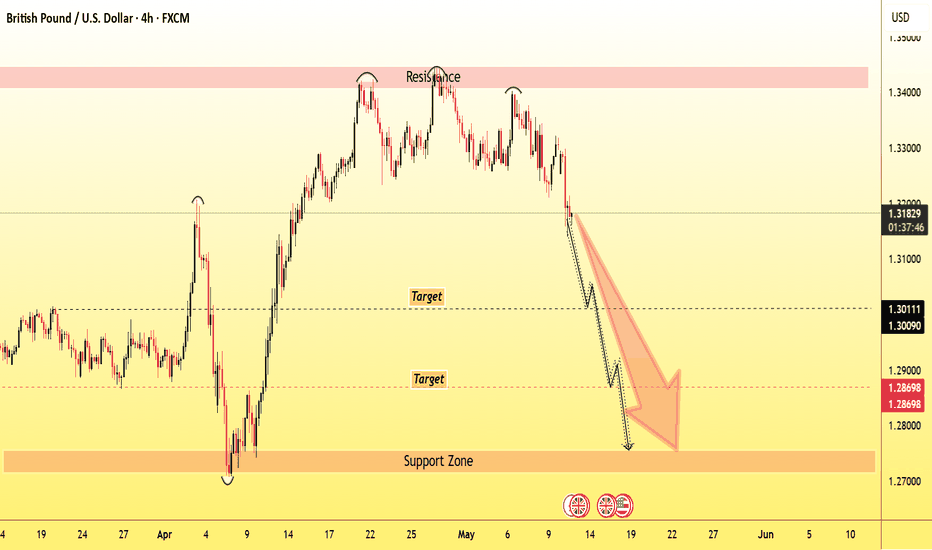

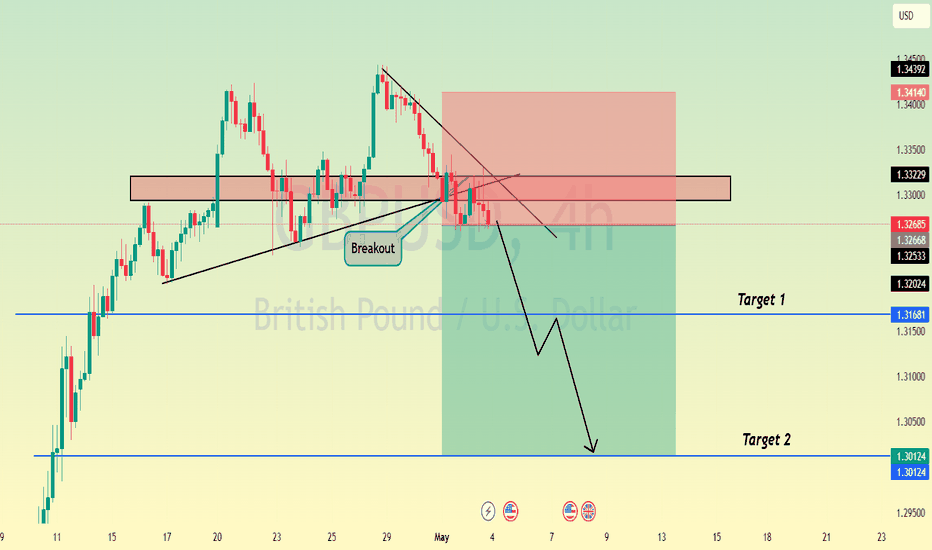

GBPUSD Analysis – Bearish Setup Into Key ResistanceGBP/USD is trading into a key multi-week resistance zone between 1.3360 and 1.3413. The pair has failed to break this area multiple times, and current price action shows signs of compression and hesitation. With elevated UK inflation limiting BoE easing flexibility and renewed USD support following bond yield spikes, this setup offers a compelling bearish opportunity. Clean downside targets lie at 1.3177, 1.3016, and potentially 1.2890. The trade remains valid unless price breaks and holds above 1.3413.

🔍 Technical Analysis

Structure:

Price is testing a significant resistance zone (1.3360–1.3413) that’s held since early April.

Bearish trendline from May highs remains intact.

A descending structure is forming with lower highs and failed breakouts.

Support Levels to Watch:

1.3177 – Previous structure low

1.3016 – Strong horizontal support

1.2890 – March swing low and fib extension target

Confluence:

EUR/USD overlay shows rejection at similar highs, reinforcing risk-off dollar strength

Price failing to hold above fib retracement levels from prior swings

🌍 Fundamental Context

🇬🇧 British Pound (GBP):

UK inflation is climbing again (expected 3.0% CPI for April), delaying BoE's ability to cut further.

BoE’s Pill has pushed back on rapid easing, citing persistent service inflation.

UK-EU trade agreement provides medium-term support, but short-term upside appears priced in.

🇺🇸 U.S. Dollar (USD):

Despite Moody’s downgrade, U.S. yields are rising, supporting USD demand.

Trump’s tariff threats have injected global risk-off tones, lifting the dollar as a safe haven.

Fed remains cautious — no rate cuts expected soon.

🎯 Trade Setup

Bias: Bearish

Entry Zone: Near 1.3360–1.3413 resistance (wait for rejection candle confirmation)

Targets:

First: 1.3177

Second: 1.3016

Third: 1.2890

Invalidation: A daily close above 1.3413 would invalidate the bearish thesis

⚠️ Risk & Management Tips

Don’t short blindly into resistance — wait for strong wick or bearish engulfing candle.

Watch upcoming UK inflation data or Fed commentary for macro triggers.

Avoid over-leveraging: false breakouts near highs are common.

🧭 Conclusion

GBP/USD is coiling near a powerful resistance area. A confirmed rejection opens the door for a multi-leg downside move into 1.30 and below. As long as price holds beneath 1.3413, the risk-reward profile favors sellers. Patience and precision are key at this stage.

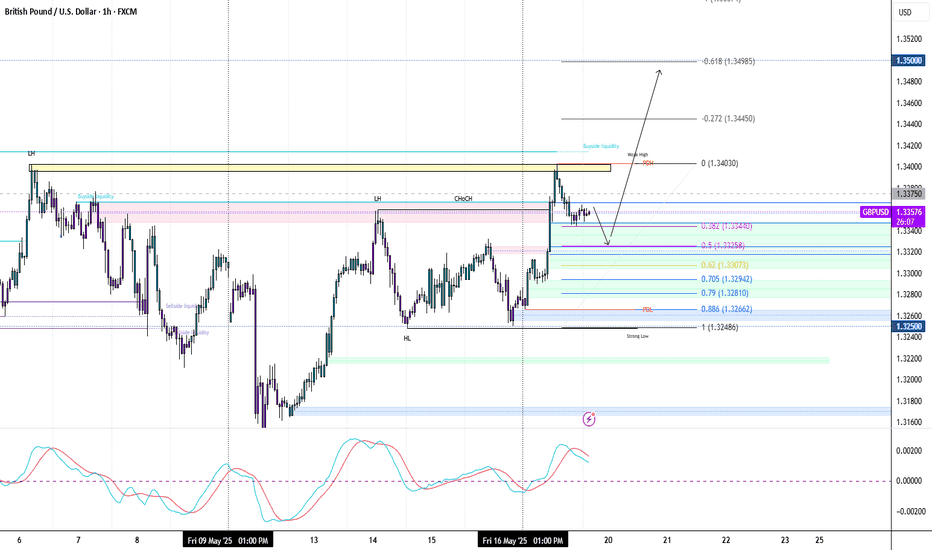

GBPUSD: Bulls Are Gearing Up For The Next RallyBullish Confirmations:

- Double bottom formed at QP at end of last week

- Creating HLs and HHs

- Bullish Choch

- Multiple bullish FVGs (showing bullish momentum)

- Multiple bullish breaker blocks

🟢ENTRY 1.33578

SL 1.331

TP1 1.33778

TP2 1.34078

TP3 1.34578

There's a chance we may get a deeper pullback. If so no big deal, we'll just catch a better entry.

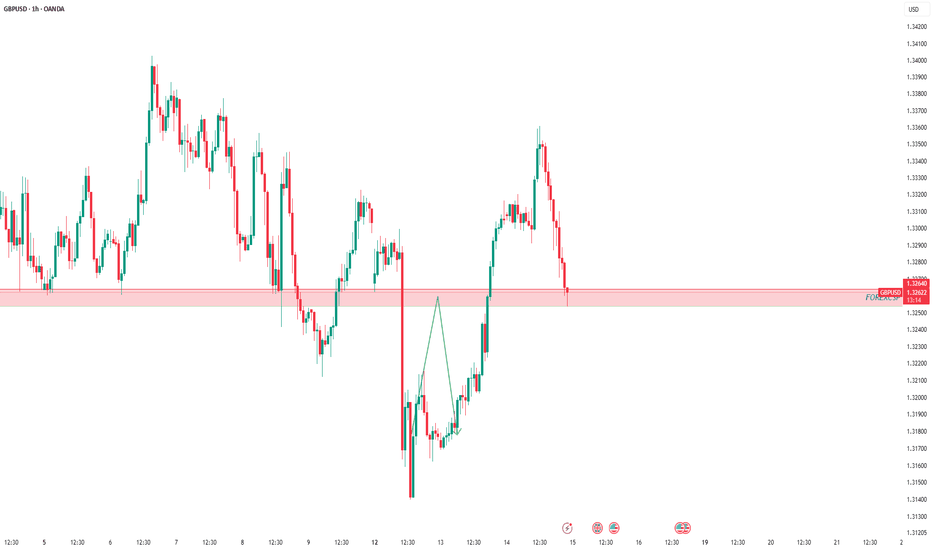

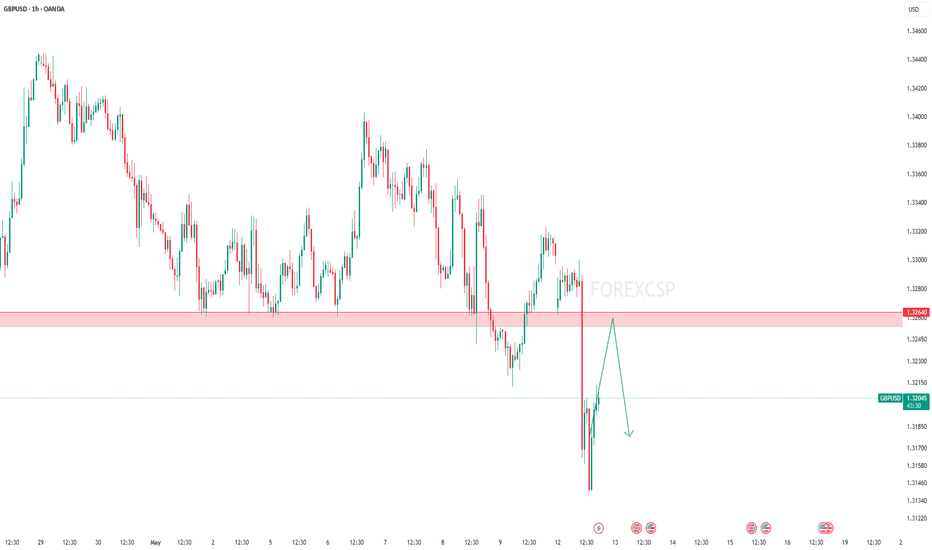

GBPUSD pullbackOANDA:GBPUSD

As shown in our pinned analysis, this level was previously considered for a short trade. But after being broken, according to our plan, it has now turned into a buy zone.

We are ready to enter a long position,

but if the price drops below and holds, this level will lose its validity and the analysis will be invalid.

Follow us for more trades analysis!

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

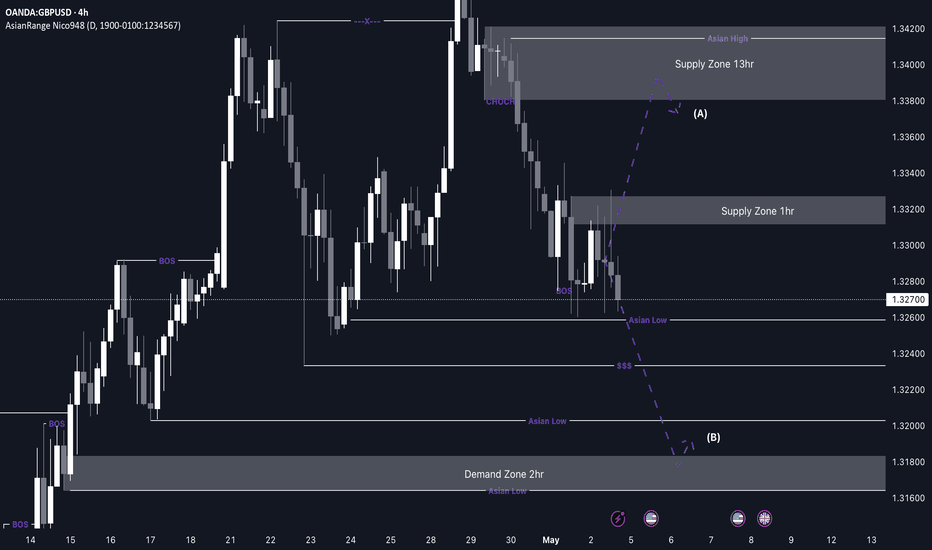

GBP/USD potential shorts back downMy analysis revolves around a possible bearish reaction from the 2‑hour supply zones. If price does respect these zones, I’ll look for a sell setup to drive price lower—though I’ll approach with caution because there’s liquidity resting just above those points of interest.

Should price push downward, my next target is the 10‑hour demand zone that triggered the recent change of character. This discounted area could spark a bullish response.

Confluences for GU sells are as follows:

- An unmitigated 4‑hour supply zone overhead.

- A “sell‑to‑buy” scenario fits: price sits closer to supply and still needs a retracement.

- Imbalance and untapped liquidity lie below, inviting a move south.

- Liquidity has just been swept above, leaving a clean supply zone behind.

P.S. If price punches through these supply zones and breaks structure to the upside, I’ll watch for the new zone that forms—there could be a nearer‑term long opportunity from there.

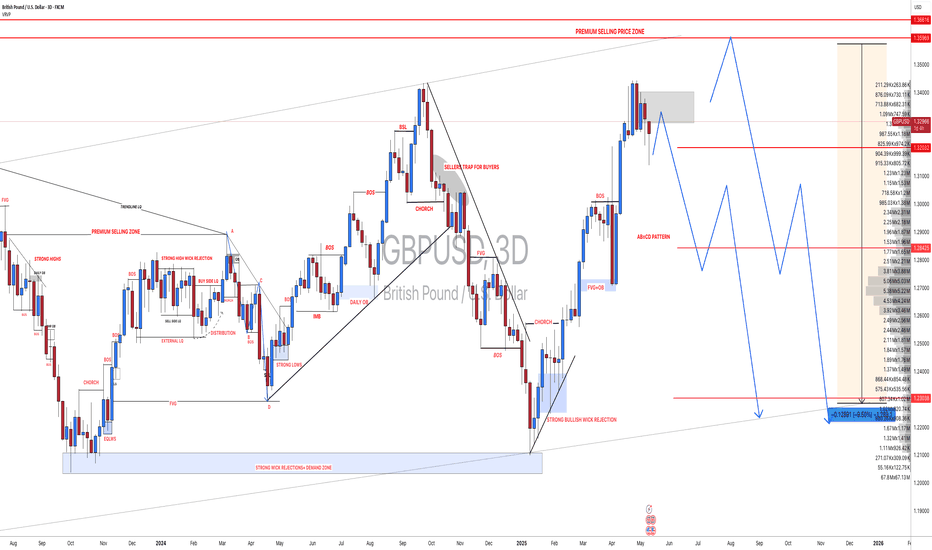

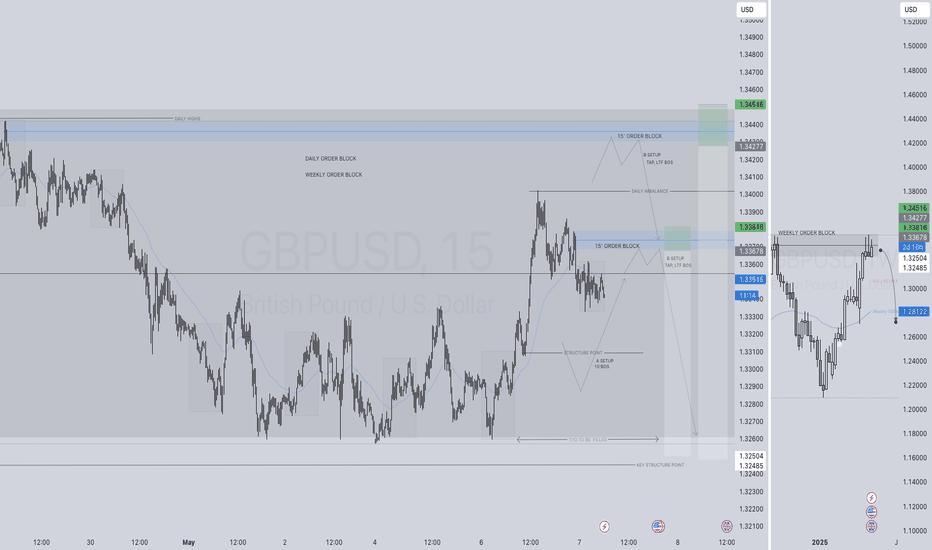

GBPUSD SHORT FORECAST Q2 W20 D16 Y25GBPUSD SHORT FORECAST Q2 W20 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

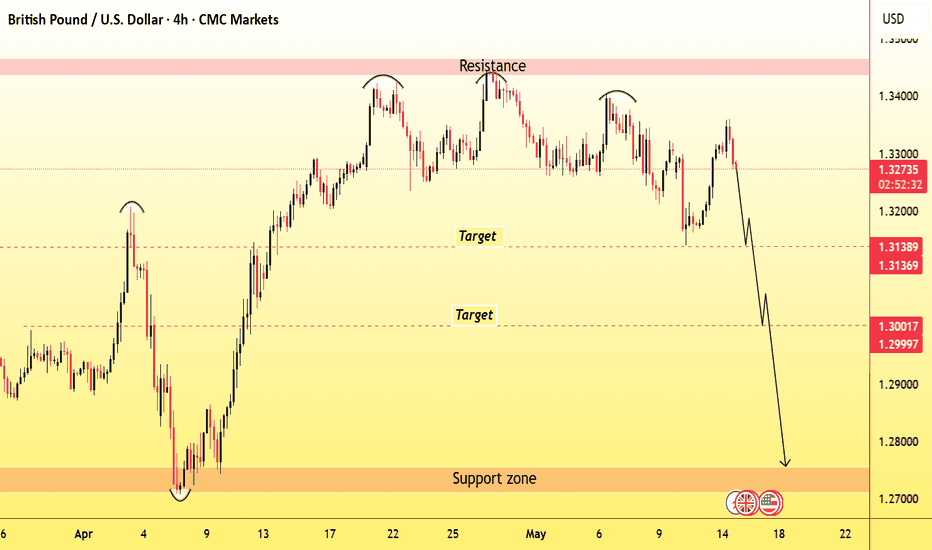

GBPUSD TRIPPLE TOP BEARISH PATTERNGBPUSD TRIPPLE TOP BEARISH PATTERN

Market Finds the Specific Adjustment where it can get possible values

This market moves towards bearish trend making a Tripple Top bearish pattern.

GBPUSD market want to reach some targets, resistance and support level.

1st Target Zone 1.31400

Final Target Zone 1.30000

Resistance level. 1.34300

Support level. 1.27600

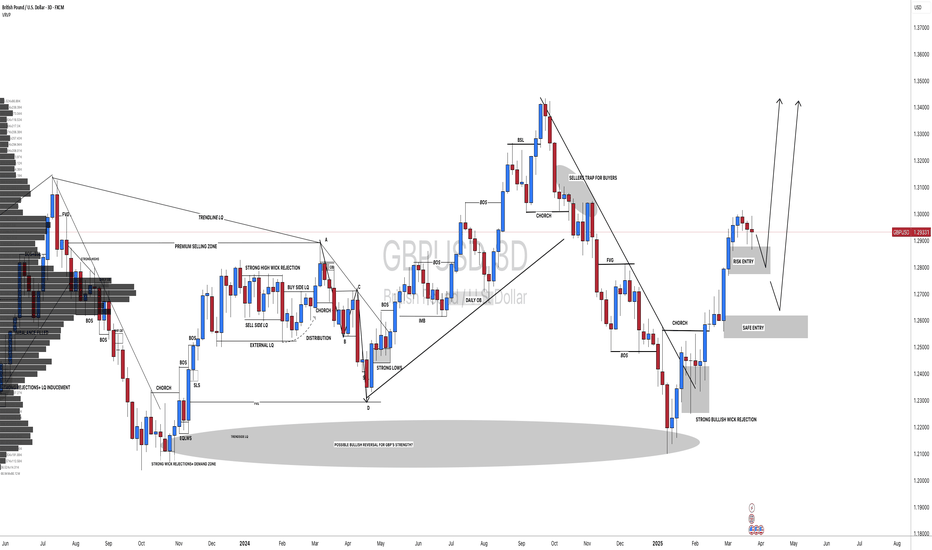

#GBPUSD: Risk Entry Vs Safe Entry, Which One Would You Chose? The GBPUSD currency pair presents two promising opportunities for entry, potentially generating gains exceeding 500 pips. However, entering these markets carries a substantial risk of stop-loss hunting during the commencement of the week. Conversely, adopting a safe entry strategy offers a favourable chance for a bullish position.

We encourage you to share your thoughts and feedback on our ideas. ❤️🚀

Team Setupsfx_

GBPUSD Analysis🔁 GBPUSD update!

As our followers know,

we previously took a great profit from this level (see pinned idea below).💸

Now, that level is broken and we are patiently waiting for a pullback to enter a short trade.🔻

***If the price breaks above, we may switch to a buy setup — let’s wait for a clear signal!🕵️

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

Market Analysis: GBP/USD Edges HigherMarket Analysis: GBP/USD Edges Higher

GBP/USD is attempting a fresh increase above the 1.3270 resistance.

Important Takeaways for GBP/USD Analysis Today

- The British Pound is attempting a fresh increase above 1.3250.

- There was a break above a key bearish trend line with resistance at 1.3270 on the hourly chart of GBP/USD at FXOpen.

GBP/USD Technical Analysis

On the hourly chart of GBP/USD at FXOpen, the pair declined after it failed to clear the 1.3440 resistance. As mentioned in the previous analysis, the British Pound traded below the 1.3200 support against the US Dollar.

Finally, the pair tested the 1.3140 zone and is currently attempting a fresh increase. The bulls were able to push the pair above the 50-hour simple moving average and 1.3215.

There was a break above a key bearish trend line with resistance at 1.3270. The pair surpassed the 50% Fib retracement level of the downward move from the 1.3402 swing high to the 1.3139 low. It is now showing positive signs above 1.3300.

On the upside, the GBP/USD chart indicates that the pair is facing resistance near 1.3340 and the 76.4% Fib retracement level of the downward move from the 1.3402 swing high to the 1.3139 low.

The next major resistance is near 1.3400. A close above the 1.3400 resistance zone could open the doors for a move toward 1.3440. Any more gains might send GBP/USD toward 1.3500.

On the downside, immediate support is near 1.3270. If there is a downside break below 1.3270, the pair could accelerate lower. The first major support is near the 1.3215 level and the 50-hour simple moving average.

The next key support is seen near 1.3140, below which the pair could test 1.3080. Any more losses could lead the pair toward the 1.3000 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

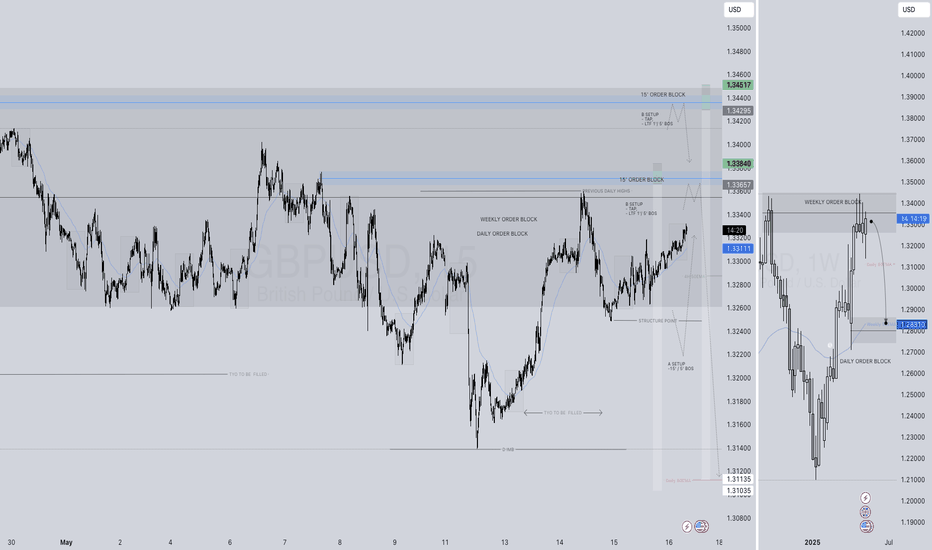

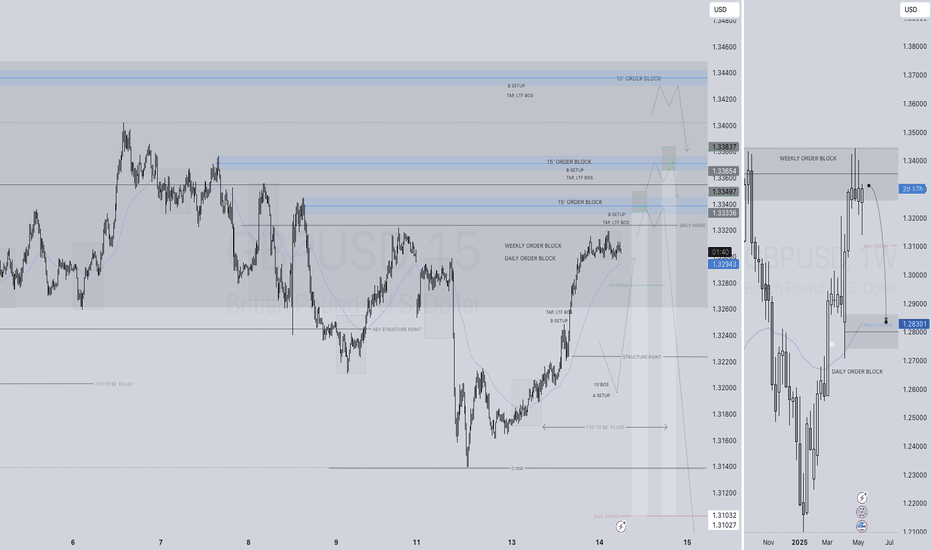

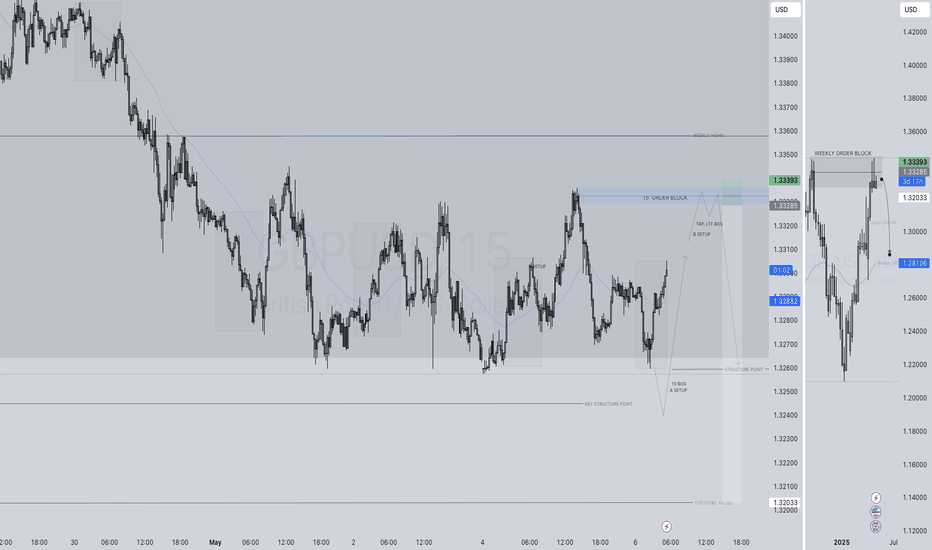

GBPUSD SHORT FORECAST Q2 W20 D14 Y25GBPUSD SHORT FORECAST Q2 W20 D14 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

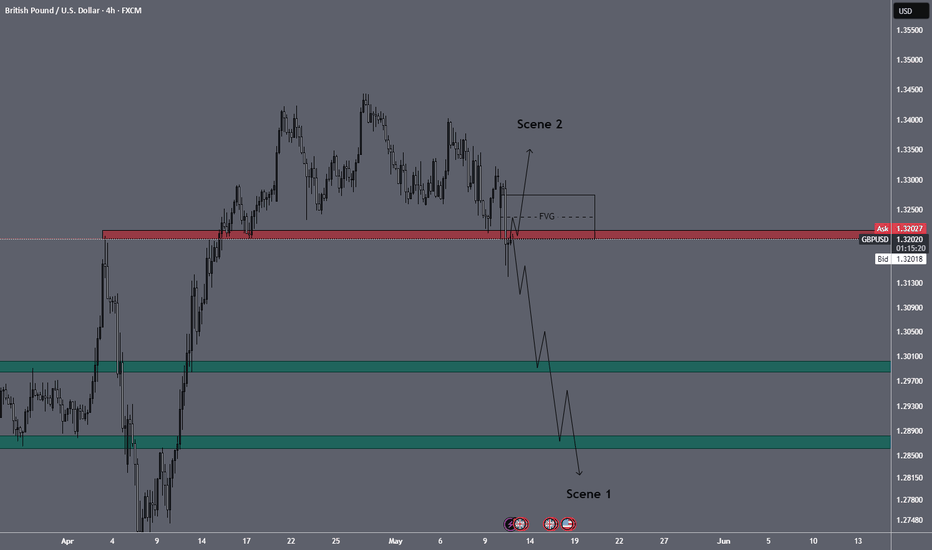

GBPUSD Brace for a Sharp Drop to 1.3000! Free signal!Hello everyone.

I want share my idea about GBPUSD.

The U.S.-China trade deal breakthrough has fueled USD strength, pressuring GBP/USD after a surge to 1.3330. BoE’s dovish stance, with a potential 25 bps rate cut priced in, contrasts with a hawkish Fed, favoring USD. Upcoming UK CPI and U.S. CPI data this week could drive volatility—soft UK inflation may weaken GBP, while high U.S. inflation could bolster USD further. UK wage growth (5.9%) offers GBP support, but weak PMI and employer sentiment cap gains. Watch U.S.-UK trade deal news for potential GBP upside.

With technical we can see last week we had some consolidation and this week started with high volatility and brake support. at the moment price testing resistance + 4h FVG.

Scenario 1 (Bearish – Primary View): Price rejects the 1.3200–1.3275 FVG/resistance zone and resumes its downtrend, targeting the next major support at 1.3000—a psychological and structural level. This aligns with USD strength from the trade deal and BoE’s dovish stance . Trade Setup: Short below 1.3200, target 1.3000, stop above 1.3300 (above FVG).

Scenario 2 (Bullish – Less Likely): Buyers break above the FVG (1.3275) and 1.3300, targeting 1.3350–1.3400. This would require a catalyst like soft U.S. CPI data weakening USD, but current fundamentals favor bears.

Trade Setup:

Entry below - 1.3190 (current price 1.32048) ensures confirmation of rejection.

Stop above - 1.3280 (above FVG) protects against a bullish breakout.

Target - I will follow trend with trail stop.

For collaboration text me private!

Always make your own research!!!

GBPUSD: Strong Sell Momentum Built Up! What is next?GBPUSD is building strong sell momentum, increasing sell volume. At the same time, DXY is in correction mode, so keep that in mind. If DXY plummets again, it may invalidate our first entry. However, there’s a second entry that could be a safer zone for those looking for a stable entry.

There are three take profit targets that can be set according to your trading plan. This analysis doesn’t guarantee that the price will move as described.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

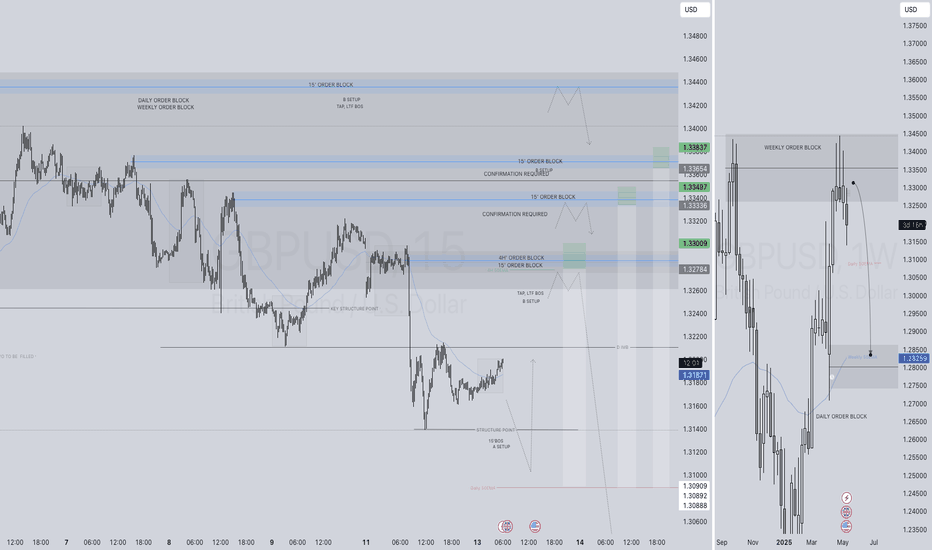

GBPUSD SHORT FORECAST Q2 W20 D13 Y25GBPUSD SHORT FORECAST Q2 W20 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPUSD INVERSE CUP AND HANDLE PATTERNTechnical Overview

Resistance Level: 1.34400

Support Level: 1.27500

Bearish Targets: 1.30200 and 1.28800

The resistance at 1.34400 represents the peak before the formation of the inverted cup, serving as a critical level where selling pressure may intensify. The support at 1.27500 aligns with the neckline of the pattern; a decisive break below this level would confirm the bearish breakout, potentially leading to the projected targets.

📉 Trading Strategy

Consider entering a short position upon a confirmed break below the 1.27500 support level, accompanied by increased trading volume to validate the breakout.

Place a stop-loss order above the handle's peak, near 1.34400, to protect against false breakouts and limit potential losses.

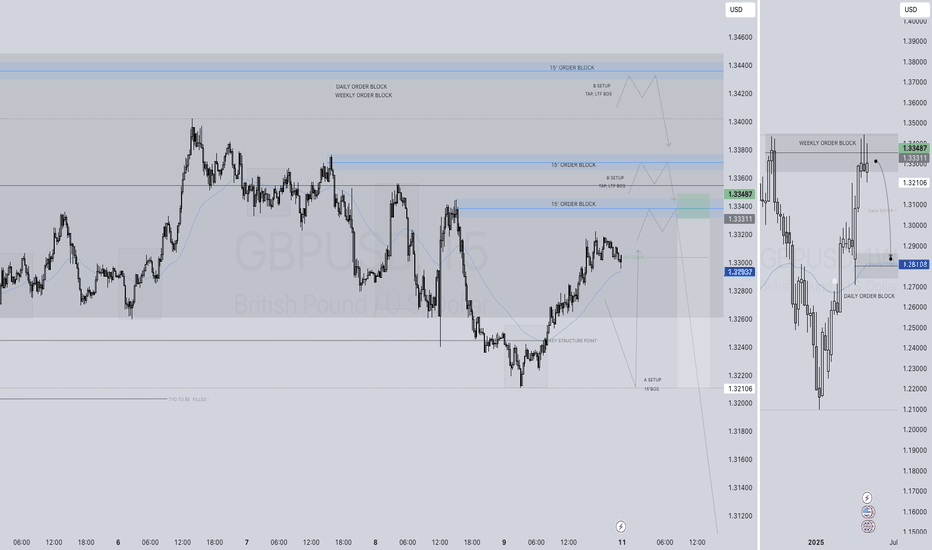

GBPUSD SHORT FORECAST Q2 W20 D12 Y25GBPUSD SHORT FORECAST Q2 W20 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

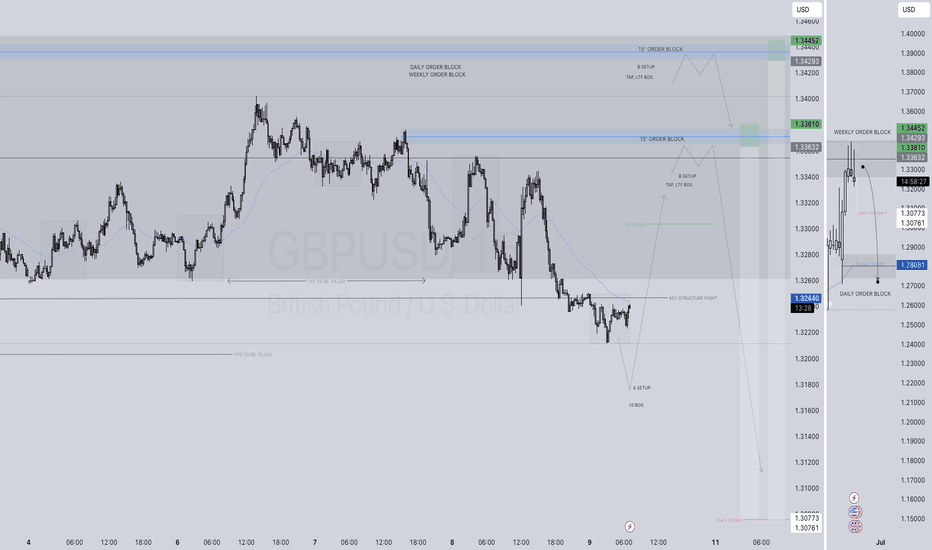

GBPUSD SHORT FORECAST Q2 W19 D9 Y25GBPUSD SHORT FORECAST Q2 W19 D9 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPUSD SHORT FORECAST Q2 W19 D7 Y25GBPUSD SHORT FORECAST Q2 W19 D7 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPUSD SHORT FORECAST Q2 W19 D6 Y25GBPUSD SHORT FORECAST Q2 W19 D6 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

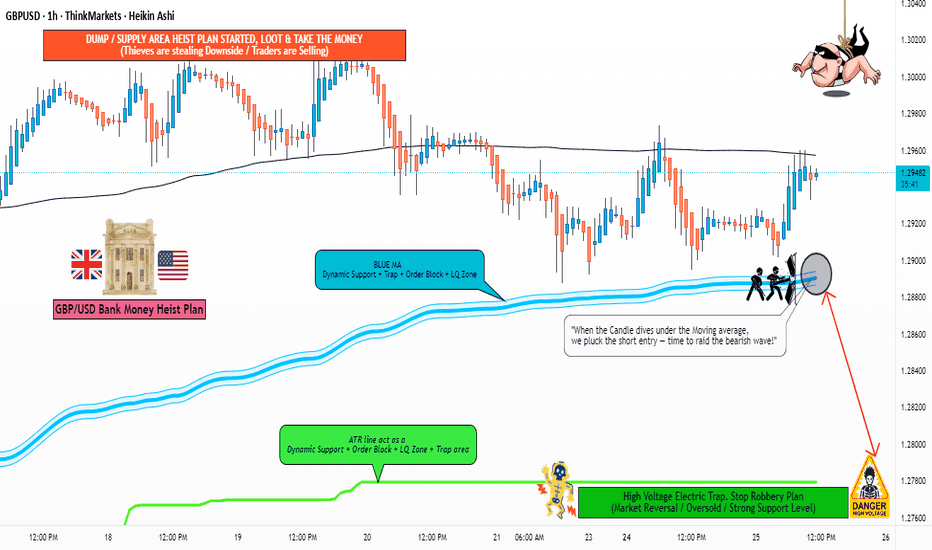

GBP/USD "The Cable" Forex Bank Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/USD "The Cable" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.28877) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at 1.29600 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.27800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GBP/USD "The Cable" Forex Bank Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/USD Buy from 2hr demand zone?This week, my analysis for GU focuses on a potential buy opportunity from the 2H demand zone. Although this zone is still quite a distance from current price action, I’m patiently waiting to see which side of liquidity gets taken first — that will help highlight a more immediate area of interest.

Given the recent bearish movement, I’m anticipating a possible break of structure to the downside, targeting the underlying Asia lows. This move could create a new supply zone, which may present a more valid setup in the short term.

However, if price maintains its current trajectory, I’m also eyeing the 13H supply zone, which would offer a strong POI for future sell opportunities after a bullish correction.

Confluences for GU Buys:

- Price is approaching a 2H demand zone.

- Market has been bearish, suggesting a correction may be due.

- DXY analysis aligns with a potential GU recovery.

- Liquidity buildup points toward a possible retracement to the 13H supply zone.

P.S. If the week starts with a bullish move, that could offer a better setup for shorts later on as price approaches the higher supply zone. Stay alert and flexible with your setups — wishing everyone a strong and disciplined trading week!