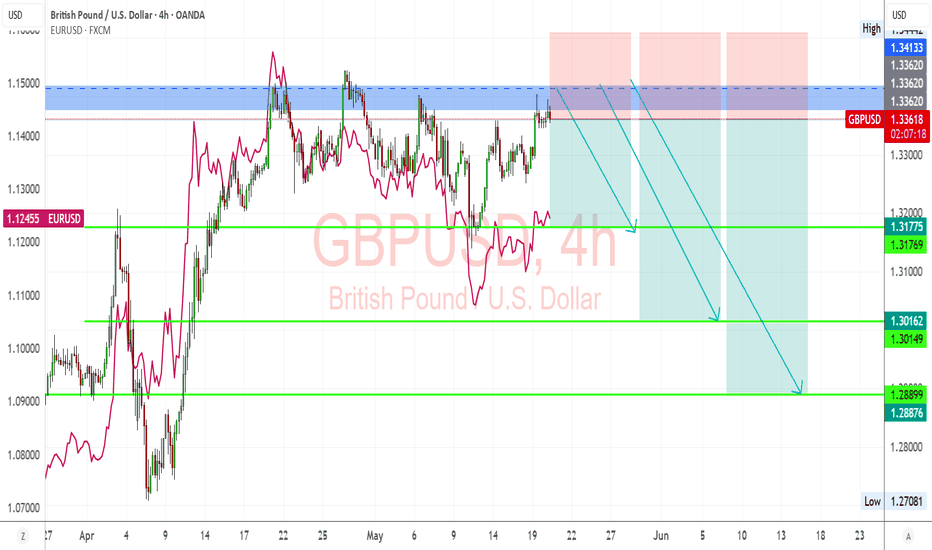

GBPUSD Analysis – Bearish Setup Into Key ResistanceGBP/USD is trading into a key multi-week resistance zone between 1.3360 and 1.3413. The pair has failed to break this area multiple times, and current price action shows signs of compression and hesitation. With elevated UK inflation limiting BoE easing flexibility and renewed USD support following bond yield spikes, this setup offers a compelling bearish opportunity. Clean downside targets lie at 1.3177, 1.3016, and potentially 1.2890. The trade remains valid unless price breaks and holds above 1.3413.

🔍 Technical Analysis

Structure:

Price is testing a significant resistance zone (1.3360–1.3413) that’s held since early April.

Bearish trendline from May highs remains intact.

A descending structure is forming with lower highs and failed breakouts.

Support Levels to Watch:

1.3177 – Previous structure low

1.3016 – Strong horizontal support

1.2890 – March swing low and fib extension target

Confluence:

EUR/USD overlay shows rejection at similar highs, reinforcing risk-off dollar strength

Price failing to hold above fib retracement levels from prior swings

🌍 Fundamental Context

🇬🇧 British Pound (GBP):

UK inflation is climbing again (expected 3.0% CPI for April), delaying BoE's ability to cut further.

BoE’s Pill has pushed back on rapid easing, citing persistent service inflation.

UK-EU trade agreement provides medium-term support, but short-term upside appears priced in.

🇺🇸 U.S. Dollar (USD):

Despite Moody’s downgrade, U.S. yields are rising, supporting USD demand.

Trump’s tariff threats have injected global risk-off tones, lifting the dollar as a safe haven.

Fed remains cautious — no rate cuts expected soon.

🎯 Trade Setup

Bias: Bearish

Entry Zone: Near 1.3360–1.3413 resistance (wait for rejection candle confirmation)

Targets:

First: 1.3177

Second: 1.3016

Third: 1.2890

Invalidation: A daily close above 1.3413 would invalidate the bearish thesis

⚠️ Risk & Management Tips

Don’t short blindly into resistance — wait for strong wick or bearish engulfing candle.

Watch upcoming UK inflation data or Fed commentary for macro triggers.

Avoid over-leveraging: false breakouts near highs are common.

🧭 Conclusion

GBP/USD is coiling near a powerful resistance area. A confirmed rejection opens the door for a multi-leg downside move into 1.30 and below. As long as price holds beneath 1.3413, the risk-reward profile favors sellers. Patience and precision are key at this stage.

Gbpusdsignal

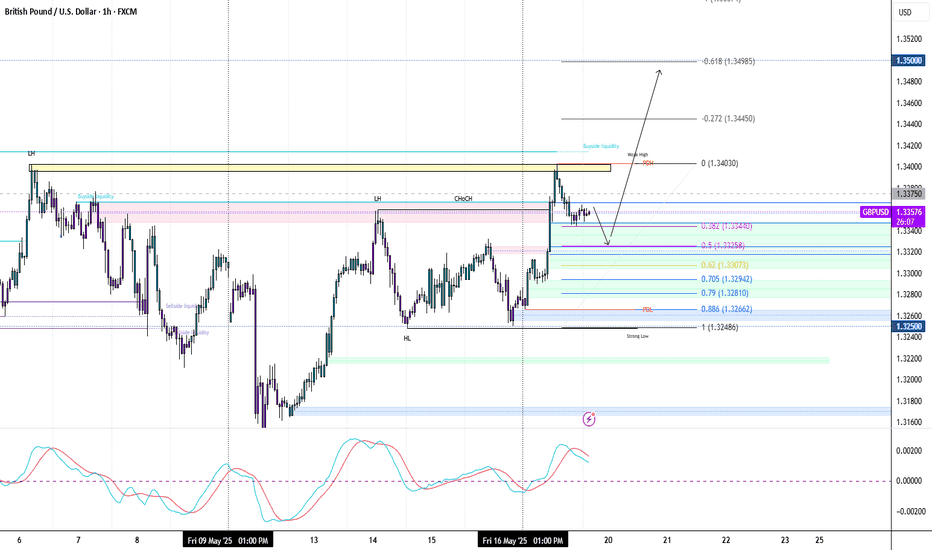

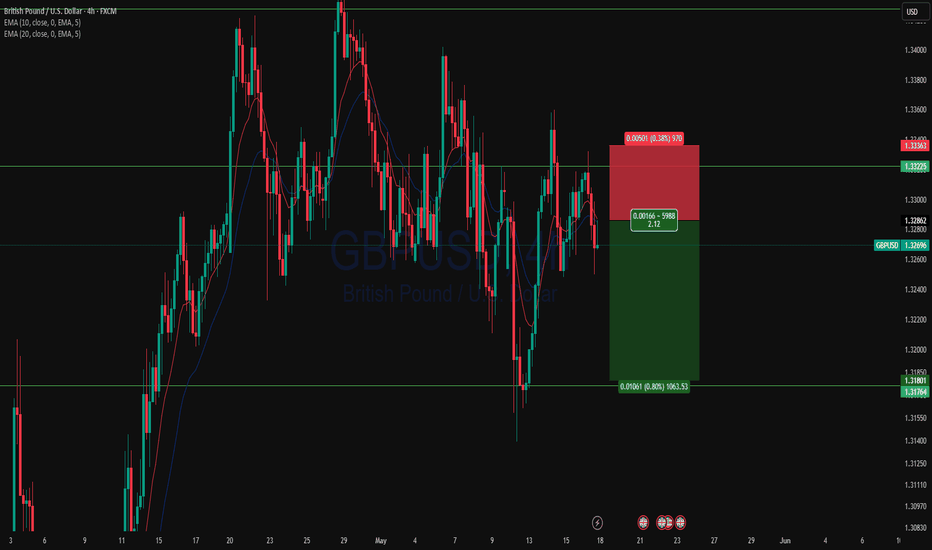

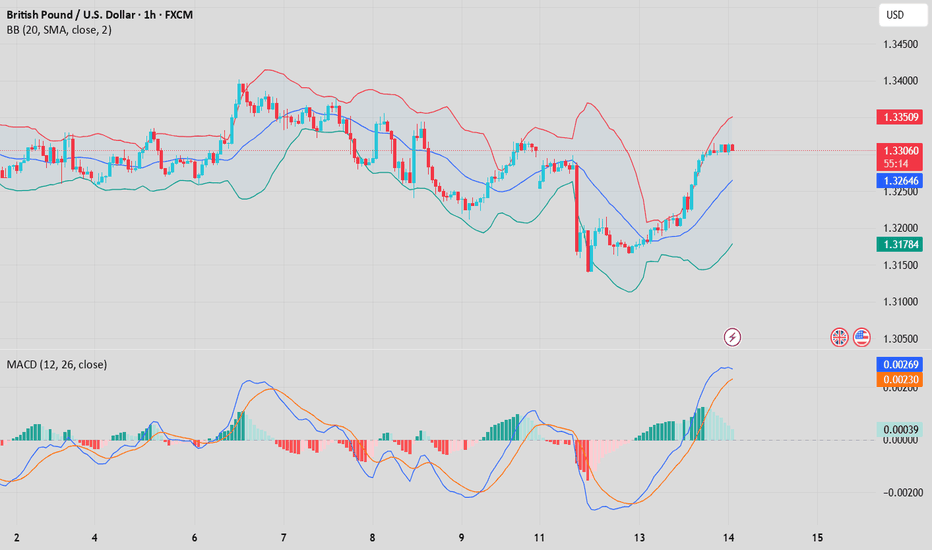

GBPUSD: Bulls Are Gearing Up For The Next RallyBullish Confirmations:

- Double bottom formed at QP at end of last week

- Creating HLs and HHs

- Bullish Choch

- Multiple bullish FVGs (showing bullish momentum)

- Multiple bullish breaker blocks

🟢ENTRY 1.33578

SL 1.331

TP1 1.33778

TP2 1.34078

TP3 1.34578

There's a chance we may get a deeper pullback. If so no big deal, we'll just catch a better entry.

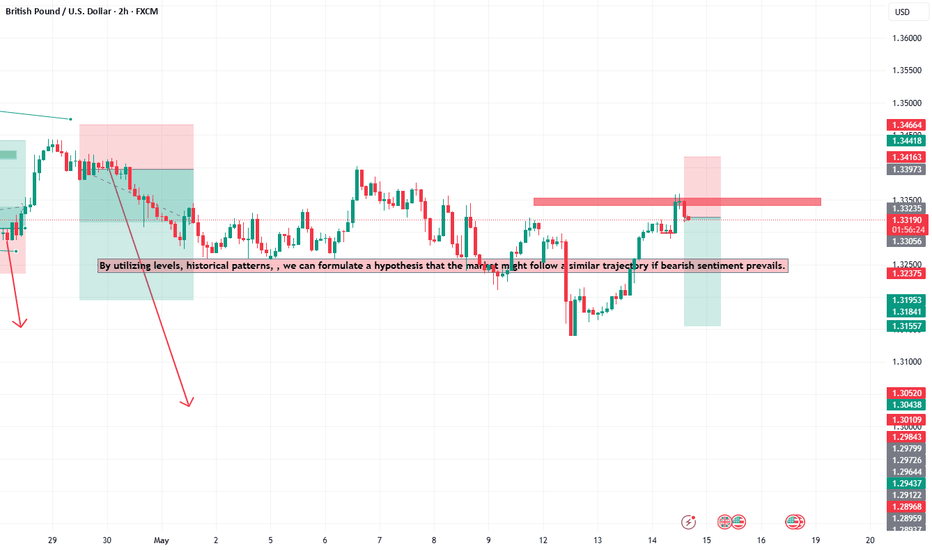

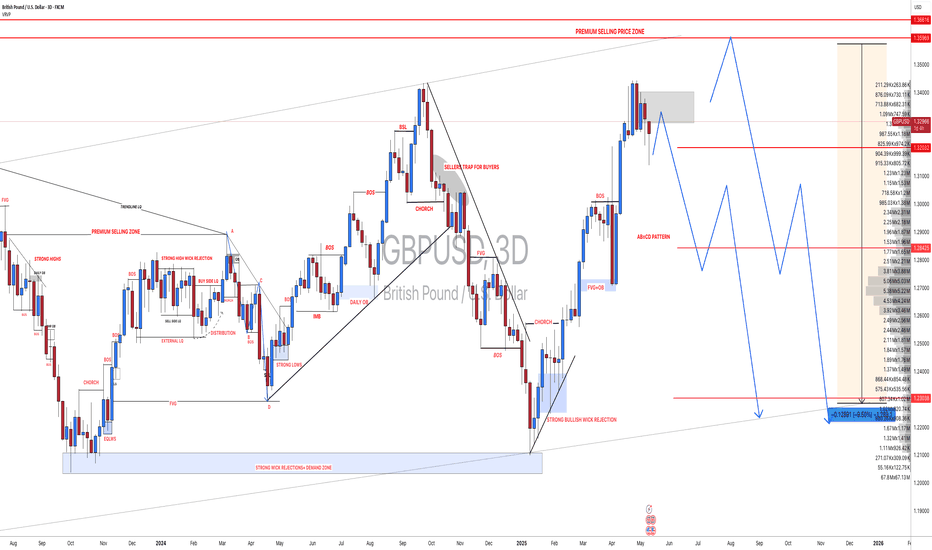

GBPUSD and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

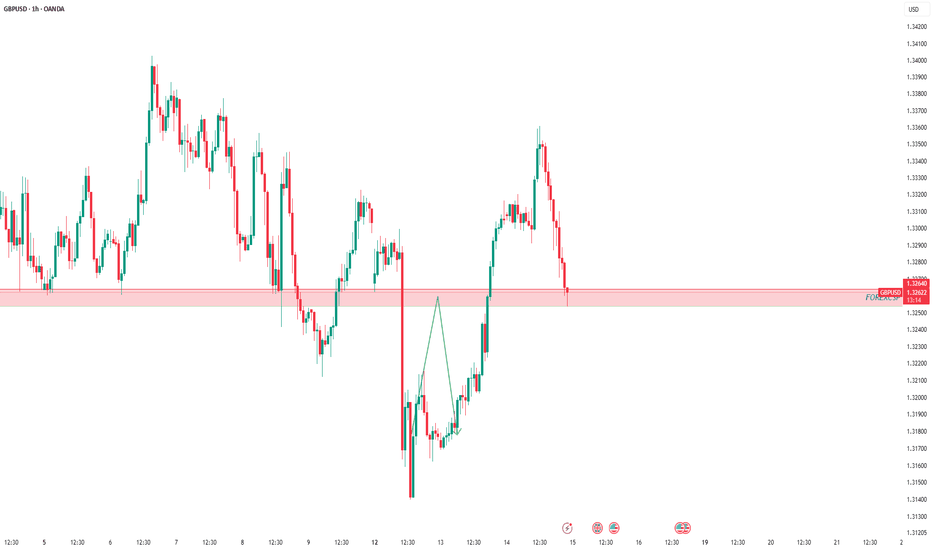

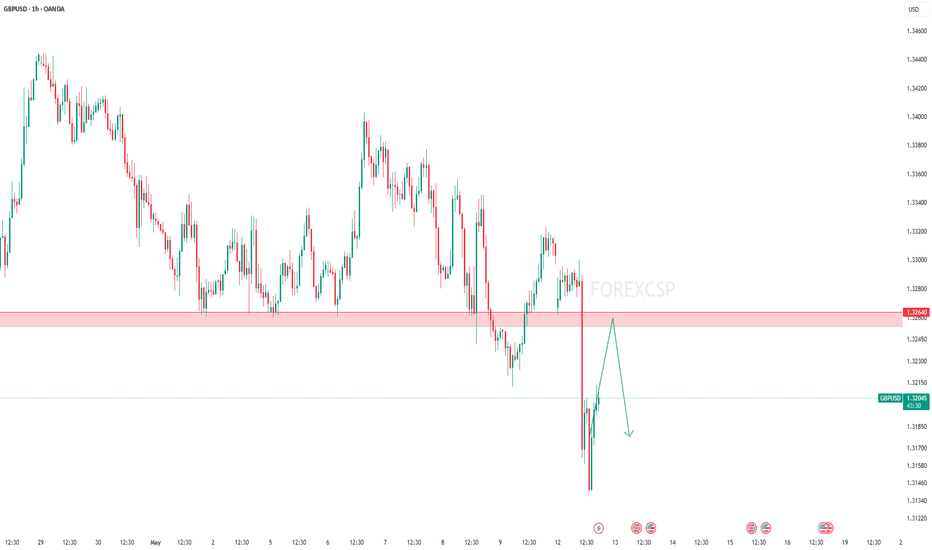

GBPUSD pullbackOANDA:GBPUSD

As shown in our pinned analysis, this level was previously considered for a short trade. But after being broken, according to our plan, it has now turned into a buy zone.

We are ready to enter a long position,

but if the price drops below and holds, this level will lose its validity and the analysis will be invalid.

Follow us for more trades analysis!

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

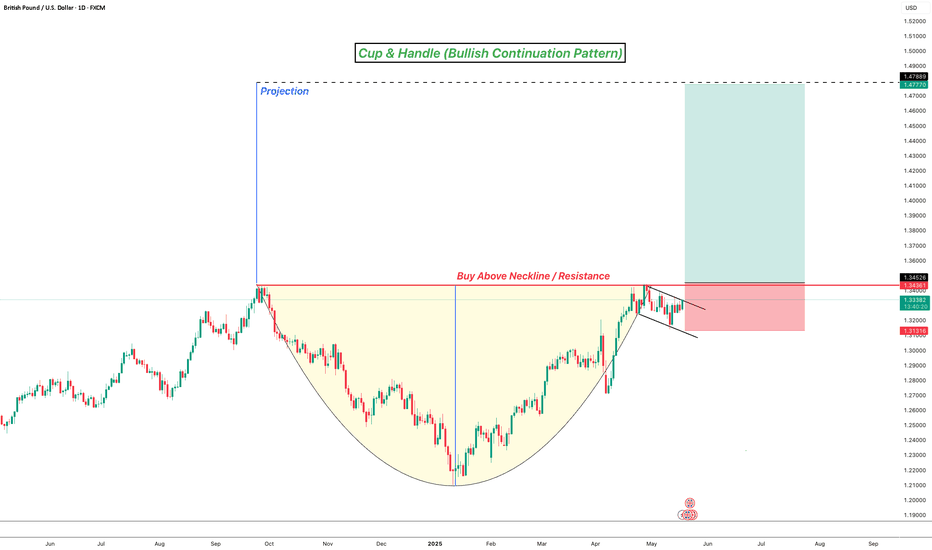

Cup & Handle - Bullish Continuation PatternFX:GBPUSD continues its bullish trend, printing higher highs and higher lows. Currently price has formed a Cup & Handle pattern signalling potential bullish continuation!

Following the analysis, buys should only be triggered once neckline / resistance has been broken!

GBPUSD inverted head and shoulder?Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

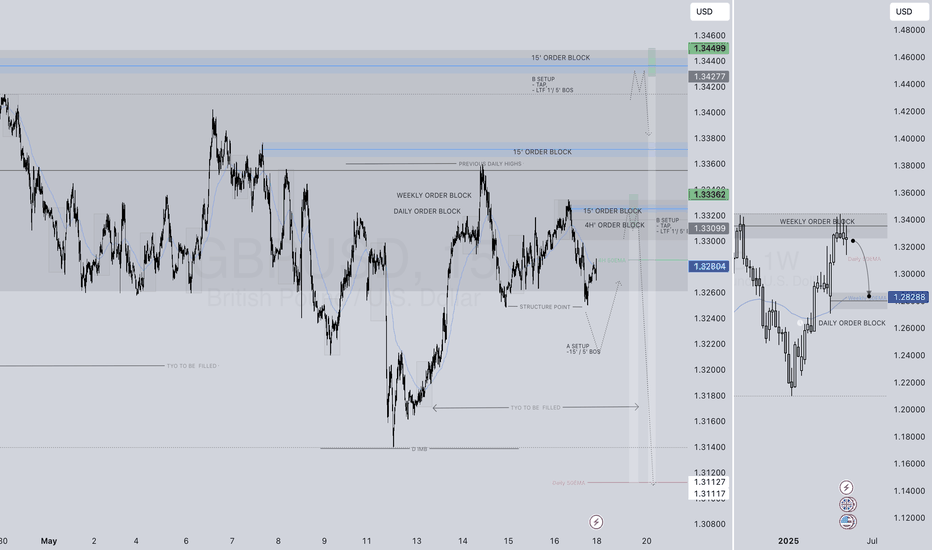

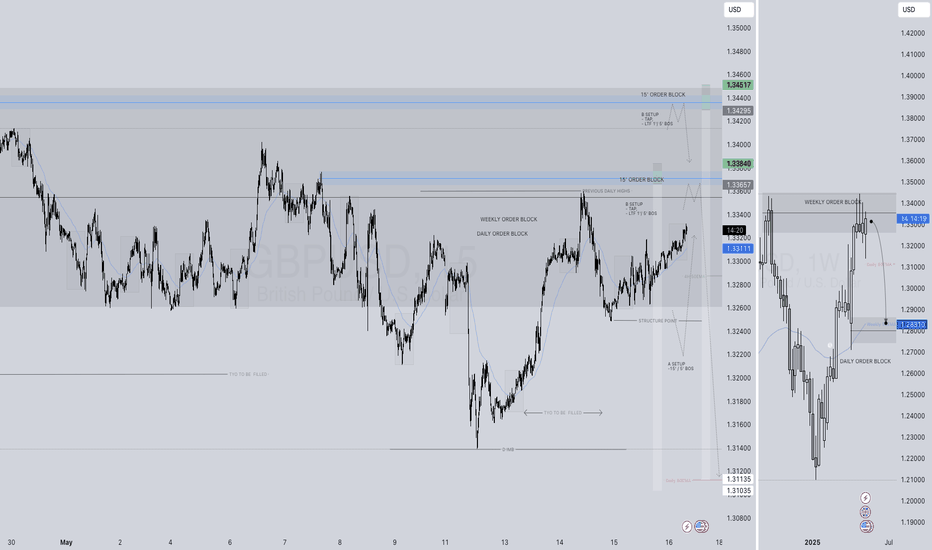

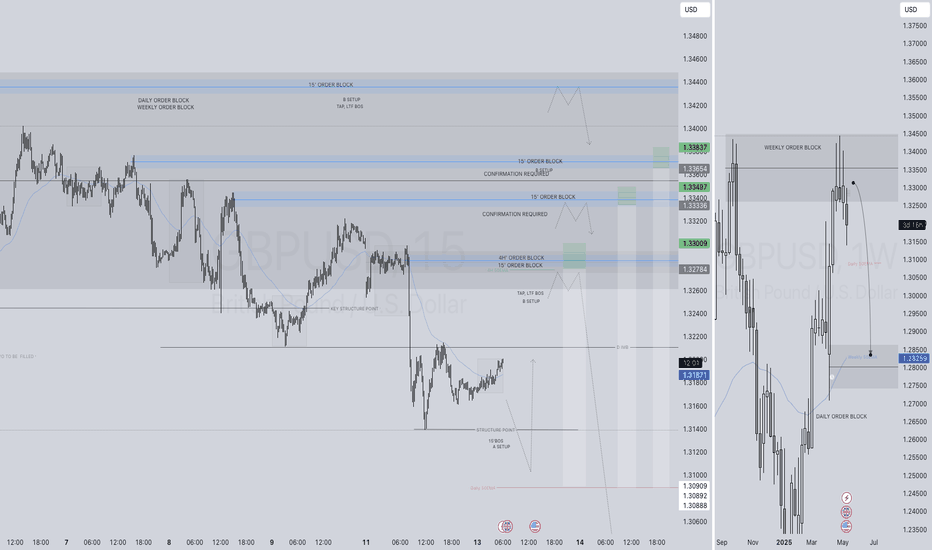

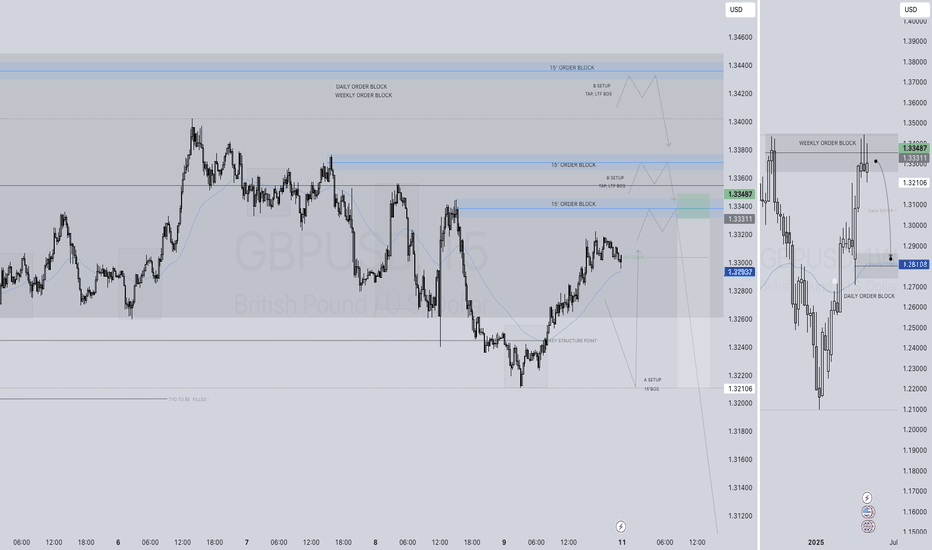

DON'T MISS OUT ON GBPUSD SHORTS IN W21 OF Q2 Y25GBPUSD SHORT FORECAST Q2 W21 Y25

DON'T MISS OUT ON GBPUSD SHORTS IN W21 OF Q2 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPUSD(20250516)Today's AnalysisMarket news:

Fed Chairman Powell: The Fed is adjusting its overall policy-making framework. Zero interest rate is no longer a basic situation. The wording of underemployment and average inflation rate needs to be reconsidered. PCE is expected to drop to 2.2% in April.

Technical analysis:

Today's buying and selling boundaries:

1.3291

Support and resistance levels:

1.3356

1.3332

1.3316

1.3267

1.3251

1.3227

Trading strategy:

If the price breaks through 1.3316, consider buying, the first target price is 1.3332

If the price breaks through 1.3291, consider selling, the first target price is 1.3267

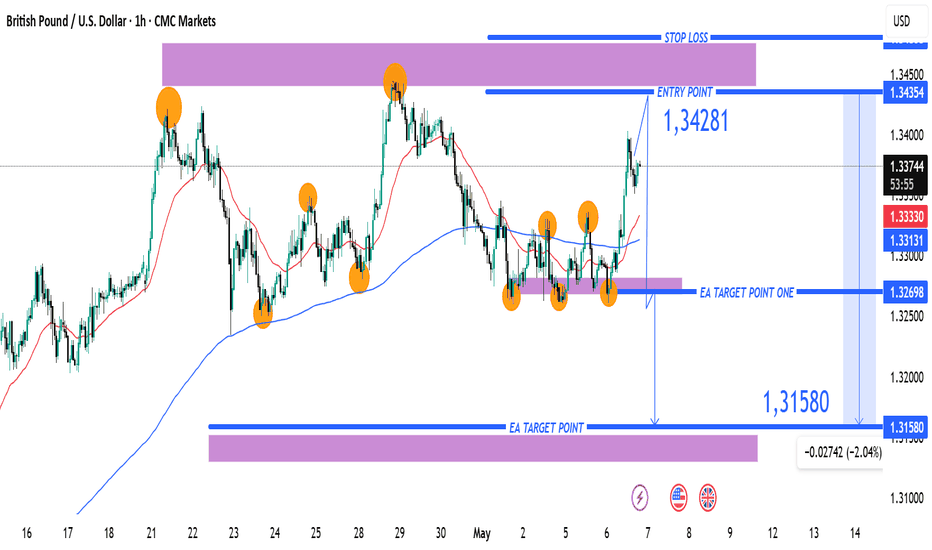

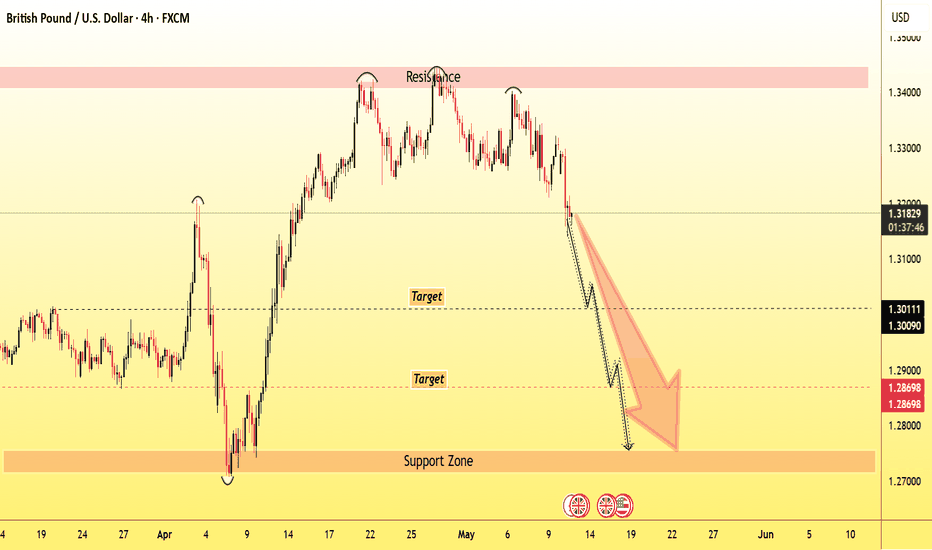

GBP/USD Short Trade Setup – Targeting 1.31580 from 1.34281Entry Point: 1.34281

Stop Loss: 1.34554 (about 27 pips above entry)

Target Points:

Target One: 1.32698

Final Target (EA Target Point): 1.31580 (approx. 270 pips from entry)

Risk/Reward Ratio: Favorable, given the tight stop and wider target.

📈 Chart Features

Highlighted Zones:

Resistance Zone (top purple area): A strong supply zone, where price reversed multiple times.

Support Zone (bottom purple area): Historical demand zone, previous price reactions.

Orange Circles: Represent key swing highs and lows (likely used to confirm the zones or a double/triple top/bottom pattern).

Moving Averages:

Red Line: Likely a shorter-period MA (e.g., 20 EMA).

Blue Line: Likely a longer-period MA (e.g., 50 or 200 EMA), often used for trend confirmation.

🧠 Interpretation

Price Action: The chart suggests the price recently hit a resistance zone and is expected to reverse.

Trade Bias: Bearish – expecting the market to drop from the resistance.

Indicators Support:

Price has rejected multiple times at the top.

Entry is slightly below resistance, confirming a potential reversal.

Targets align with support and past consolidation zones.

GBPUSD SHORT FORECAST Q2 W20 D16 Y25GBPUSD SHORT FORECAST Q2 W20 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPUSD SHORT FORECAST Q2 W20 D15 Y25GBPUSD SHORT FORECAST Q2 W20 D15 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

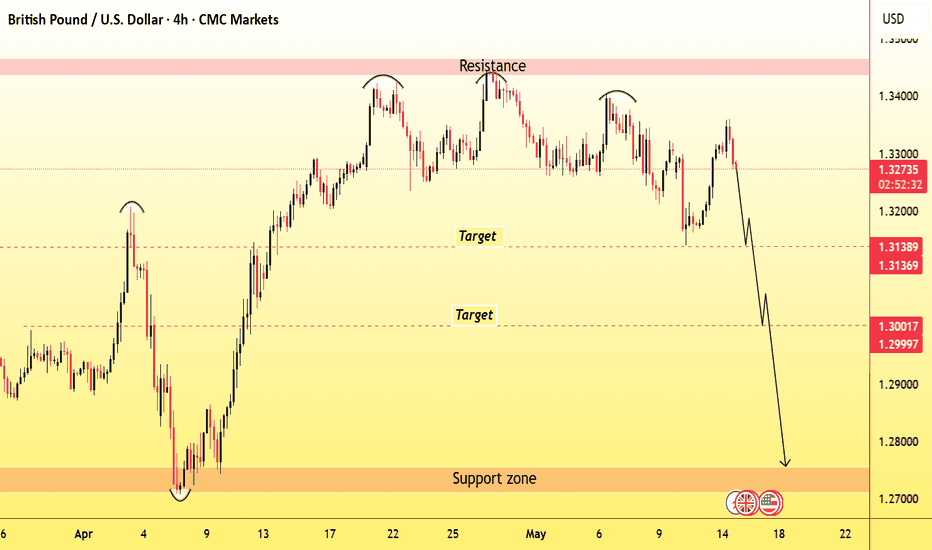

GBPUSD TRIPPLE TOP BEARISH PATTERNGBPUSD TRIPPLE TOP BEARISH PATTERN

Market Finds the Specific Adjustment where it can get possible values

This market moves towards bearish trend making a Tripple Top bearish pattern.

GBPUSD market want to reach some targets, resistance and support level.

1st Target Zone 1.31400

Final Target Zone 1.30000

Resistance level. 1.34300

Support level. 1.27600

GBP/USD Bullish Playbook – Multi-Timeframe Strategy (May 2025)GBP/USD is in a clear daily uptrend, with price respecting an ascending channel since December 2024. A recent pullback to the 1.3200–1.3250 support zone set the stage for a bounce, aligning with a 1-hour double bottom and a 15-minute bull flag forming around 1.3300–1.3360.

Key short-term levels:

Support: 1.3300–1.3310 (H1 neckline & intraday trendline).

Resistance: 1.3360–1.3370 (flag high and daily breakout zone).

Trading plan:

Buy dips near 1.3300 with stops under 1.3285.

Target: 1.3360, then 1.3400–1.3450.

Breakout trade: Long above 1.3370 if momentum holds.

Fade scenario: Short 1.3360 rejections back to 1.3320.

All three timeframes support a bullish bias into higher highs, with clean setups and tight stops. This plan favors high-RR trades in a tight range with breakout potential.

GBPUSD Analysis🔁 GBPUSD update!

As our followers know,

we previously took a great profit from this level (see pinned idea below).💸

Now, that level is broken and we are patiently waiting for a pullback to enter a short trade.🔻

***If the price breaks above, we may switch to a buy setup — let’s wait for a clear signal!🕵️

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

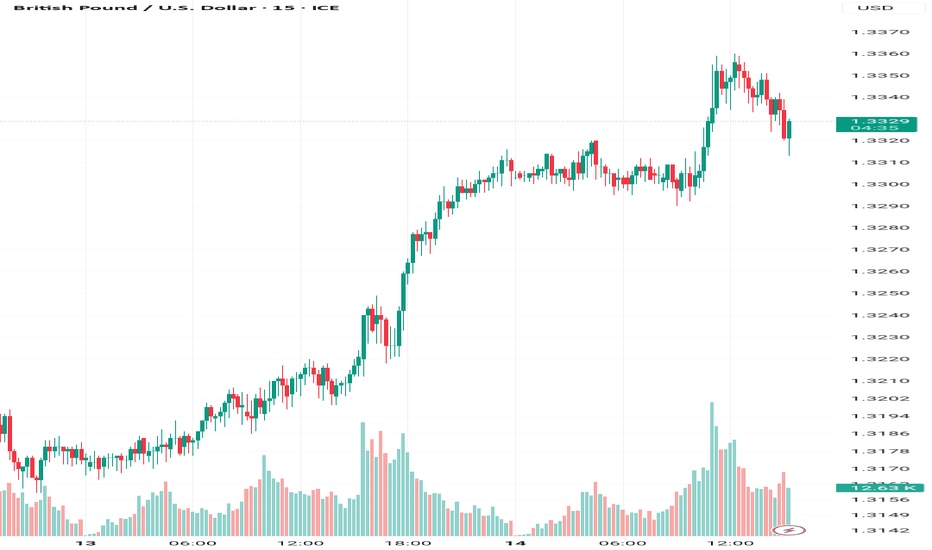

GBPUSD(20250514)Today's AnalysisMarket news:

The U.S. unadjusted CPI annual rate unexpectedly dropped to 2.3% in April, the lowest since February 2021.

Technical analysis:

Today's buying and selling boundaries:

1.3262

Support and resistance levels:

1.3408

1.3353

1.3318

1.3205

1.3170

1.3115

Trading strategy:

If the price breaks through 1.3318, consider buying, the first target price is 1.3353

If the price breaks through 1.3262, consider selling, the first target price is 1.3205

GBPUSD: Strong Sell Momentum Built Up! What is next?GBPUSD is building strong sell momentum, increasing sell volume. At the same time, DXY is in correction mode, so keep that in mind. If DXY plummets again, it may invalidate our first entry. However, there’s a second entry that could be a safer zone for those looking for a stable entry.

There are three take profit targets that can be set according to your trading plan. This analysis doesn’t guarantee that the price will move as described.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

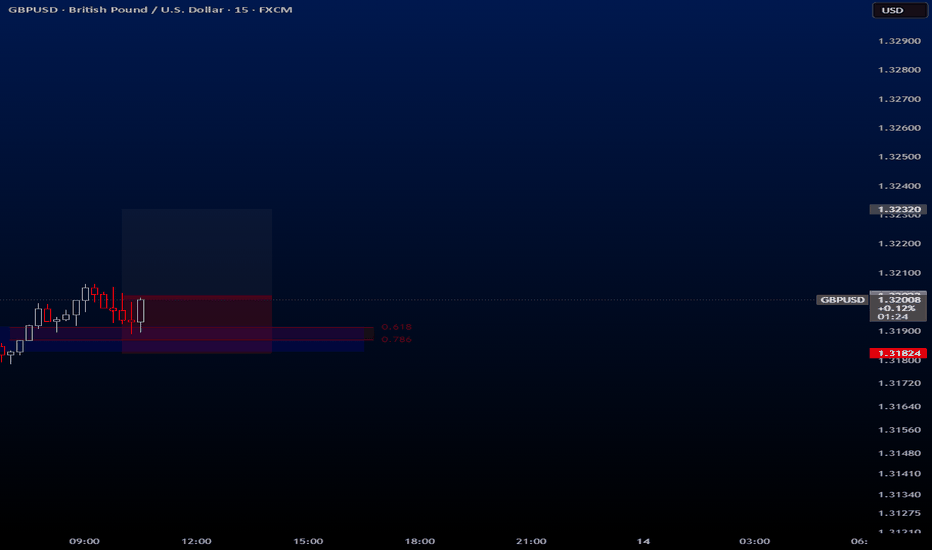

GBPUSDHello traders.

Today's first signal comes from GBPUSD. To be honest, I don’t feel entirely confident about this trade — but I’m still taking it, trusting my system and strategy.

🔍 Criteria:

✔️ Timeframe: 15M

✔️ Risk-to-Reward Ratio: 1:1.50

✔️ Trade Direction: Buy

✔️ Entry Price: 1.32022

✔️ Take Profit: 1.32320

✔️ Stop Loss: 1.31824

🔔 Disclaimer: This is not financial advice. It's a trade I’m taking based on my own system, shared purely for educational purposes.

📌 If you're also interested in systematic and data-driven trading strategies:

💡 Don’t forget to follow the page and subscribe to stay updated on future analyses.

GBPUSD SHORT FORECAST Q2 W20 D13 Y25GBPUSD SHORT FORECAST Q2 W20 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

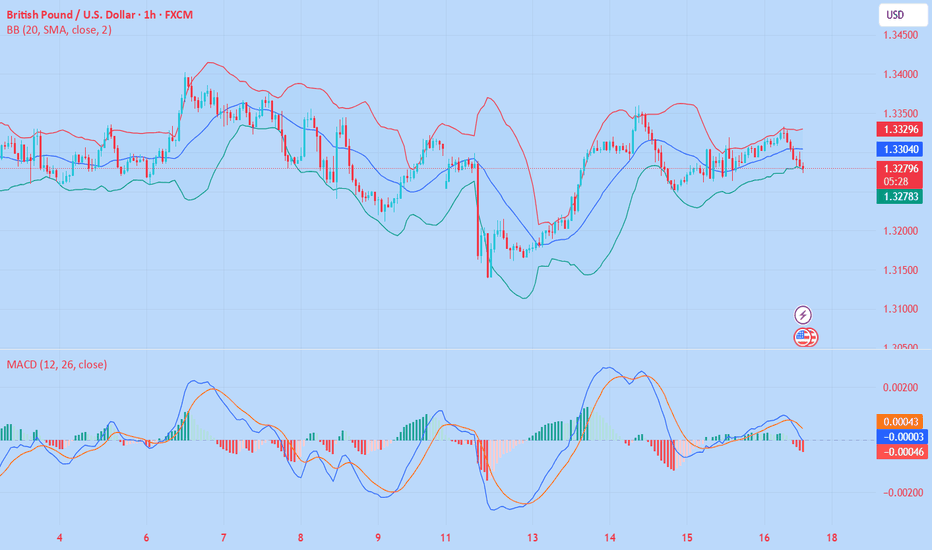

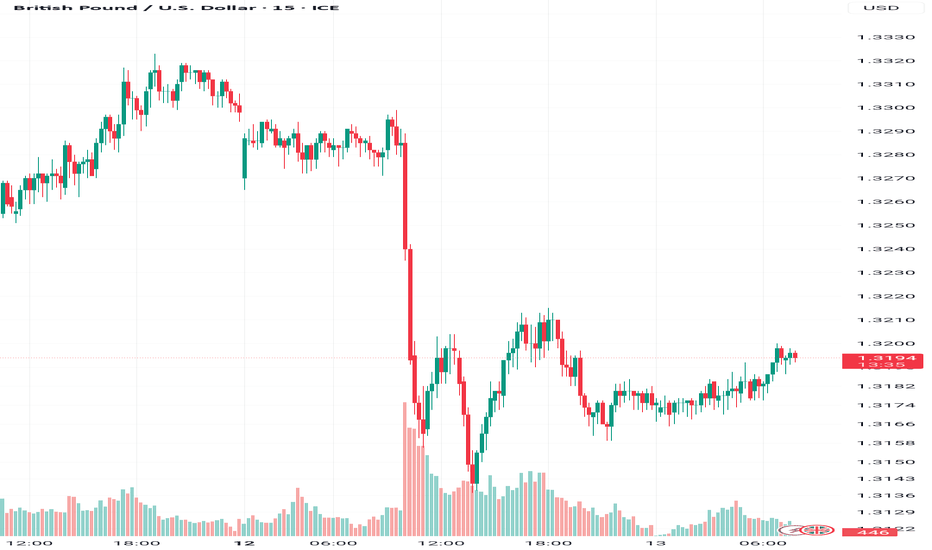

GBP/USD Multi-Timeframe Summary (May 13–17):GBP/USD Multi-Timeframe Summary (May 13–17):

On the daily chart, GBP/USD faces strong resistance at 1.345–1.350 (double-top) and support near 1.280–1.290. The recent pullback to 1.320 aligns with the 61.8% retracement of the April–May rally.

On the hourly chart, price is consolidating in a falling channel between 1.318–1.336, with a bear trap on May 8 indicating demand near the lows. A clean hourly break above 1.336 suggests momentum toward 1.345, while a break below 1.318 targets the 1.300–1.290 daily demand zone.

The 15-minute chart shows a V-reversal from 1.314, followed by a tight flag between 1.318–1.322. This zone offers short-term breakout or fade trades.

Key levels:

Resistance: 1.336, 1.345

Support: 1.318, 1.312, 1.290

Trade triggers: Buy >1.322, Sell <1.318 (tight stops, 15–30 pip targets)

Strategy:

Scalp intraday flags on 15′, trade hourly range extremes, and watch for a breakout from the daily structure.

GBPUSD INVERSE CUP AND HANDLE PATTERNTechnical Overview

Resistance Level: 1.34400

Support Level: 1.27500

Bearish Targets: 1.30200 and 1.28800

The resistance at 1.34400 represents the peak before the formation of the inverted cup, serving as a critical level where selling pressure may intensify. The support at 1.27500 aligns with the neckline of the pattern; a decisive break below this level would confirm the bearish breakout, potentially leading to the projected targets.

📉 Trading Strategy

Consider entering a short position upon a confirmed break below the 1.27500 support level, accompanied by increased trading volume to validate the breakout.

Place a stop-loss order above the handle's peak, near 1.34400, to protect against false breakouts and limit potential losses.

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPUSD SHORT FORECAST Q2 W20 D12 Y25GBPUSD SHORT FORECAST Q2 W20 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X